Adjusting an Options Position - The USO Edition

At Sentimentrader, we do not attempt to issue "predictions" or "forecasts." Our focus is on quantitatively comparing current market action to things that have happened in the past and to try as best we can to highlight when something seems to line up as typically bullish or typically bearish.

Well, this is one case where you can't say we didn't warn you. Based on a variety of factors (breadth, sentiment, seasonality), we have mentioned a "few" times in recent months that trouble appeared to be brewing in the energy sector - see here, here, here, here, and here (I told you we were all over this one). And in the latest fortnight, both the energy sector and energy products took a beating. As a side note - and a positive one at that - Jason highlighted here that a rebound in the energy sector might not be all that far off.

But the purpose of this piece is to update an options trade example I detailed on 7/15 - which was based on Dean's system work - and highlight a possible course of action regarding that trade.

ORIGINAL USO EXAMPLE TRADE

The original USO example trade utilized a strategy referred to as a "Bear Call Credit Spread." It involved:

- Selling 10 USO July30 52 calls @ $0.34

- Buying 10 USO July30 55 calls @ $0.11

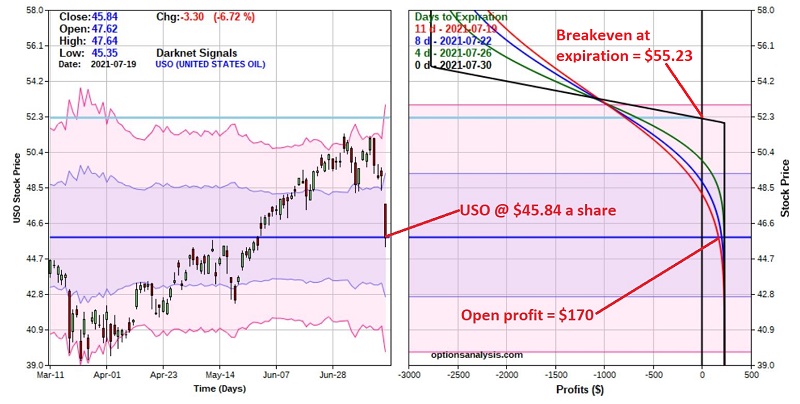

The original USO example trade status at the close on 7/19 appears in Figures 1 and 2 below (all figures below are courtesy of http://www.Optionsanalysis.com).

The purpose of this bear call spread trade was to:

- Generate a profit if crude oil remained relatively unchanged or declined in price in the next two weeks

Trading a 10-lot, the original example trade had:

- Maximum profit potential of $230 (if USO was below $52 a share at option expiration)

- Maximum risk of $2,770 (if USO was above $55 a share at option expiration)

Since 7/15 ticker (as this is written), USO has declined from $49.04 a share to $45.84, and the options trade has an open profit of +$170 (i.e., 74% of its maximum profit potential).

With option trades with limited profit potential, it is often a good idea to plan to take an early profit if a large portion of the maximum profit is available early.

NOTE: Ideally, this type of decision is made when the option trade is entered and becomes part of the risk management plan for that trade. For example, some credit spread traders say if they can close the trade and capture x% (50%-70% typically) of the original credit ($230 in this example trade) before expiration, they will close the trade, take a profit, eliminate risk and move on to the next trade. However, there are no hard and fast rules regarding when to take a profit.

At this point in our example trade, we have hypothetically captured 74% of our maximum profit potential in just 2 trading days. At this point, a trader holding this position has two obvious choices:

- Close both legs of the trade, take a quick, easy profit, and move on to the next trade

- Continue to hold the trade in hopes of harvesting the remaining $60 of profit potential (with the expectation that USO will remain below $52 a share between now and option expiration on July 30th).

A MORE AGGRESSIVE ALTERNATIVE

The adjustment that follows is definitely not a "recommended" way to play. Instead, it is intended to point out the flexibility available to option traders.

For the sake of argument, let's assume that a trader holding our example position now thinks that the selloff in crude oil was overdone in the short-term and that there is a strong possibility of a snap-back rally in the very short term. If a trader held this outlook, one alternative possibility would be to:

- Buy 10 July 30 52 calls

- BUT continue to hold the 10 July 30 55 calls

In this case, the trader is left with 10 long calls at a strike price of $55 a share for ticker USO. Is USO likely to rally all the way to $55 a share in the next 11 days? Not really. So why would a trader even consider this action?

First off, the chart below displays the risk curves for the new, adjusted trade (i.e., having taken a profit on 10 short calls and continuing to hold 10 long calls. Notice how the nature of the reward-to-reward profile changes dramatically from the one above.

Consider the following:

- The 55 calls bid/ask spread is $0.02/$0.03, so selling all 10 calls will likely net $20 of additional profit, BUT commissions would likely eat some portion of that.

- Take a close look at the red, blue, and green risk curves in the chart above. If USO DOES rally sharply in the days ahead, the trader MAY have an opportunity to sell the 55 calls at a higher price and generate a larger profit

A long shot? Absolutely. There is very little time left until option expiration and one can argue that the likelihood of a huge upside reversal in crude oil is low.

But the point here is NOT to argue whether or not crude oil will rally in the days ahead. The point here is that the position above affords a trader who believes there COULD be a rally in the next week:

- The opportunity to profit from that outlook

- Without having to enter an entirely new trade

- And without risking their current open profit

As I said, options trading offers traders a great deal of flexibility. Whether they ultimately use that flexibility to their advantage or disadvantage is entirely up to each trader.