Seasonal Commodity Trends to Pay Attention To

Seasonal trends are NOT predictions or forecasts. They merely show when a given tradable has tended to trend in a particular direction in the past.

In using seasonal trends myself, I focus on the major trends rather than on every little squiggle in the Annual Seasonal Trend chart for a given security or commodity.

Basic Rules for Using Seasonal Trends:

- NEVER assume a given seasonal trend will play out as expected "this time"

- Use ST as a "weight of the evidence" factor, NOT as a standalone indicator

- IF you are bullish AND ST is bullish (or if you are bearish and ST is bearish), it is a time to aggressively press your advantage (while still respecting your own position sizing and risk management rules)

- IF you are bullish AND ST is bearish (or if you are bearish and ST is bullish), you can still enter a bullish trade, BUT be more mindful of risk (i.e., perhaps commit less capital and/or use a tighter stop)

I am watching a number of these right now, including energies, metals, and currencies.

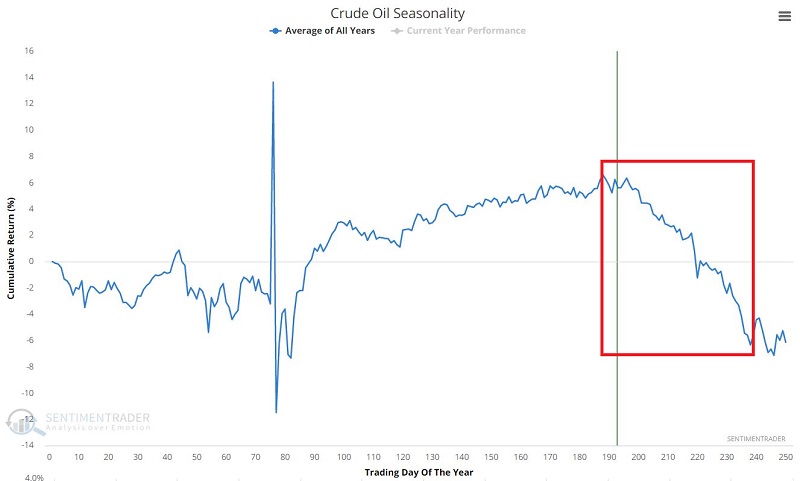

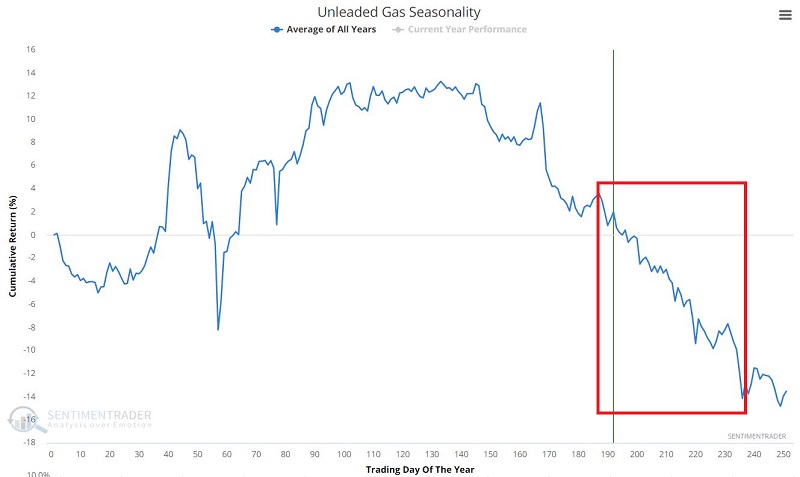

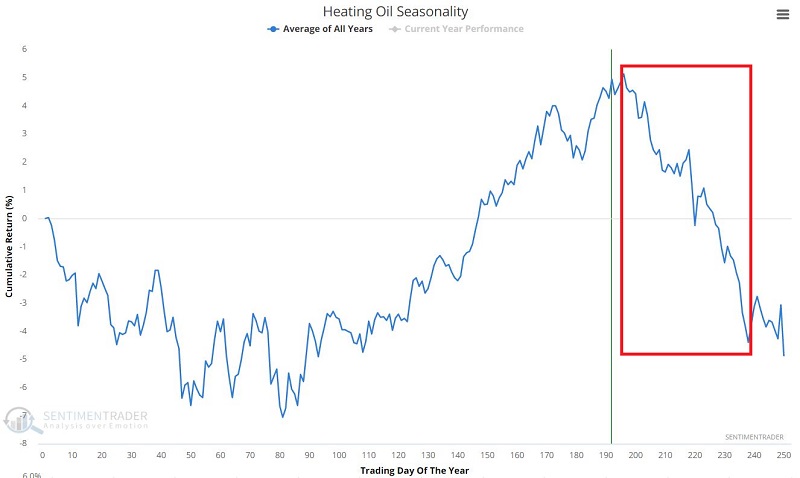

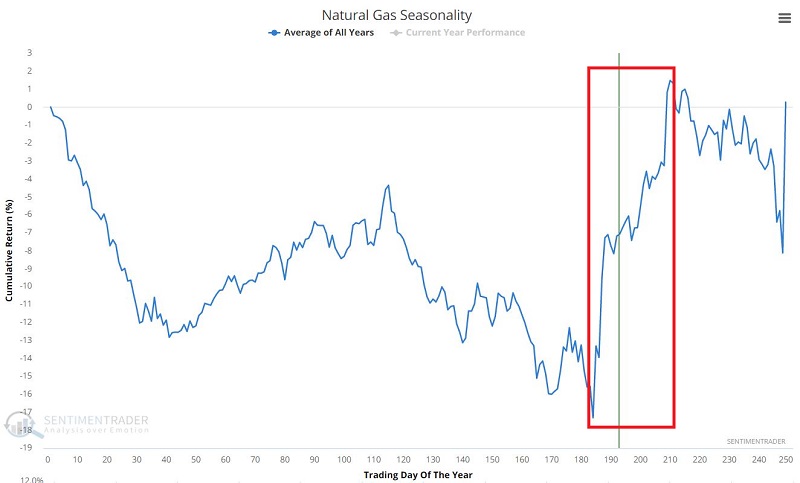

ENERGIES

As I discussed here and here, the energy sector is at an important juncture. To wit:

- According to seasonal trends, crude oil, heating oil, and unleaded has SHOULD be expected to decline in the months ahead (while natural gas is still in the middle of a favorable period)

- Meanwhile, in real-time, the energy products are soaring and breaking out to new highs

- IF these energy products DO NOT reverse during the seasonally unfavorable period - and they all recently broke out to new highs - it may signal that we are in a true inflationary spiral

Let's talk real-world trading:

- IF you are playing the long side, there is no reason not to let your profits run, BUT beware of the potential for a quick reversal - and consider moving trailing stops up to lock in profits

- IF you are looking to play the short side (i.e., expecting seasonality to assert itself ultimately), be very careful about shorting into a soaring market and consider waiting for some sign of a reversal (remember, sometimes seasonal trends are just plain wrong, and jumping in front of a freight train is fraught with peril)

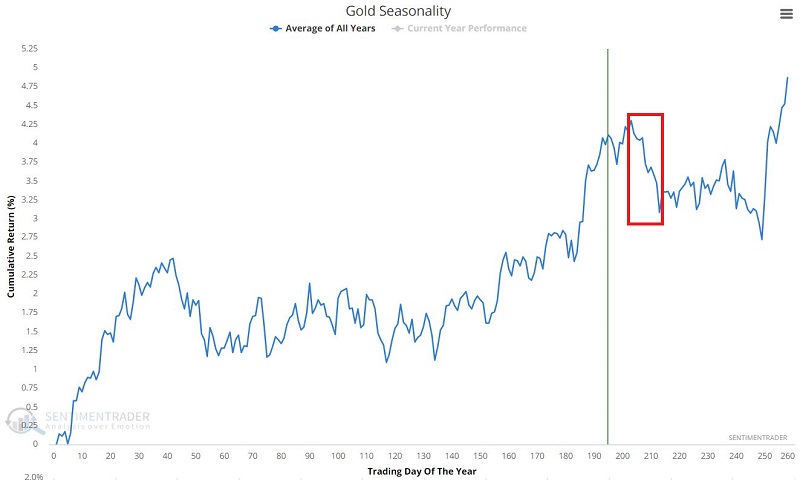

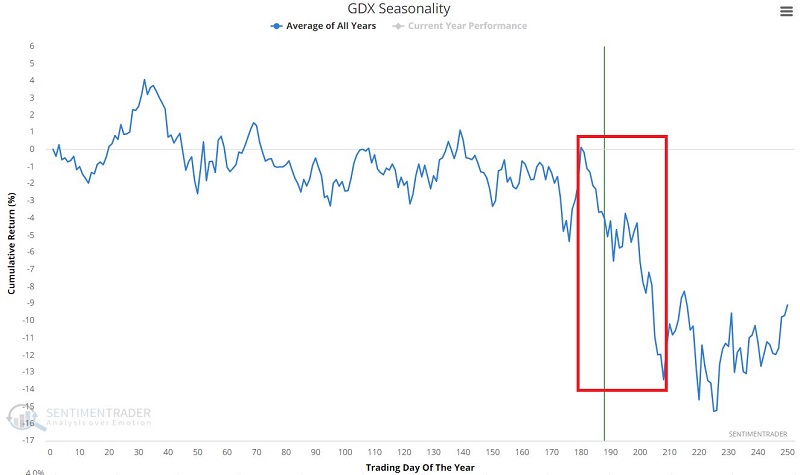

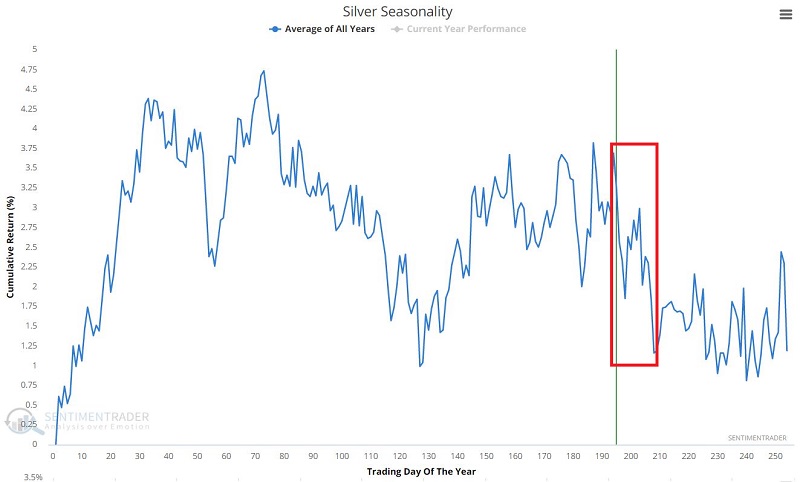

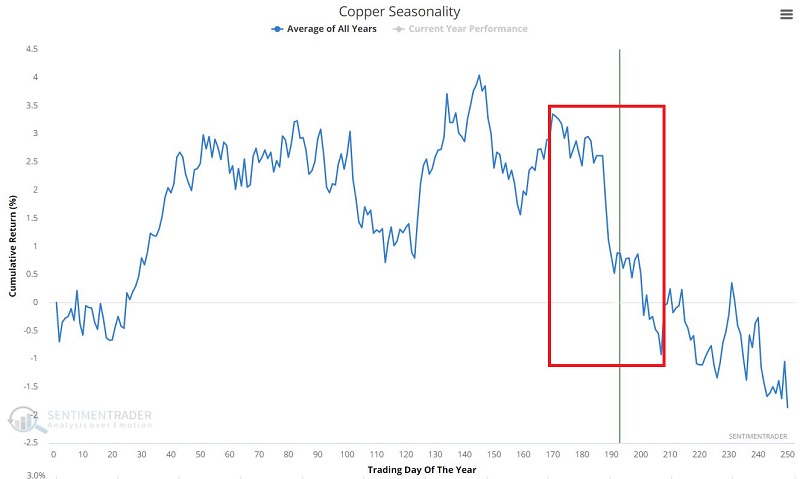

METALS

Precious metals and copper have been under pressure of late. Precious metals have disappointed many investors who expected them to act as a "hedge" against inflation. No such luck so far in 2021. These markets are oversold, and a bounce is certainly a possibility. However, if the Annual Seasonal Trend plays out, there may be little relief in the near term.

Also, note that as I detailed here, the stocks of gold miners are in the middle of a particularly weak seasonal period (which - again - DOES NOT mean that that cannot rally, it only means that they typically show above-average weakness, which traders should be aware of).

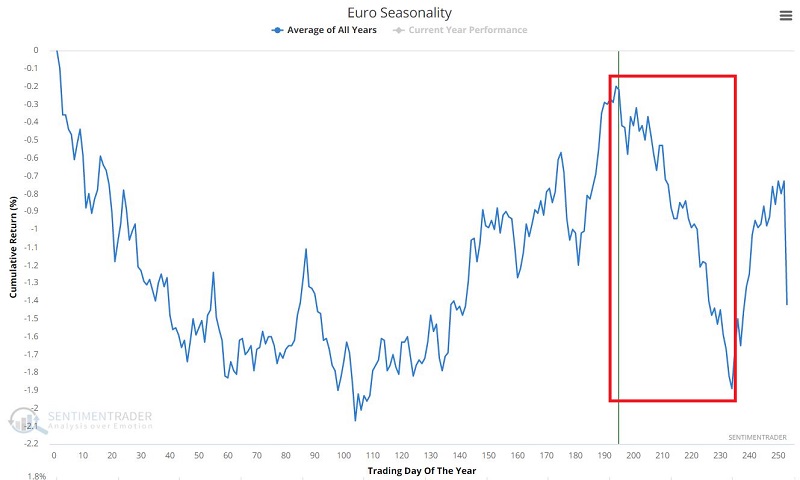

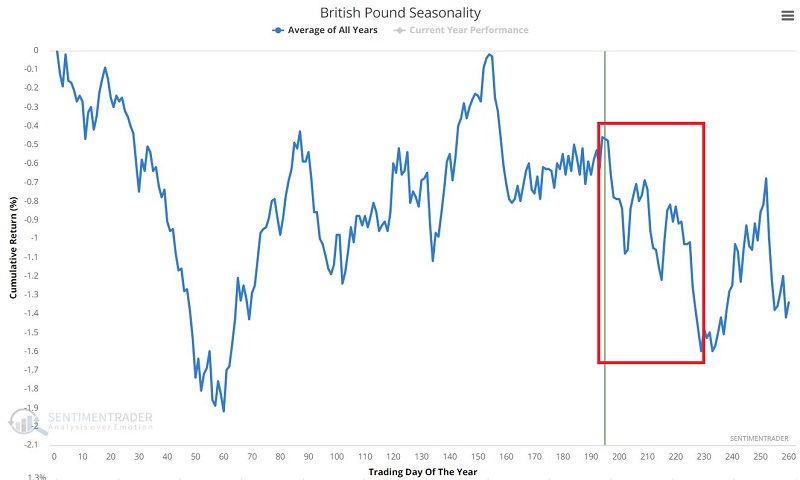

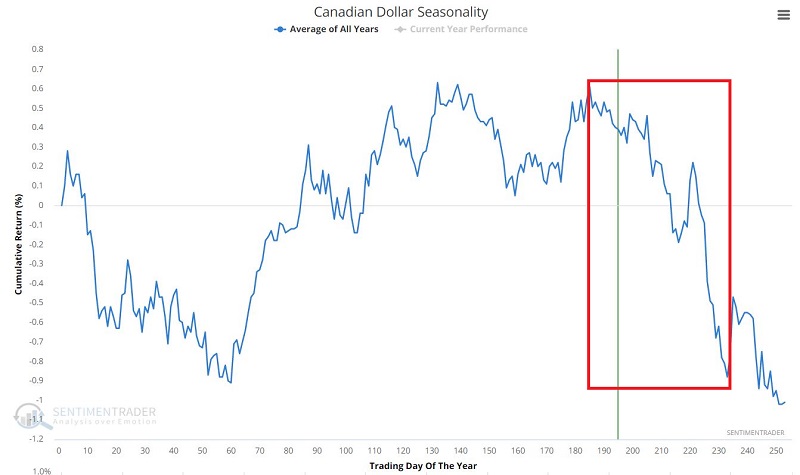

CURRENCIES

Many traders are surprised to learn that foreign currencies also have a seasonal element to their price movements. At the moment, several currencies are entering periods of seasonal weakness. It should be noted that during this time of year:

- When they go up, they tend to go up a little

- But when they go down, they tend to go down a lot