Natural Gas for the Rest of Us

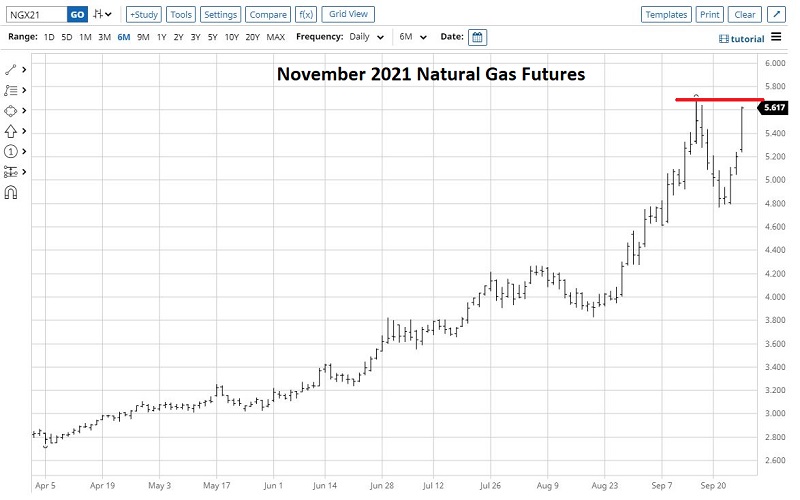

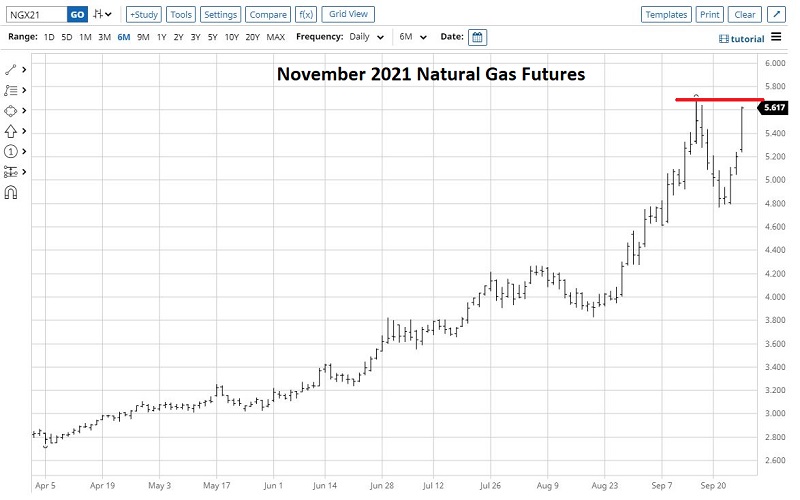

As this is written, natural gas futures are soaring (as you can see in the chart below, courtesy of Barchart.com). However, it is also facing a critical resistance level just above its current price.

As I write, the November 2021 NG futures contract is up 0.417 points for the day. That equates to a gain of $4,170 so far today for anyone holding a long position - and a -$4,170 loss so far today for anyone holding a short position.

Welcome to the exciting world of commodity futures!

The danger of jumping on board the bullish natural gas train is that a failure to break out to a new high could lead to a swift and costly reversal.

Of course, riding $4,000 daily swings is not for everyone. In fact, unless you are extremely well-capitalized - and very experienced in handling large dollar value swings (AND with a proven track record of being able to cut your losses when need be), riding $4,000 daily swings should probably NOT be for you.

So, what about the rest of us? Let's assume that a trader has done their analysis and believes that natural gas will continue to rise in price. Is there a way to play without risking one's shirt? (Would I ask the question if I thought the answer was "No?")

For the record, what follows is NOT a "recommendation." I am fully agnostic on the future price of natural gas and am not "predicting" a continuation nor a reversal. But the example below will show you that it is possible to trade even the most volatile situations without taking on more risk than you can handle.

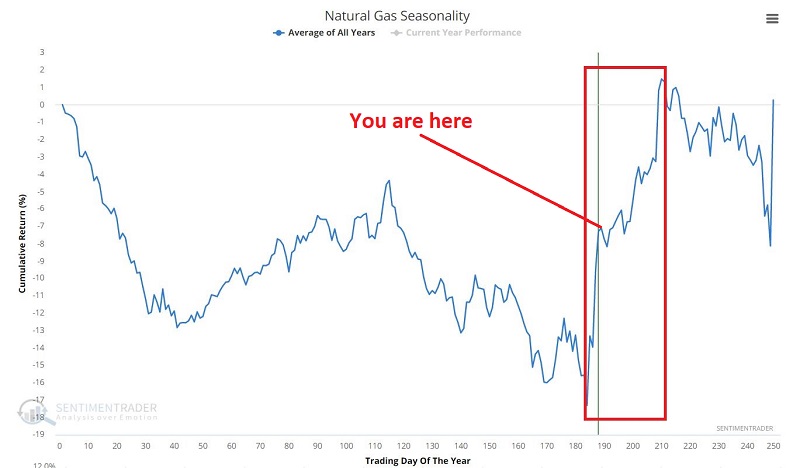

FACTOR #1: SEASONALITY

As you can see in the chart below, natural gas remains in a favorable seasonal period, with further potential upside in the next month and a half.

In the short term, the question (referring back to the first chart) is, "will price breakout above the recent high, or will it fail?" Again, I am making no prediction.

But for the sake of example, we will assume that a trader wants to bet on an upside breakout while keeping risk at a reasonable level.

FACTOR #2: IMPLIED OPTION VOLATILITY

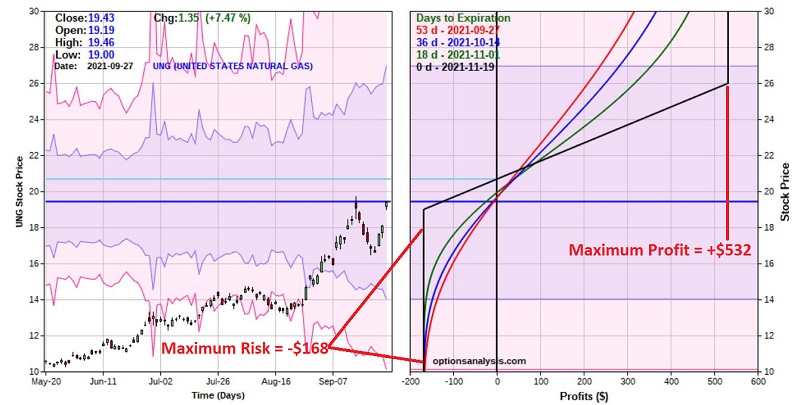

To do this, we will turn from natural gas futures to option on the ETF ticker UNG (United States Natural Gas Fund, LP). In the chart below (courtesy of StockCharts.com), we see that UNG is also threatening to take out its previous high. However, if it fails, there also appears to be plenty of downside risk.

Finally, in the chart below (courtesy of Optionsanalysis.com), we see that the implied volatility (solid black line) for options on ticker UNG has risen to a very high level. This tells us that UNG options are "expensive," i.e., there is a great deal of time premium built into the price of the options.

This high implied volatility tells us that if we buy a call option:

- IF the breakout falls to materialize AND price retreats (or even remains mostly unchanged for a while)

- There is a good chance that call option IV will plummet

- Thus leading to a large loss of time premium in the call option we bought

So I will invoke two arbitrary assumptions/decisions:

- Because of high price volatility, I do not want to sell premium (for fear of getting stuck on the wrong side)

- Because of high implied options volatility, I do not want to buy straight calls or puts

So, what does that leave? In this instance, let's look for the potential to buy one option at a lower volatility and sell another option at a higher volatility.

ASSUMING YOU WANT TO BET ON A BREAKOUT

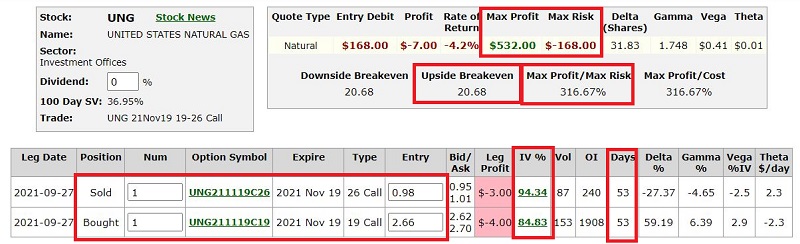

Our example trade involves:

- Buying the Nov19 UNG 19 strike price call @ $2.66

- Selling the Nov19 UNG 26 strike price call @ $0.98

Note that the option we are buying trades at an IV of 84.83%. However, the option we are selling trades at an even higher IV of 94.34%. This is an example of trying to take advantage of option "skew" (i.e., in this case, the out-of-the-money options are trading at higher IVs).

The particulars of this trade and the risk curves (i.e., the expected P/L based on the price of UNG shares as of a given date) appear in the screenshots below.

For a trader who expressly wants to bet on an upside breakout and significantly higher natural gas prices, this trade offers good profit potential and limited dollar risk.

Things to note:

- The maximum risk on a 1-lot is -$168

- The maximum profit potential is $532

- The breakeven price is $20.68 a share for UNG (in other words, UNG MUST rise in price somewhere between now and expiration, or this trade is guaranteed to lose money)

- There are 53 days left until option expiration

Ideally a trader would do the following:

- A = Total trading capital

- B = Maximum % of total trading capital to risk on one trade

- C = (A x B)

- D = INT (C / $168) = # of option spreads to buy.

So, for example, a trader with:

- A = $50,000

- B = 2.5%

- C = $1,250

- D = INT ($1,250 / $168) = The trader could trade up to a 7-lot

SUMMARY

Once more, I am agnostic on the future price of natural gas and UNG, and you should NOT view the trade above as a "recommendation." If you are an options trader, what you SHOULD do is study this example and file it away as one way to play a situation where:

- Price is extremely volatility

- Option volatility is extremely high (and could rise further)

- You hold a particular market opinion (for the sake of this example, the opinion is that natural gas WILL break out)

- You want to limit your risk to a limited and reasonable amount

In this circumstance, the big danger is that price will fail to break out. A swift reversal could lead to very large losses for a futures trader holding a long position and potentially for a trader simply holding a UNG call option.

That is why a bull call spread (where you can sell a more "expensive," i.e., higher volatility call to help pay for the long call) can make a great deal of sense in terms of minimizing downside risk while also holding above-average profit potential.