What To Do When Things Go Right

Options trading is a different game.

Owning a particular stock is often akin to a relationship. Typically (ideally), you get to know it a little before making a commitment. If it mistreats you from the outset, typically, there is a feeling of betrayal, and in the end, you wonder, "what was I thinking about?" On the other hand, the longer you hold a stock - and especially the more it advances in price - the more your fond feeling towards it grows. When the day finally comes to "part ways," there is occasionally a hint of sadness.

Option trades tend to be more of the "baadda boom, baadda bing" variety.

And they can be a source of great angst, right up until the last minute, when things suddenly "work out." It is important to understand and accept this if you trade or are going to trade options.

OVERVIEW

When you buy a stock or mutual fund, and it goes in the right direction, very often you get to hold onto that winner - while it is a winner, and as it becomes an even bigger winner - for some meaningful length of time.

There is a great deal of psychological satisfaction involved when that happens. And even after that happens. "Yeah, I bought XYZ stock at $20 a share. Six months later, it was $90 a share. I sold half. I went to $110, and I sold the rest."

Yes, you can come away from a big stock winner feeling pretty darned good the stock - and yourself. It doesn't always - or even usually - work like that with options.

Because options have an expiration date, very often, a "winning scenario" goes something like this:

- You buy an option

- It goes nowhere

- Expiration draws closer and time decay starts to eat away at your position

- Day after day, your loss grows bigger

- Then, in a very short period of time, the stock "pops" or "craters," and all of a sudden, you are sitting with a profit

When this happens, there are two common scenarios:

- Since time to expiration is dwindling, the trader sells the option and walks away with a profit. But because the trade was a loser for roughly 90% of the life of the trade, there is very little psychological gratification (you may be grateful for the profit, but it is more of a "wait, what just happened?" scenario

- Because the trader didn't get to "enjoy" riding a winning trade, often there is a temptation to "hold on" rather than "cash out." And very often, in that situation, a winning options trade turns into a losing option trade

Welcome to the "exciting" world of options trading.

The bottom line is that how you handle trades that were "losers" most of their lives and then suddenly turned into "winners" is critically important to your long-term success as an options trader.

FOLLOWING UP

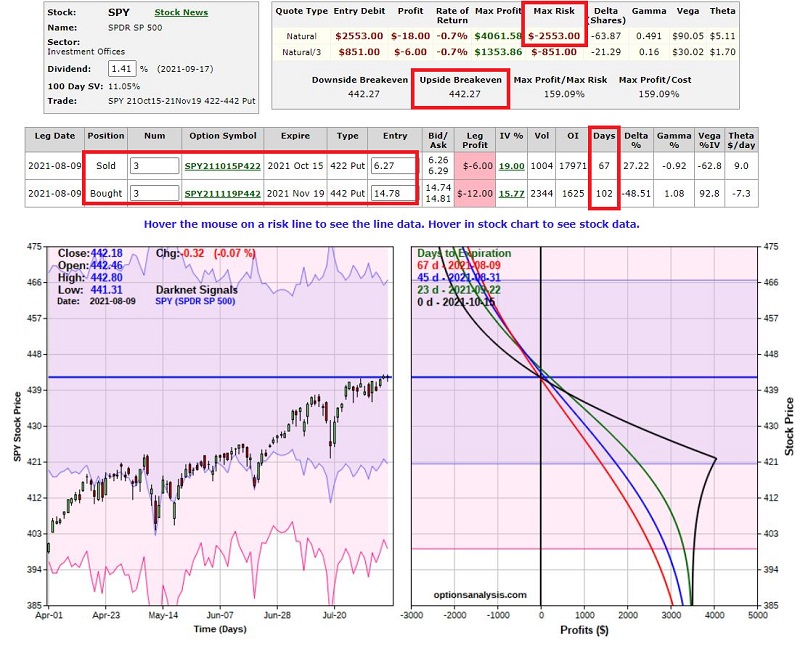

In this piece, dated 8/10, I wrote about a hypothetical diagonal put calendar spread using options on ticker SPY.

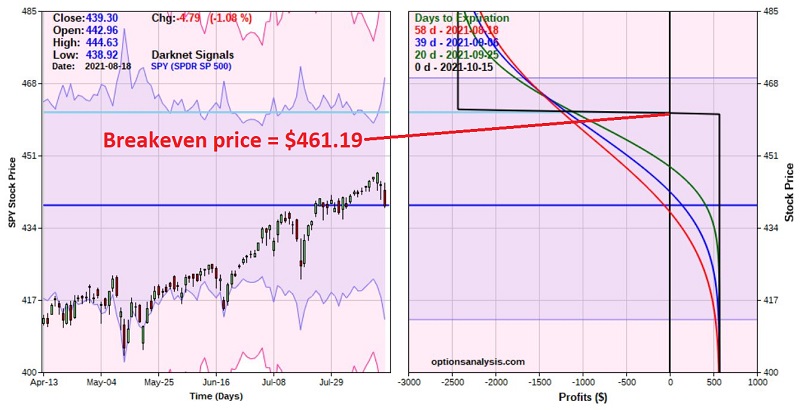

Then in this piece dated 8/19, I wrote about a hypothetical bear call option spread using options on ticker SPY.

Following the sell-off on 9/20, both of these positions were sitting in profitable territory. So:

- Let's update these example trades and see where things stand

- And to complete these examples, let's also consider possible actions for a trader holding a position that suddenly "goes right" after several weeks to a month or more of "going wrong"

BEAR CALL SPREAD

The particulars and the risk curves for the original example trade when it was entered (8/18) appear below. This trade is based on a trader willing to commit and risk $2,500, so a 30-lot is traded. All screenshots below are courtesy of Optionsanalysis.com.

The basic plan was to hold the trade unless and until SPY threatened the breakeven price of $461.19 a share.

By 9/2:

Ticker SPY has advanced from $439.18 to $453.23 a share. As you can see in the screenshot below, at that point, the trade had an open loss of -$540.

While the option trade showed a loss of -22%, ticker SPY was still 8 points below our breakeven price of $461.19. So, at that point, there was nothing to do but wait.

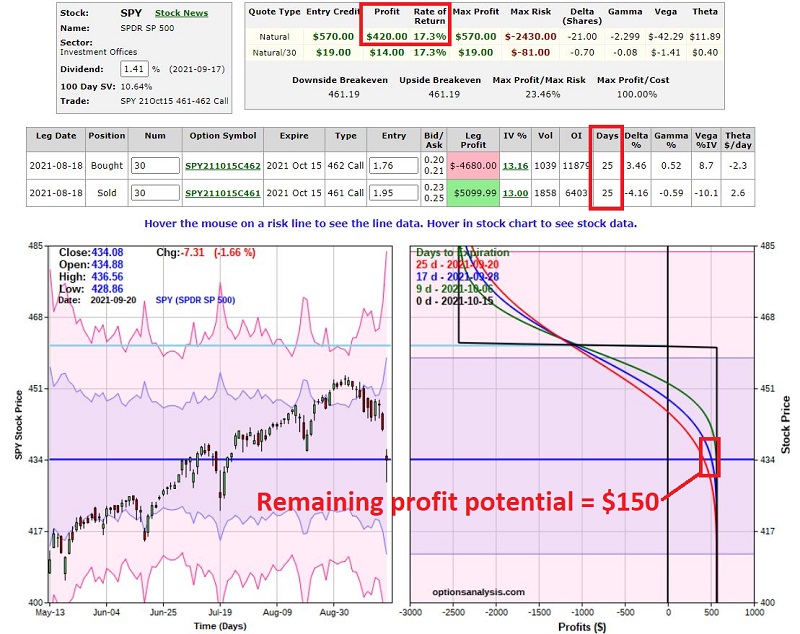

By 9/20:

After 9/2, the stock market headed lower, and on 9/20, ticker SPY closed at $434.08. At this point, the trade shows an open profit of +$420.

At this point - with 25 calendar days left until option expiration - the trade has earned 74% of the maximum profit potential ($420 out of a possible $570).

At this point, our hypothetical trader has a decision to make. The choices are:

- Close the entire position and take the profit (+17.3% in 33 days)

- Close some fraction of the position and hold the rest

- Let the full position ride in hopes of garnering more profit

Two things to note:

- Ideally, decisions regarding when to take a profit and/or adjust a trade are made at the time the trade was entered (to avoid emotional decision-making in the heat of battle)

- There is no "correct" choice - a trader must weigh the pros and cons of each and decide which is best for them

Pros and Cons

- Closing the entire trade has a large appeal. The remaining profit potential is only another $150, and the maximum risk remains -$2,430. Still, a trader who is confident that the market will not bounce sharply higher in the next 3+ weeks may opt to hold on in hopes of having the entire position expire worthless.

- Closing a portion of the trade (in the author's personal opinion) only makes sense if you can a) lock in a profit and b) still retain meaningful additional profit potential. That does not seem possible in this trade at the moment.

- "Letting it ride" allows a trader to do absolutely nothing and still garner the remaining profit potential. On the flip side, if the market does turn and start to rally, the open profit on this position can dwindle very quickly.

DIAGONAL PUT CALENDAR SPREAD

The particulars and the risk curves for the original example trade when it was entered (8/9) appear below. This trade is based on a trader willing to commit and risk $2,500, so a 3-lot is traded.

The basic plan was to close the trade if an open loss of -$1,000 was experienced (an arbitrary "hard dollar" stop).

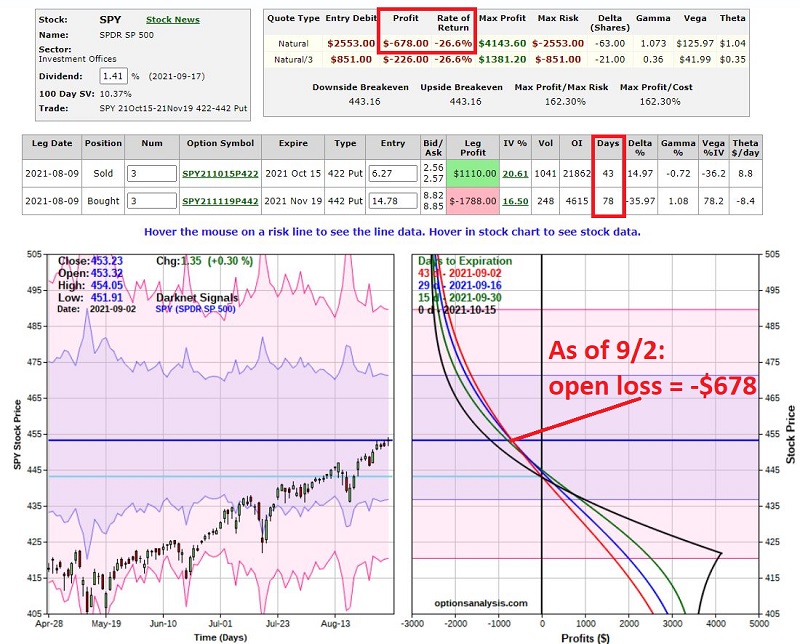

By 9/2:

Ticker SPY has advanced from $442.18 to $453.23 a share. As you can see in the screenshot below, at that point, the trade had an open loss of -$678.

At that point, it would not have taken much more of a rise for an open loss of $1,000 to be reached. So, an options trader holding this position would need to be monitoring the position at least daily.

By 9/20:

After 9/2, the stock market headed lower, and on 9/20, ticker SPY closed at $434.08. At this point, the trade shows an open profit of +741.

At this point - with 25 calendar days left until the short option expires - the trade has an open profit of +29% of the capital risked.

Once again, our hypothetical trader has a decision to make. The choices are:

- Close the entire position and take the profit (+29% in 42 days)

- Close some fraction of the position and hold the rest

- Let the full position ride in hopes of garnering more profit

The same two notes as above apply here:

- Ideally, decisions regarding when to take a profit and/or adjust a trade are made at the time the trade was entered (to avoid emotional decision-making in the heat of battle)

- There is no "correct" choice - a trader must weigh the pros and cons of each and decide which is best for them

Pros and Cons

- Closing the trade now allows the trader to lock in a profit and release the capital committed to finding a new trade.

- Closing a portion of the trade (in the author's personal opinion) only makes sense if you can a) lock in a profit and b) still retain meaningful additional profit potential. That does not seem possible in this trade at the moment.

- "Letting it ride" has several potential pros and one serious con.

The con to "Letting it Ride":

- The trade can still end up a loser if SPY turns and rallies between now and October option expiration.

The pros to "Letting it Ride":

- The stock market does appear overdue for a significant correction. So far, SPY is -5.3% off of its high. If this turns into a 10% or 15% correction, this trade can garner additional profits.

- Time decay works in favor of this trade if SPY is below roughly $444. If you look at the colored risk curve lines in the chart above, you will note that with each passing date, they move further into profitable territory (this is because the short Oct15 puts are experiencing time decay much more quickly than the long puts, which have an additional 35 days left until expiration).

- This trade has positive "Vega" of $82.72. This means that this position should gain $82.72 if the implied volatility (IV % in the screenshots above) on the options rises one full percentage point. In the stock market, market volatility typically rises during price declines. Therefore, IF price continues to decline and IF implied volatility rises as a result, this trade can garner significant profit due solely to a rise in volatility.