Spotting and Exploiting Opportunity with Ticker SPY

As I write often, trading essentially comes down to two steps:

- Spot Opportunity

- Exploit Opportunity

For the record, both of these steps often involve a series of other steps. But this can vary from trader to trader and from trade to trade.

For example, "exploiting opportunity" may include:

- Identifying a possible trade

- Assessing whether you are comfortable with the reward-to-risk tradeoff of the potential trade

- Then either taking or eschewing the trade based on assessment above

In other words, part of the process can be doing a whole lot of work only to ultimately do absolutely nothing (Welcome to the exciting world of trading!).

SPOTTING OPPORTUNITY IN SPY

In this piece, Jason identified a potential opportunity by highlighting:

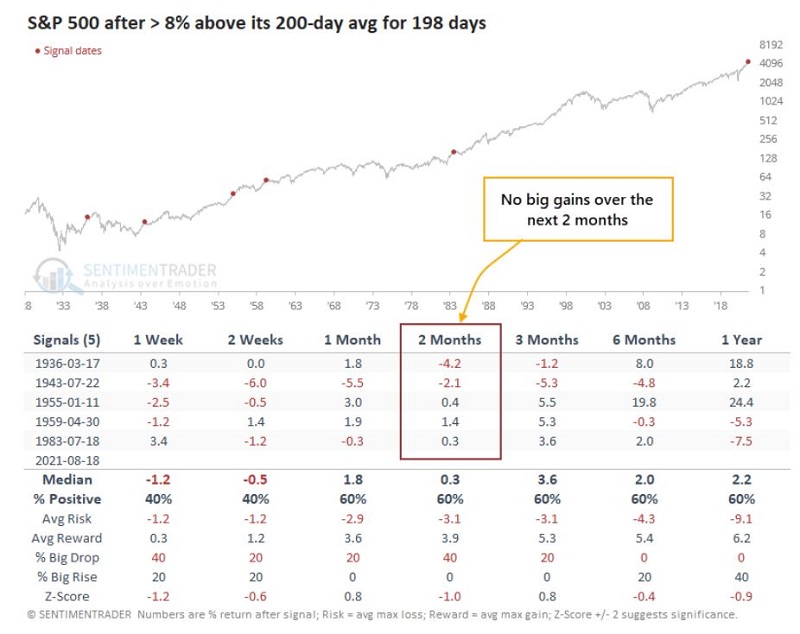

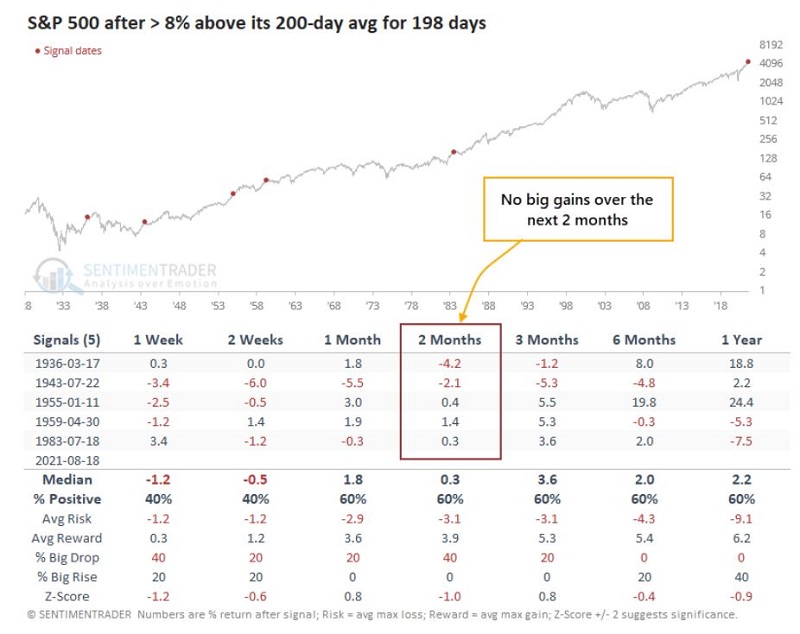

S&P 500 performance after S&P 500 > 8% above 200-day avg for 198 days

The results of his test appear below.

- Note his note about performance two months out

- Also, note the extremely small sample size - which can be a viable reason to bypass the example trade discussed below

Jason correctly noted that there were no big gains over the next two months following previous signals. This setup can create a potential scenario for an options trade.

THE BEAR CALL SPREAD

- As always, the first order of business is to remind you that Sentimentrader.com does NOT offer investment advice and that the example trade that follows is just that - an example - and NOT a "recommendation"

- Also, note that the prices used in the trade below were pulled at around 2 PM Central time on 8/18. So actual prices in the market may be substantially different by the time you read this

Using options and a strategy referred to as a "Bear Call Spread," it is possible to profit from a scenario whereby a given security merely stays below a given price. So, we will look for a trade that will profit if ticker SPY (SPDR S&P 500 ETF Trust ) remains below a given price for roughly the next two months.

The first question is, "what given price are we looking to stay below?" In the screenshot below - also from Jason's article - if we look at the largest "Reward" for each period leading up to 2 months was 4.0%. So, for our trade, we will look to sell a call option at least 4% above the current price of SPY. In other words, the "catalyst" for the example trade below is a belief that ticker SPY will NOT rally by more than 4% in the next months.

As I write, SPY is trading at $442.39 a share. If we add 4%, we get roughly a strike price of $460.08. So given this information, we will look to sell a SPY call:

- With a strike price of 461

- With roughly two months left until expiration

Our example trade then involves:

- Sell SPY Oct15 461 call @ 1.95

- Buy SPY Oct15 462 call @ 1.76

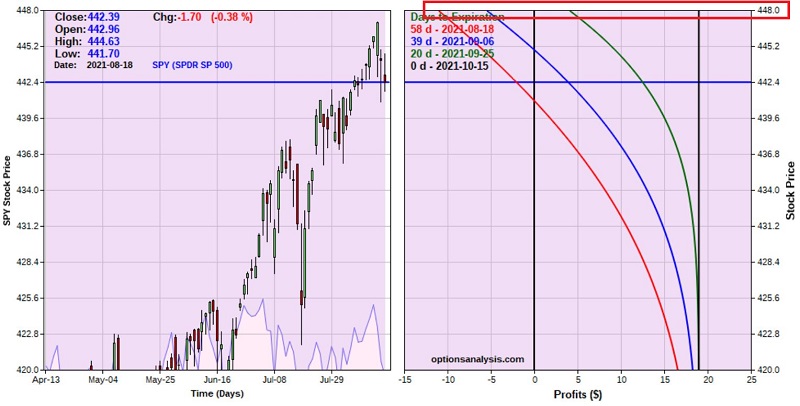

The particulars for this position appear in the screenshot below, and the risk curves (i.e., the expected $ P/L based on a given price for SPY shares as of a given date) appears below that (both courtesy of Optionsanalysis)

Things to note:

- There are 58 calendar days left until option expiration

- The maximum profit potential is $19 on a 1-lot (or 23.46% of capital at risk), which will be earned if SPY is below $461 a share at the close on 10/15

- The maximum risk is -$81 on a 1-lot, which will be realized if SPY is above $462 a share at the close on 10/15

- The breakeven price is $461.19

ASSESSING REWARD-VERSUS-RISK

Consider the following:

- This position has an above-average statistical probability of profit (because SPY can rally 4%, and the trade will still earn the maximum profit)

- However, there are 4 times as much risk as there is profit potential

- For the record, this type of tradeoff is not at all uncommon when "selling option premium."

- This 1-to-4 max reward-to-max risk ratio means that this is NOT a "Set it and Forget it" type of trade (a plan to minimize risk and a willingness to act if need be are essential requirements)

The key point here is that we do not want to wait until expiration and suffer the maximum loss if this trade goes against us. As a result, before we can fully assess whether or not to enter the trade in the first place, we need to consider how we might manage this trade to mitigate some of the potential risks.

A TRADING PLAN TO MANAGE RISK

Now let's consider a trading plan for this position. Two things we know going in:

- The most we can make (on a 1-lot) is $19

- SPY made a recent high at $447.11

- Serious trouble can ensue if SPY rises above the breakeven price of $461.19

In terms of managing risk, there are two basic choices.

CHOICE #1. A STOP ABOVE THE RECENT HIGH

The chart below "zooms in" on the chart above and highlights at the very top of the chart the expected P/L if SPY rises to $448 a share as of 4 different dates (the red line is immediate, the black line is as of expiration and the blue and green line represent dates in between immediate and expiration).

What we find is that if SPY hits $448 a share:

- Immediately (red line), our expected loss would be approximately -$11

- 9/6 (blue line), our expected loss would be approximately -$6

- 9/25 (green line), our expected gain would be approximately +$4

- 10/15 (black line), our gain would be +$19

You see in the chart above the positive effect of time decay that occurs when you sell option premium. As the options lose time value with each passing day, this trade becomes more profitable over time.

IMPORTANT NOTE: Bid/ask spread, changes in implied volatility, and large price gaps can affect these results, so all numbers above are approximate, except at expiration.

So, the good news is that if a trader:

- Firmly believes that the recent high will NOT be pierced at any time in the next two months

- And is ready, willing, and able to cut bait and exit the trade if SPY hits $448 a share at any time between now and October expiration

- There is minimal dollar risk associated with this position

The problem, of course, if that $448 is an extremely tight stop (only +1.3% from the current price), and the probability of getting stopped out is fairly high.

So, let's consider the reward-to-risk tradeoff of placing our stop just above our breakeven price of $461.19.

CHOICE #2. A STOP ABOVE THE BREAKEVEN PRICE

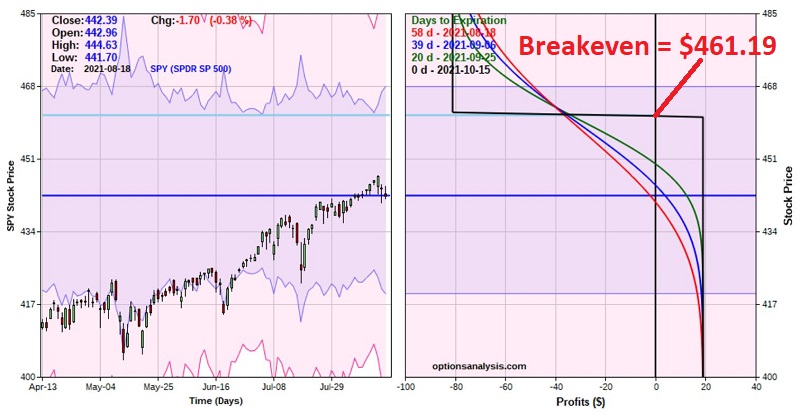

The chart below "zooms in" on the chart above, and at the very top of the chart highlights the expected P/L if SPY rises to $461.30 a share as of 4 different dates (the red line is immediate, the black line is as of expiration and the blue and green line represent dates in between immediate and expiration).

What we find is that if SPY hits $461.30 a share:

- Immediately (red line), our expected loss would be approximately -$38

- 9/6 (blue line), our expected loss would be approximately -$37

- 9/25 (green line), our expected loss would be approximately -$35

- 10/15 (black line), our gain would be +$19

IMPORTANT NOTE: Bid/ask spread, changes in implied volatility, and large price gaps can affect these results, so all numbers above are approximate, except at expiration.

- The good news is that if SPY does anything EXCEPT rally 4% or more in approximately the next two months, this trade will earn a profit of up to +23.8% of the capital risked

- The bad news is that the trader entering this trade with a stop-out point of $461.30 a share for SPY is risking roughly twice as much (-$35 to -$38) as their maximum profit potential of +$19 if the options expire worthless

ASSESSING THE TRADE

It is up to each trader to decide if this example trade is a "good trade" or a "bad trade." The important things to do are to:

- Assess your own expectations (if any) for ticker SPY - If you think it is still in a relentless uptrend, you might wish to bypass this trade, whereas if you think SPY is "due for a rest," this trade can offer a fairly high return (23+%) in a relatively short period of time (2 months)

- Decide a price at which you would cut a loss ($448? $461.30? Something else?) and resolve to act if needed

- Decide on a plan for taking a profit - Some traders will consider closing a bear call spread if 50% to 80% of the original credit can be captured by closing the trade early

There are no "correct" answers - only hard choices to be made.

See this link for a similar opportunity with SPY but using a different strategy with a different objective.