Oil Shock

We're going to be inundated with analysis about the oil market disruption this week, and for good reason. Oil shocks have set off some previous recessions and turbulence across seemingly unrelated markets.

With the full understanding that this time is different (the disruption is likely temporary, the U.S. has more market control, etc.) there are also some factors that are not different, such as the possibility that this triggers a geopolitical response.

Let's focus on the price action and the "shocking" nature of the jump in oil prices. It's impossible to know whether this is one of the multitude of one-off shocks oil has endured over the decades, or a true supply-driven shock that could eventually prove to be an economic drag. Opinions will be varied and plentiful on that topic.

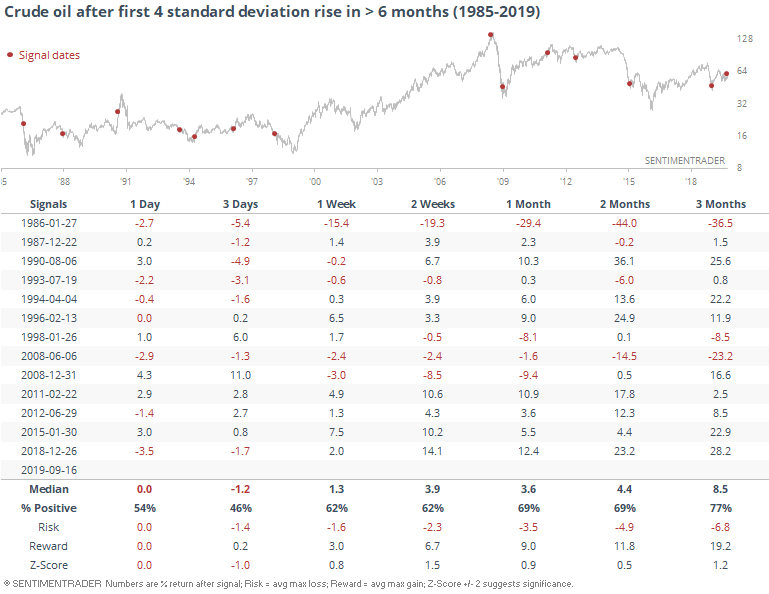

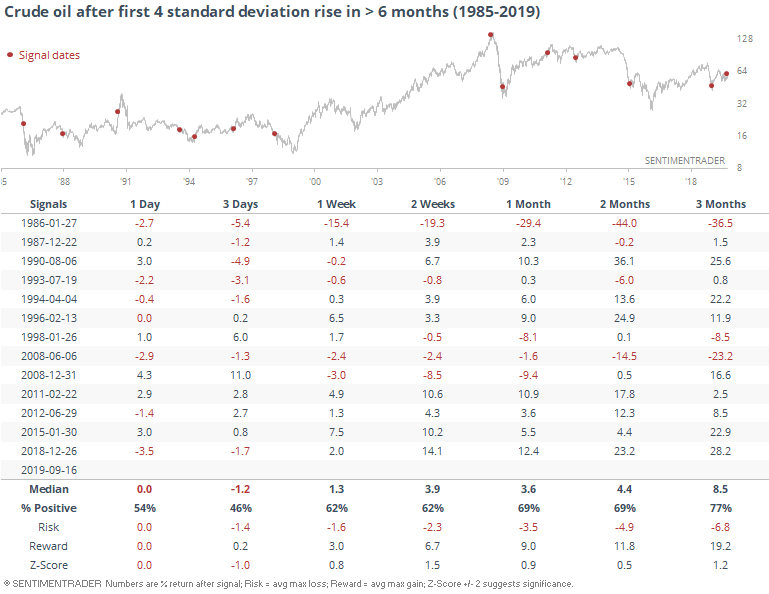

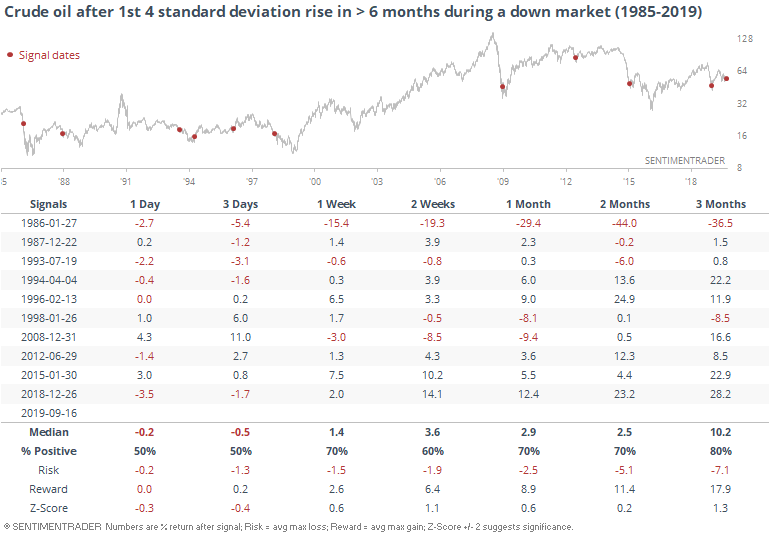

Below, we can see every time that crude oil futures saw a one-day price increase that was more than 4 standard deviations from what investors had seen during the past year. Only the first such move in at least 6 months qualifies.

Oil tended to dip in the short-term but rise afterward. The losses were immediate, and sustained, only in 1986 and 2008. If we exclude the few shocks that occurred when oil was already rising, there was a slightly stronger tendency to see further gains in the weeks/months ahead.

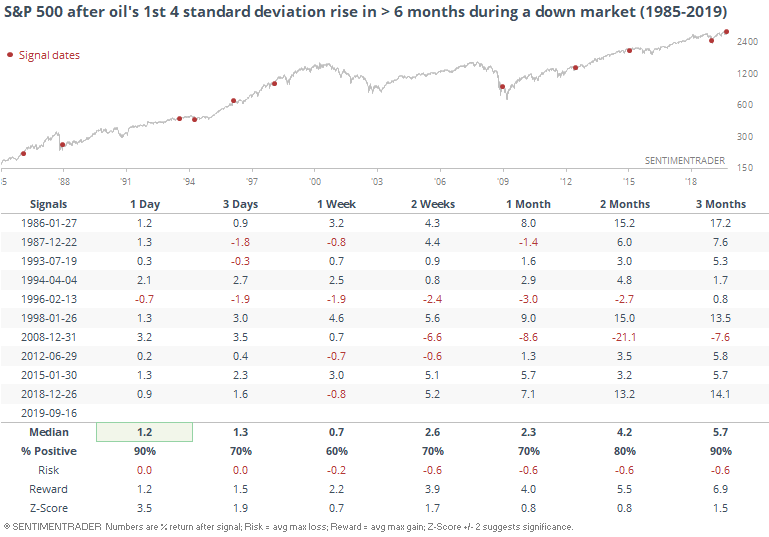

For U.S. stocks, these did not have the impact that probably most believe they did. In the days, weeks, and months following similar oil shocks, the S&P 500 did very well.

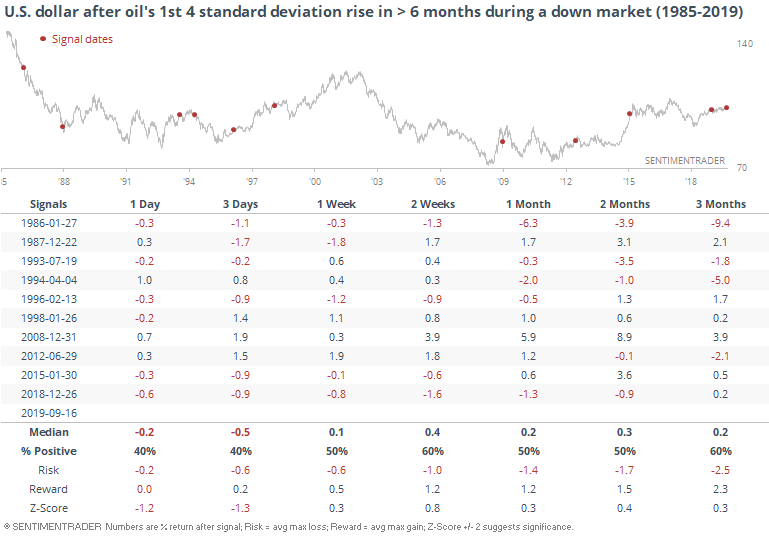

There wasn't much consistency in future returns on the dollar.

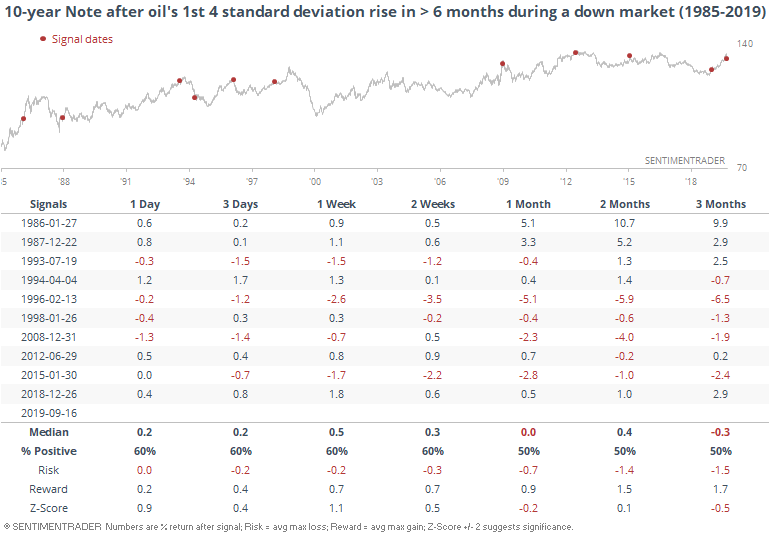

Or 10-year Treasury note futures. Maybe a slight bias for weakness in bond prices (rise in yields) but it's iffy.

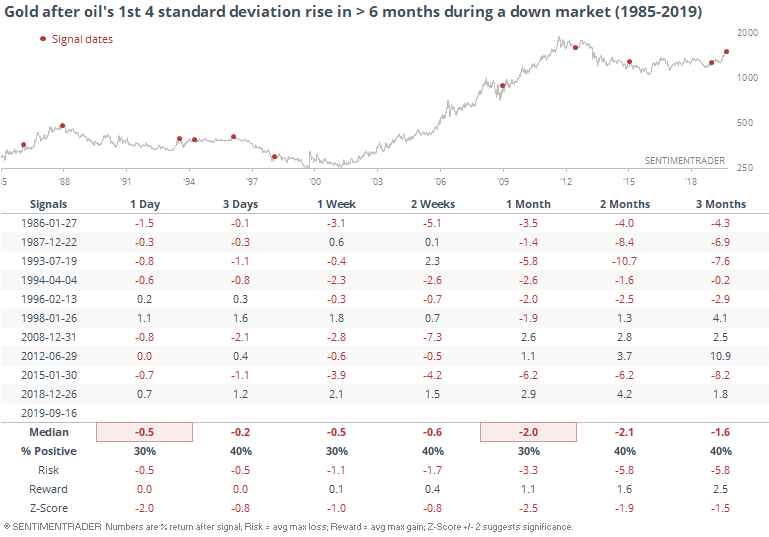

Gold did not exactly prove to be a haven from these oil shocks.

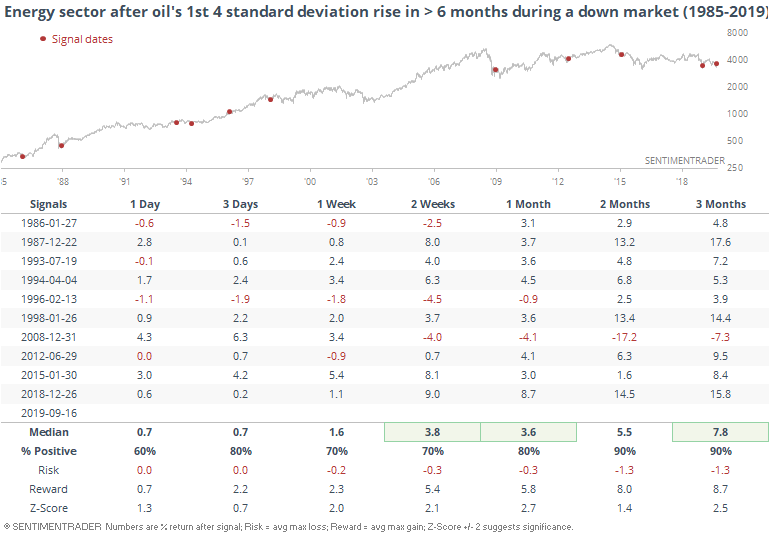

Within U.S. sectors, these quick jumps in oil prices proved to be a boon to energy stocks. The risk/reward here was unusually strong, especially for a sector that has gone through many multi-year periods of lagging price action.

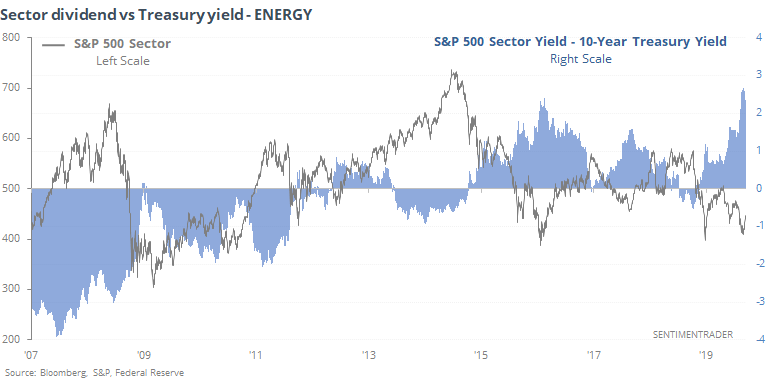

It's probably worth re-mentioning this chart from last week. Out of all sectors, energy has the best spread in dividend yield relative to Treasuries. That's going to change with today's moves, but it's still going to be at/near record territory.

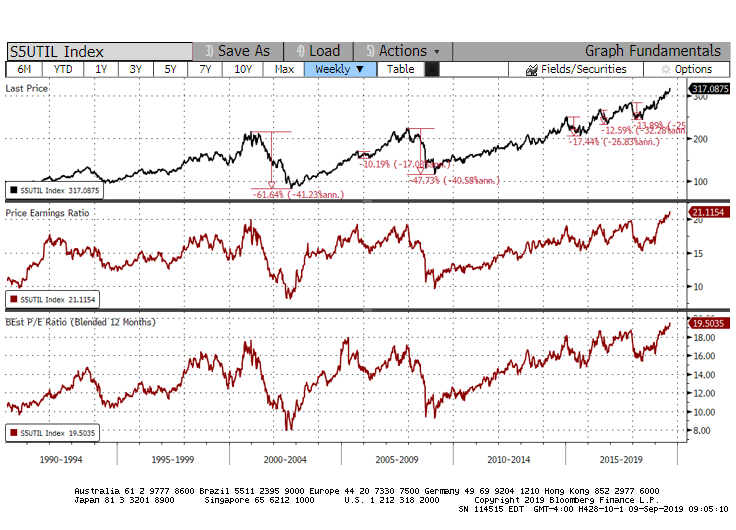

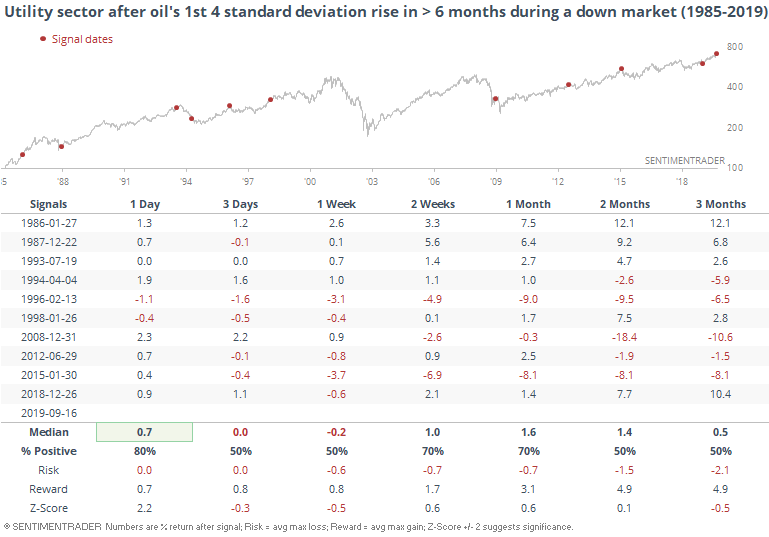

Utility stocks had the worst reaction to these moves in oil.

This is another potential headwind for the sector, following what we already looked at a couple of weeks ago, and the fact that they're the most richly valued in nearly 30 years.