Market & fundamentals overview: the rally continues

Here's my market outlook:

- Long term risk:reward (e.g. 1-5 year basis) doesn’t favor bulls. Valuations are high, but valuations can remain high for years before stocks crash.

- Fundamentals (6-12 months): still bullish because there is no significant U.S. macro deterioration.

- Technicals (1-3 months): mixed/bearish

Fundamentals (6-12 months)

The economy and the stock market move in the same direction in the long term. Hence, leading economic indicators are also long term leading indicators for the stock market.

Overall, there is no significant U.S. economic deterioration right now. This is bullish for the stock market on a 6-12 month time frame. The main weak points in U.S. macro revolve around trade, manufacturing, and the yield curve. For more details and charts, please see the bottom of this post.

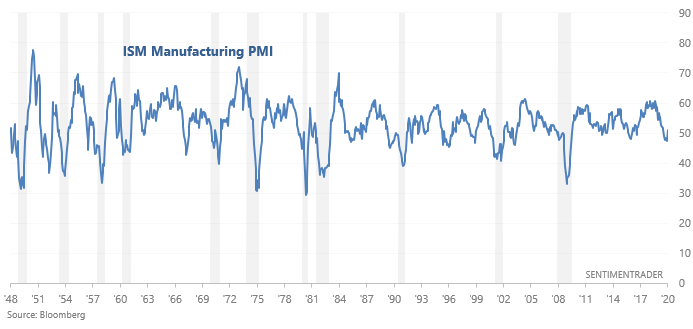

And as a sidenote, I mentioned on Monday that the recent *potential* turnaround in U.S. manufacturing (ISM manufacturing PMI) is a positive for stocks on a 3-12 month forward basis.

Technicals (1-3 months)

Our outlook over the next 1-3 months is mixed/bearish. Let's start with the bearish factors, and then we'll examine the bullish factors.

Bearish:

Breadth

As Jason noted on Tuesday, a cluster of Hindenburg Omen signals have been triggered recently. This led to losses for the S&P 69% of the time over the next 3 months.

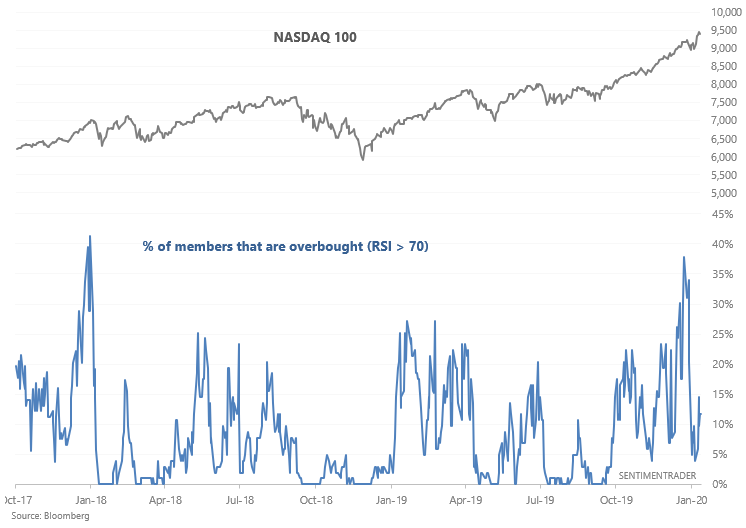

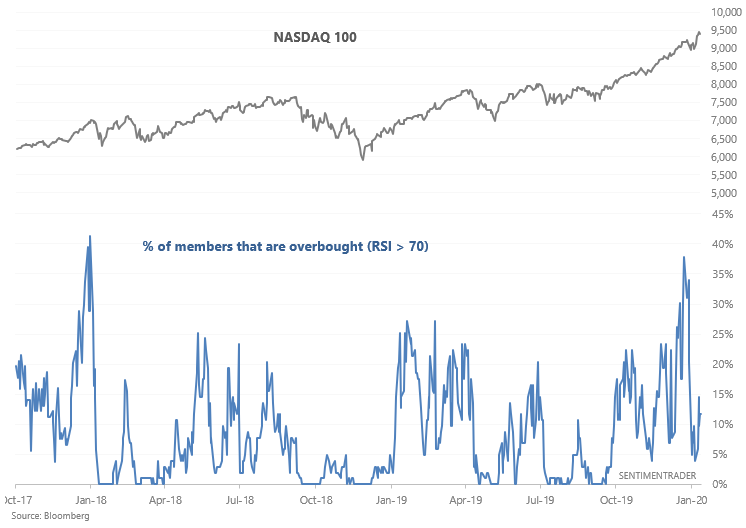

In the meantime, tech stocks continue to push higher.

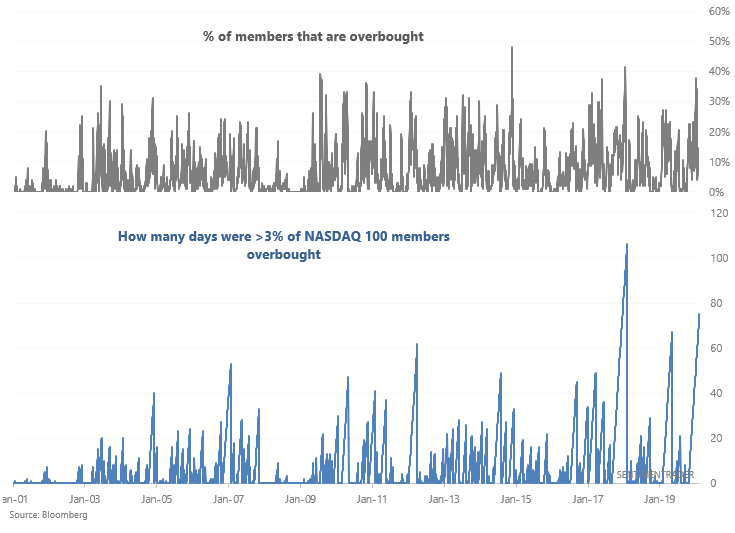

More than 3% of the NASDAQ 100 stocks have been overbought for 75 consecutive days, which is the 2nd longest streak from 2001-present:

The only other streak this long was during the stock market's non-stop rally in 2017, which ended with a correction + a VIX explosion in early-2018.

Sentiment

As Jason noted on Monday, sentiment is starting to become less extreme for the first time in months. While this may be interpreted as a good sign for U.S. equities, stocks usually needed more time in the short term to work off recent excess (up to 2 months).

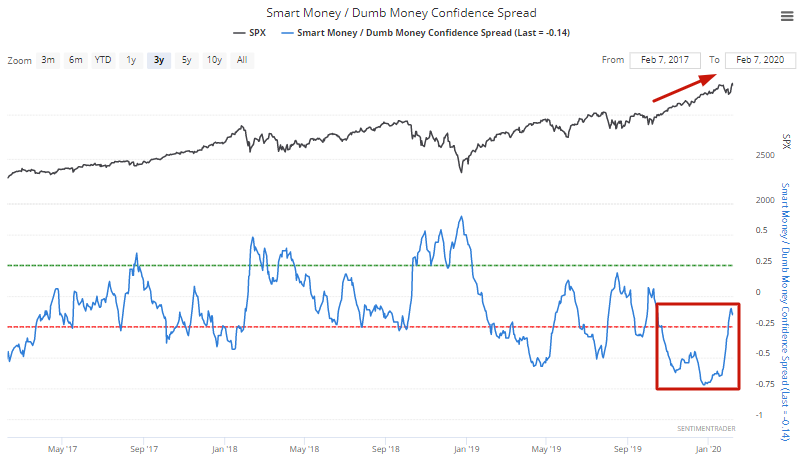

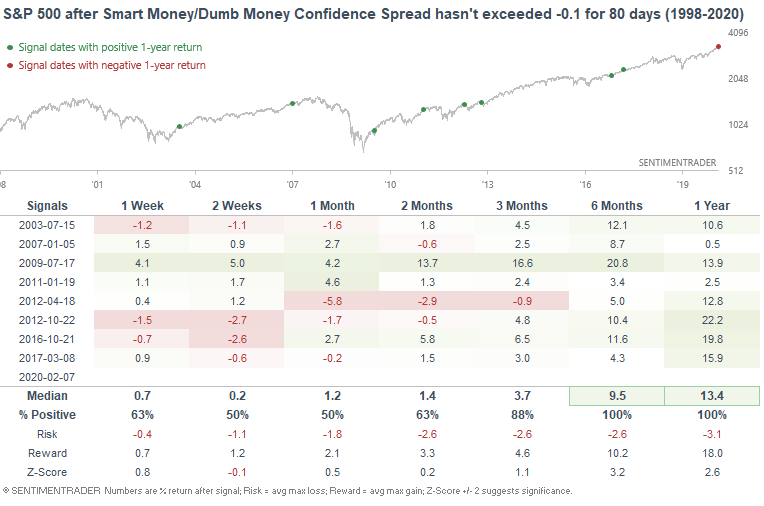

But on a longer term basis (e.g. 6-12 months), extreme optimism is bullish for equities since it tends to happen during bull markets. For example, the Smart Money/Dumb Money Confidence Spread has not exceeded -0.1 for 80 consecutive days:

Such long streaks of optimism usually led to more gains for stocks over the next 6-12 months:

Nonstop rally

As I mentioned on Friday, tech stocks have rallied relentlessly over the past few months. The NASDAQ 100 has gone up 18 of the past 24 weeks, and when it did so during this bull market, the NASDAQ 100 usually fell over the next 1-2 months.

Mixed:

Oil

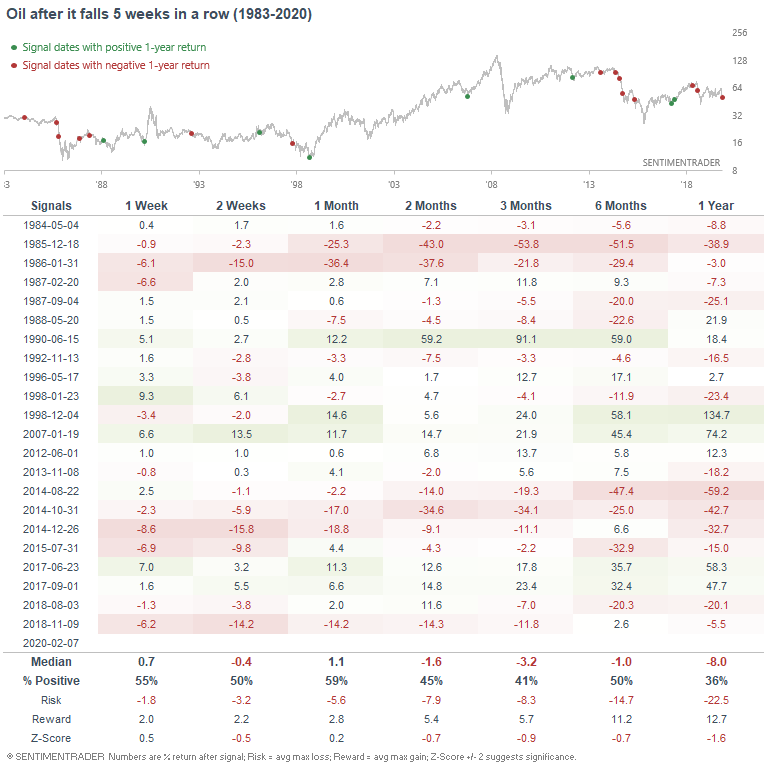

Commodities have tanked on global health fears. Among these falling commodities is oil, which is down 5 weeks in a row:

When oil fell 5 weeks in a row, it usually experienced weakness over the next year since many of these historical cases occurred within the context of an oil bear market:

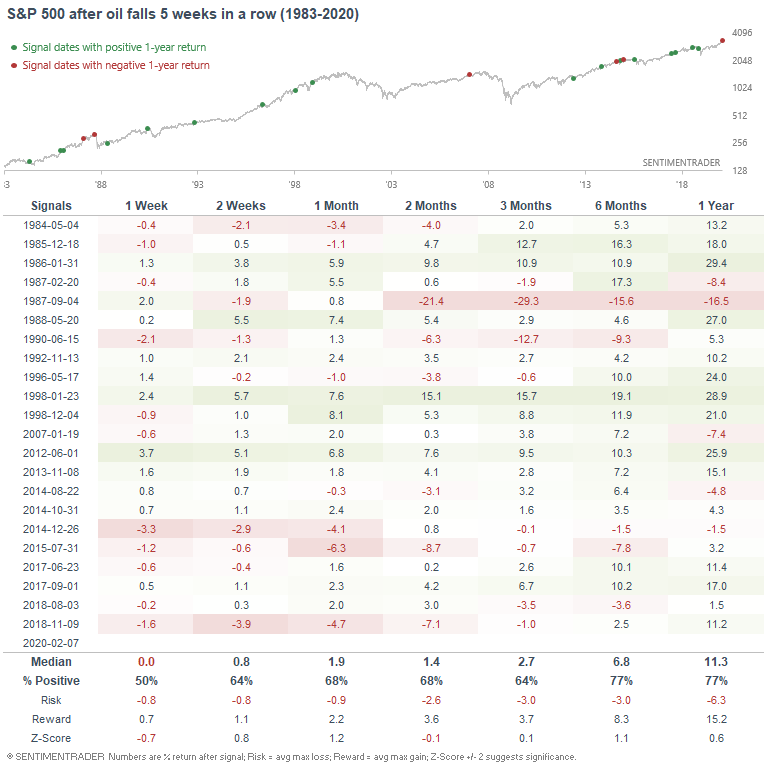

Does this mean that U.S. equities will fall as well, since "coronavirus fears can spill over into the global economy"? Historically, long DOWN streaks weren't consistently bullish nor bearish for the S&P 500:

Bullish:

Trend

There is no reason for a trader to be bearish on stocks from a trend following perspective. Major U.S. equity indices remain above almost all moving averages. In case you've ever wondered what the best moving average is, please check out this video.

Momentum

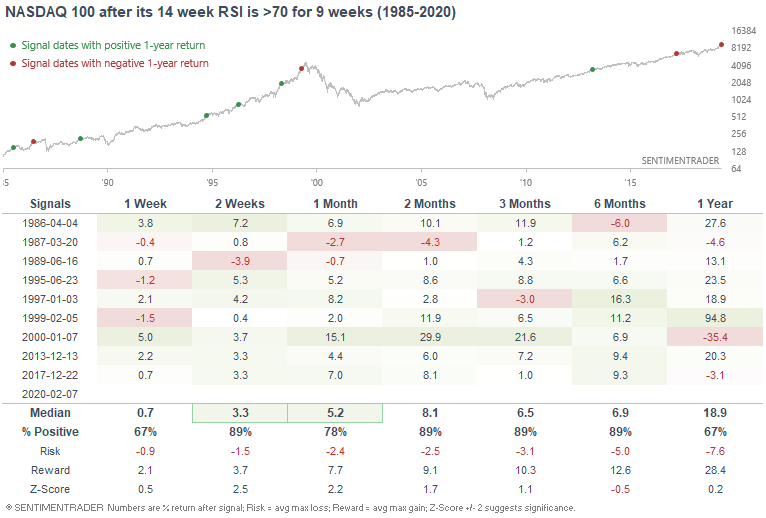

The stock market's momentum is still relatively strong after a brief pullback. Tech continues to lead the rally, which is why the NASDAQ 100 remains consistently overbought:

When the NASDAQ 100's RSI was consistently overbought (i.e. momentum was consistently strong), the NASDAQ 100 usually rallied further in the coming weeks and months. "Sooner or later" there was a pullback, but it's hard to pinpoint where exactly. Sometimes the market fell immediately, and sometimes it rallied further before falling.

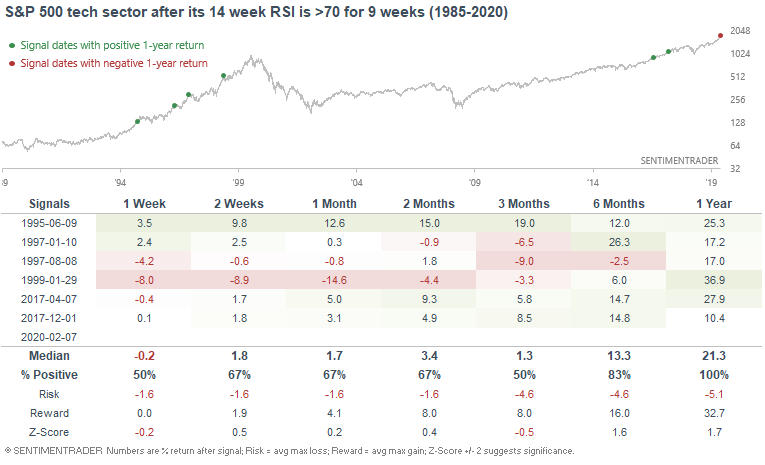

Here's the same stat, applied to the S&P 500 tech sector. Overall, strong momentum is bullish for stocks on a 6-12 month forward basis:

Breadth

As I mentioned on Wednesday, the sudden jump in "% of S&P 500 stocks in a correction" is bullish for U.S. stocks on a 1 month forward basis. This usually happens when the market experiences a period of strong momentum and then makes a quick pullback.

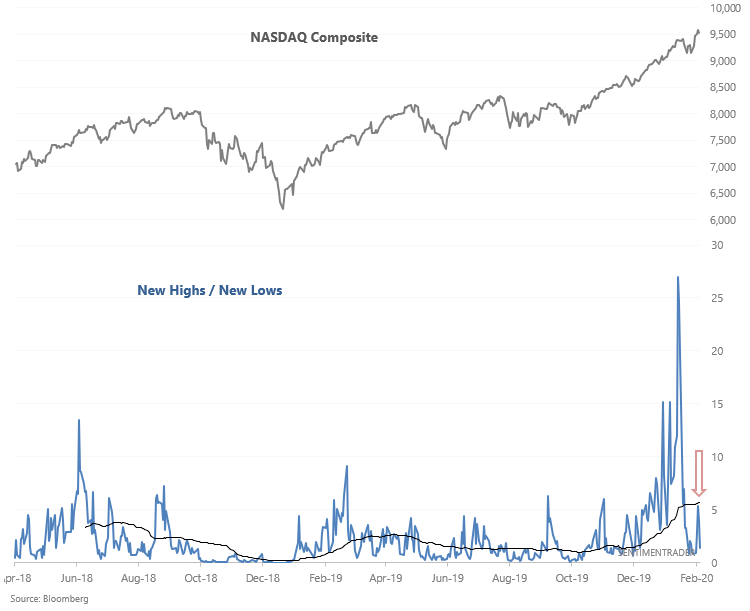

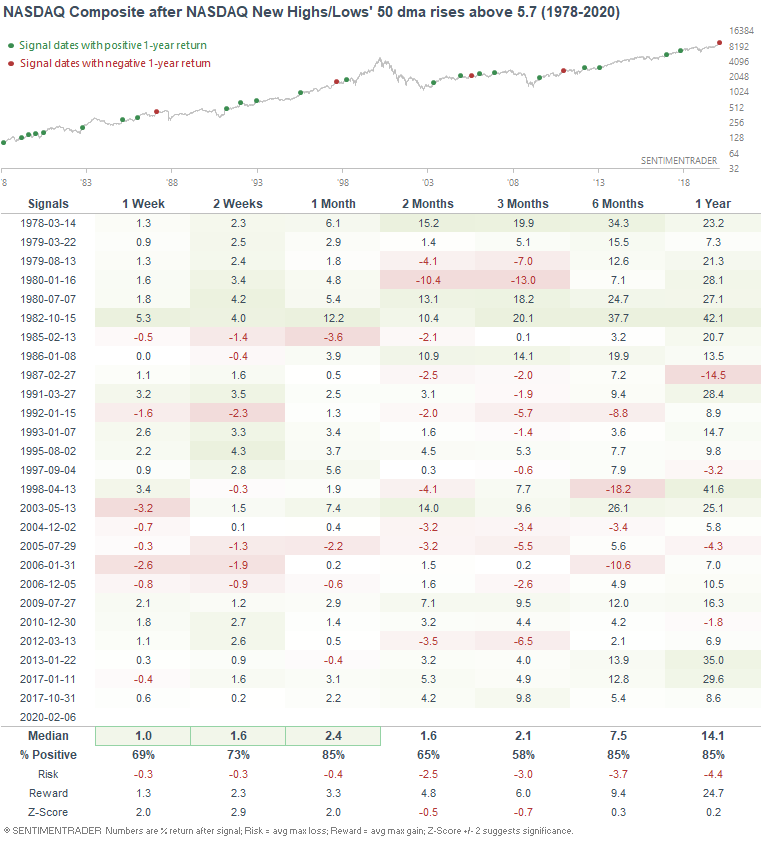

In addition, the NASDAQ New Highs/Lows ratio's 50 dma has risen to 5.7 as tech stocks continue to make all-time highs:

When it did so in the past (i.e. strong trend), the NASDAQ Composite usually continued to rally:

February 8, 2020: Fundamentals Overview Part 2

This is Part 2 of a weekly update on the U.S. stock market's long term fundamentals. Part 1 can be found here.

Fundamentals 1-3 years: market timing

I don't try to predict the future of the economy. Plenty of very smart people try, and when you add up the successes+failures, the results are usually no better than a 50/50 coin toss. That's why I focus instead on leading economic indicators. Look at what has already happened instead of predicting the future.

The economy drives corporate earnings, which drives the stock market in the long term. As a result, bull markets usually coincide with economic expansions, and big bear markets usually coincide with recessions.

Since the stock market tends to peak before recessions begin, we need to look at leading economic indicators, which also deteriorate before recessions begin. This doesn’t mean that the stock market’s exact top cannot occur before macro starts to peak. This happened in January 1973, when the stock market peaked a few months before macro started to deteriorate. However, the biggest part of bear markets always occur after macro has deteriorated significantly.

Here’s a brief summary of the leading and most important economic indicators I track, some of which I include in the Macro Index. The ones that are included in the Macro Index have an asterisk beside them**

Bullish factors right now

- Labor market**

- Housing**

- Financial conditions

- Heavy Truck Sales**

- Inflation-adjusted retail sales

Neutral/bearish factors right now

- Corporate profits

- High yield spreads

- Manufacturing**

Bearish factors right now

- Yield curve**

Bullish factors

Labor market

Labor market indicators do not show any significant deterioration right now.

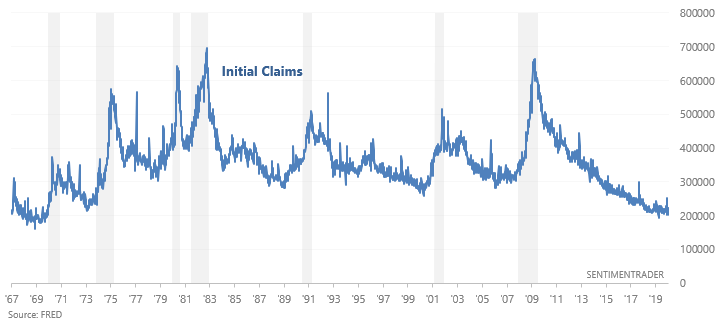

Initial Claims

Initial Jobless Claims measures the number of jobless claims filed by people who are seeking to receive jobless benefits. In other words, this measures the number of people who are recently unemployed. This economic indicator continues to trend sideways. In the past, Initial Claims trended higher before a recession began. This is still a positive point for macro, but watch out over the next few months in case Initial Claims trends upwards because Initial Claims is very low right now.

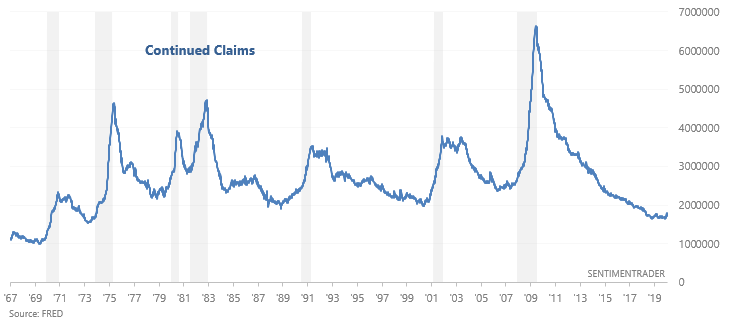

Continued Claims

Continued Jobless Claims measures the number of people who are still filing jobless claims (past the initial claim). This economic indicator continues to trend sideways. In the past, Continued Claims trended higher before a recession began. This is still a positive point for macro, but watch out over the next few months in case Continued Claims trends upwards because Continued Claims is very low right now.

Housing

Housing market indicators do not show significant deterioration right now.

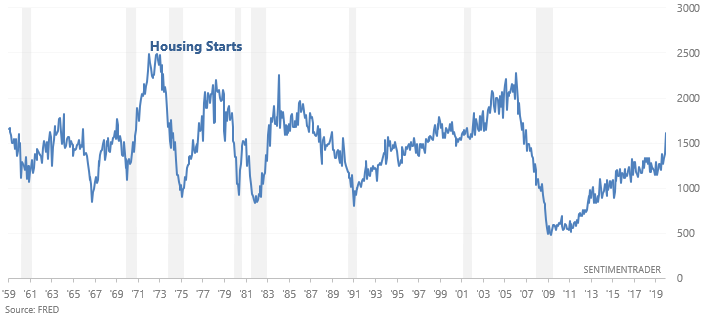

Housing Starts

Housing Starts measures the number of new homes that are starting to be built in the U.S., from the time of first excavation. This figure is trending higher right now. In the past, Housing Starts trended downwards before recessions began. This is a positive for macro.

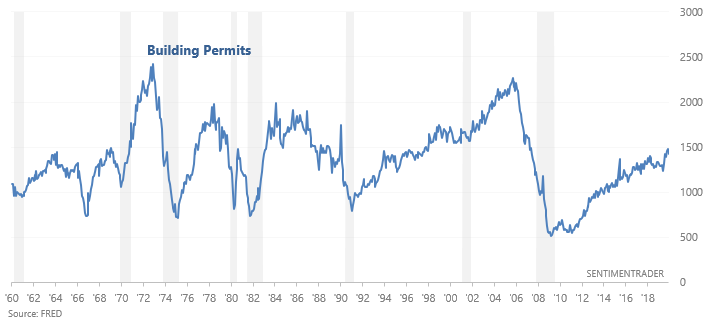

Building Permits

Building Permits are trending upwards right now. In the past, Building Permits trended downwards before recessions began. This is a positive for macro.

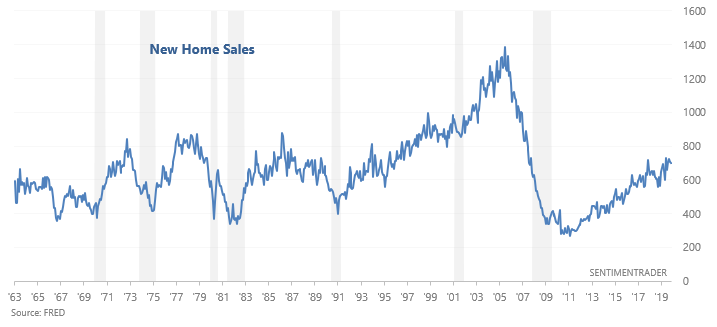

New Home Sales

New Home Sales are trending upwards right now. In the past, New Home Sales trended downwards before recessions began. This is a positive for macro.

Financial Conditions

Indicators related to financial conditions remain relatively loose. This is a positive for macro.

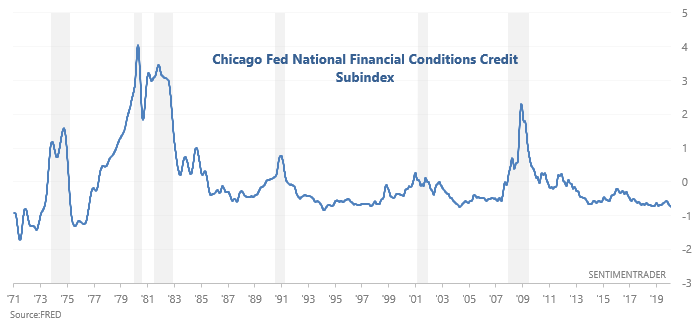

Chicago Fed Financial Conditions Credit Subindex

The Chicago Fed Financial Conditions Credit Subindex remains quite low. Looking at the bigger picture, the Credit Subindex is trending sideways right now. In a credit-driven economy, the Credit Subindex tends to trend solidly upwards (i.e. tighten) before a recession begins.

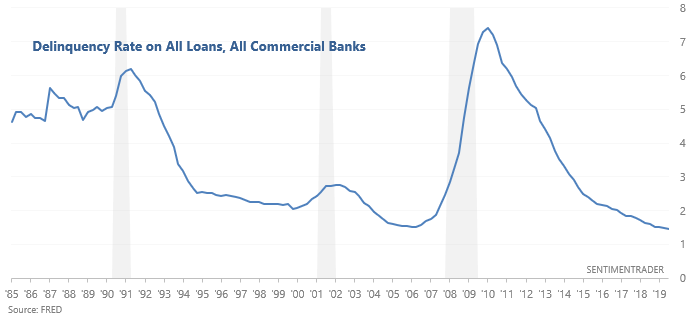

Loans

The Delinquency Rate on All Loans continues to trend downwards. In the past, the Delinquency Rate trended higher before a recession began. This is a positive for macro.

Banks’ lending standards

Banks are starting to tighten their lending standards right now. In the past, lending standards tightened for several quarters before a recession began, causing the Net Percentage of Banks Tightening Standards to trend higher. This was a positive for macro, but is now something that bulls should watch out for in case lending standards continue to tighten.

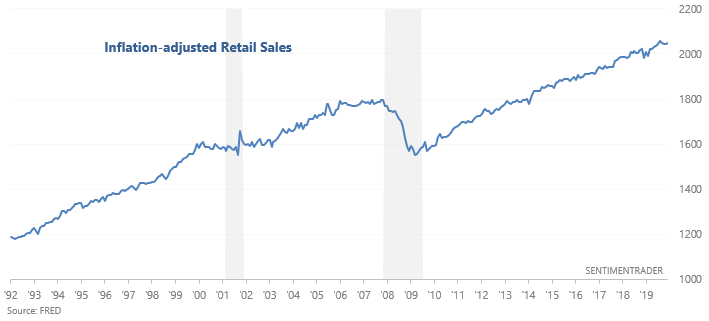

Inflation-adjusted retail sales

Inflation-adjusted Retail Sales continue to trend higher. In the past, inflation-adjusted Retail Sales trended sideways before recessions began. This is a positive for macro.

Neutral/bearish factors

Corporate Profits

Figures related to corporate profits suggest that the economic expansion is definitely late-cycle.

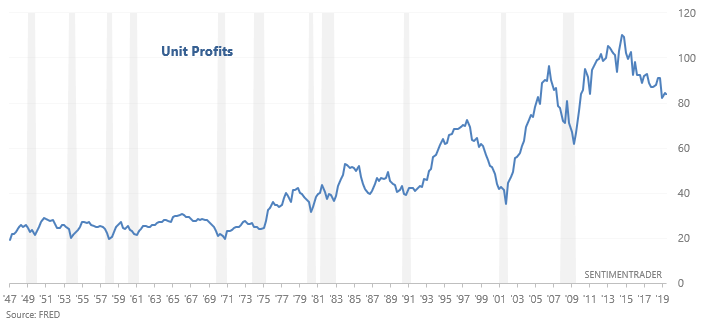

Unit Profits

Unit Profits continue to trend downwards, which is typically what happens in the second half of an economic expansion cycle. However, this indicator is not a timing tool. Unit Profits can fall for years before a recession begins.

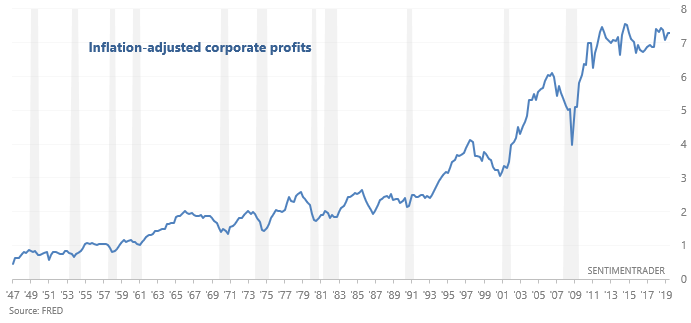

Corporate Profits

Inflation-adjusted corporate profits are trending sideways. In the past, inflation-adjusted corporate profits trended downwards for several quarters before recessions began. If corporate profits start to trend downwards, this will be a negative for macro in 2020.

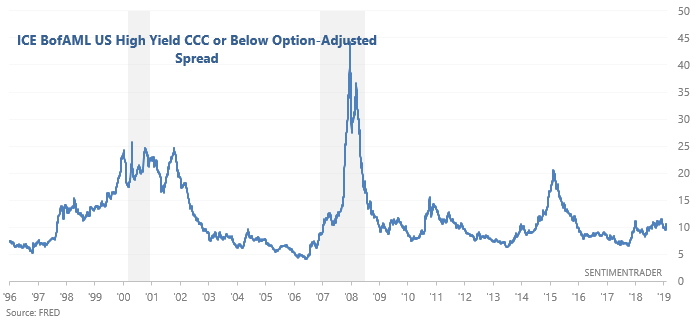

High yield spreads

From September 2018 – present, high yield spreads on the lowest rated bonds have been trending higher while the stock market has made higher highs. This is a necessary but not sufficient condition for bear markets and recessions. In the past, high yield spreads on these bonds trended higher before bear markets and recessions began. Meanwhile, high yield spreads in general are still trending lower. Overall, this is a neutral factor for stocks right now.

Manufacturing

The manufacturing sector remains one of the weakest parts of the U.S. economy. For example, the ISM Manufacturing PMI is currently just above 50. This is a bullish factor for our Macro Index.

Bearish factors

Yield Curve

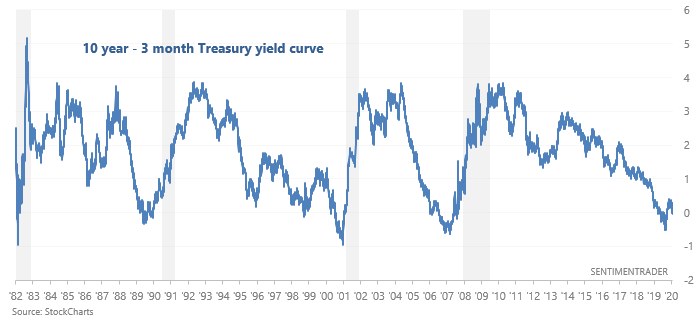

Both the popular 10 year - 2 year and 10 year - 3 month sections of the yield curve were recently inverted, and are now trending higher. Here's the 10 year - 3 month yield curve, which historically has been a better market timing indicator than the 10 year - 2 year yield curve:

Overall, the yield curve is a bearish factor for macro right now because inversions & post-inversion steepenings tend to occur 1-2 years before recessions and bear markets begin. HOWEVER, the yield curve is merely one of many factors to consider, and it is not flawless.

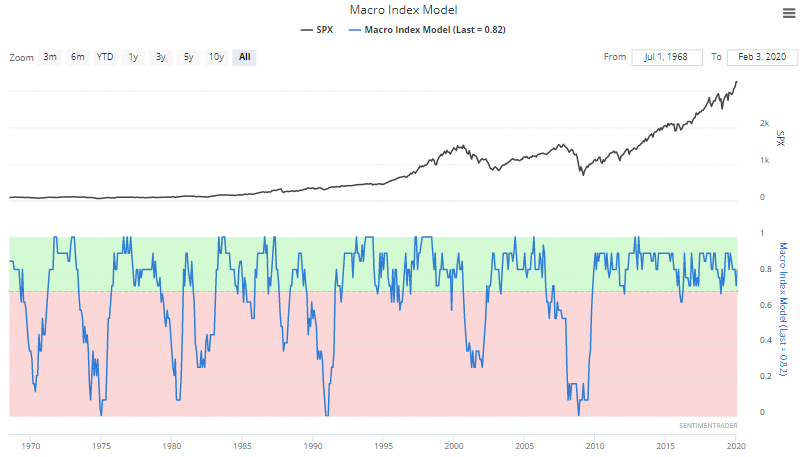

Macro Index

The Macro Index includes:

- New Home Sales

- Housing Starts

- Building Permits

- Initial Claims

- Continued Claims

- Heavy Truck Sales

- 10 year - 3 month Treasury yield curve

- S&P 500's 10 month average

- ISM Manufacturing PMI

- Margin Debt

- Inflation