It May Be Now or Never for Grain Bears

That well-known adage states quite succinctly that "Patience is a virtue."

The lesser-known full version of that adage states that "Patience is a virtue. And also, a pain in the a__."

This is particularly true in the realm of trading, as captured in:

Jay's Trading Maxim #38 - Two of the keys to trading success are:

- Taking decisive action when the moment to take decisive action arrives (and doubt is highest)

- Doing nothing the rest of the time (when the urge to "do something" is at its height)

In this piece on 7/12, I highlighted several reasons to be bearish on corn (also see this post), but in light of market action at the time, I also added the following:

As a result, before taking the plunge, traders may be wise to exhibit a small bit of patience and wait for:

- A clear breakdown below recent lows as confirmation of the start of a new down leg

- OR, for a short-term bounce in corn to relieve the current oversold status

In this piece on 7/6, I wrote about the potential for trouble in soybeans but issued similar cautions about the short-term.

Now it appears that the decisive moment may be at hand for grain bears.

RECENT PRICE ACTION

The charts below display the recent price action for both corn and soybeans.

Note that both markets:

- Rallied in the past few weeks

- Did not come anywhere close to testing the previous highs

- Are no longer oversold (basis the 3-day RSI)

In a nutshell, both of these markets are set up for another potential decline.

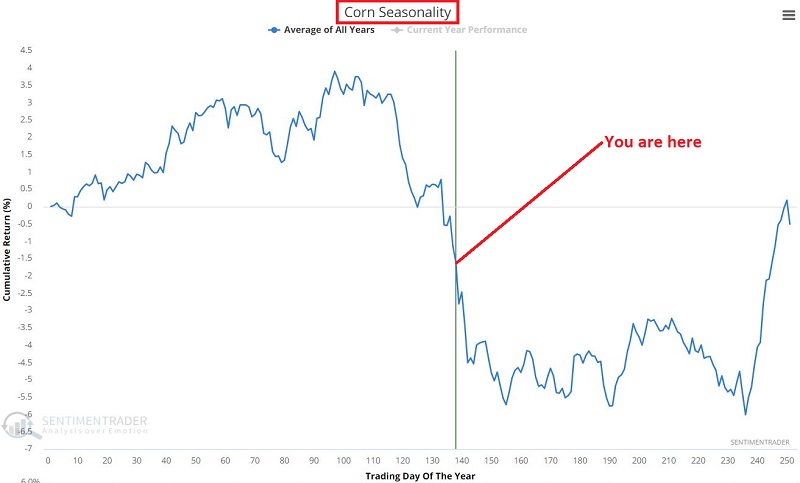

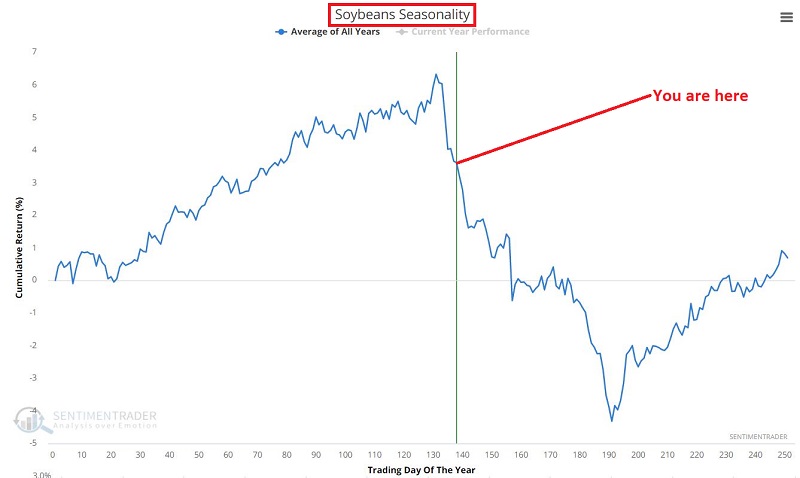

THE SEASONAL HEADWIND

As a reminder, the annual seasonal trend for corn and soybeans appears in the charts below.

It is important to note that despite the scary nature of the seasonal charts above, in any given year, corn and/or soybeans can rally sharply when they are "not supposed to," typically due to extreme weather in the planting and/or growing seasons.

WHERE TO FROM HERE?

The reality is that it is impossible to predict whether the typical seasonally unfavorable bias will kick in or whether this will be "one of those years" for grains.

But regardless, your job as a trader is to:

- Weigh the evidence

- Make your choice

- Take action (or not)

- And - most importantly - incorporate steps to minimize your risk if you are wrong

As I write, both Corn and Beans have broken down below the low of recent days. Is this the beginning of the "big seasonal down leg?"

It beats me. But if it is going to happen this year, this seems like as good a time as any.