What I'm looking at - South Korea PPI, TLT Optix, McClellan Oscillator, Utilities Optix

With stocks moving on political news, here's what I'm looking at:

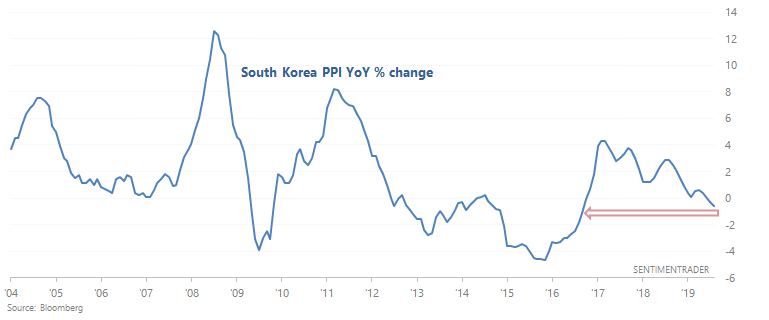

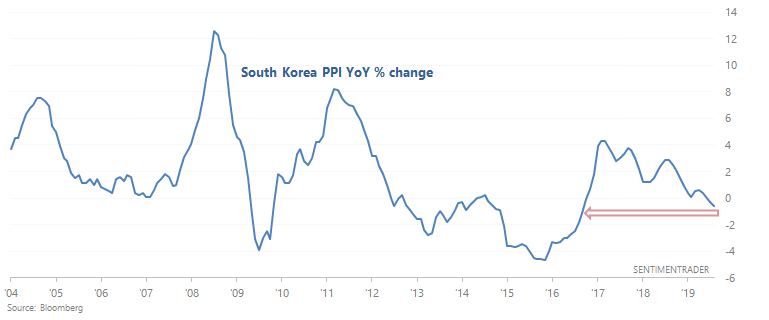

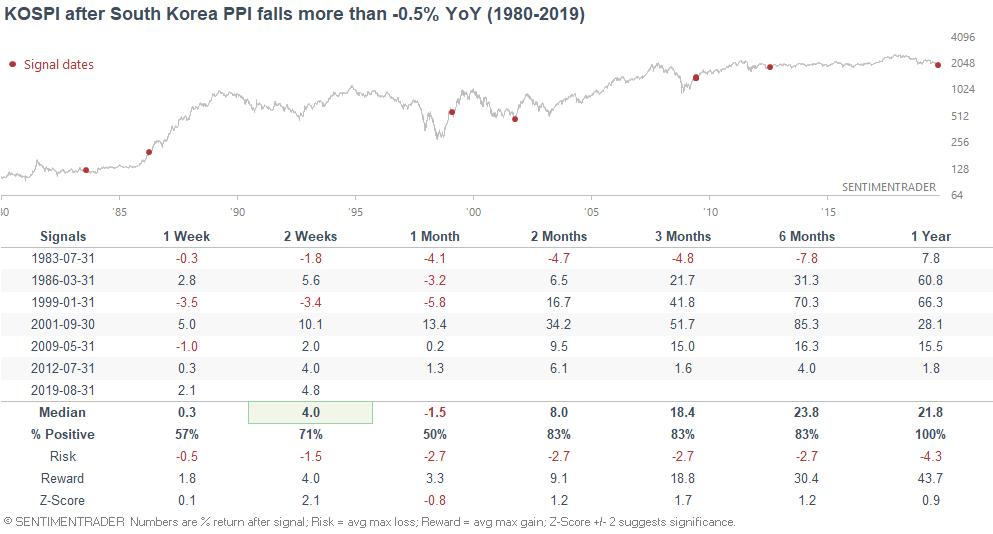

South Korea PPI

As the WSJ notes, South Korea's PPI continues to fall, with the YoY change currently at -0.6%

This is just another data point in the "global manufacturing is weak" theme. Same story, spun in a different way. And when South Korean PPI was this weak in the past, the South Korean and U.S. stock market's forward returns weren't terrible.

*Your job is to time the market. It's not to predict a "recession".

So from a market timing perspective, this is not a consistently bearish factor for equities.

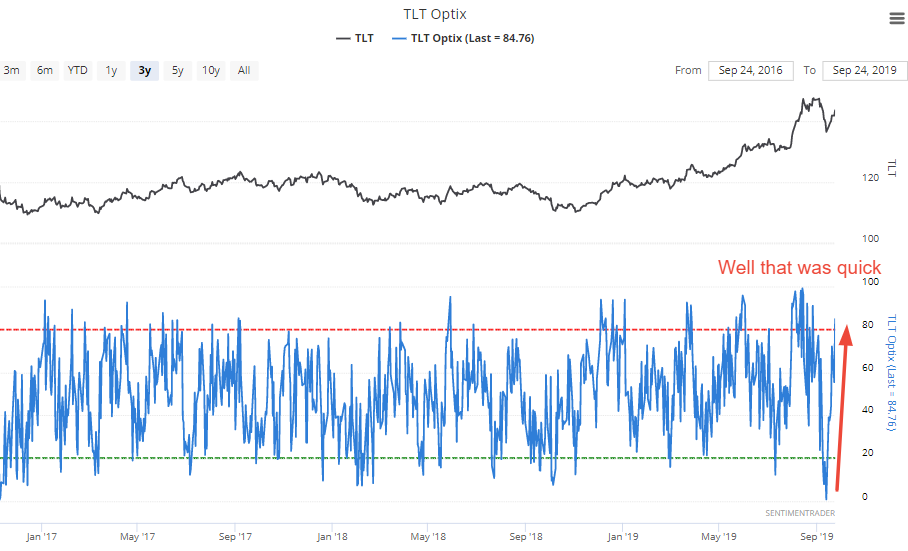

TLT Optix

In July and August many contrarian traders were betting that interest rates would stop falling (and bond prices would stop rising). With the stock market's rally earlier this month, it seemed they were vindicated. But now that various concerns are once again in traders' minds, bond prices are going back up (and rates are going back down).

As a result of this gyrations, our TLT Optix has very quickly gone from excessive pessimism (one of the lowest readings ever) to excessive optimism.

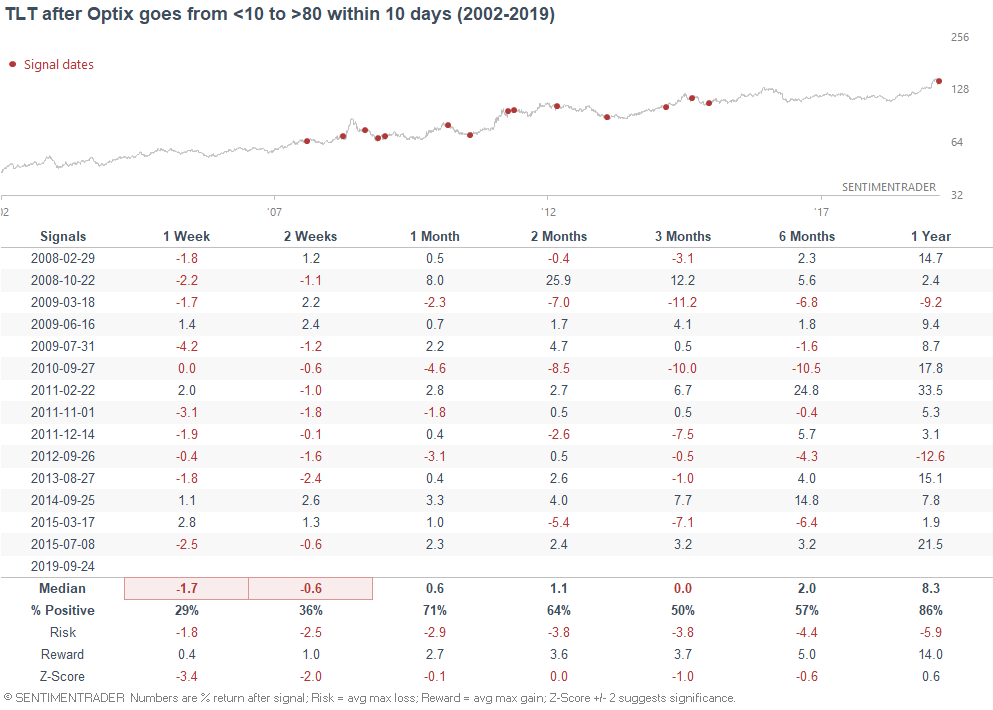

These quick ramps in TLT optimism were not good for bonds in the short term, with TLT typically pulling back over the next 1-2 weeks.

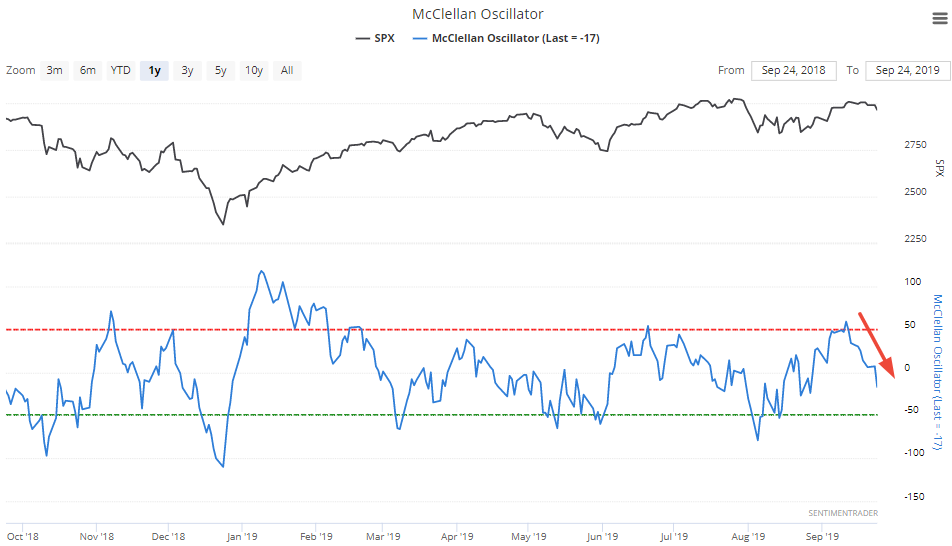

Stocks & breadth

Mirroring the rapid decline and subsequent rally in bonds, the McClellan Oscillator reached excessive optimism (>50) and is dropping rapidly.

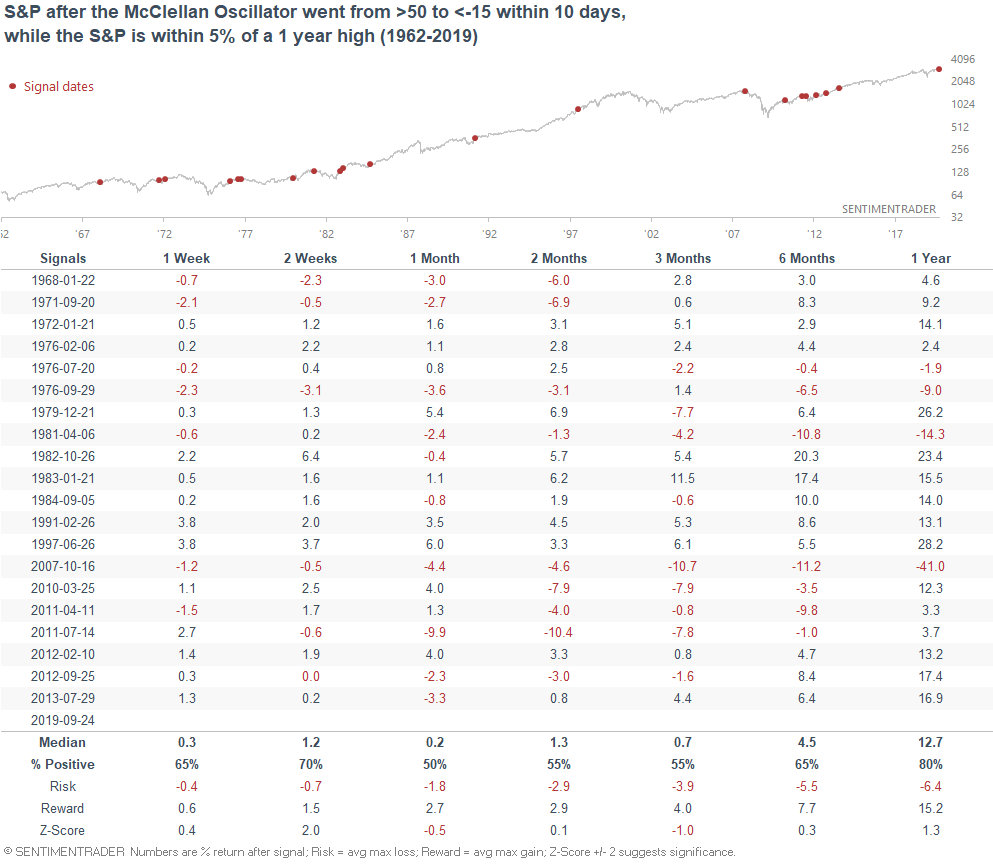

When this happened while stocks were near an all-time high in the past, the S&P's 2 week forward returns were more bullish than random.

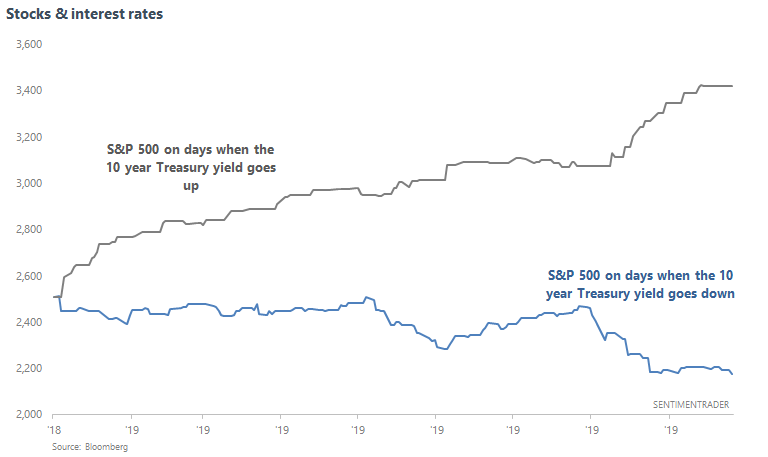

The TLT stat and McClellan Oscillator stat paint a scenario in which interest rates and stocks may rally together in the short term. This is an entirely possible scenario, considering that stocks and interest rates are moving in together on a day-to-day basis.

Defensive sectors' optimism & outperformance

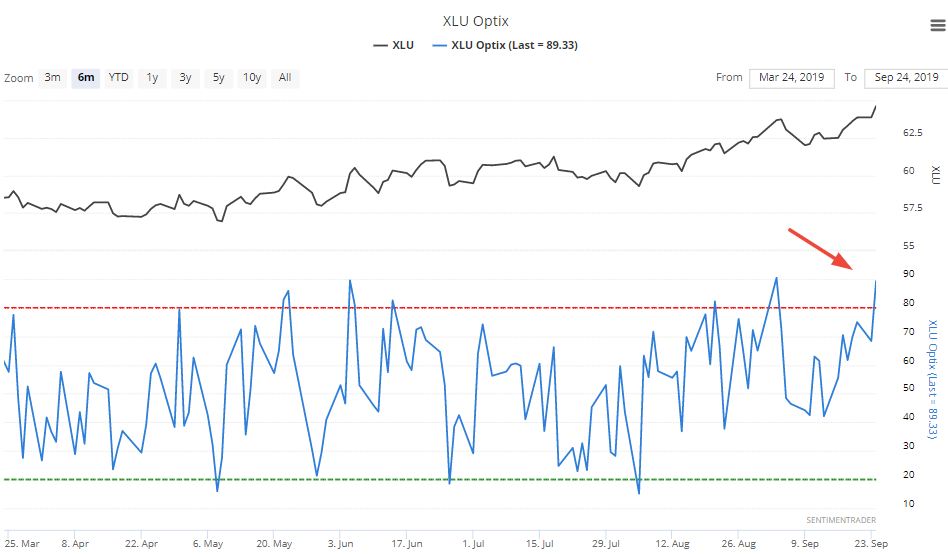

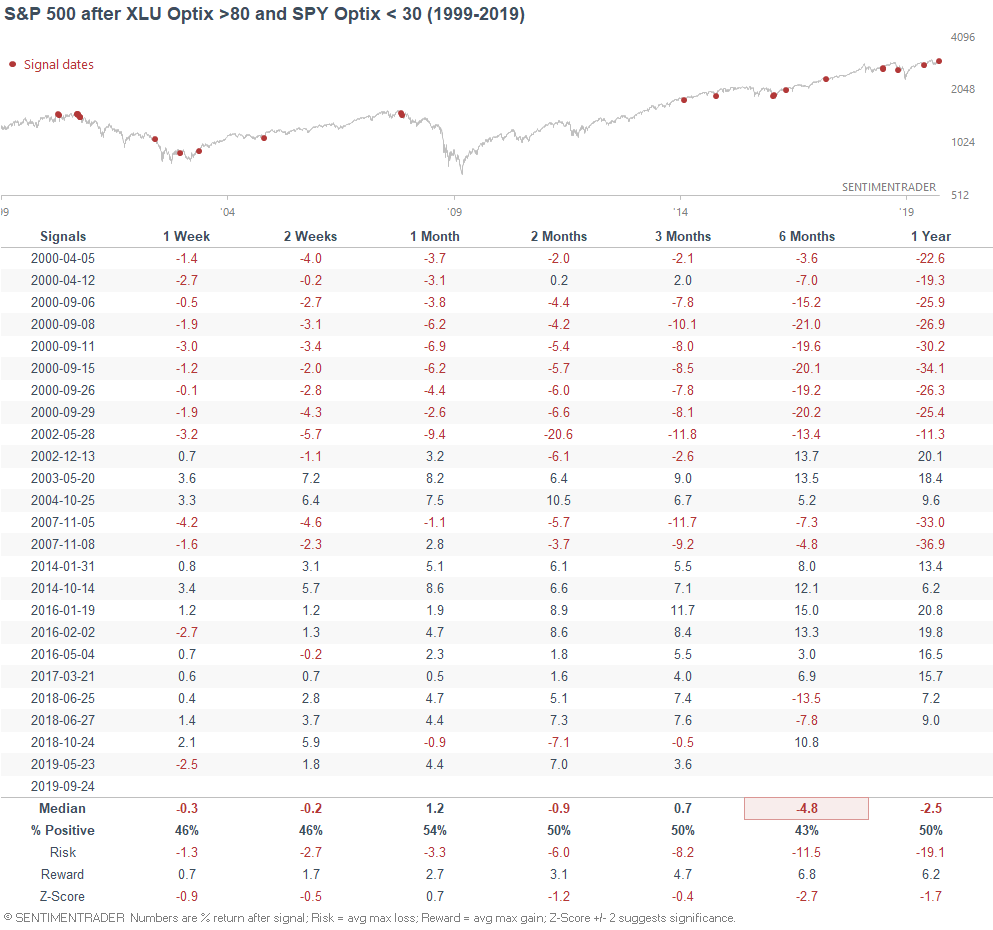

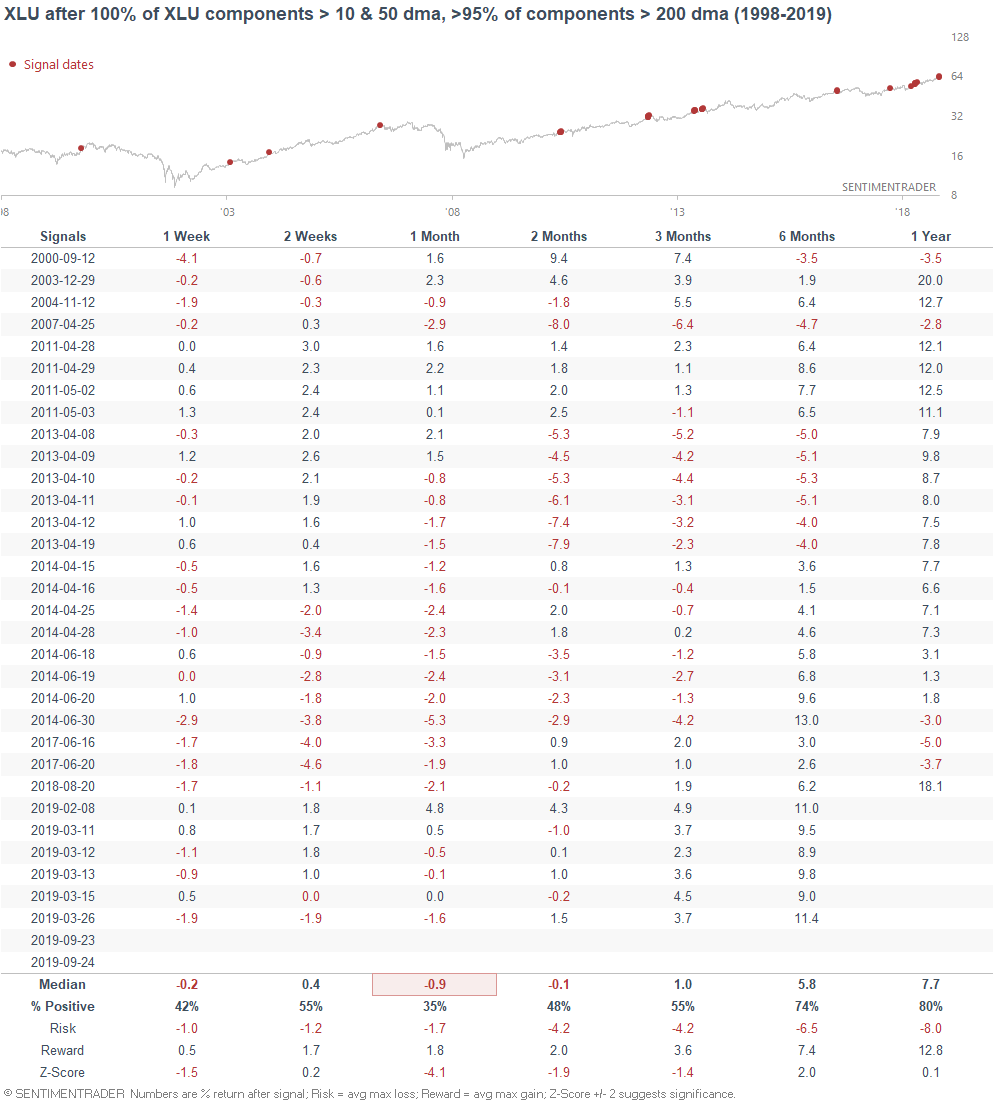

While the broad equity markets are mostly moving sideways, utilities (defensive sector) continue to outperform. XLU is making new all-time highs, taking sentiment along with it.

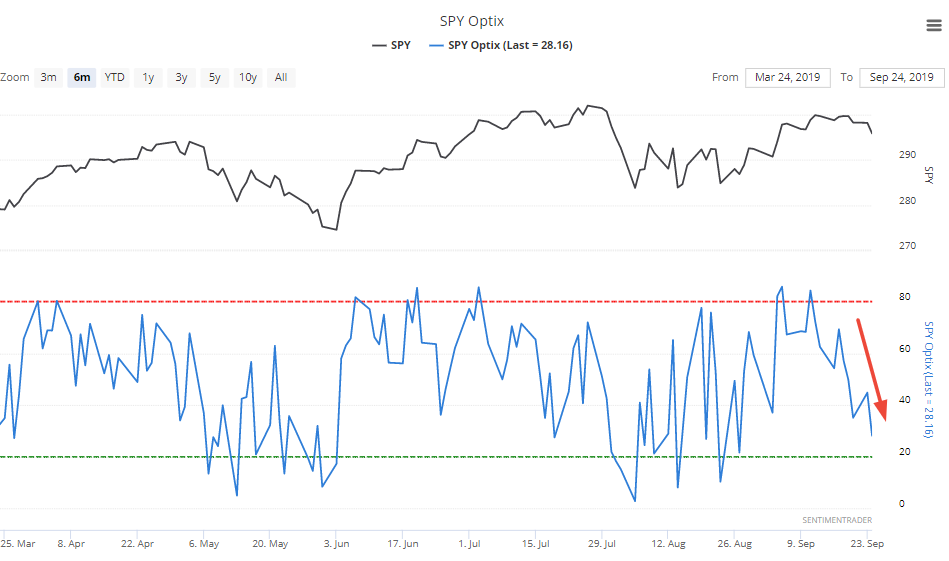

This stands in stark contrast with SPY's Optix...

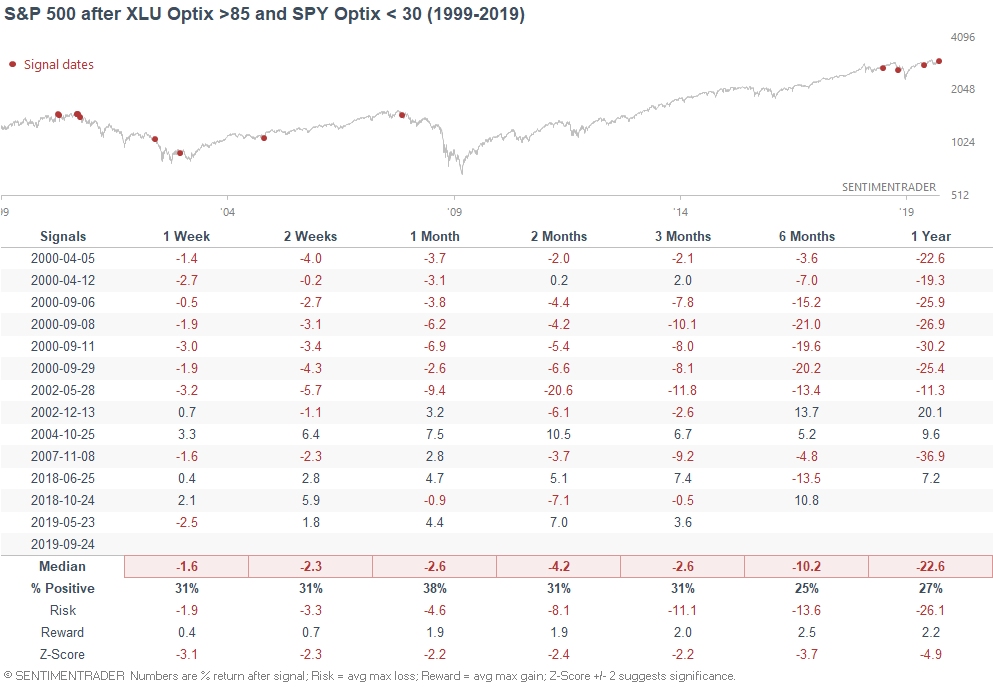

It's rare for traders to become this much more optimistic towards utilities than the broader SPY. When it happened in the past to this extent, the stock market's forward returns were not good. This happened before last year's Q4 crash, 2007, and 2000.

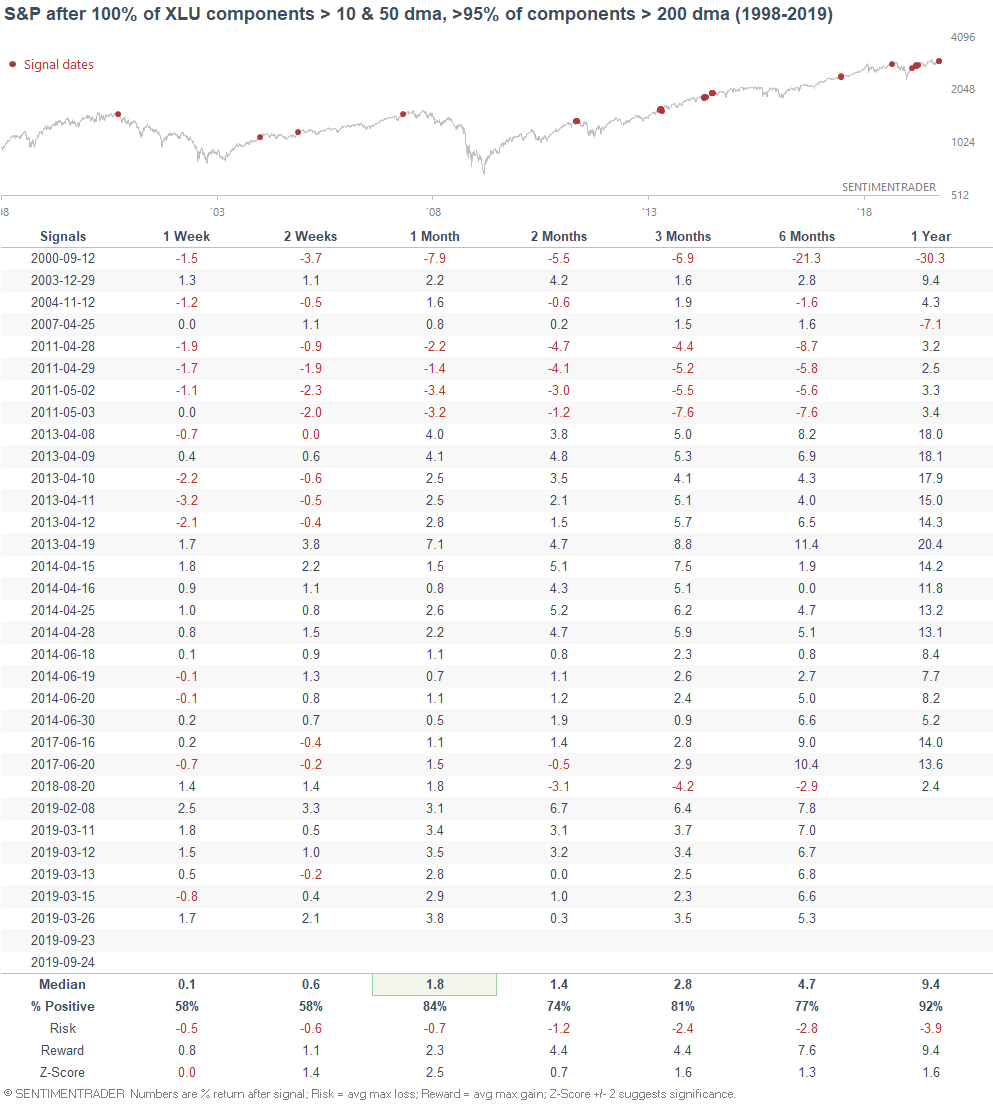

Even if we increase the sample size by relaxing the parameters, the S&P's forward returns were still below average.

Overall, bulls should watch the continued outperformance in defensives.