This breadth composite model signals risk-off

Key points:

- A breadth composite model issued a risk-off signal on Friday

- Similar conditions preceded negative returns over the next 2 weeks

The S&P 500 breadth composite divergence model

A new signal from a voting member in the composite risk-off model registered an alert on Friday. The component is called the Breadth Composite Divergence model.

The composite includes the following long-duration indicators:

- S&P 500 percentage of issues above the 200-day moving average

- S&P 500 percentage spread between 252-day highs and lows

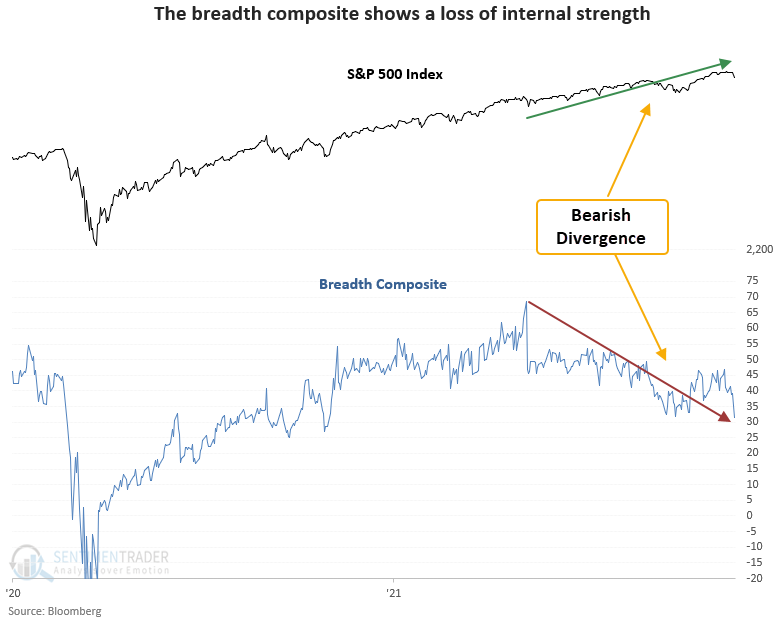

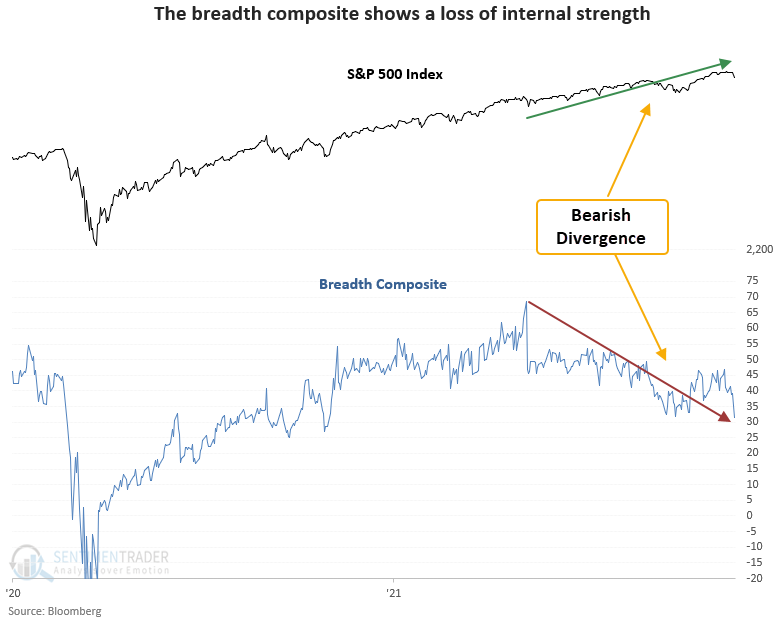

Breadth composite shows deteriorating internal trends

The composite peaked in May and has made a series of lower highs and lower lows. Conversely, the S&P 500 has made a series of higher highs and higher lows. This pattern is known as a bearish divergence setup.

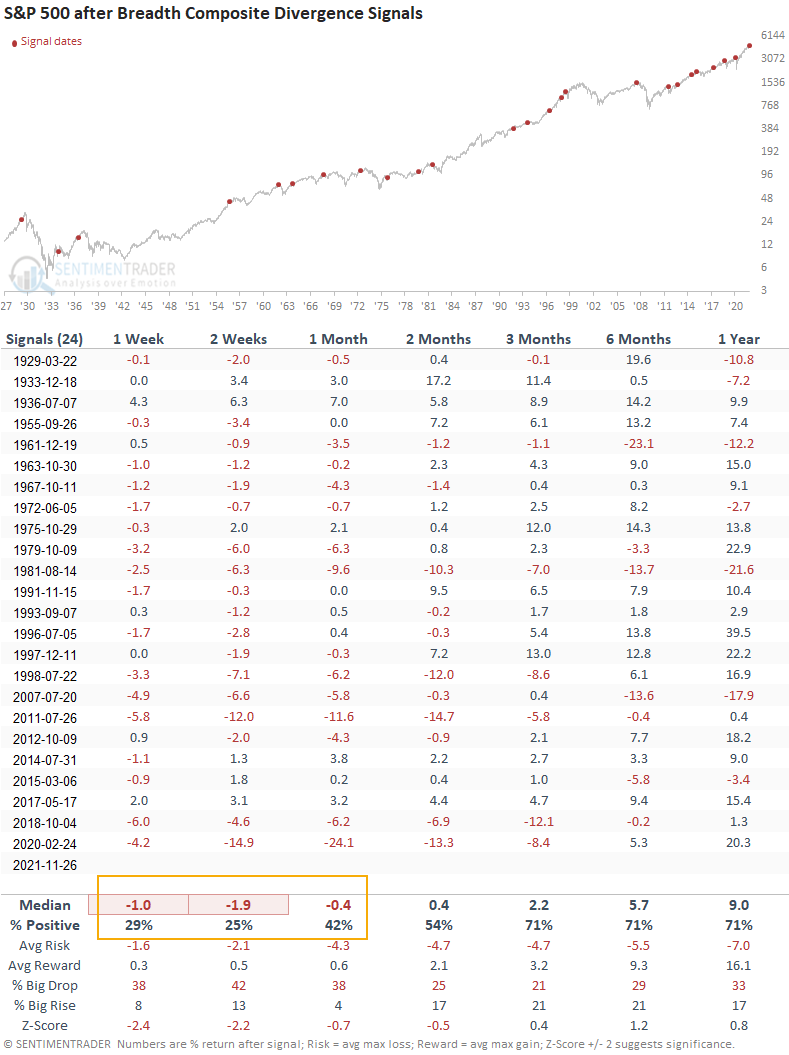

Similar signals preceded weak returns in the near term

This signal has triggered 24 other times over the past 93 years. After the others, future returns and win rates were weak in the short term with several unfavorable risk/reward profiles. The long-term results look slightly better than historical averages, even with a few notable signals around significant market peaks.

What the research tells us...

The breadth composite model identifies a divergence between the price of an index and its members. Similar setups to what we're seeing now have preceded weak returns and win rates in the short term. However, the long-term results suggest a pause that refreshes.