The struggle in high-yield bonds is a bull market warning

Key points:

- Since the high-yield bond market suffered a historic panic and then rebound, buyers went on strike

- The market has seen steady selling pressure since January, a break from past recoveries

- That's worrisome, though a few indicators suggest that junk bonds are oversold and nearing a positive seasonal window

High-yield bonds have had poor follow-through from initial surge

Since the peak in pessimism in October, followed by a rolling avalanche of breadth thrusts, things went about as perfectly as possible for bulls for several months. Now it's cheek-clenching time.

Ostensibly, one of the first places for trouble to show up is in high-yield bonds. As a sort of hybrid market between stocks and bonds, this is often where smoke will first start to smolder, as credit traders sell in anticipation of a shaky economy, corporate earnings, and debt coverage.

And those bonds have been acting terribly.

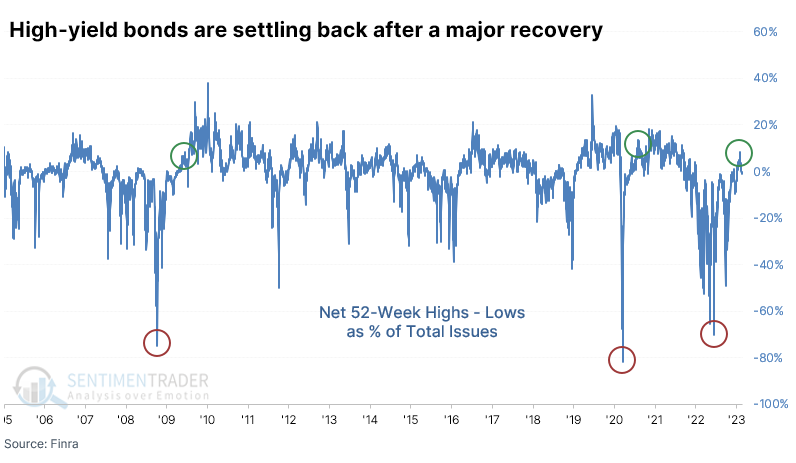

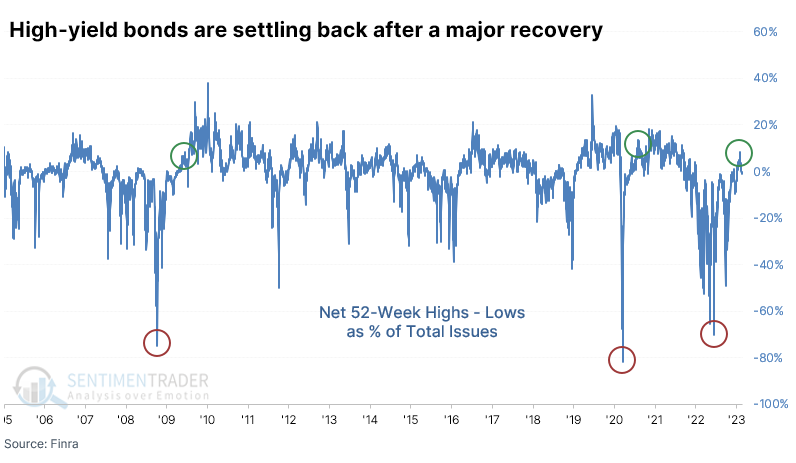

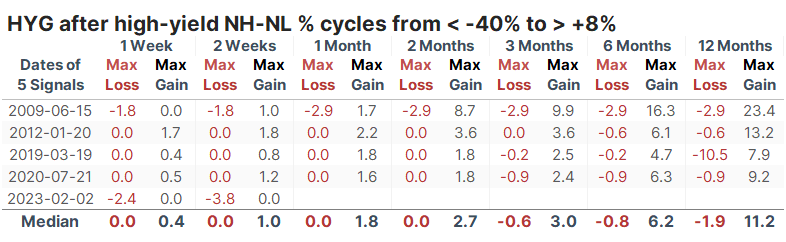

When investors panicked in October, there was a spike lower in the net percentage of high-yield bonds trading at a 52-week high minus 52-week low. It took until January for new highs to outnumber new lows - something not seen during the entirety of 2022 - and continued to surge into early February. This was similar to the last two recoveries in 2009 and 2020.

There is a sample size of two here, so of course, we can't read much, in anything, into it. It is disturbing that the reaction this time is significantly worse a couple of weeks after the surge than it was after the prior two instances.

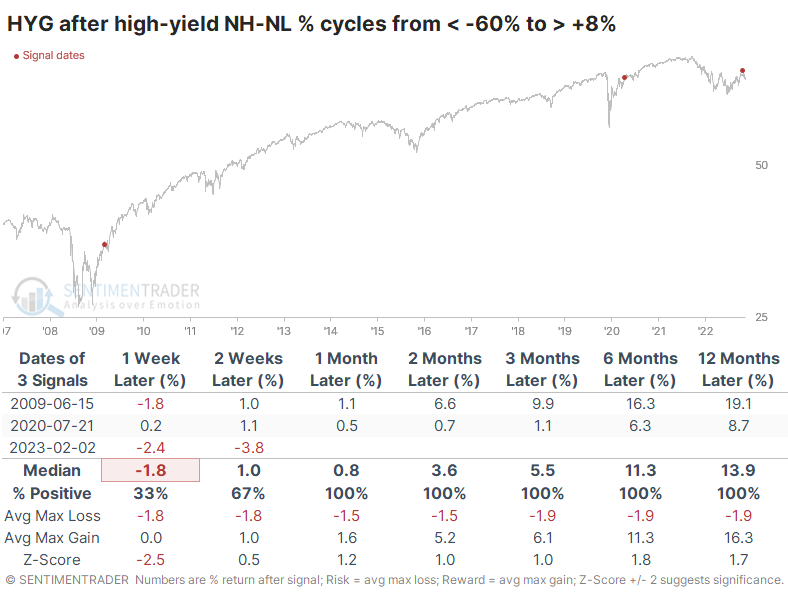

If we look for lesser panics in 52-week lows and subsequent recoveries, we still see the worst reaction in the first two weeks. The others saw positive returns each time.

The maximum losses and gains table across each time frame shows how much the current signal is an outlier. There was a dip after the 2009 surge, but even that was less than the current one. And after the initial surge this time, there has been no upside whatsoever. That's not the kind of behavior seen during bull markets.

Other indicators show heavy selling pressure

The breadth thrust in high-yield bonds last August suggested higher prices long-term, though there were some indications that it could be a rough month or so before that occurred. For the most part, that's what transpired so far, so no major worries there.

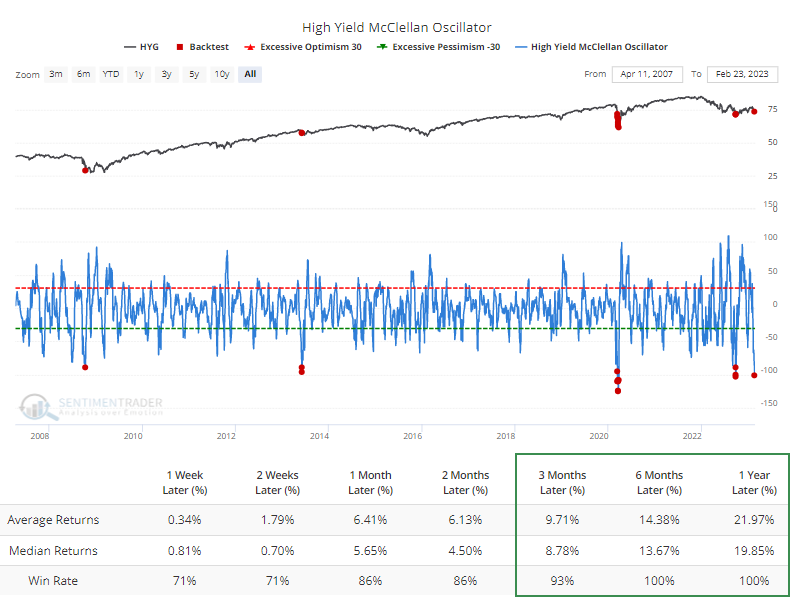

Over the past month, the wholesale selling of high-yield bonds has pushed some core breadth indicators into oversold territory. The Backtest Engine shows that whenever the McClellan Oscillator nears -90 or below, forward returns over the next 3-12 months were excellent.

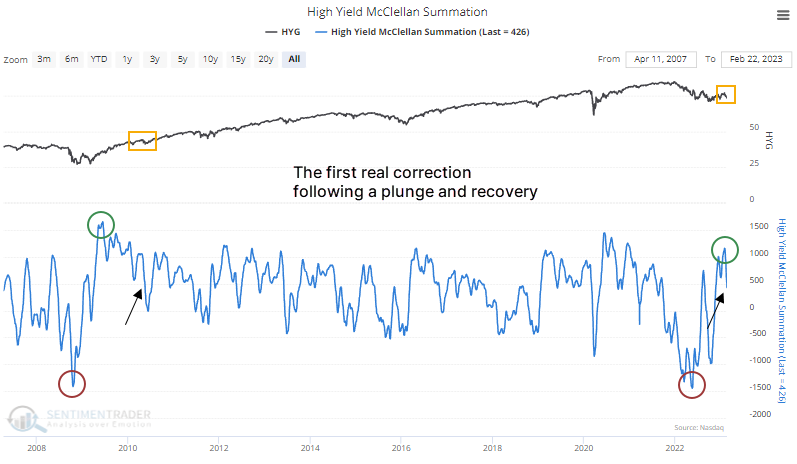

The long-term Summation Index has pulled back significantly after cycling from the worst oversold reading ever to an extremely high one. When this happened in 2010, high-yield bonds went through months of consolidation.

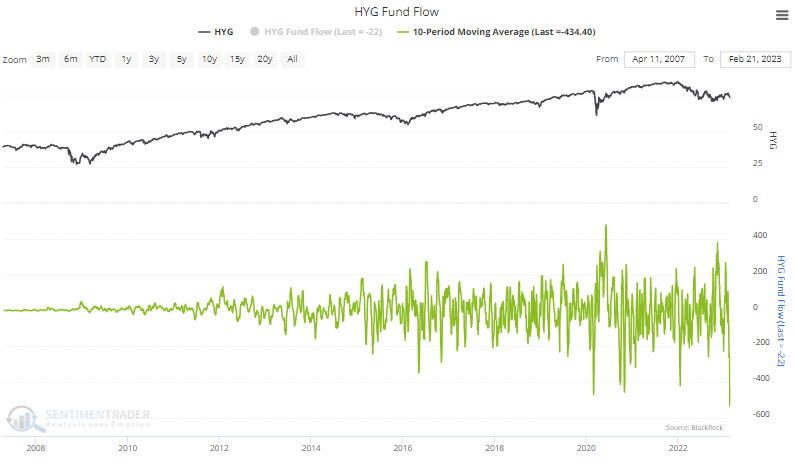

Traders have been fleeing the market, with the worst fund flow in the existence of HYG. Traders have pulled out an average of more than $400 million daily.

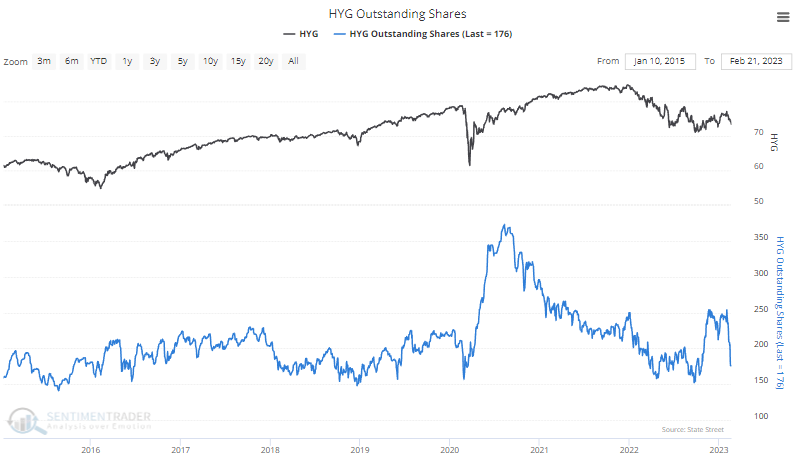

The exodus has led to a plunge in outstanding shares, a rough gauge of overall investor interest in a fund. It's now down to the lower end of the range since 2015.

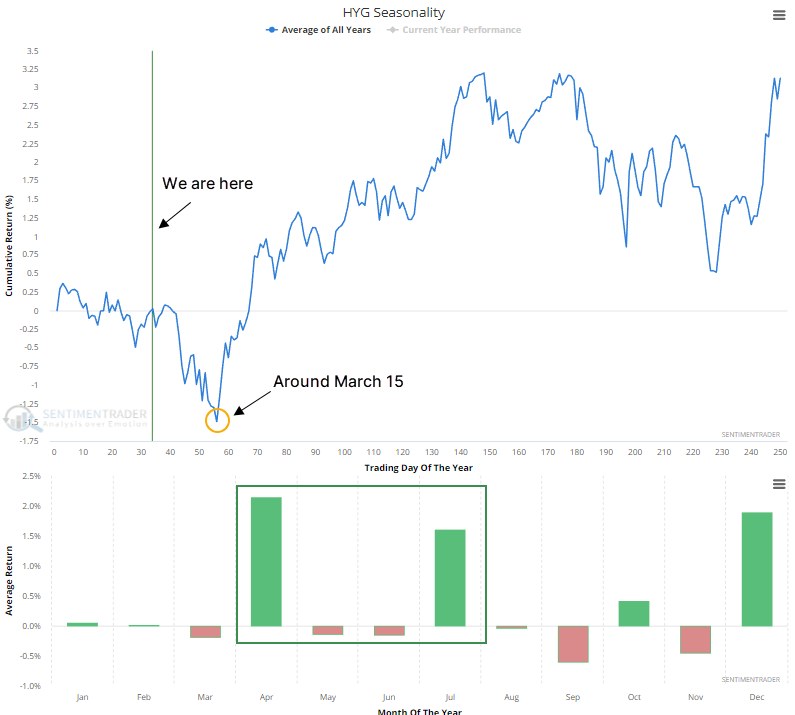

The seasonal window for high-yield bonds remains weak for a few more weeks. The seasonal cycle has troughed around mid-March, and April has historically shown the strongest returns, with the overall trend drifting higher throughout the summer months.

What the research tells us...

From October through January, pretty much everything we looked at suggested the rally differed from any during 2022 and, indeed, during essentially any other bear market going back at least 70 years. The recovery's magnitude, persistence, and breadth were more comprehensive than what is seen during ongoing bear markets. There is a first time for everything, and we can't rule out the last three months were anything other than a miserable rug-pull.

We haven't seen many signs that that's the most likely scenario, though the failure of high-yield bonds to follow through on its initial surge is disquieting. Selling pressure is on par with past oversold readings, though a bit more pressure, especially considering the calendar, wouldn't be out of bounds. Bulls need to see buyers willing to step up and buy into that falling market, or it will be a significant black mark against the "new bull market" thesis.