The options market hasn't done this since 2002

On Monday, we saw that the smallest of options traders had become so aggressively optimistic about a continued rally that they established a record number of bullish versus bearish trades.

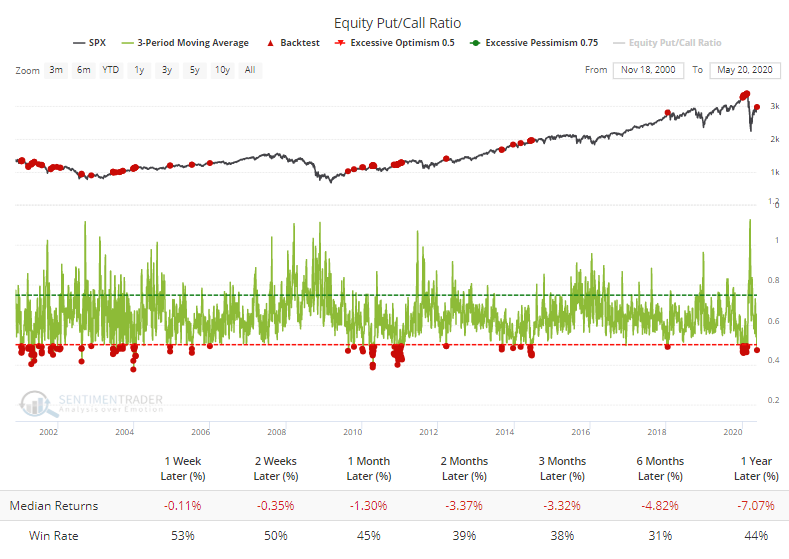

That sentiment seems to have spread to the options market at large. Over the past three sessions, options traders have turned over only half as many put contracts as call contracts. This is the first time in months that the 3-day average of the Equity-only Put/Call Ratio has been below 0.5.

The Backtest Engine shows that the S&P 500 has struggled when the ratio was this low. This is only the last 20 years - prior to that, the ratio was persistently low. The pricking of the internet bubble triggered an overall higher range in put/call ratios.

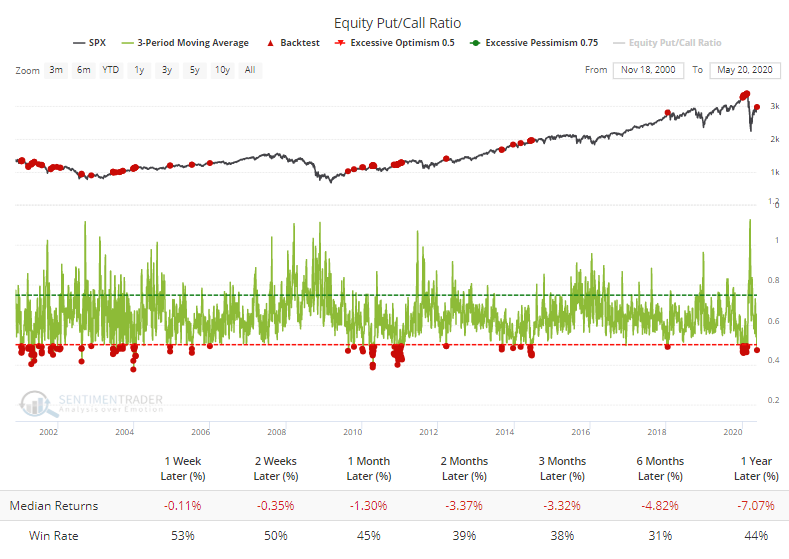

If we focus only on the first time that the 3-day average of the ratio fell below 0.5 in at least 30 sessions, then we get the following returns for the S&P 500.

It still showed a flat to negative bias up to three months later in the risk/reward ratio. Of the 24 signals, 19 of them showed a negative return either 1, 2, or 3 months later.

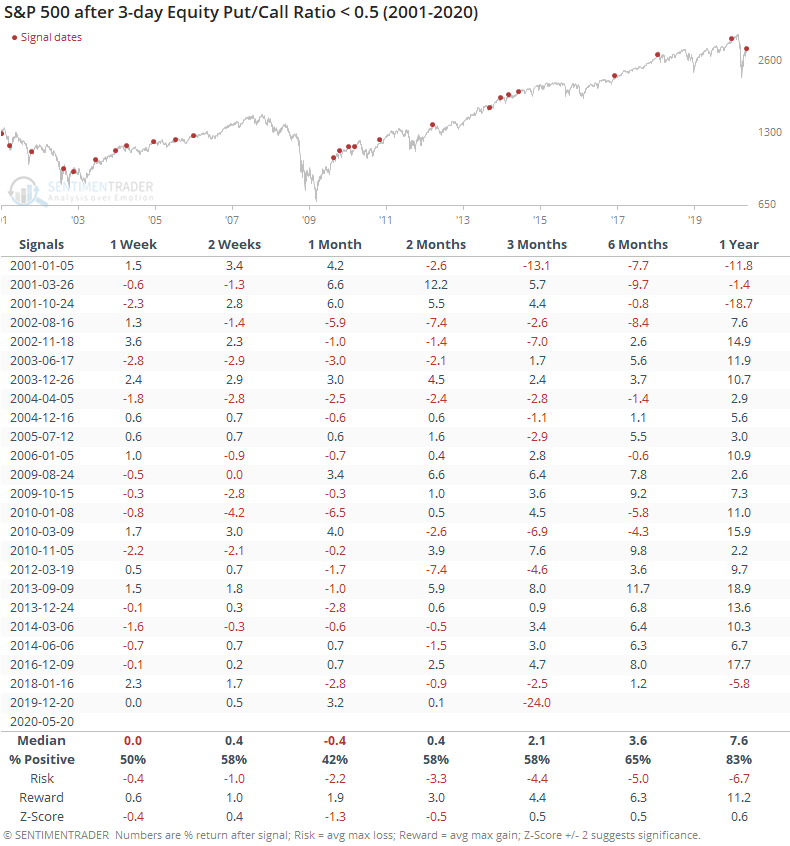

What's especially notable now is that this apparent optimism is occurring while the S&P is still trading below its 200-day average. That has only happened in 2001 and 2002, never since.

Returns were mixed after those, with it taking various lengths of time before the optimism wore off with lower prices. Because it was a protracted bear market, these bouts of optimism led to poor results over the next 2-6 months.

When we see readings like this lead to poor returns even during bull markets, the current level of options activity is a worry. The saving grace might be that we're early enough in a new bull market to run over any negatives like this, but that's placing a lot of faith in the idea that we've passed the worst of the damage.