Small options traders establish record bullish bets

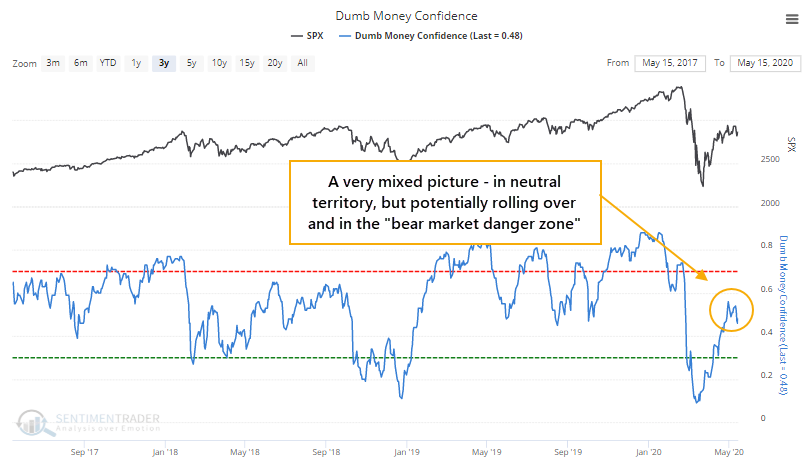

We've been noting in recent weeks that many sentiment indicators are mixed after recovering from extreme pessimism off the March low and the subsequent chop in prices.

The rally has been extremely front-end loaded, with a handful of stocks driving the rally. The lack of continued participation among many stocks has helped some longer-term measures, including surveys like AAII, remain in pessimistic territory. Others, usually shorter-term, are showing more optimism.

As a result, aggregate models like Dumb Money Confidence are stuck in neutral.

Sentiment is most reliable at extremes, and there is no clear one at the moment. It can also be used in a trend-following way, as we typically want to side with whichever way sentiment is heading. The tricky part about that now is sentiment is around the general level that often precedes trouble during bear markets. Maybe we're in a new bull market, but that isn't clear, either.

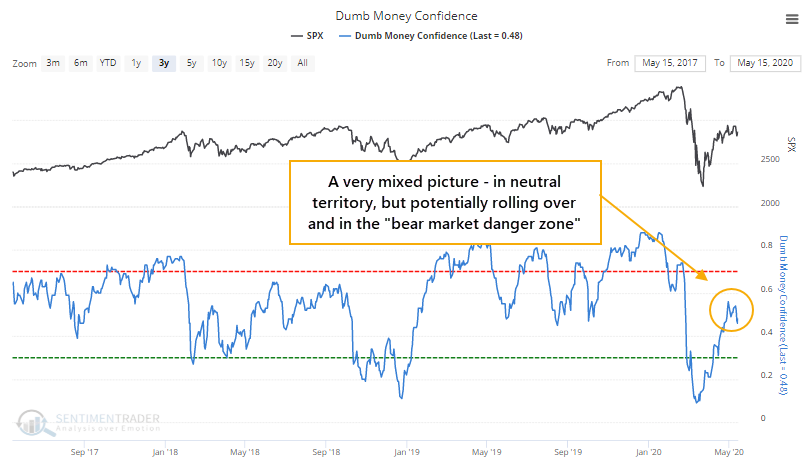

Another issue is just how extreme some of the shorter-term indicators are. When we look at a group of traders who tend to be wrong at emotional extremes, the warning sign is clear.

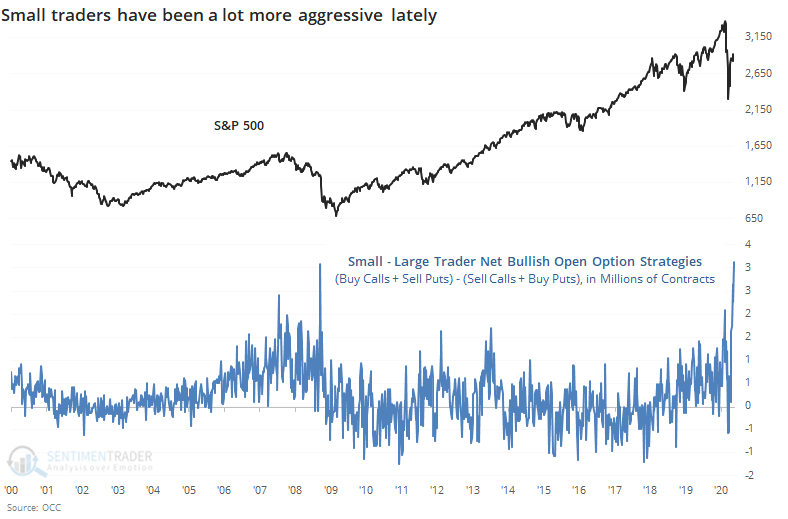

Last week, the smallest of options traders, those with trades for 10 contracts or fewer at a time, opened a new record of net bullish positions.

- Bullish options positions: Buying calls and selling puts to open

- Bearish options positions: Selling calls and buying puts to open

When we net out the bullish and bearish positions, we can see those small traders set a new record last week. There is no data we follow that is more worrying than this.

The prior record was February 14, about the peak of the bull market. There have been some very wide swings in 2020 as volume exploded, and a relatively high spread in 2014 (compared to prior years) didn't lead to anything more than a few weeks of choppiness, but big extremes in this data have consistently led to poor market returns.

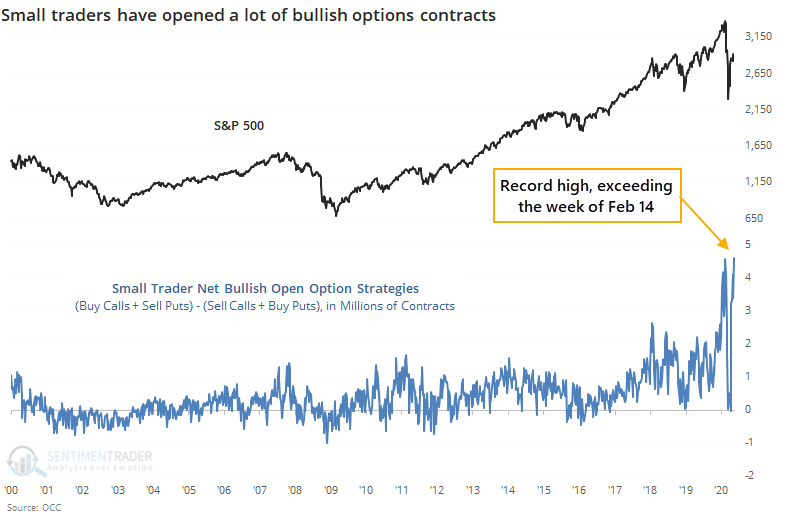

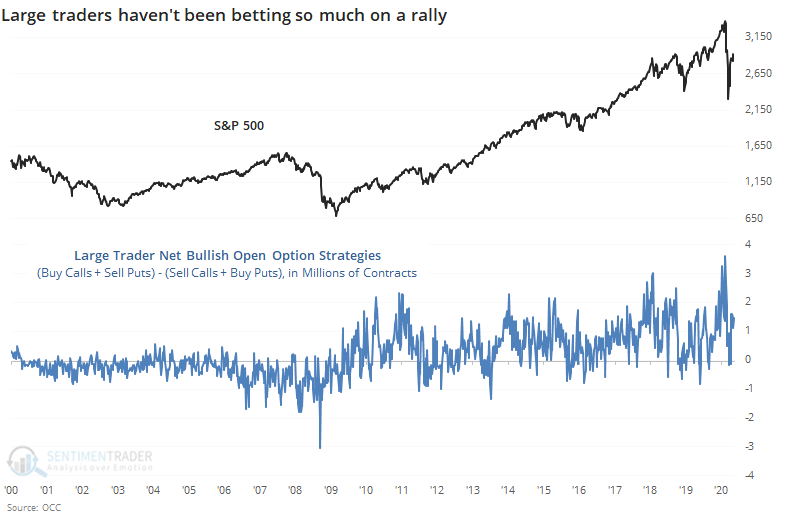

At the same time, very large traders, those with trades of 50 or more contracts at a time, are more subdued.

That means the spread between small trader and large trader net bullish positions has also hit a record high. It has soared over the last couple of weeks like it did in 2008.

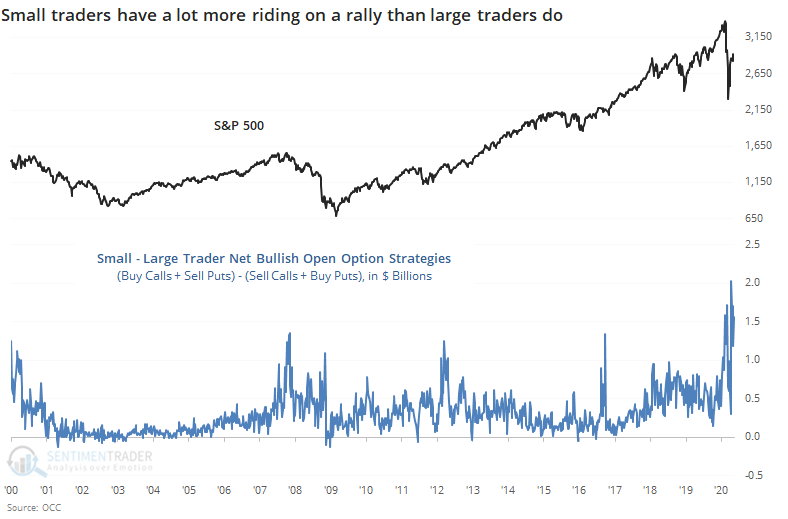

In terms of actual money at risk, small traders established more than $1.5 billion of net bullish strategies more than large traders last week. That's off the record high but still extremely large.

With many indicators, we can only infer who's sentiment is being reflected, and what they might be doing about it. With options data, we have a much better idea of who is doing exactly what, and with real money. That's why we tend to give them more weight when they reach a compelling extreme.

Because of that, the data from last week is disturbing, because it clearly shows that the smallest of traders, who tend to be the most consistently ill-positioned at extremes, have gone aggressively long, in a leveraged fashion. This has a strong tendency to lead to lower prices over the short- to medium-term.