The impact of the yield curve's potential super-steepening cycle

In recent notes, we've shown that U.S. consumers are increasingly confident about the future relative to the present. They feel that their current troubles are temporary and the economy will soon be growing again.

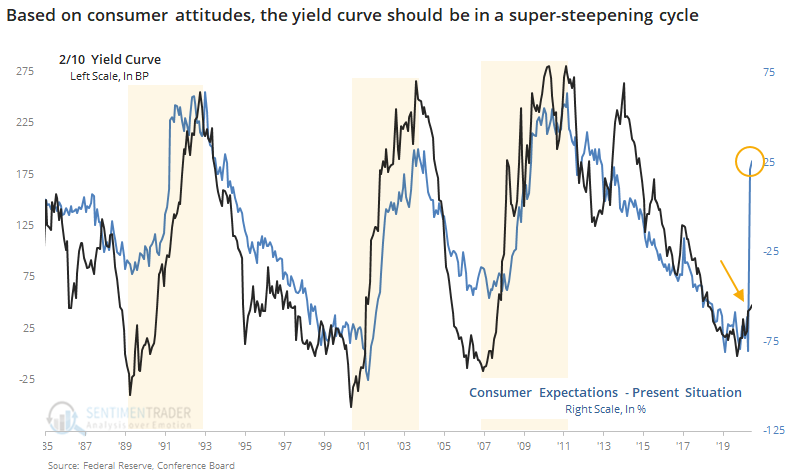

The Wall Street Journal on Wednesday showed that this difference in confidence based on time frames has had an extremely strong correlation to the yield curve.

Indeed it has, and it suggests that the 2/10 yield curve is in for a super-steepening cycle.

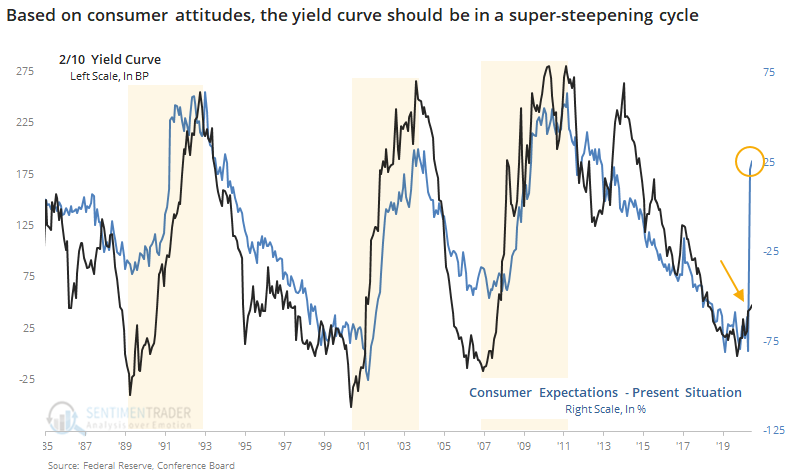

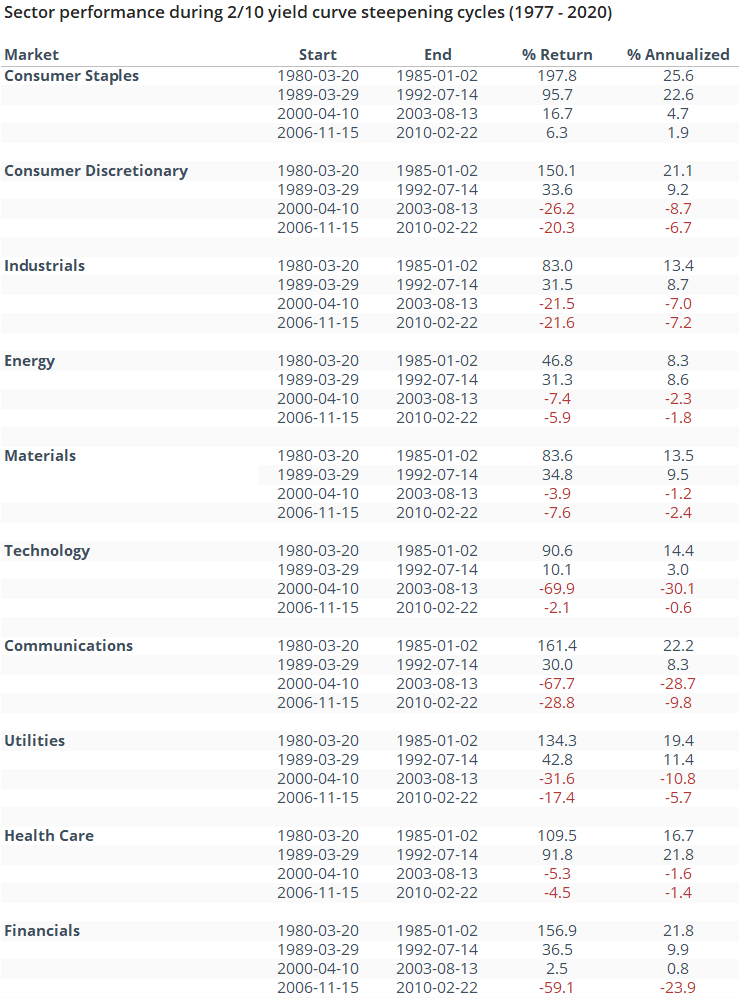

To see what that might mean for various markets, sectors, and factors, the tables below show their returns through the four major steepening cycles on a price-return and annualized basis, including dividends or inflation.

The first two cycles coincided with double-digit annualized gains in the S&P 500, while the last two were terrible times for stocks. The dollar declined during three out of the four cycles, while 10-year Treasury futures rallied.

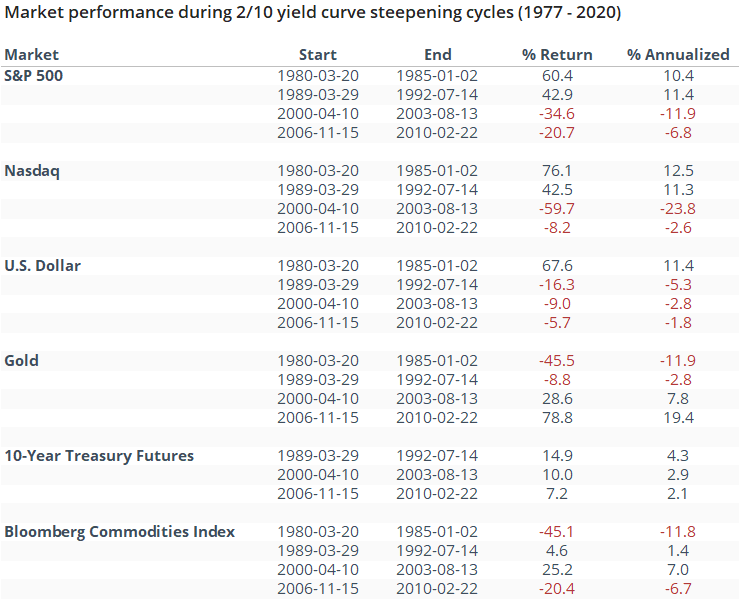

Among sectors, the only winner during all four cycles was consumer staples. People gotta eat and drink and smoke. The less-bad sectors included energy, health care, and financials. Technology stocks were volatile, along with communications.

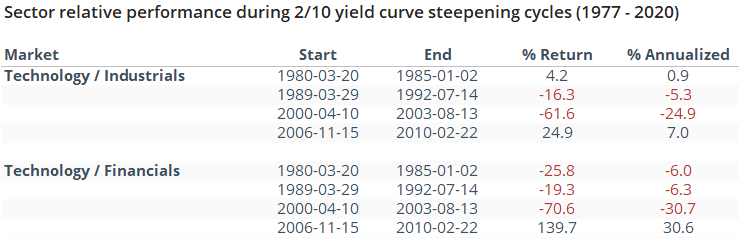

In recent notes (here and here), we've seen how far technology has outpaced industrial and financial stocks. If we look at the ratio of tech to those two sectors during the four cycles, the only one when tech meaningfully outpaced them was during the last one.

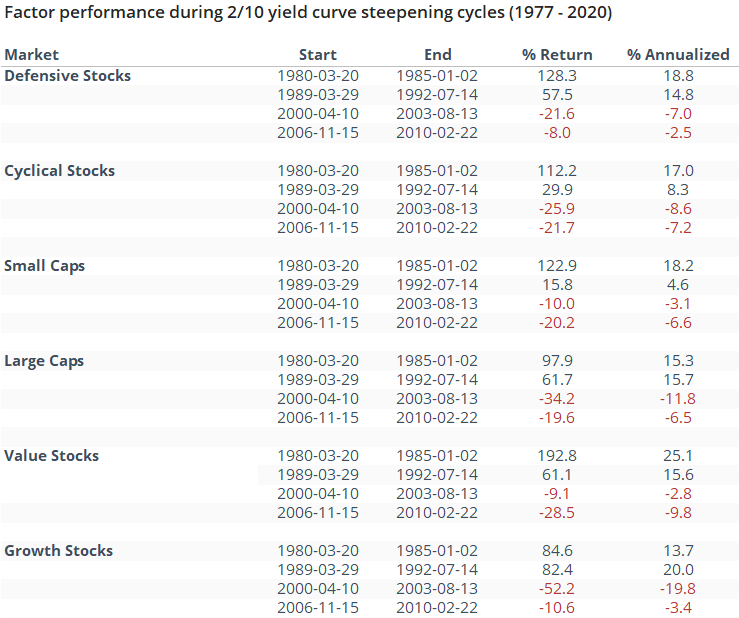

For factors, there was no clear winner. All of them show two losses and two gains.

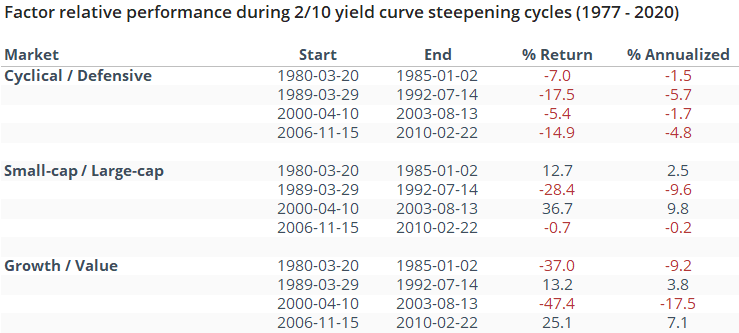

The table below shows ratios between the factors, to see if there was any pattern to what type of stock did better during these cycles.

Cyclical stocks underperformed defensive ones during all four cycles, which isn't a huge surprise given that consumer staples was the only sector to show a positive return all four times.

We're dealing with a tiny sample size, and as always this time could be different. With a small sample, the precedents need to be extremely consistent to have even a small chance that it could tell us something. From the table, about the only suggestion we can make is that the chance we're in a super-steepening cycle has increased, and defensive stocks (namely consumer staples) are more likely to outperform in the years ahead.