Taiwan (TWSE) RSI Buy Signal

The percentage of Taiwan (TWSE) members trading below a Relative Strength Index (RSI) level of 30 registered a mean reversion buy signal on the close of trading on 5/25/21.

PERCENT OF MEMBERS WITH RSI < 30 BUY SIGNAL

The RSI mean reversion signal seeks to identify instances in history when the percentage of Index members trading below an RSI level of 30 cycles from high to low, and Index momentum is positive. The model will issue an alert based upon the following conditions.

SIGNAL CRITERIA

1.) Percentage of members cross above 29. i.e., the oversold reset

2.) Percentage of members cross below 0.5.

3.) If Condition2 and the TWSE Index 5-day rate of change is >= 1%, then buy.

Let's take a look at the current chart and historical signal performance.

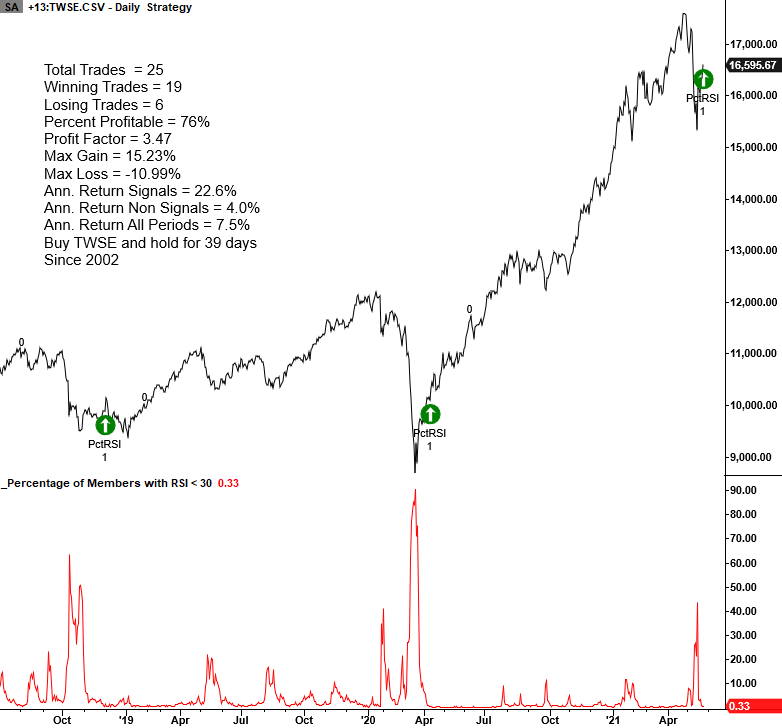

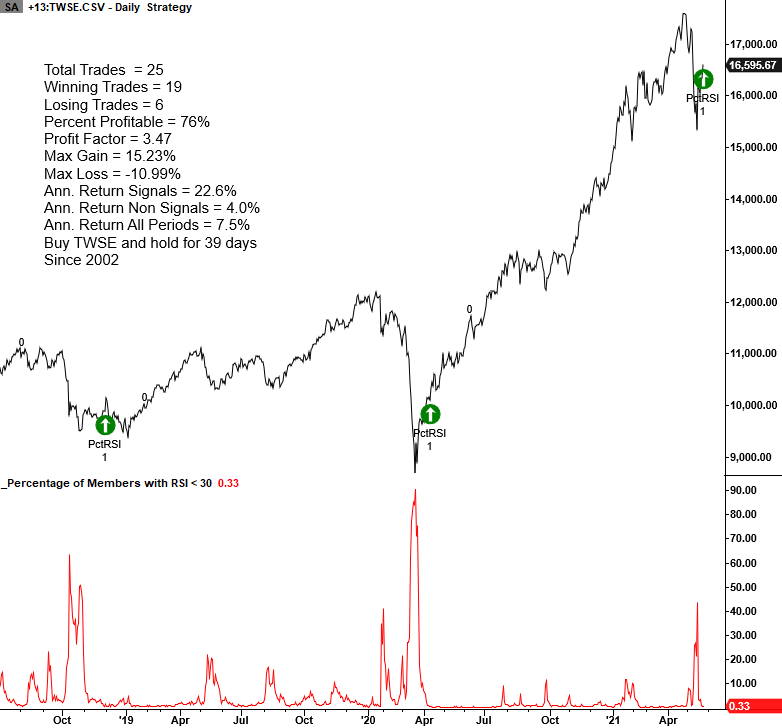

CURRENT DAY CHART

Please note that the chart's trading statistics are based on buying and selling the next day open.

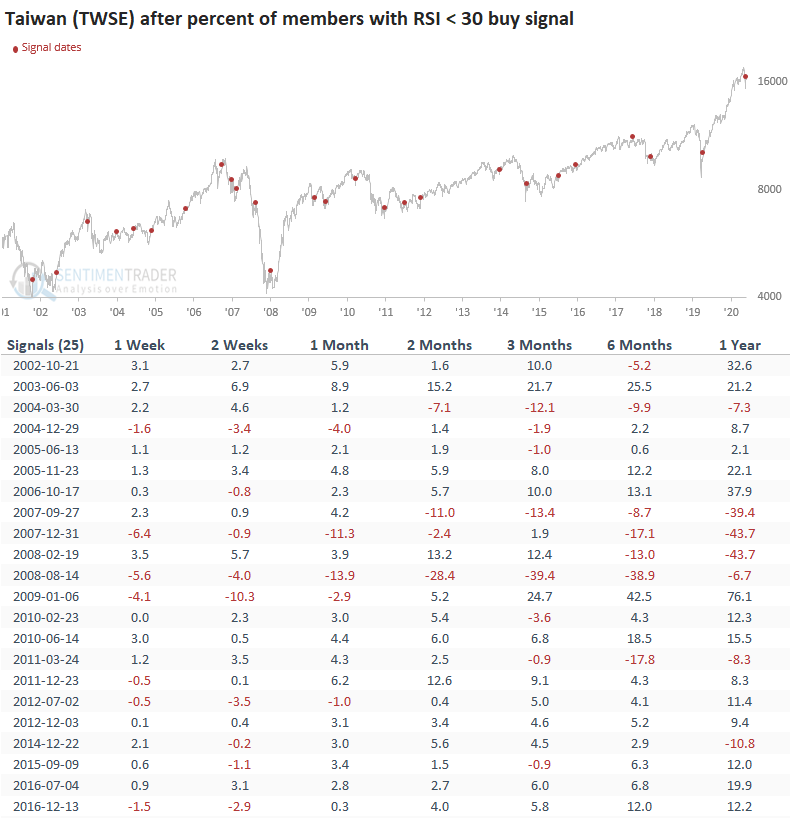

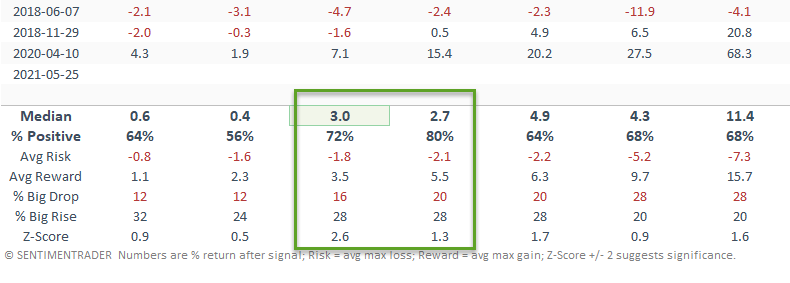

HOW THE SIGNALS PERFORMED

As the table shows, the RSI mean-reversion signal offers a good risk/reward profile in the 1-2 month timeframe.

We now have three mean reversion buy signals for the Taiwan Index since 5/12/21. Please click on the following links to see the other notes.