Taiwan (TWSE) Bollinger Band Buy Signal

The percentage of Taiwan Stock Exchange (TWSE) Index members trading below their respective lower Bollinger Band registered a mean reversion buy signal on the close of trading on 5/20/21.

PERCENT BELOW LOWER BOLLINGER BAND BUY SIGNAL

The Bollinger Band signal seeks to identify instances in history when many Index members trading below their respective lower Bollinger Band cycles from a high to a low percentage, and Index momentum turns positive. The model will issue an alert based upon the following conditions.

SIGNAL CRITERIA

1.) Percentage of members cross above 39. i.e., the reset

2.) Percentage of members cross below 0.5

3.) If Condition1 and 2, start days since true count

4.) If Days since true count <= 15, and the TWSE Index 5-day rate of change is >= 2%, then buy.

Data Source: Bloomberg

Let's take a look at the current chart and historical signal performance.

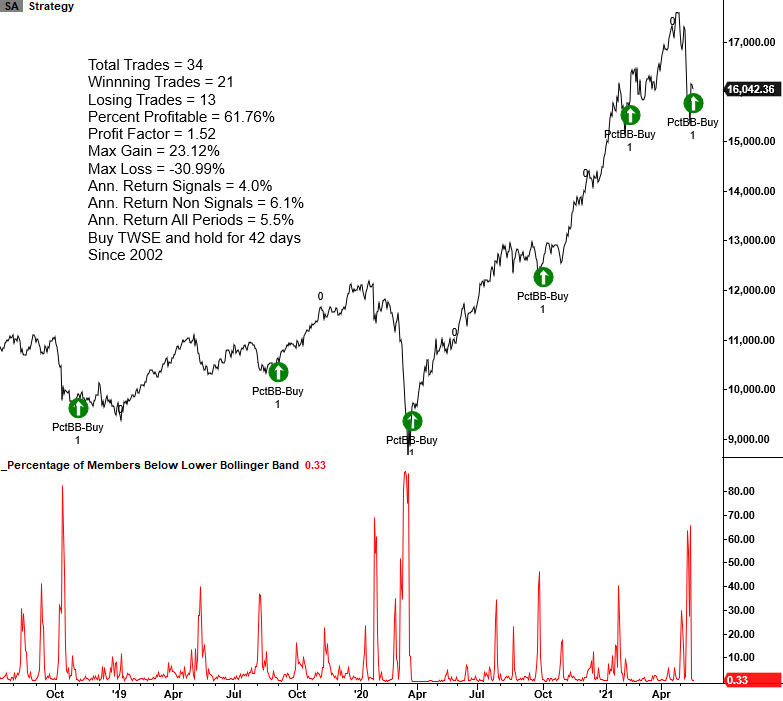

CURRENT DAY CHART

While the most recent signals on the chart look good, I would note that the overall trading statistics exhibit below-average metrics. I prefer to see a profit factor of at least 2/1, and the annualized returns are below the non-signal and all-period values. I would be mindful that mean reversion systems can suffer during bear market periods that exhibit several counter-trend rallies. The 2007-08 market was a notable example.

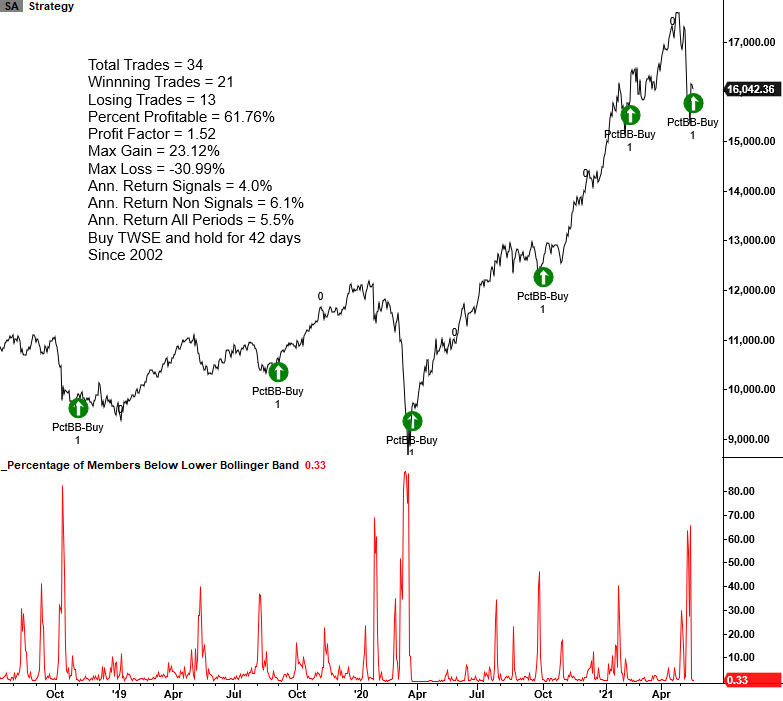

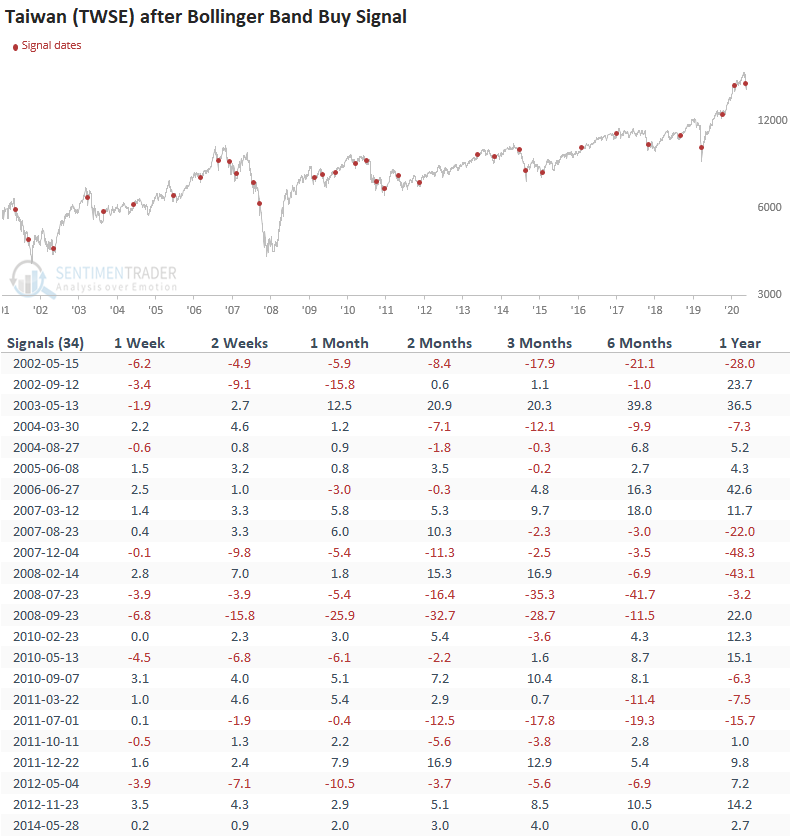

HOW THE SIGNALS PERFORMED

Results look good in the 2-4 week timeframe. I would also add that the four-week period has registered nine consecutive winning trades.

The Bollinger Band mean reversion buy signal works better on some indexes than others. I would classify Taiwan as a less than stellar mean-reversion market. If one applies the signal to the Taiwan ETF (EWT), the results are a little weaker.

We now have two mean reversion buy signals for the Taiwan market. Please here for a note on a spike in 4-week lows.

As always, I like to see a turn in momentum before dipping my toe in the sand. I'm in a holding pattern until further notice.