Small traders keep pressing their bets...both ways

During the week ended May 15, we saw that the smallest of options traders opened a new record of net bullish positions.

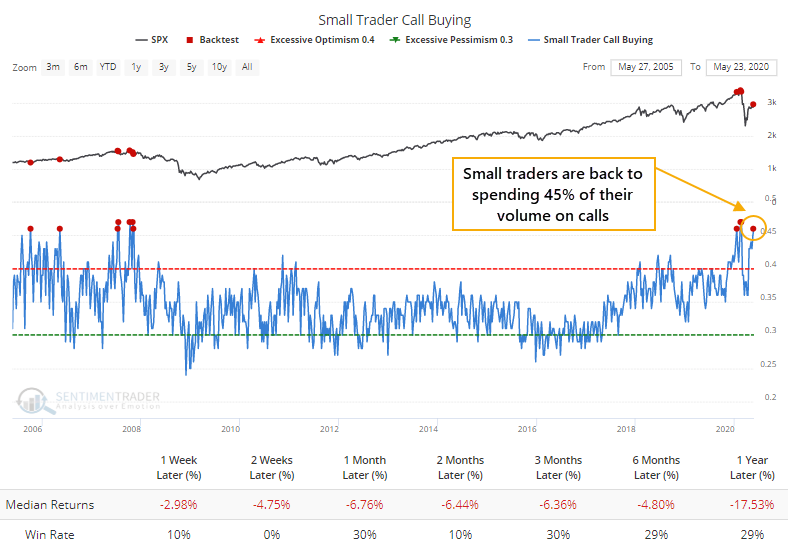

The positive market further encouraged them. For the week ended May 22, they used more than 45% of their total volume on buying speculative call options, on par with the highest levels of aggressive betting in 15 years. Prior to that, it only happened in the year 2000.

It has not worked out well for them. According to the Backtest Engine, the S&P 500 declined every time small traders got this bullish.

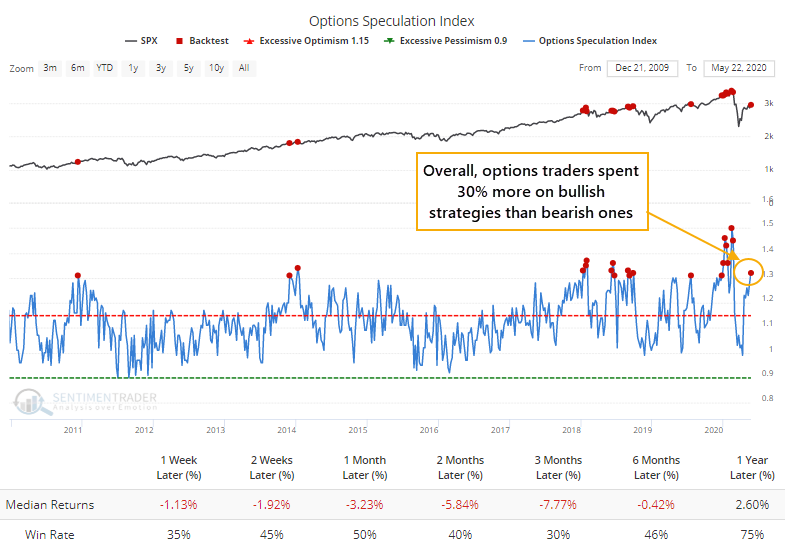

They're not the only ones placing heavy bets on a continued rally. Call buying and put selling was so popular across all traders that it pushed the Options Speculation Index above 1.3, meaning that traders opened 30% more bullish contracts than bearish ones. Again, the Engine shows this has not worked out well when traders across the spectrum were betting so heavily on a rally.

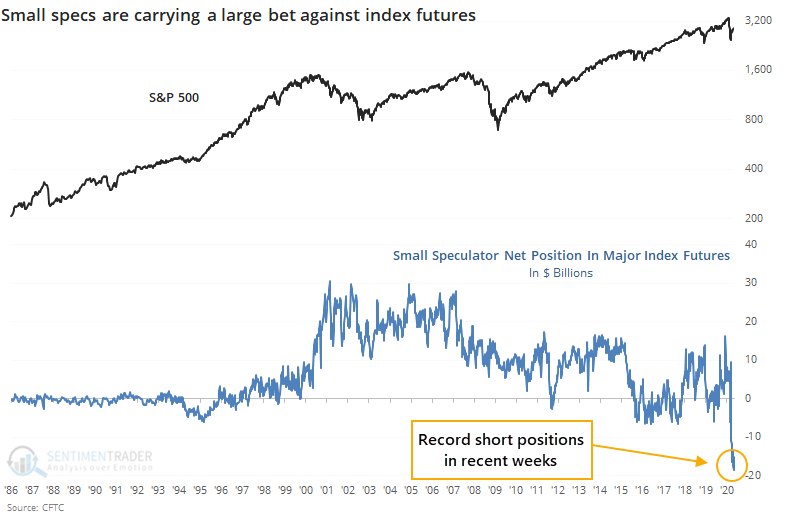

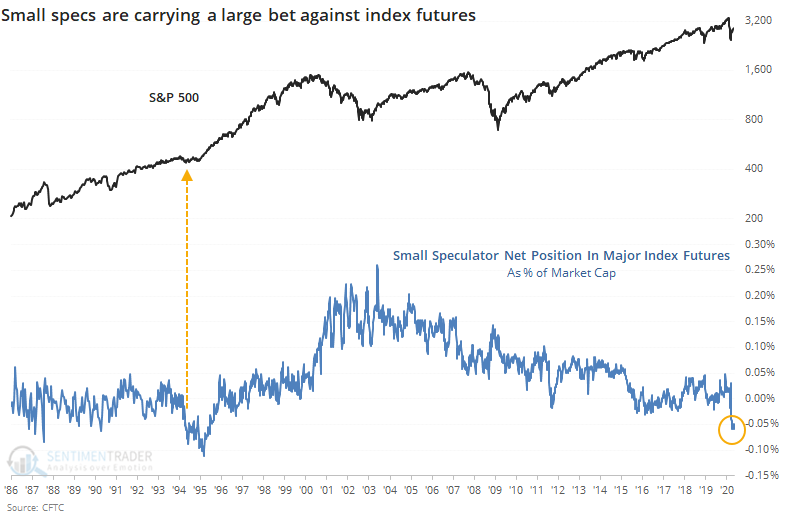

The curious thing is that at the same time they're aggressively buying speculative call options, they're shorting the major equity index futures. Their net position hasn't changed much in recent weeks, and they're still net short about $15 billion worth of contracts.

In the past 30 years, as a percentage of stocks' market capitalization, it has really only been exceeded by 1994-95, which was a very good sign for stocks.

Small traders' position in the futures markets isn't a particularly good contrary indicator since they have less of a correlation (positive or negative) with prices.

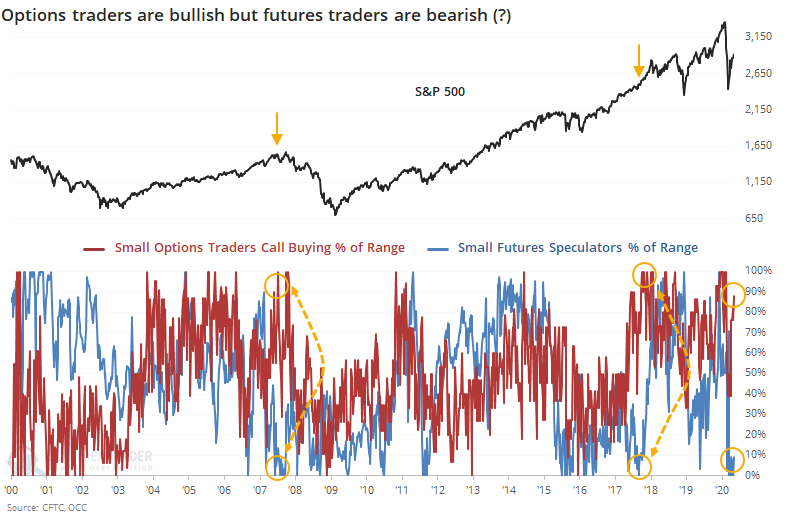

If we look at both sets of data together, then we can see that this kind of behavior has happened twice before.

The chart below shows each data set relative to its range over the past 3 years. Small trader call buying is in red, and small speculator positions in index futures is in blue. When the red line is high, it means they're buying a lot of speculative call options. When the blue line is high, it means they're buying a lot of futures.

Right now, the red line is high and the blue line is low. Usually, the two move together, so this is unusual. It's only happened twice before to this degree, in July 2007 and November 2017.

In 2007, it was clearly negative as stocks declined almost immediately. In 2017, stocks rocketed higher for a few months then ultimately collapsed. There isn't a lot to go on there.

There are several possible explanations for why this is happening - maybe they're long a lot of stock, and using the futures to hedge against that, while others are buying calls as a cheap flier in case stocks take off (like they have been). Or maybe they're really betting against stocks by speculating on their short futures positions and using calls as a form of stock replacement. Nobody knows.

All we can go off of is how they've behaved in the past. The contrary record of their call buying activity is much better than their futures positioning, and we'd give that a lot more weight. Even the couple of times they were buying a lot of calls that weren't confirmed by their futures positions led (at some point) to a decline. Overall, it's not a clear warning sign like it would be if their options and futures positions were more in alignment, but we'd still consider it a negative.