Small-Caps Did This Right Before the Pandemic Plunge

Tech stocks have been struggling. Another area of risk appetite, Small-Cap stocks, have struggled right along with them.

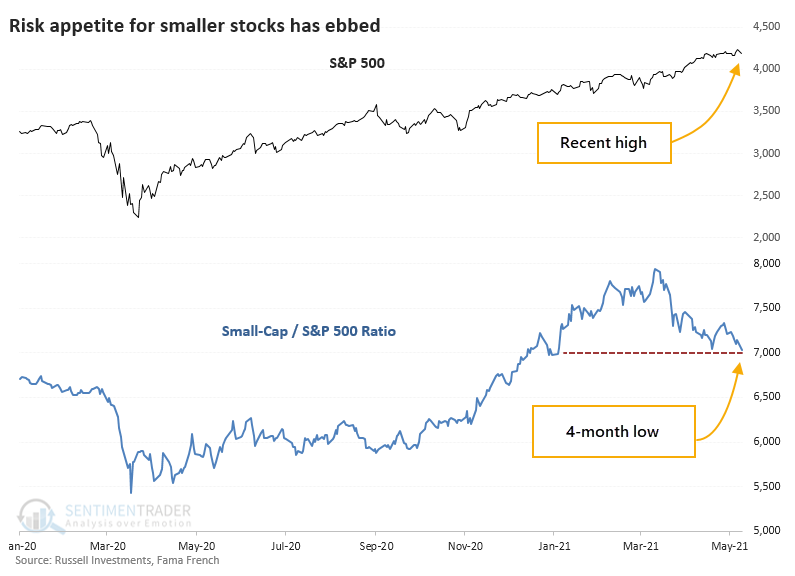

On Thursday, we saw that the ratio of the Tech sector to the S&P 500 has sunk to nearly its lowest level in a year. While not as extreme, a ratio of Small-Cap stocks to the S&P has just dropped to a 4-month low.

This is a quick pullback in the appetite for riskier, or at least higher-beta, stocks - headlines were trumpeting all-time highs in the S&P 500 just a few days ago.

Other times when the S&P was recently at a 52-week high, then the ratio of Small-Cap stocks to the S&P plunged to at least a 4-month low, it preceded returns about in line with random for the S&P since 1928.

But across almost all time frames, Small-Cap stocks continued to underperform their larger-capitalized siblings. Over the past 30 years, only once out of 11 times did Small-Caps completely reverse course and resume strong leadership.

| Stat Box On Thursday, the Nasdaq Composite rallied more than 0.7% but only 41% of volume flowed into advancing stocks on that exchange. Going back nearly 40 years, that's the lowest percentage of up volume for any day when the Composite rallied more than 0.7%. |

What else we're looking at

- Full returns in the S&P 500, Small-Cap stocks, and the ratio between them after relative Small-Cap weakness

- What happened in QQQ after a surge in stocks falling below their Bollinger Bands

- There is one Asian market setting up an oversold signal

- What credit spreads are suggesting about stocks right now