Profit taking in small cap options

Key points:

- In an earlier article, I wrote about a bullish options strategy for small-cap stocks using options on ticker IWM (iShares Russell 2000 ETF)

- When a trade reaches your specific objective, the proper course of action is typically to take your profit and move on

The original options trade

Last week I detailed an example of a bullish trade using options on ticker IWM (iShares Russell 2000 ETF).

Our example trade was a Bull Call Spread using Dec31 2021 call options on IWM as follows:

- Buy 3 IWM Dec31 2021 230 calls @ $9.89

- Sell 3 IWM Dec31 2021 245 calls @ $2.80

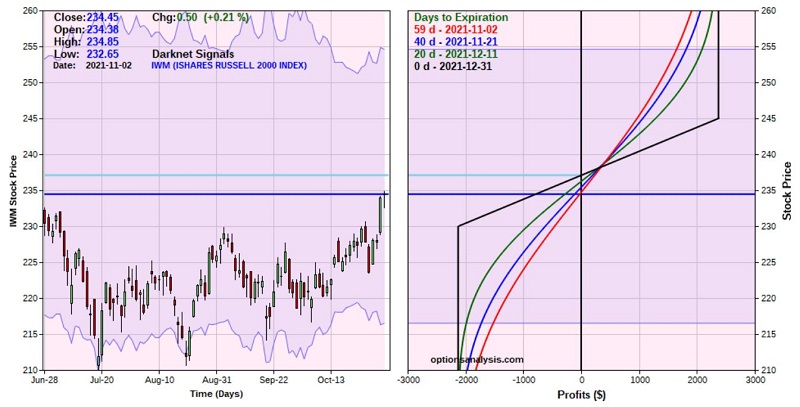

The particulars and risk curves for this position at the time of entry appear below (courtesy of Optionsanalysis):

At the time of entry, this trade had 59 days left until expiration, roughly two months. Buying a 3-lot gives this trade a delta of 98.5, which means that (for now) this position will behave similarly to a position holding 100 shares of IWM.

The cost to enter this trade is $2,127 versus $23,445 to buy 100 shares of IWM stock.

Ticker IWM hits the target price

In Jason's original article, he noted that the average 2-month gain for the Russell 2000 Index (which is the index that ticker IWM tracks) was +2.7%. With IWM trading at $234.45 a share, this created a profit target of $241 a share for IWM. When we checked this position at midday on 11/5, IWM was trading at $242.29. This action by IWM created an opportunity to take a quick profit on the options position.

The updated particulars and risk curves from midday on 11/5 appear below.

By contrast, buying 100 shares of IWM at $234.45 would have earned a profit of $784, or 3.3% of the $23,445 committed to entering the trade.

The good and the bad

The good news is that this example trade garnered a 33% return on capital risked in just a matter of days. No one would turn down that rate of return. Still, a lot of traders will naturally ask the question, "why exit the trade when things seem to be going in the right direction?" And it is a fair question. The answer is simple: If you enter a trade with a specific price objective and that price objective is reached, it is time to take your profit and move on to the next opportunity.