An options strategy to bet on rising small cap stocks

Key points:

- The breakout in small-caps has a tendency to lead to still-higher prices

- A Bull Call Spread can help leverage potential gains while minimizing risk

Small-cap stocks have broken out to record highs

As Jason wrote about on Monday, and as you can see in the chart below (courtesy of Stockcharts), the small-cap sector finally broke out of its long sideways channel to the upside.

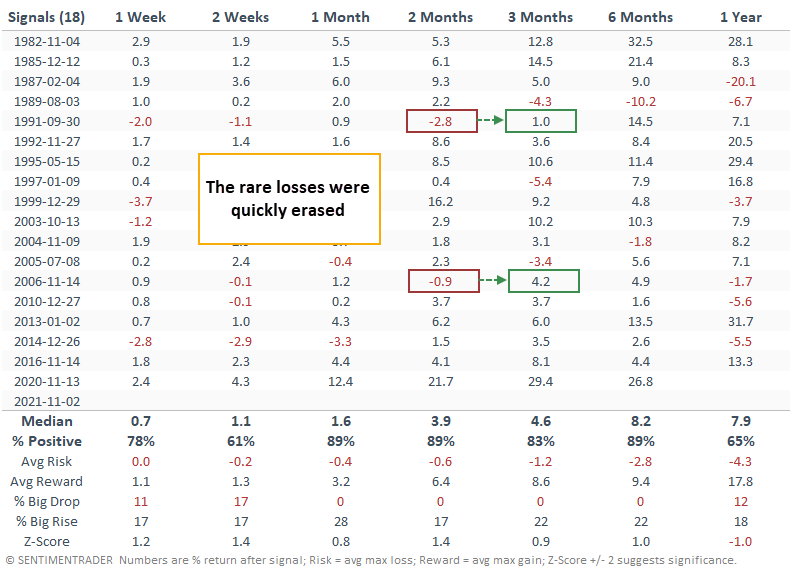

He also highlighted the performance of the Russell 2000 Index after previous signals. The median 2-month gain was +2.7% with an 89% Win Rate.

Using the research in the real world

Now let's talk real-world trading.

With IWM (iShares Russell 2000 ETF) closing on at $234.45 on Monday, a trader would put up $23,445 to buy 100 shares. If IWM rose 2.7% in 2 months, it would reach $240.78, and a trader could sell their 100 shares for a profit of $633, or 2.7% ROI.

Some traders want more. And there is a way to get more. The catch is you have to understand exactly what you are getting into and the unique risks involved.

The steps are to:

- Identify your objective and create a trade

- Quantify your risk

- Make a plan to manage the trade

In this case, we believe that IWM will advance in price during the months ahead. As such, we want to leverage our gains beyond what we might make simply by buying shares of IWM. We also need to recognize that we will likely lose money if IWM does not advance as we had hoped.

Using options to structure a trade

Our example trade is entered using end-of-day options prices for IWM on Monday.

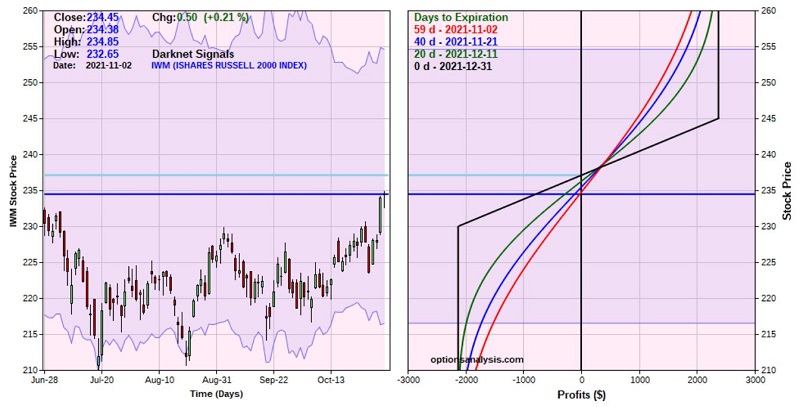

Our trade is a Bull Call Spread using Dec31 2021 call options on IWM as follows:

- Buy 3 IWM Dec31 2021 230 calls @ $9.89

- Sell 3 IWM Dec31 2021 245 calls @ $2.80

The particulars and risk curves for this position appear below (courtesy of Optionsanalysis):

At the time of entry, this trade has 59 days left until expiration, roughly 2 months. Buying a 3-lot gives this trade a delta of 98.5, which means that (for now) this position will behave similarly to a position holding 100 shares of IWM.

The cost to enter this trade is $2,127 versus $23,445 to buy 100 shares of IWM stock.

The maximum profit potential is +$2,373, which would be realized if we hold the trade through expiration and IWM is at $245 or higher at the time. The maximum risk is -$2,127 if IWM is below $230 a share at option expiration and the breakeven price at expiration is $237.09.

What happens if we're wrong

If IWM fails to rally, this trade will lose money - even if the shares are merely unchanged. This is one cost of being long options.

Consider what happens if we hold this trade until expiration and IWM closes the year exactly unchanged at $234.45:

- The trader who paid $23,445 to buy 100 shares will have no gain or loss

- The option trader who had $2,127 to buy a 3-lot of the 230-245 bull call spread will lose roughly -$727 due to time decay

Another risk is that of missing out if IWM were to stage a spectacular rally. If IWM exploded 20% to 281.34:

- The stock buyer would make $4,689, or 20% on their investment

- The option buyer would see their profit potential capped at $2,373

So, why would we accept a position where:

- We lose money if the underlying shares are unchanged?

- We cannot fully participate in the gains if IWM rises above $245 a share?

The reason: Remember our initial objective. This trade is intended to deliver above-average gains IF IWM rises as it has on average in the past (+2.7% or more). If you want unlimited profit potential and/or make money if IWM remains unchanged, you will have to craft a different options position intended to achieve those goals.

What happens if things go as planned

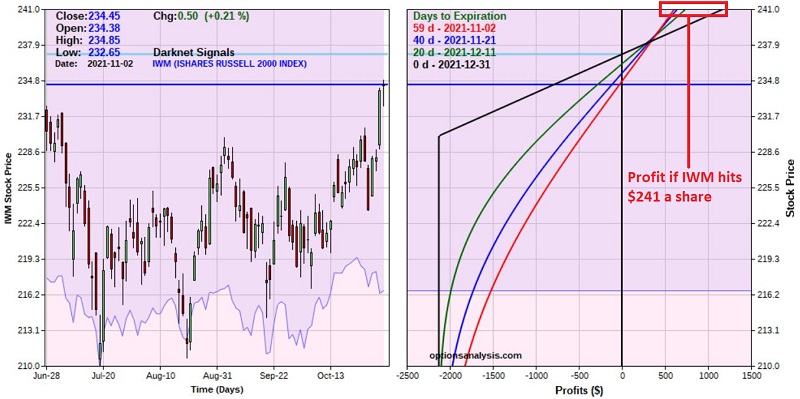

Let's say that things go exactly as planned, and IWM rises +2.7% (or so) and hits $241 a share sometime in the next two months. The chart below sets the upper price limit on the chart at $241 a share for IWM.

Notice that the profit potential at $241 a share (at the top of the right-hand side of the chart above where the colored lines hit $241) changes - and actually increases - over time. This is due to time decay and the fact that the further out-of-the-money 245 short option will lose its time premium more quickly than the in-the-money 230 long option.

If IWM hits $241 a share during the next 59 days, the profit will be roughly $610 (if $241 is hit sooner) to $1,170 (if $241 is hit at expiration). This would represent a profit of +28.7% to +55.1%. The trader who instead bought 100 shares of IWM would make a profit of $655, or a 2.8% return.

While there is no guarantee that this trade will work out, it offers the potential to achieve the initial objectives:

- The potential to make 28% to 55% instead of 2.8%

- And committing 91% less capital ($2,127 for the option position versus $23,445 to buy 100 shares)

What the research tells us...

The breakout in small-cap stocks offers a compelling reason to expect IWM to rally in the months ahead. Using a Bull Call Spread, we have an opportunity to make a high rate of return while committing substantially less capital than buying shares directly. Like all trades, there are tradeoffs and that's left to the trader to determine if it's appropriate for them.