Options traders have been very confident

On Monday, we saw that the smallest of options traders had become so aggressively optimistic about a continued rally that they established a record number of bullish versus bearish trades.

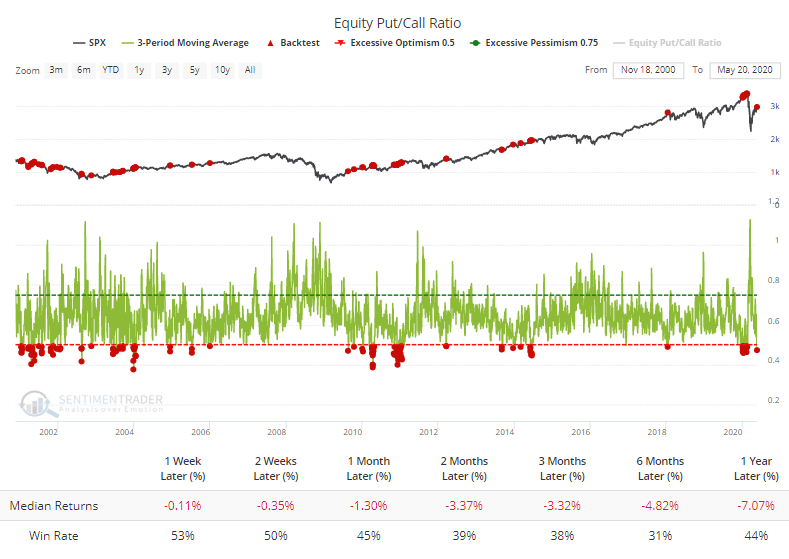

That sentiment seems to have spread to the options market at large. This is the first time in months that the 3-day average of the Equity-only Put/Call Ratio has been below 0.5. Our Backtest Engine shows that the S&P 500 has struggled when the ratio was this low.

When we see readings like this lead to poor returns even during bull markets, the current level of options activity is a worry. The saving grace might be that we're early enough in a new bull market to run over any negatives like this, but that's placing a lot of faith in the idea that we've passed the worst of the damage.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- What happens when the S&P 500 approaches its 200-day average but can't rise above it

- More and more news articles are talking about FOMO (Fear Of Missing Out)

- The spread between Smart and Dumb Money Confidence is nearing zero

- Financial conditions are easing, both in the U.S. and overseas

- On a monthly basis, growth/value is historically stretched for the Russell 2000 and S&P 500