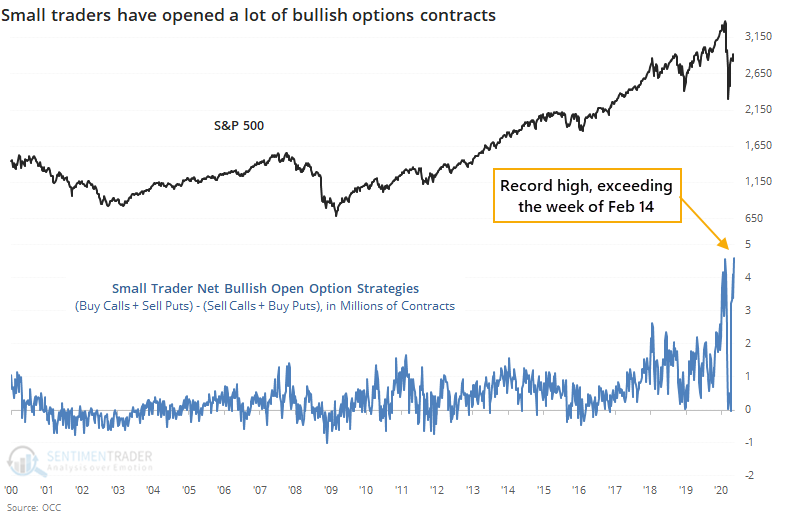

Small options traders have never done this before

The rally in stocks since March 23 has been extremely front-end loaded, with a handful of stocks driving the rally. The lack of continued participation among many stocks has helped some longer-term measures, including surveys like AAII, remain in pessimistic territory. Others, usually shorter-term, are showing more optimism.

Last week, the smallest of options traders, those with trades for 10 contracts or fewer at a time, opened a new record of net bullish positions.

- Bullish options positions: Buying calls and selling puts to open

- Bearish options positions: Selling calls and buying puts to open

When we net out the bullish and bearish positions, we can see those small traders set a new record last week. There is no data we follow that is more worrying than this.

The prior record was February 14, about the peak of the bull market.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- What trader options traders are doing, and the spread between large and small, in contracts and $ amount

- What it means when the Bullish Percent Index cycles back to a low level like now

- There has been a surge in 90% up days lately

- Most S&P and Nasdaq stocks are above their 50-day moving averages

- But most are still below their 200-day