October 12, 2019: Fundamental Overview Part 2

This is Part 2 of a weekly update on the U.S. stock market's long term fundamentals. Part 1 can be found here.

Fundamentals 1-3 years: market timing

I don't try to predict the future of the economy. Plenty of very smart people try, and when you add up the successes+failures, the results are usually no better than a 50/50 coin toss. That's why I focus instead on leading economic indicators. Look at what has already happened instead of predicting the future.

The economy drives corporate earnings, which drives the stock market in the long term. As a result, bull markets usually coincide with economic expansions, and big bear markets usually coincide with recessions.

Since the stock market tends to peak before recessions begin, we need to look at leading economic indicators, which also deteriorate before recessions begin. This doesn’t mean that the stock market’s exact top cannot occur before macro starts to peak. This happened in January 1973, when the stock market peaked a few months before macro started to deteriorate. However, the biggest part of bear markets always occur after macro has deteriorated significantly.

Here’s a brief summary of the leading and most important economic indicators we track, some of which we include in the Macro Index. The ones that are included in the Macro Index have an asterisk beside them**

Bullish factors right now

- Labor market**

- Housing**

- Financial conditions

- Heavy Truck Sales**

- Inflation-adjusted retail sales

Neutral/bearish factors right now

- Corporate profits

Bearish factors right now

- Yield curve**

- High yield spreads

- Manufacturing**

- Average weekly hours

Bullish factors

Labor market

Labor market indicators do not show any significant deterioration right now.

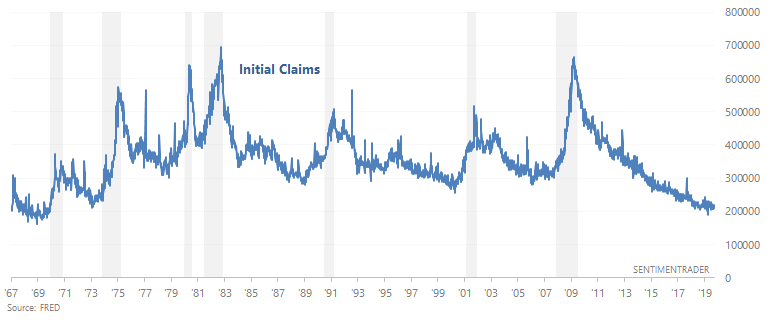

Initial Claims

Initial Jobless Claims measures the number of jobless claims filed by people who are seeking to receive jobless benefits. In other words, this measures the number of people who are recently unemployed. This economic indicator continues to trend sideways. In the past, Initial Claims trended higher before a recession began. This is still a positive point for macro, but watch out over the next few months in case Initial Claims trends upwards because Initial Claims is very low right now.

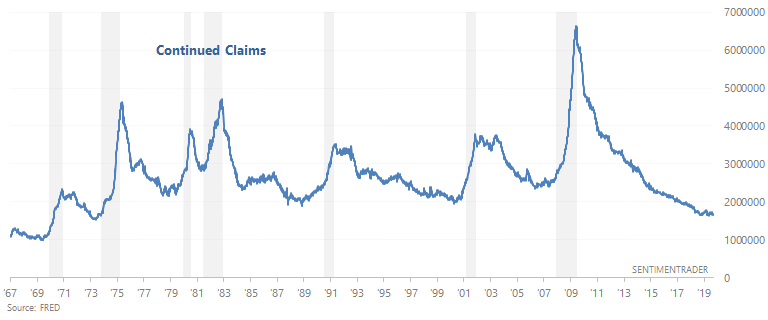

Continued Claims

Continued Jobless Claims measures the number of people who are still filing jobless claims (past the initial claim). This economic indicator continues to trend sideways. In the past, Continued Claims trended higher before a recession began. This is still a positive point for macro, but watch out over the next few months in case Continued Claims trends upwards because Continued Claims is very low right now.

Housing

Housing market indicators do not show significant deterioration right now.

Housing Starts

Housing Starts measures the number of new homes that are starting to be built in the U.S., from the time of first excavation. This figure is trending sideways right now. In the past, Housing Starts trended downwards before recessions began. This is a positive for macro, especially since Housing Starts had been trending downwards in late-2018.

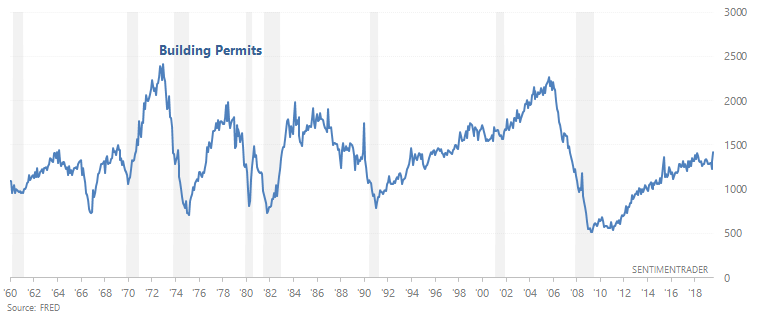

Building Permits

Building Permits are trending sideways right now. In the past, Building Permits trended downwards before recessions began. This is a positive for macro.

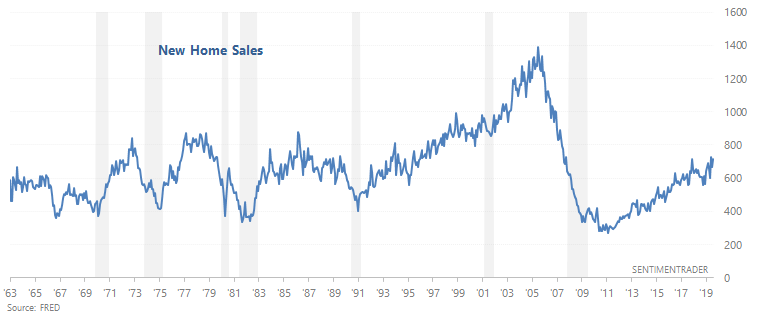

New Home Sales

New Home Sales are trending sideways/upwards right now. In the past, New Home Sales trended downwards before recessions began. This is a positive for macro.

Financial Conditions

Indicators related to financial conditions remain relatively loose. This is a positive for macro.

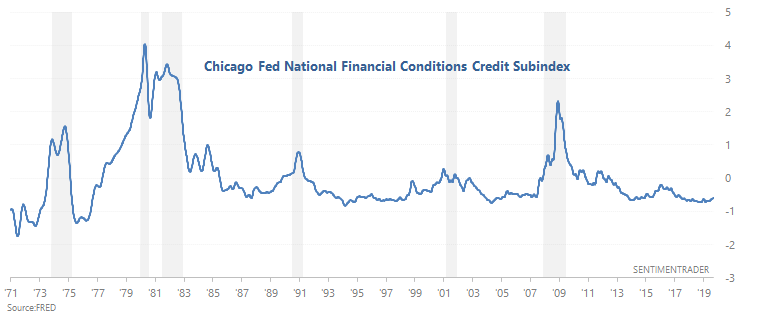

Chicago Fed Financial Conditions Credit Subindex

The Chicago Fed Financial Conditions Credit Subindex remains quite low. Looking at the bigger picture, the Credit Subindex is trending sideways/upwards right now. In a credit-driven economy, the Credit Subindex tends to trend solidly upwards (i.e. tighten) before a recession begins.

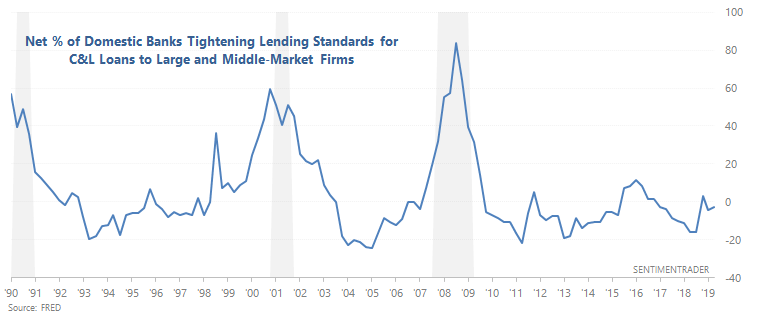

Banks’ lending standards

Banks are not significantly tightening their lending standards right now. In the past, lending standards tightened for several quarters before a recession began, causing the Net Percentage of Banks Tightening Standards to trend higher. This is a positive for macro right now.

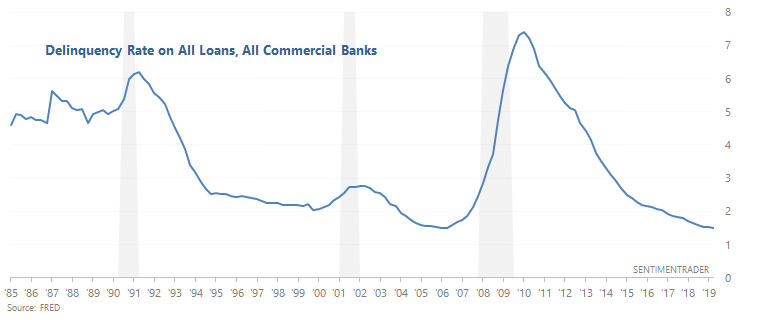

Loans

The Delinquency Rate on All Loans continues to trend downwards. In the past, the Delinquency Rate trended higher before a recession began. This is a positive for macro.

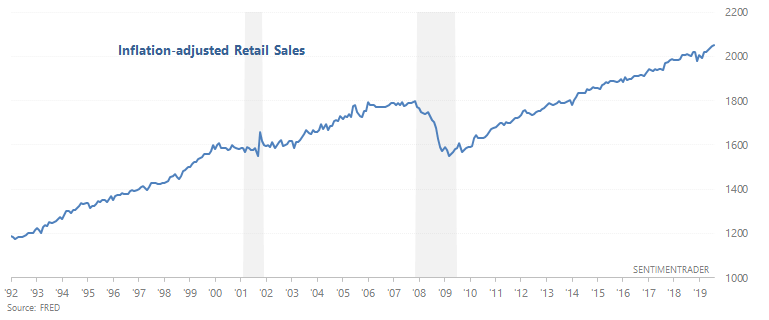

Inflation-adjusted retail sales

Inflation-adjusted Retail Sales continue to trend higher. In the past, inflation-adjusted Retail Sales trended sideways before recessions began. This is a positive for macro.

Neutral/bearish factors

Corporate Profits

Figures related to corporate profits suggest that the economic expansion is definitely late-cycle.

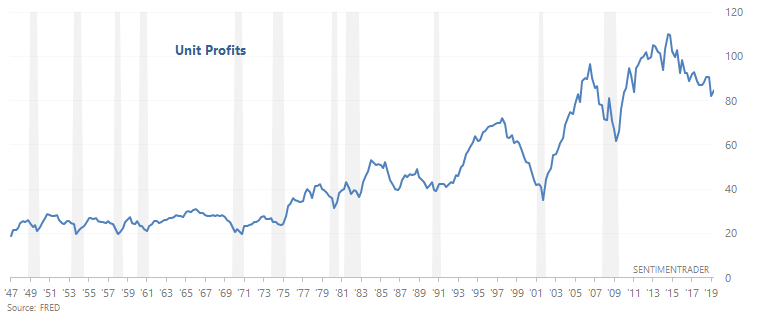

Unit Profits

Unit Profits continue to trend downwards, which is typically what happens in the second half of an economic expansion cycle. However, this indicator is not a timing tool. Unit Profits can fall for years before a recession begins.

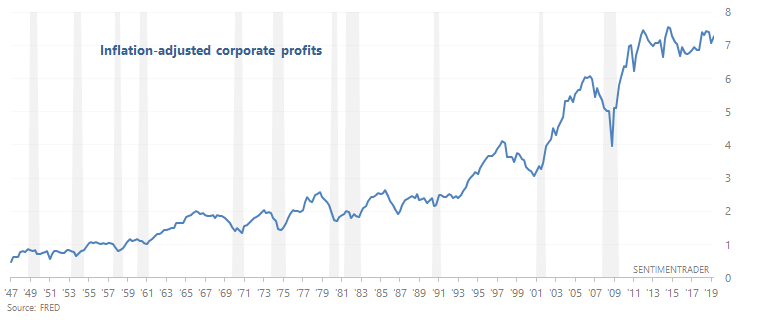

Corporate Profits

Inflation-adjusted corporate profits are trending sideways. In the past, inflation-adjusted corporate profits trended downwards for several quarters before recessions began. If corporate profits start to trend downwards, this will be a negative for macro in 2020.

Bearish factors

Yield Curve

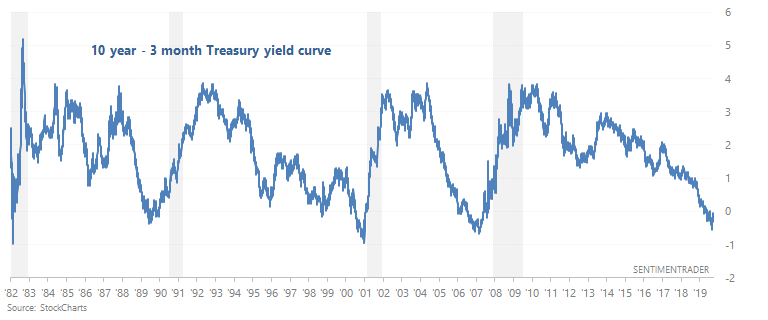

Both the popular 10 year - 2 year and 10 year - 3 month sections of the yield curve have inverted. Here's the 10 year - 3 month yield curve, which historically has been a better market timing indicator than the 10 year - 2 year yield curve:

Overall, the yield curve is a bearish factor for macro right now because the yield curve tends to invert 1-2 years before a recession and bear market begins. HOWEVER, the yield curve is merely one of many factors to consider, and it is not flawless. (See this and this study by the St. Louis Fed).

High yield spreads

From September 2018 – present, high yield spreads have been making higher lows while the stock market has made higher highs. This is a necessary but not sufficient condition for bear markets and recessions. In the past, high yield spreads trended higher before bear markets and recessions began. This is because the average bond market participant is usually more aware of risk than the average stock market participant..

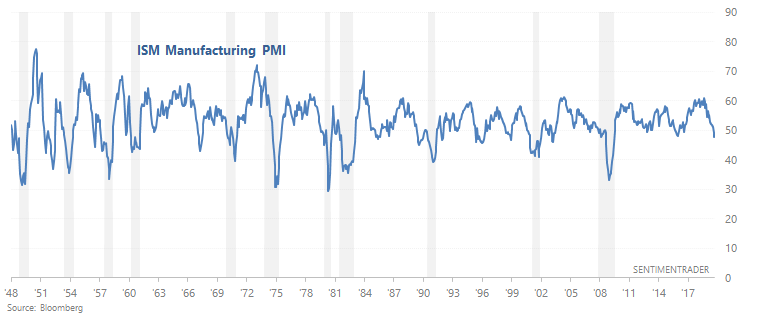

Manufacturing

The manufacturing sector remains one of the weakest parts of the U.S. economy, and this is probably related to the trade war. For example, the ISM Manufacturing PMI is currently below 50, which signals contraction. This is a bearish factor for our Macro Index.

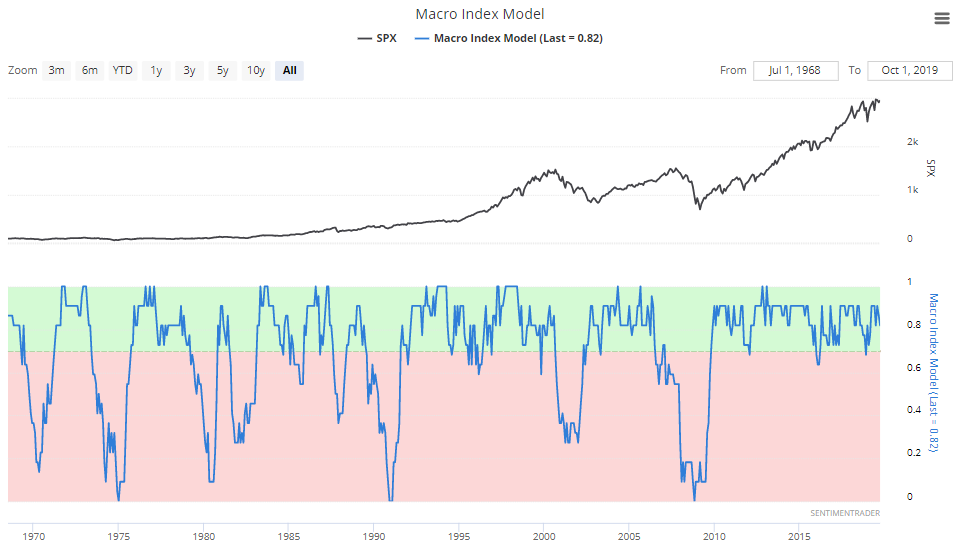

Macro Index

The Macro Index includes:

- New Home Sales

- Housing Starts

- Building Permits

- Initial Claims

- Continued Claims

- Heavy Truck Sales

- 10 year - 3 month Treasury yield curve

- S&P 500's 10 month average

- ISM Manufacturing PMI

- Margin Debt

- Inflation