No Rush to Buy Platinum or the U.S. Dollar

There is a tendency in the financial markets to read every headline as a "prediction" or "forecast" of what is coming next. From there, articles are read as "supporting documentation" that makes a case for the "prediction" in the headline. And in the end, the reader either finds the argument compelling or not.

And all of this is well and good from an "intellectual" and "informational" point of view. But once you cross into the realm of real-world trading, the game changes dramatically.

In real-world trading, it's not so much about being "right or wrong." It is more about "how much" and "how often?"

Ultimately your entire trading world gets boiled down to the following formula:

- (# of winning trades / # of losing trades) x (average winning trade/average losing trade)

In the end, the numbers that you plug into the formula above will determine your success or failure.

Another consideration is that few traders have unlimited capital, and therefore decisions have to be made regarding how to allocate one's capital.

- Given the importance of the formula above, it is critically important to allocate capital to whatever you deem to be the "best" opportunities.

- By extension, it is also therefore important to avoid opportunities with poorer prospects

This leads us back to today's headline regarding platinum and the U.S. dollar. Given the explanations above, hopefully, the assertions below will make more sense:

- The argument being made is NOT that platinum and/or the U.S. dollar are doomed to decline from current levels

- The argument being made is also NOT that platinum and/or the U.S. dollar CANNOT rally from here (they can)

- The argument being made IS that risking your trading capital on the long side of these markets may not be the best use of said capital

PLATINUM

I wrote about platinum recently here. As you can see in the chart below (courtesy of StockCharts.com), platinum has struggled in the past month.

The "story" is that platinum (which is used a lot now in making new cars) has suffered due to the slowdown in car production resulting from the shortage of semiconductor chips.

And of course, the "counter-story" is that once chip production once again ramps up, platinum will "soar."

Whatever.

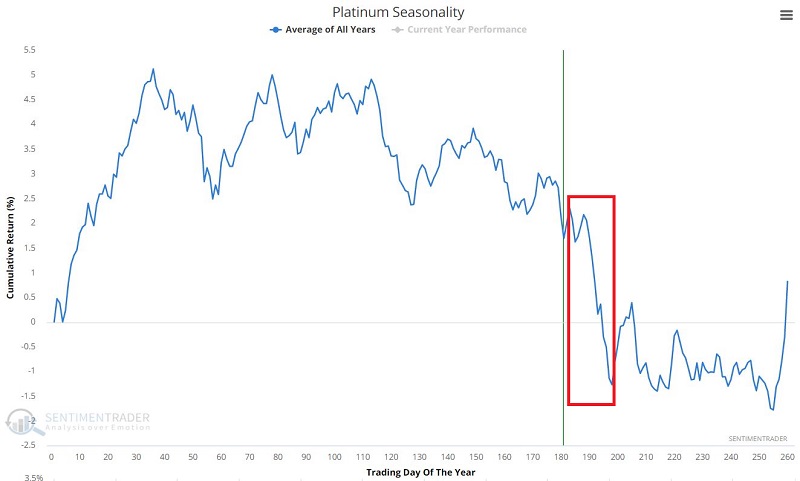

The chart below displays the Annual Seasonal Trend for platinum. The bottom line is that there is not too much to get excited about on a seasonal basis.

In the chart above, we see an impending period of seasonal weakness. Let's focus on the period from Trading Day of the Year #183 through Trading Day of the Year #193.

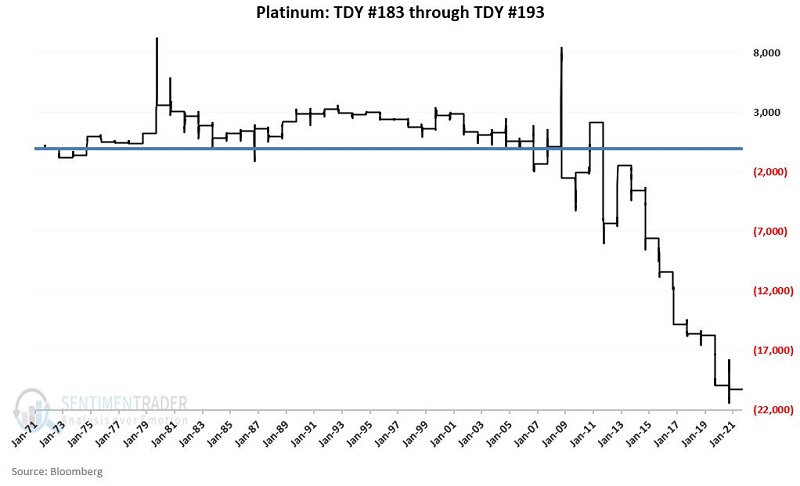

The chart below displays the cumulative dollar +/- for a long position in platinum futures held only from the close on TDY #183 through TDY #193.

To review what I mentioned earlier:

- Does this chart suggest a long position in platinum is guaranteed to lose?

- Does this chart suggest that platinum cannot advance in the days and weeks ahead?

- Does this chart suggest that you might find a better opportunity elsewhere?

U.S. DOLLAR

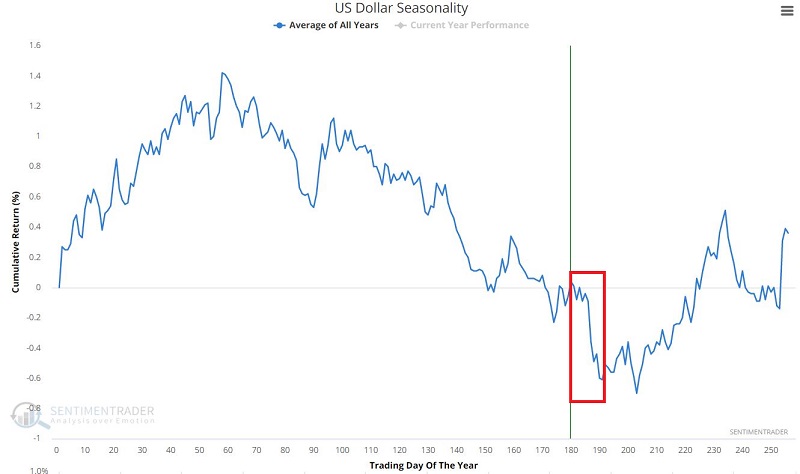

I wrote about the dollar just last week here. The dollar is now entering the seasonally unfavorable period I wrote about in that piece. A quick review appears below.

The chart below displays the dollar entering a weak seasonal period.

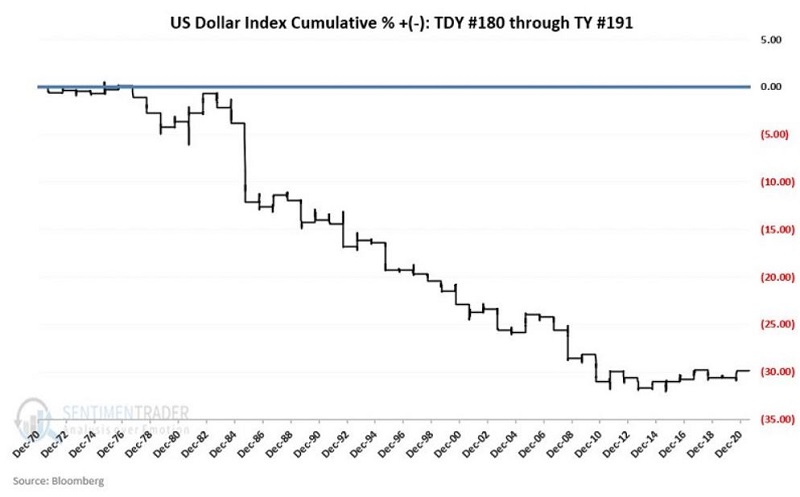

The chart below displays the cumulative dollar +/- for a long position in U.S. Dollar futures held ONLY from the close on TDY #180 through TDY #191.

And once again, the relevant question is NOT, "what do you think is going to happen?"

The relevant question is, "what are you going to do with your trading capital?"