New lows tick higher even with historic year-ago comparisons

One of the major developments we've been watching for ever since there was overwhelming evidence of excessive optimism is weakening internals.

That can take any number of forms, and for the most part, we haven't really seen it.

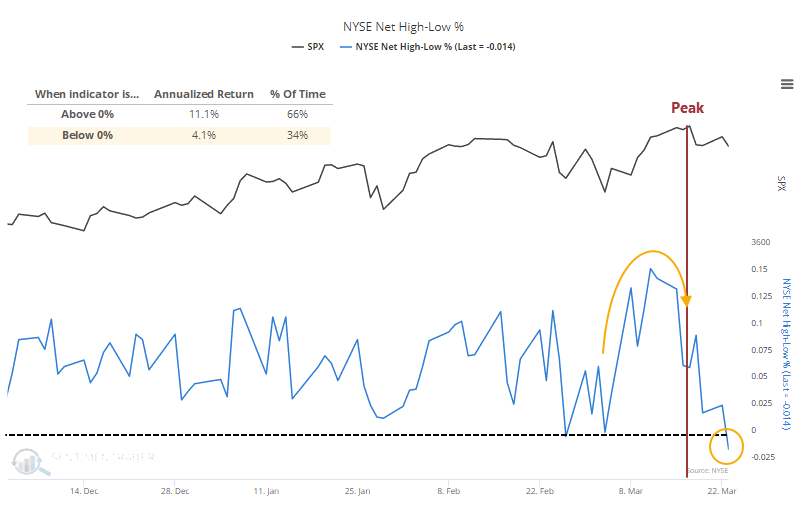

One of the clearest ways to look for this is the net percentage of securities on the NYSE that reach 52-week highs versus 52-week lows. After the surge in new highs in early March, there was a minor divergence as those figures weakened even as the S&P 500 made a new high, but it wasn't major.

More concerning is that by Tuesday, there were more 52-week lows than 52-week highs. We can see the stark difference in forward returns in the chart below when this metric is below zero. It's also a worry that this has flipped so soon after a new high in the S&P, triggering the Titanic Syndrome noted in Tuesday's Daily Report.

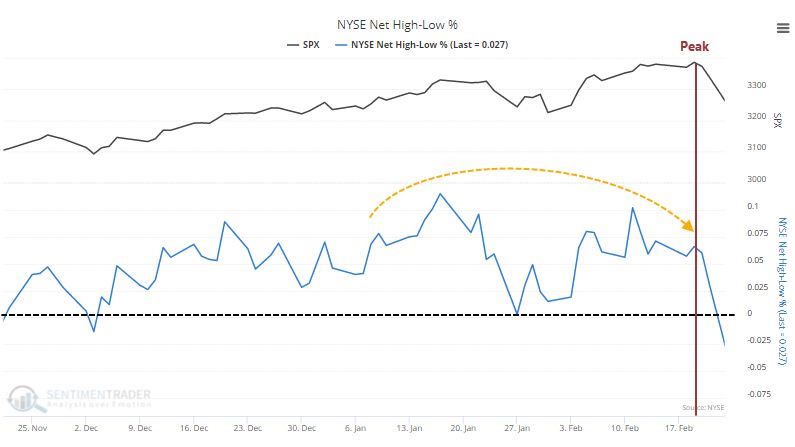

When the S&P peaked last year, there was more of a divergence but even that wasn't too major. And when stocks peaked, there were still many more issues hitting new highs than new lows.

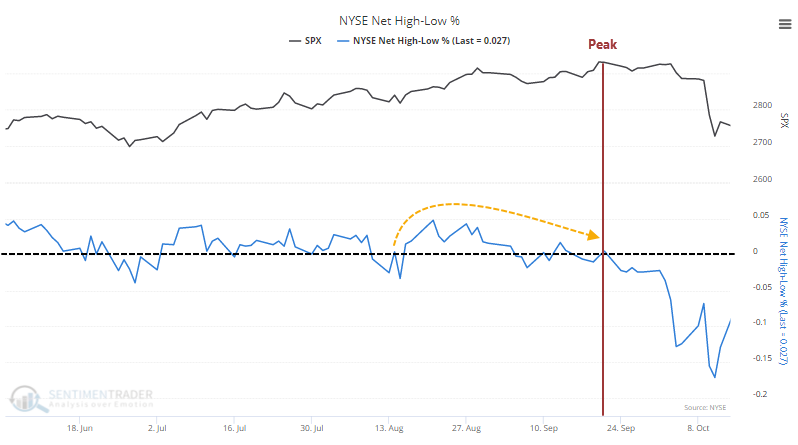

The peak prior to that, in September 2018, was much more pronounced. Even as stocks were hitting new highs, there were actually more new lows on the NYSE than new highs. Major warning sign.

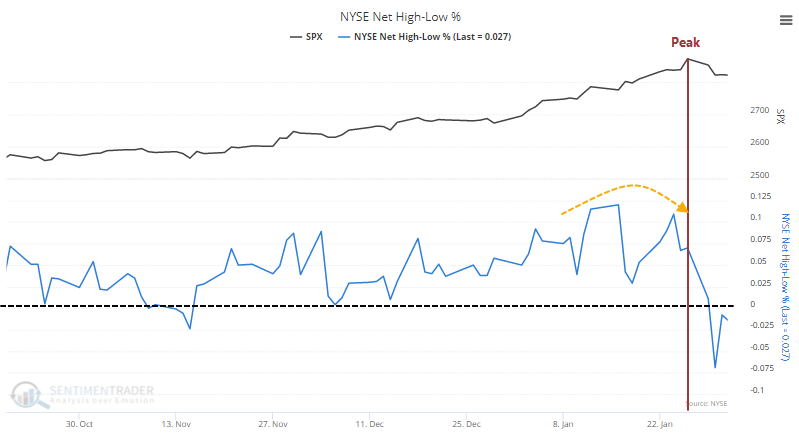

The big rally at the end of 2017 and into early 2018 didn't show any major divergence before stocks peaked.

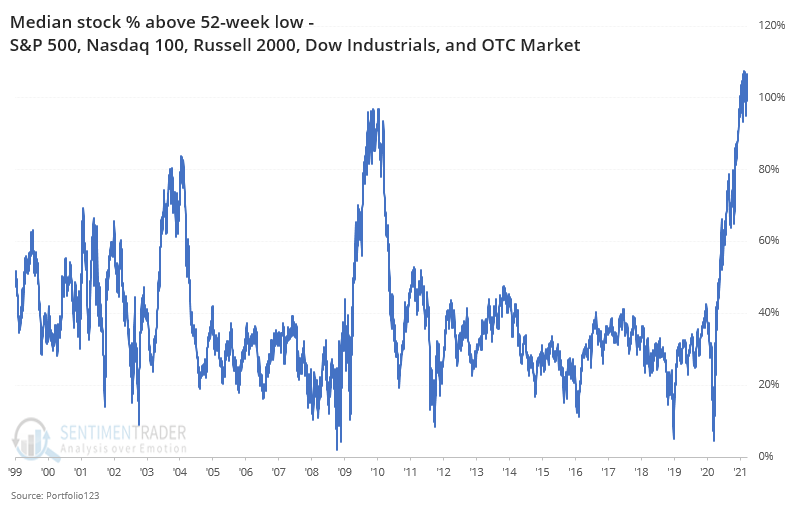

The reason we shouldn't expect a divergence this time is simply how far stocks have traveled. Across all the major equity indexes, and throwing in over-the-counter stocks just because they have seen such a tremendous surge of interest, the median stock is up more than 100% from its lows.

That's more than the initial recoveries off the bear market bottoms in 2003 and 2009.

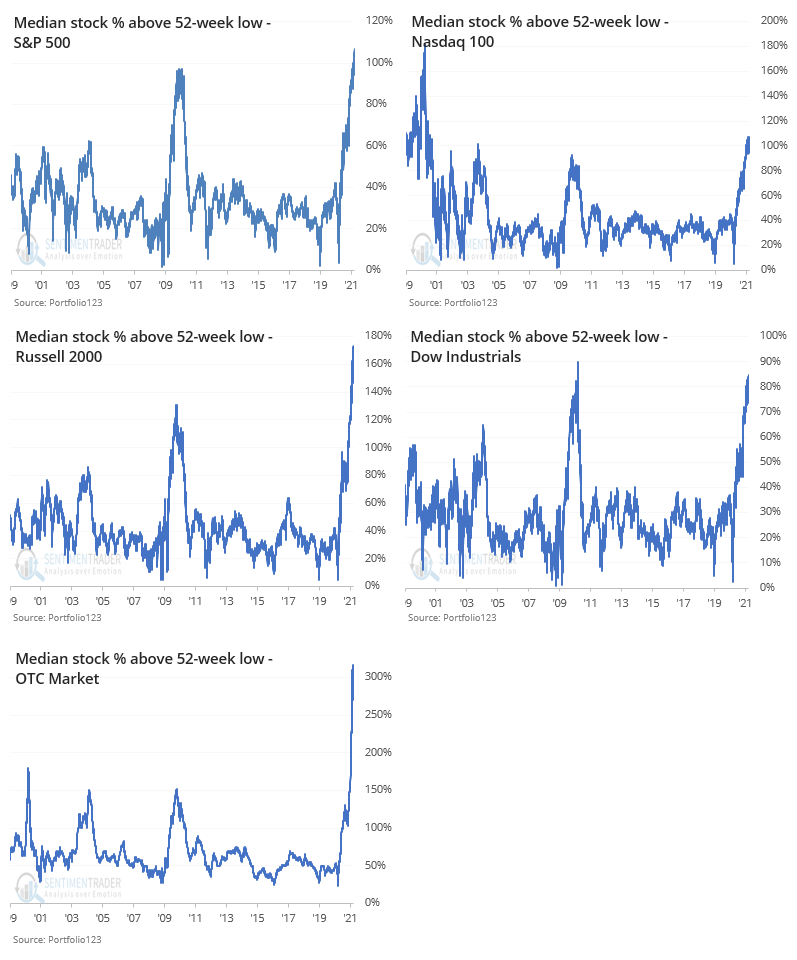

Among the indexes, we can see just how much the average stock has rallied.

If we go back to the other two times when the median stock was at least 80% above its 52-week low, then we can see if there were divergences then between the S&P 500 and the NYSE Net New High / New Low line.

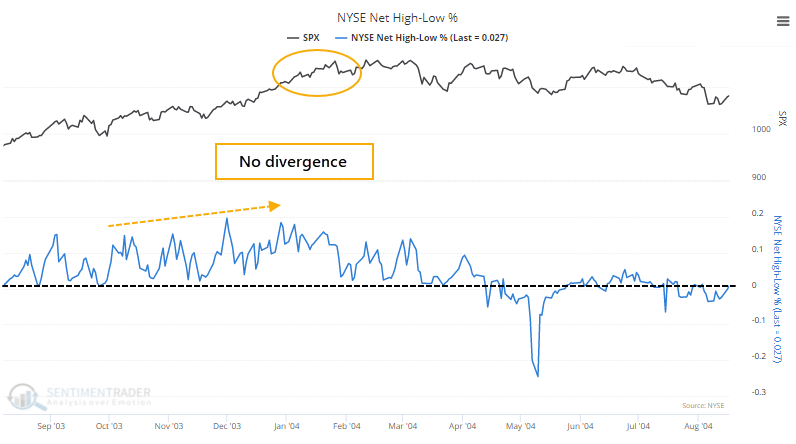

In early 2004, when the median stock was more than 80% above its low, breadth was still very strong and there was no divergence before stocks slumped into months of choppy downside.

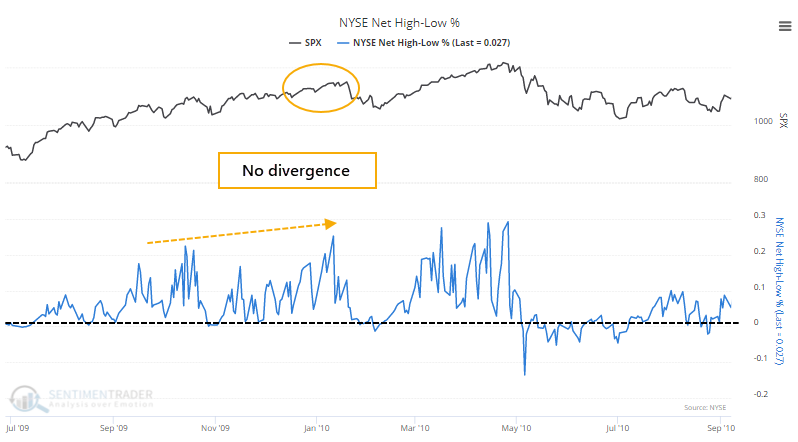

Same goes for early 2010, when the median stock had doubled off its financial crisis low.

Based on this, we're not likely to see the 52-week low list grow any time soon. The average stock has skyrocketed off its low from a year ago, so it will take either a massive decline, or simply more time to generate easier 52-week comparisons, before the list will grow and potentially trigger a divergence with indexes like the S&P. Those divergences, while a warning sign if present, are not required before stocks correct. The more the net percentage of securities remains below zero, the more risk there is of a weakening market.