Minutes Digest for Feb 17 2021

Relative Ratio Rank Risk-On Update

- Published:

2021-02-17 10:42:23 - Author: Dean Christians

In today's note, I want to provide an update on the relative strength ratio rank risk-on composite model and take a look at a few other ratio relationships I'm monitoring. Please see my note from 1/19/21 to learn more about how I designed the model.

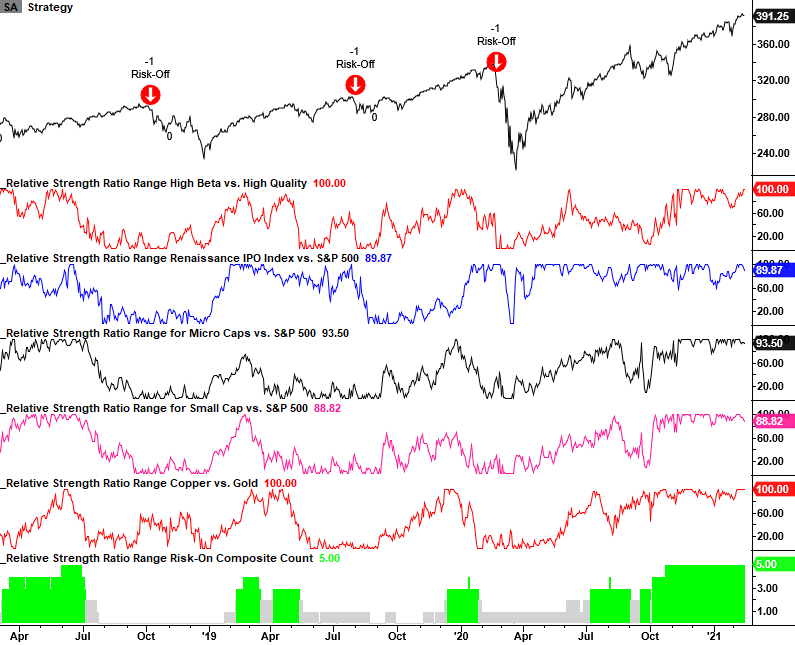

Relative Ratio Rank Risk-Off Model

The relative strength ratio rank risk-on model remains in a firm position with a composite count of five and all components in the 88th percentile or higher. Remember, the model will trigger a risk-off signal when the count falls to one or less, and the S&P 500 turns down. Please note, in the late January market dip, only one component fell below the 75th percentile. Risk appetite remains firm.

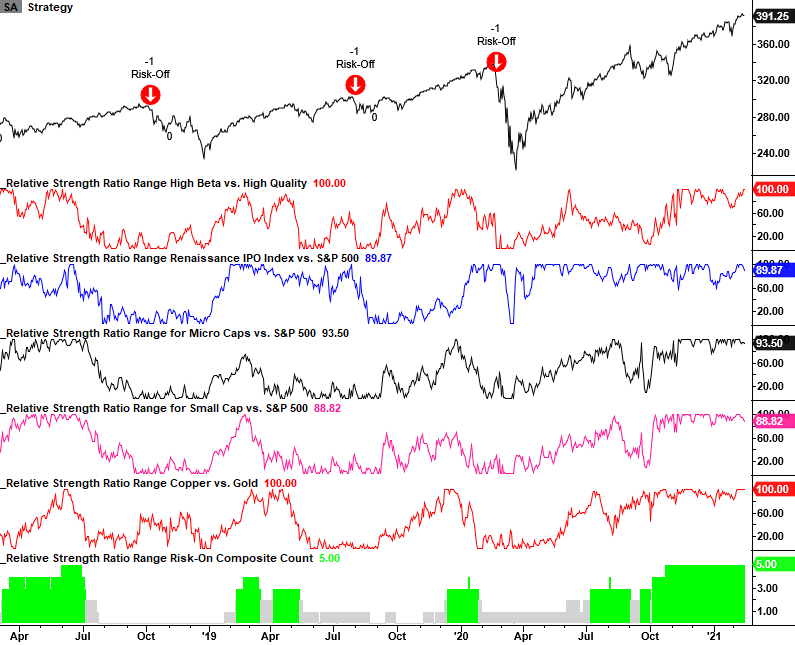

Weak Balance Sheet versus Strong Balance Sheet

Weak balance sheet stocks continue to outperform strong balance sheet stocks with a range rank above the 86th percentile.

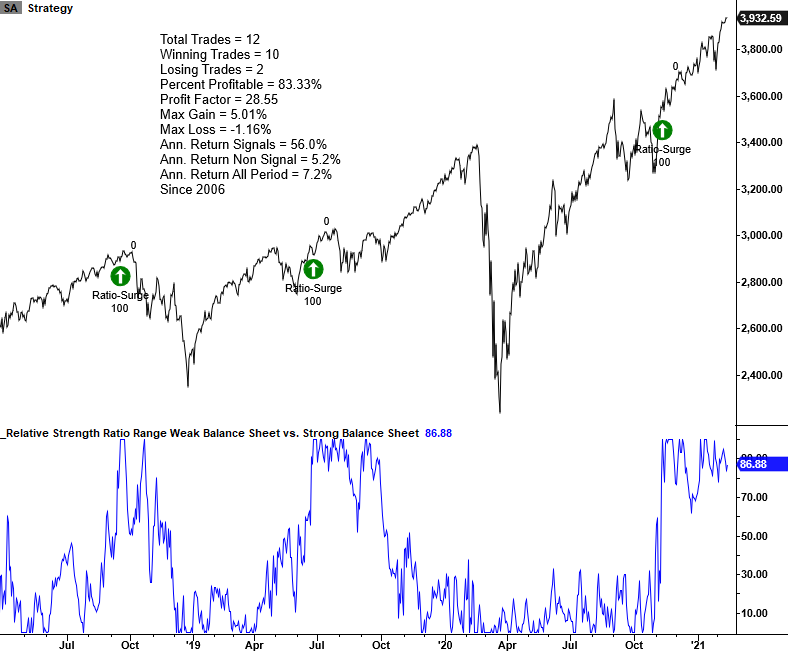

CCC High Yield versus Investment Grade Bonds

CCC high yield bonds continue to outperform investment-grade bonds with a range rank in the 100th percentile. Please note, the underperformance in IG bonds of late has been due to rising rates.

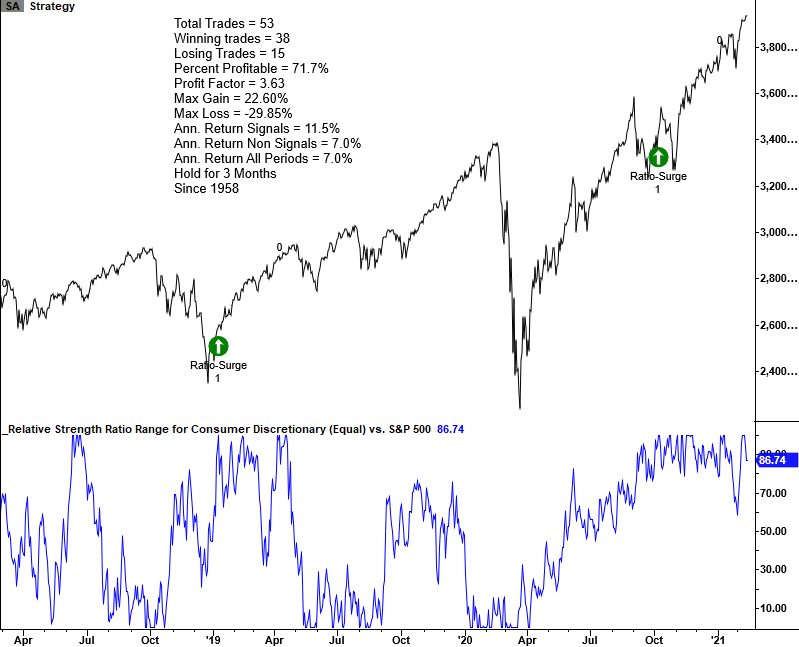

Consumer Discretionary Equal-Weighted versus S&P 500

The Consumer Discretionary (equal-weighted) sector continues to outperform S&P 500 Index with a range rank above the 86th percentile. I prefer the equal-weighted sector over the cap-weighted one as it neutralizes a stock like Amazon.

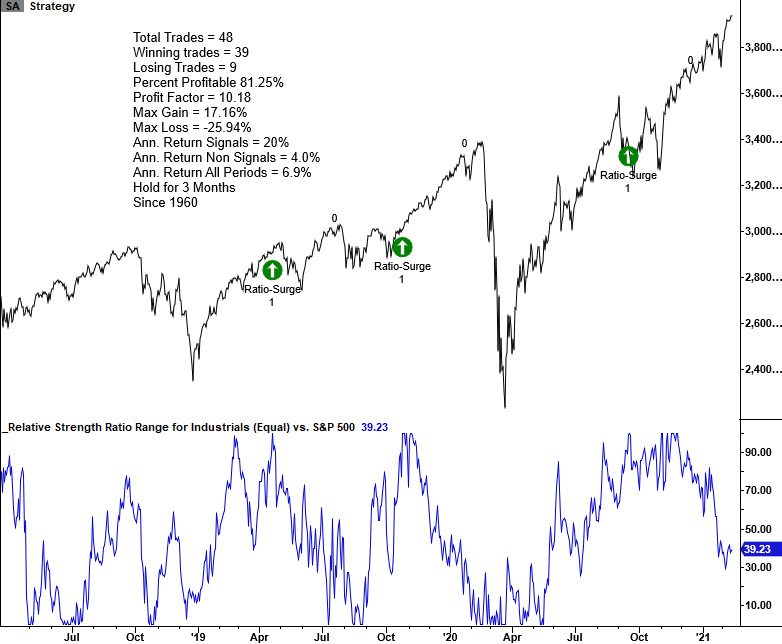

Industrials Equal-Weighted versus S&P 500

The Industrials (equal-weighted) sector range rank versus the S&P 500 Index has turned down considerably. The rank currently resides in the 39th percentile.

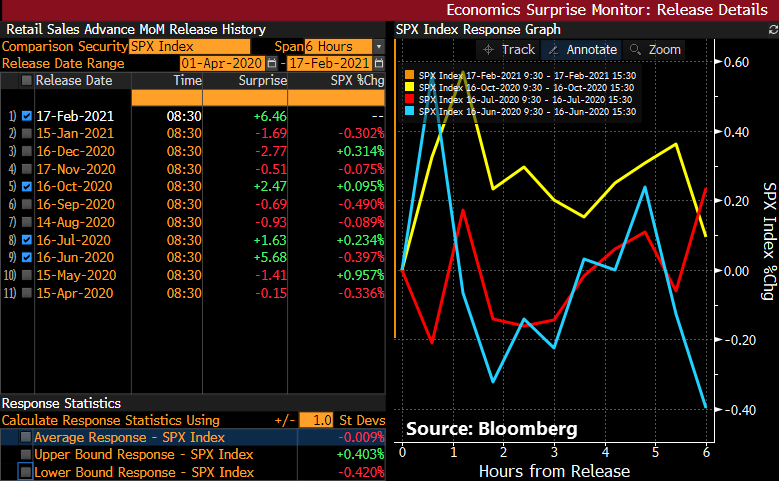

Retail surprise

- Published:

2021-02-17 08:04:59 - Author: Jason Goepfert

The big beat in retail sales is sure to generate a lot of opinions about what it means for stocks in the coming day(s). Looking at other retail sales releases since the bottom last March, there have only been 3 months where they beat expectations. The S&P 500's reactions were "meh."

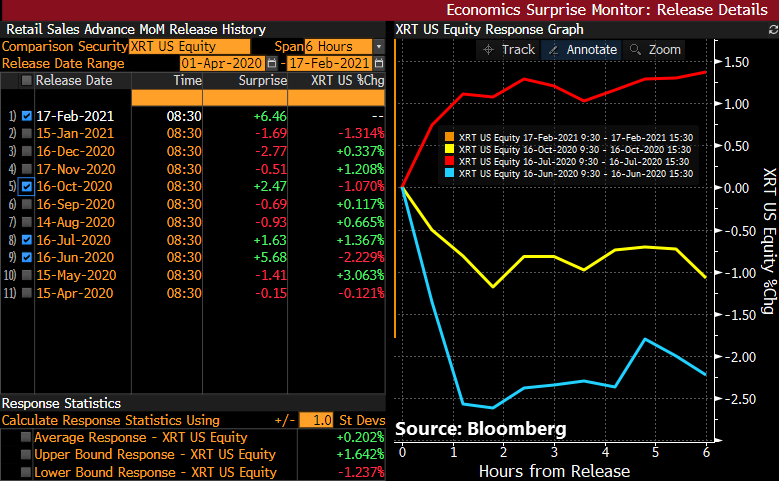

The XRT retail fund saw a big positive day, and two big negative ones, after the other surprises.

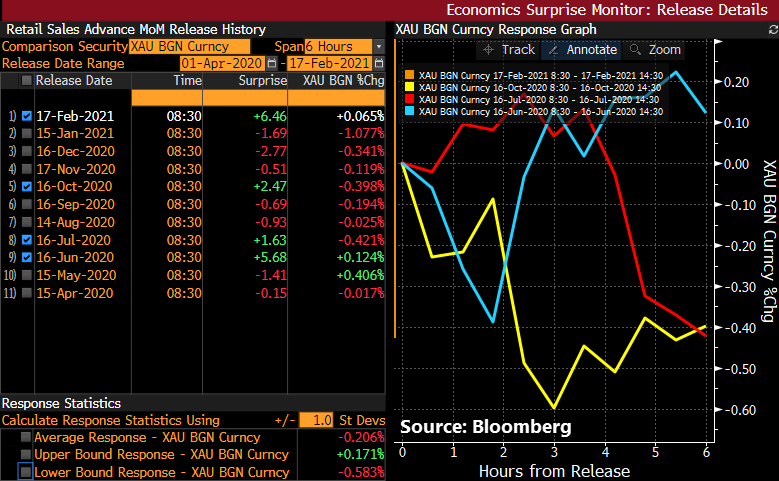

Gold fell twice and worked higher once.

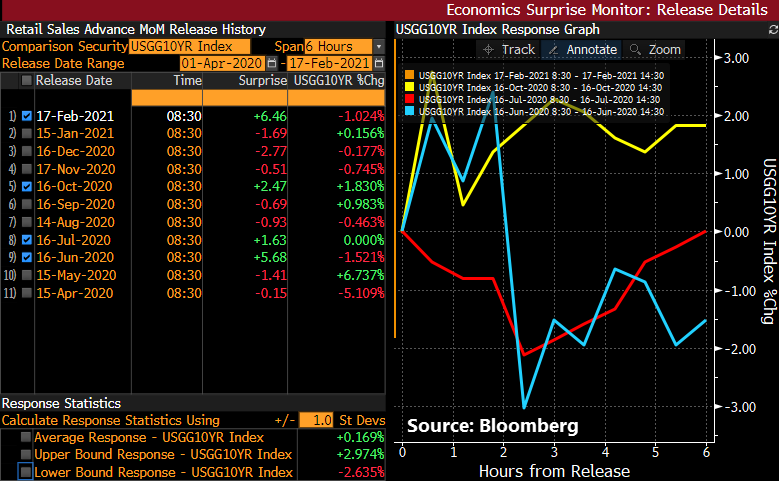

Same goes for 10-year Treasury yields.

Not a lot here to hang one's hat on.