EWZ (Brazil) Bollinger Band Buy Signal

The percentage of Ibovespa Index members trading below their respective lower Bollinger Band registered a mean reversion buy signal on the close of trading on 3/11/21.

Please note, I use the EWZ ETF (Brazil) as the trading vehicle rather than the Ibovespa Brasil Sao Paulo Stock Exchange Index (IBOV) for trading results.

Please see the following note from Jason on the McClellan Summation Index for the Ibovespa Index for further evidence of Brazil's potential turn.

Percent Below Lower Bollinger Band Buy Signal

The Bollinger Band signal seeks to identify instances in history when many Index members trading below their respective lower Bollinger Band cycles from a high to a low percentage, and Index momentum turns positive. The model will issue an alert based upon the following conditions.

Signal Criteria

Condition1 = Percentage of members cross above 35. i.e., the reset

Condition2 = Percentage of members cross below 1.0

Condition3 = If Condition1 and 2, start days since true count

Condition4 = If Days since true count <= 10, and the EWZ 5-day rate of change is >= 2%, then buy.

Let's take a look at the current chart and historical signal performance.

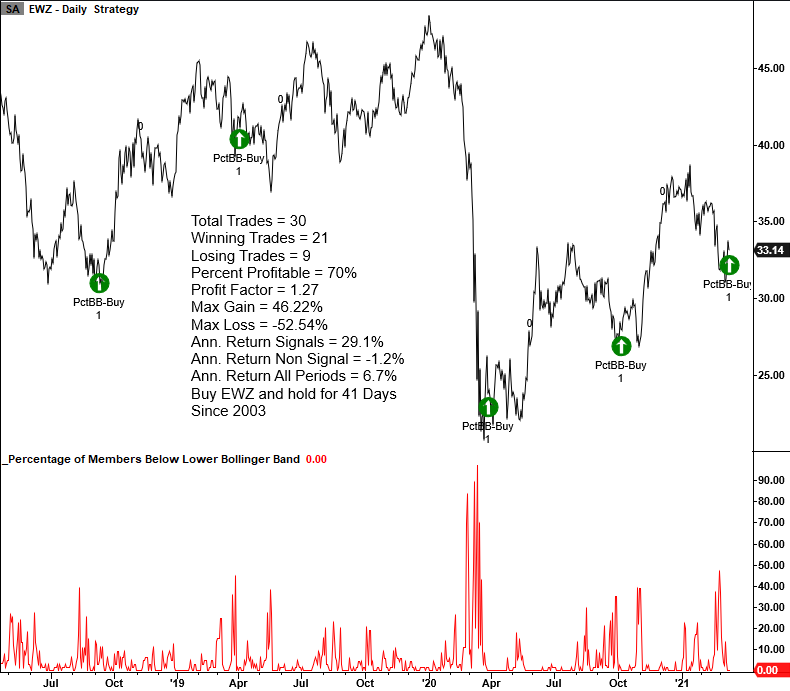

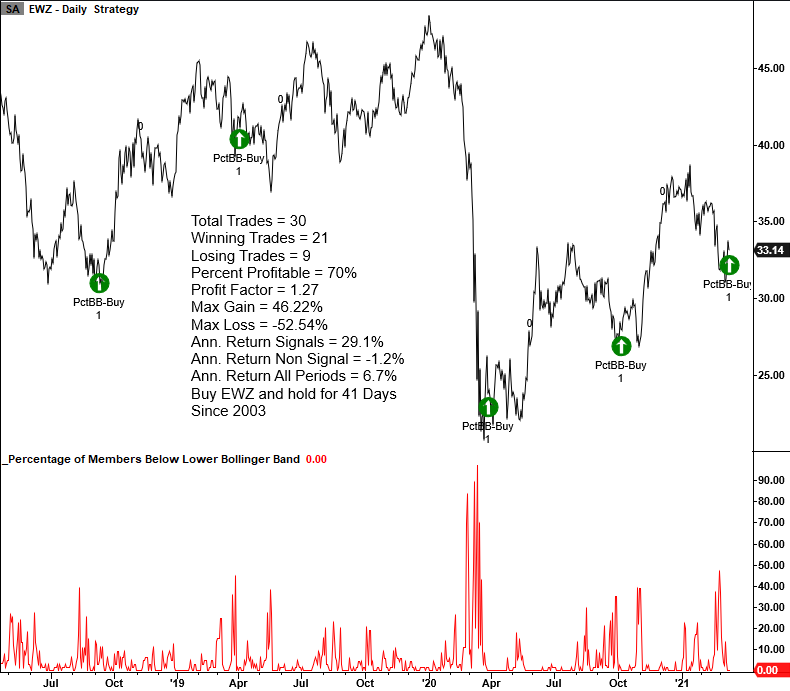

EWZ Current Chart Example

Please note that the chart's trading statistics are based on buying and selling the next day open. The numbers also reflect an optimized days-in-trade exit signal. The study does not use a sell stop or profit target exit.

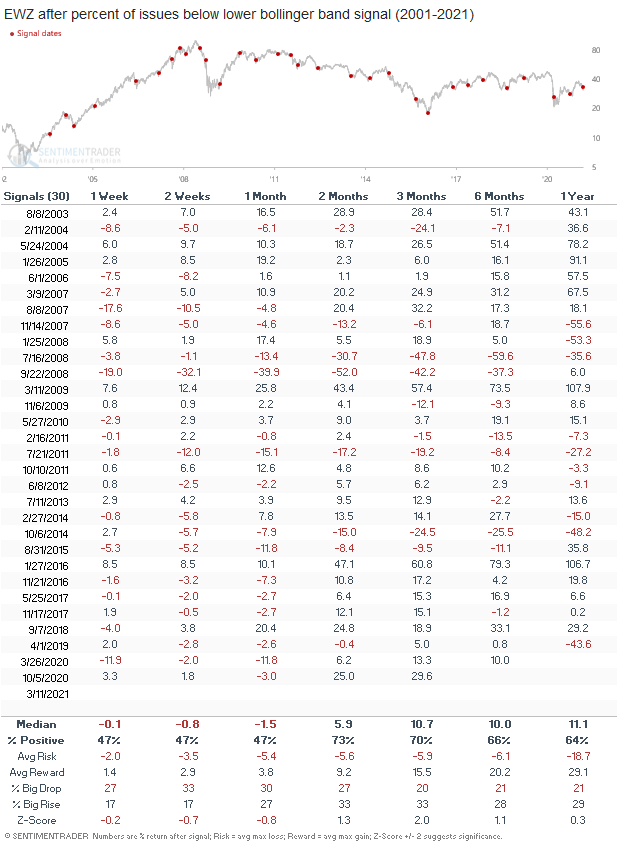

EWZ Signal Performance

Signal performance looks good in the 2-3 month timeframe. However, with weak performance in the first 4 weeks, one might be better suited to combine this signal with other mean reversion indicators to identify a better entry point. Obviously, a sell stop would help to avoid instances like 2008.

Breadth Data Source: Bloomberg

Website Disclosure

"We do not provide investment advice. Our goal is always to find some practical angle, but what you do with the research is up to you. By no means is it ever suggested that you make a trade or investment based on a single reference; we consider our research to be only one part of what should be a comprehensive investment philosophy that includes fundamental and technical data."