Brazil bouncing

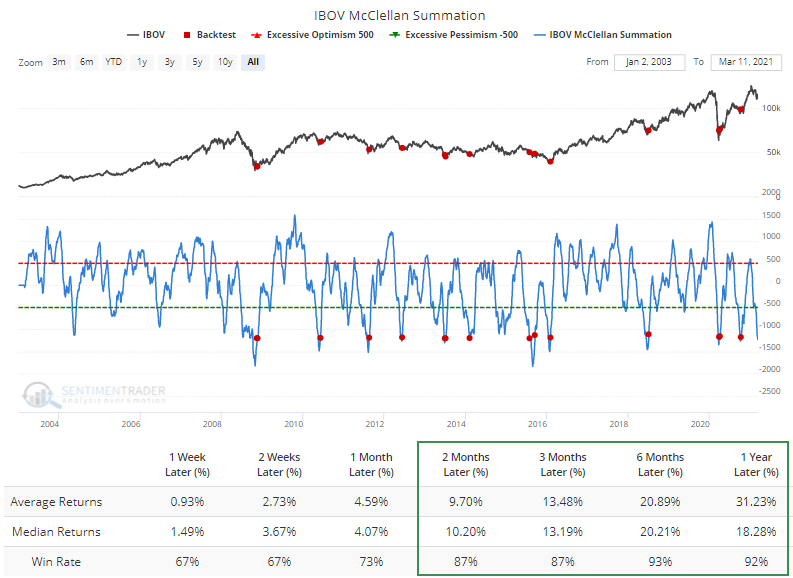

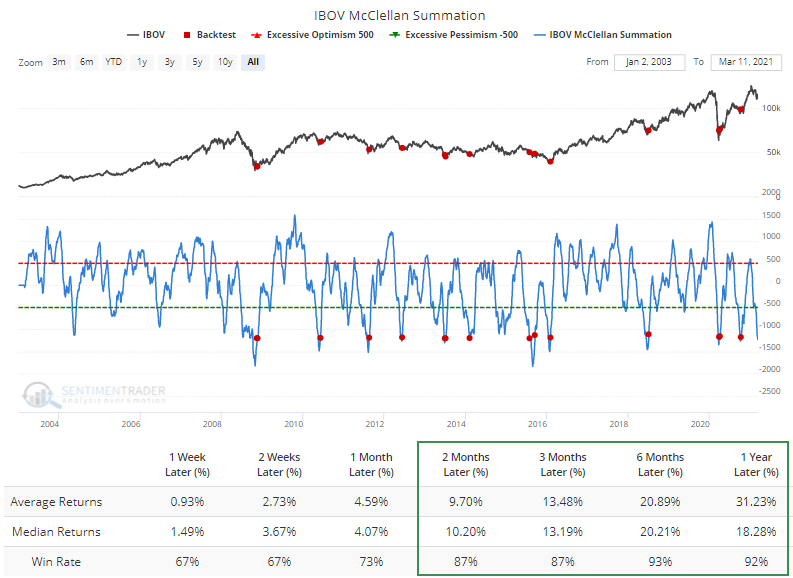

Last week, we touched on some oversold signals being generated in Brazil's Ibovespa index. Now that those stocks are recovering a bit, the McClellan Summation Index will likely curl up from below -1200, one of its most severe oversold readings in nearly 20 years.

This has been a very good medium- to long-term sign, with an average 6-month gain of more than 20% per the Backtest Engine.

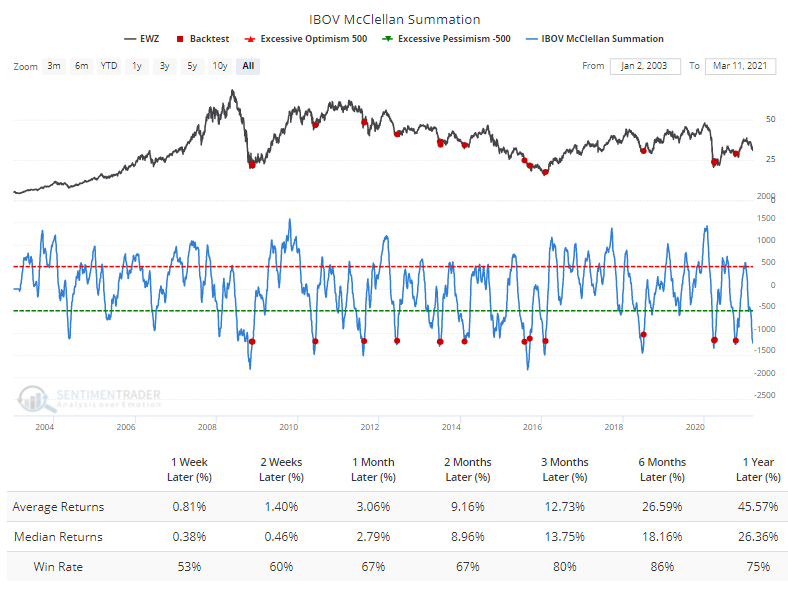

For dollar-based investors, there is currency risk. But even using the EWZ fund, forward returns were excellent.