Defensive Sectors Signal Risk-Off

The defensive sector composite model issued a new risk-off warning alert on the close of trading on 5/11/21. Historically, it's not uncommon to see a signal after the market has been consolidating, which is the case now.

The model is a secondary risk management tool that I monitor in conjunction with other models. I would also add that it is not a component in the TCTM Risk Warning Model.

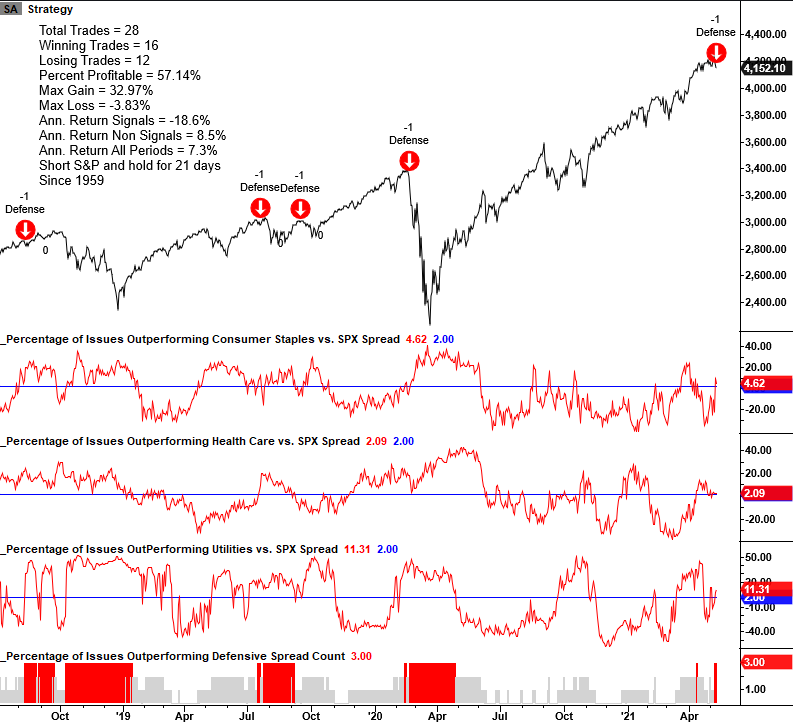

DEFENSIVE SECTOR COMPOSITE MODEL CONCEPT

The Defensive sector composite model seeks to identify periods when traditionally defensive sectors are outperforming the broad market as the S&P 500 maintains a level near its 252-day high. Typically, defensive sectors lag during bull market phases. Therefore, we should heed the market message when the sectors begin to outperform.

The composite includes the following:

- Percentage of Consumer Staple Members Outperforming the S&P 500 Index

- Percentage of Health Care Members Outperforming the S&P 500 Index

- Percentage of Utility Members Outperforming the S&P 500 Index

- Percentage of S&P 500 Members Outperforming the S&P 500 Index

I calculate the composite by measuring the difference between each sector series and the S&P 500 series. I then count the number of groups with a spread above a user-defined threshold. The threshold for this model is plus two or above.

For more information on the model concept, please see the following note.

CURRENT CHART

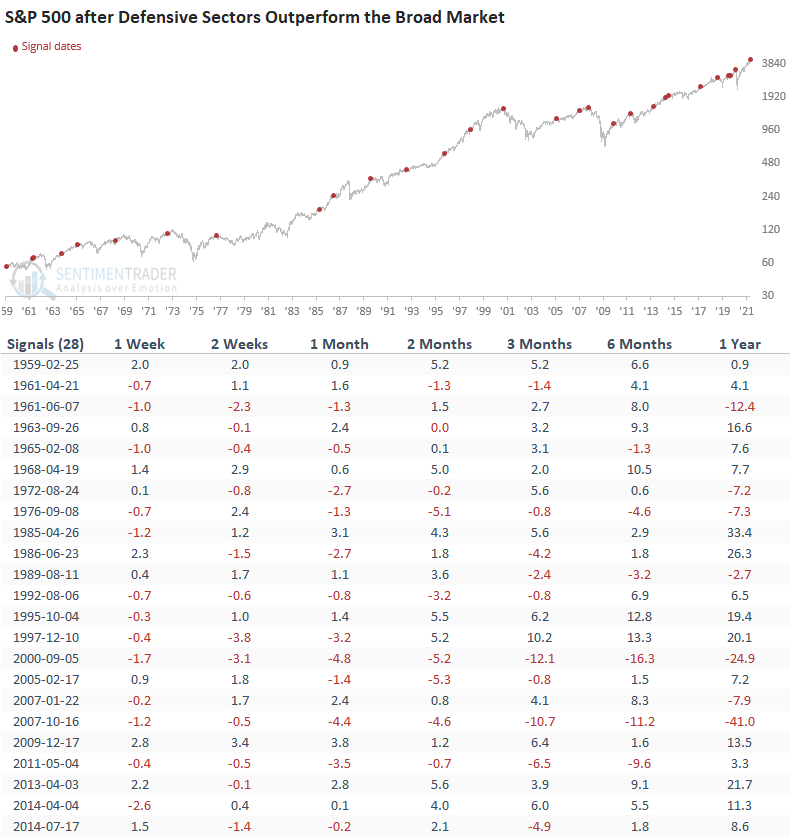

HOW THE SIGNALS PERFORMED

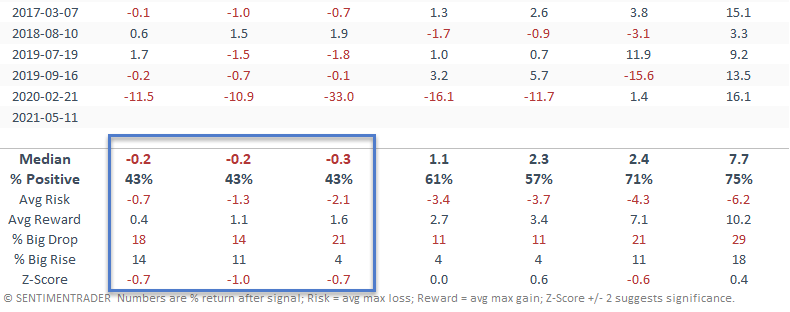

Returns are weak in the 1-4 week timeframe. I suspect the current consolidation continues in the near term.

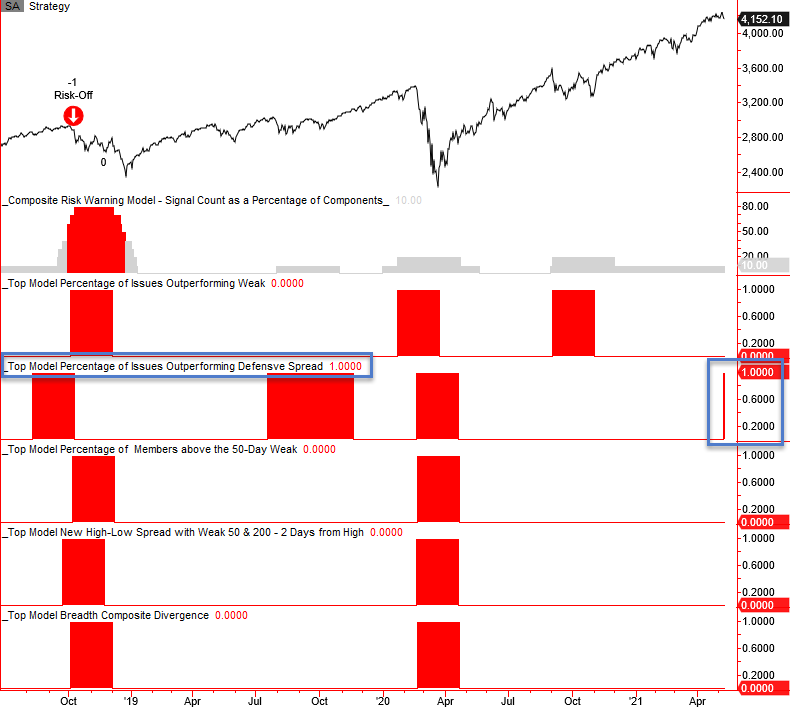

WEIGHT-OF-THE-EVIDENCE

The following chart contains the composite risk warning model count and several other secondary risk-off models shared with subscribers. The defensive sector model is the only measure with a warning signal aside from the sentiment component in the TCTM Risk Warning Model. Without corroborating evidence from other models, a weight-of-the-evidence approach does not suggest that a big risk-off moment is imminent.