Headlines

|

|

Building on a very good year:

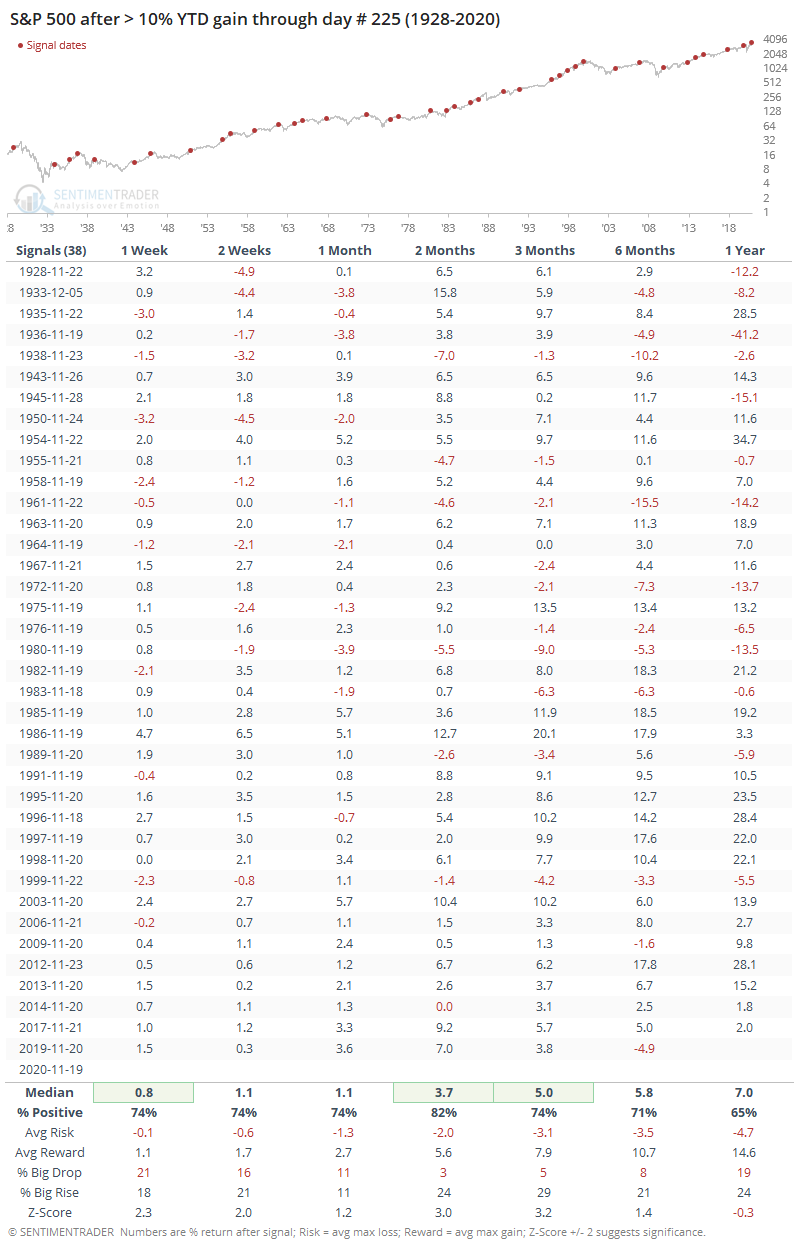

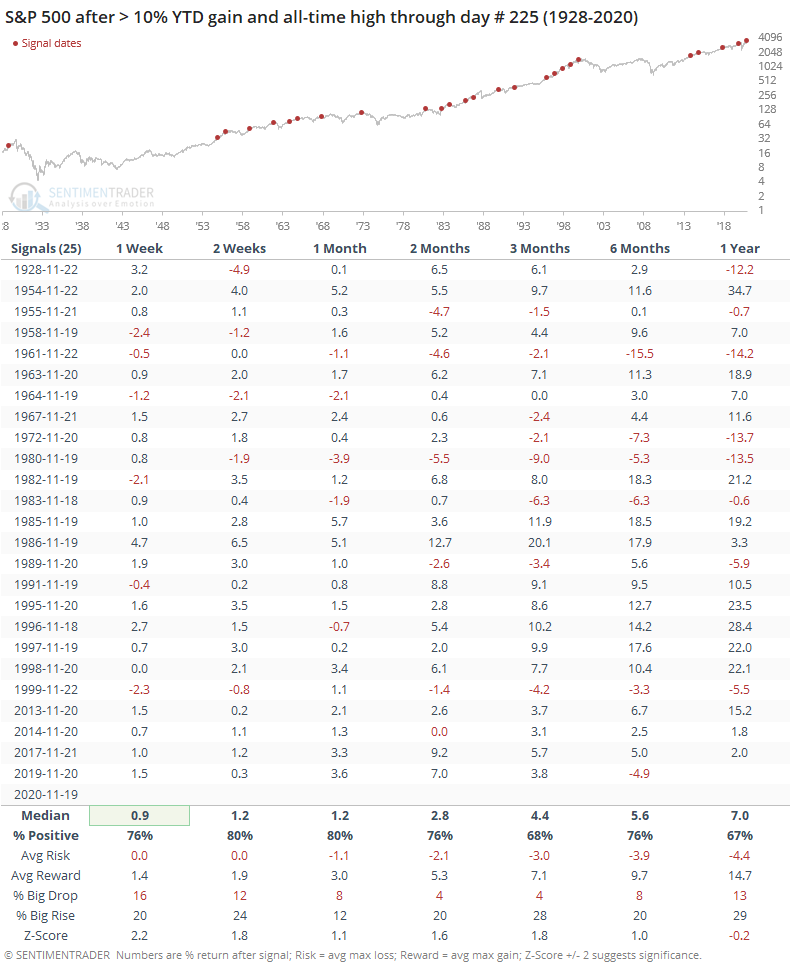

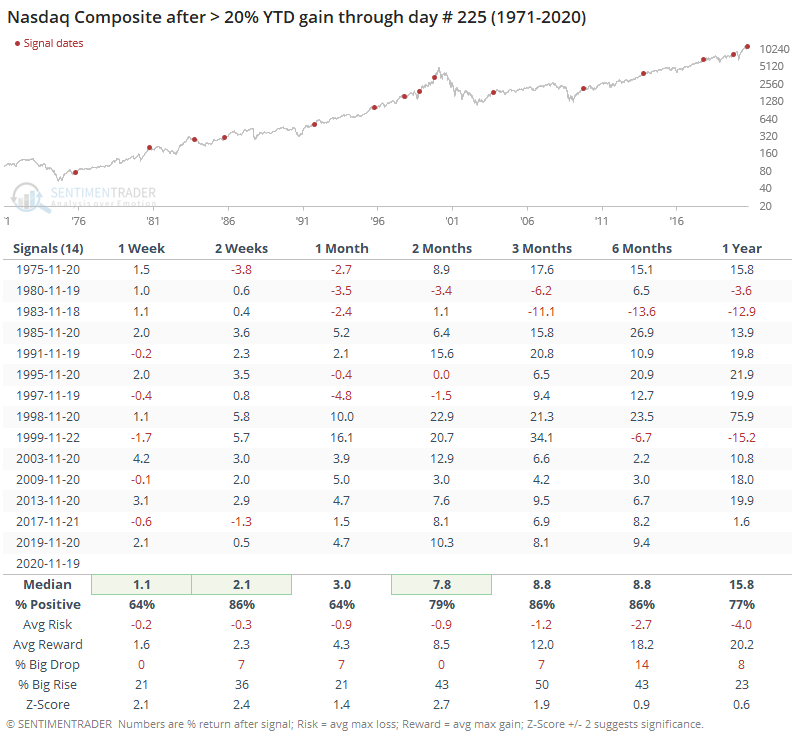

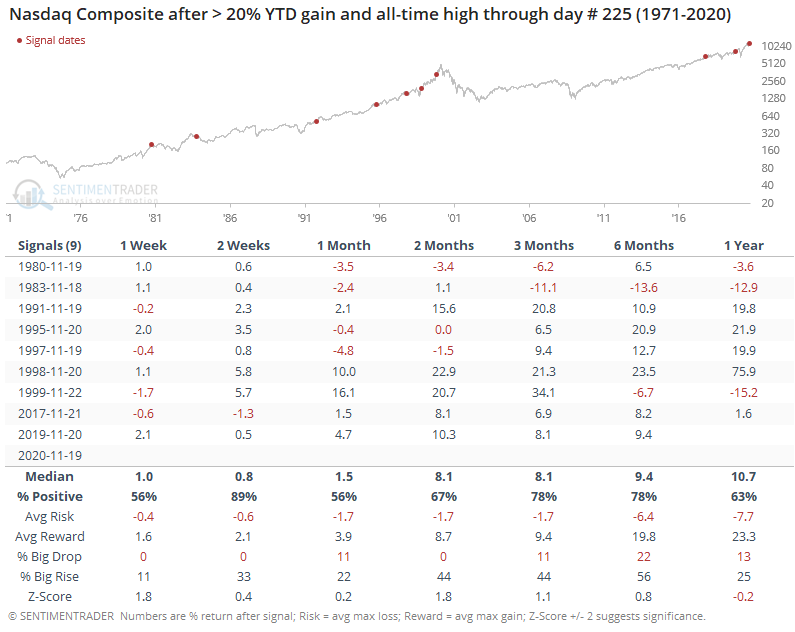

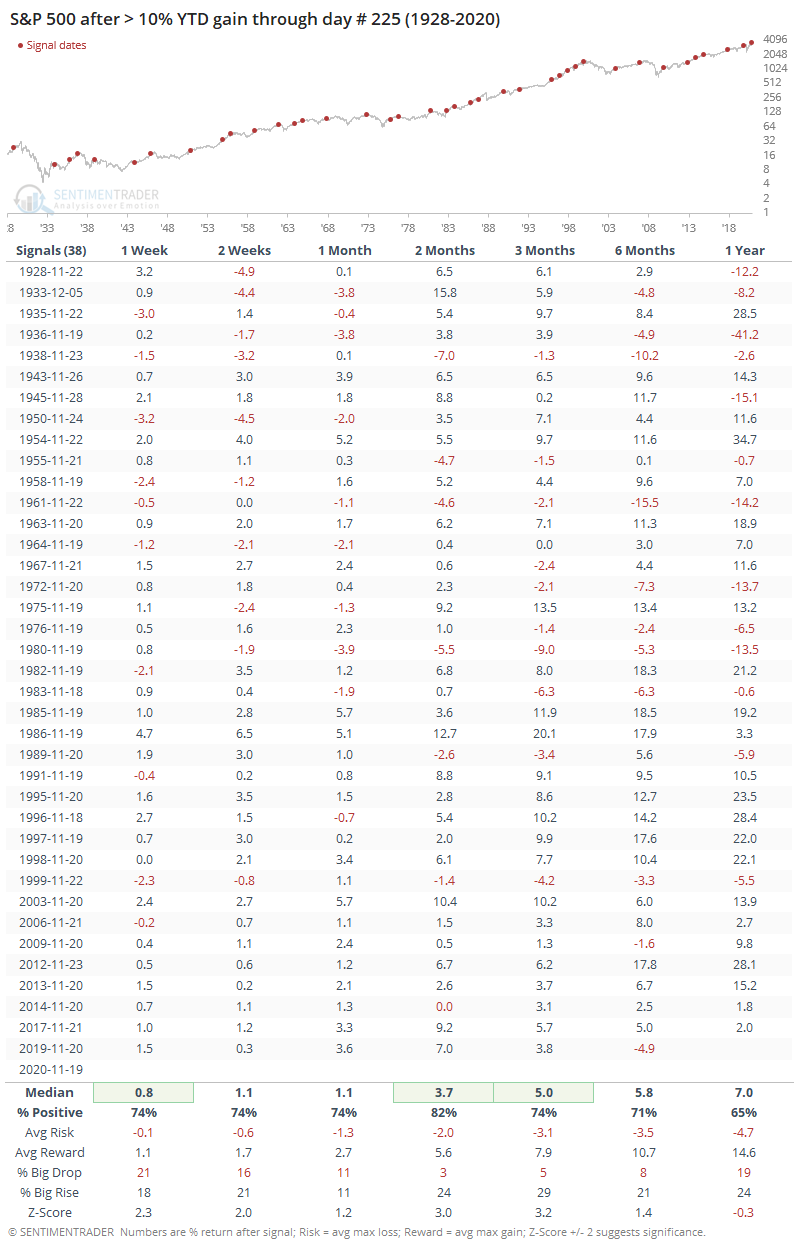

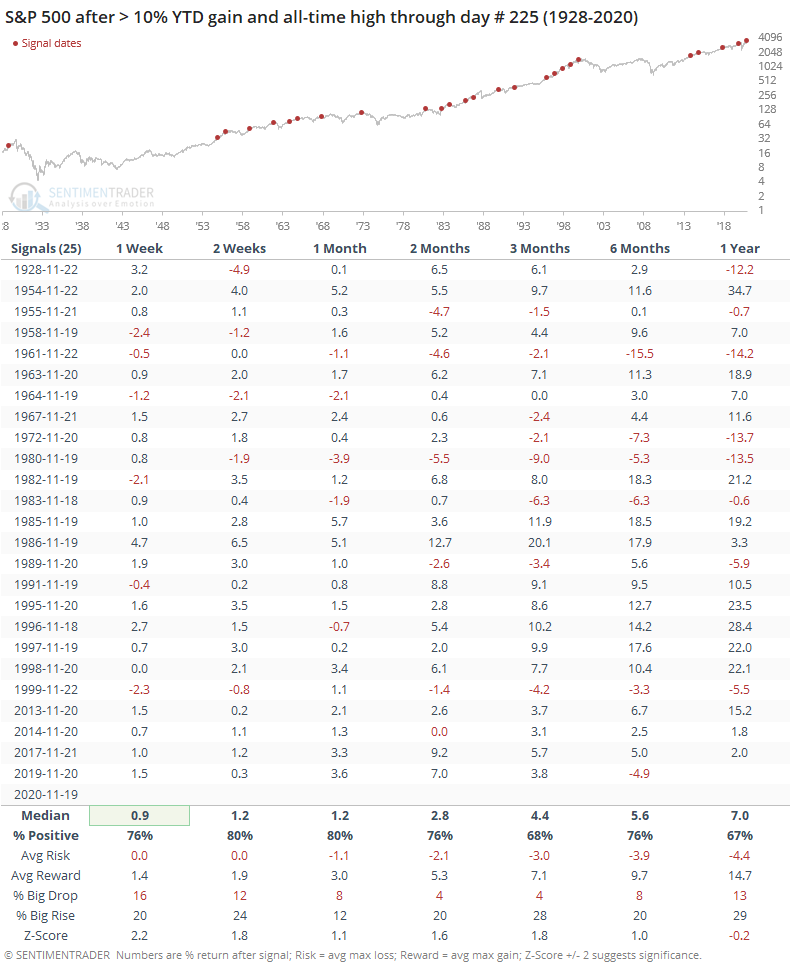

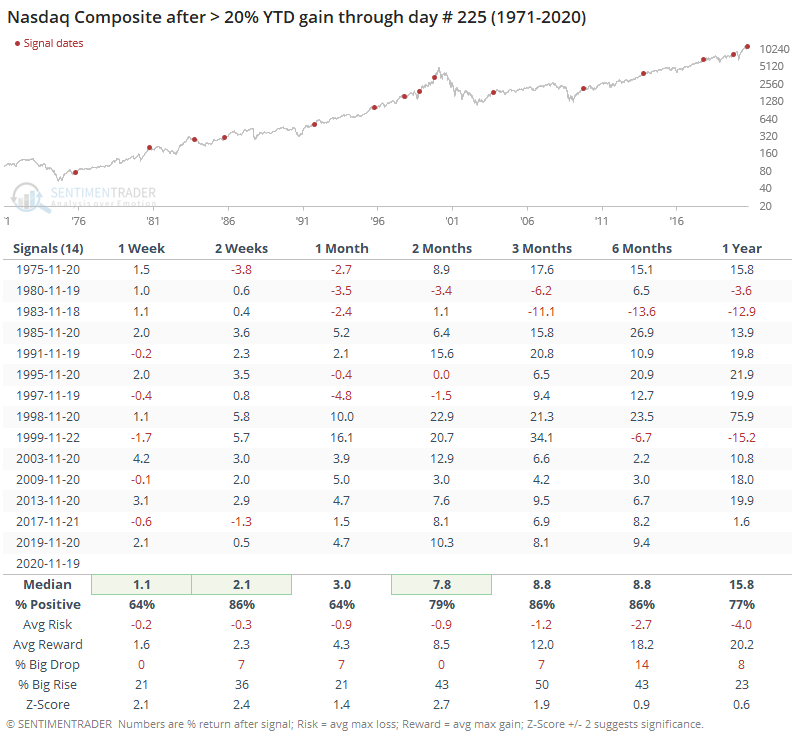

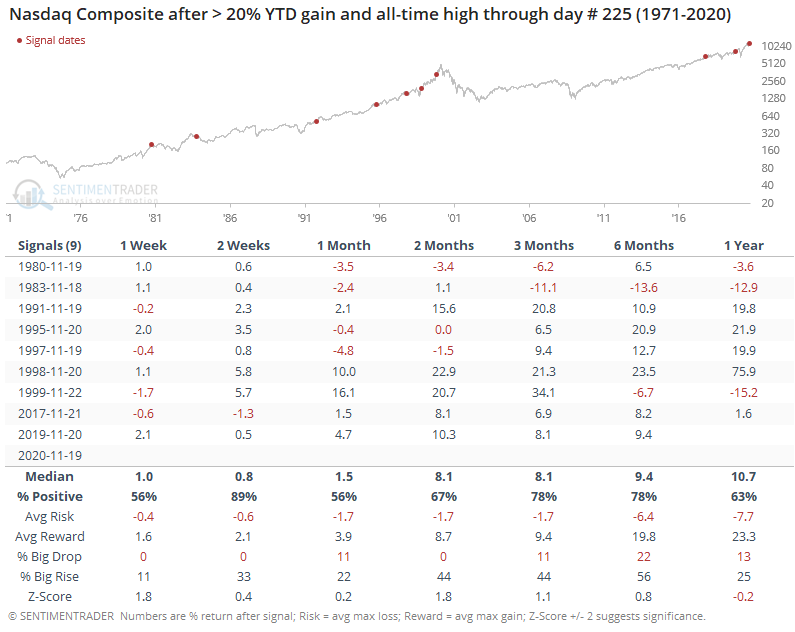

The S&P 500 is up around 10% through late November, which has tended to lead to further gains that build on momentum and seasonality. When the Nasdaq Composite gains 20% or more through this late in the year, it has also tended to keep following through.

Big fund managers bet on stocks, yield curve:

Fund managers in a monthly Bank of America survey have turned highly optimistic on the prospect for stocks, but it has been a poor contrary indicator. Likewise, they're betting on small-caps and a steeper yield curve.

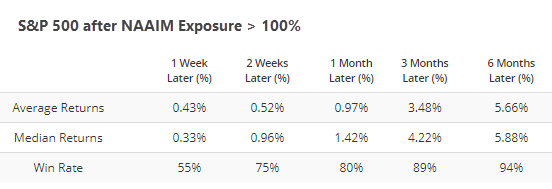

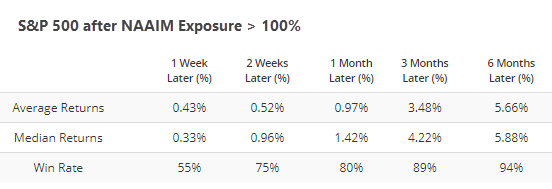

Active manager exposure: There is a lot of eagerness to consider everything a contrary indicator. The world doesn't work that way, though. The latest survey of active investment managers from NAAIM shows that they are leveraged long stocks with the 4th-highest reading on record. According to the Backtest Engine, there have been 18 weeks since the survey's inception when managers were leveraged long. That should be a negative headwind for further gains, but over the next 3 months, the S&P accommodated them by rising after 16 of them, an 89% win rate.

Bottom Line:

- The market environment is pristine, but with near-historic optimism, gains tend to be muted, with a high probability of being reversed at some point over the ensuing weeks.

|

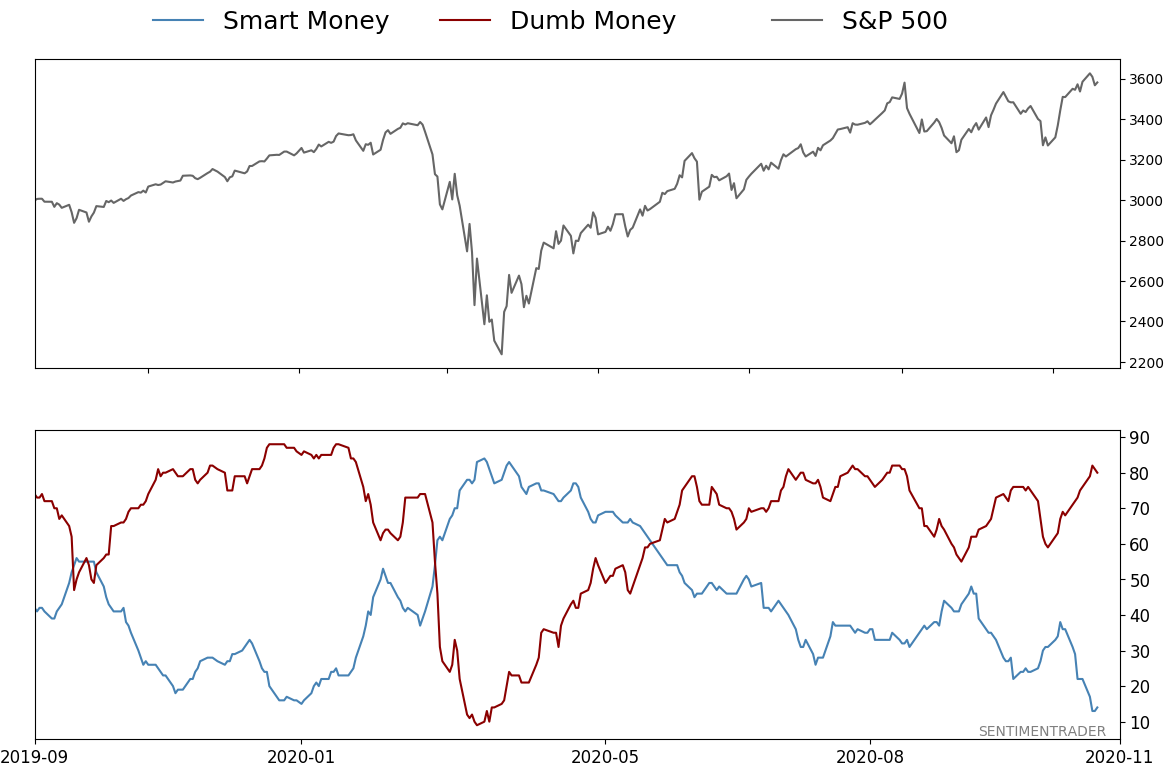

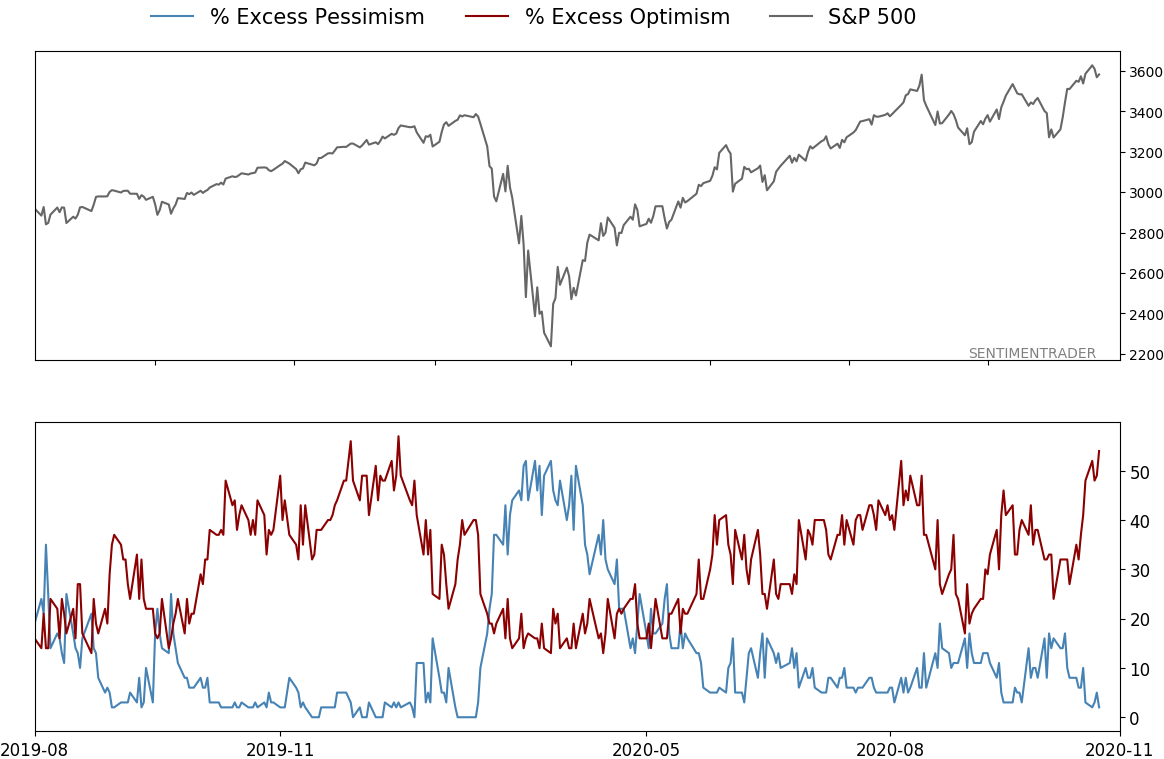

Smart / Dumb Money Confidence

|

Smart Money Confidence: 14%

Dumb Money Confidence: 80%

|

|

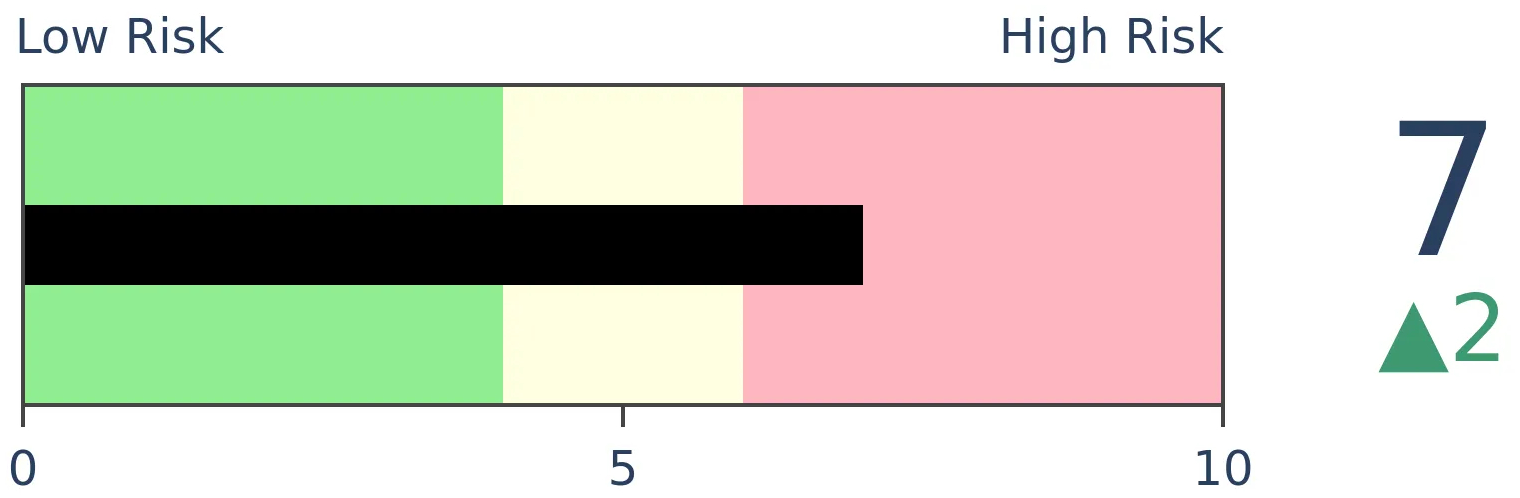

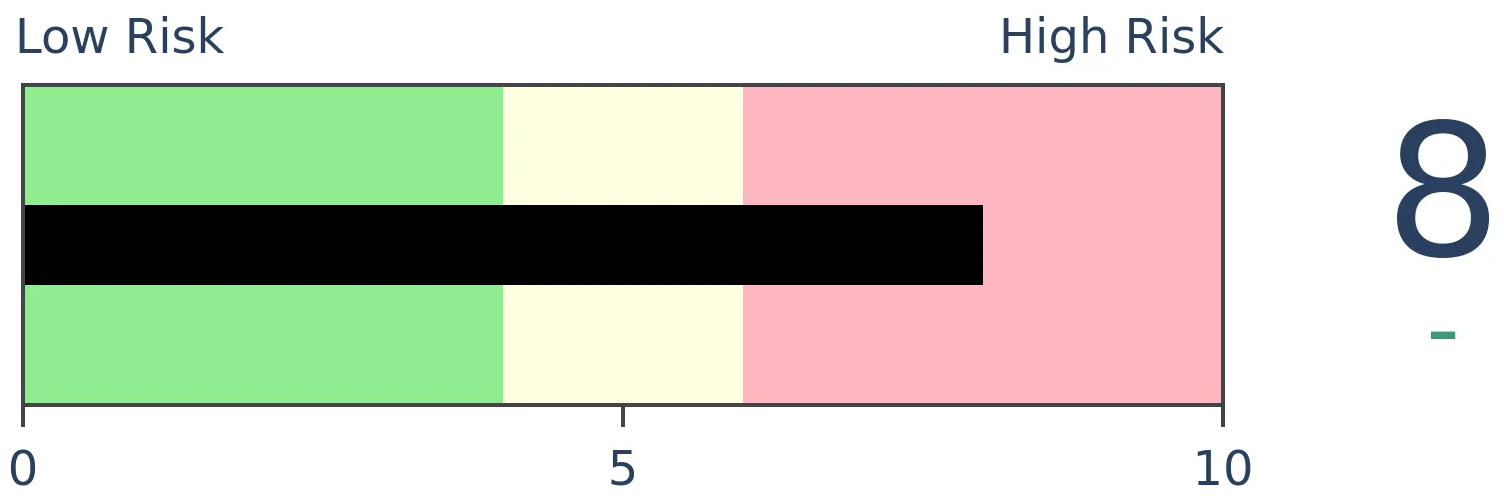

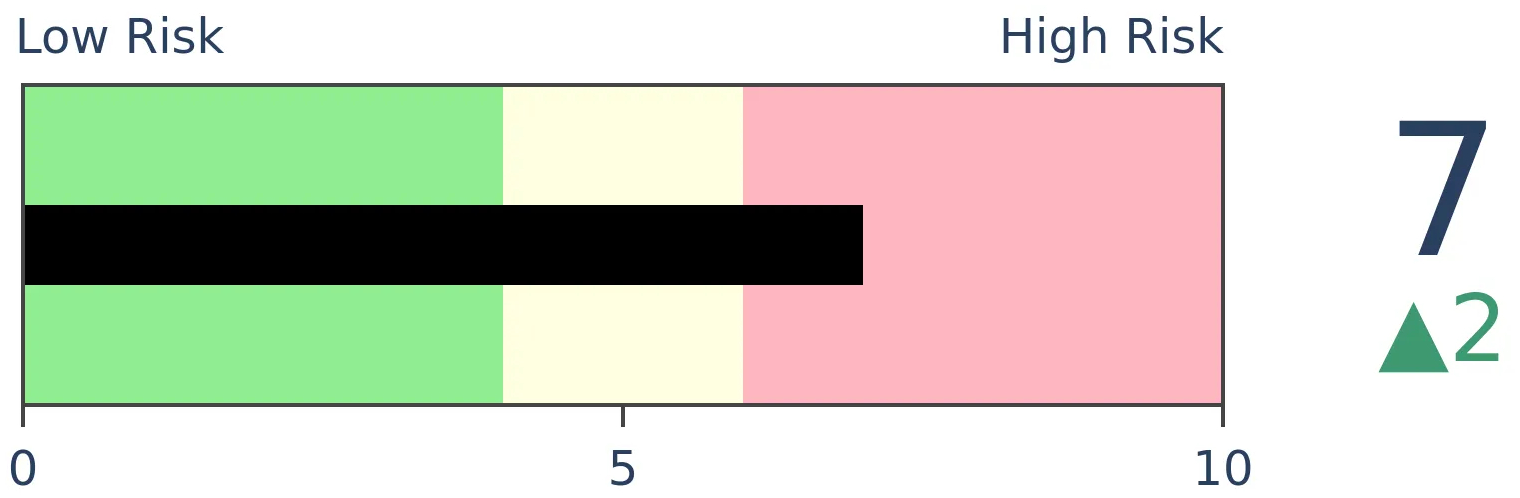

Risk Levels

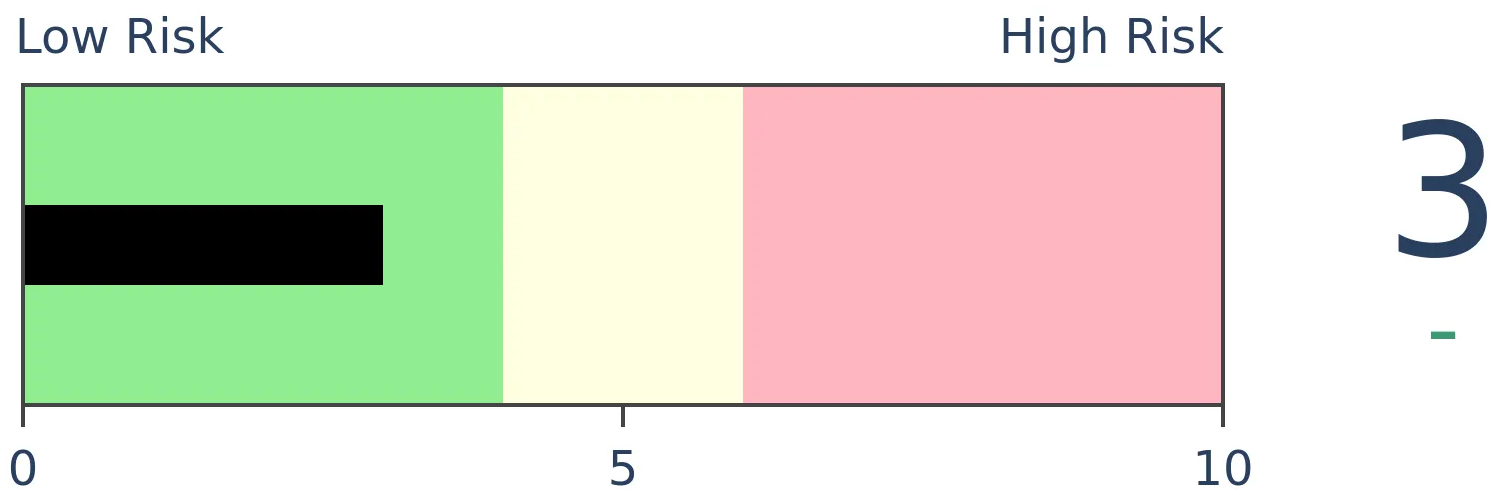

Stocks Short-Term

|

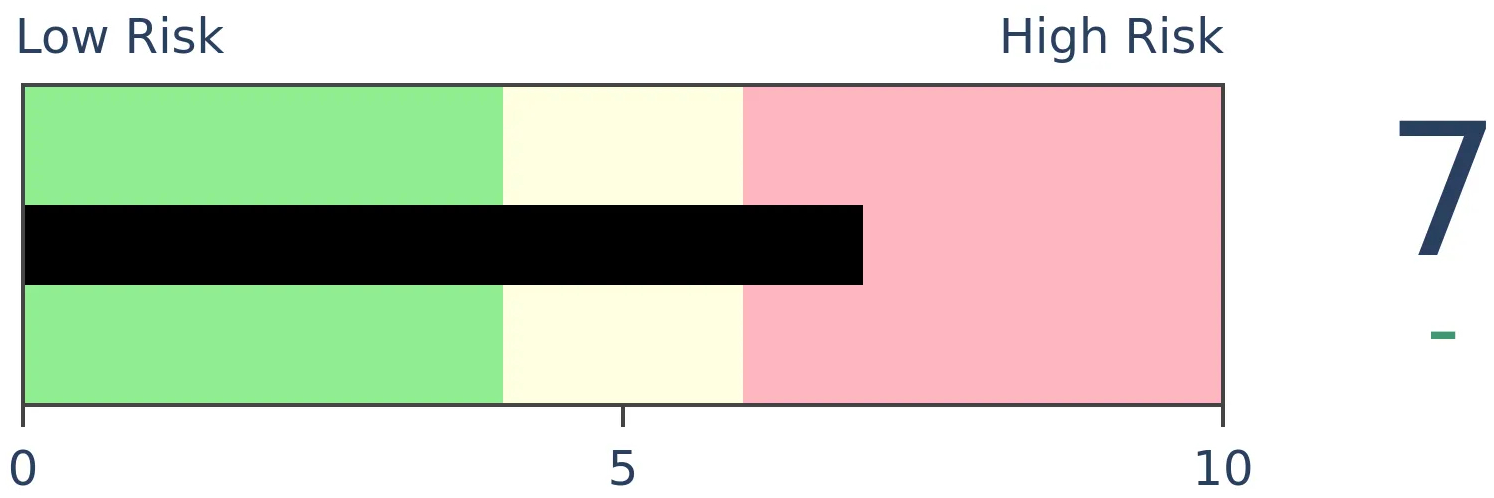

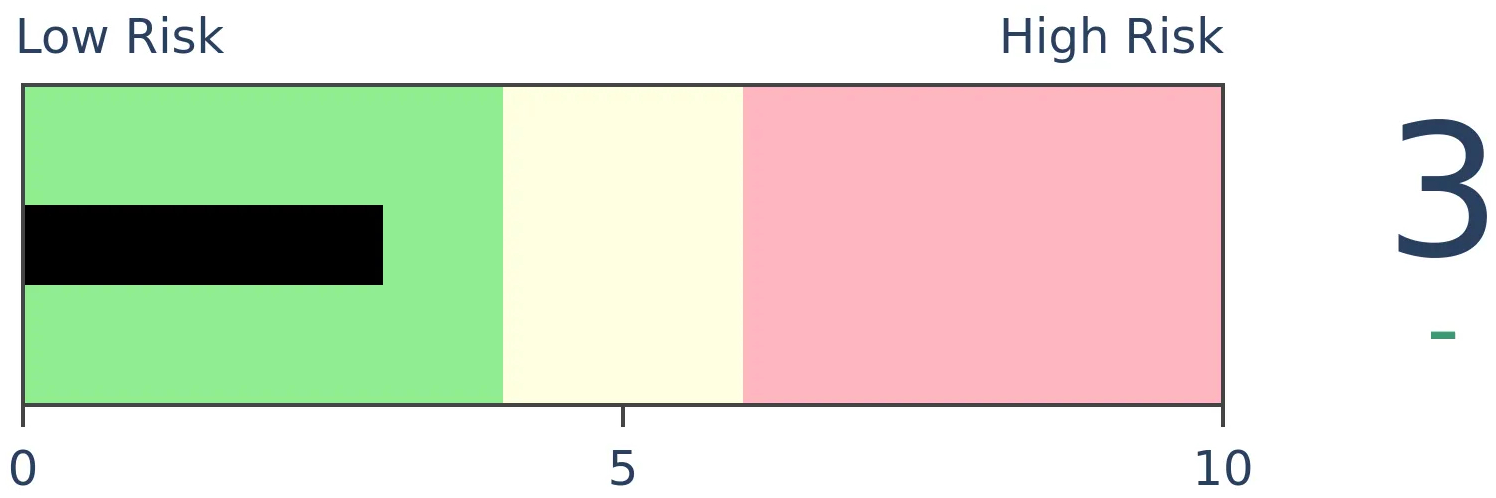

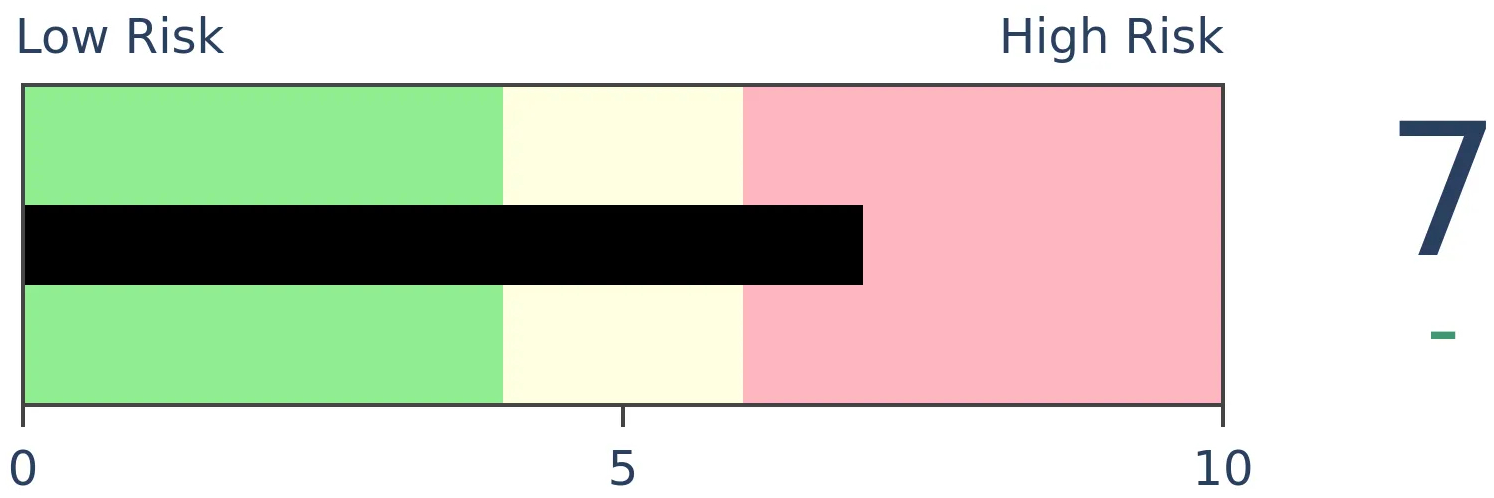

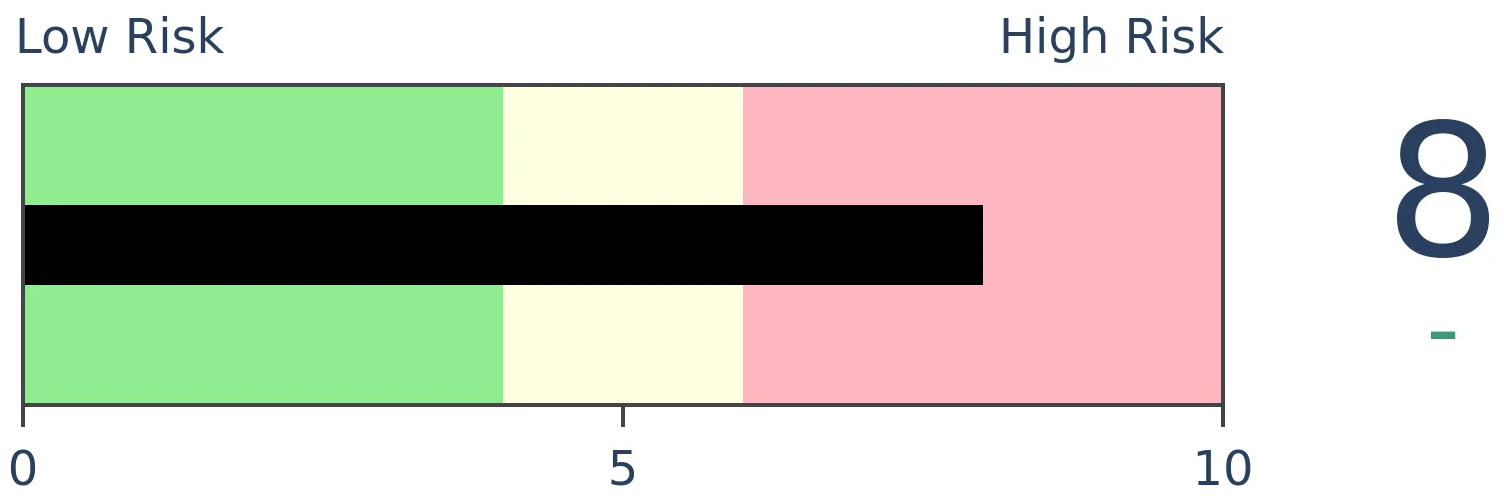

Stocks Medium-Term

|

|

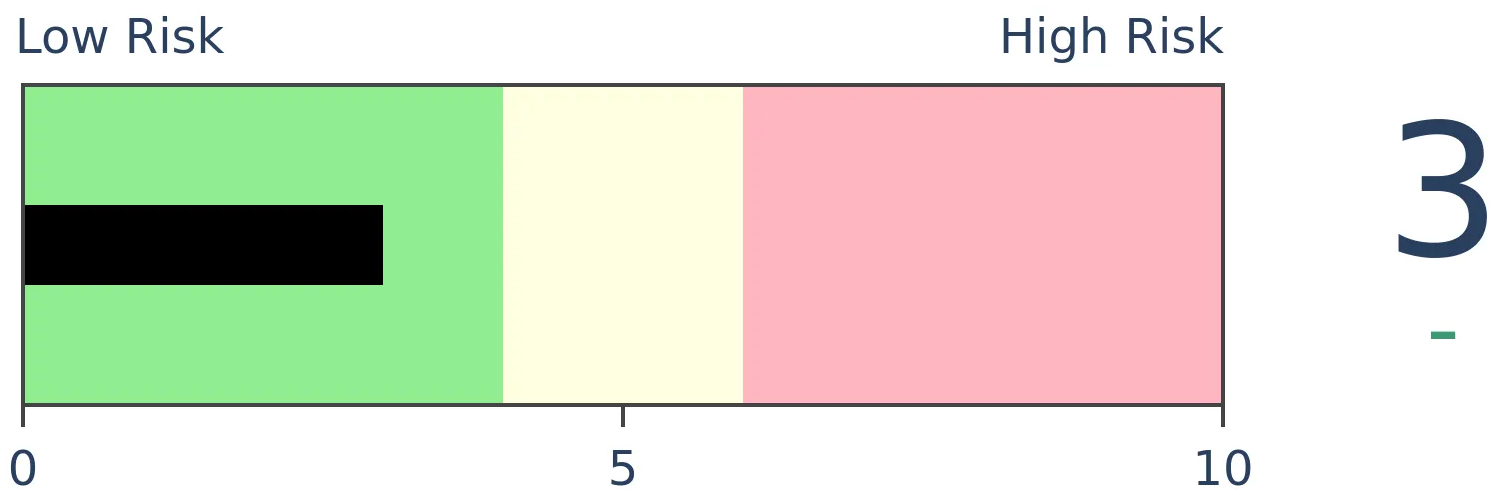

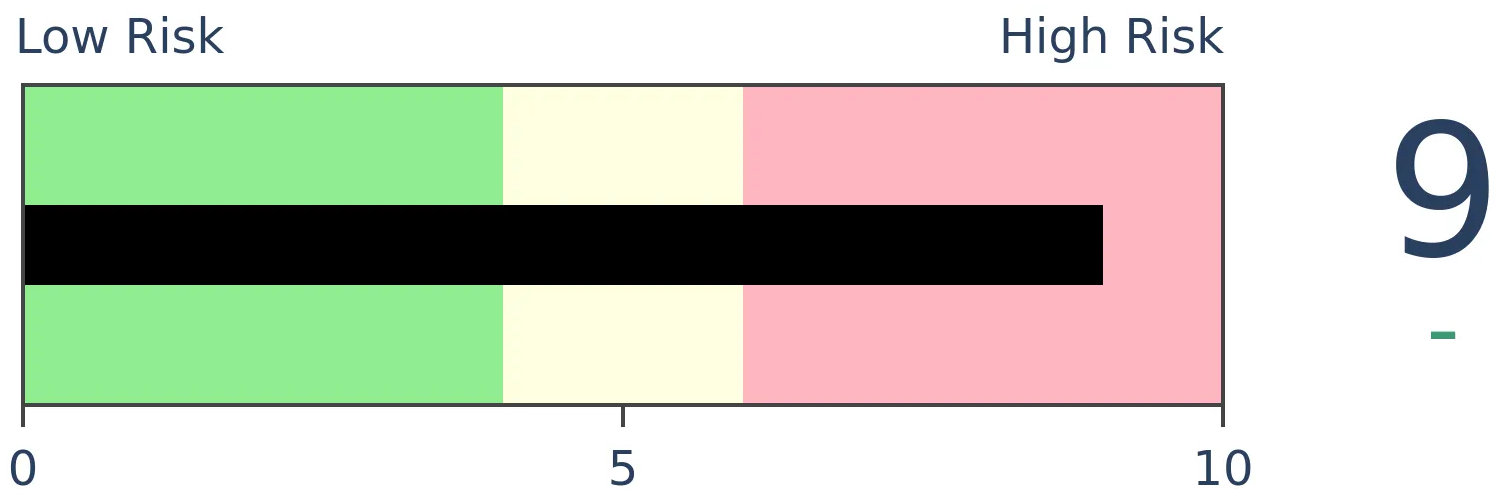

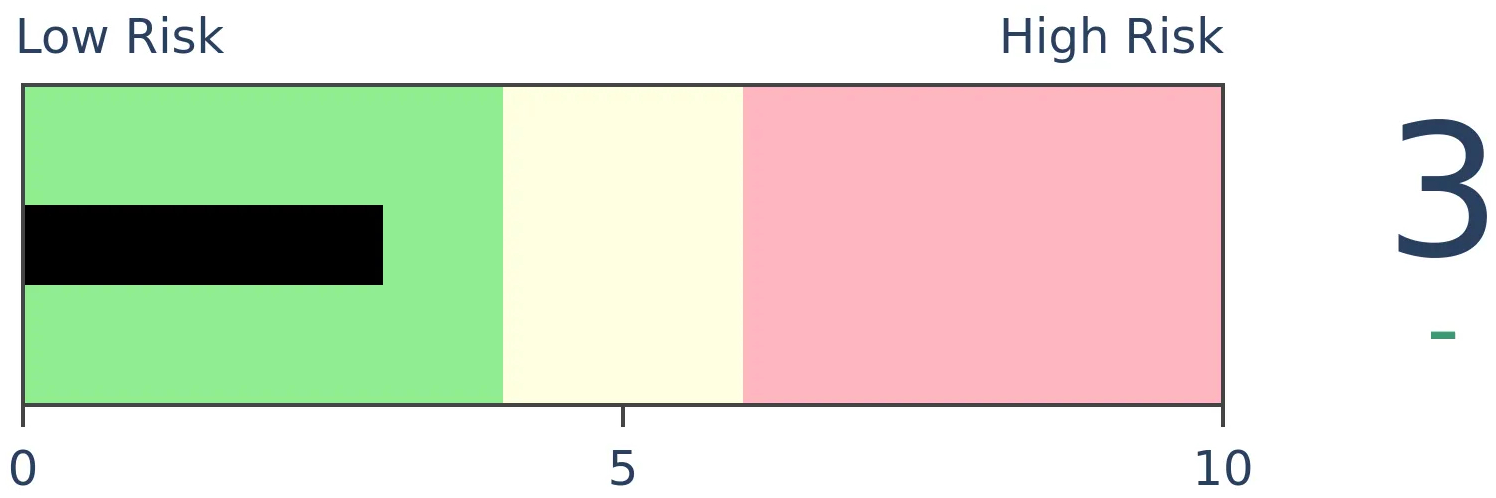

Bonds

|

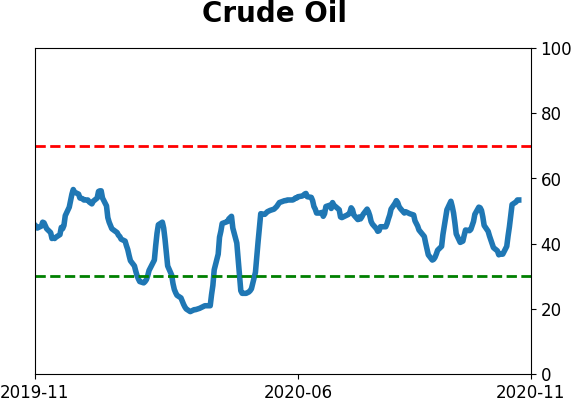

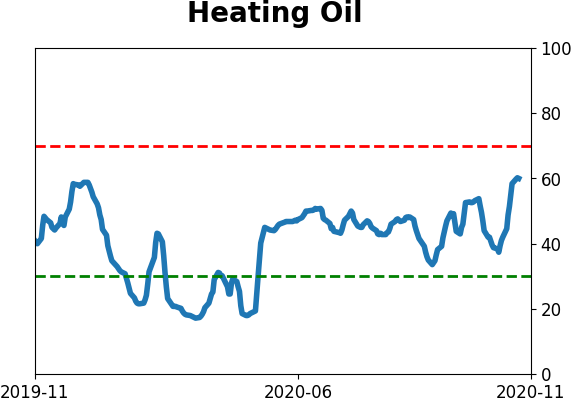

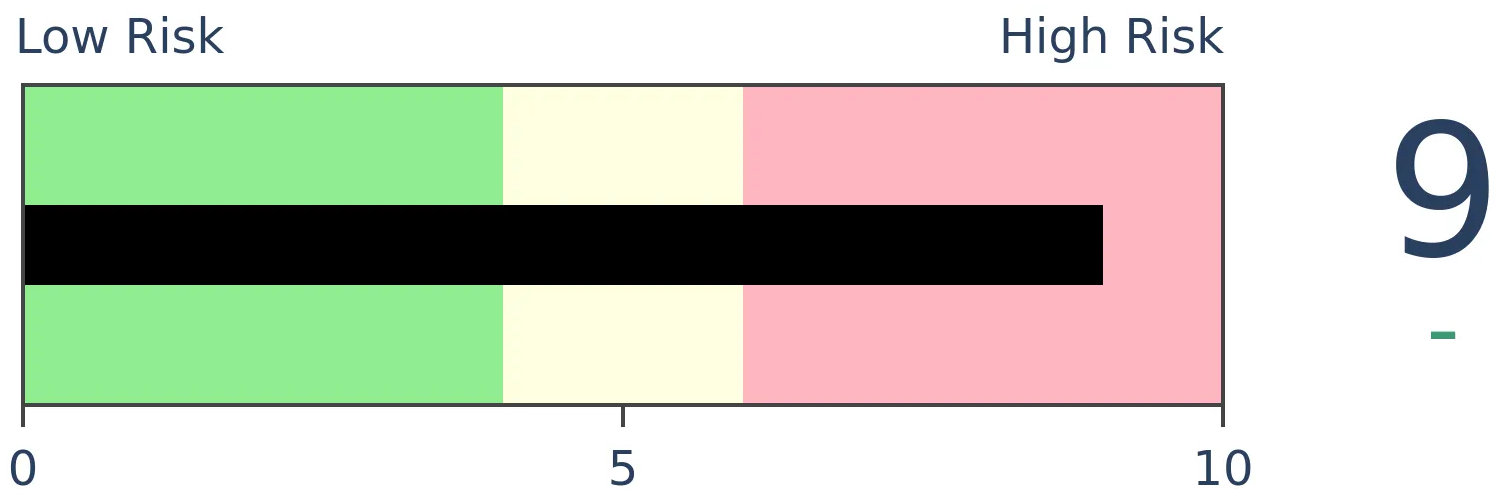

Crude Oil

|

|

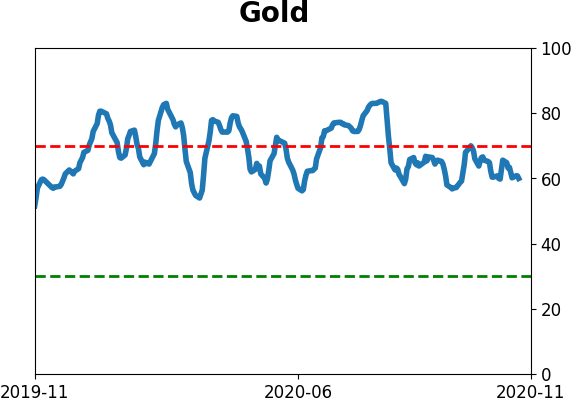

Gold

|

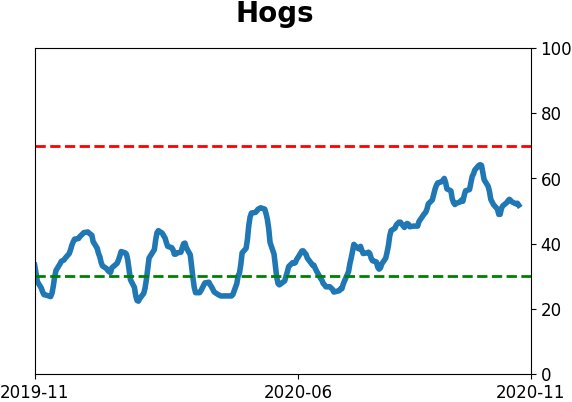

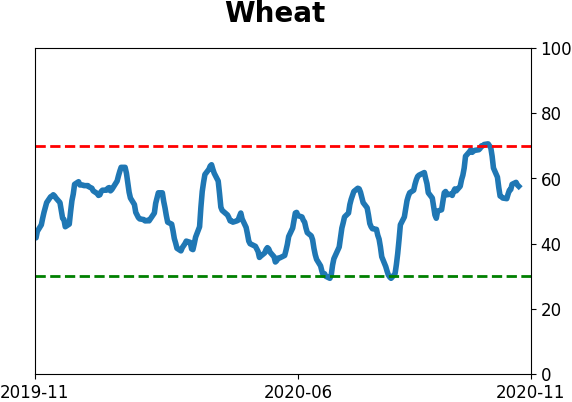

Agriculture

|

|

Research

BOTTOM LINE

The S&P 500 is up around 10% through late November, which has tended to lead to further gains that build on momentum and seasonality. When the Nasdaq Composite gains 20% or more through this late in the year, it has also tended to keep following through.

FORECAST / TIMEFRAME

None

|

In February, a double-digit gain for the year in the S&P would have seemed perfectly reasonable. A few weeks later, it would have seemed nearly impossible. And yet here we are.

Investment strategist Callie Cox from Ally noted that a double-digit gain in the S&P through these many days of the year has had a good record at preceding even more gains in recent decades as positive momentum builds on positive seasonality.

If we go back to 1928, then there is a long table of instances, and indeed the forward returns were impressively consistent.

Since 1985, there was only a single loss either 2 or 4 weeks later, and both were less than -1%, so recent history has been very kind to these setups.

If we further stipulate that the index must have reached an all-time high at some point during the year, then it turns a little less positive, but mostly still showed gains over the next 2-4 weeks.

The Nasdaq has been even more impressive, with more than a 30% gain. If we relax that to a 20% gain to generate more of a sample size, then we can see that it, too, tended to continue to rally going forward.

When it had also hit a fresh all-time high during the year, returns moderated somewhat like they did with the S&P, but over the next couple of weeks, there was only a single small loss that was quickly erased.

With a look at recent breadth thrusts and other signs of momentum, we've seen strong evidence that displays like the past couple of weeks have a strong tendency to persist. Seasonality is an iffy factor when it comes to stocks, but the combination of the two have been a compelling sign that the probability of a large and sustained decline seems relatively low.

BOTTOM LINE

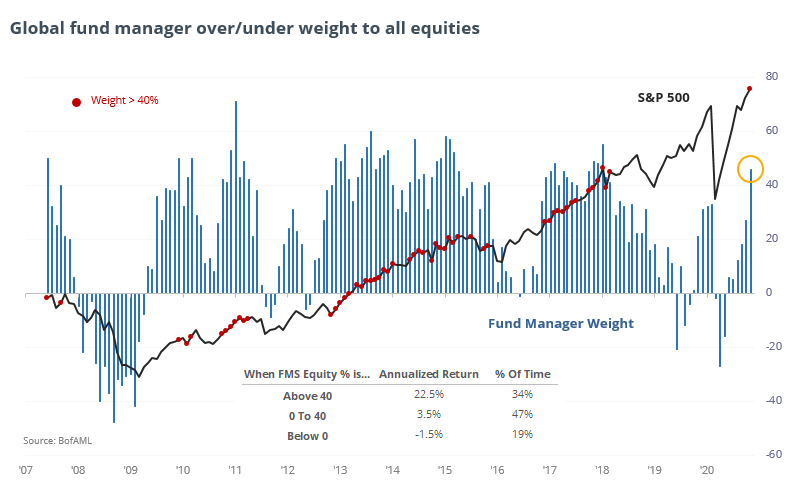

Fund managers in a monthly Bank of America survey have turned highly optimistic on the prospect for stocks, but it has been a poor contrary indicator. Likewise, they're betting on small-caps and a steeper yield curve.

FORECAST / TIMEFRAME

None

|

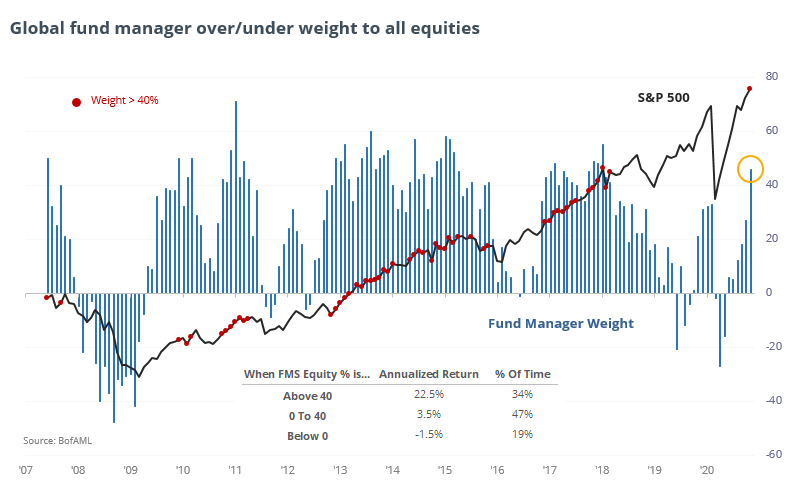

Each month, Bank of America releases a widely-followed survey of professional fund managers. The latest results, released earlier this week, showed that 216 managers with $573 under management are the most optimistic on stocks in more than 2 years.

The percentage of managers who are overweight equities jumped again in the past month, with more than 45% of them positioned to benefit on a rising market.

As we can see from the chart, however, this was not a good reason to bet against them. Most "smart money" surveys show at least a modest contrary bias when there is clear evidence of group-think, but that hasn't been the case so much with this particular one. The S&P 500's annualized return when the overweight percentage was 40% or higher was an impressive +22.5%, versus -1.5% when managers were underweight stocks.

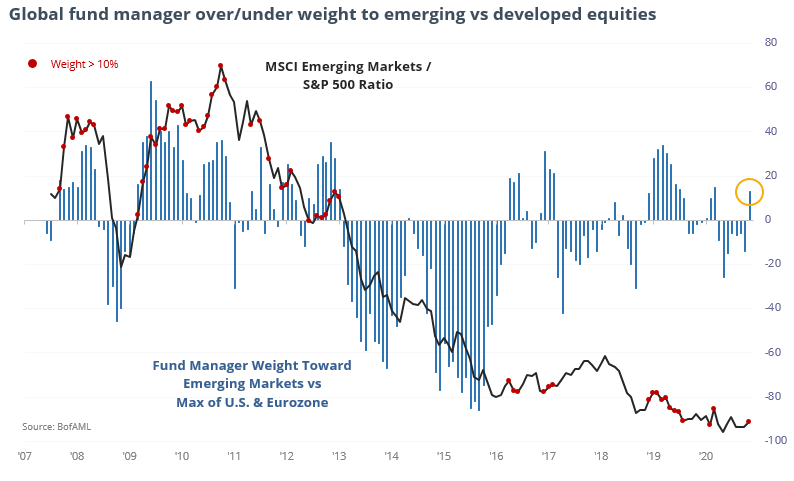

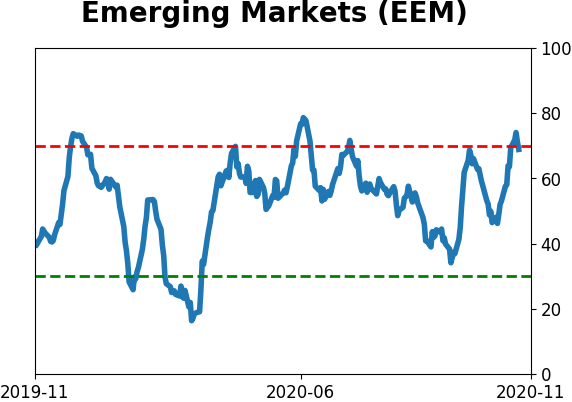

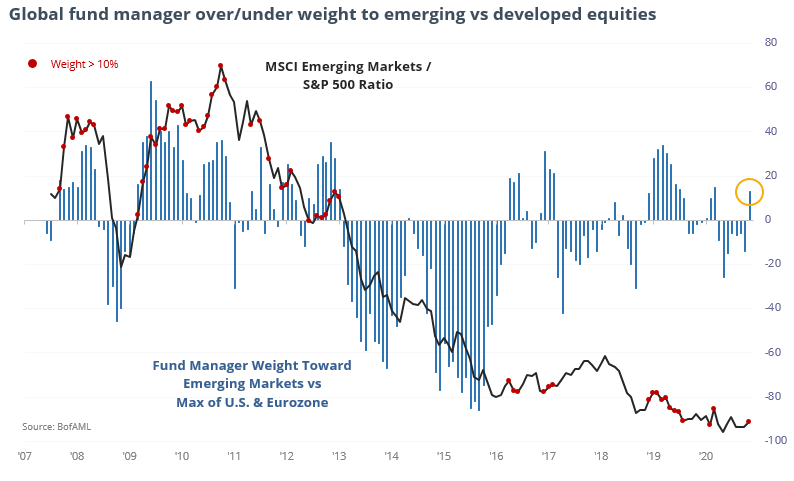

The same goes for potential concern that managers have bought too much into the nascent outperformance from emerging market stocks. Managers now have more than 10% overweight toward those stocks than either the U.S. or eurozone. But other times they were relatively overweight those stocks, it didn't lead to a consistent change in the ratio of emerging markets to the S&P.

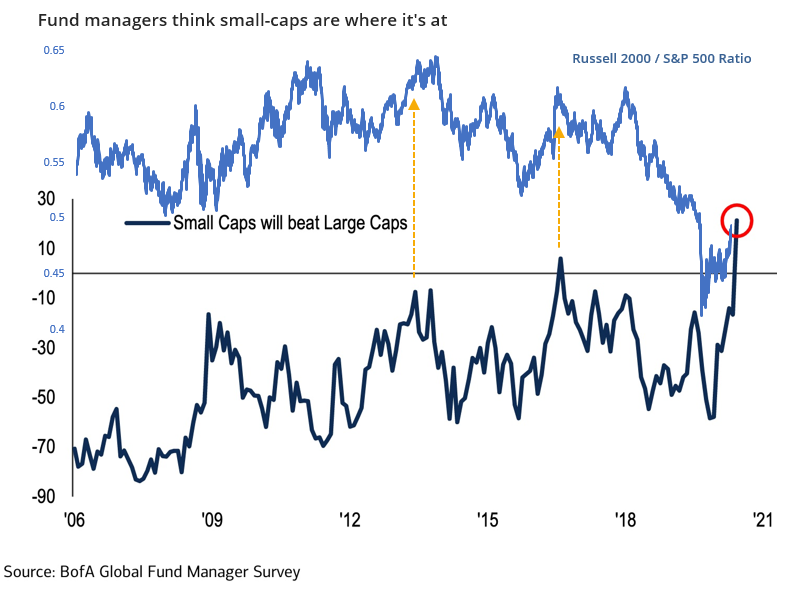

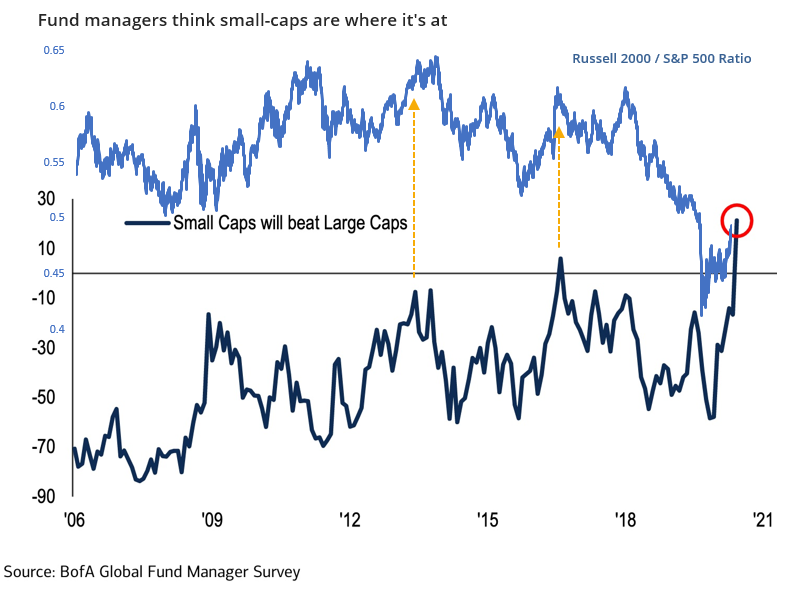

The survey is more of a contrary indicator in other aspects. For example, they're currently enamored with small-cap's prospects relative to large-caps, which has not been a great sign for the lil' guys over the past 14 years. Other times these managers decided to bet on small stocks versus large ones, the ratio of the Russell 2000 to S&P 500 turned south.

The same goes for the yield curve. These managers are currently very confident that the curve will steepen in the months ahead, but the few other times they were similarly confident, the curve promptly flattened.

Like everything, it pays to watch how these factors play out in the coming month(s). If small-caps continue to outperform (and there are signs that they should) and the yield curve continues to steepen (and there are signs it should) then we'll have some good evidence that this time is indeed different than the multiple false starts over the past decade.

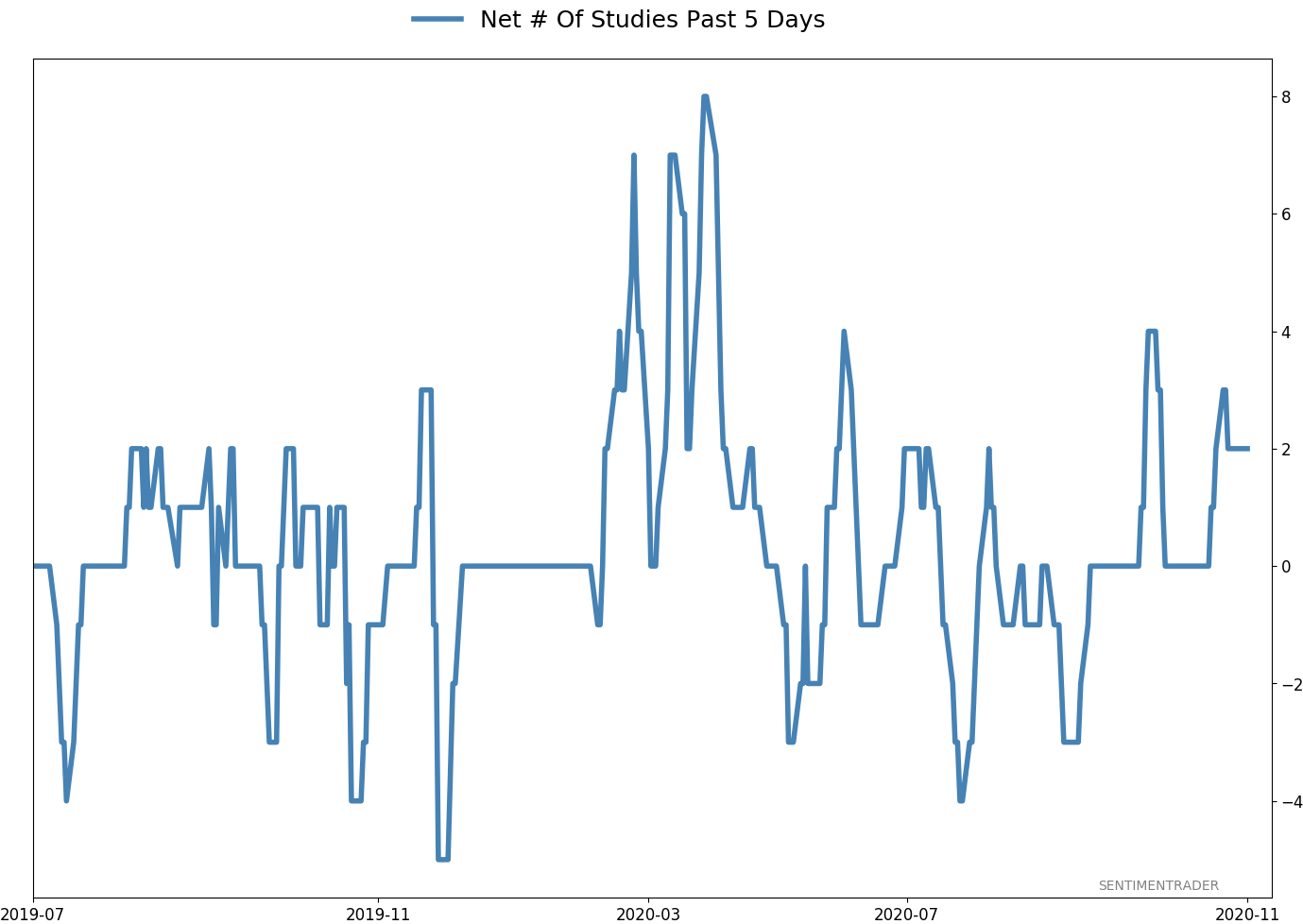

Active Studies

| Time Frame | Bullish | Bearish | | Short-Term | 0 | 0 | | Medium-Term | 5 | 8 | | Long-Term | 51 | 2 |

|

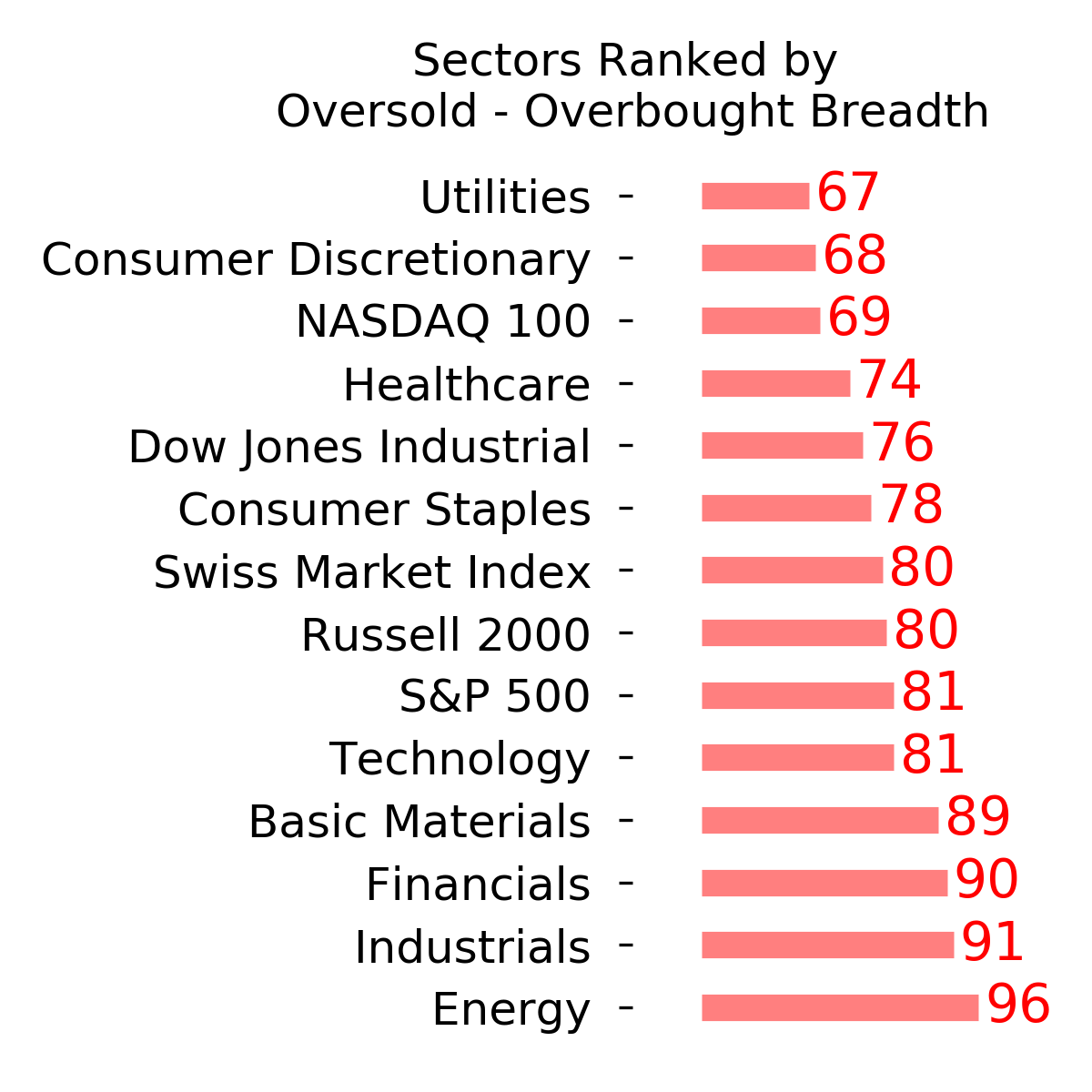

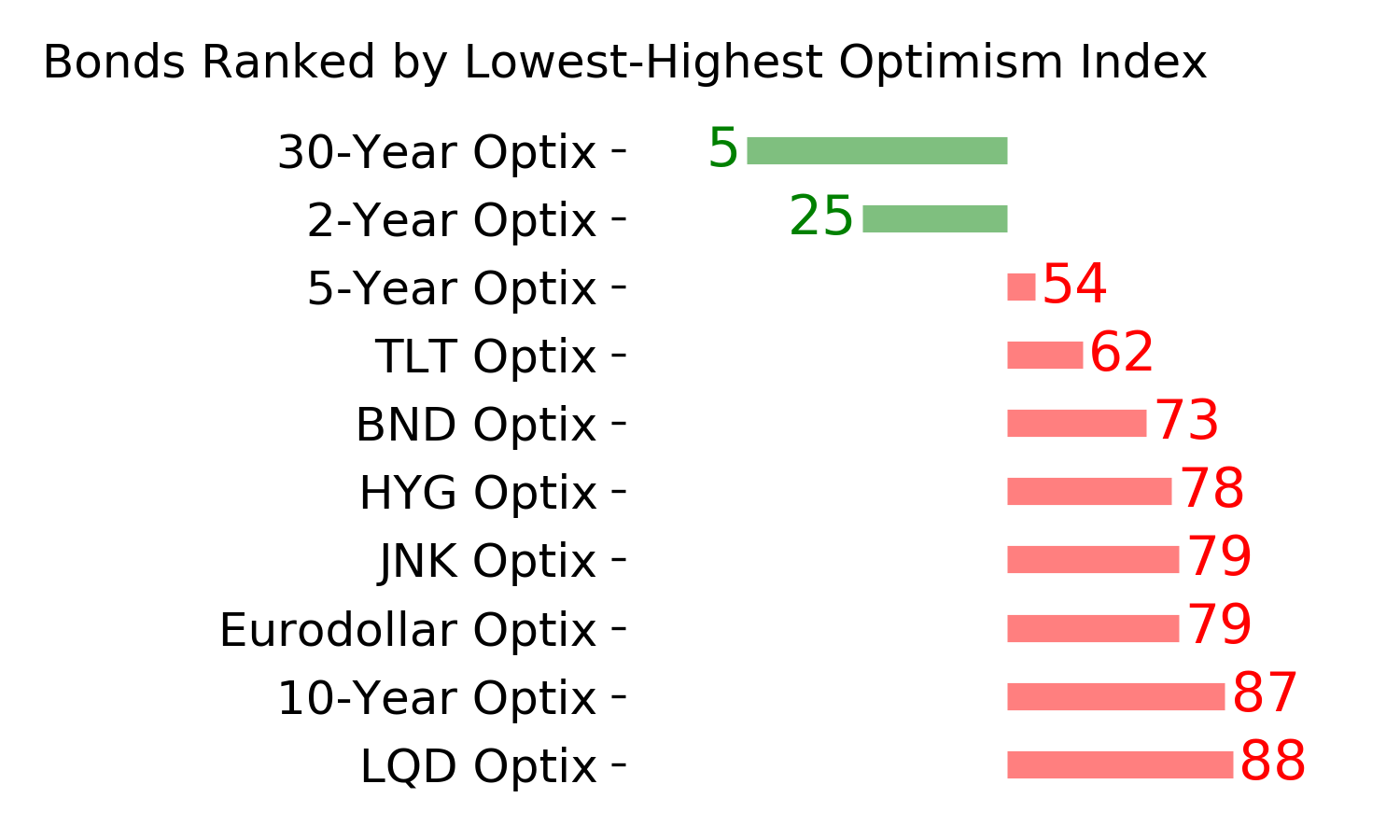

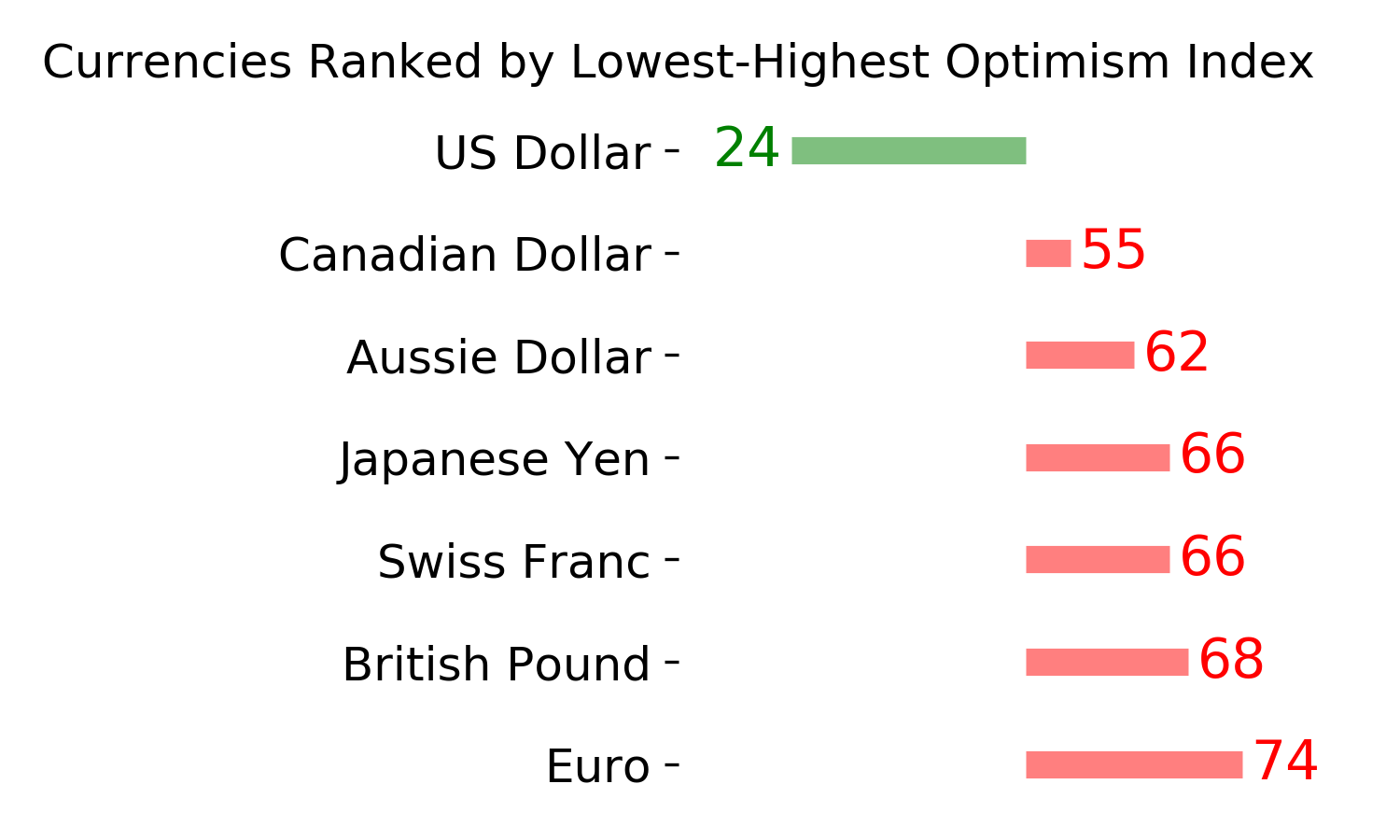

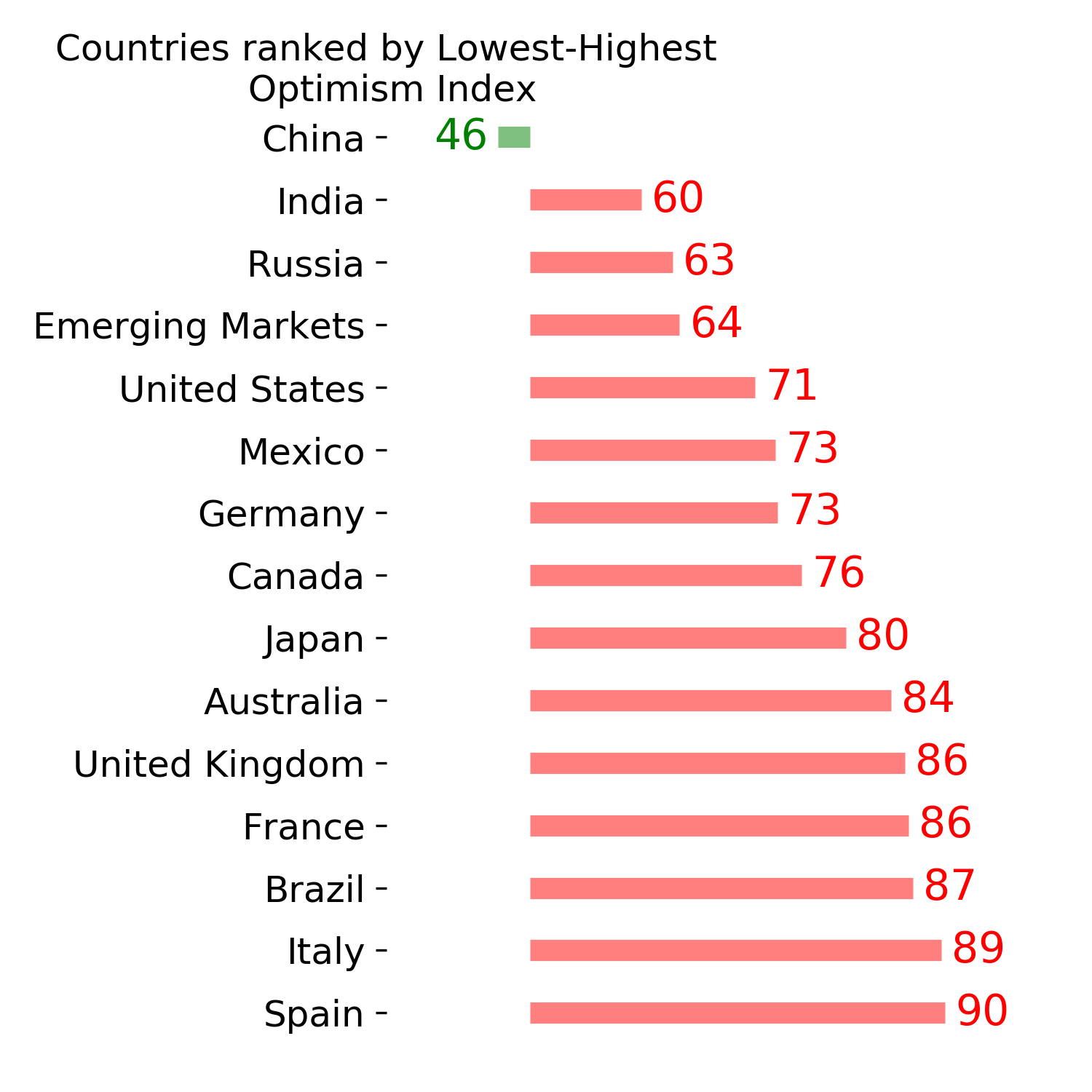

Indicators at Extremes

Portfolio

| Position | Description | Weight % | Added / Reduced | Date | | Stocks | 15.6% RSP, 10.1% VWO, 7.5% XLE, 5.1% PSCE | 38.2 | Added 5% | 2020-10-15 | | Bonds | 10% BND, 10% SCHP, 10% ANGL | 29.7 | Reduced 0.1% | 2020-10-02 | | Commodities | GCC | 2.4 | Reduced 2.1%

| 2020-09-04 | | Precious Metals | GDX | 4.7 | Added 5% | 2020-09-09 | | Special Situations | | 0.0 | Reduced 5% | 2020-10-02 | | Cash | | 25.0 | | |

|

Updates (Changes made today are underlined)

After the September swoon wrung some of the worst of the speculation out of stocks, there are some signs that it's returning, especially in the options market. It's helped to push Dumb Money Confidence above 70%. A big difference between now and August is that in August, there was a multitude of days with exceptionally odd breadth readings. Some of the biggest stocks were masking underlying weakness. Combined with heavy speculative activity, it was a dangerous setup. Now, we've seen very strong internal strength, in the broad market, as well as tech and small-cap stocks. Prior signals almost invariably led to higher prices. That's hard to square with the idea that forward returns tend to be subdued when Confidence is high, but that's less reliable during healthy market conditions, which we're seeing now (for the most part). I added some risk with small-cap energy stocks, due to an increasing number of positive signs in both small-caps and energy. This is intended as a long-term position.

RETURN YTD: 3.9% 2019: 12.6%, 2018: 0.6%, 2017: 3.8%, 2016: 17.1%, 2015: 9.2%, 2014: 14.5%, 2013: 2.2%, 2012: 10.8%, 2011: 16.5%, 2010: 15.3%, 2009: 23.9%, 2008: 16.2%, 2007: 7.8%

|

|

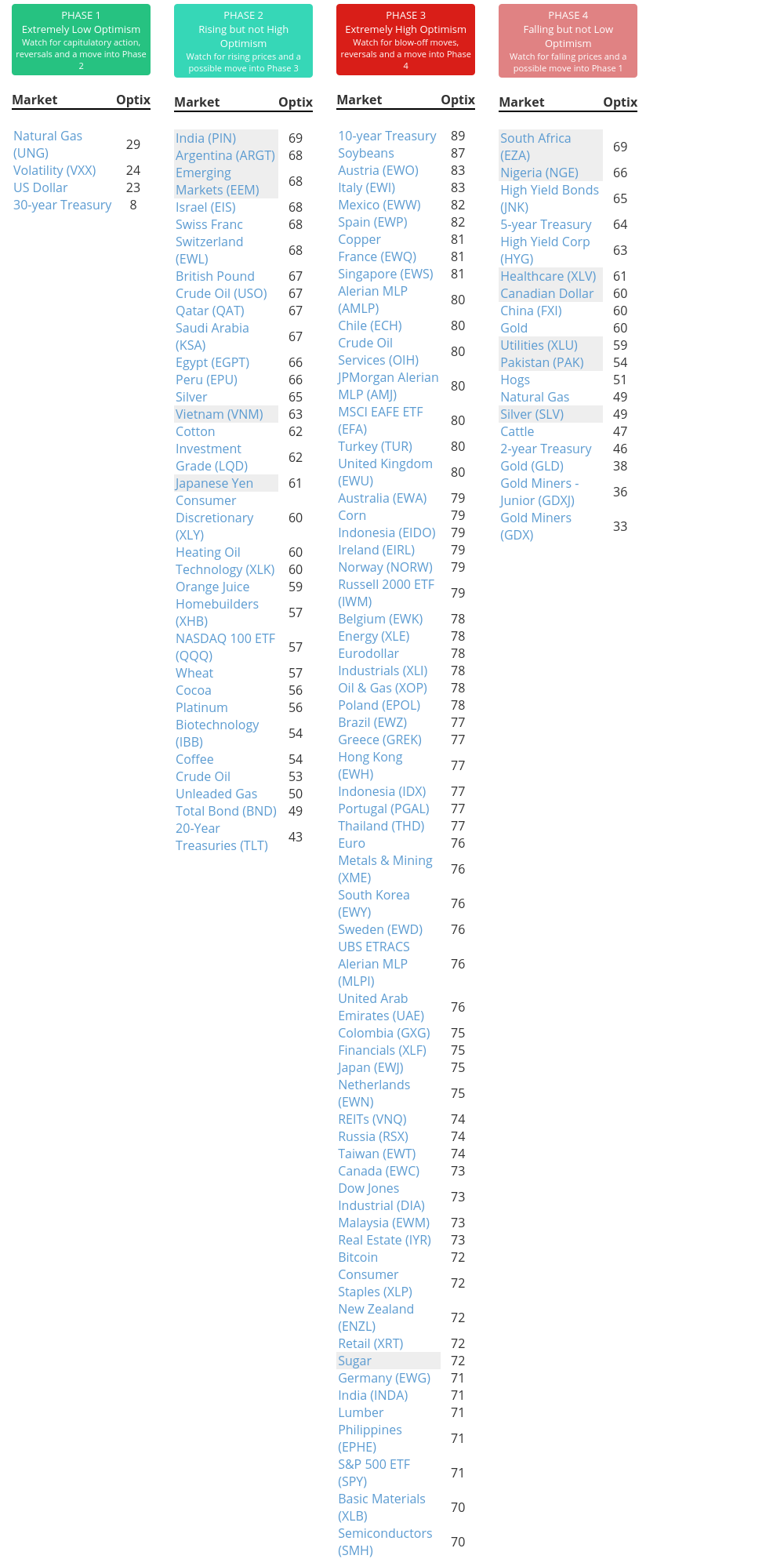

Phase Table

Ranks

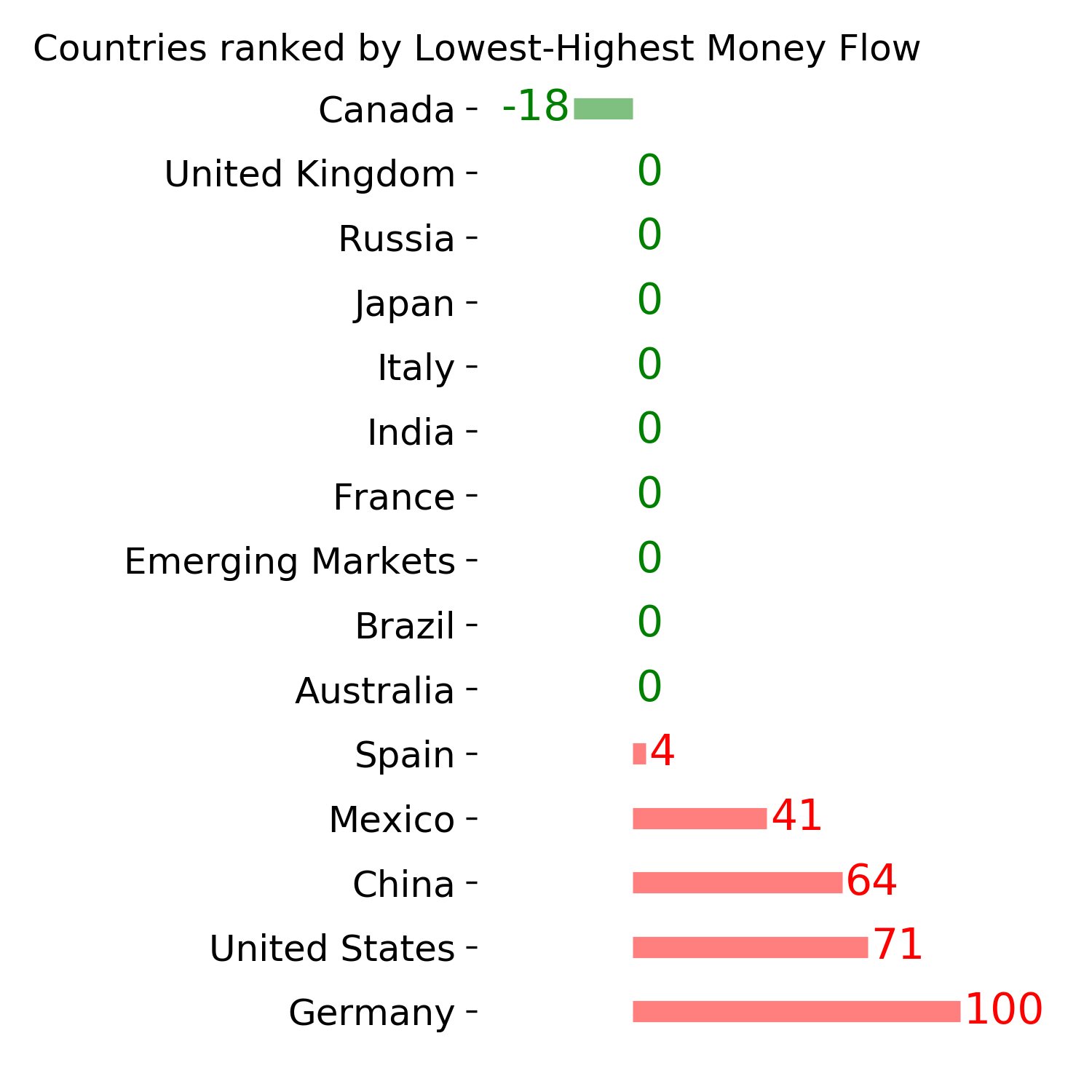

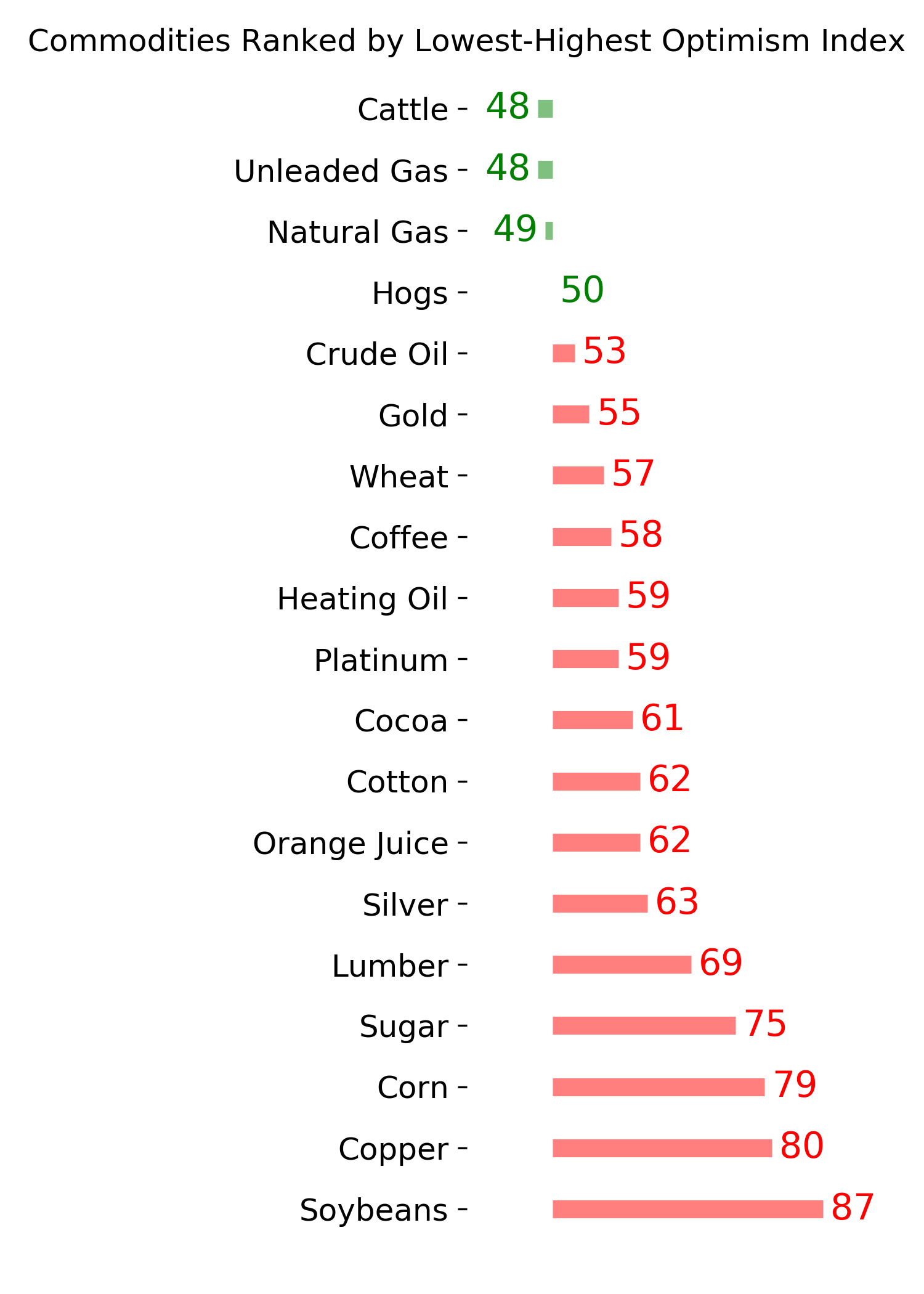

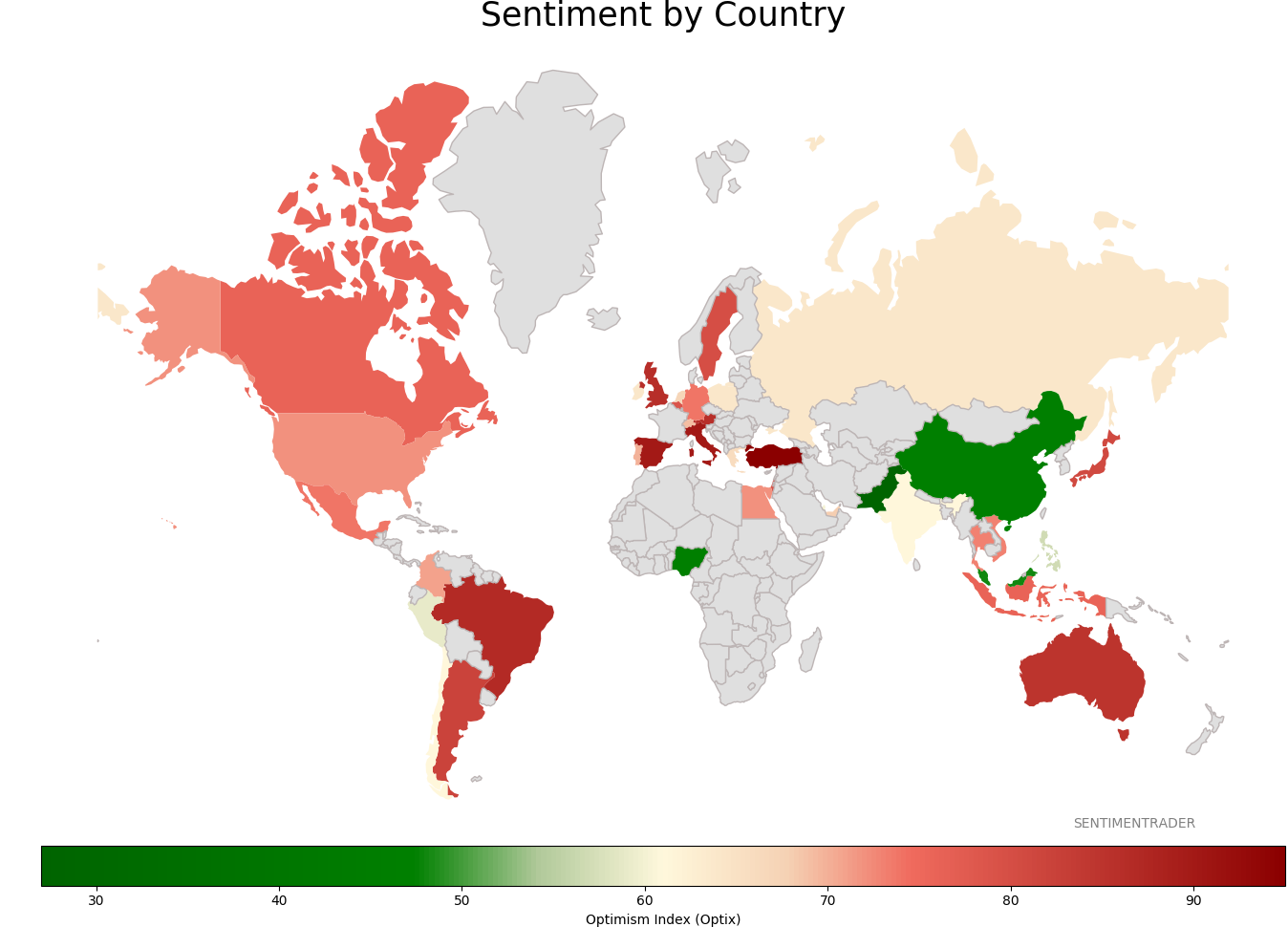

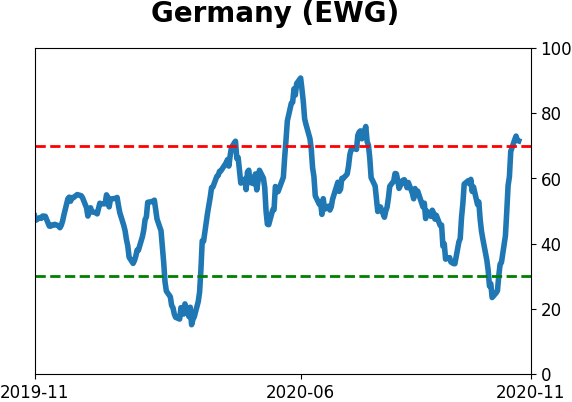

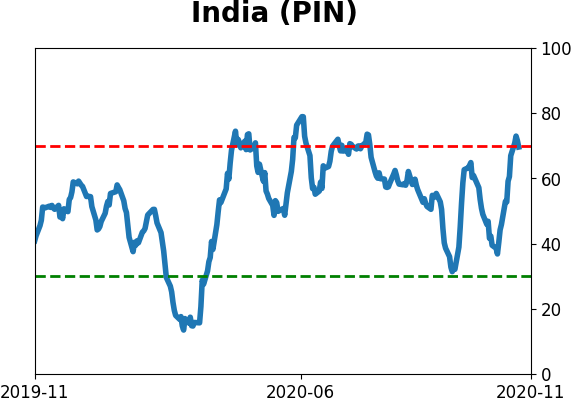

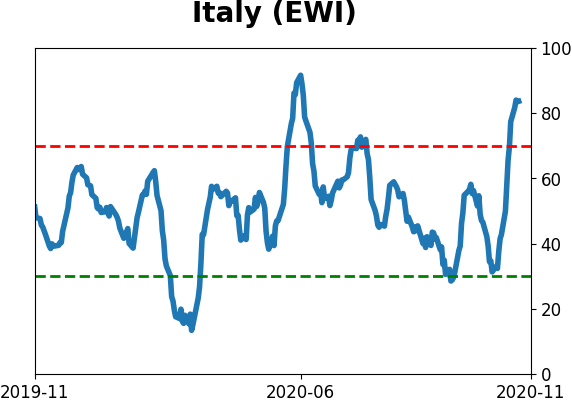

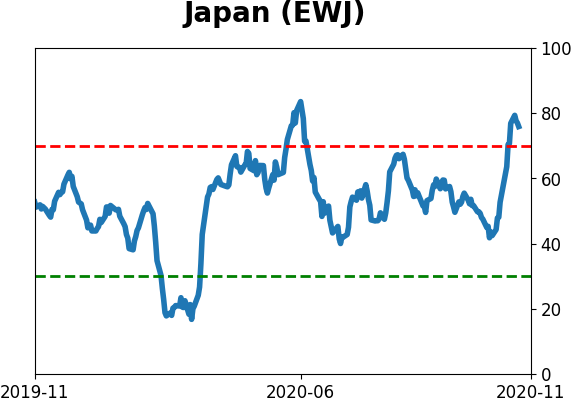

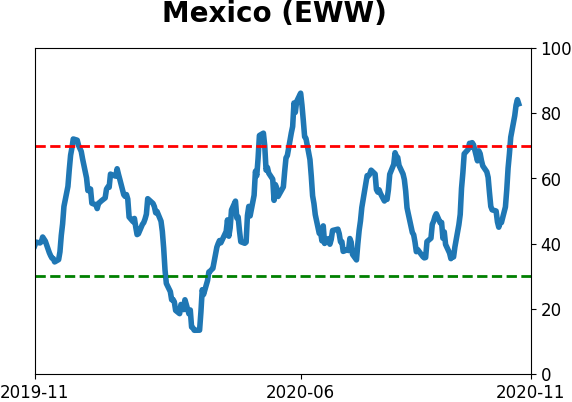

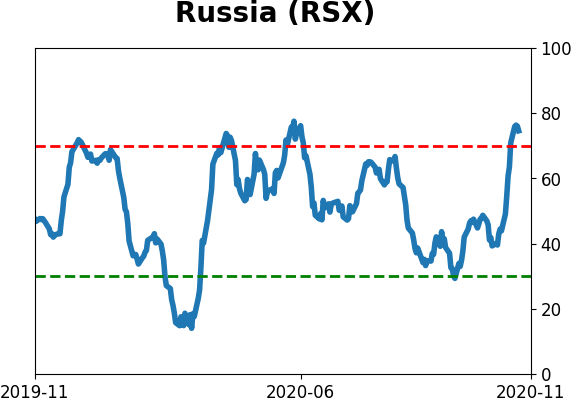

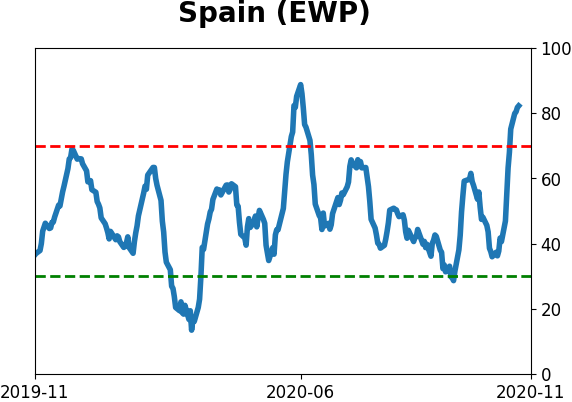

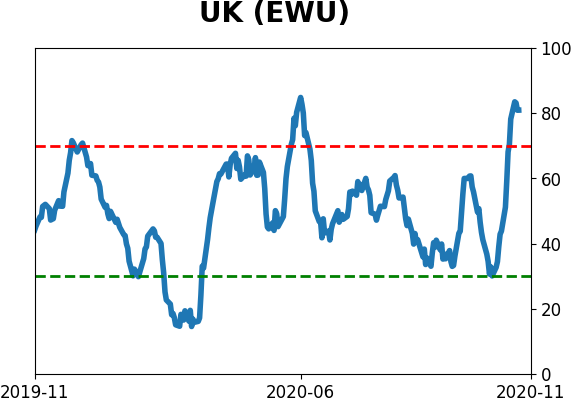

Sentiment Around The World

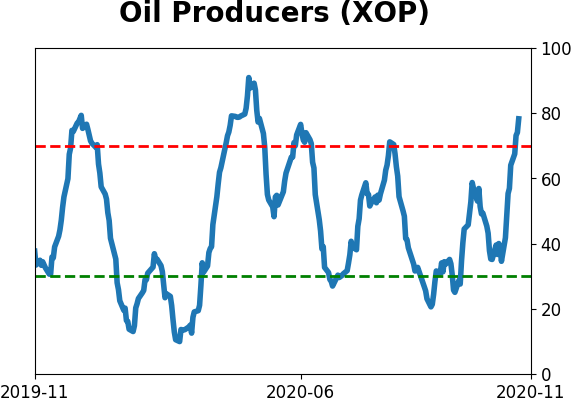

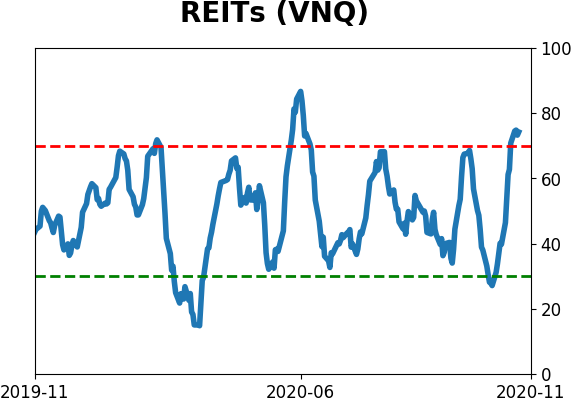

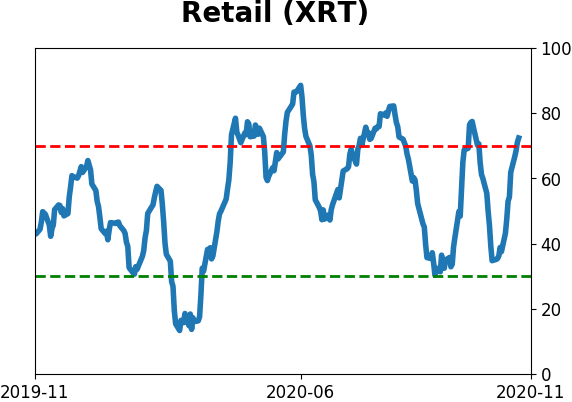

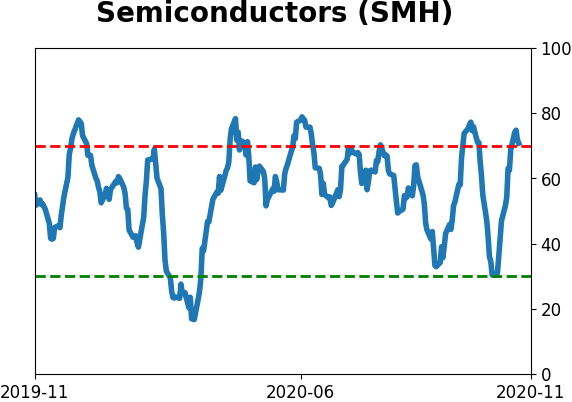

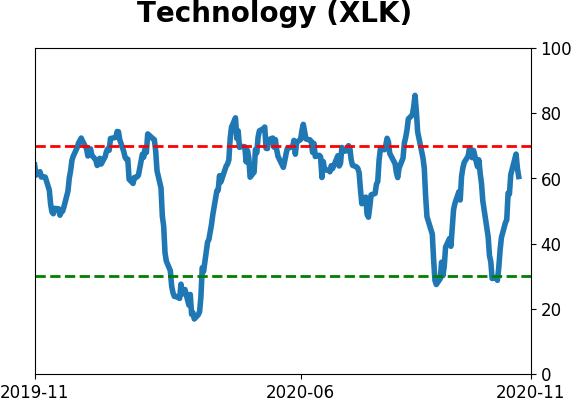

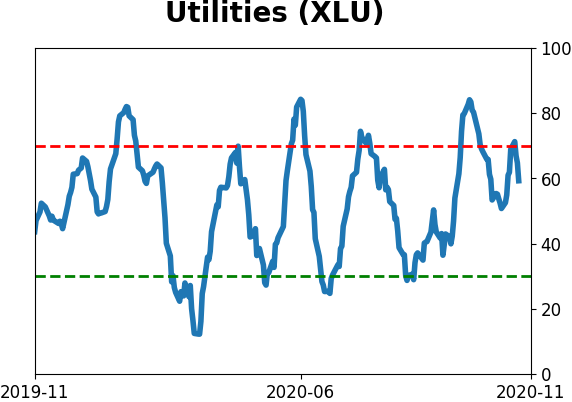

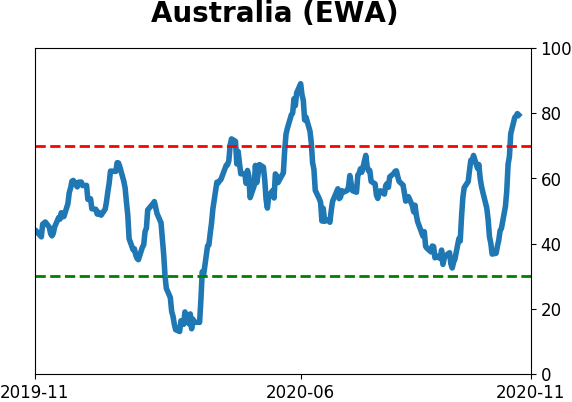

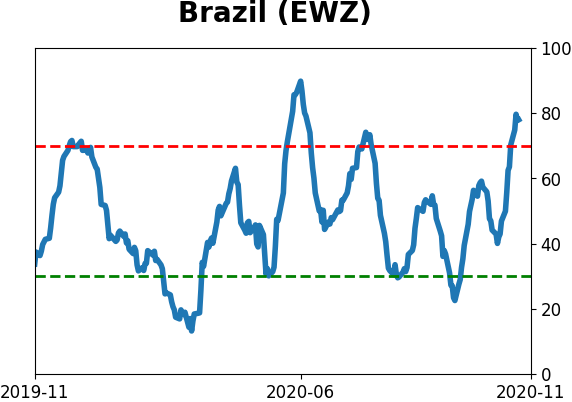

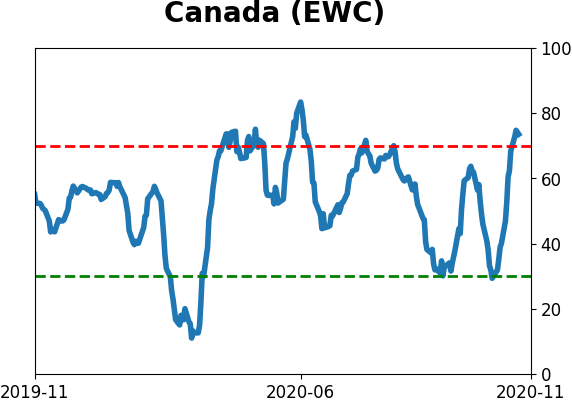

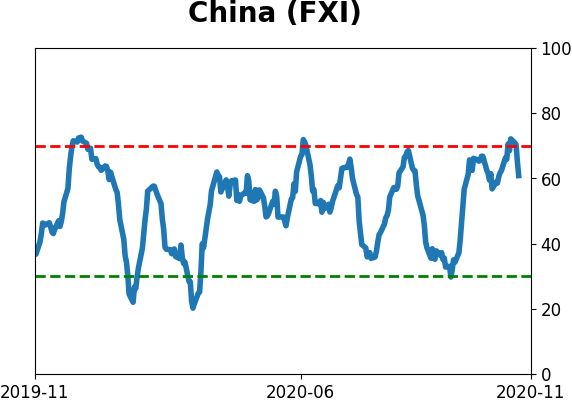

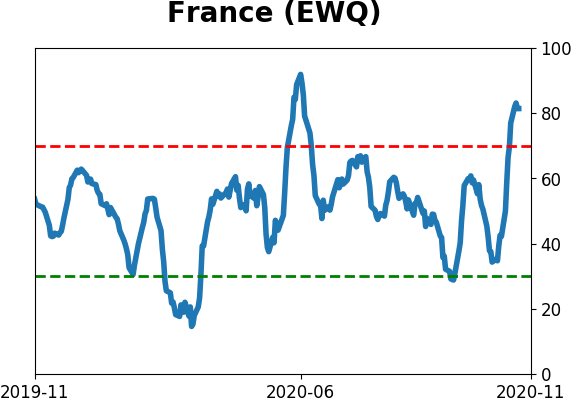

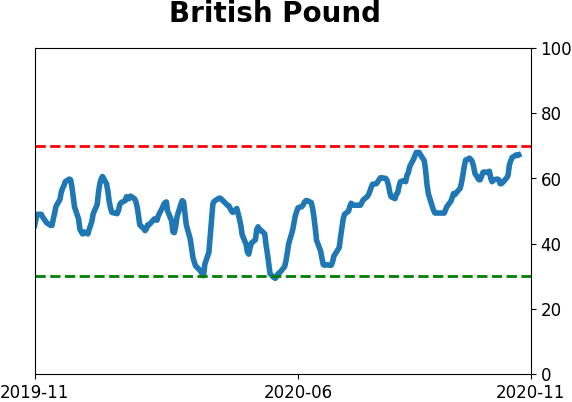

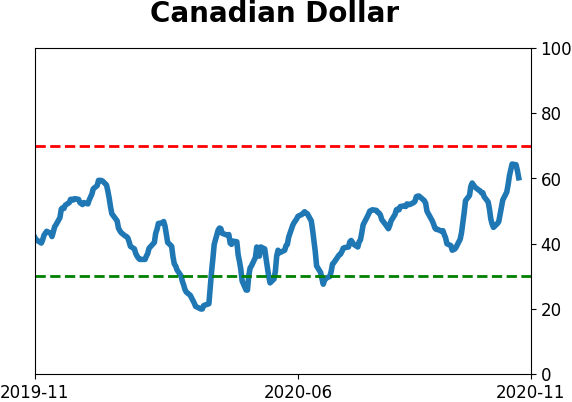

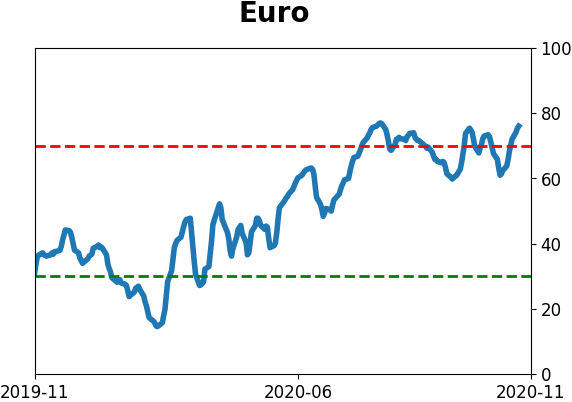

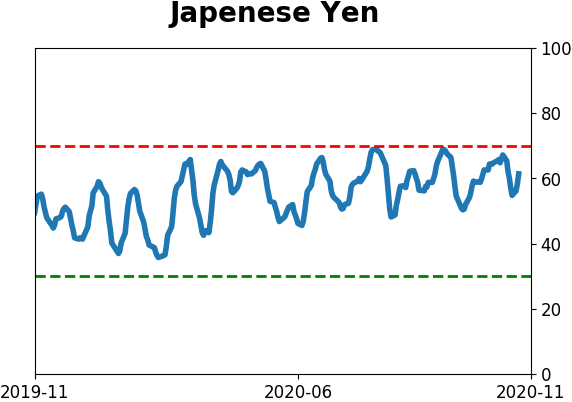

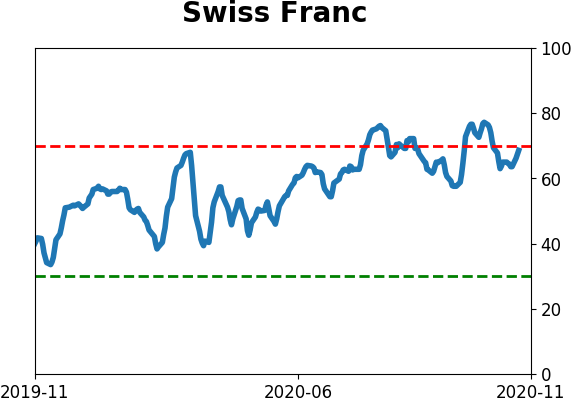

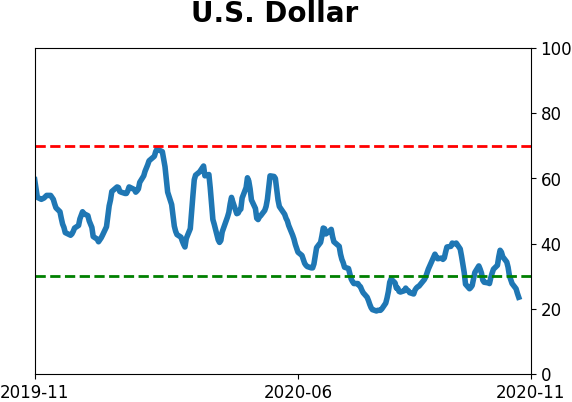

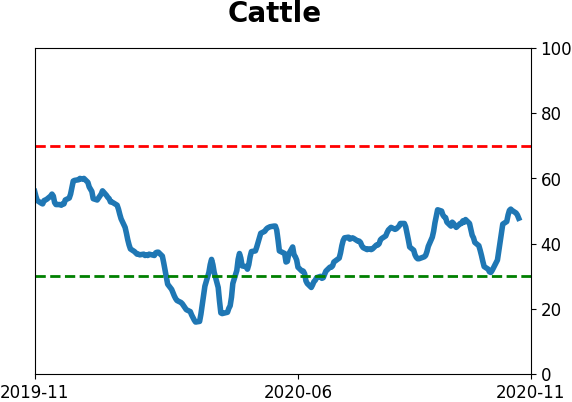

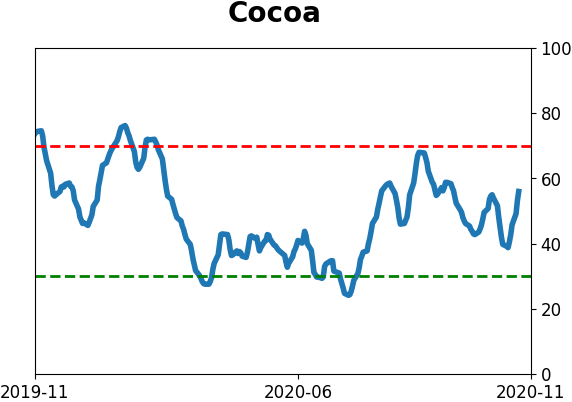

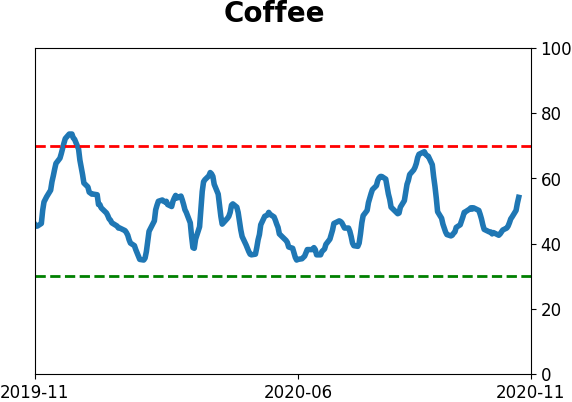

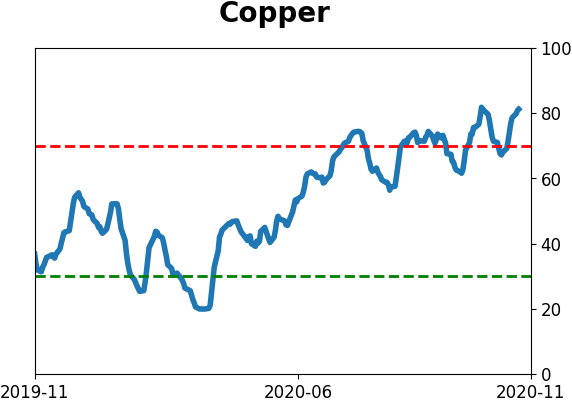

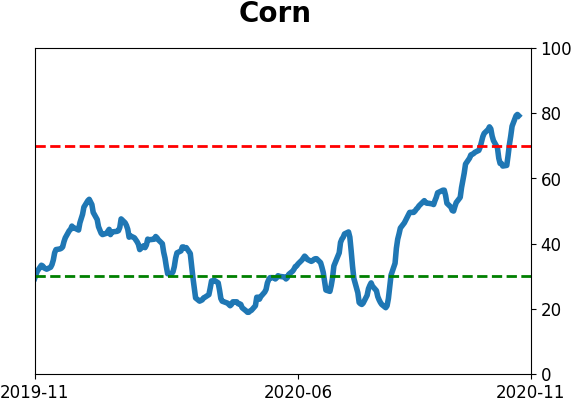

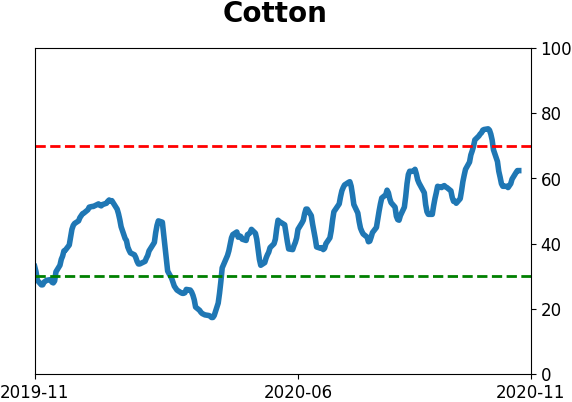

Optimism Index Thumbnails

|

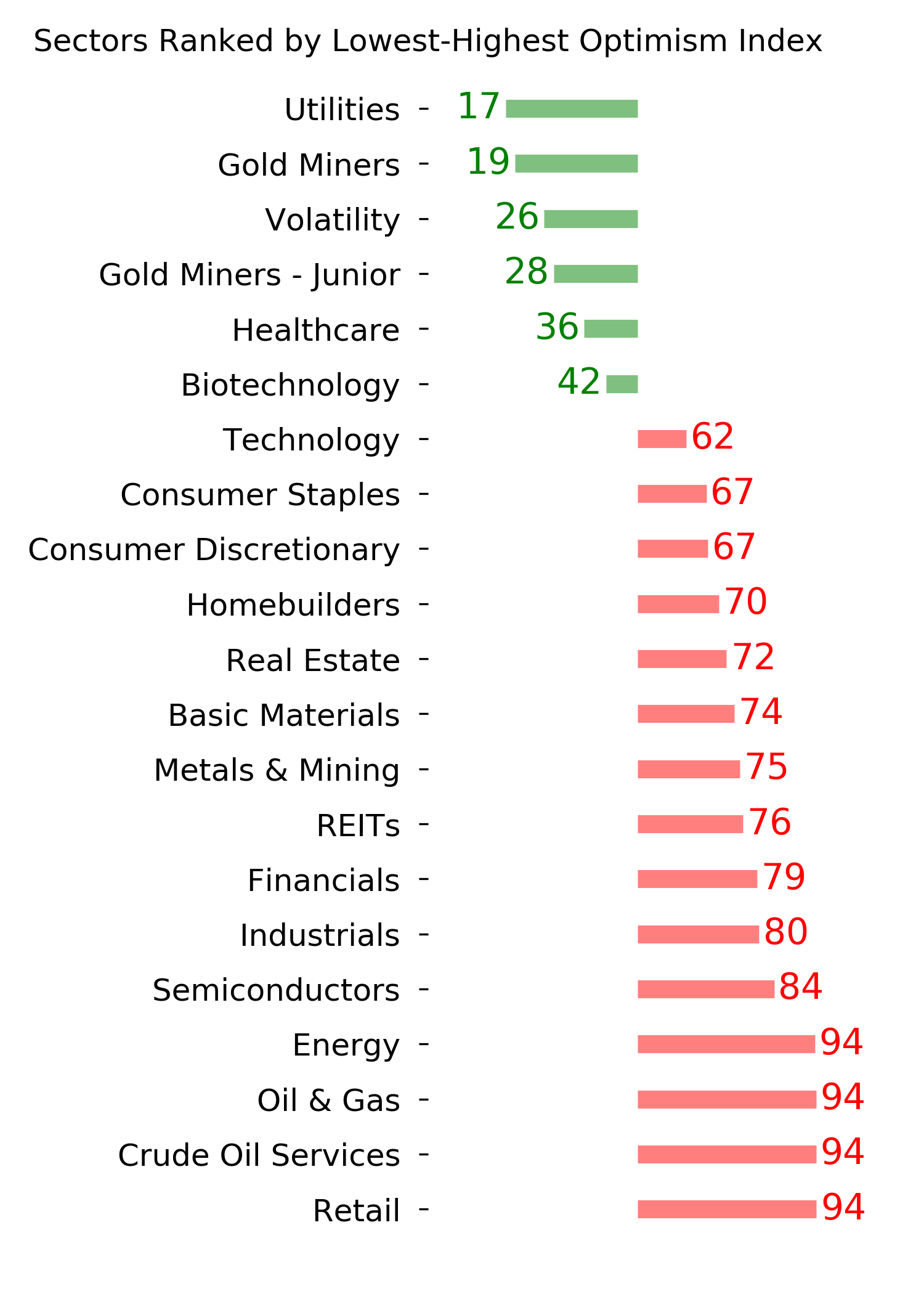

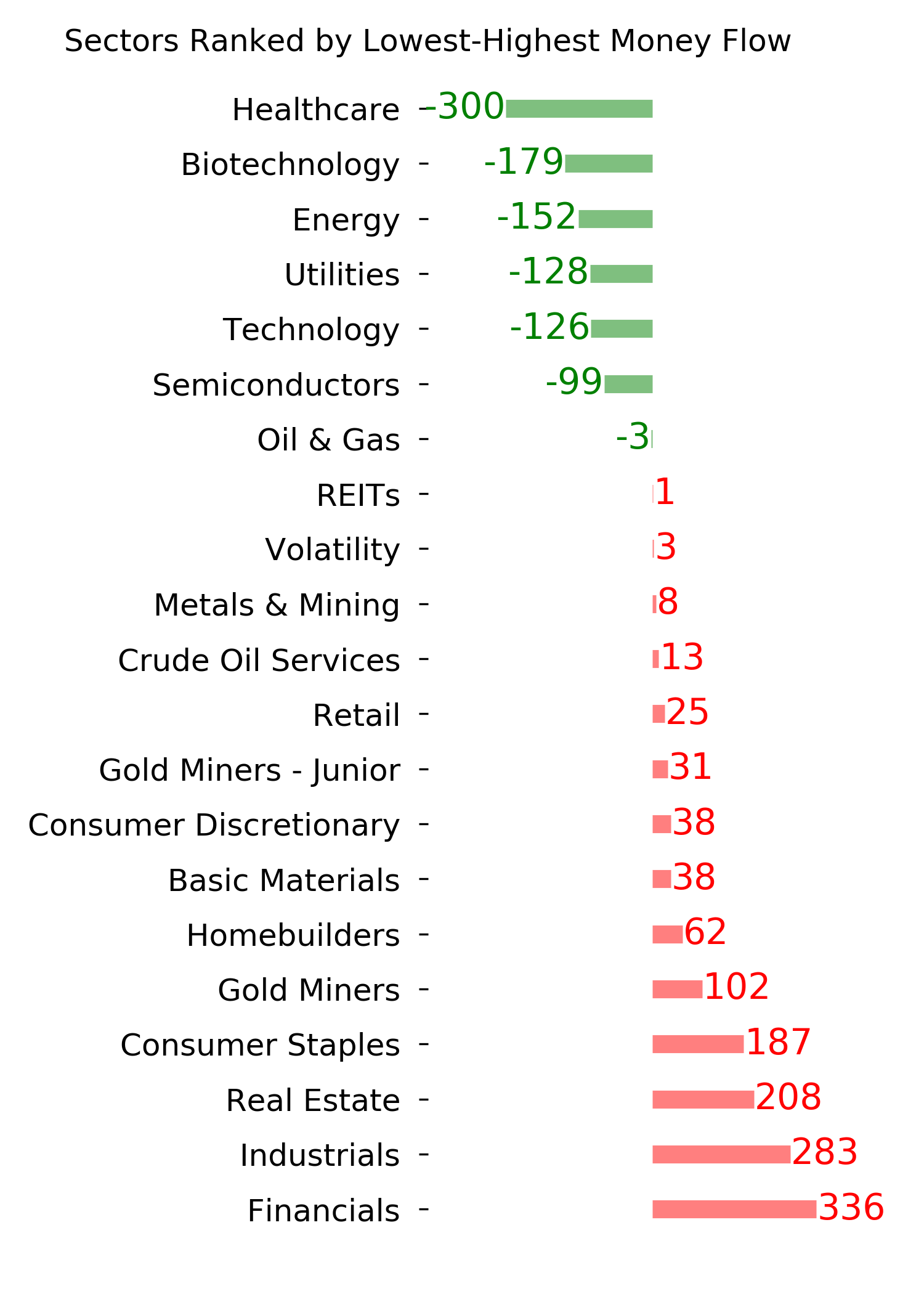

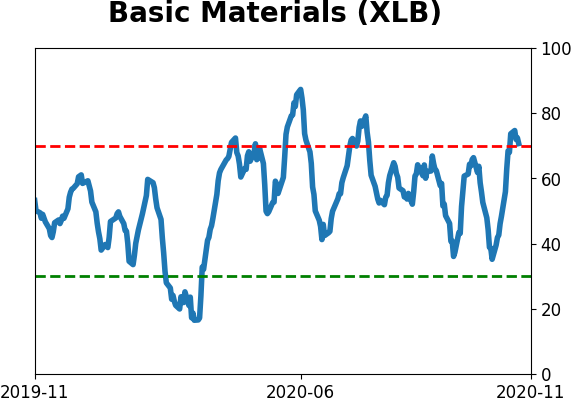

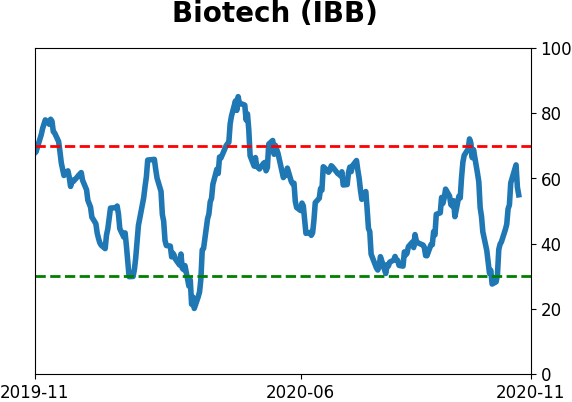

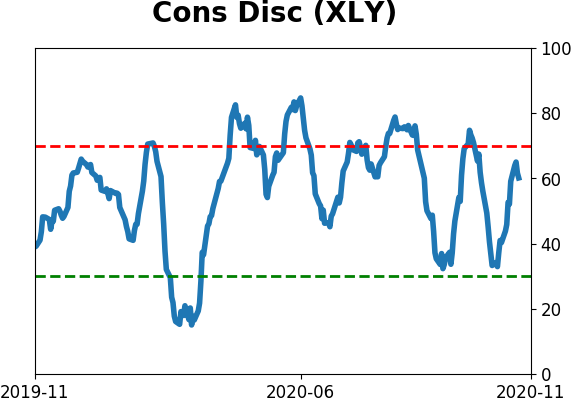

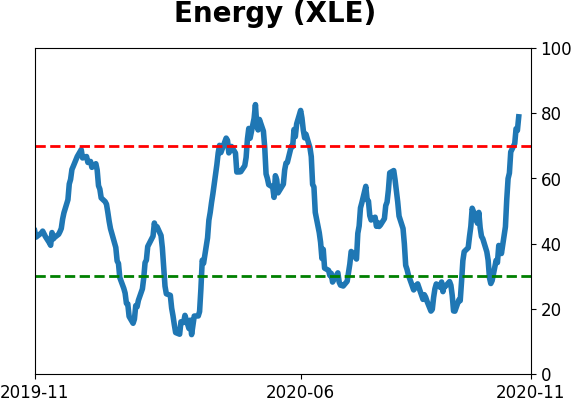

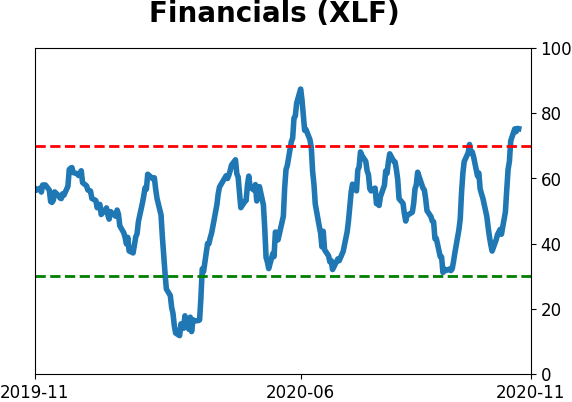

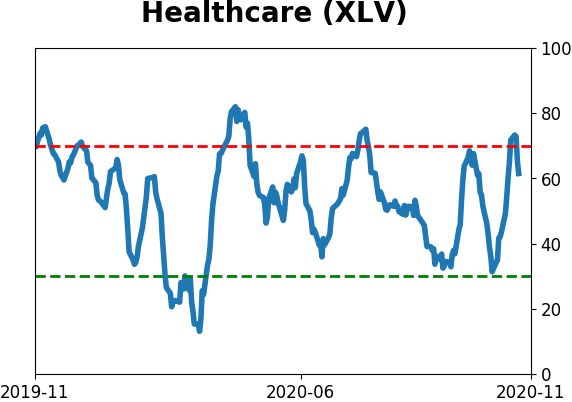

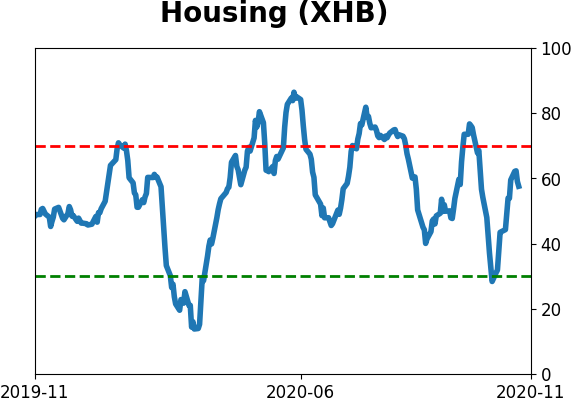

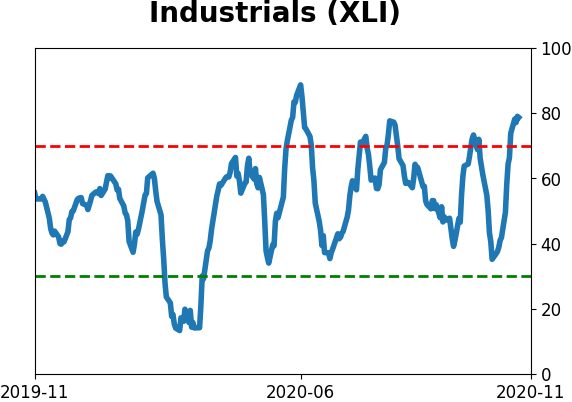

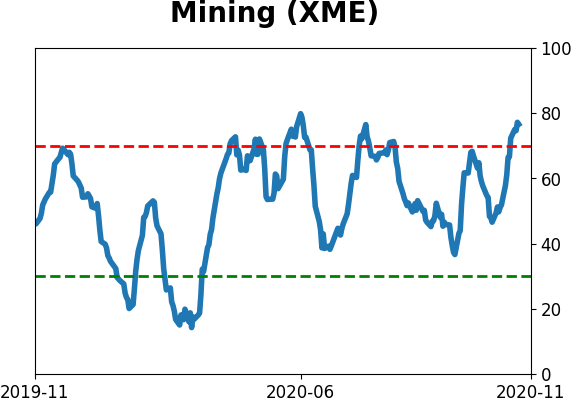

Sector ETF's - 10-Day Moving Average

|

|

|

Country ETF's - 10-Day Moving Average

|

|

|

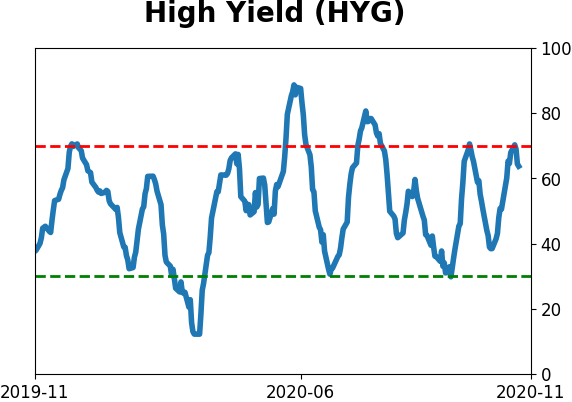

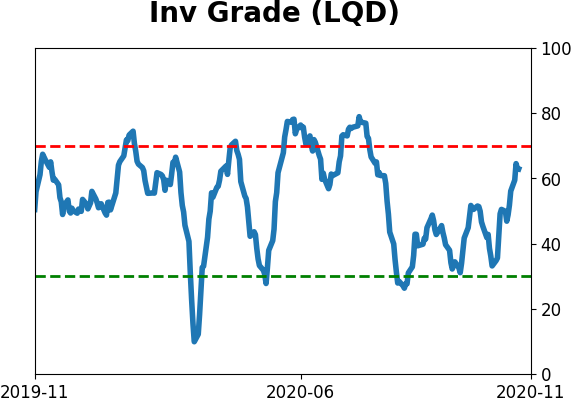

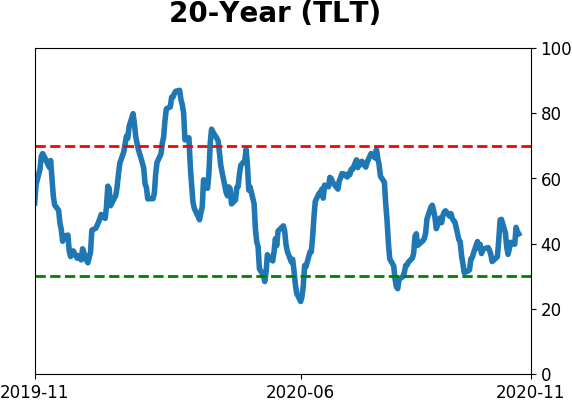

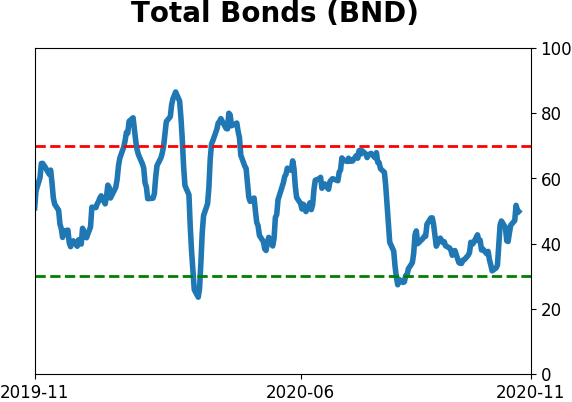

Bond ETF's - 10-Day Moving Average

|

|

|

Currency ETF's - 5-Day Moving Average

|

|

|

Commodity ETF's - 5-Day Moving Average

|

|