Headlines

|

|

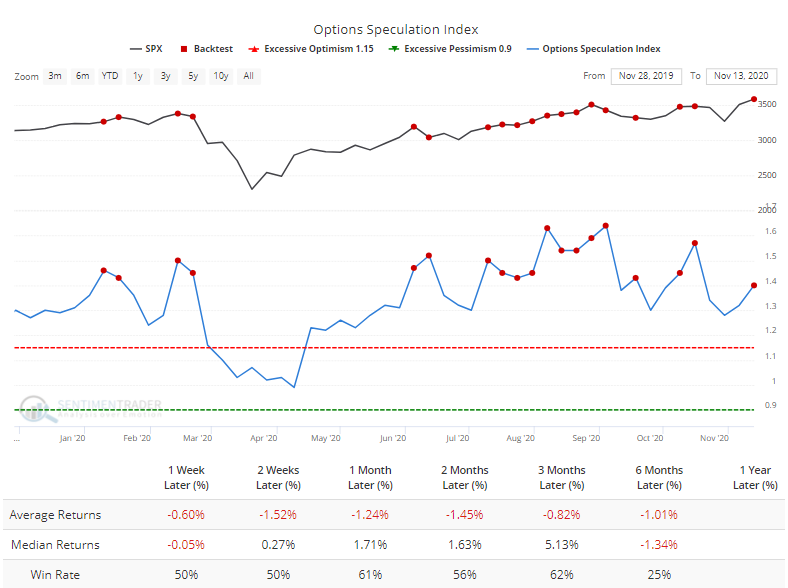

Small options traders come back as buyers press:

Last week, the smallest of options traders picked up the pace of speculative call buying, but at least they didn't pull back much on protective puts. Overall options activity is still beyond its extreme thresholds, which has preceded poor annualized returns for stocks. But breadth has been exceptional as small-cap stocks break out.

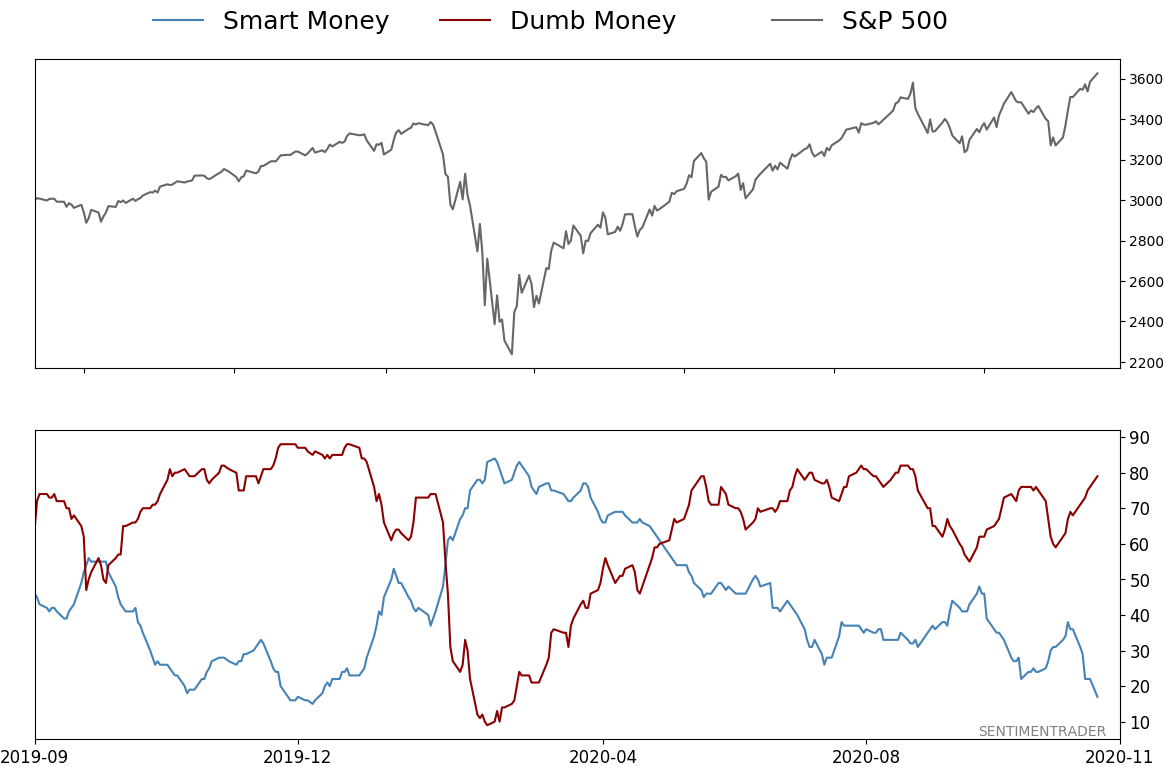

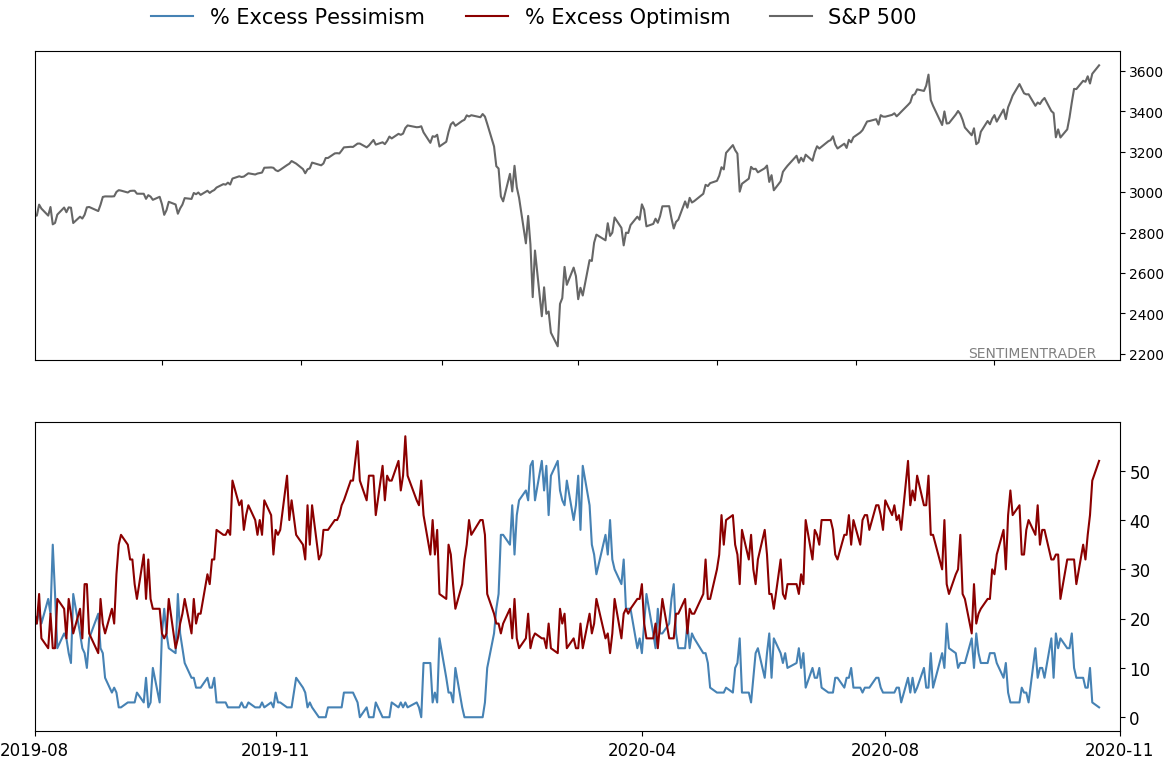

Sentiment is the most stretched since January: The spread between Smart Money and Dumb Money Confidence has eroded to -62%, one of the widest since we began tabulating this in 1999. According to the Backtest Engine, a spread this wide led to a negative average return over the next 2-3 months. More notably, out of the 151 days that had a spread this wide, only 17 of them, or 11% of the days, managed to escape with no losses on any time frame. Once late buyers see prices start to wobble, the typical reaction is a pullback of 3% - 8%.

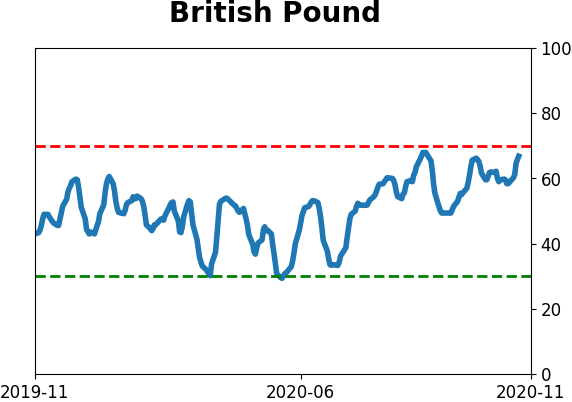

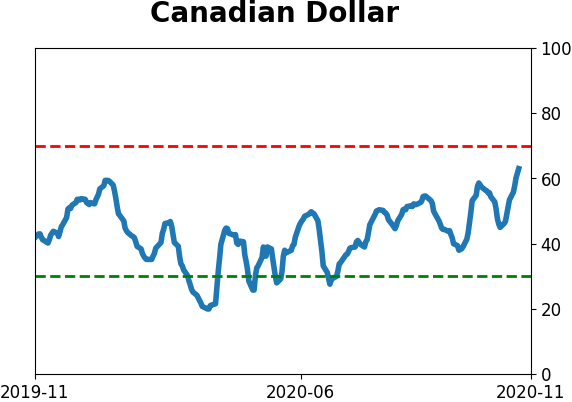

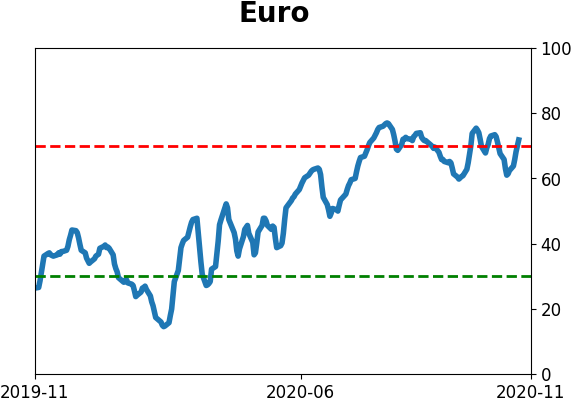

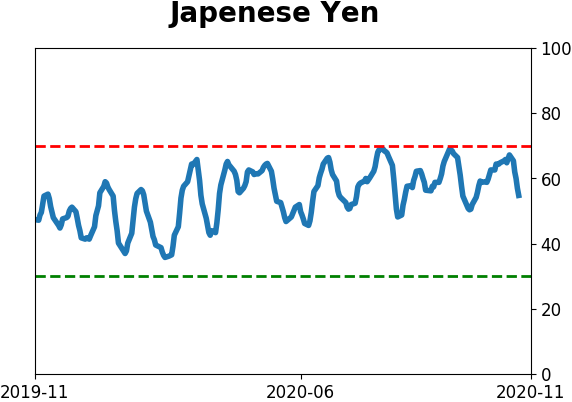

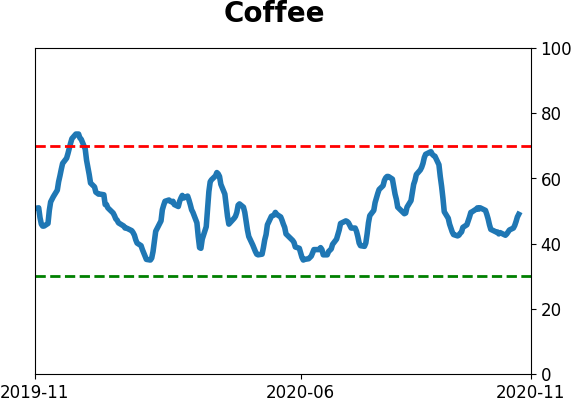

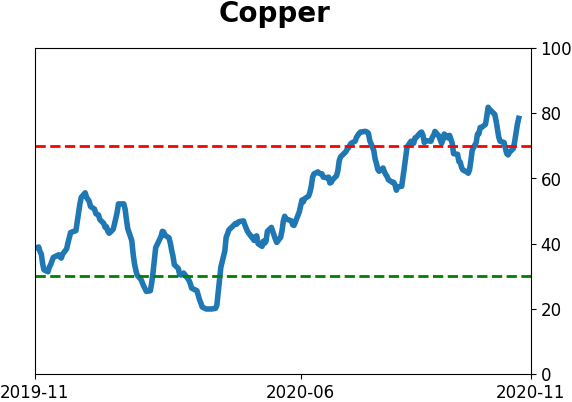

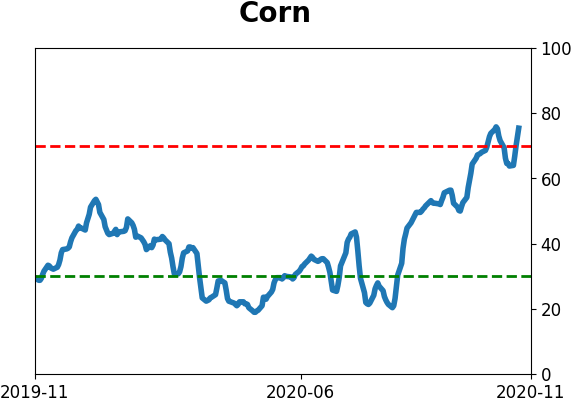

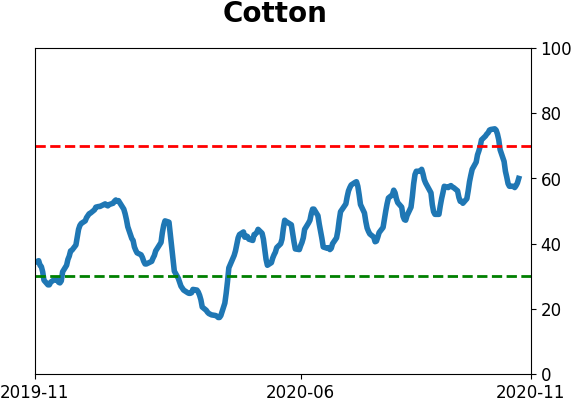

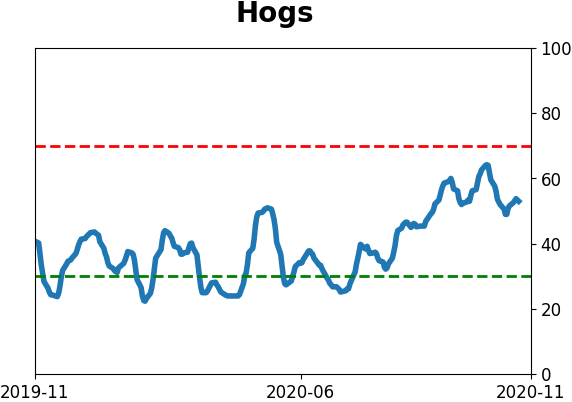

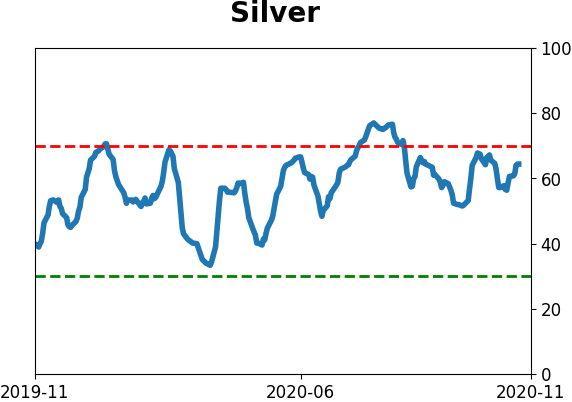

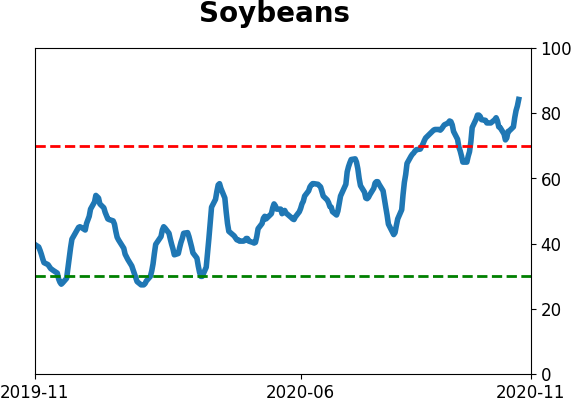

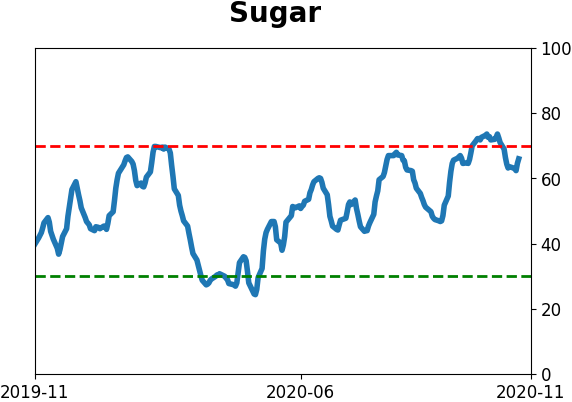

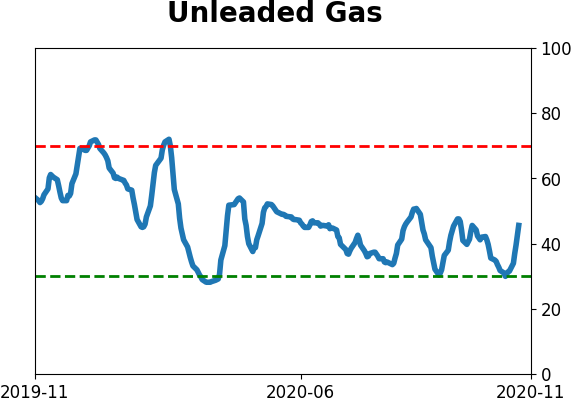

The latest Commitments of Traders report was released, covering positions through Tuesday: There was a delay in the Commitments of Traders report on trader positioning due to last week's Veteran's Day holiday. The 3-Year Min/Max Screen shows few new extremes other than "smart money" commercial hedgers establishing a multi-year extreme short position against the Japanese yen and continued selling in soybeans. They remain heavily short commodities in general and agriculture in particular. For soybeans, the Backtest Engine shows that when hedgers held 30% or more of open interest net short, the contract consistently fell in the weeks and months ahead. To be fair, this has been "extreme" since September and many of these contracts continue to gain, suggesting the probability of a long-term change in trend from the past decade of morass. In stocks, hedgers covered their short by a modest degree but there's nothing notable there. Same with bonds, where they are heavily long 30-year Treasuries but short the 10-year, an odd mix that's only been seen twice before.

Bottom Line:

- A positive environment favors becoming aggressive on signs of excessive pessimism, of which there are few yet.

|

Smart / Dumb Money Confidence

|

Smart Money Confidence: 17%

Dumb Money Confidence: 79%

|

|

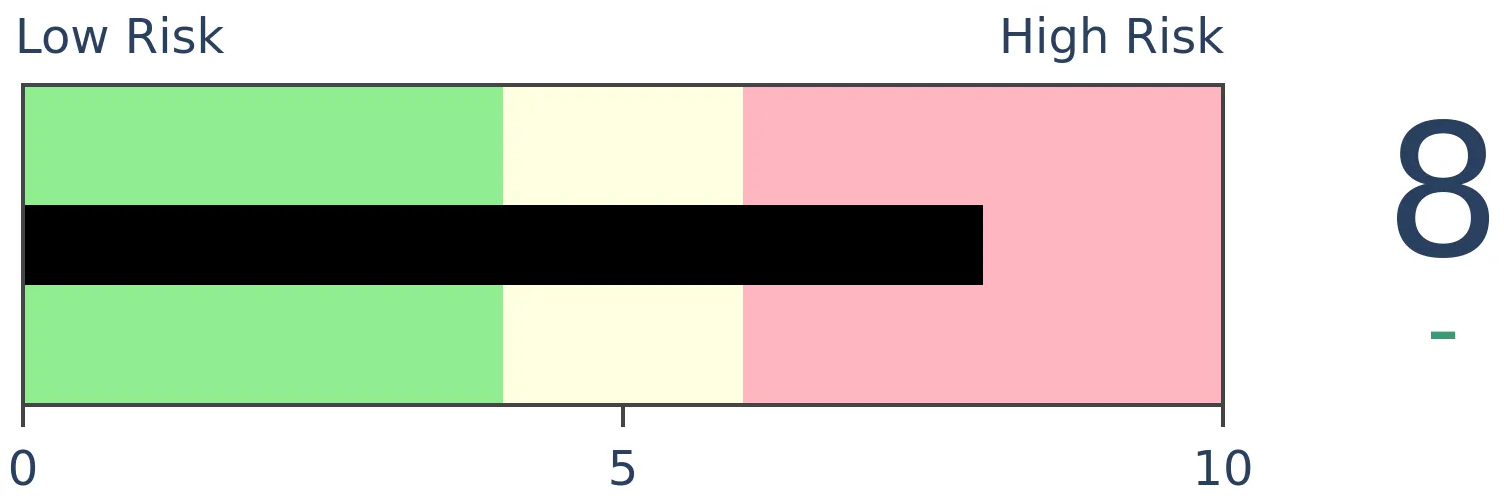

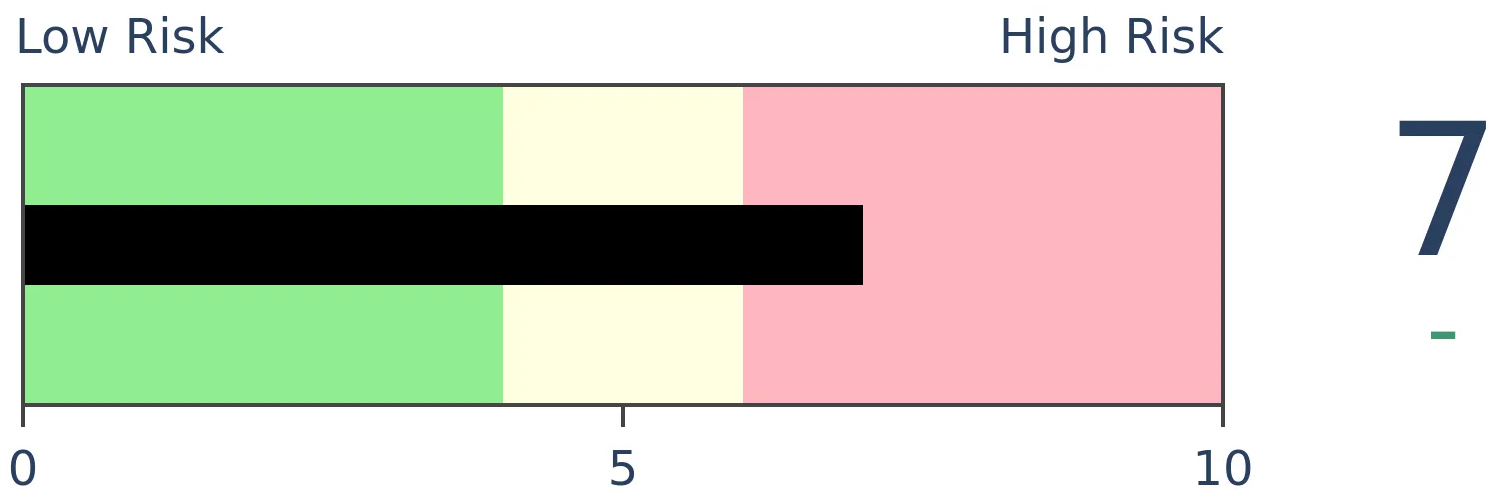

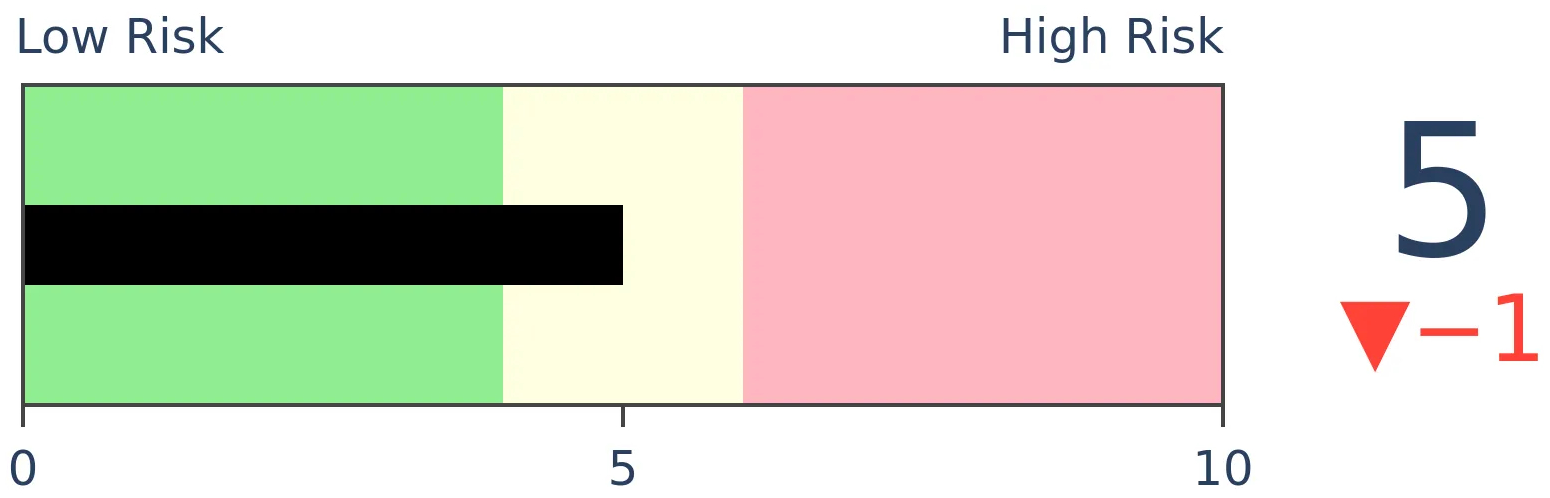

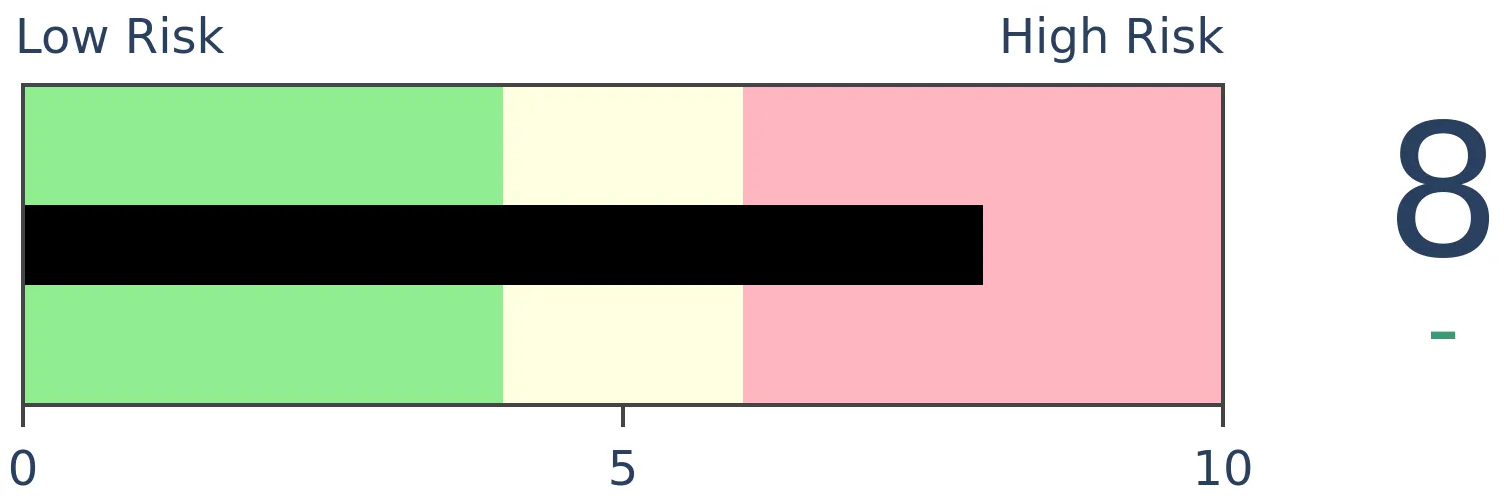

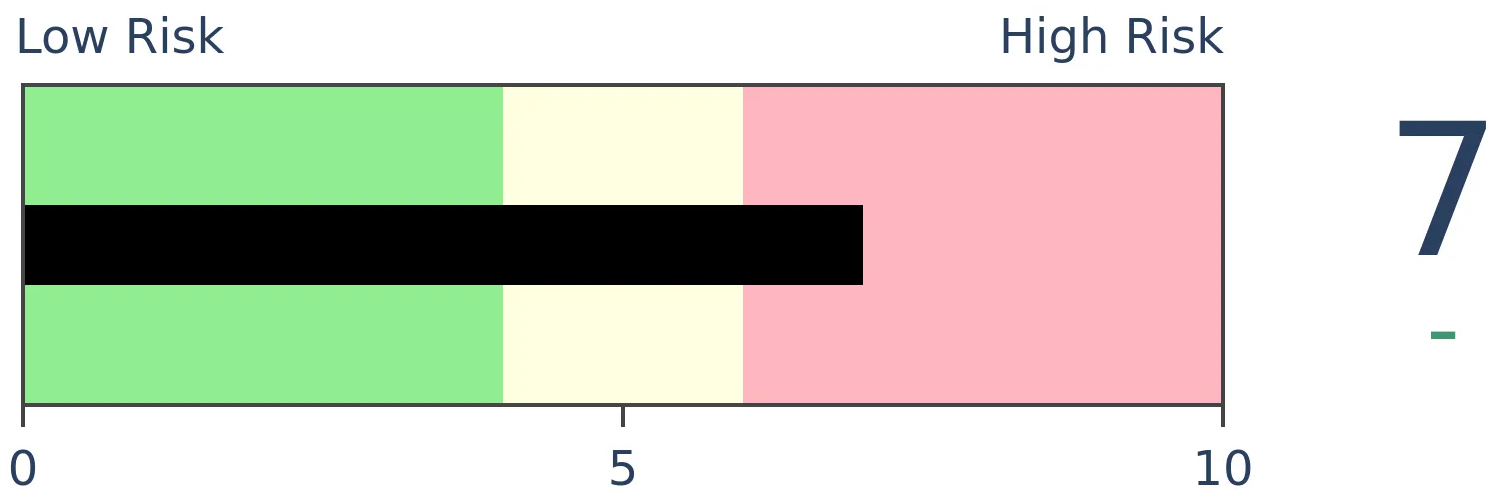

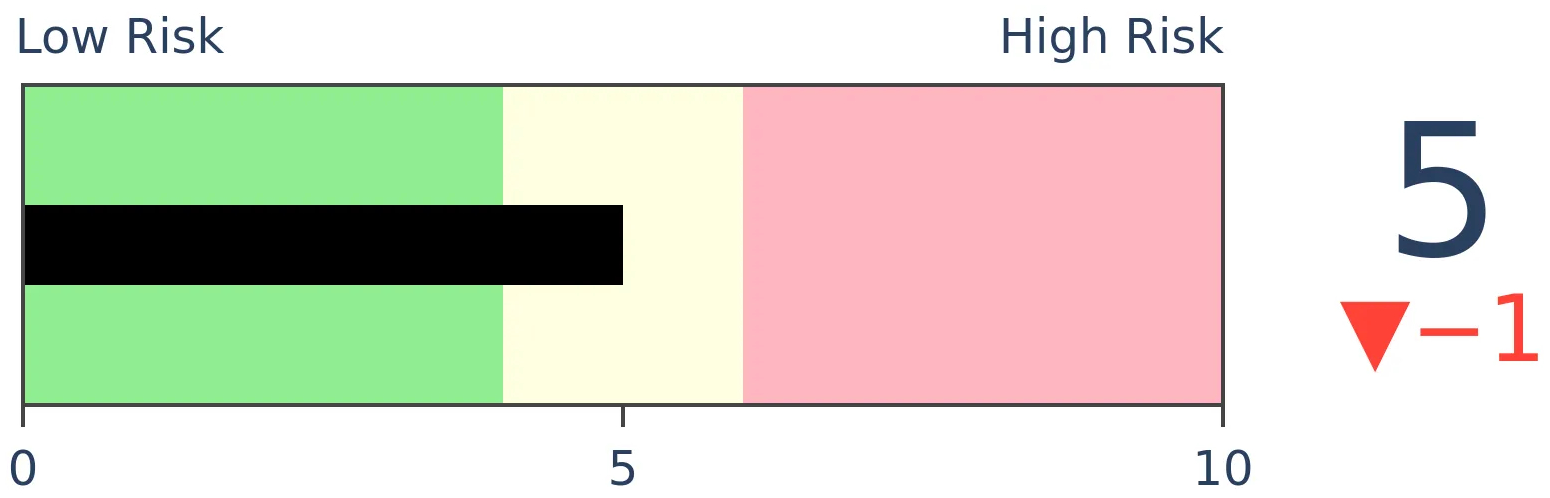

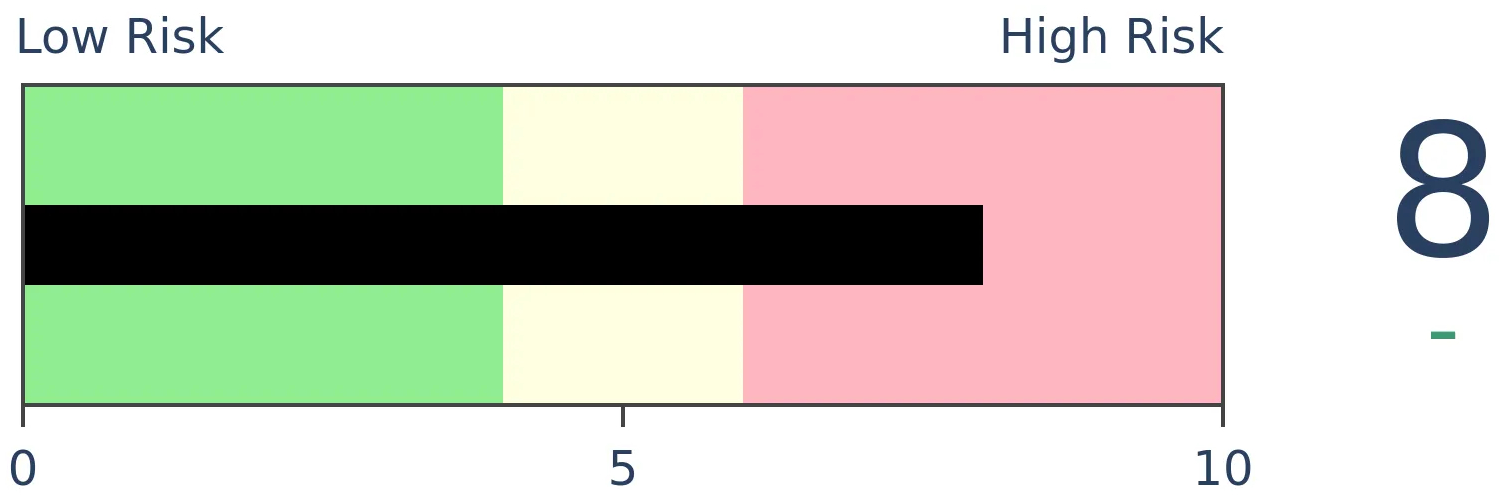

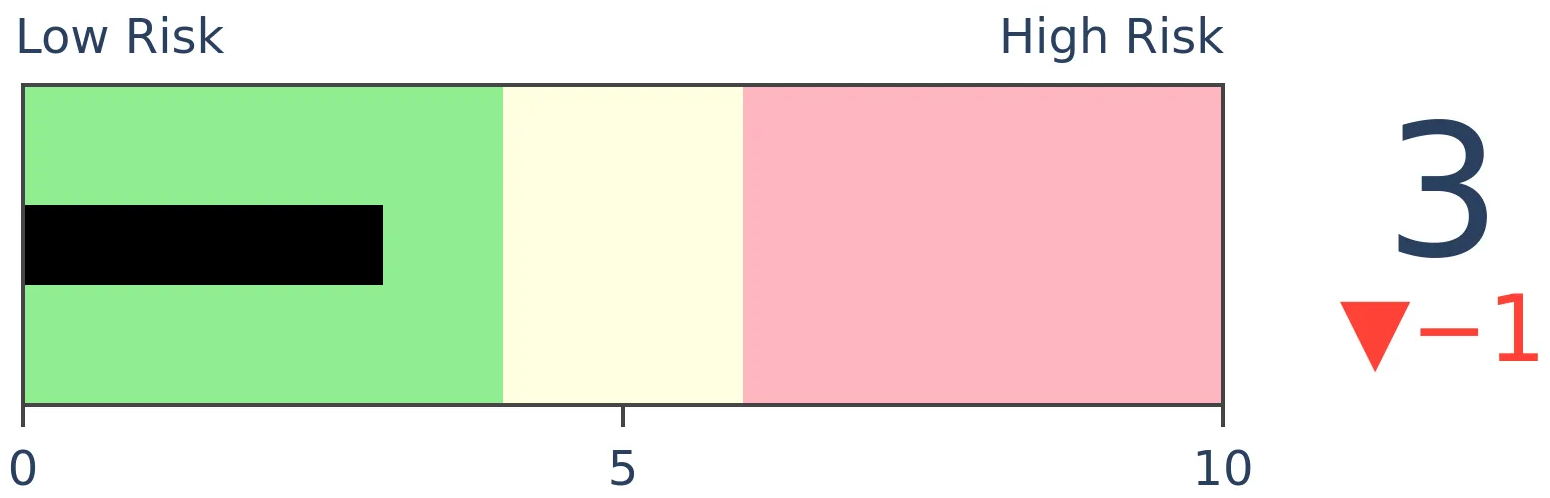

Risk Levels

Stocks Short-Term

|

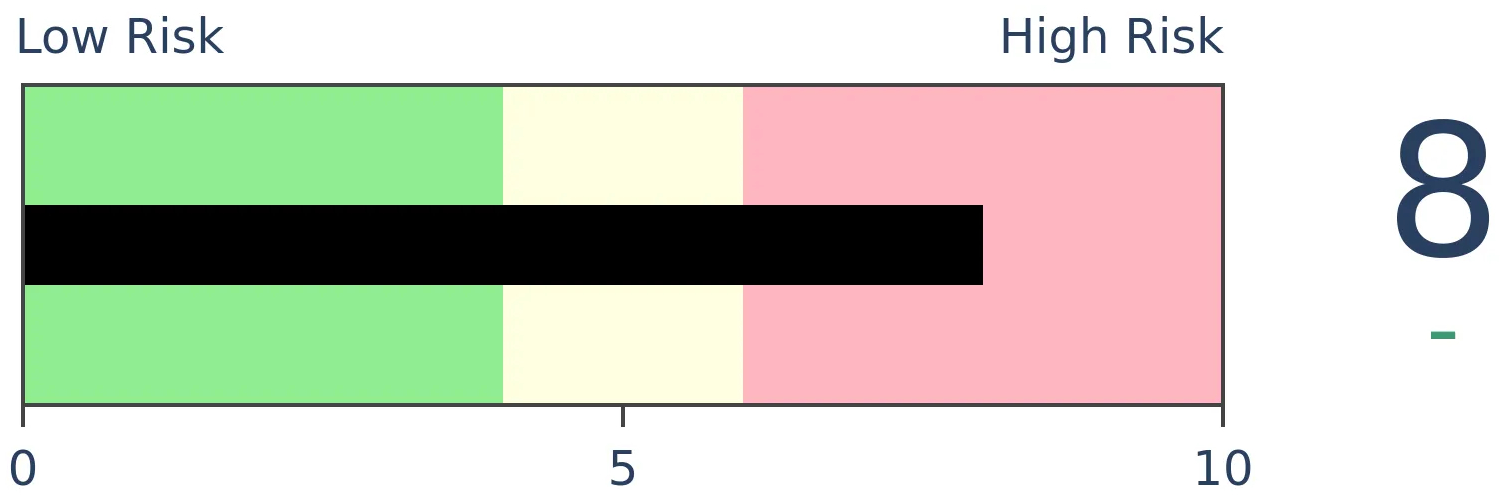

Stocks Medium-Term

|

|

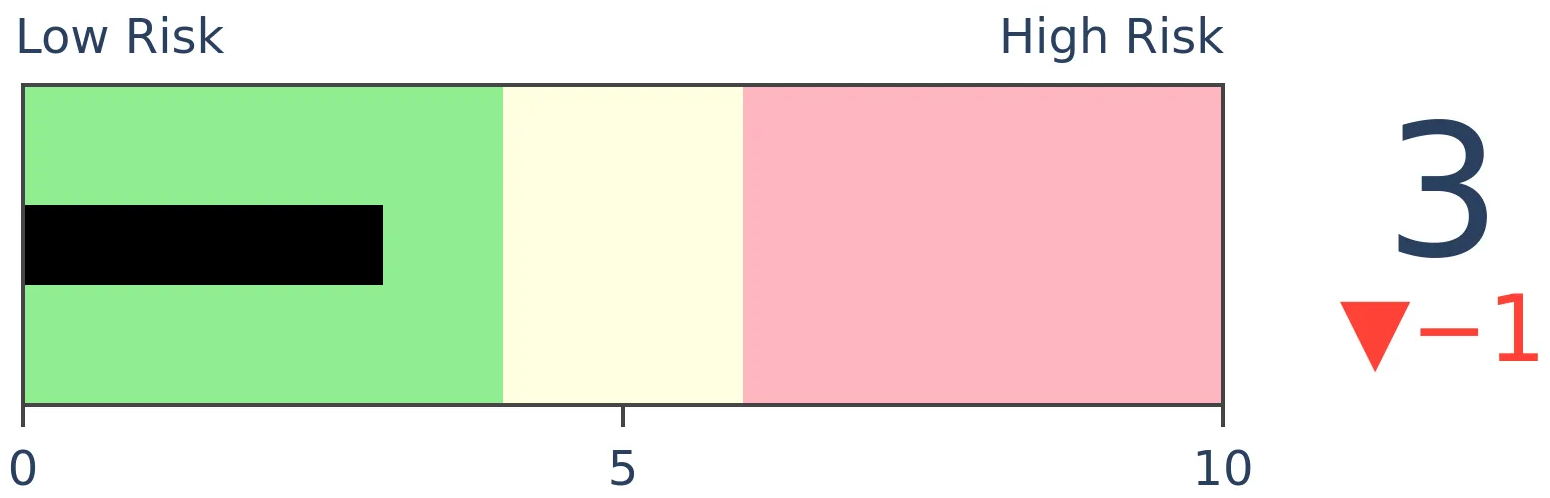

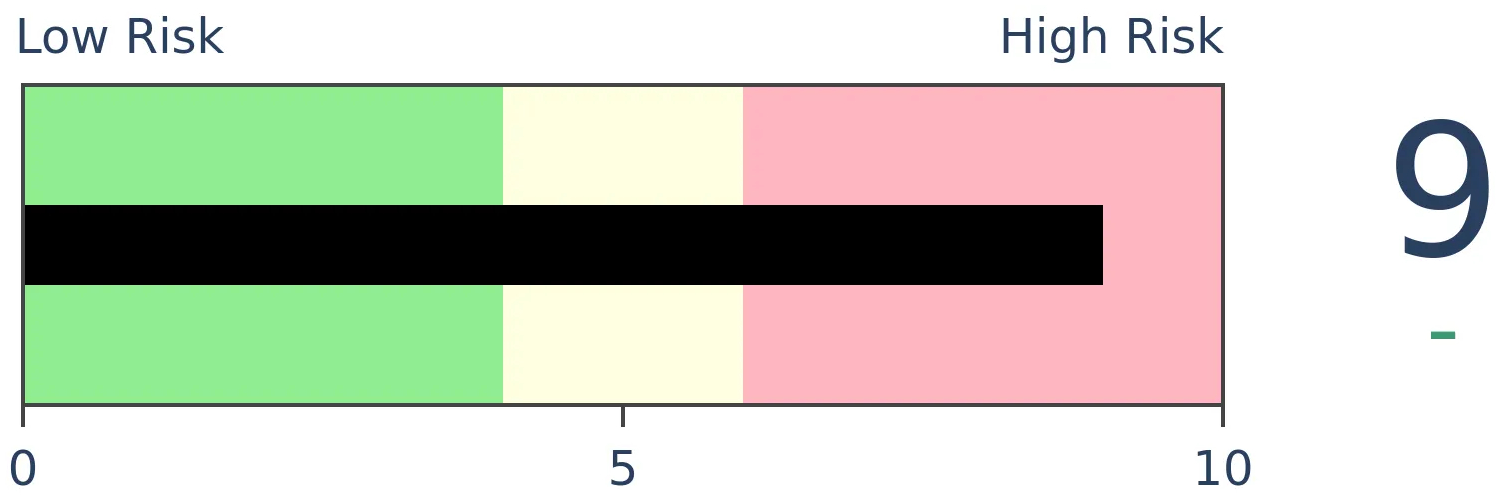

Bonds

|

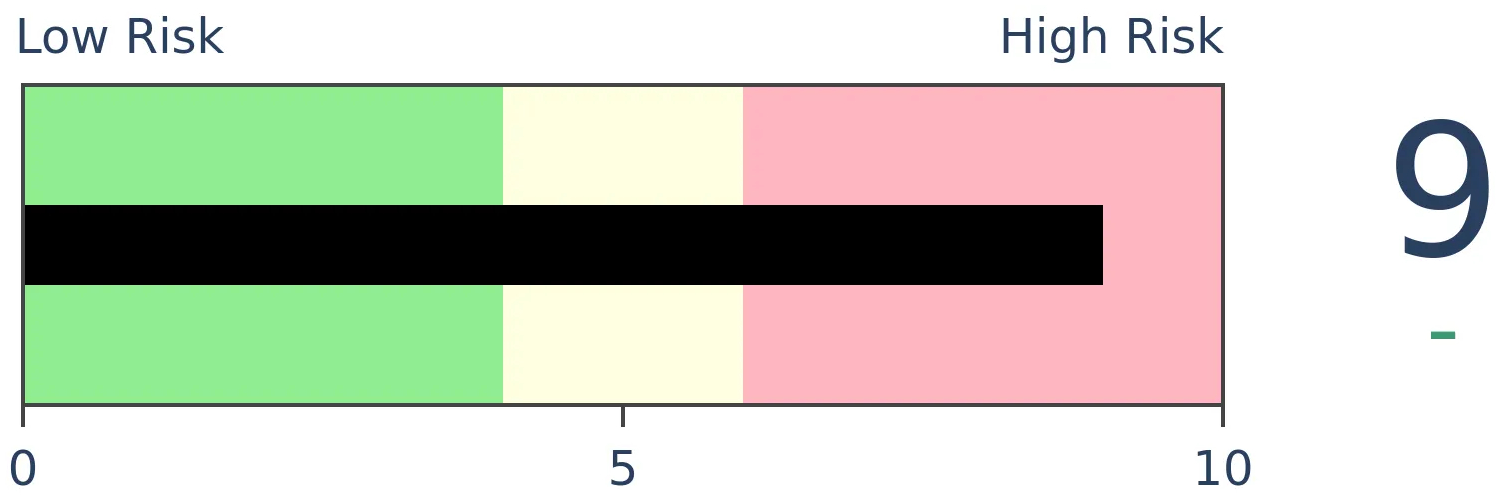

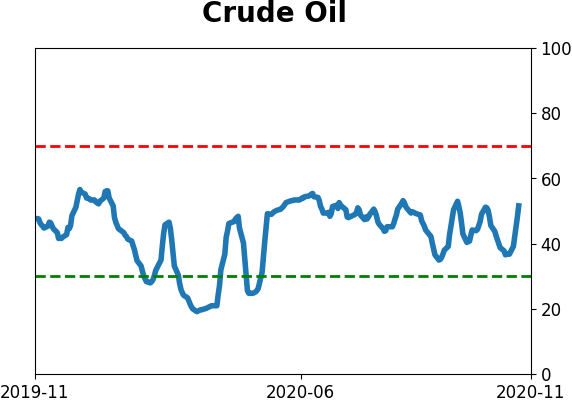

Crude Oil

|

|

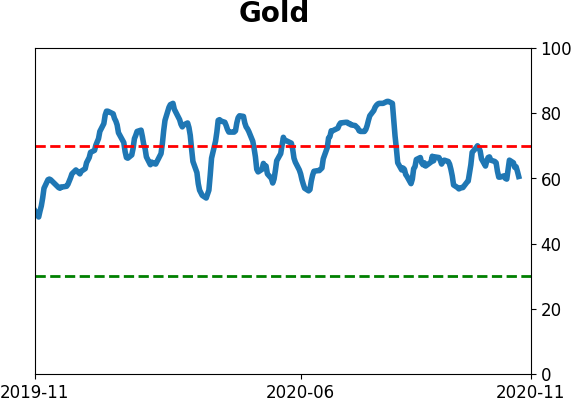

Gold

|

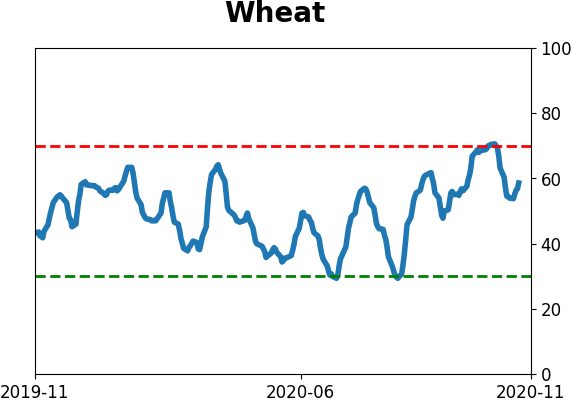

Agriculture

|

|

Research

BOTTOM LINE

Last week, the smallest of options traders picked up the pace of speculative call buying, but at least they didn't pull back much on protective puts. Overall options activity is still beyond its extreme thresholds, which has preceded poor annualized returns for stocks. But breadth has been exceptional as small-cap stocks break out.

FORECAST / TIMEFRAME

SPY -- Up, Long-Term

|

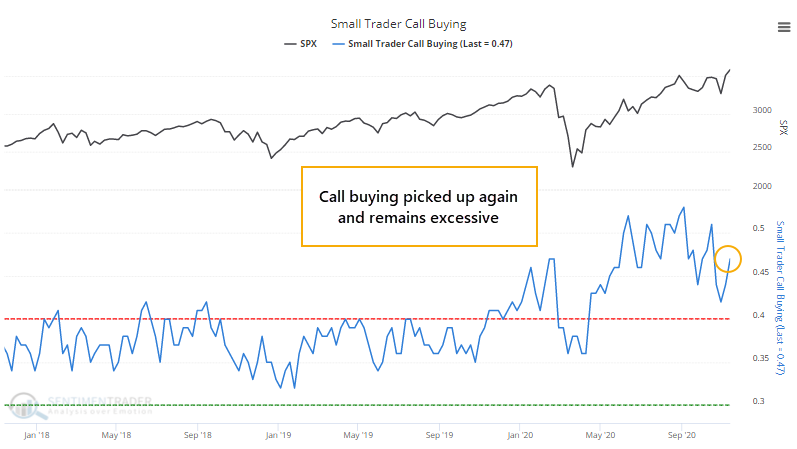

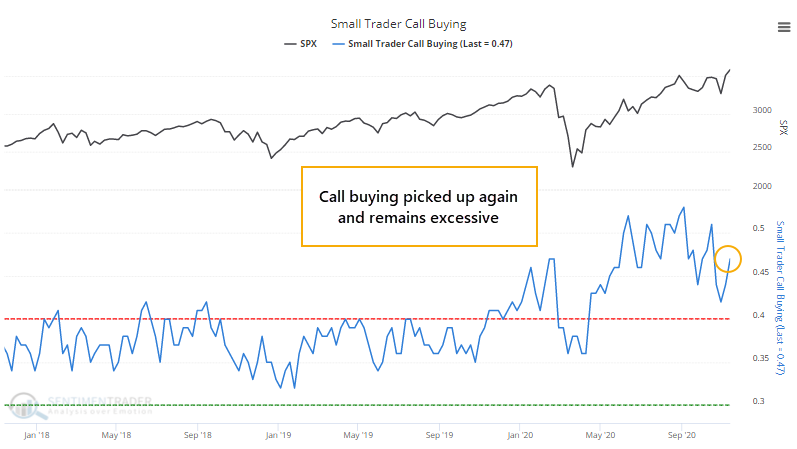

One of our primary points of focus since August has been the behavior of options traders. They broke all records dating back 20 years in terms of sheer speculative fervor.

They let up a bit during the September swoon and recent market recoveries have emboldened them again, but not quite to the same degree. They got slapped with some losses and that seems to be tempering their willingness to try again.

Even so, the smallest of options traders spent 47% of their volume on buying call options to open last week. That is once again among the highest levels since 2000, though it's still below the peaks from recent months.

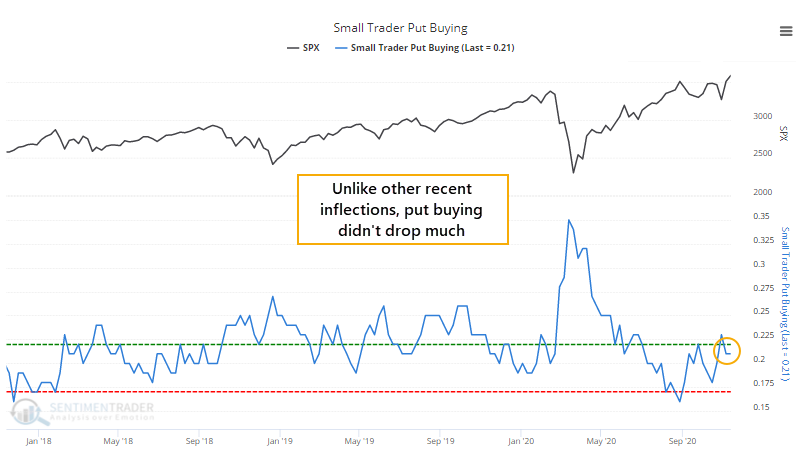

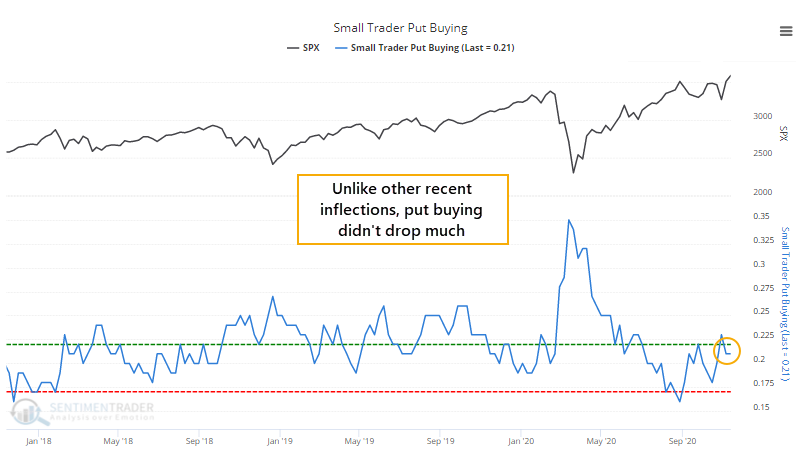

One modest difference is that they didn't completely abandon the protective allure of put options. They still spent more than 20% of their volume there, quite a bit above recent extremes.

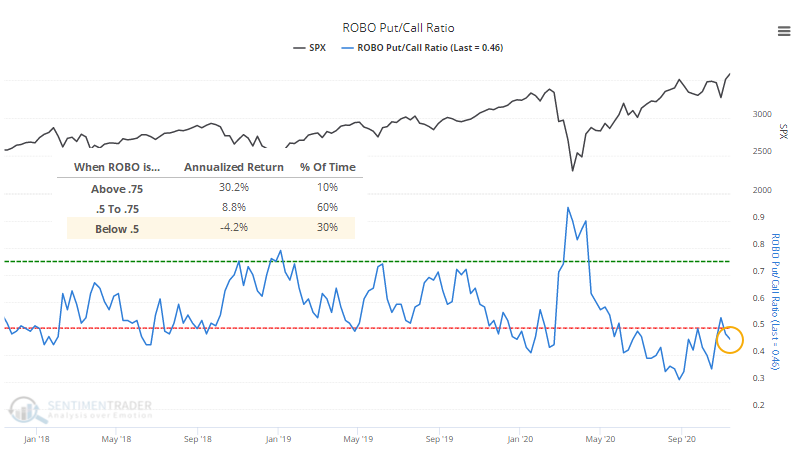

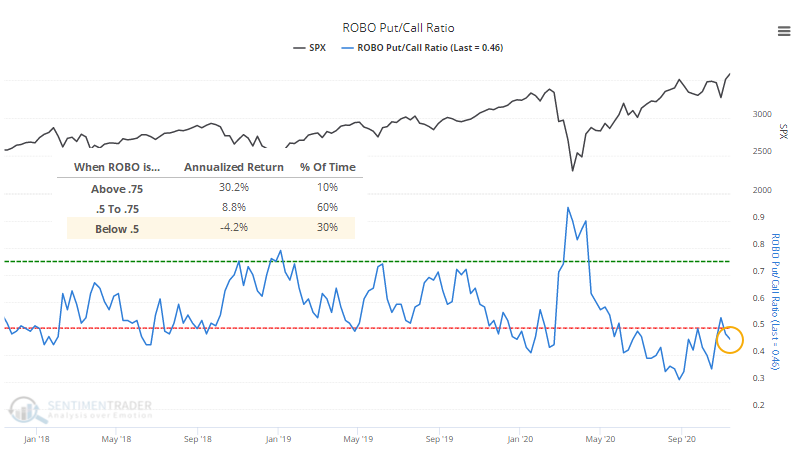

As a result, the ROBO Put/Call Ratio, which stands for Retail-Only-Buy-to-Open, dropped below its extreme threshold again. It's still above the extremes from recent months, but we can see from the chart that the S&P 500's annualized return when the Ratio is below its lower threshold is a miserly -4.2%.

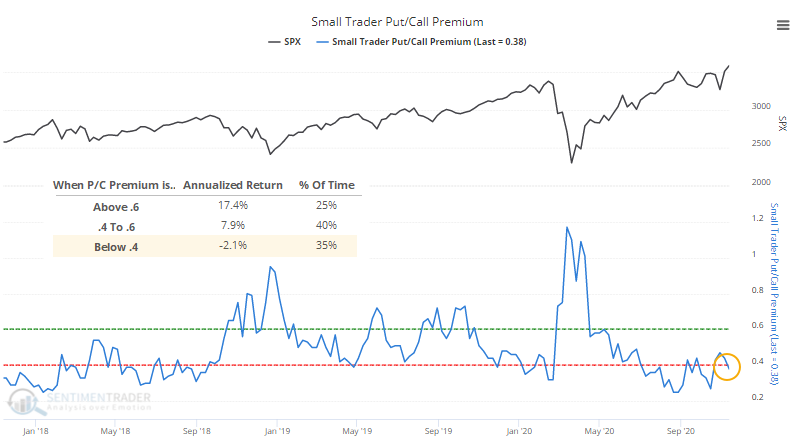

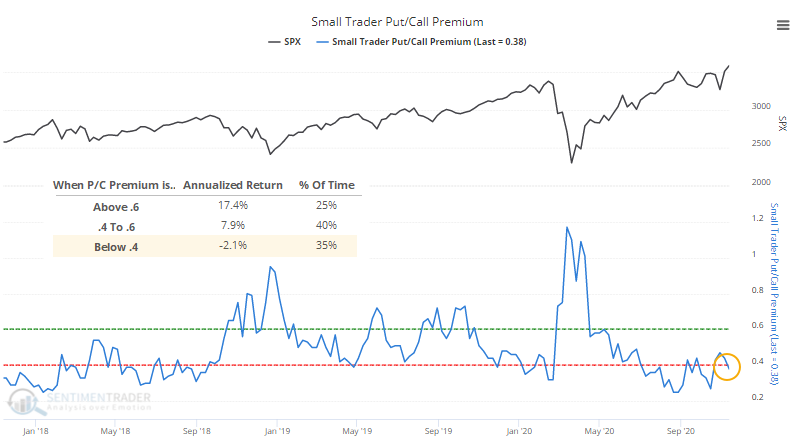

Likewise, they spent quite a bit more money on those speculative call options than they did on protective puts, so the Small Trader Put/Call Premium also dropped below its lower threshold. Again, that preceded poor annualized returns for the S&P.

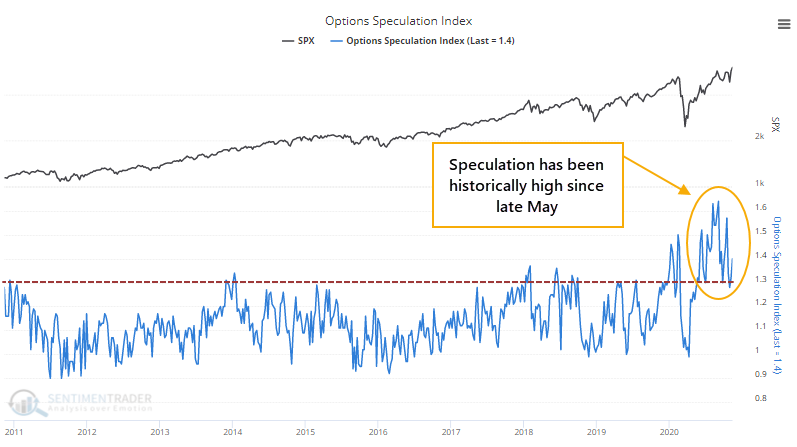

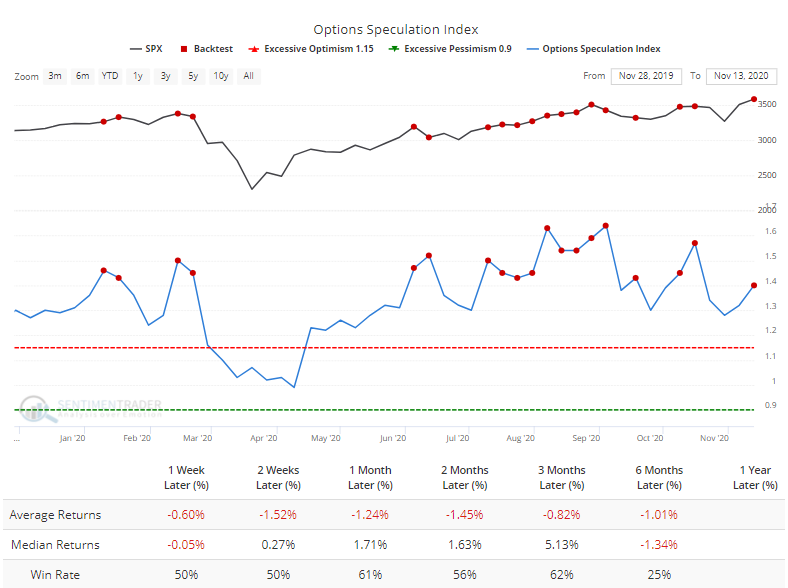

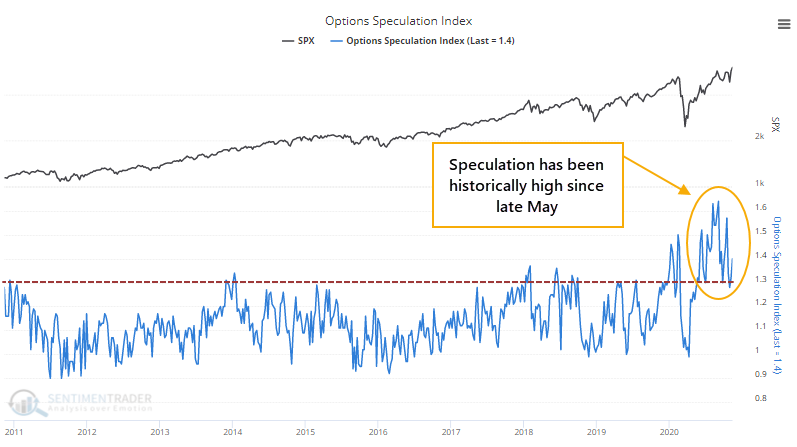

Across all trader sizes and all option configurations, volume in bullish strategies last week was 40% higher than volume in bearish strategies, so the Options Speculation Index hit 1.40.

Since the bubble burst in 2000, no week had seen this figure higher than 1.4 prior to 2020. Since then, it has triggered during 18 weeks, which the Backtest Engine shows led to generally poor returns.

Those returns would have been significantly worse if we just excluded July. The momentum that carried stocks higher then accounted for virtually all of the positive shorter-term returns.

The renewed push in call option buying is a concern, and there is no question that traders remain historically aggressive. Using only very recent history, perhaps it's a modestly good sign that at least they're still buying a few puts and haven't gone into full-bore frenzy mode like August. The biggest caveat here is that even though stocks can and do rally after such confidence among options traders, shorter-term forward returns have a strong tendency to be muted (and temporary) if they are positive at all.

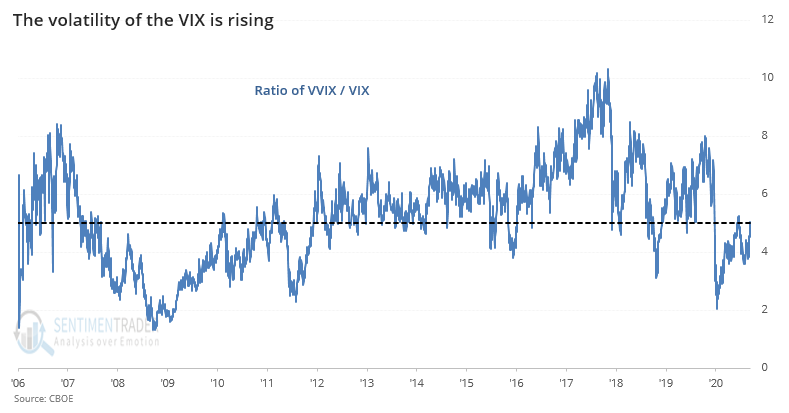

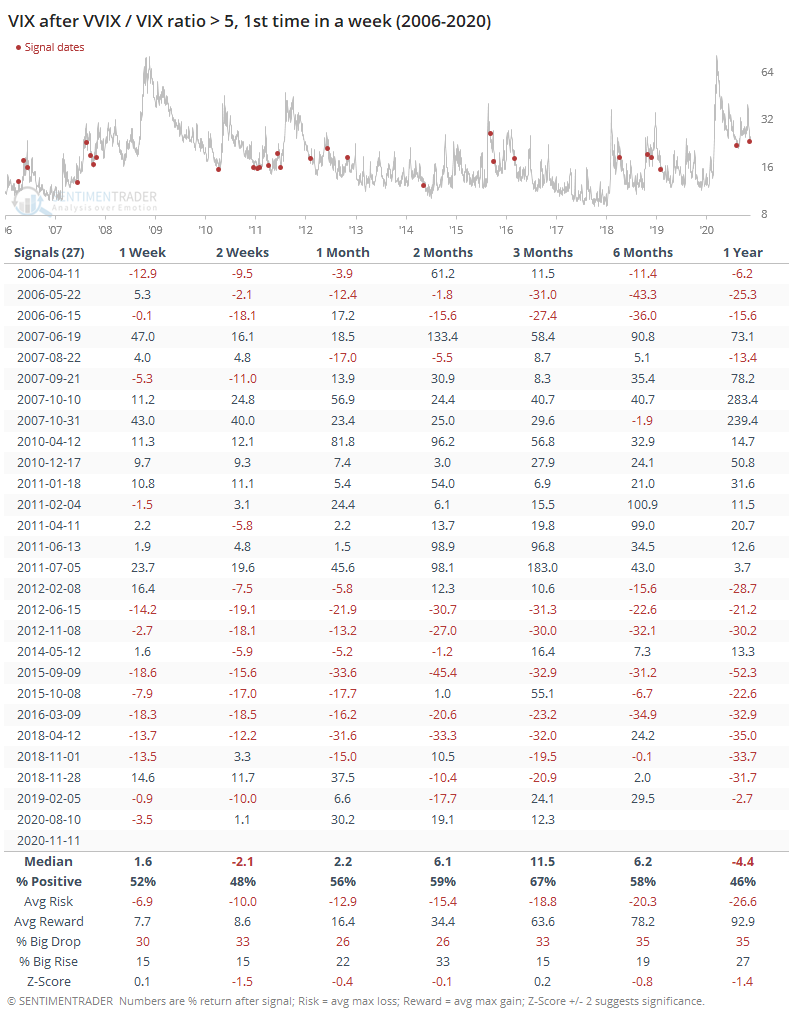

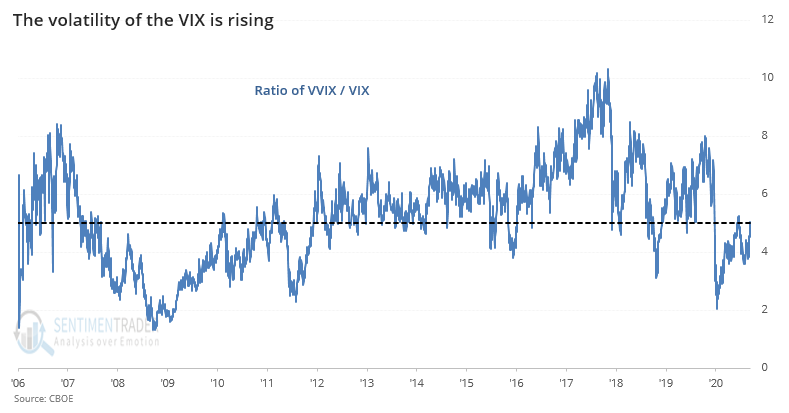

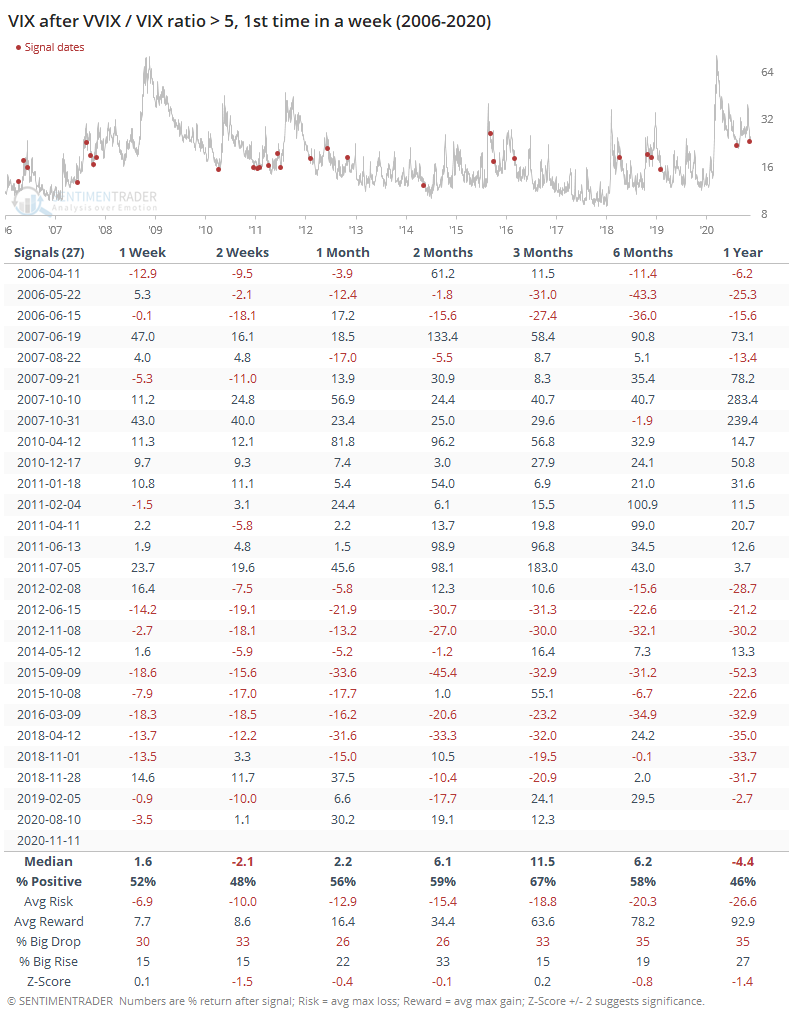

One potential concern is that these options traders have been pricing in more volatility in volatility itself. As Bloomberg notes, the VVIX is now 5 times greater than the VIX.

Not quite sure how they're looking at this, but we can't confirm the VIX's performance over the next 2 months. It did tend to rise over the next 1-3 months, but it wasn't consistent. There were some very large gains in there from 2007-2011 - they were just hard to rely on as a warning sign.

Regardless, the S&P 500 held up just fine.

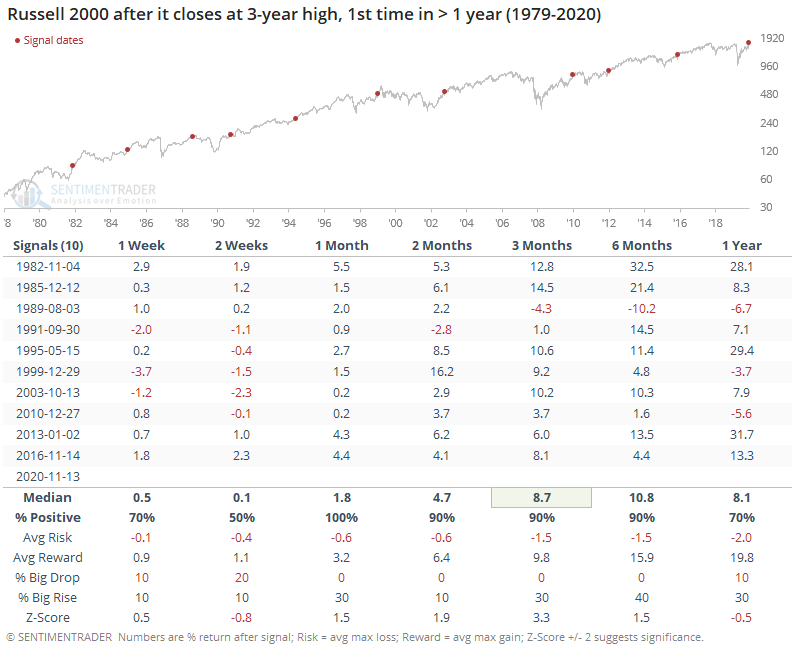

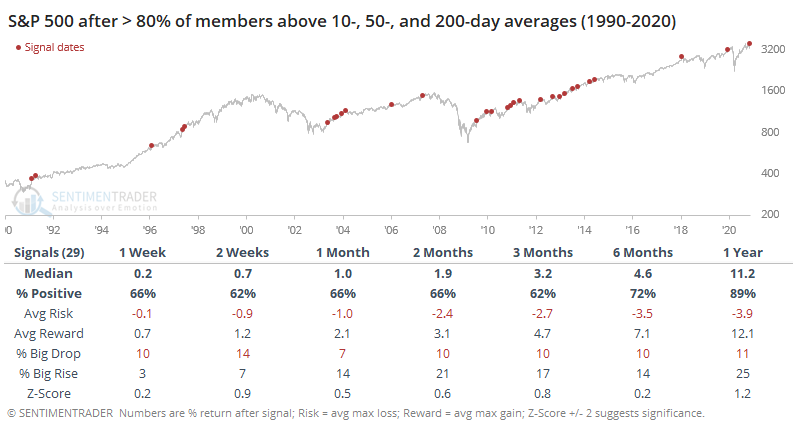

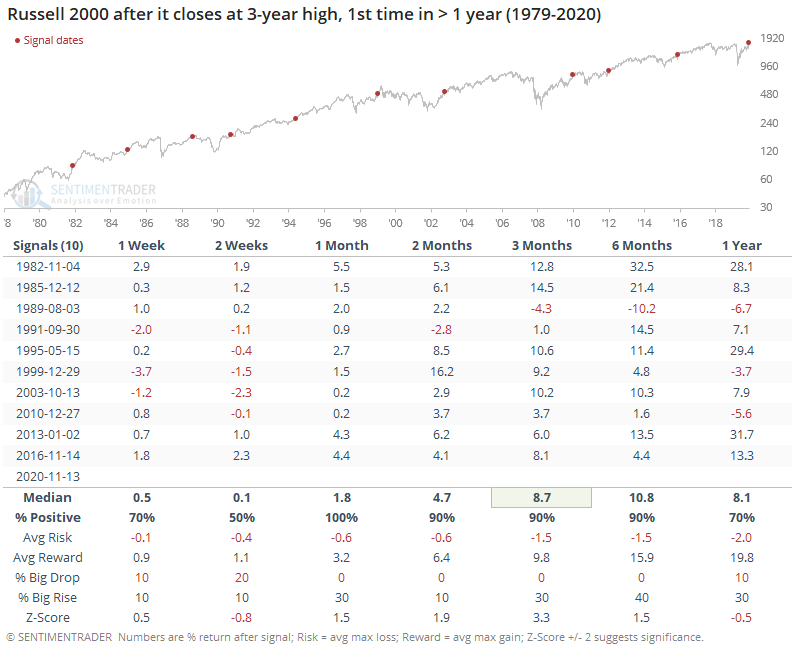

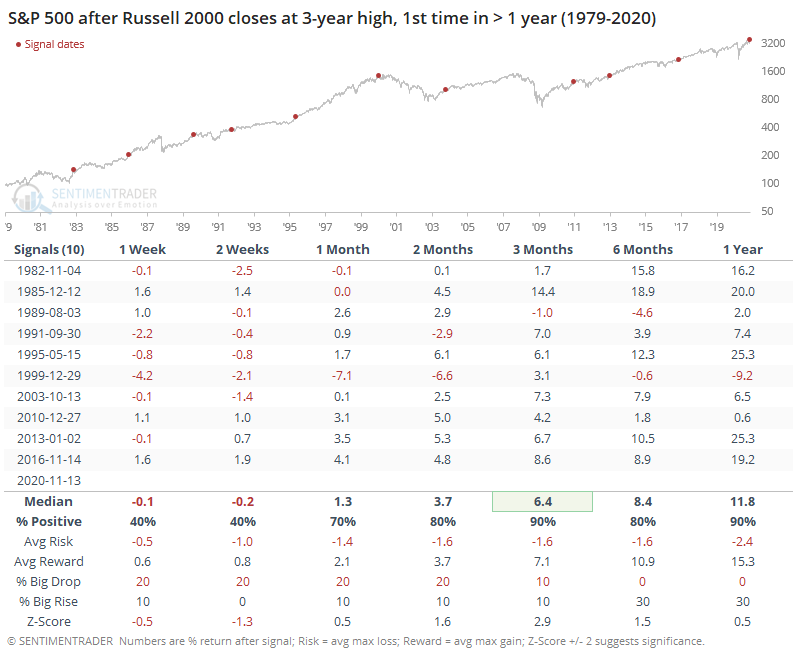

Despite the potential warnings, momentum remains extremely strong as we've outlined multiple times over the couple of weeks. Friday's rally was the icing on the cake, especially for smaller stocks, with the Russell 2000 reaching a multi-year high for the first time in over a year. When it's done that before, it never lost ground over the next month.

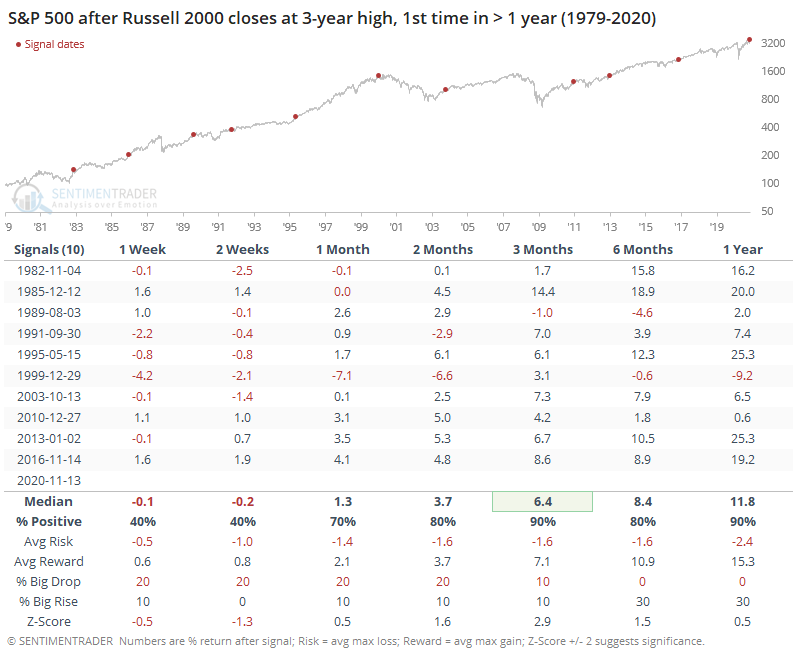

That has had very positive implications for the S&P 500 as well, with an exceptional risk/reward ratio out 2 months and beyond.

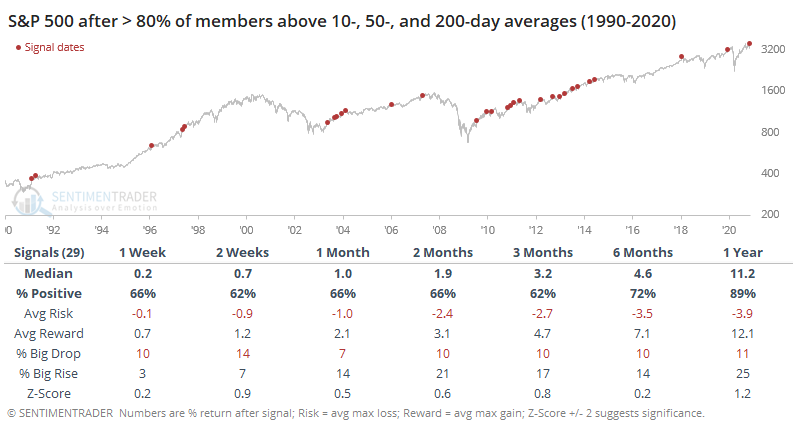

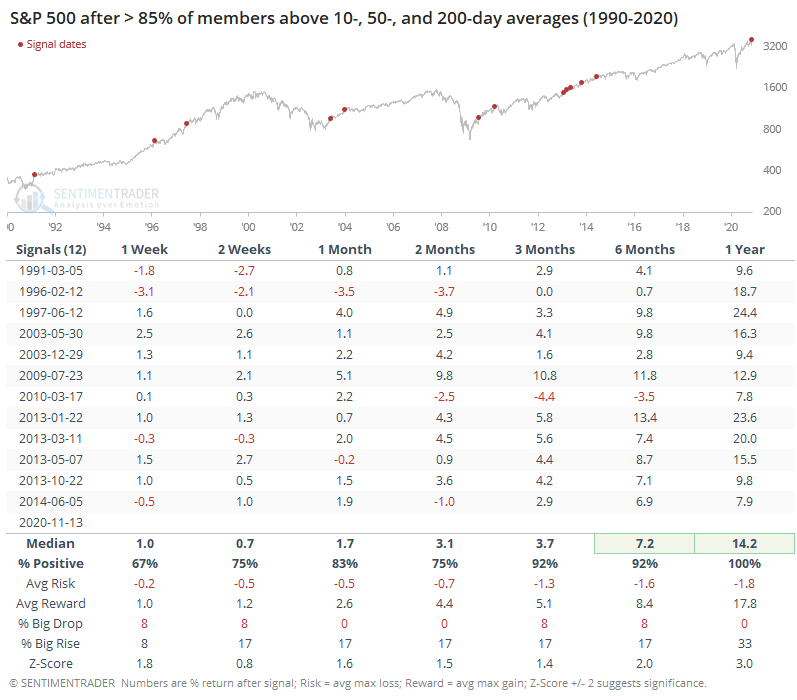

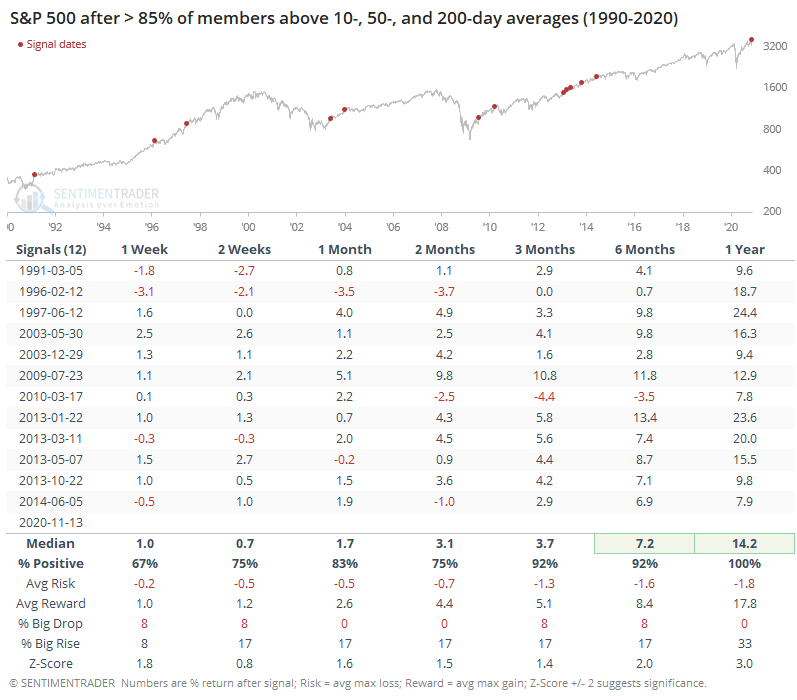

Thanks in part to the renewed vigor of small-cap stocks, breadth figures have been outstanding. Within the S&P 500, more than 85% of the stocks are trading above their 10-, 50-, and 200-day moving averages, a rare confluence of uptrends on all time frames.

Confirming other measures from recent weeks, this kind of widespread buying interest has resulted in exceptionally positive returns over a medium- to long-term time frame.

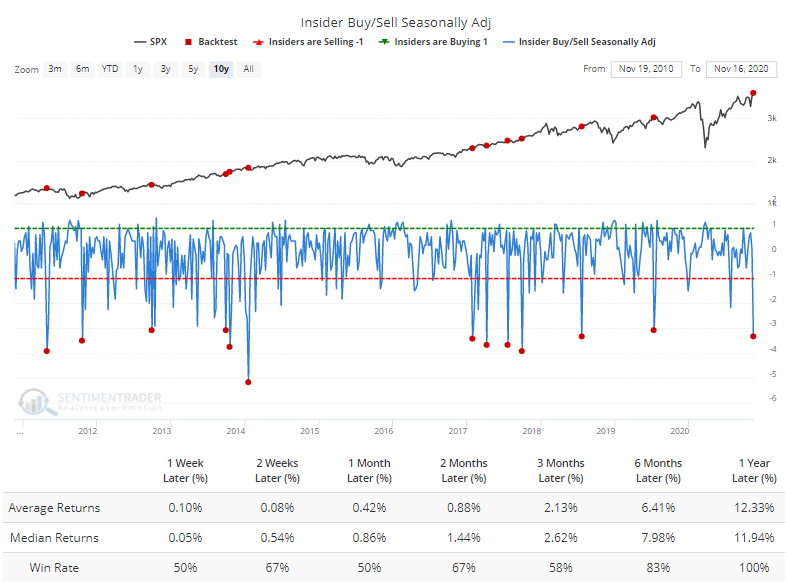

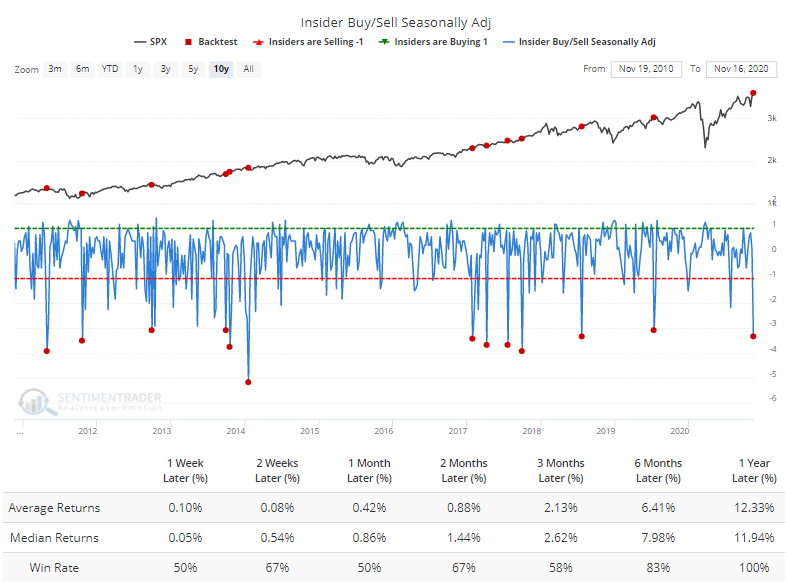

There are some initial signs that corporate insiders picked up their selling pace, but overall volume is likely still skewed by earnings season. Also, selling has typically been much less reliable than buying, with the Backtest Engine showing mostly positive returns in the S&P 500 following negative spikes in the seasonally-adjusted insider buy/sell ratio.

We're once again in a situation with a very favorable market environment, historically impressive participation, and high optimism. The Smart Money / Dumb Money Confidence Spread is back below -50%, and we've gone over that in recent years, that's been a decent setup to weakness once prices started to wobble. Even the S&P falling below its 20-day average would be a decent sign that optimism is on the cusp of being unwound. The medium- to long-term implications of yet another round of breakouts and breadth thrusts, however, suggest that even a pullback from overly optimistic conditions should only be temporary.

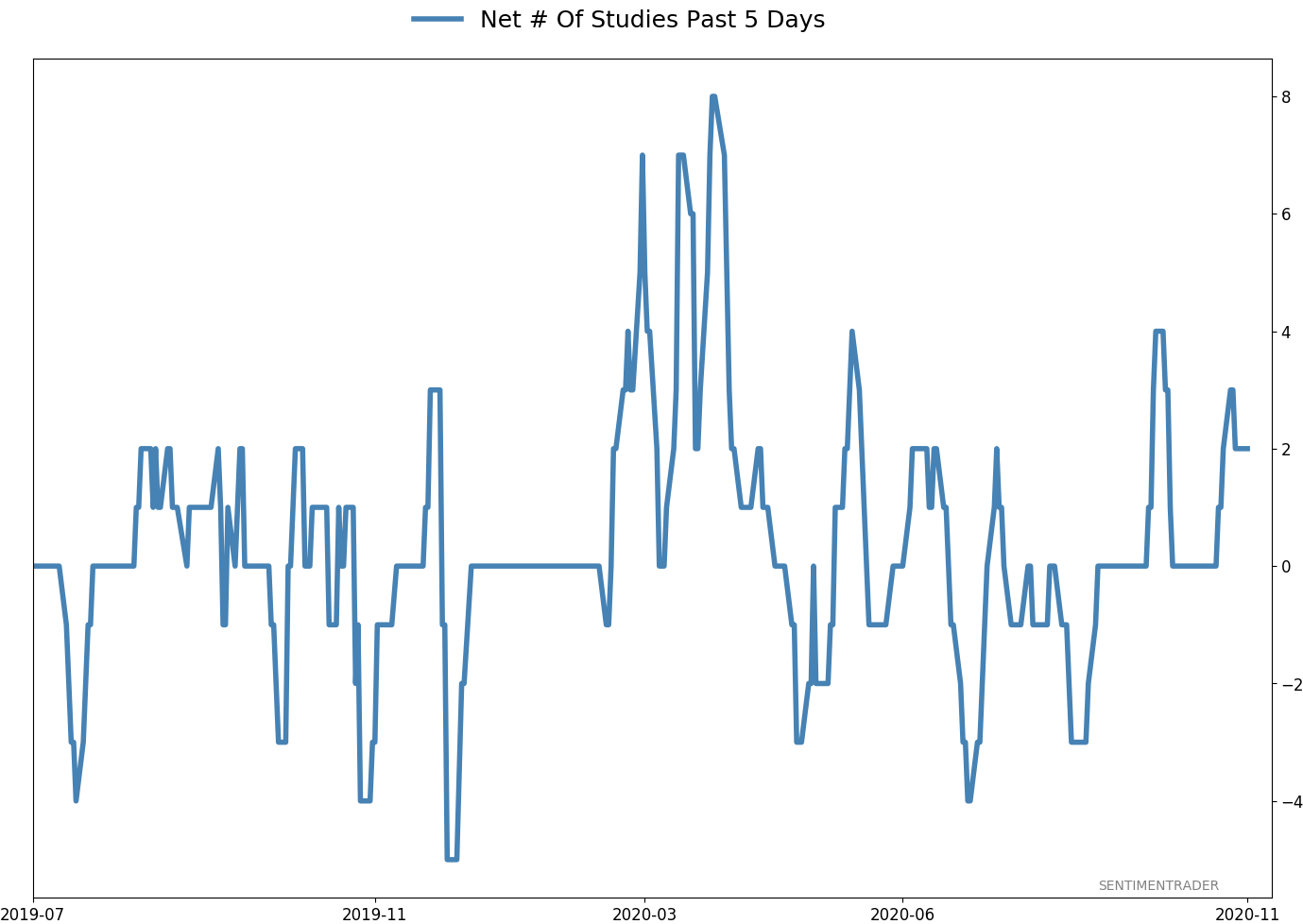

Active Studies

| Time Frame | Bullish | Bearish | | Short-Term | 0 | 0 | | Medium-Term | 5 | 8 | | Long-Term | 51 | 2 |

|

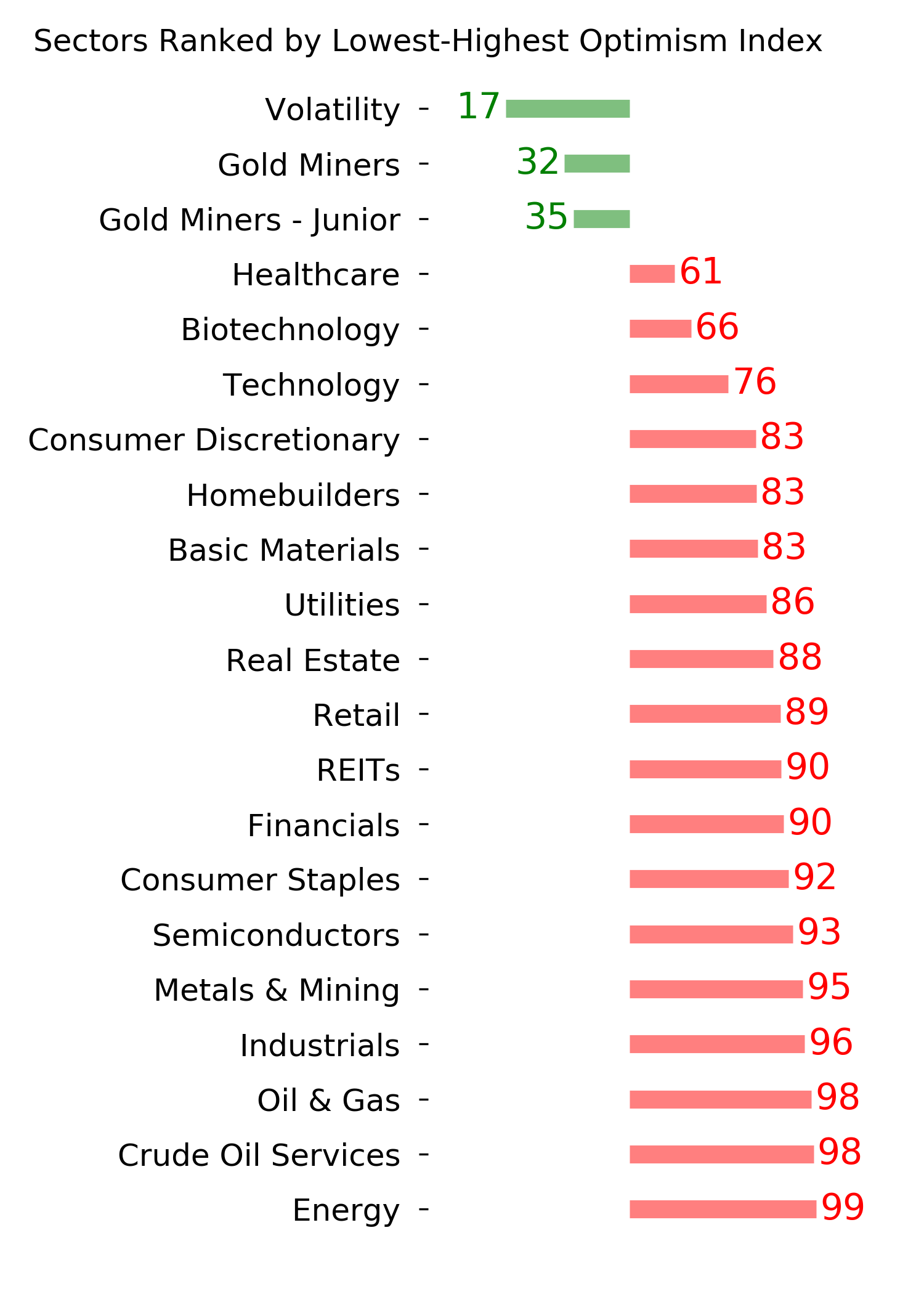

Indicators at Extremes

% Showing Pessimism: 2%

Bullish for Stocks

VIX

|

|

Portfolio

| Position | Description | Weight % | Added / Reduced | Date | | Stocks | 15.6% RSP, 10.1% VWO, 7.5% XLE, 5.1% PSCE | 38.2 | Added 5% | 2020-10-15 | | Bonds | 10% BND, 10% SCHP, 10% ANGL | 29.7 | Reduced 0.1% | 2020-10-02 | | Commodities | GCC | 2.4 | Reduced 2.1%

| 2020-09-04 | | Precious Metals | GDX | 4.7 | Added 5% | 2020-09-09 | | Special Situations | | 0.0 | Reduced 5% | 2020-10-02 | | Cash | | 25.0 | | |

|

Updates (Changes made today are underlined)

After the September swoon wrung some of the worst of the speculation out of stocks, there are some signs that it's returning, especially in the options market. It's helped to push Dumb Money Confidence above 70%. A big difference between now and August is that in August, there was a multitude of days with exceptionally odd breadth readings. Some of the biggest stocks were masking underlying weakness. Combined with heavy speculative activity, it was a dangerous setup. Now, we've seen very strong internal strength, in the broad market, as well as tech and small-cap stocks. Prior signals almost invariably led to higher prices. That's hard to square with the idea that forward returns tend to be subdued when Confidence is high, but that's less reliable during healthy market conditions, which we're seeing now (for the most part). I added some risk with small-cap energy stocks, due to an increasing number of positive signs in both small-caps and energy. This is intended as a long-term position.

RETURN YTD: 4.0% 2019: 12.6%, 2018: 0.6%, 2017: 3.8%, 2016: 17.1%, 2015: 9.2%, 2014: 14.5%, 2013: 2.2%, 2012: 10.8%, 2011: 16.5%, 2010: 15.3%, 2009: 23.9%, 2008: 16.2%, 2007: 7.8%

|

|

Phase Table

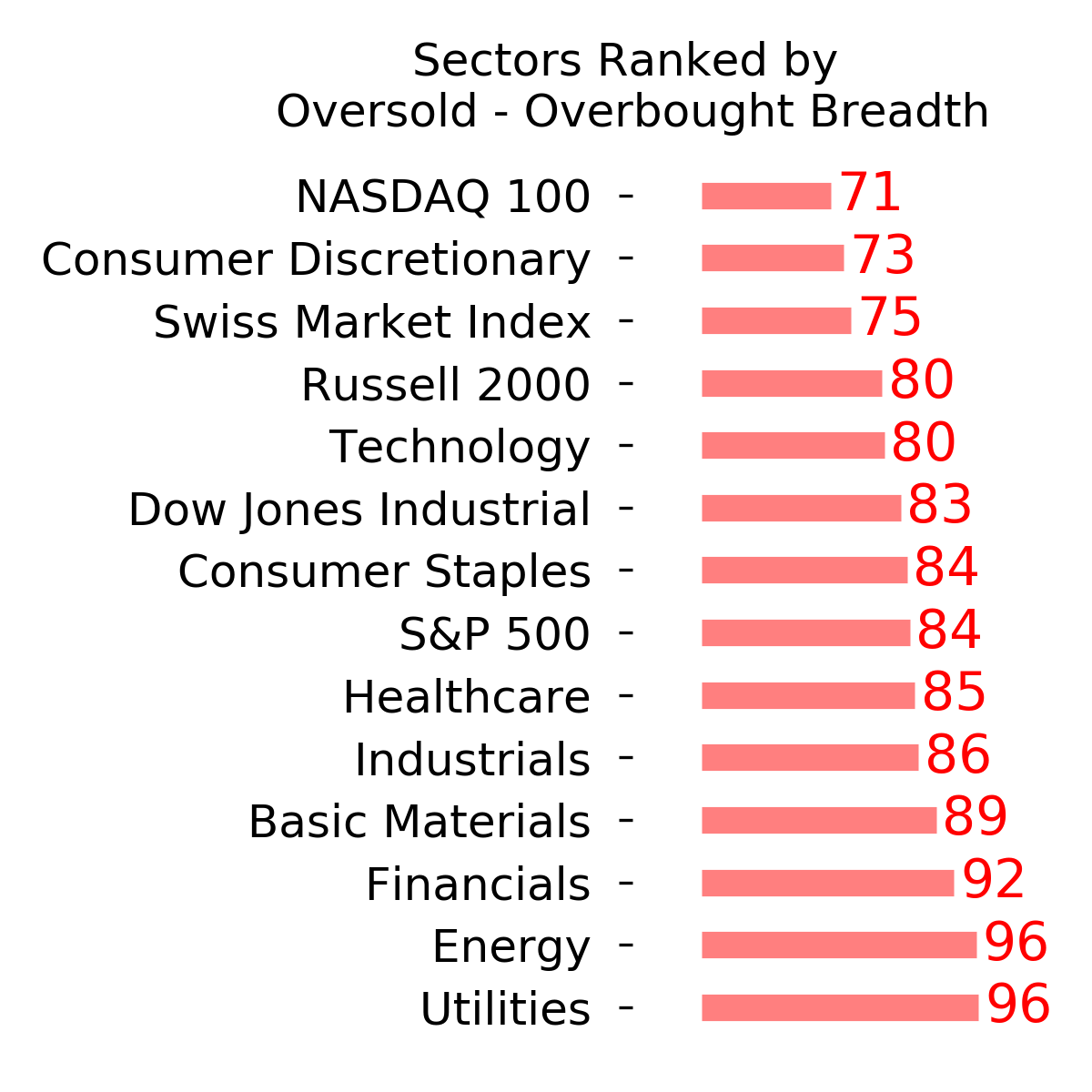

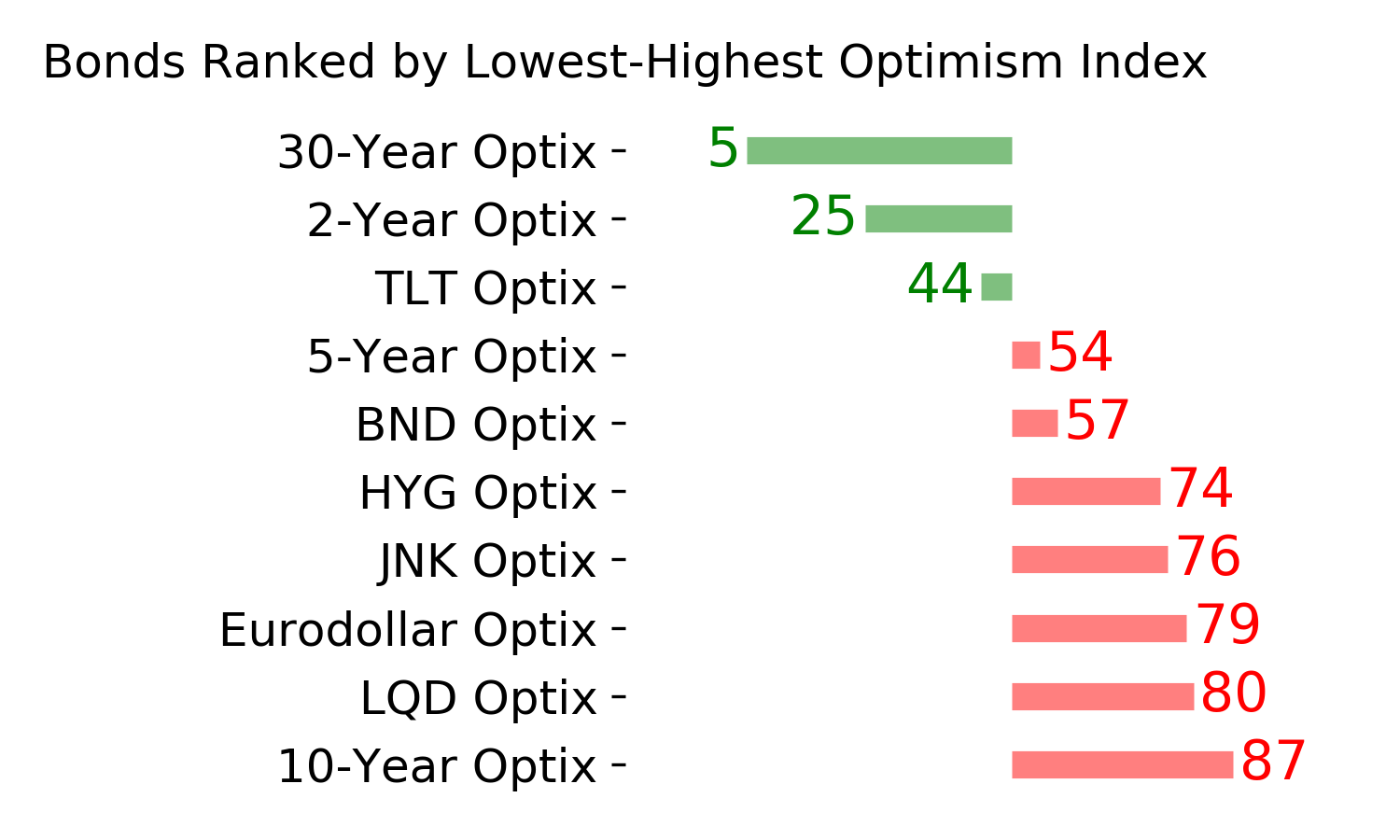

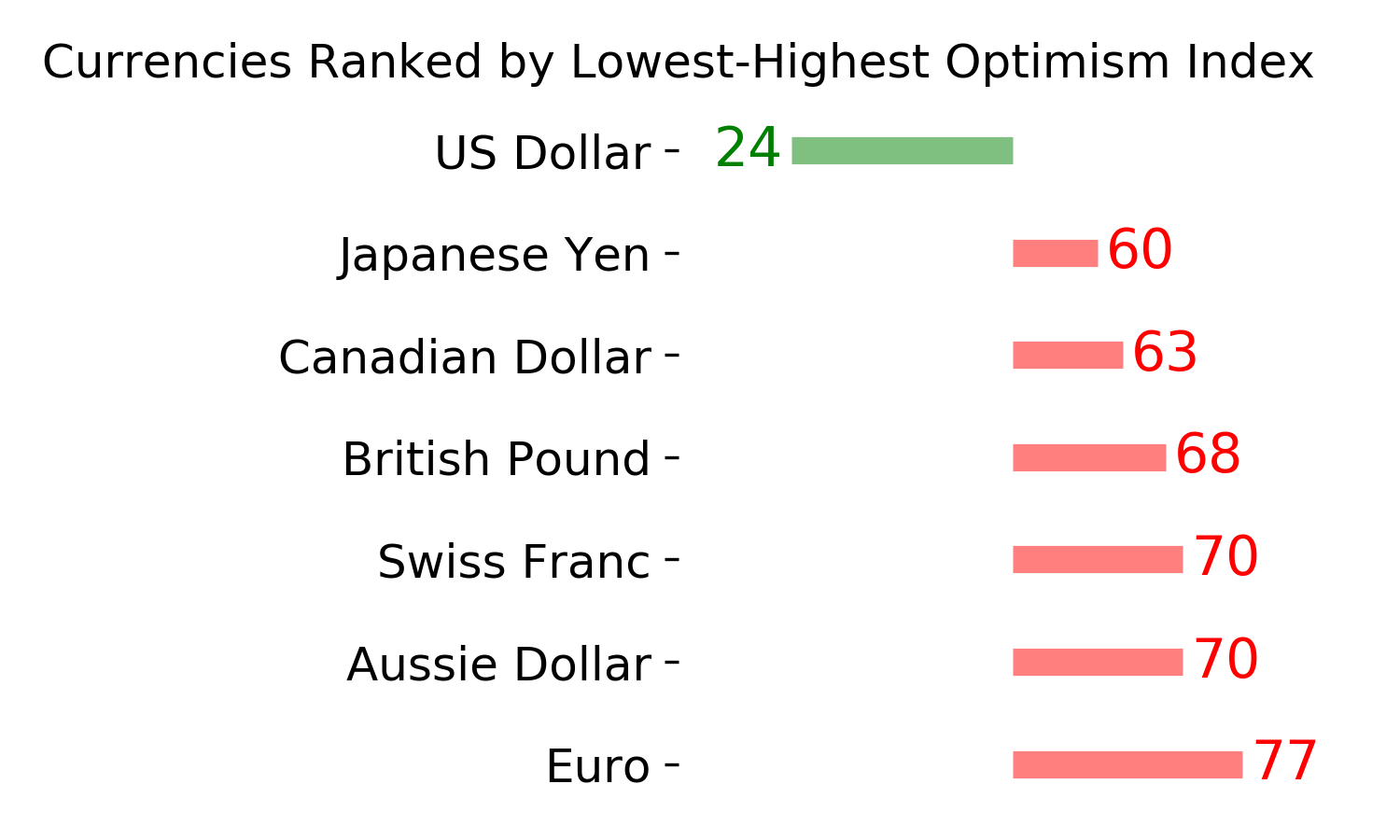

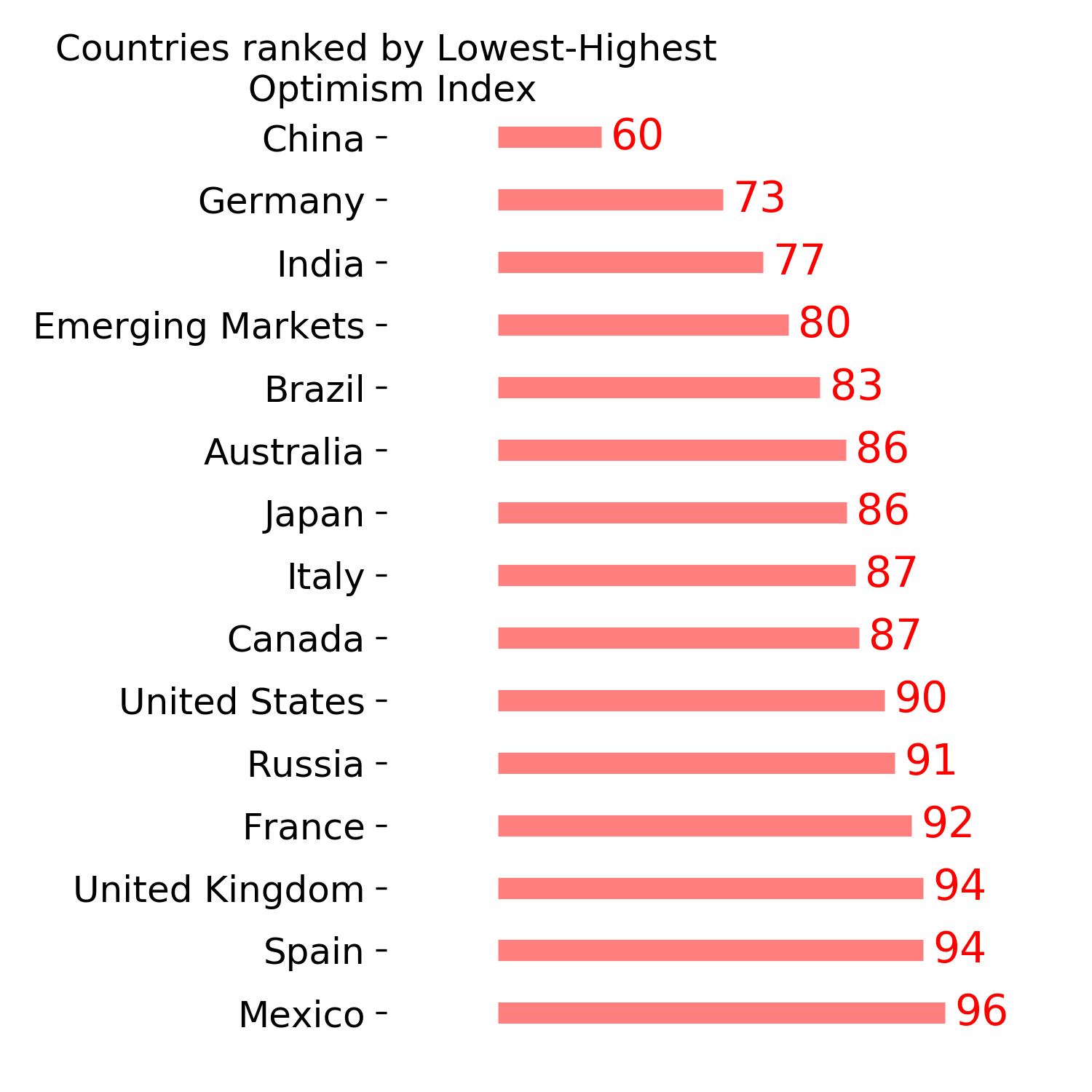

Ranks

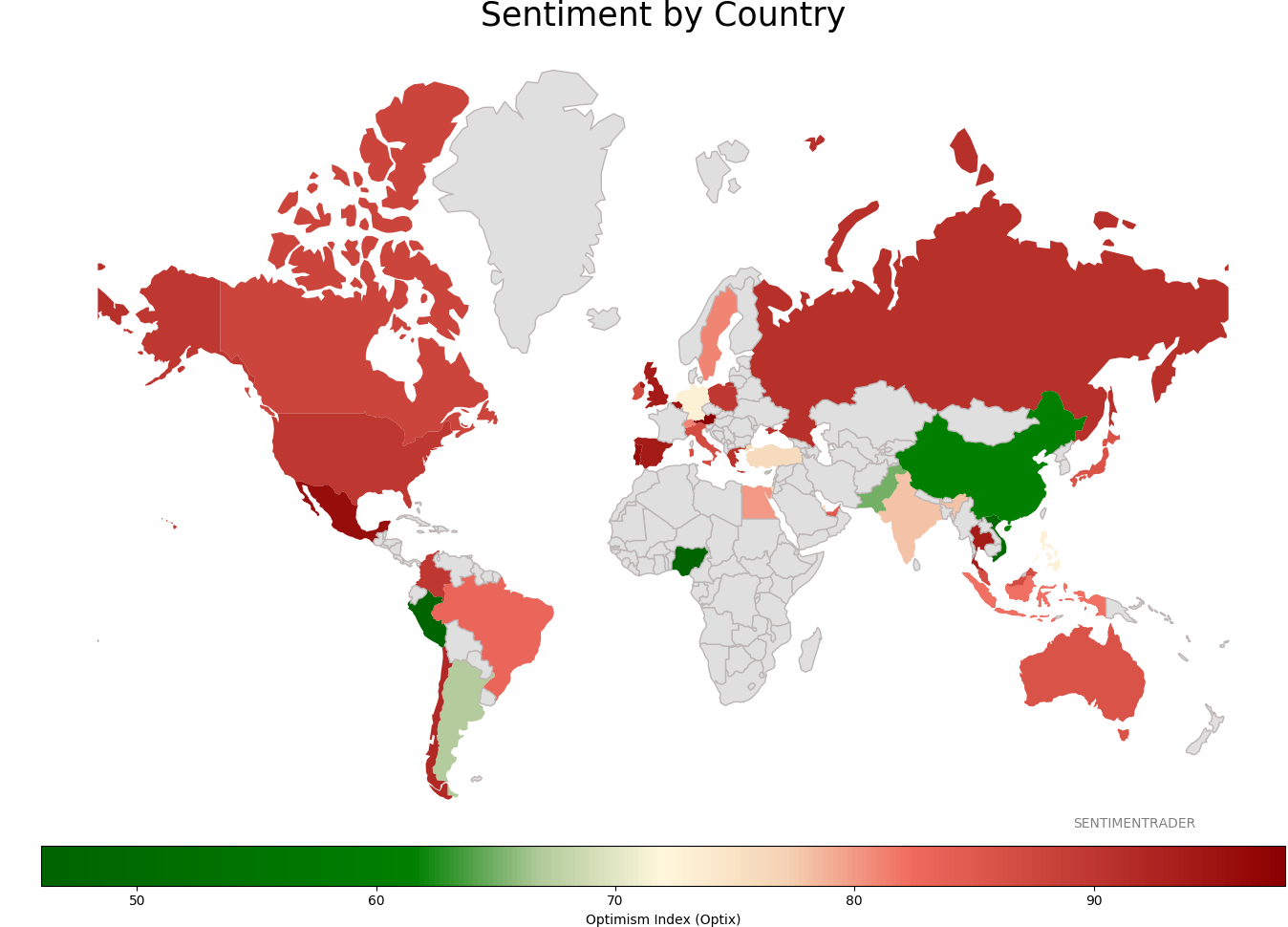

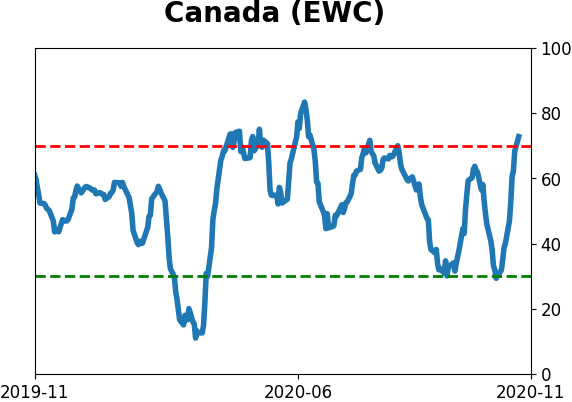

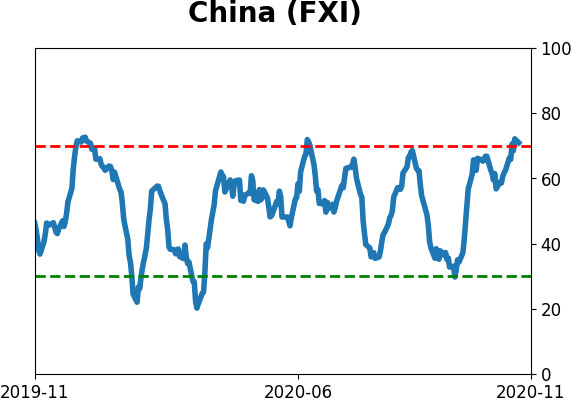

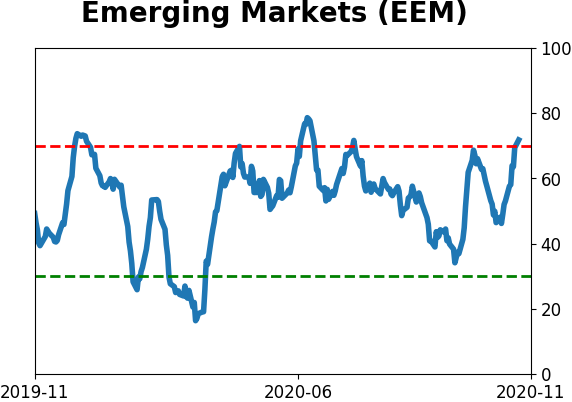

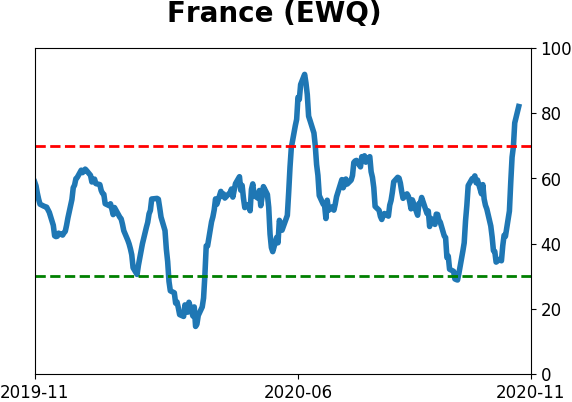

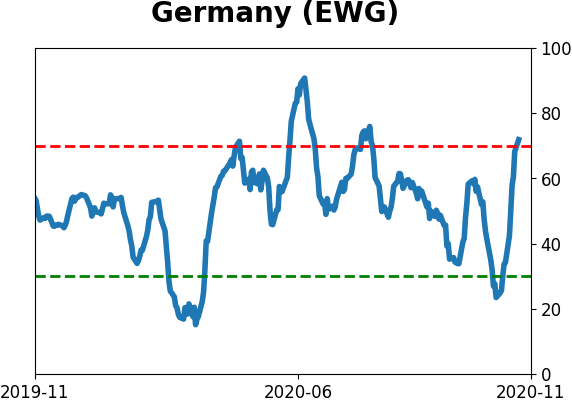

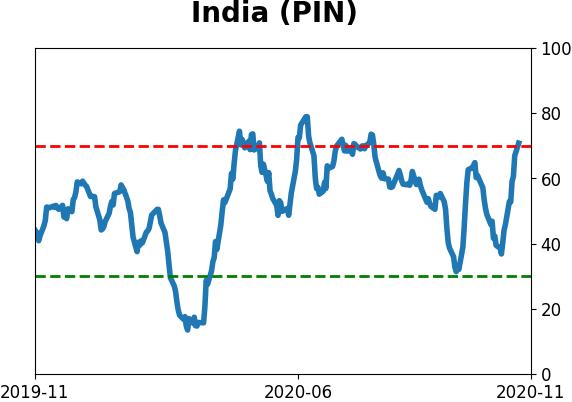

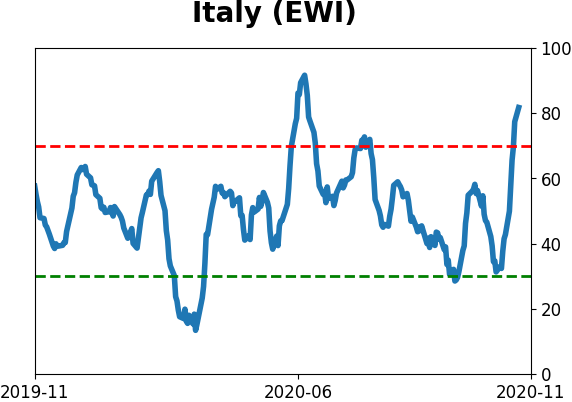

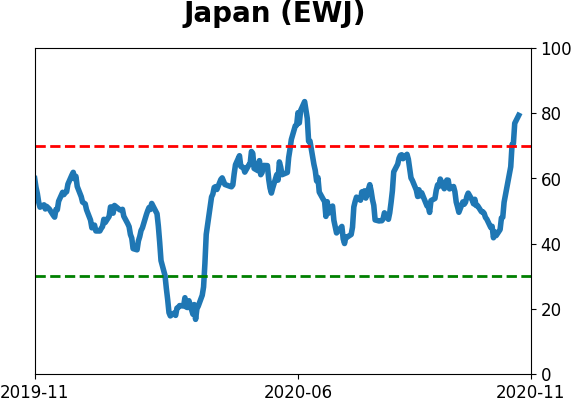

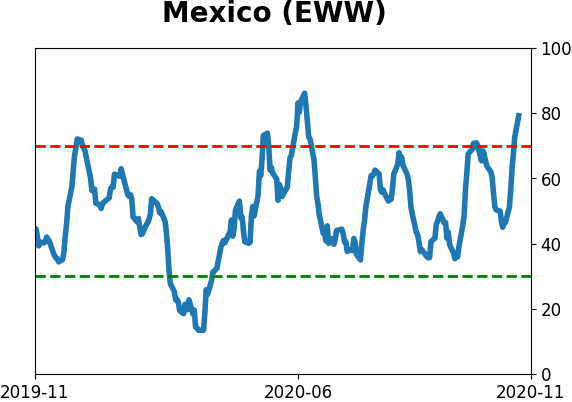

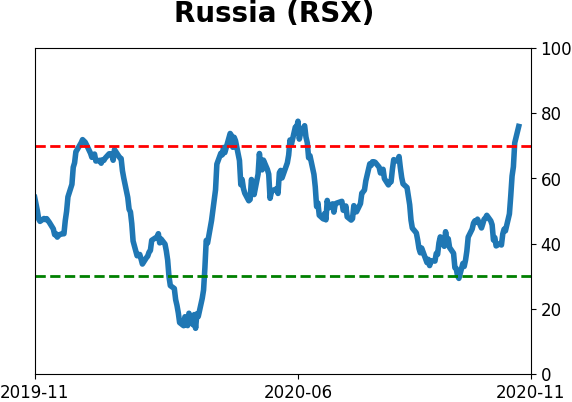

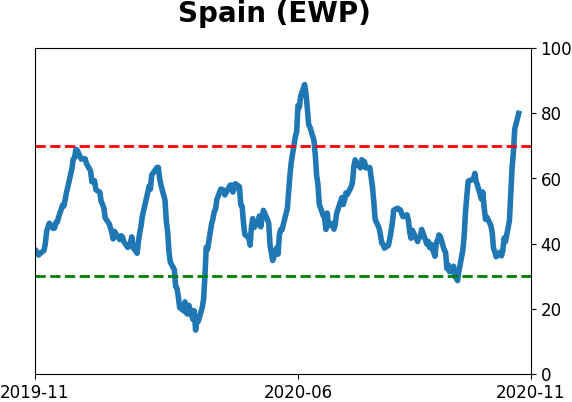

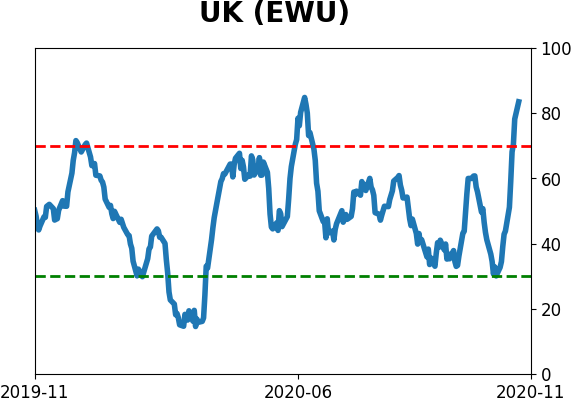

Sentiment Around The World

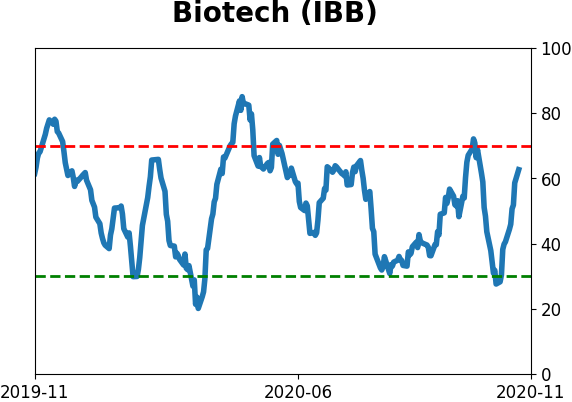

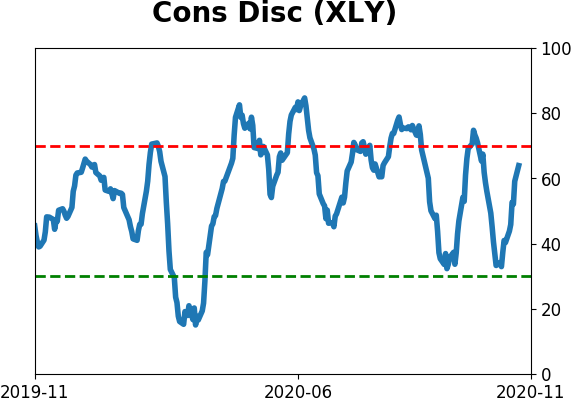

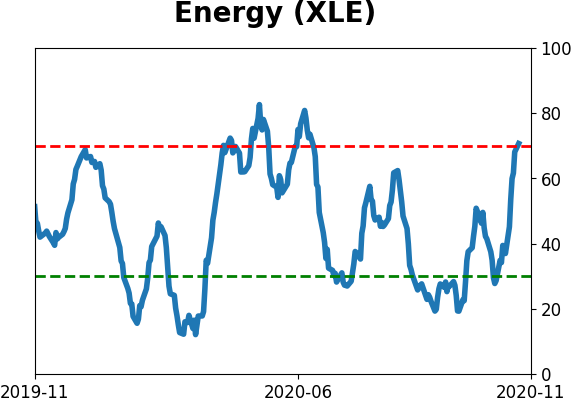

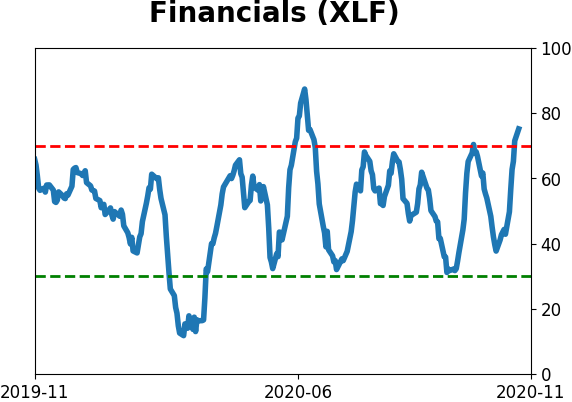

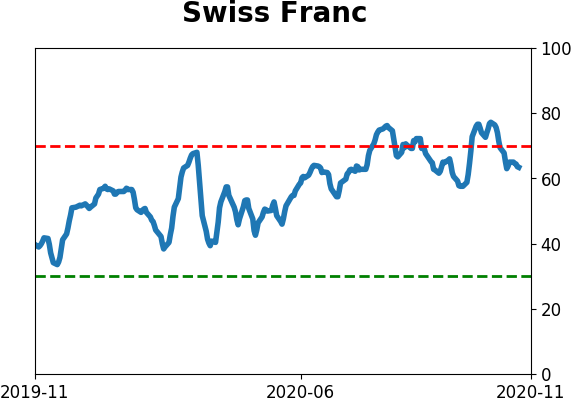

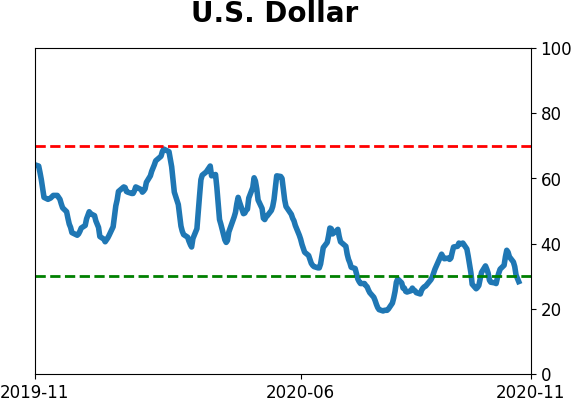

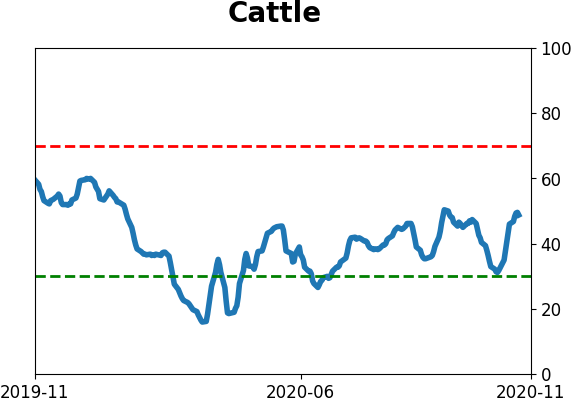

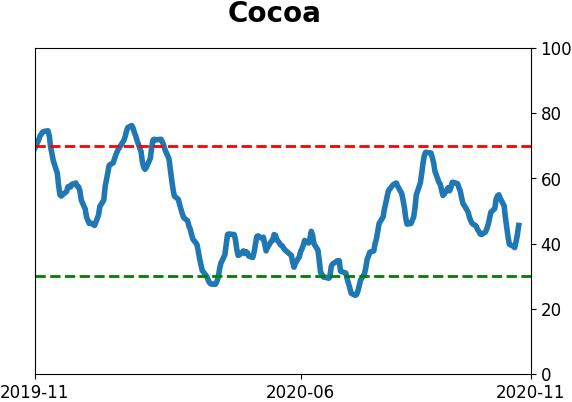

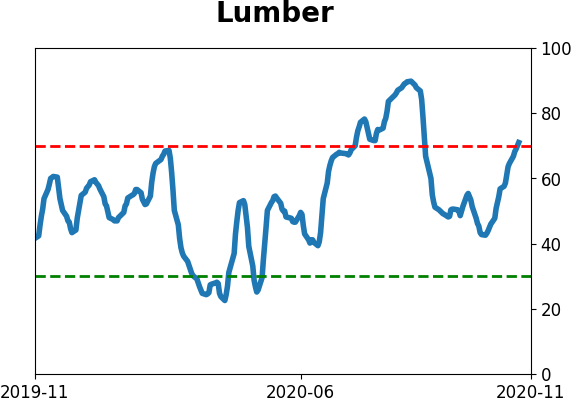

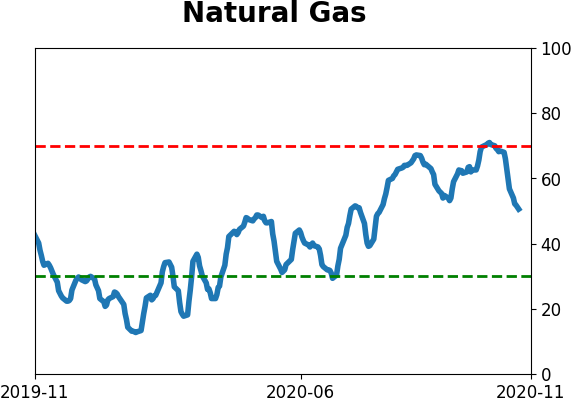

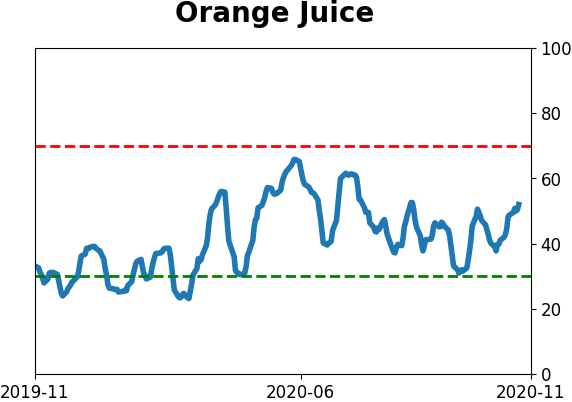

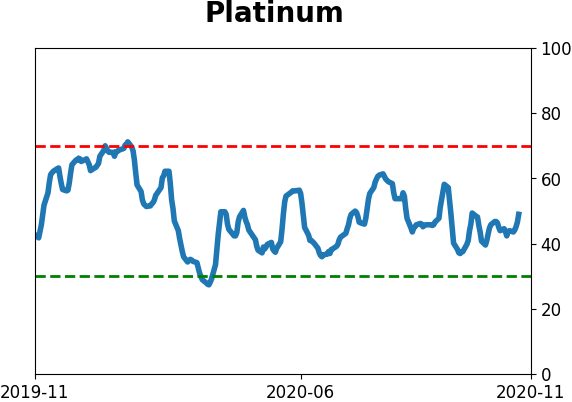

Optimism Index Thumbnails

|

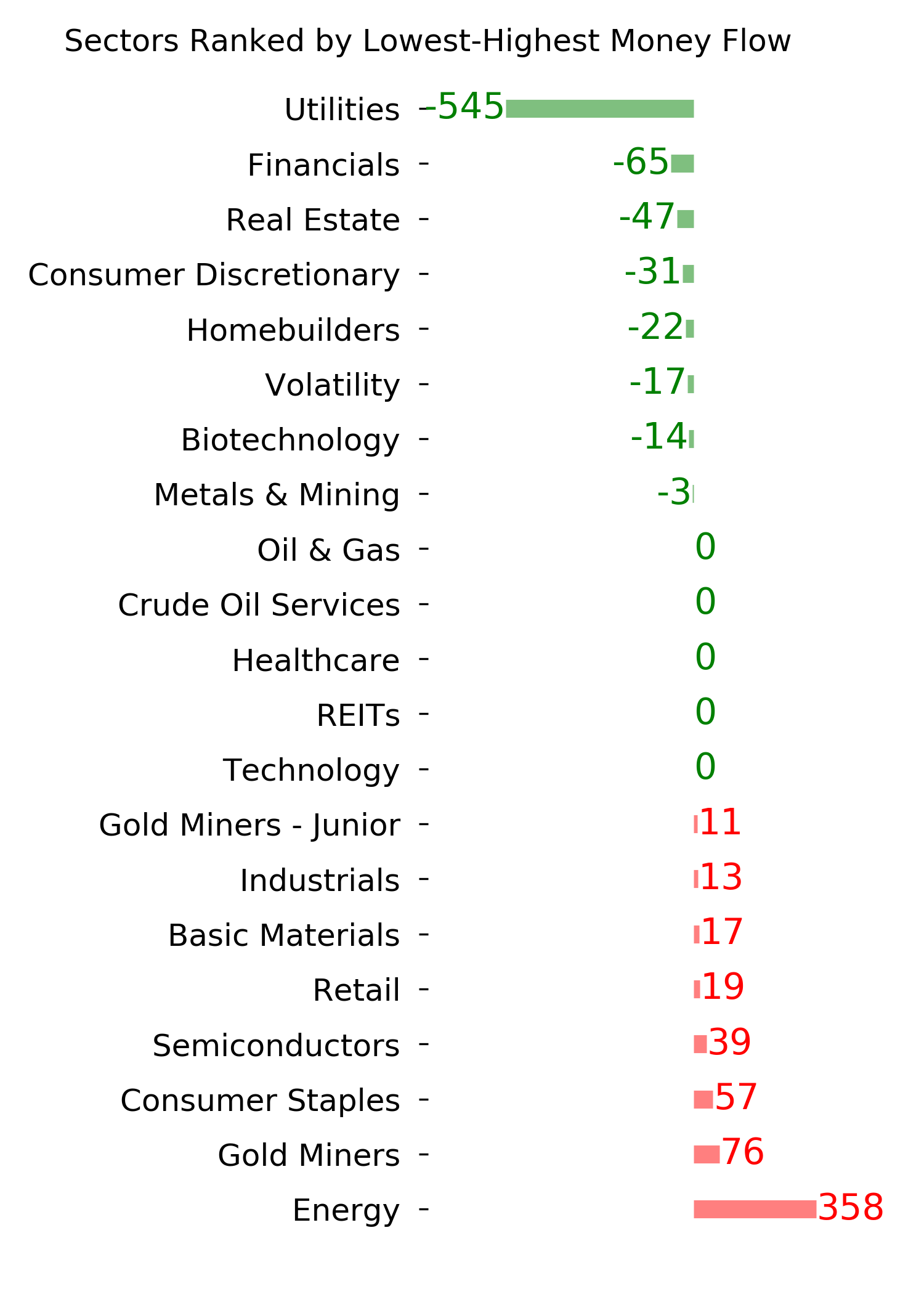

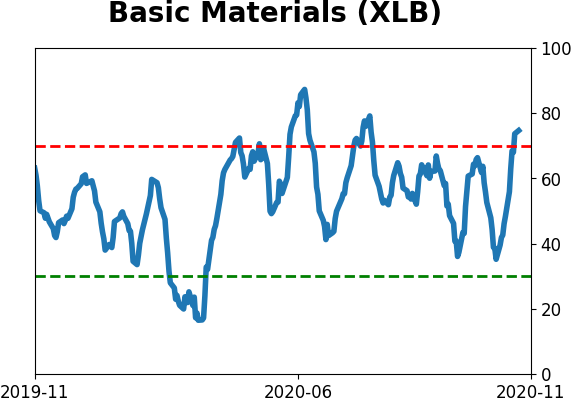

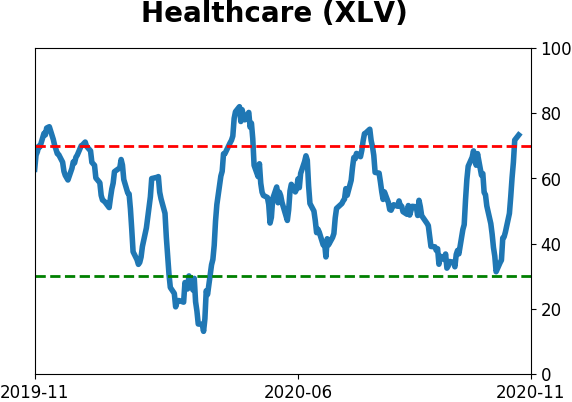

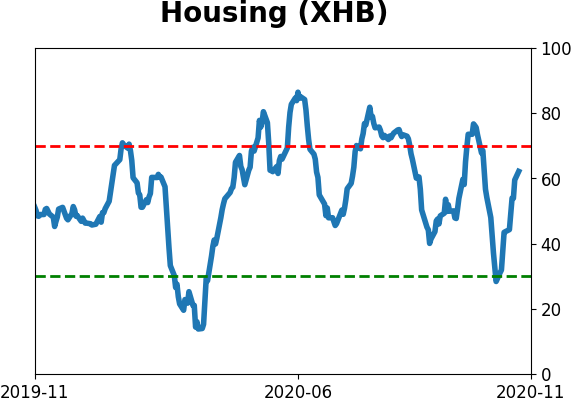

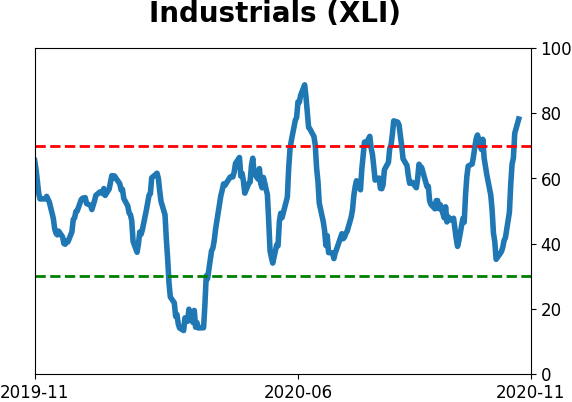

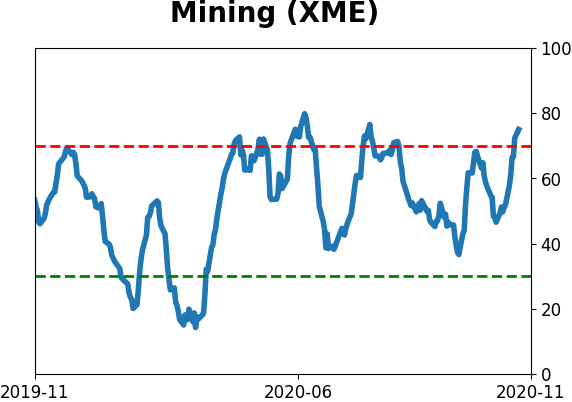

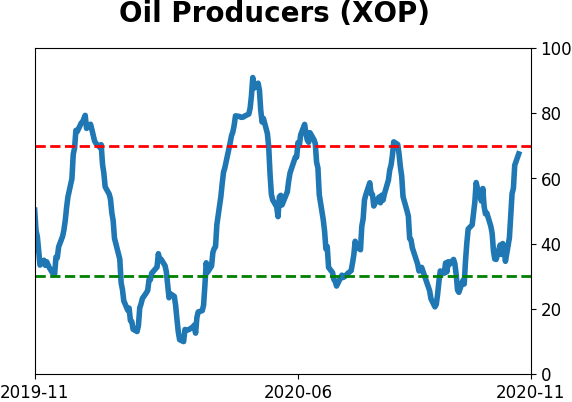

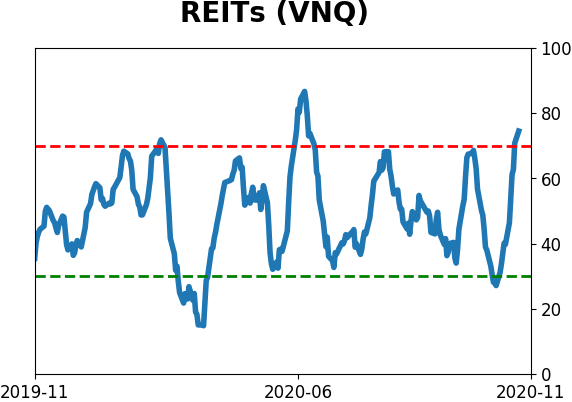

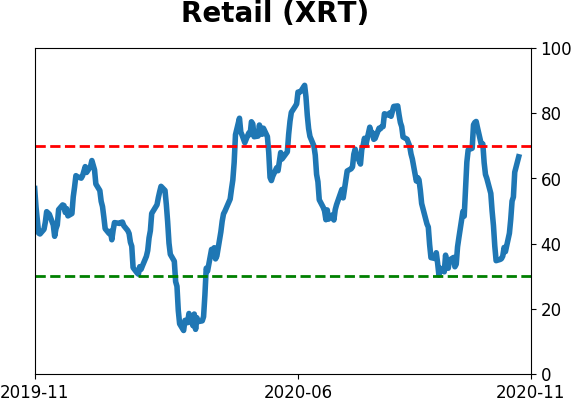

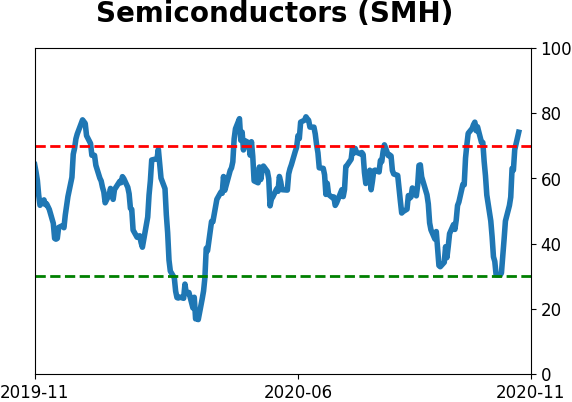

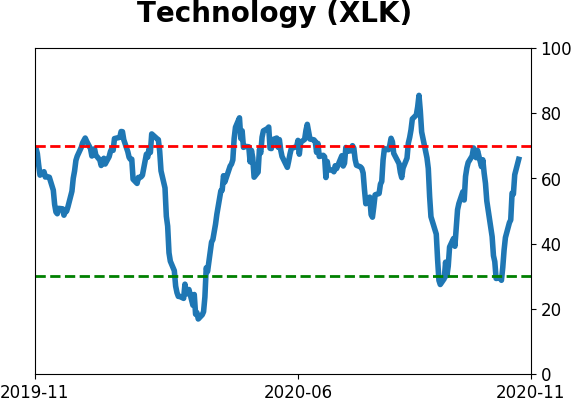

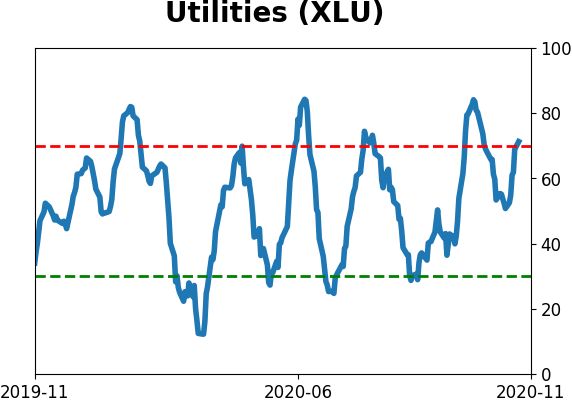

Sector ETF's - 10-Day Moving Average

|

|

|

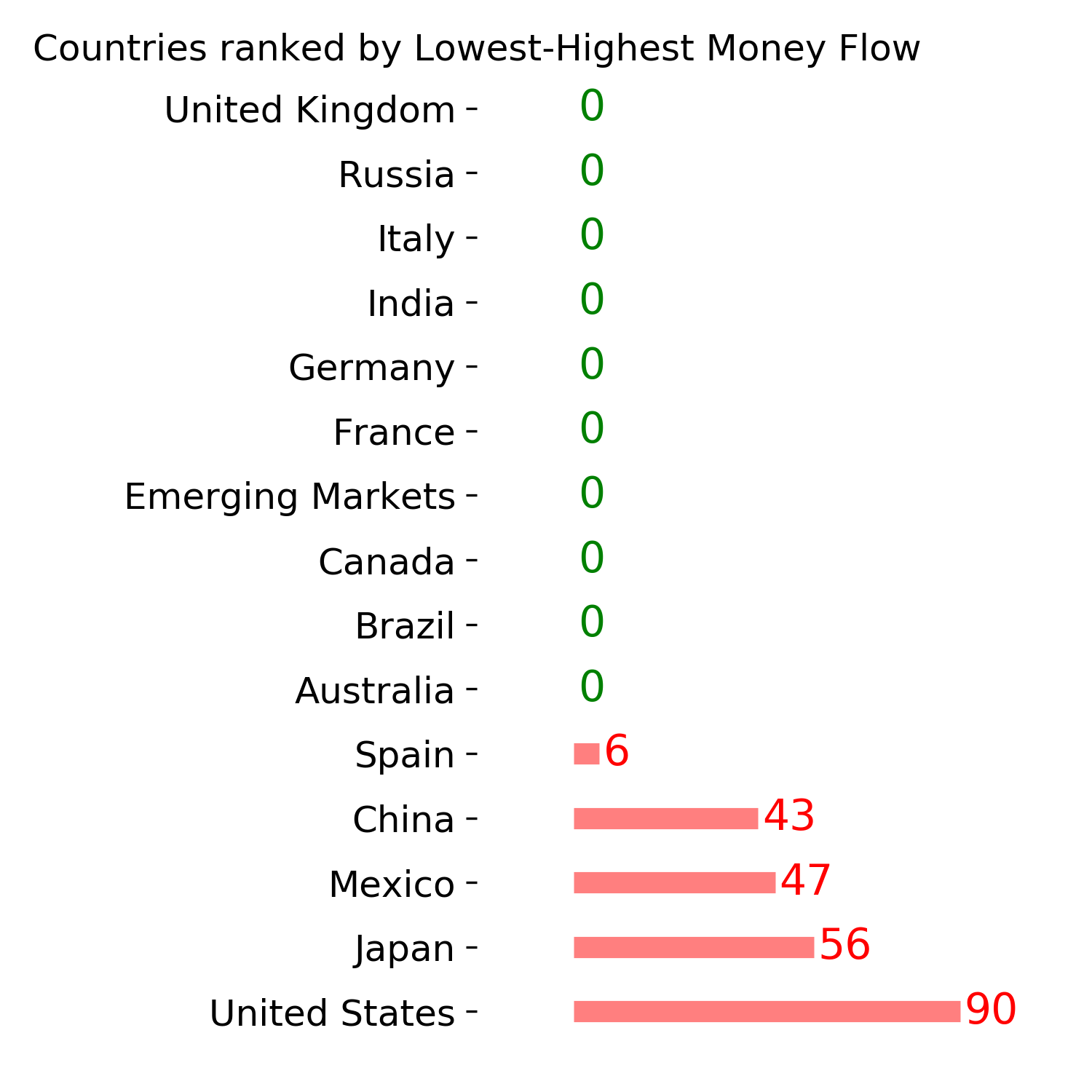

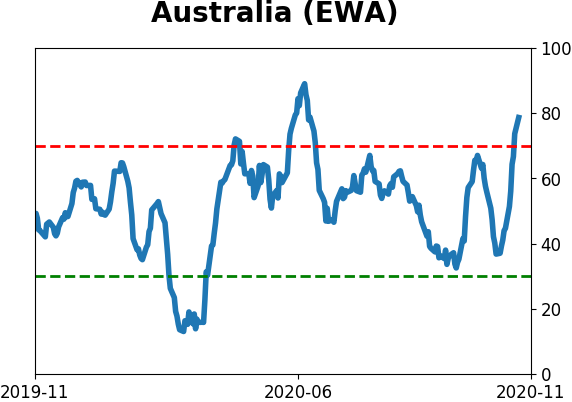

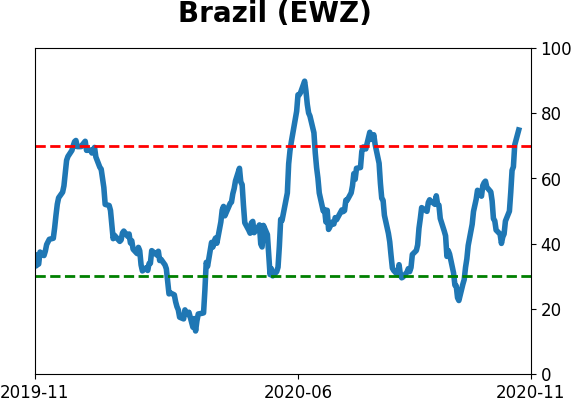

Country ETF's - 10-Day Moving Average

|

|

|

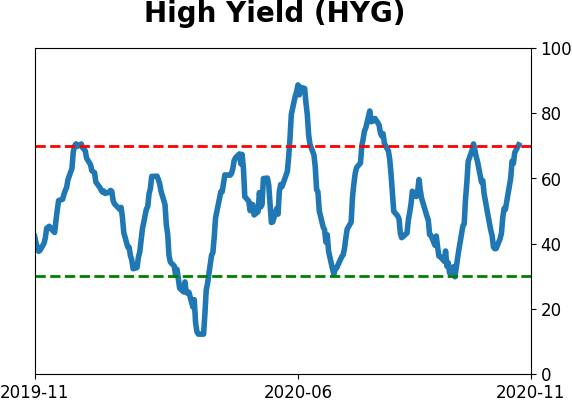

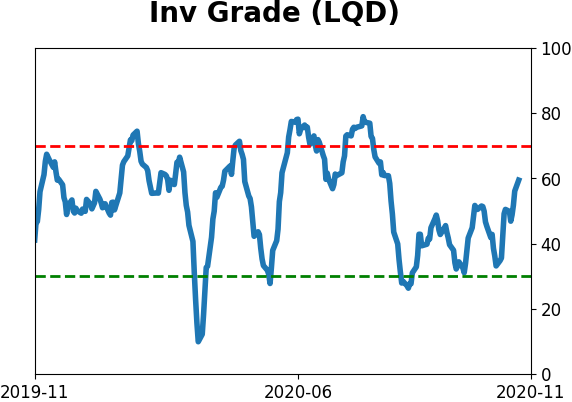

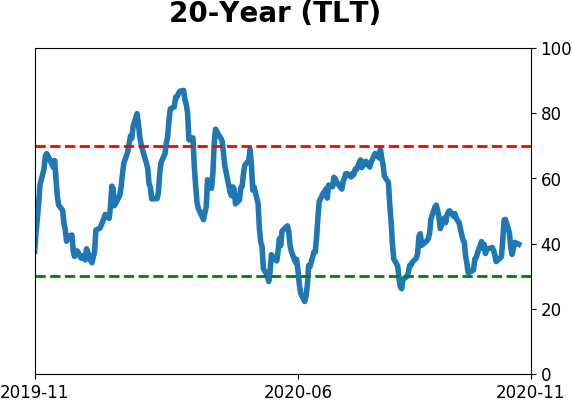

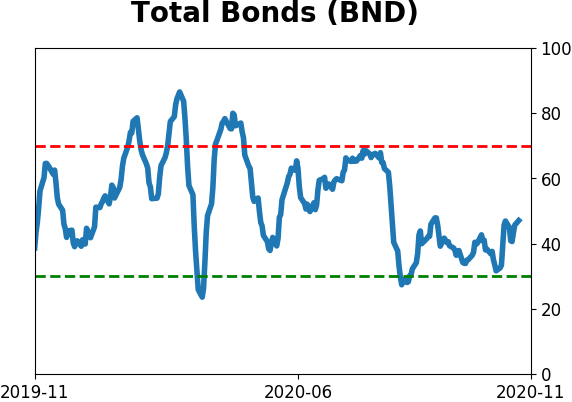

Bond ETF's - 10-Day Moving Average

|

|

|

Currency ETF's - 5-Day Moving Average

|

|

|

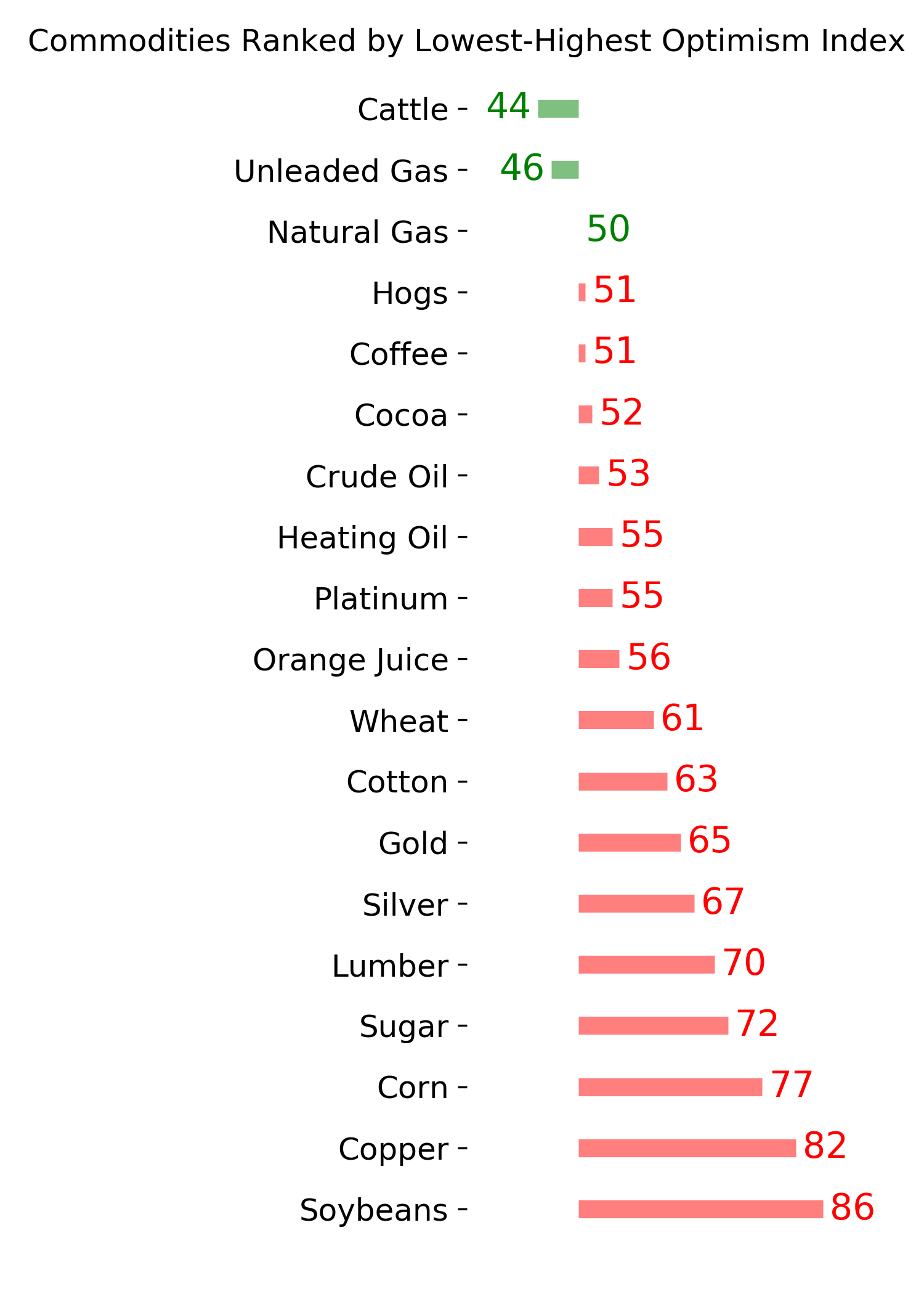

Commodity ETF's - 5-Day Moving Average

|

|