Headlines

|

|

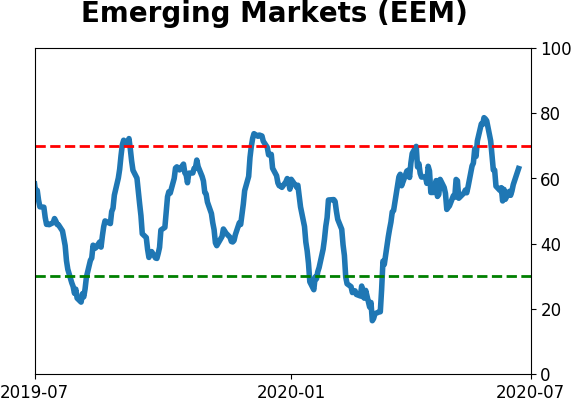

Emerging markets are showing signs of momentum:

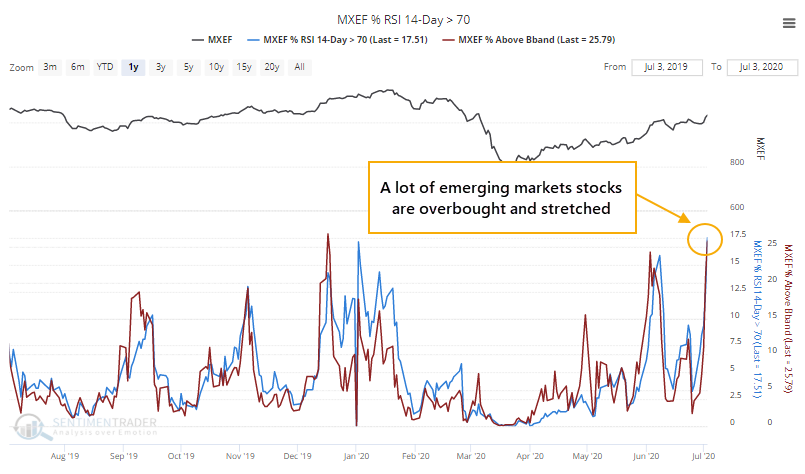

Emerging markets stocks have performed well lately, and indexes have broken away from their 200-day moving averages. Even so, less than 60% of stocks have managed to hold above their long-term averages, and there has been a jump in the number of them being overbought and spiking above their Bollinger Bands.

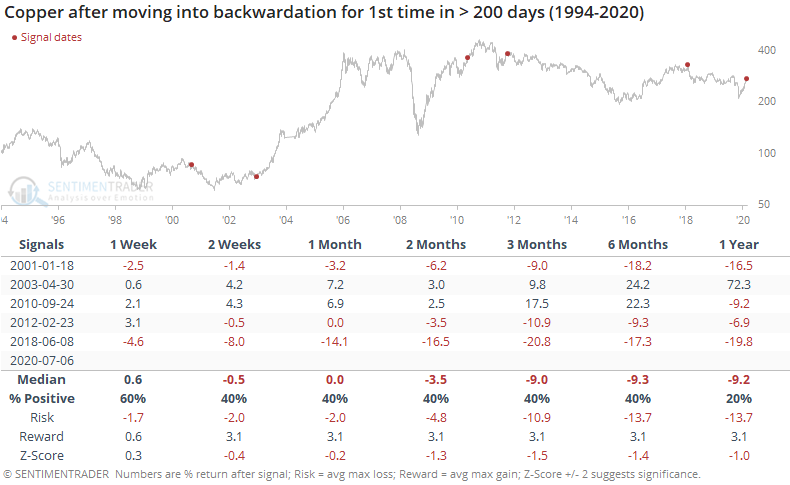

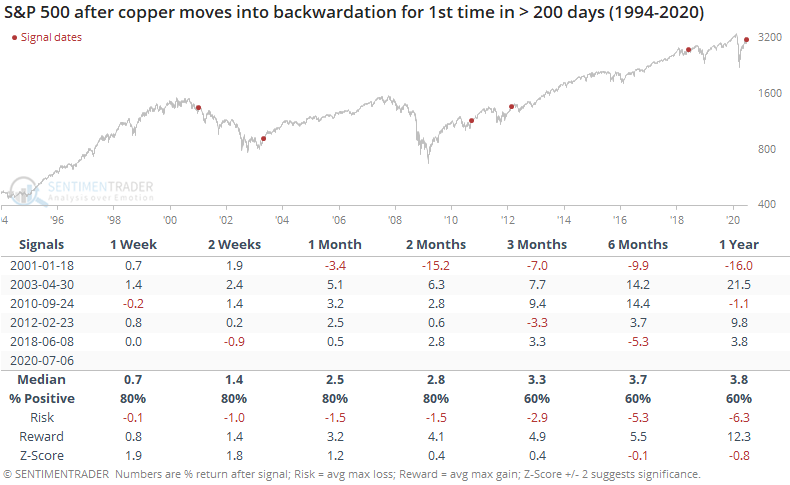

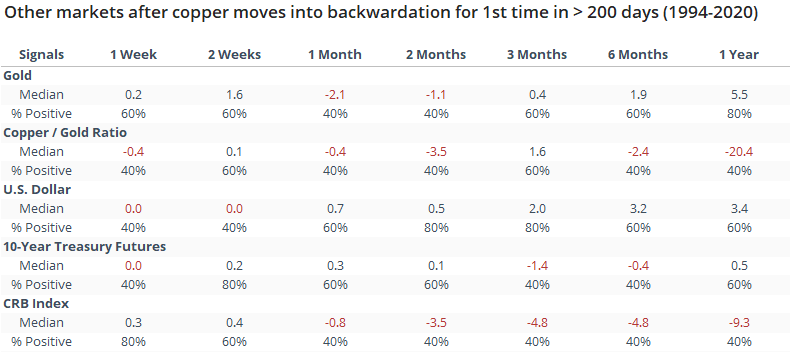

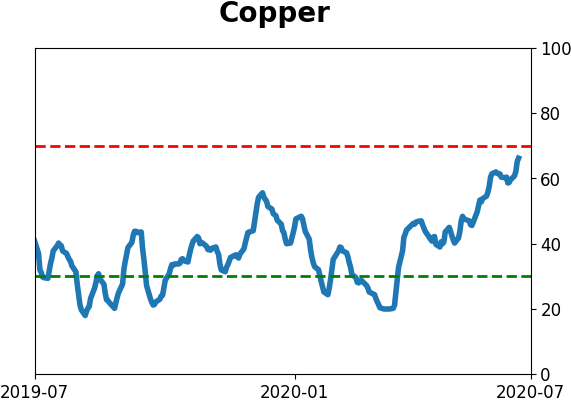

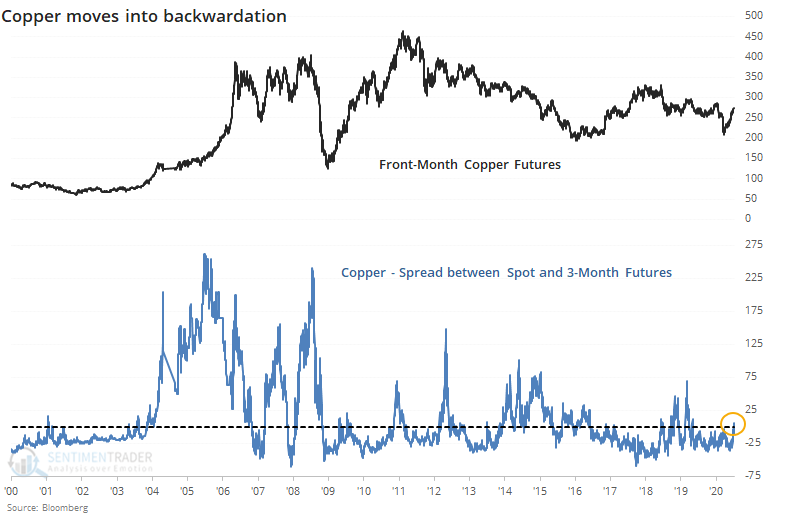

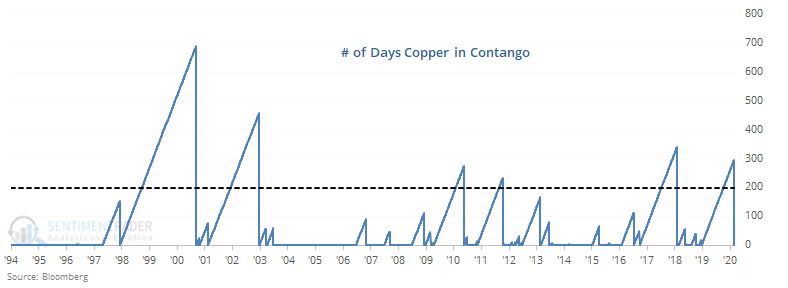

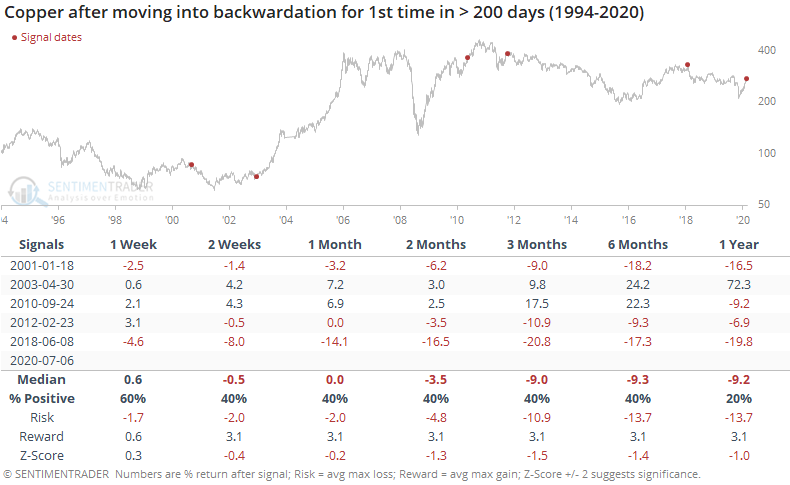

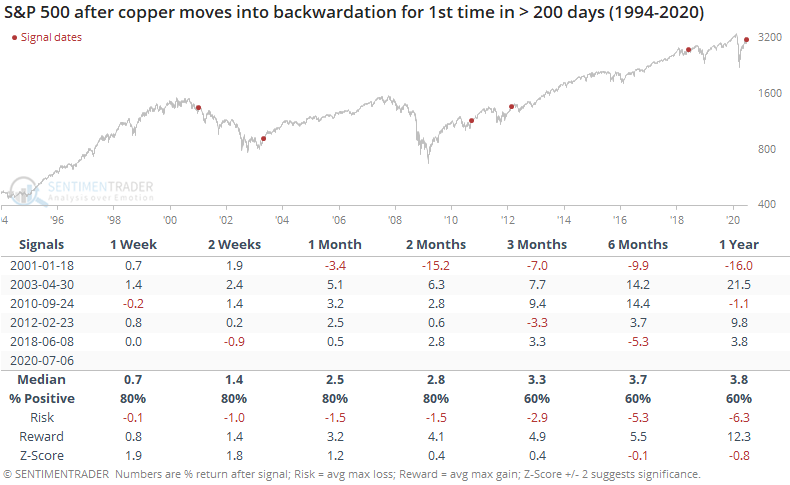

Copper curve flips into backwardation:

The spot price of copper has moved above the 3-month futures price, triggering backwardation. This is likely due to supply issues, but investors often believe it could also be due to a jump in economic demand. While it has not been a consistently good sign for copper itself, the stock market did have a tendency to rise after these episodes.

A record streak for SPY: Arguably the most important ETF in the world, SPY, enjoyed its fifth consecutive gain of at least 0.5%. That's tied for the longest streak of days with a 0.5% gain since its 1993 inception. There have been 7 other times it reached this long of a streak, and over the next month, only 2 of them managed to add to the gains. The dates were 1997-10-07, 1999-07-02, 1999-10-22, 2008-11-28, 2009-09-10, 2011-07-01, and 2011-09-16.

Bottom Line:

- Weight of the evidence has been suggesting flat/lower stock prices short- to medium-term, though that turned more neutral as stocks pulled back recently; still suggesting higher prices long-term

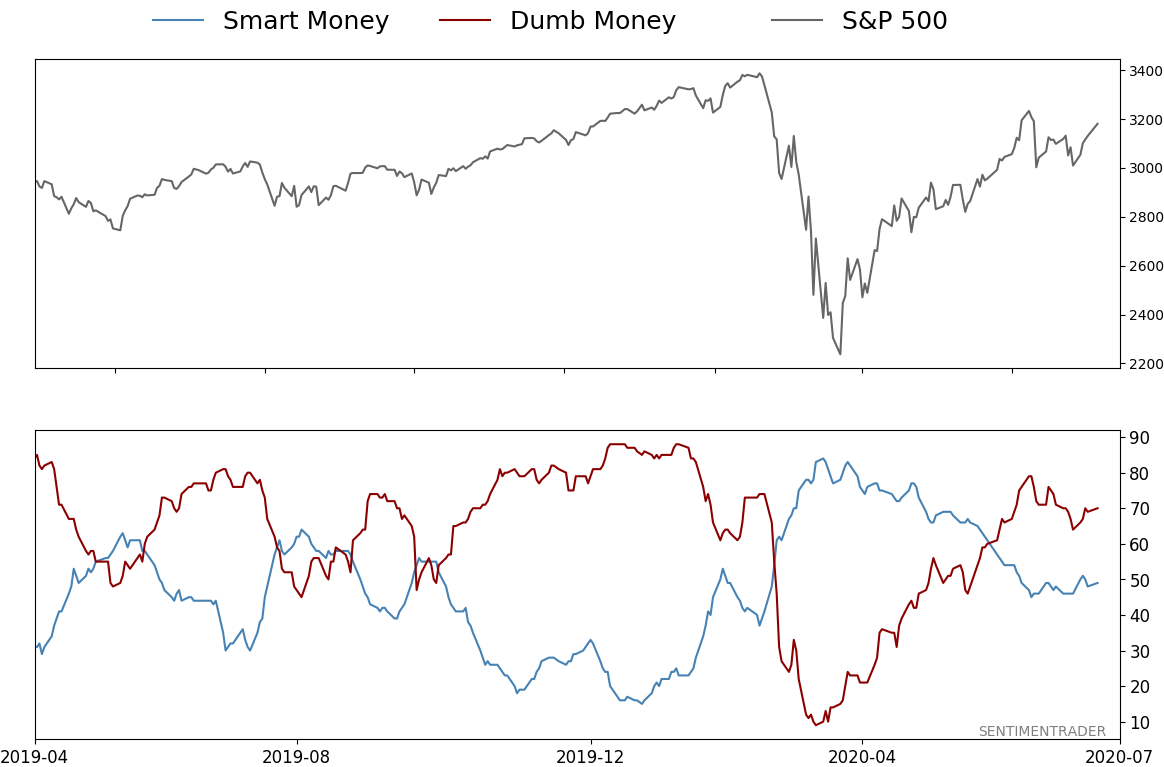

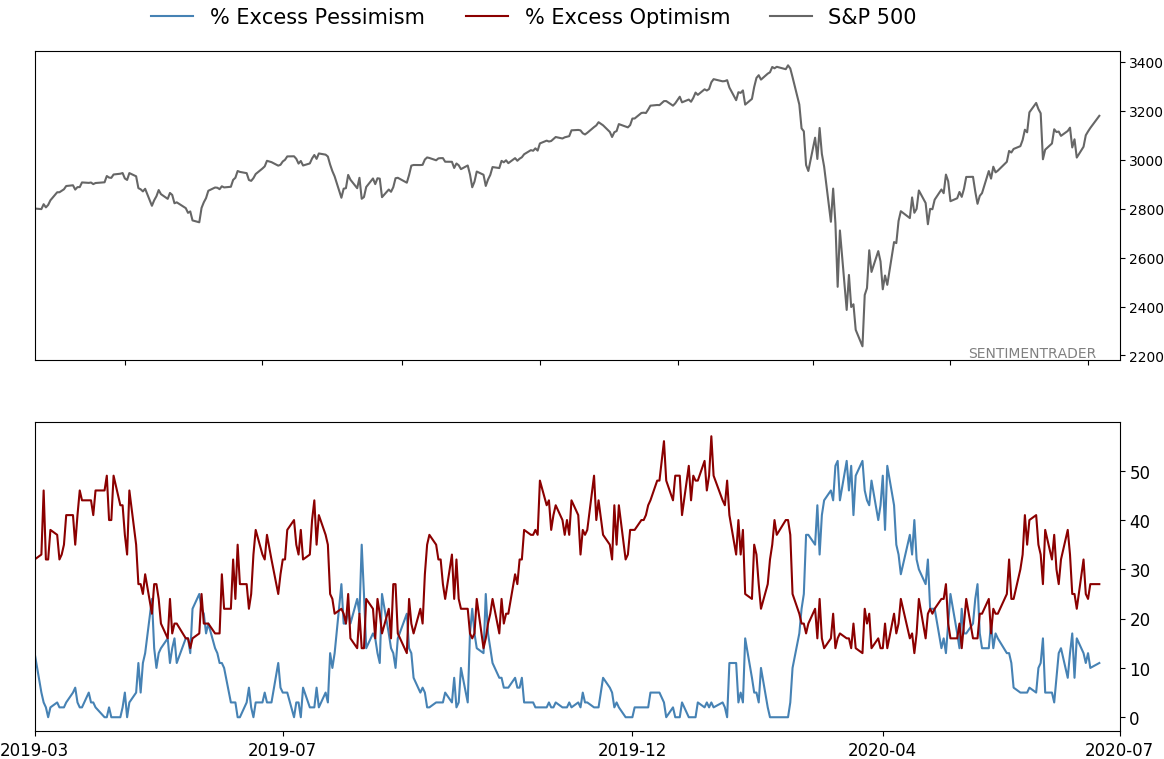

- Indicators showed high and declining optimism, as Dumb Money Confidence was recently near 80% with isolated signs of reckless speculation, during what appears to be an unhealthy market environment

- Active Studies show a heavy positive skew over the medium- to long-term; breadth thrusts and recoveries have an almost unblemished record at preceding higher prices over a 6-12 month time frame

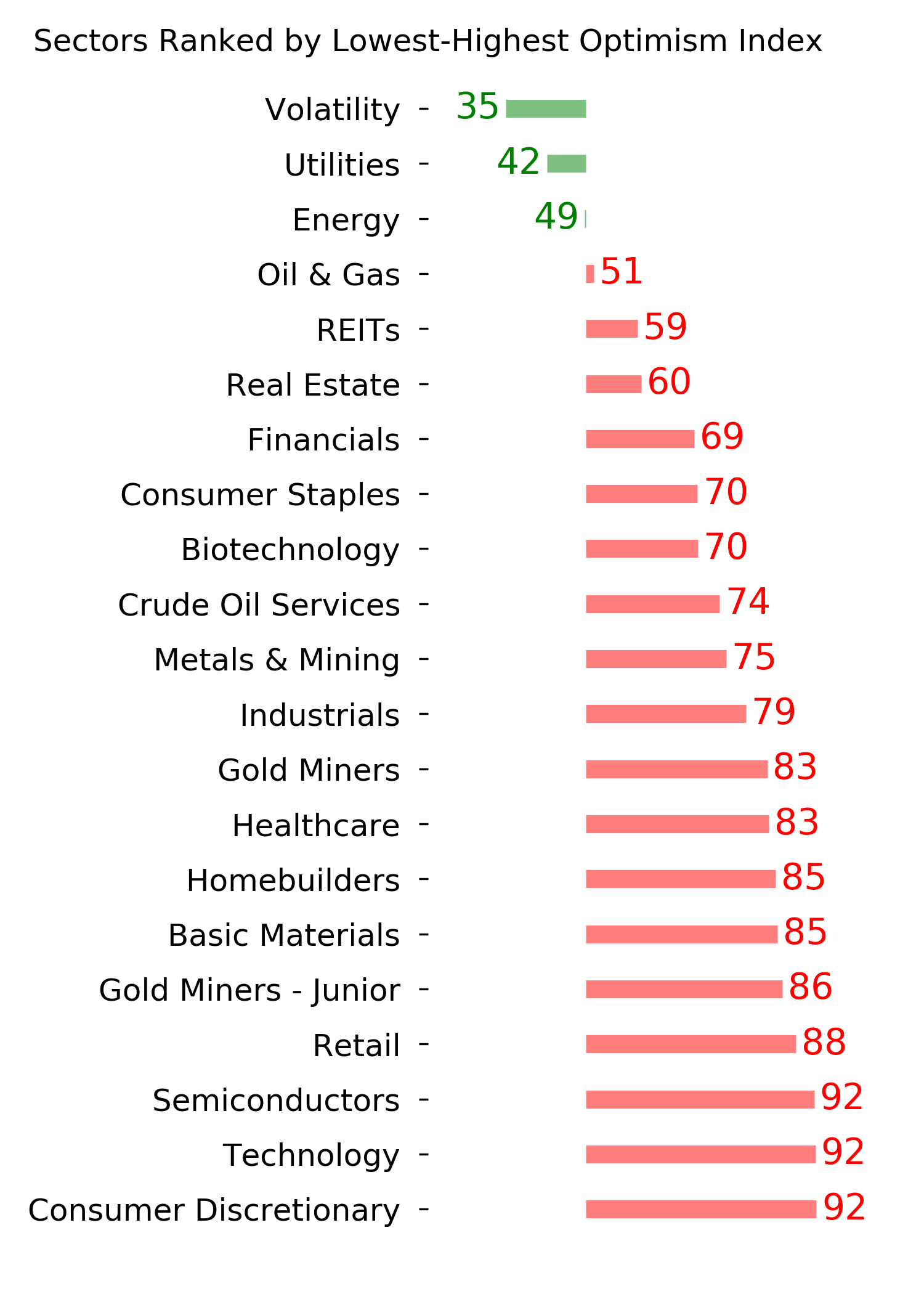

- Signs of extremely skewed preference for tech stocks nearing exhaustion, especially relative to industrials and financials (here and here)

- Indicators and studies for other markets are mixed with no strong conclusion

|

Smart / Dumb Money Confidence

|

Smart Money Confidence: 49%

Dumb Money Confidence: 70%

|

|

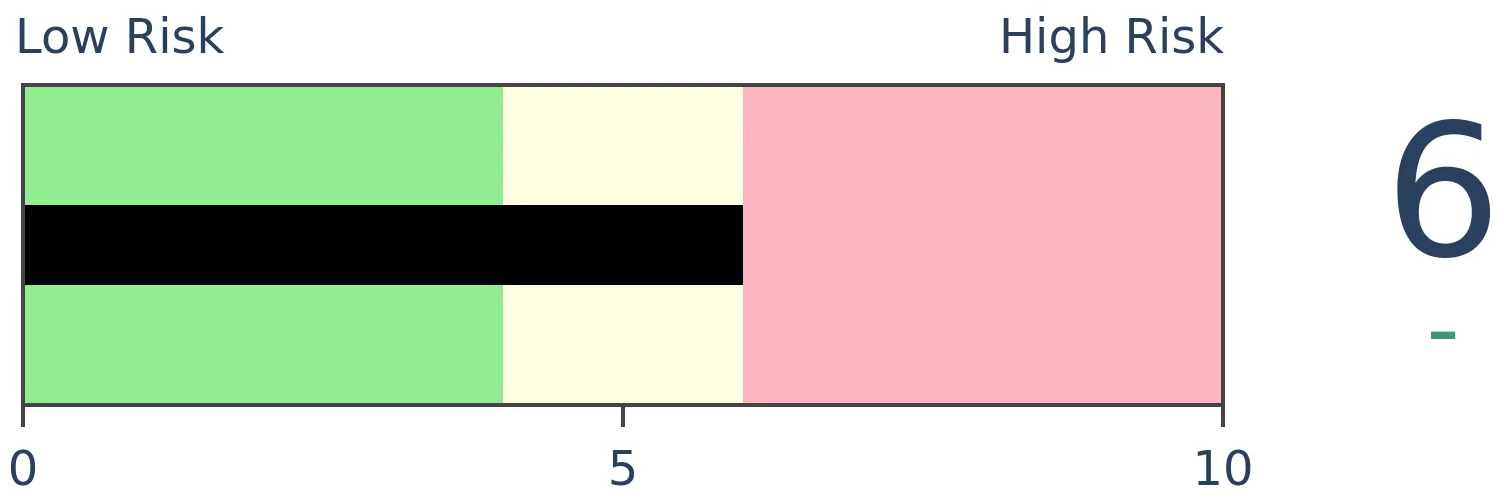

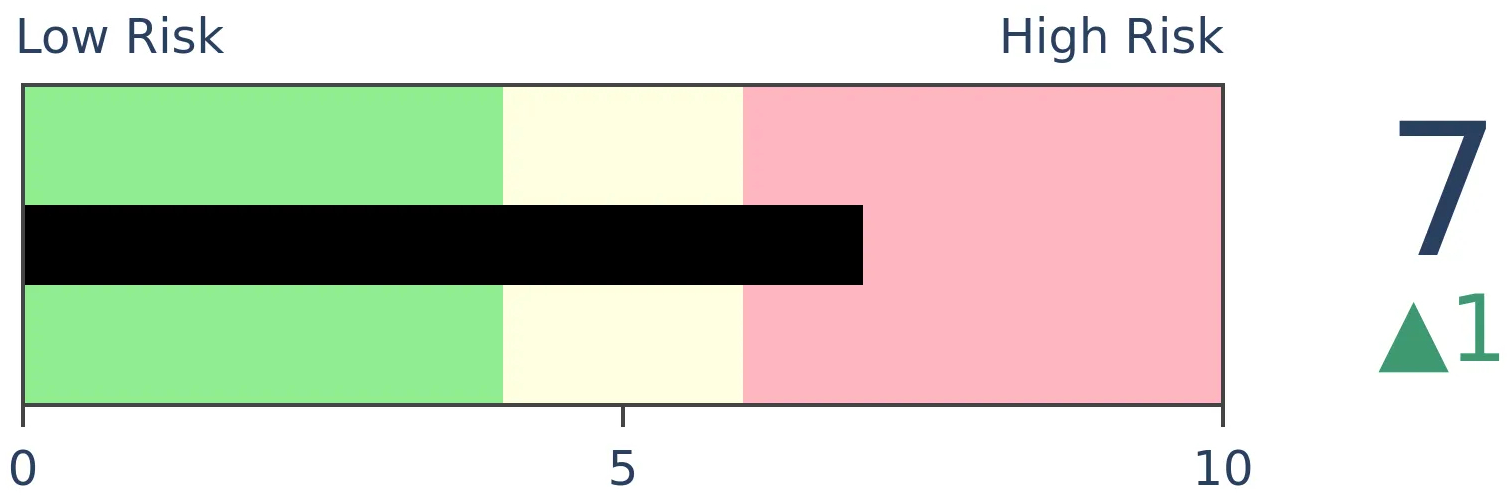

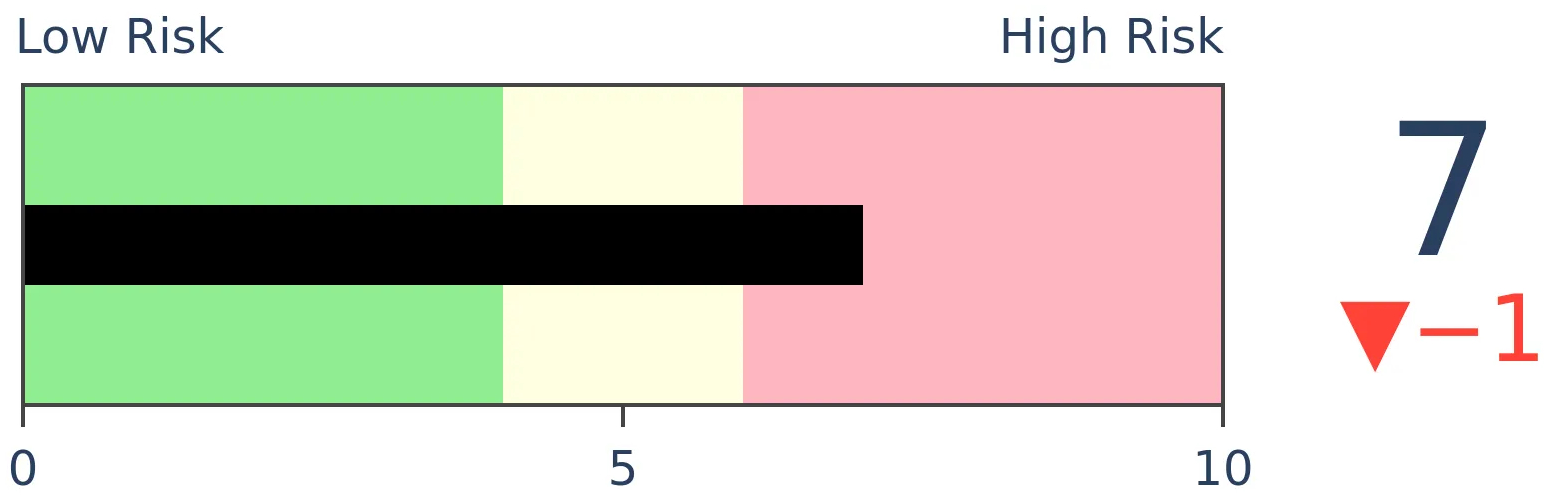

Risk Levels

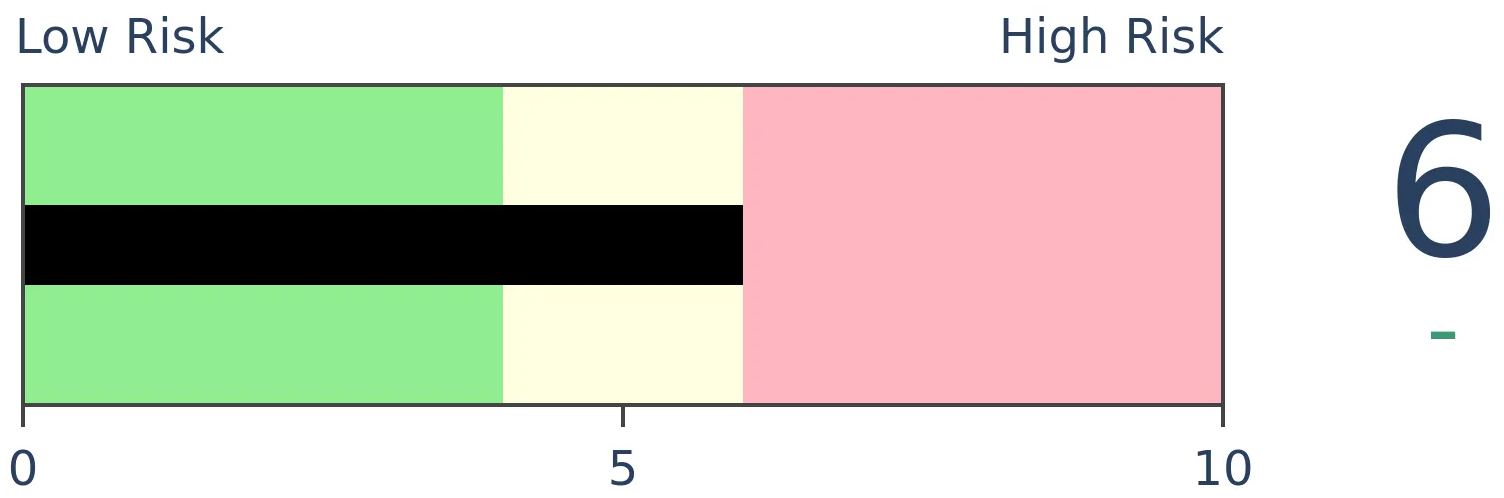

Stocks Short-Term

|

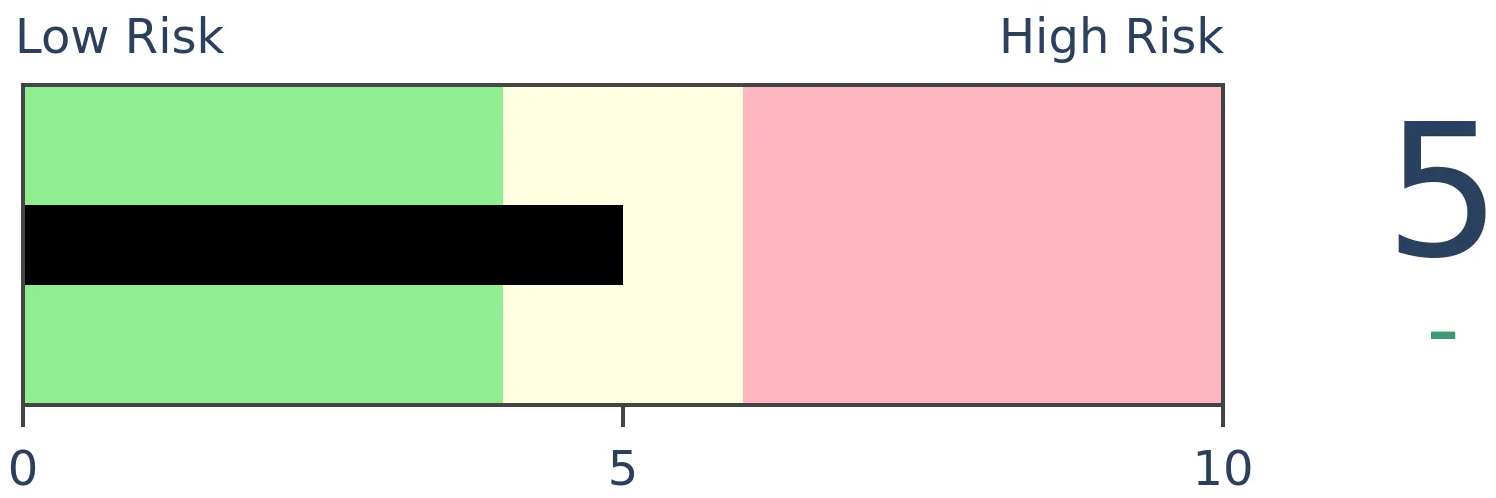

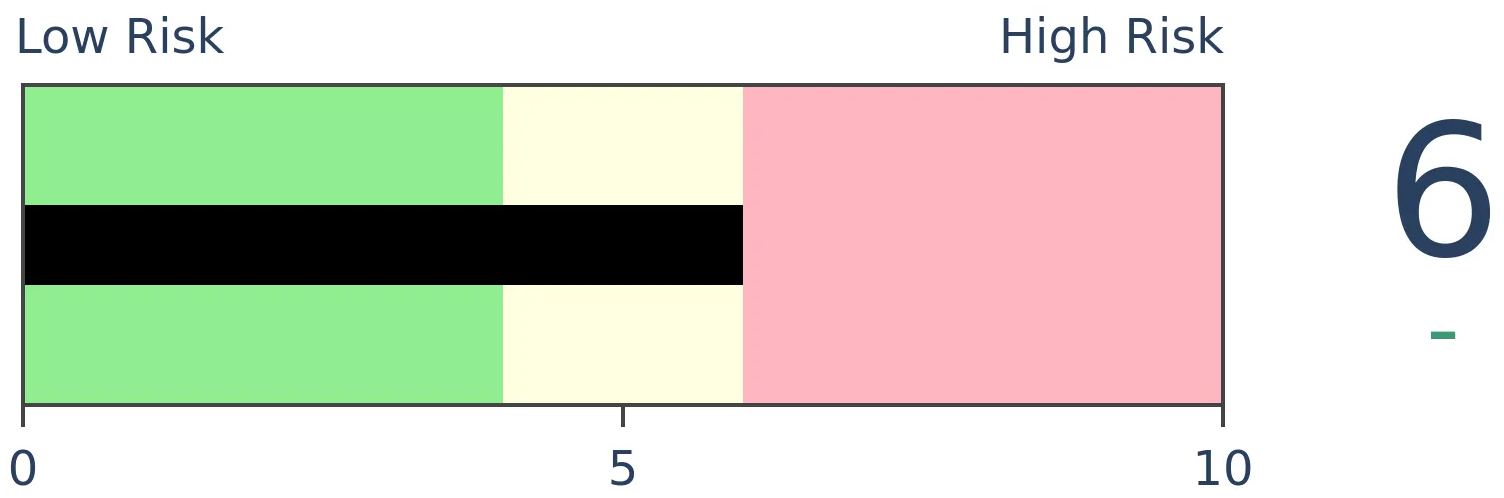

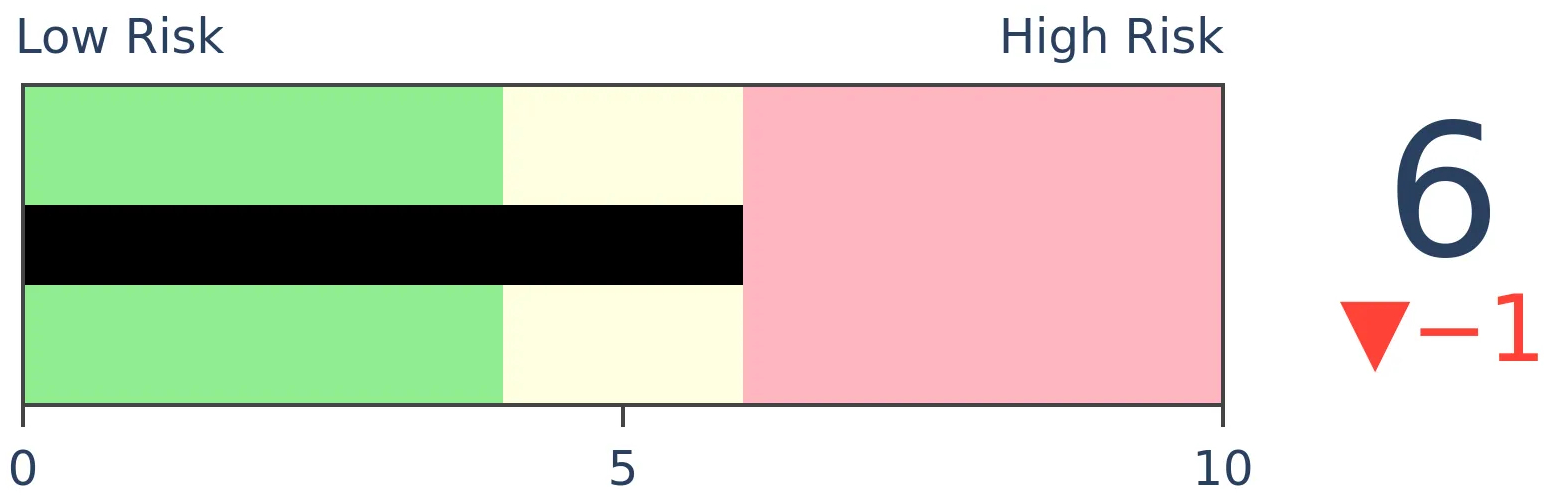

Stocks Medium-Term

|

|

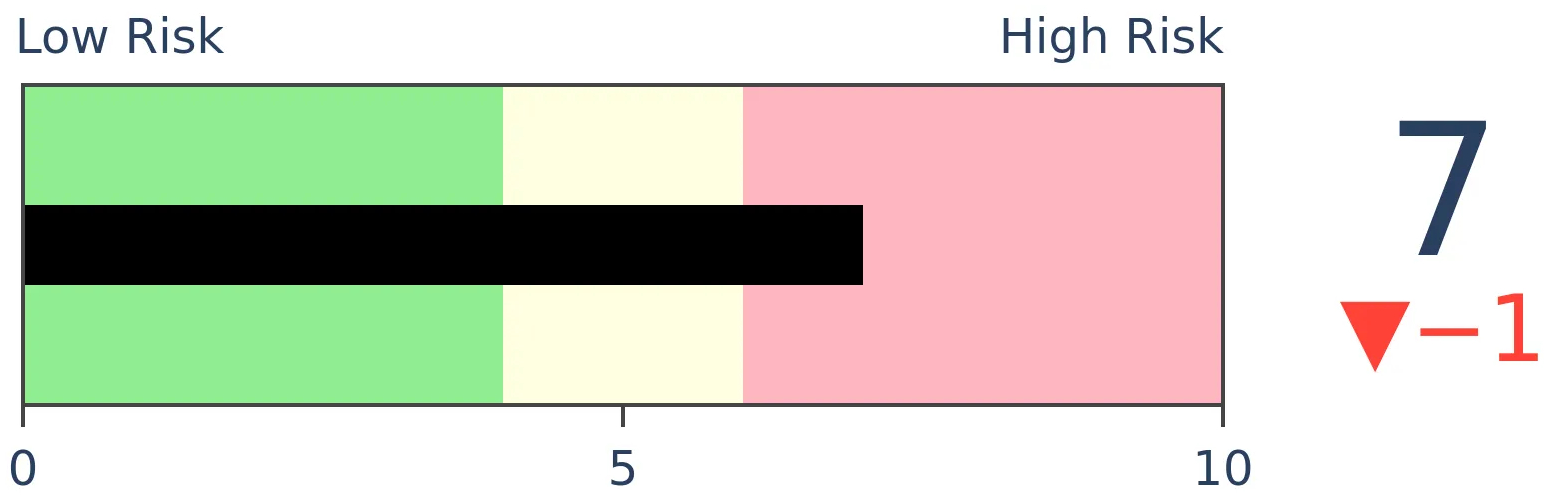

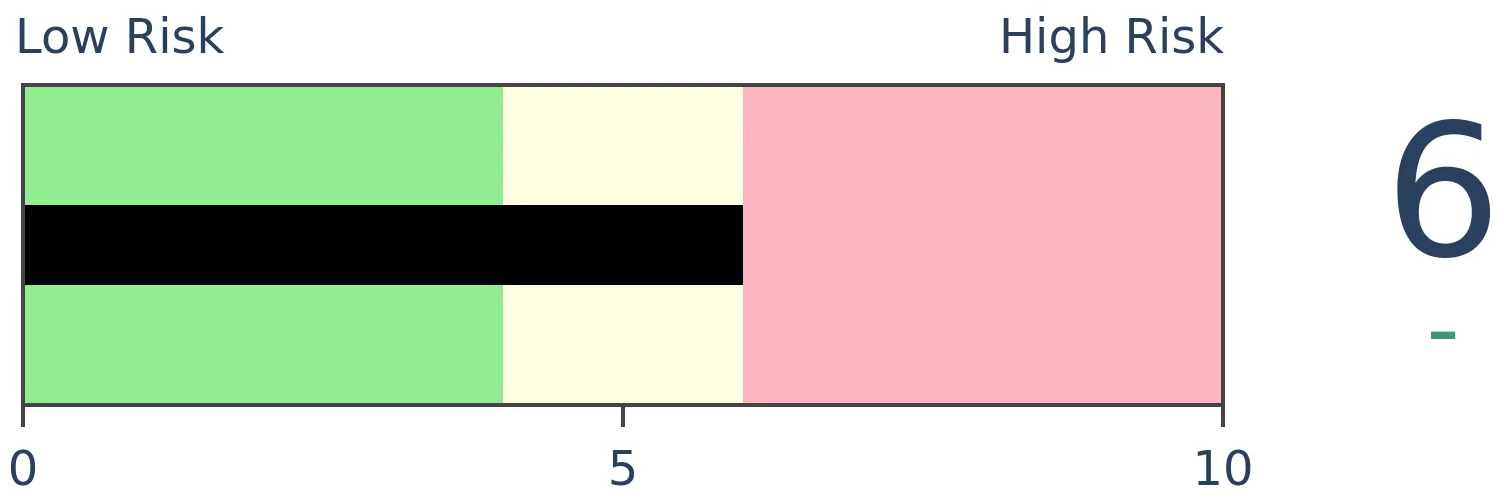

Bonds

|

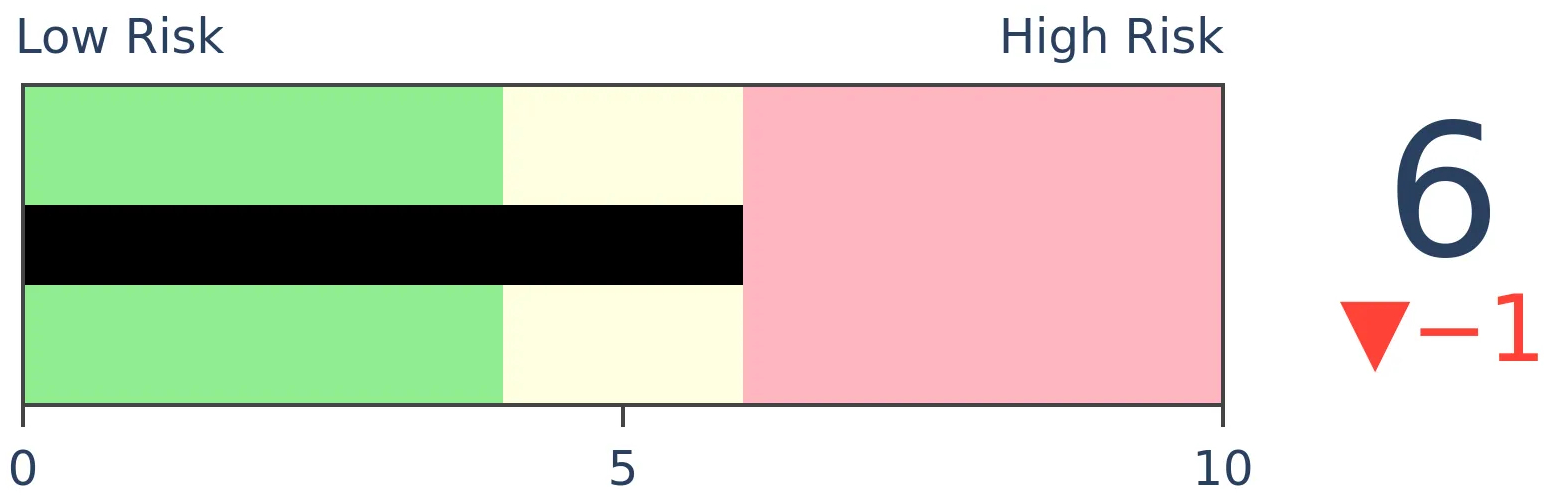

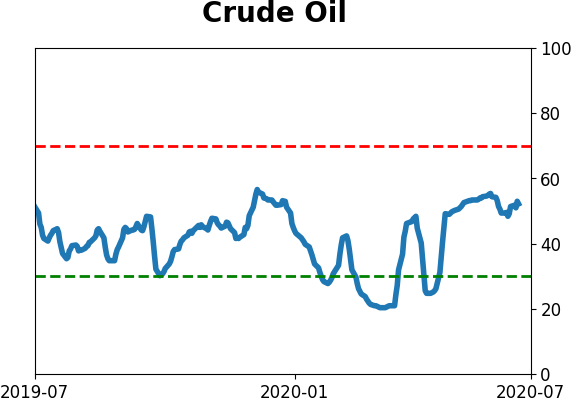

Crude Oil

|

|

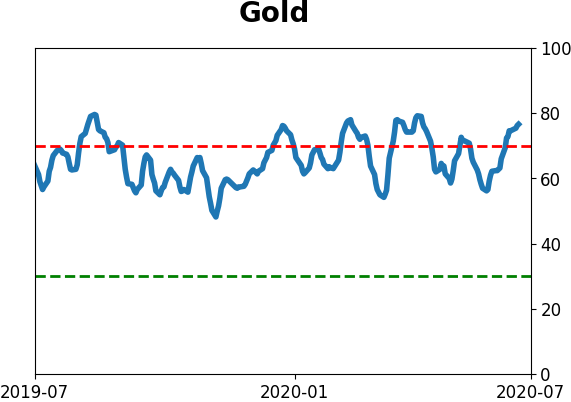

Gold

|

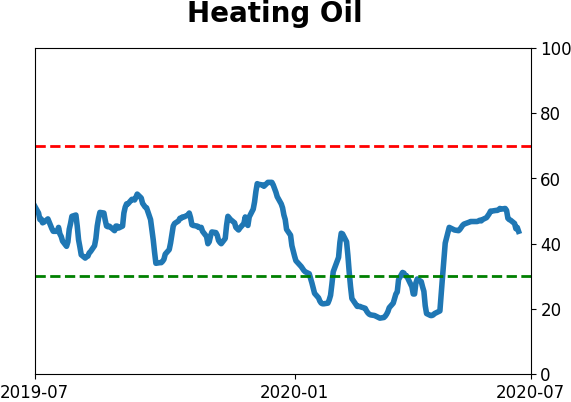

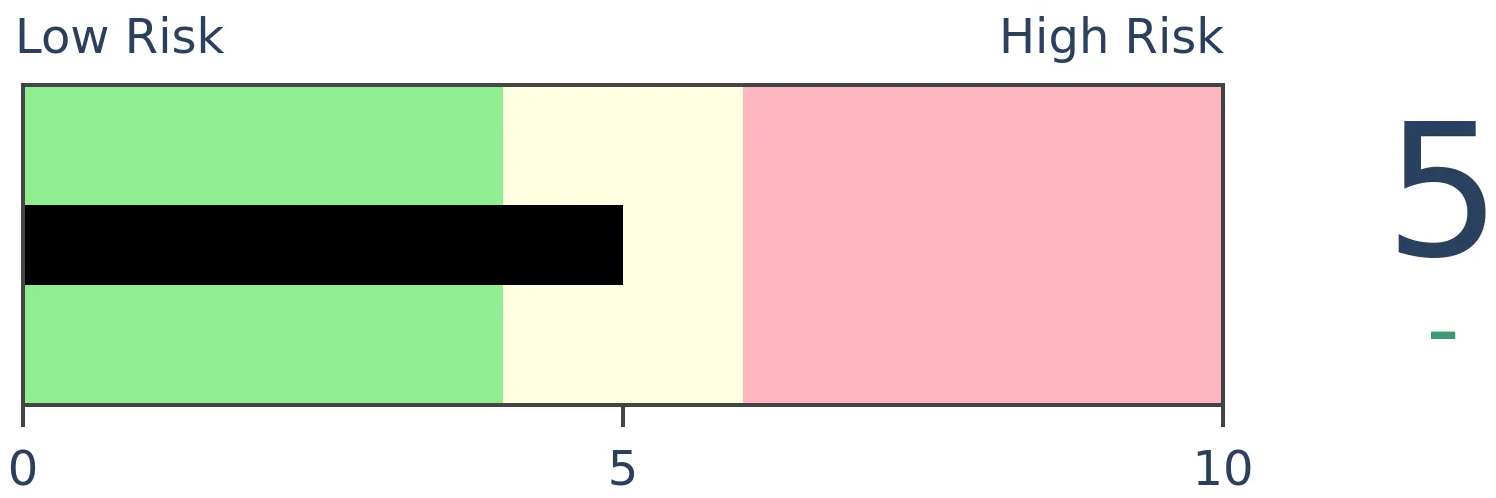

Agriculture

|

|

Research

BOTTOM LINE

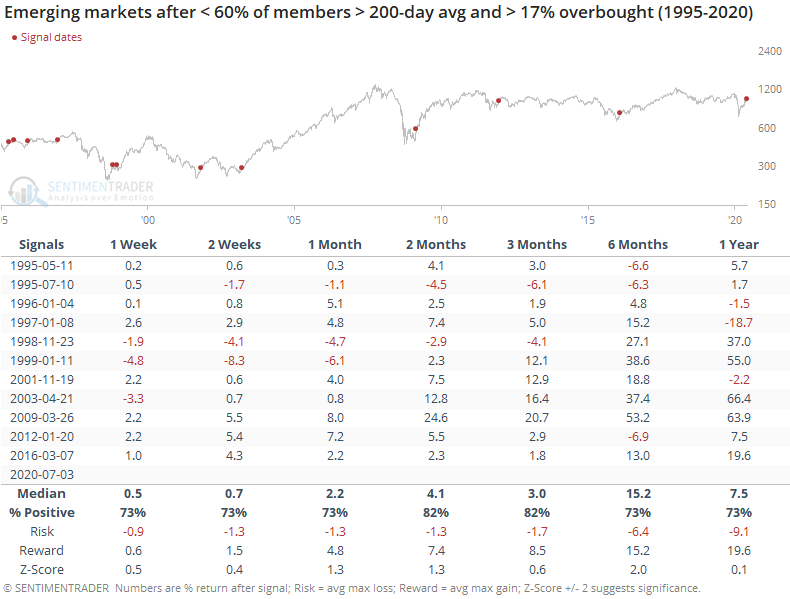

Emerging markets stocks have performed well lately, and indexes have broken away from their 200-day moving averages. Even so, less than 60% of stocks have managed to hold above their long-term averages, and there has been a jump in the number of them being overbought and spiking above their Bollinger Bands.

FORECAST / TIMEFRAME

None

|

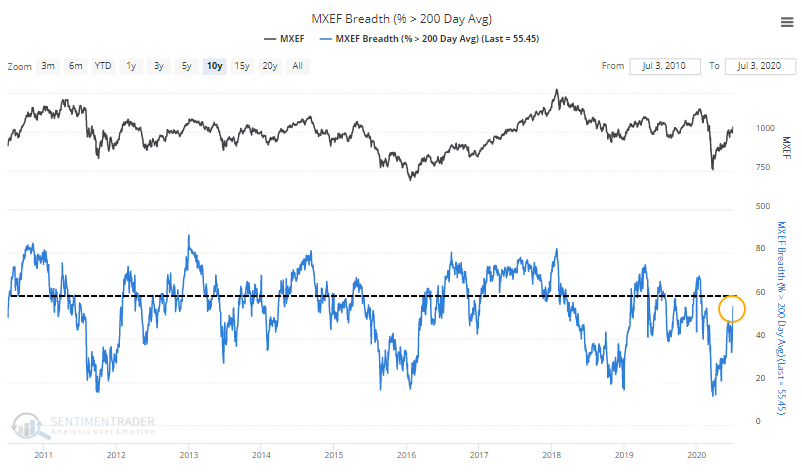

Despite the major indexes hanging tough and adding to their gains Monday, we're still not seeing a huge improvement in the numbers of stocks, industries, sectors, and global indexes rising above their 200-day averages. It takes time to improve, but this is one of the hallmarks of an unhealthy market environment.

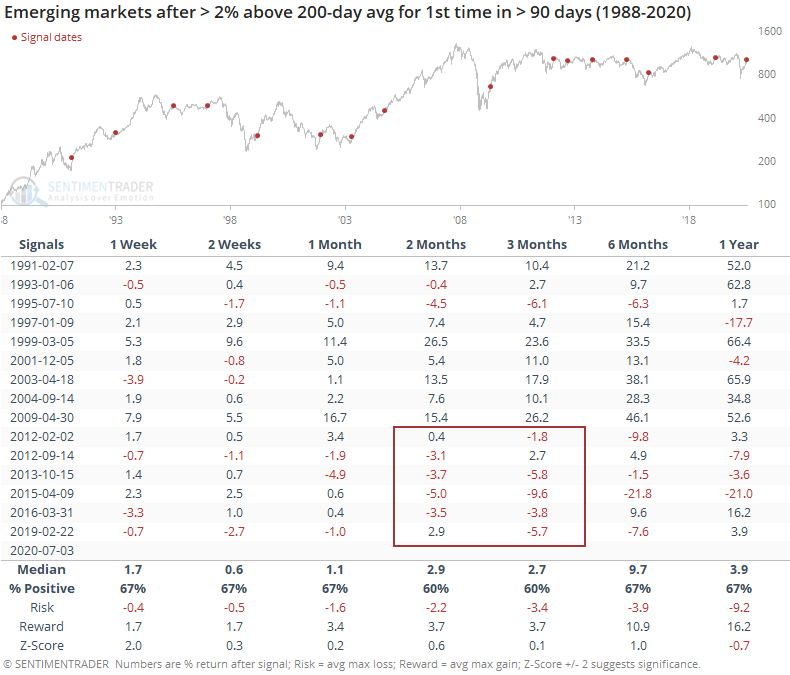

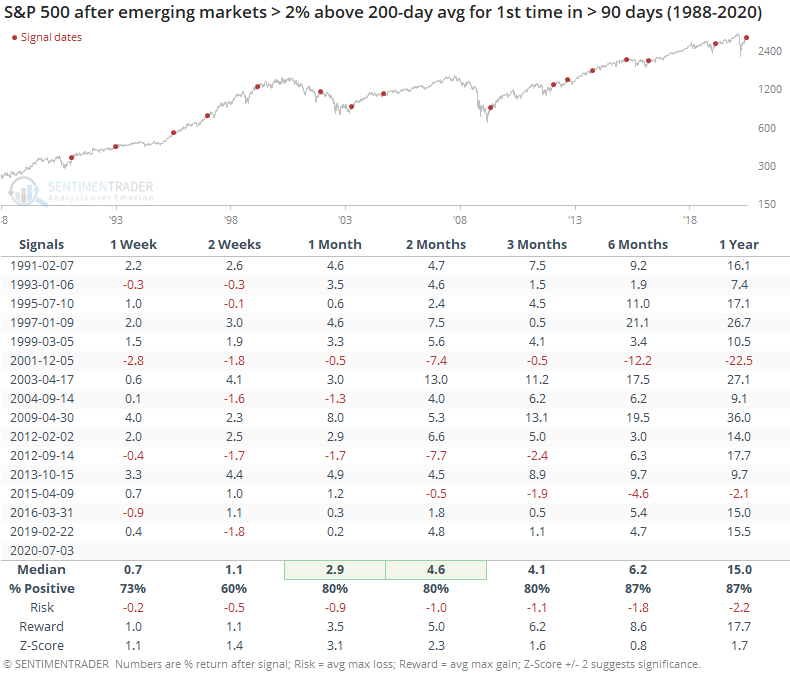

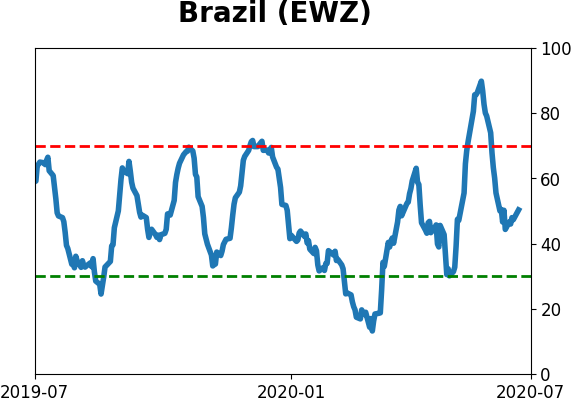

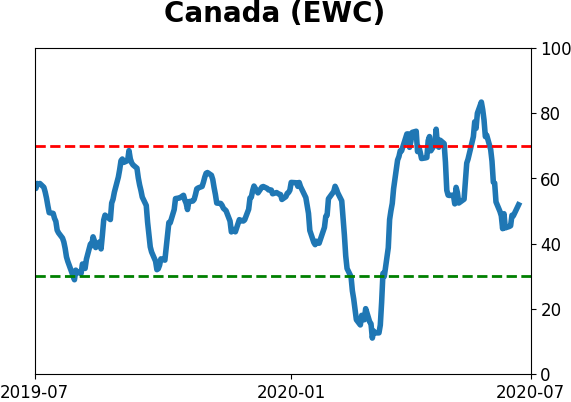

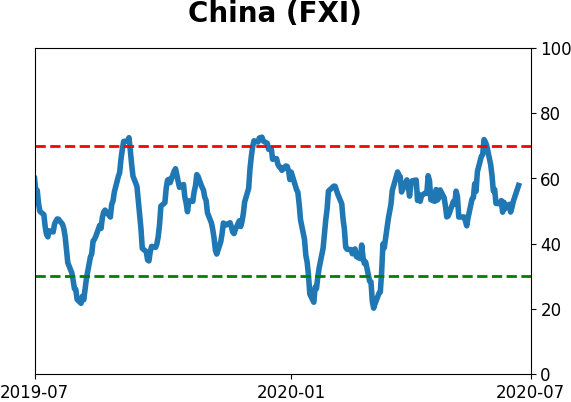

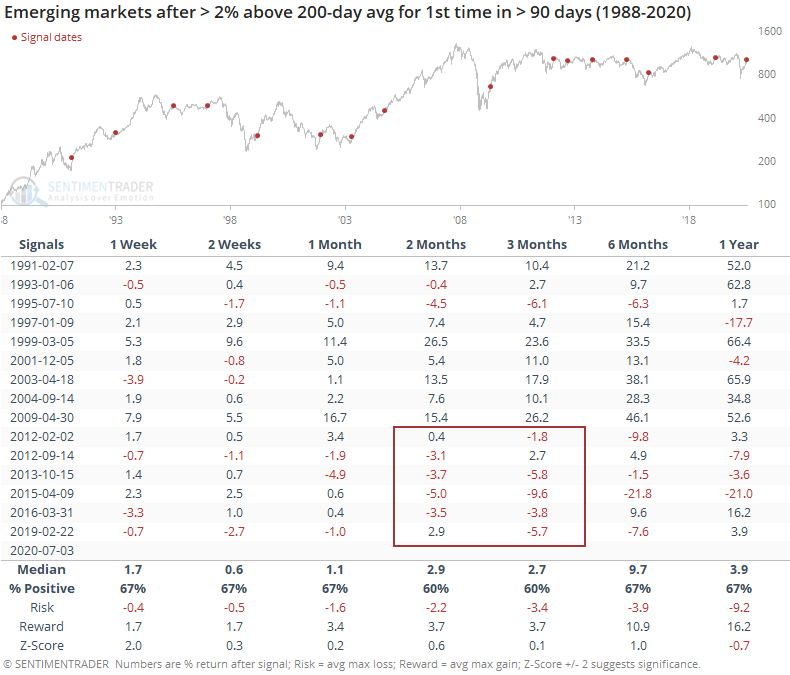

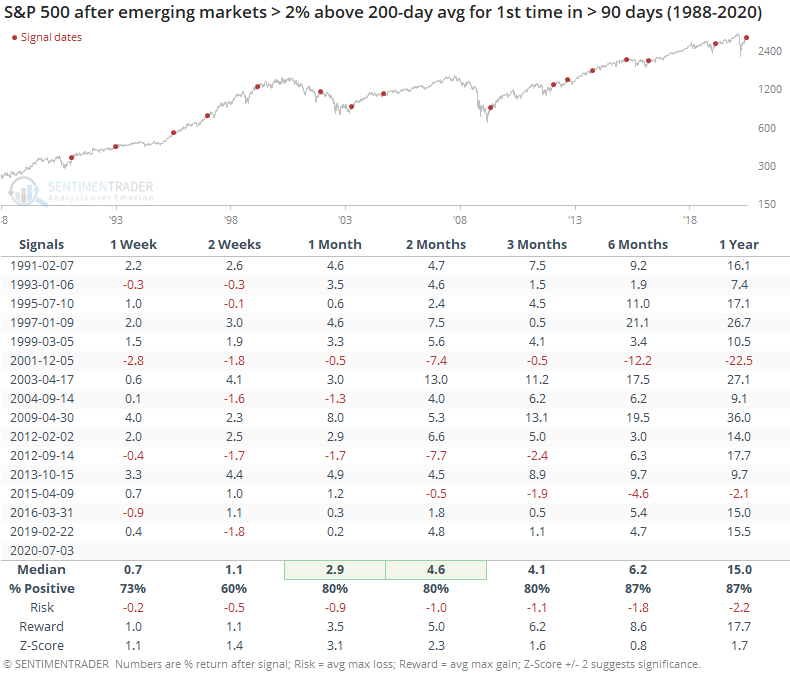

Emerging markets are often looked to as an indicator of risk appetite. If investors are buying those stocks, then it's assumed that they have a high tolerance for risk. Lately, those stocks have been doing very well, and for the first time in months, the MSCI Emerging Markets Index has moved more than 2% above its 200-day average.

It's often beneficial to build a filter around the 200-day average to filter out those times when an index gyrates slightly above or below it, without changing its longer-term trend. When emerging markets finally managed to break this far away from its average, it typically kept going, though it was not a strong edge. Since 2010, every one of these signals showed a negative return either 2 or 3 months later.

It was a better sign for the S&P 500.

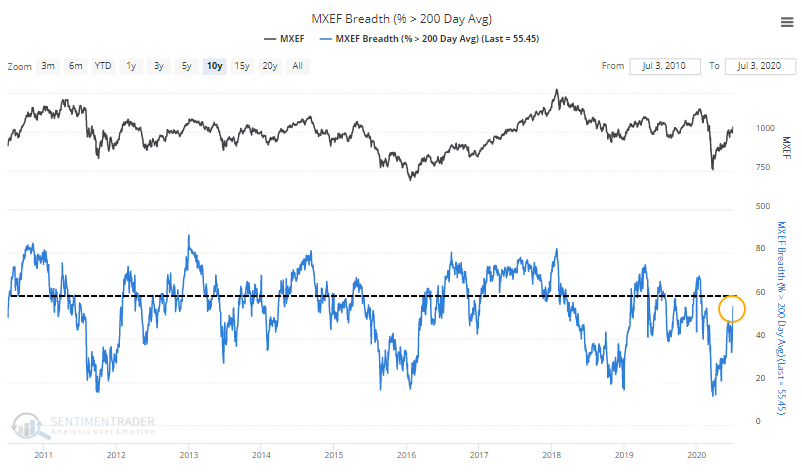

Like we're seeing with domestic indexes, even though they're holding up, many stocks are not necessarily following along. In emerging markets, there are still fewer than 60% of stocks above their long-term averages.

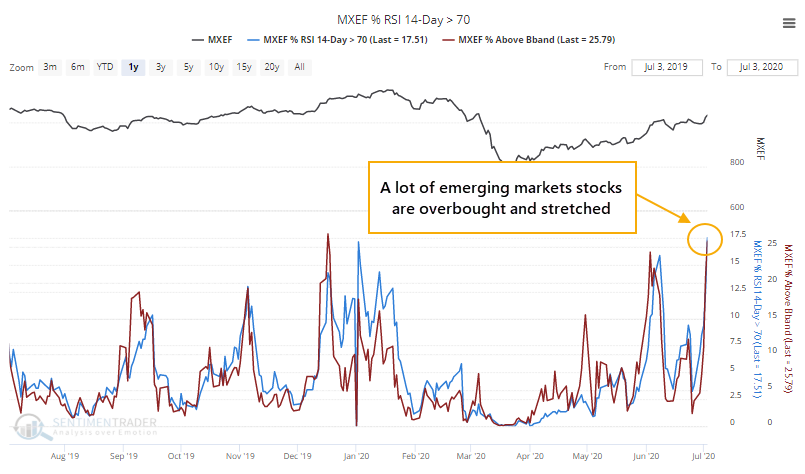

Even so, the push late last week triggered many of them to move outside of their upper Bollinger Bands and also become overbought, with a Relative Strength Index above 70.

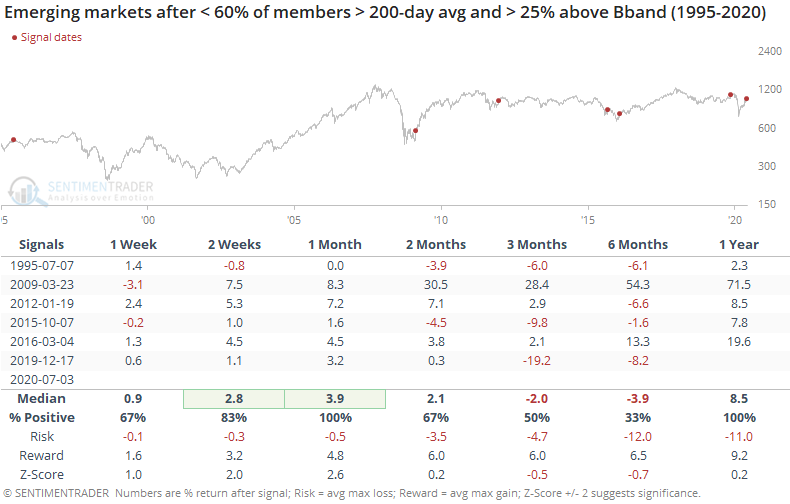

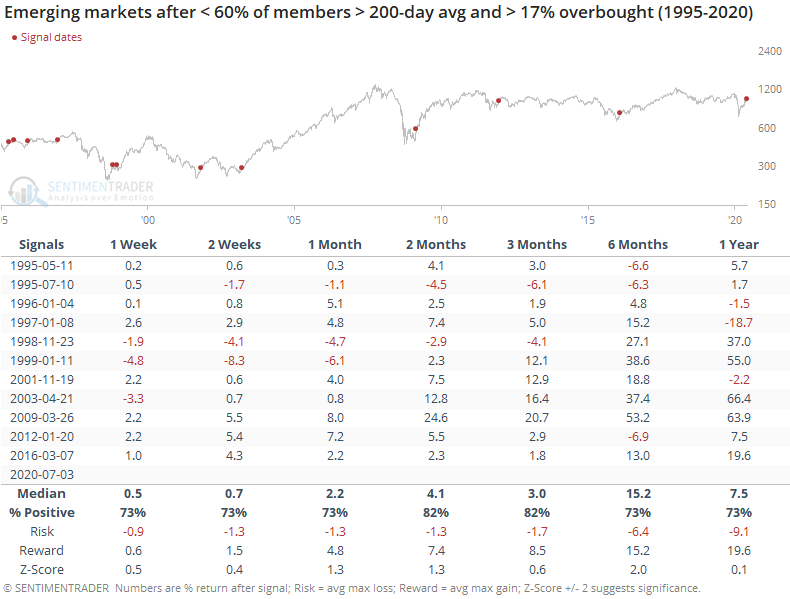

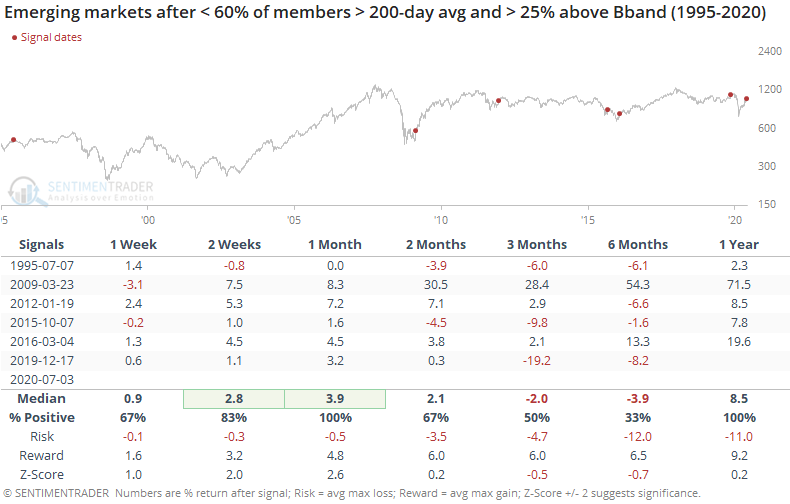

When less than 60% of them were above their 200-day averages, but more than 25% of them spiked above their volatility bands, it was a good short- to medium-term sign of momentum. Unfortunately, several of these rallies failed, and the risk/reward was poor over the next 6 months. A year later, they were higher every time, so there's that.

Returns were better when there was a big jump in the percentage of these stocks becoming overbought, even within the context of less than 60% of them being above their 200-day averages.

Global markets don't necessarily behave as domestic ones do. If we apply these same tests to indexes like the S&P 500, then forward returns are poor over the medium-term. Even though emerging markets have struggled to show sustained bull markets, when they witness momentum like this, it has been a better sign than not.

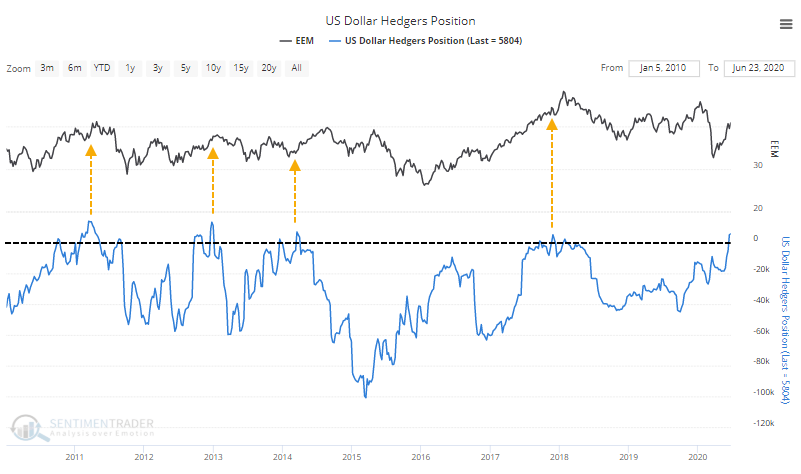

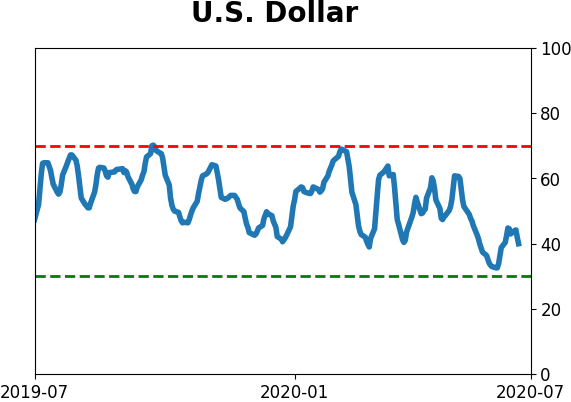

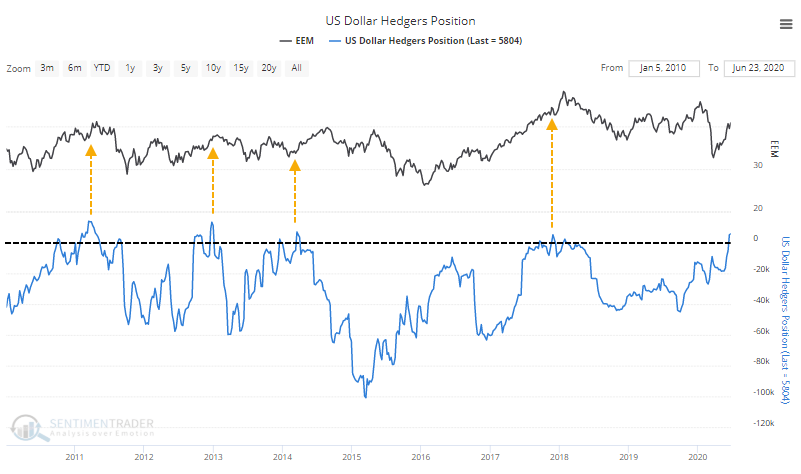

There is some concern, among U.S. investors anyway, that if the dollar rallies, emerging market investments will suffer. Since "smart money" hedgers are net long the dollar, perhaps that's more of a worry than usual.

Over the past decade, when hedgers had bets on a rising dollar, funds like EEM did tend to struggle over a multi-month time period. It wasn't a perfect indicator by any stretch, but it looks to be at least a minor worry here.

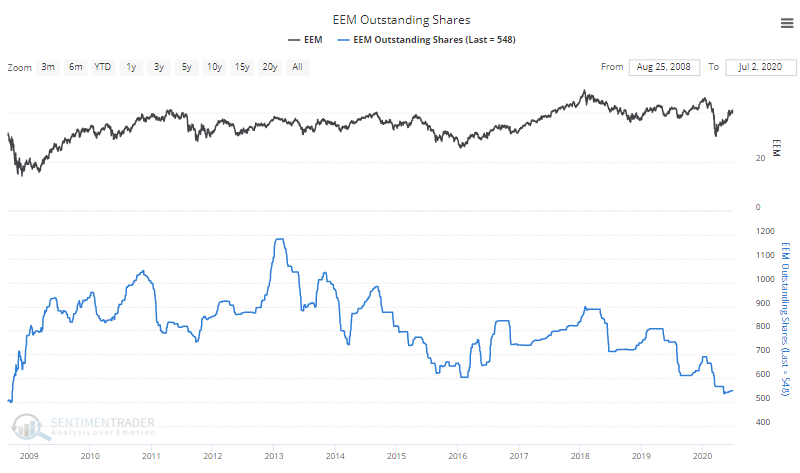

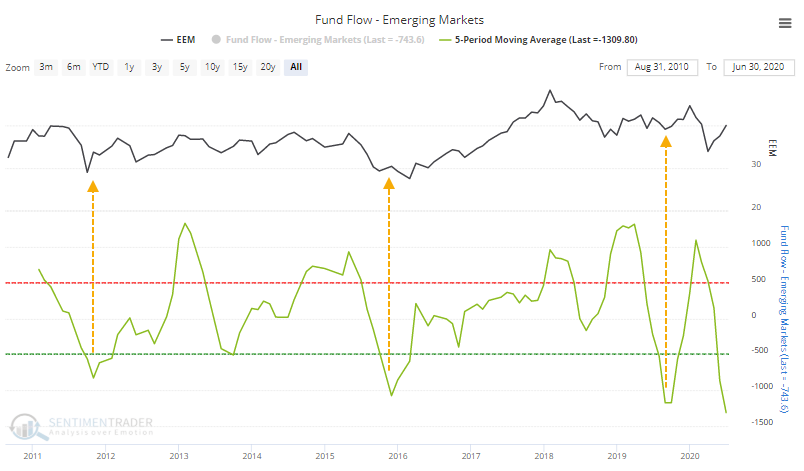

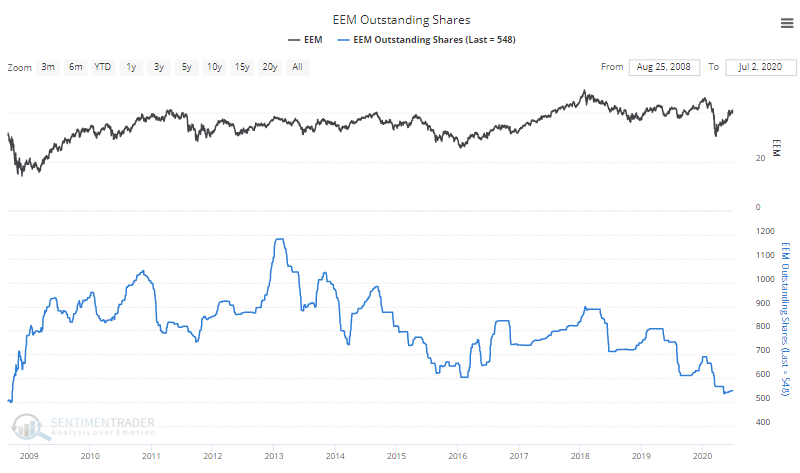

On the plus side, ETF investors seem to have become apathetic on funds like EEM, with shares outstanding falling to the lowest since the financial crisis.

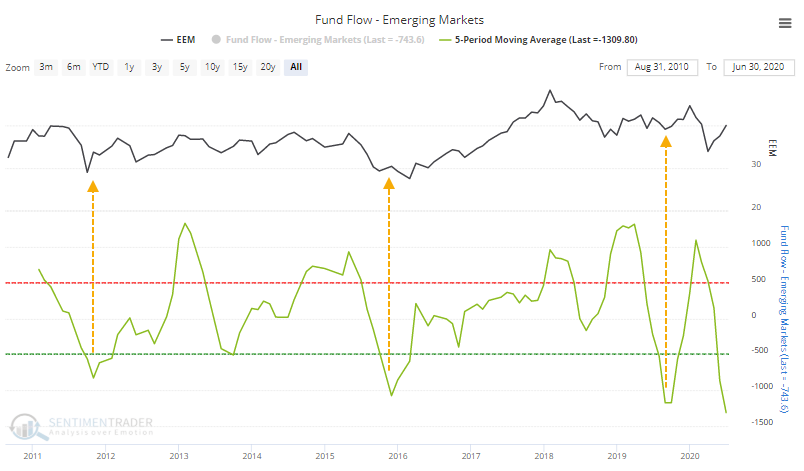

Even if investors are drifting to other funds, there isn't much evidence of it. Fund flows across all emerging market ETFs have moved to a record low. Over the past 5 months, an average of over $1.3 billion per month has flowed, and other times when the 5-month average outflow neared $1 billion, it was a good sign.

There are a couple of minor worries about emerging markets here, but the momentum is more of a good sign than an "overbought is bad" one. Ideally, for bulls, the move will become sustained enough that more than 60% of stocks can exceed and hold their 200-day averages and shift the environment to more of a healthy one. Based on preliminary signs, that should happen.

BOTTOM LINE

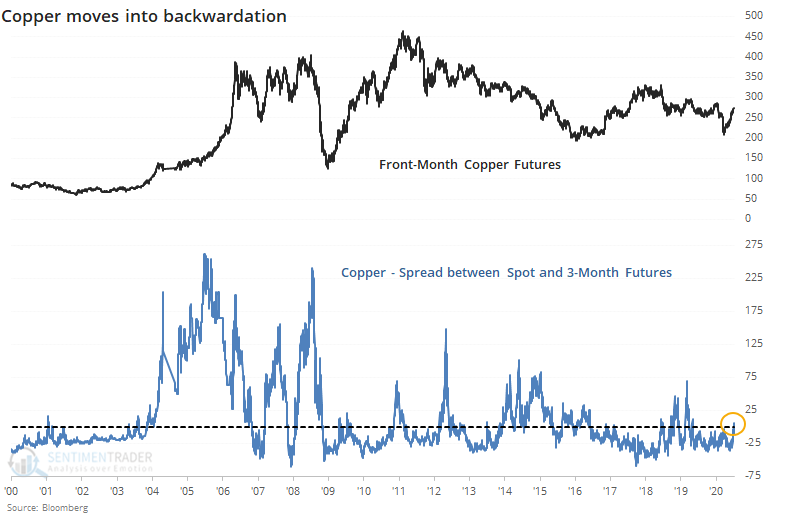

The spot price of copper has moved above the 3-month futures price, triggering backwardation. This is likely due to supply issues, but investors often believe it could also be due to a jump in economic demand. While it has not been a consistently good sign for copper itself, the stock market did have a tendency to rise after these episodes.

FORECAST / TIMEFRAME

None

|

For the first time in over a year, the spot price of copper has moved above the price of its 3-month futures contract.

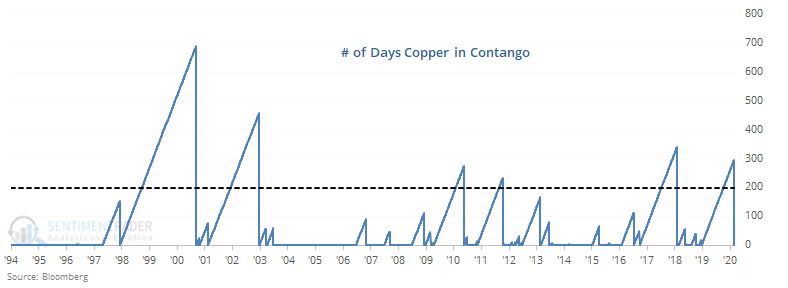

Bloomberg notes that this new environment of backwardation is likely due to supply disruptions. Whatever the cause, it ended one of the longest streaks of contango for the metal.

For copper itself, the last couple of times it first went into backwardation, it was the end of brief rallies, leading to big declines in the months ahead. Only once did it precede a sustained bull market.

One of the reasons why investors like to watch the metal is because it has a number of industrial uses, and a surge in copper might mean an uptick in economic activity as well. While the futures curve is influenced by many reasons other than economic demand and the current inversion might be unrelated, other times this happened it was mostly good for stocks, with 2001 being the biggest exception.

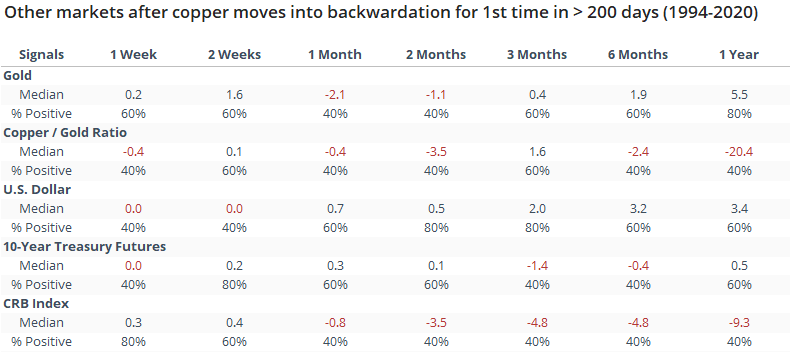

Other markets didn't show much of a bias. Copper still had a minor bias to underperform gold, and it wasn't a consistent signal for the broad commodities market, either.

Copper can be a useful indicator for other markets, primarily stocks. It's not perfect, but it does tend to be a good sign when the metal is behaving well. The fact that the market is now in backwardation hasn't been consistent enough to give us much more information, however.

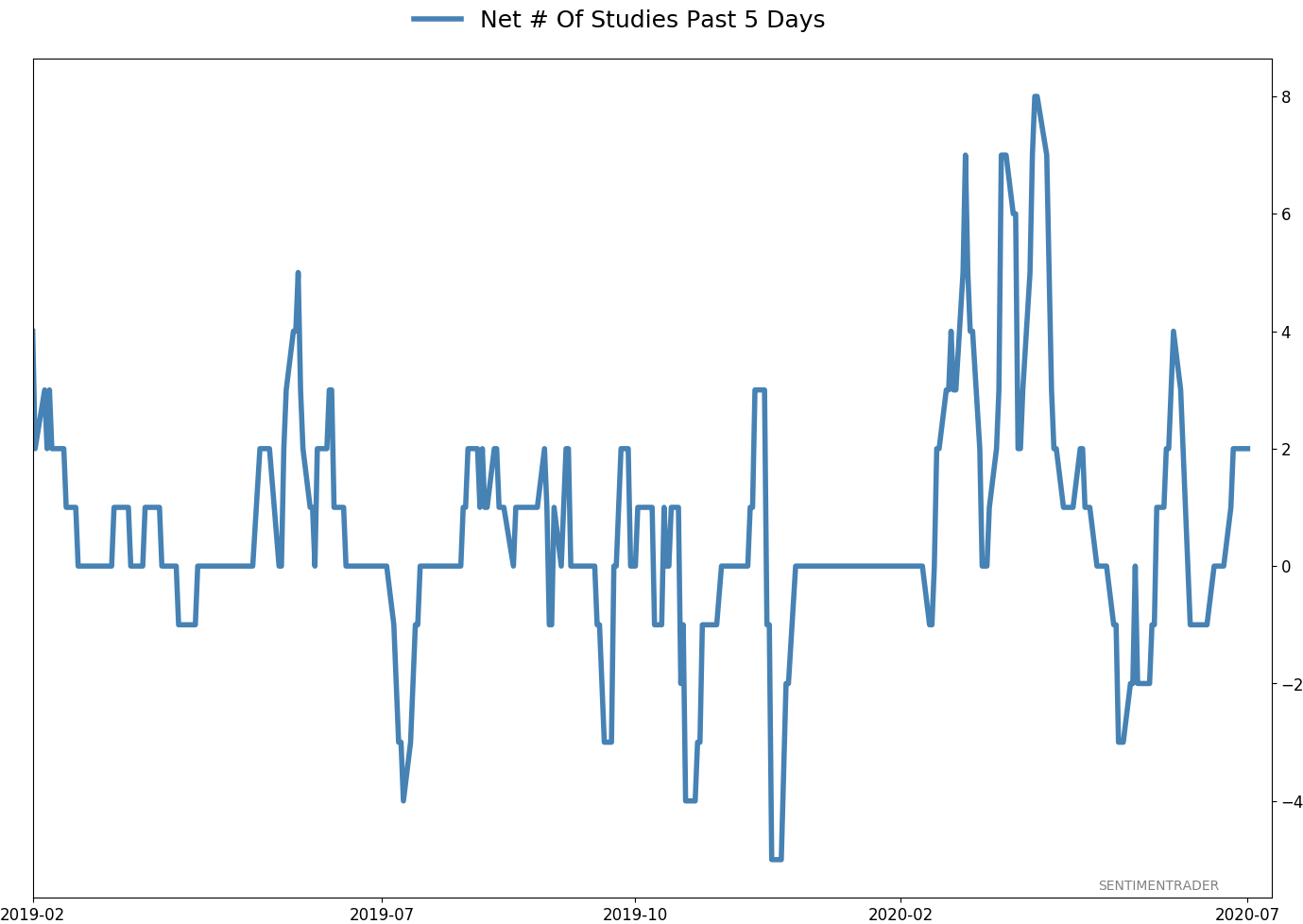

Active Studies

| Time Frame | Bullish | Bearish | | Short-Term | 0 | 0 | | Medium-Term | 8 | 6 | | Long-Term | 42 | 1 |

|

Indicators at Extremes

Portfolio

| Position | Weight % | Added / Reduced | Date | | Stocks | 29.8 | Reduced 9.1% | 2020-06-11 | | Bonds | 0.0 | Reduced 6.7% | 2020-02-28 | | Commodities | 5.2 | Added 2.4%

| 2020-02-28 | | Precious Metals | 0.0 | Reduced 3.6% | 2020-02-28 | | Special Situations | 0.0 | Reduced 31.9% | 2020-03-17 | | Cash | 65.0 | | |

|

Updates (Changes made today are underlined)

In the first months of the year, we saw manic trading activity. From big jumps in specific stocks to historic highs in retail trading activity to record highs in household confidence to almost unbelievable confidence among options traders. All of that came amid a market where the average stock couldn't keep up with their indexes. There were signs of waning momentum in stocks underlying the major averages, which started triggering technical warning signs in late January. After stocks bottomed on the 23rd, they enjoyed a historic buying thrust and retraced a larger amount of the decline than "just a bear market rally" tends to. Those thrusts are the most encouraging sign we've seen in years. Through early June, we were still seeing thrusts that have led to recoveries in longer-term breadth metrics. The longer-term prospects for stocks (6-12 months) still look decent given the above. On a short- to medium-term basis, it was getting harder to make that case. Dumb Money Confidence spiked and there were multiple signs of a historic level of speculation. This is likely the lowest I will go given what I still consider to be compelling positives over a longer time frame. There is not a slam-dunk case to be made for either direction, so it will seem like a mistake whether stocks keep dropping (why didn't I sell more?) or if they turn and head higher (why did I let short-term concerns prevail?). After nearly three decades of trading, I've learned to let go of the idea of perfection.

RETURN YTD: -4.9% 2019: 12.6%, 2018: 0.6%, 2017: 3.8%, 2016: 17.1%, 2015: 9.2%, 2014: 14.5%, 2013: 2.2%, 2012: 10.8%, 2011: 16.5%, 2010: 15.3%, 2009: 23.9%, 2008: 16.2%, 2007: 7.8%

|

|

Phase Table

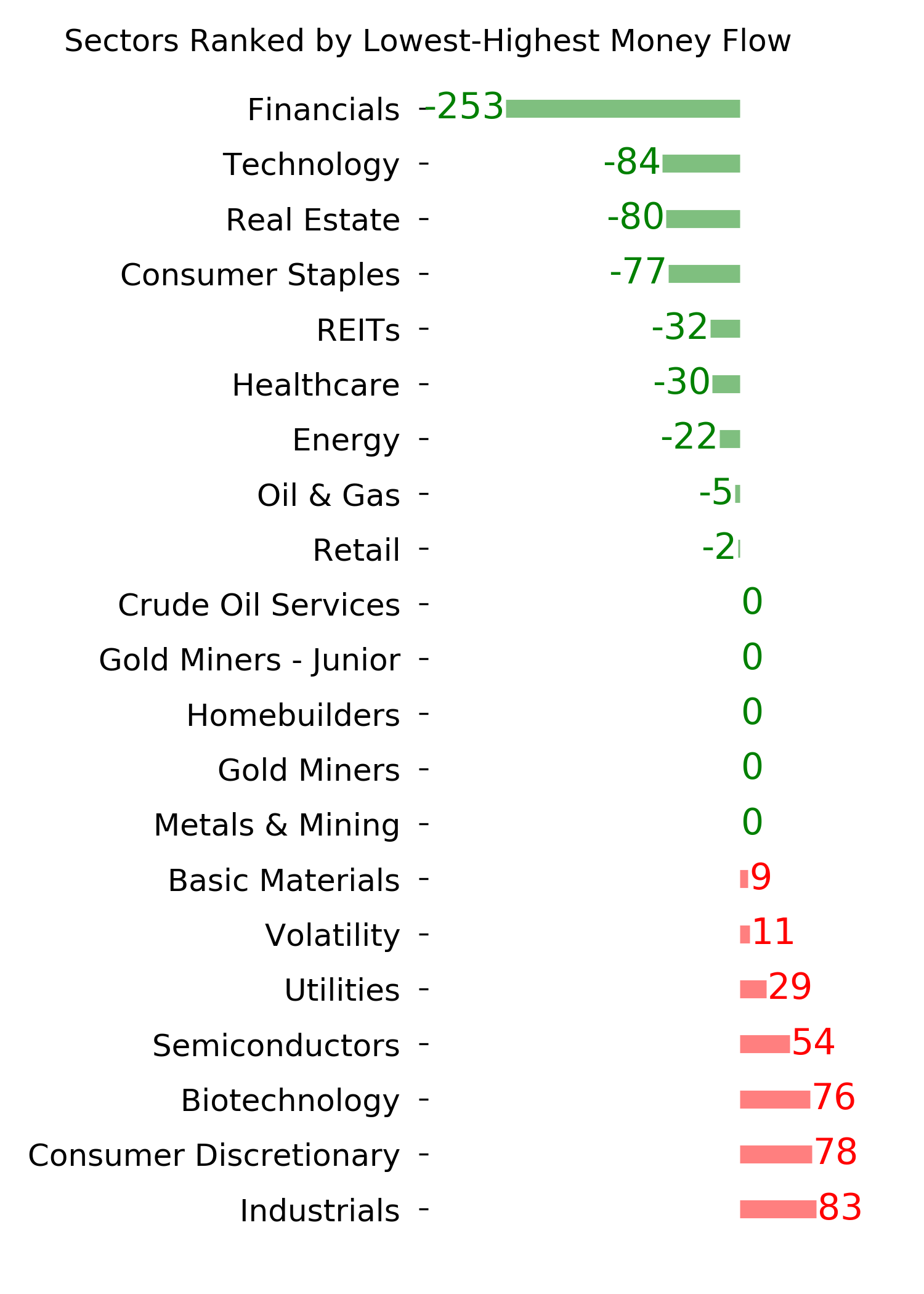

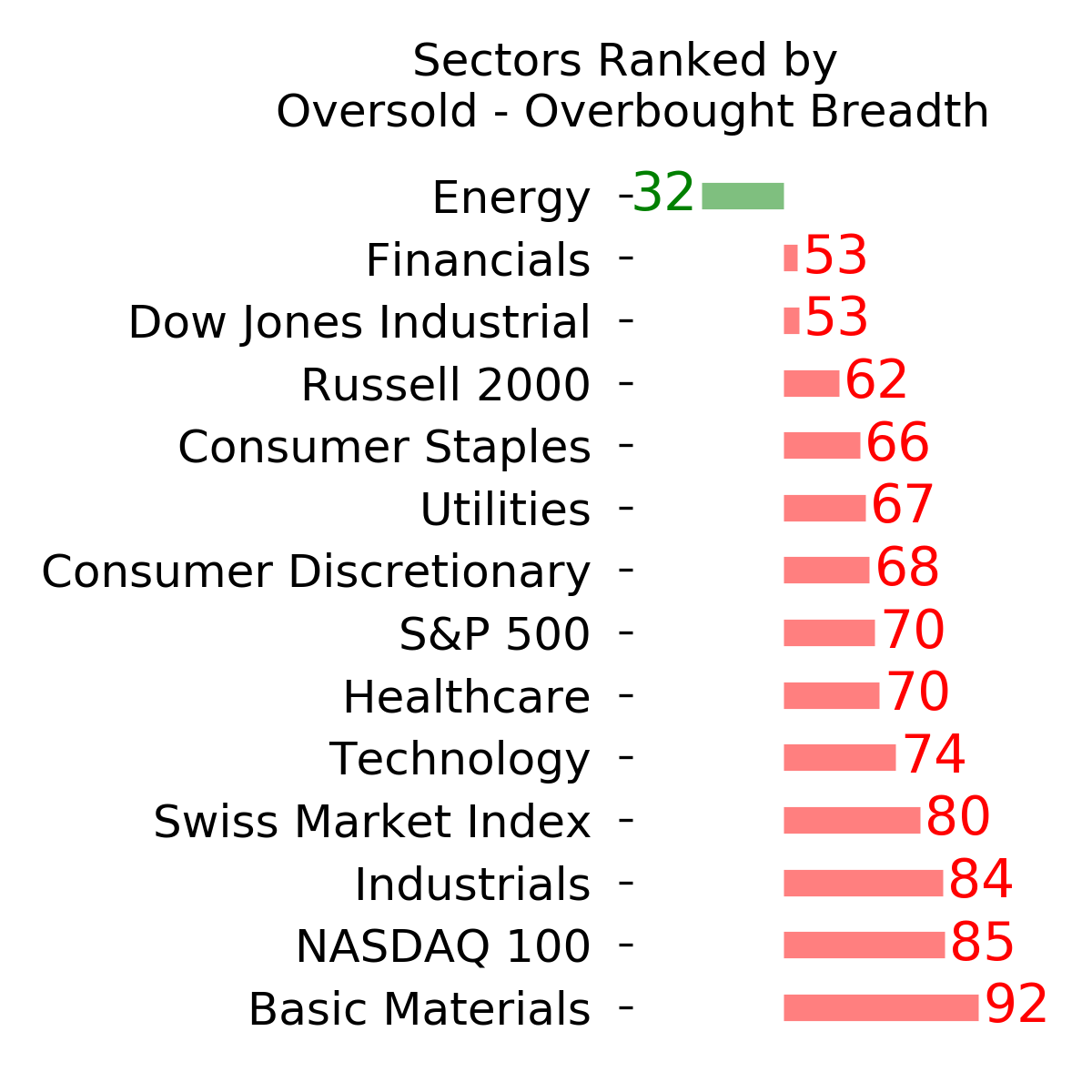

Ranks

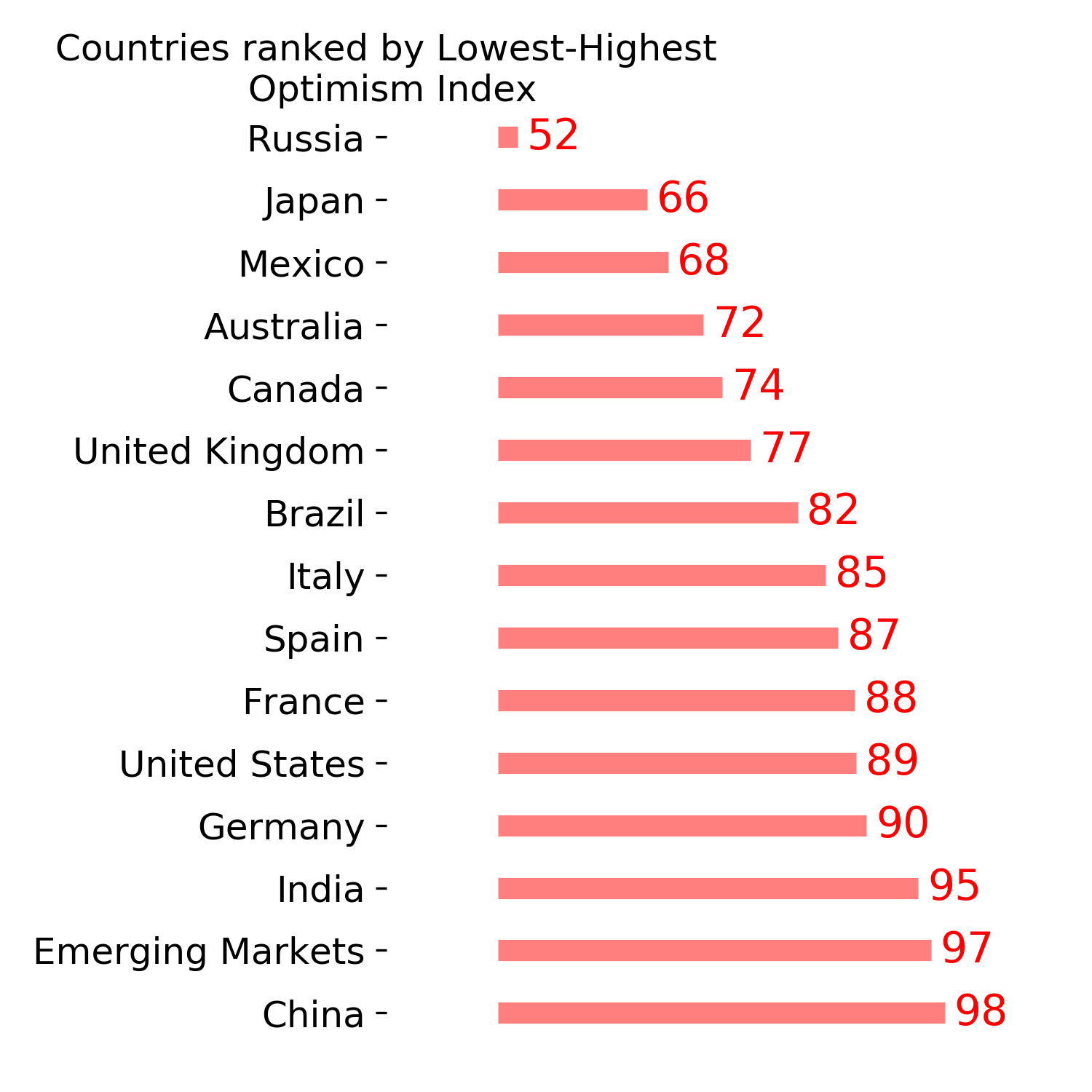

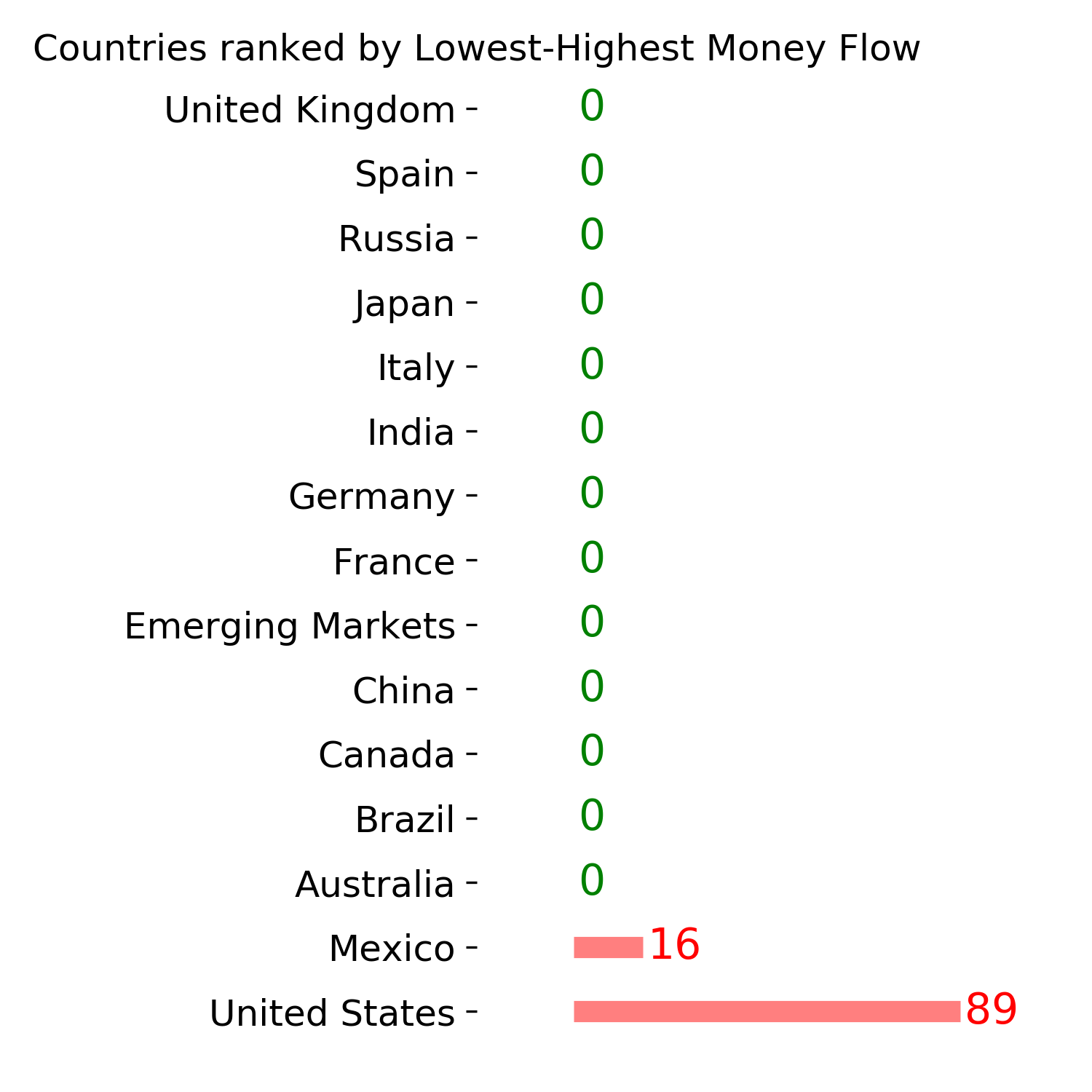

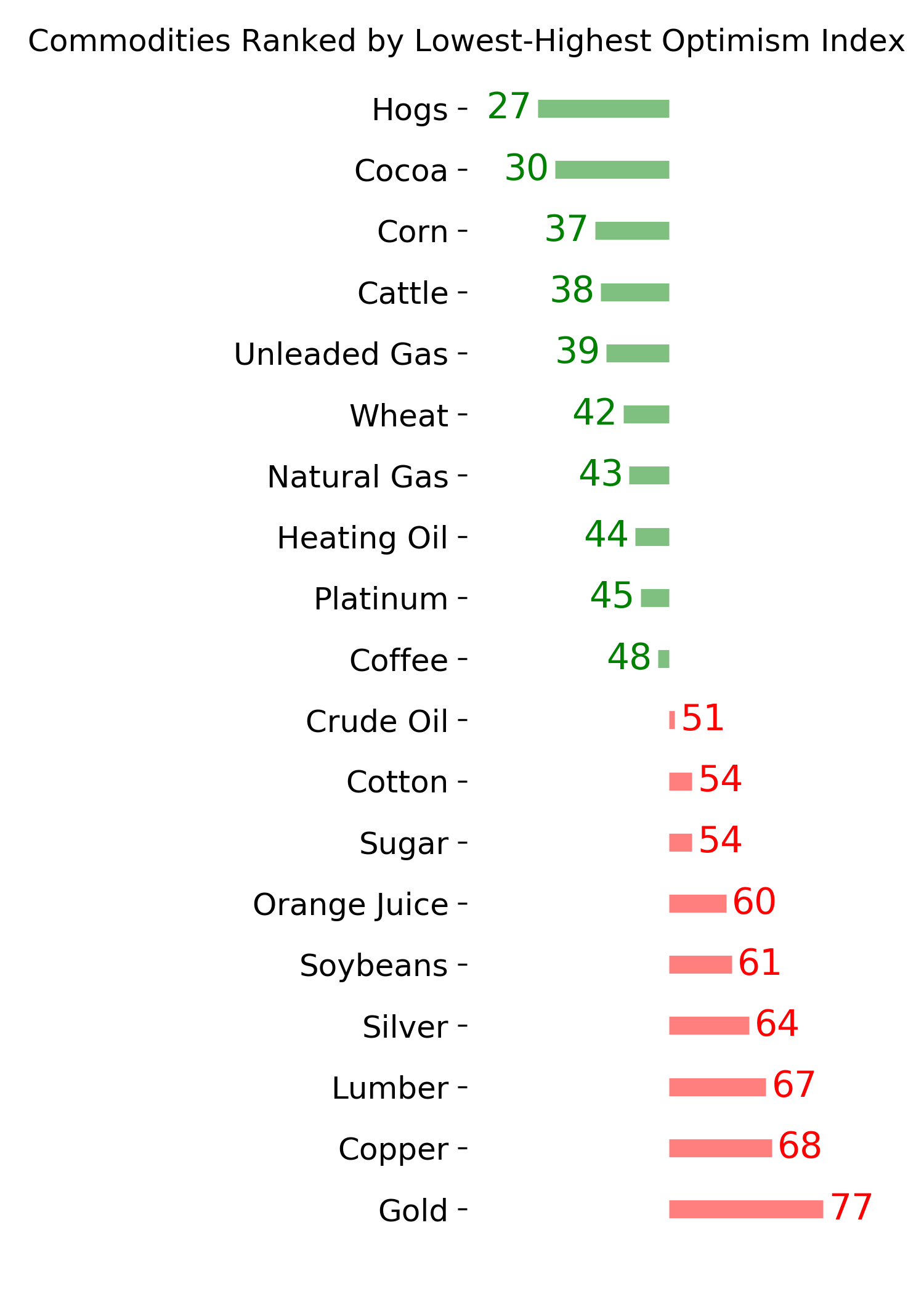

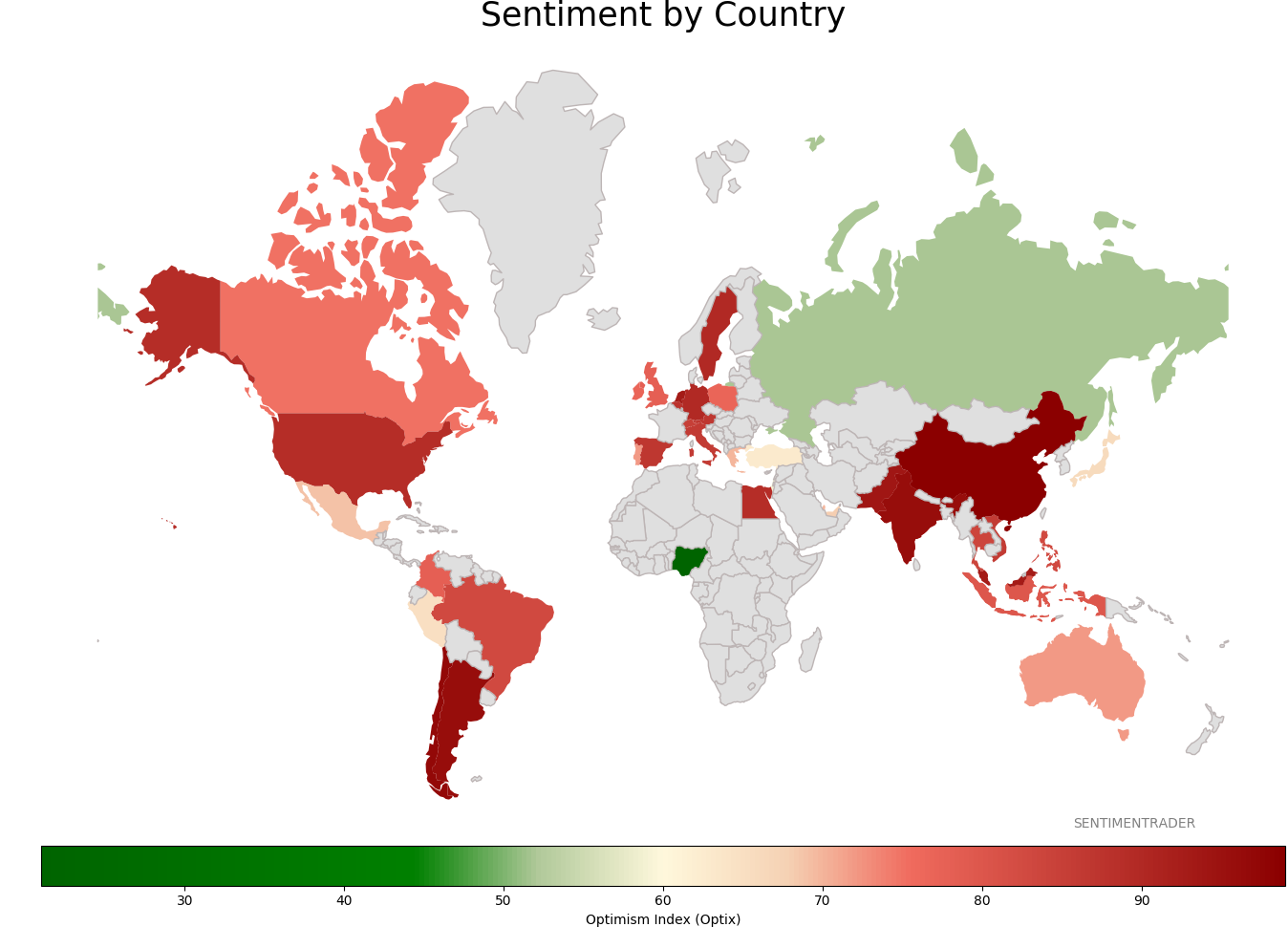

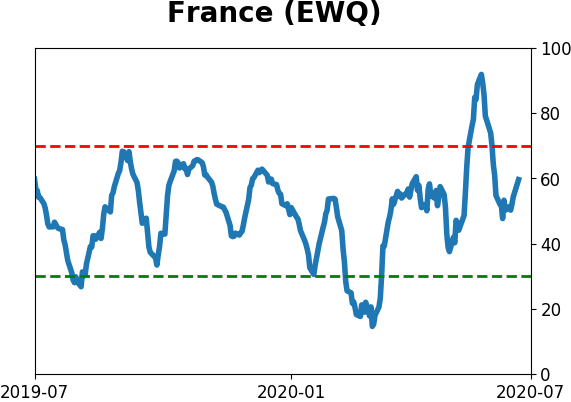

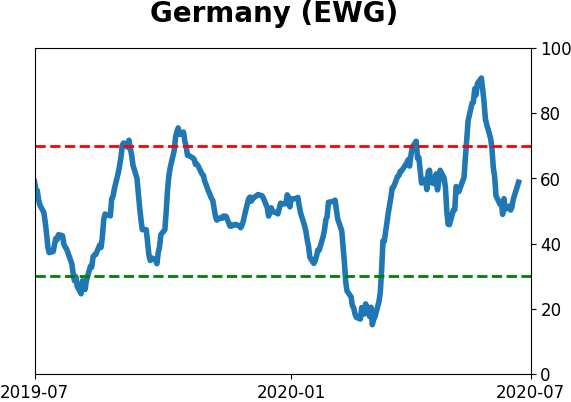

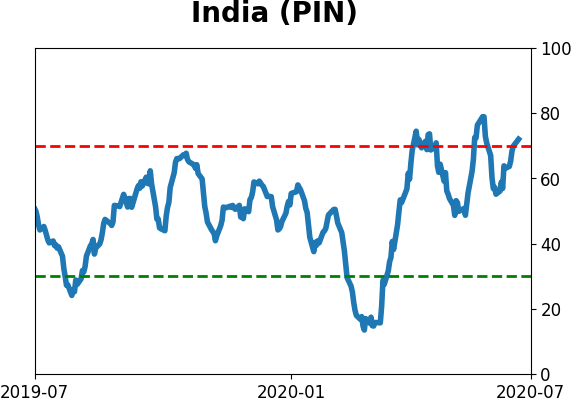

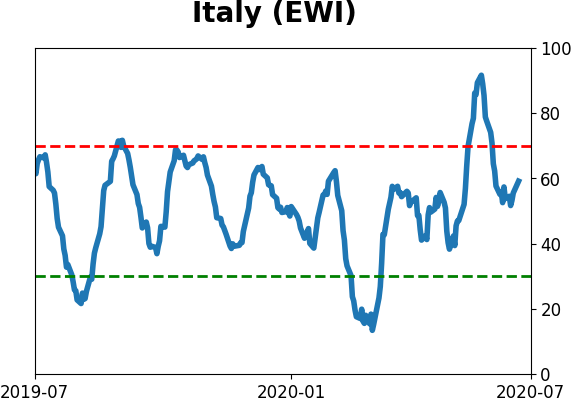

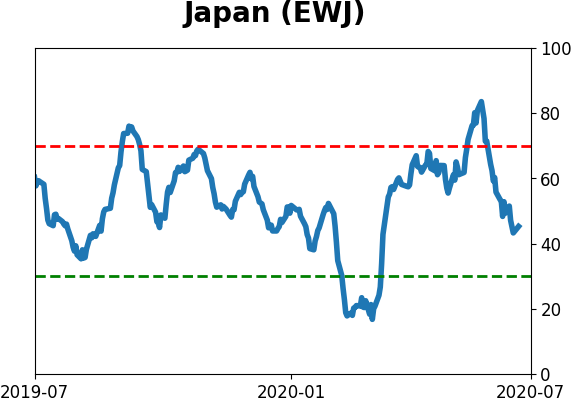

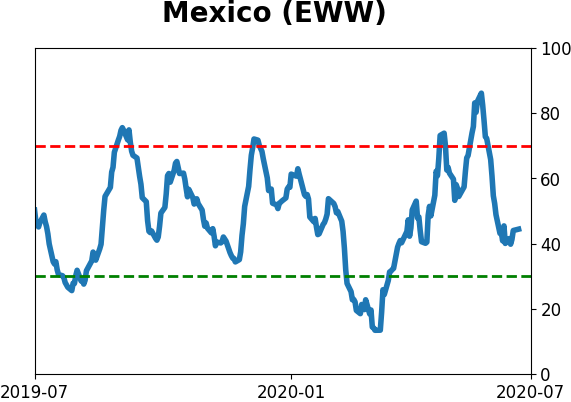

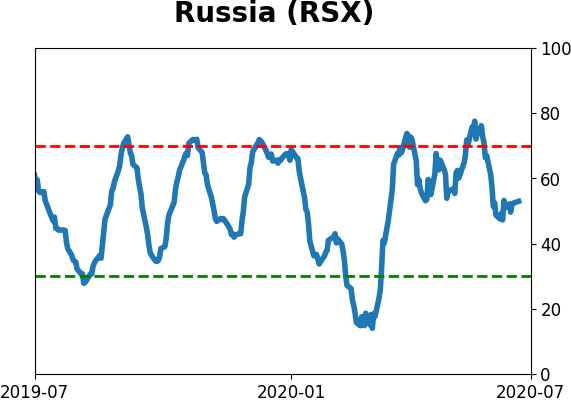

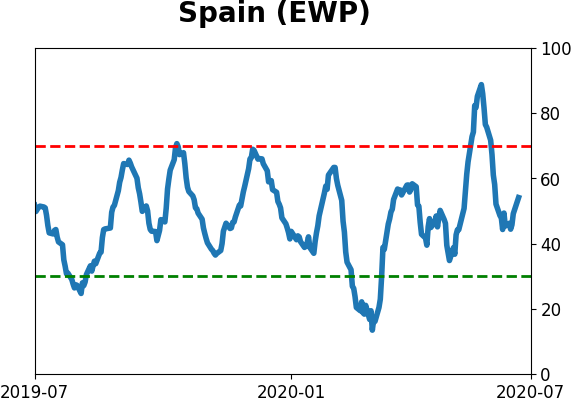

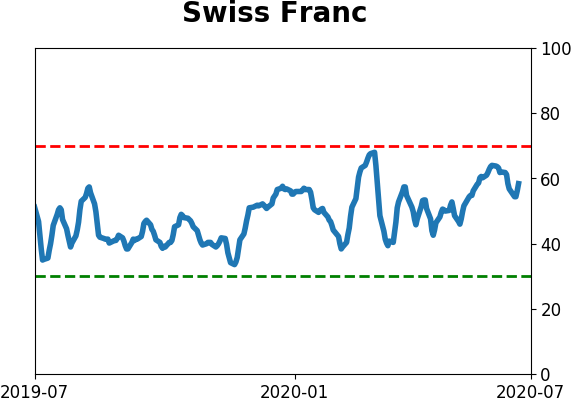

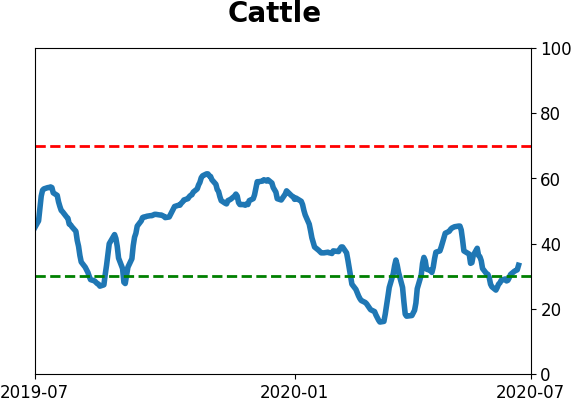

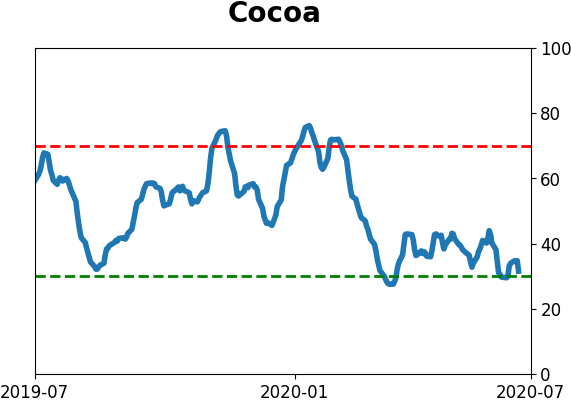

Sentiment Around The World

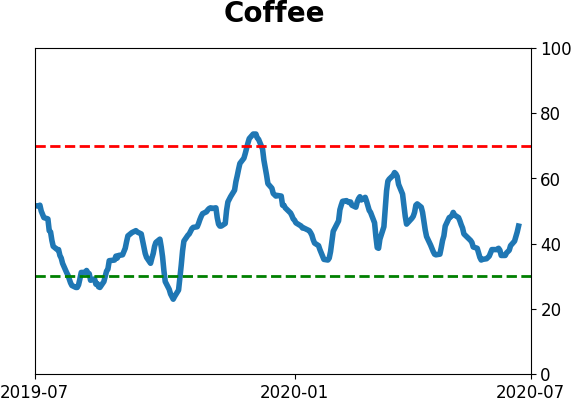

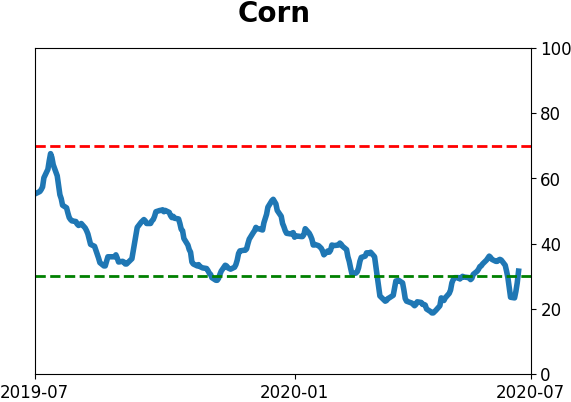

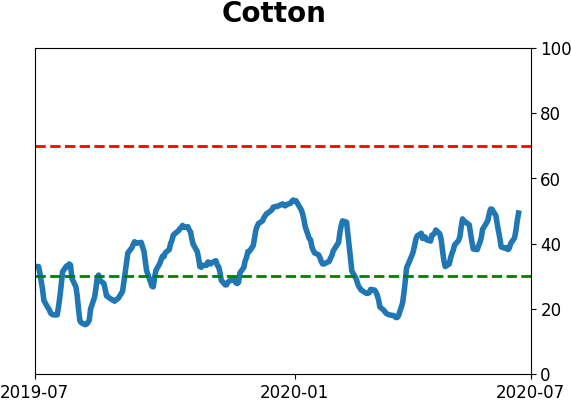

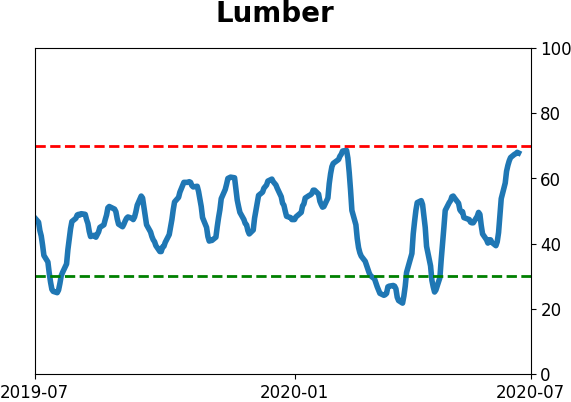

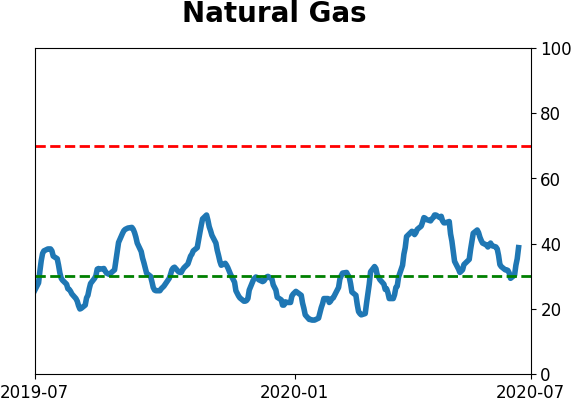

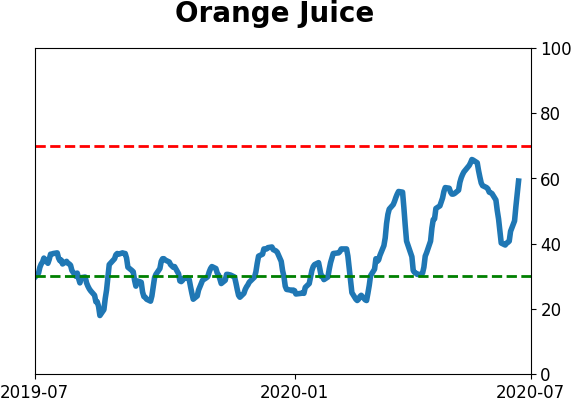

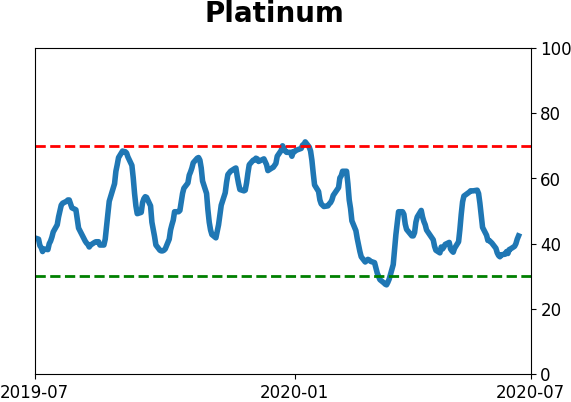

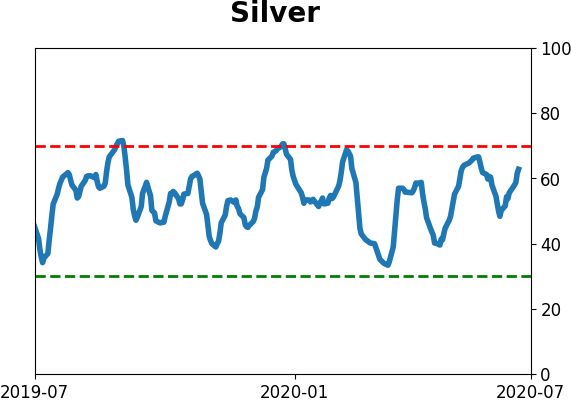

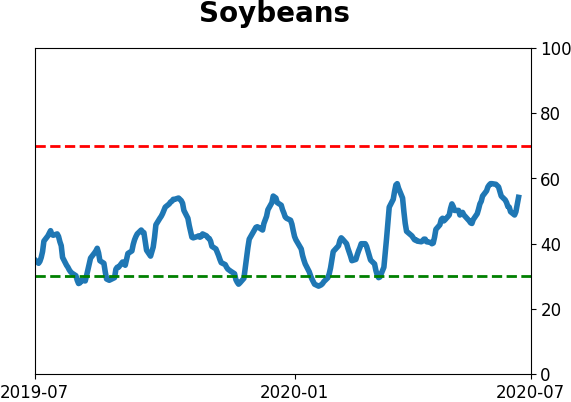

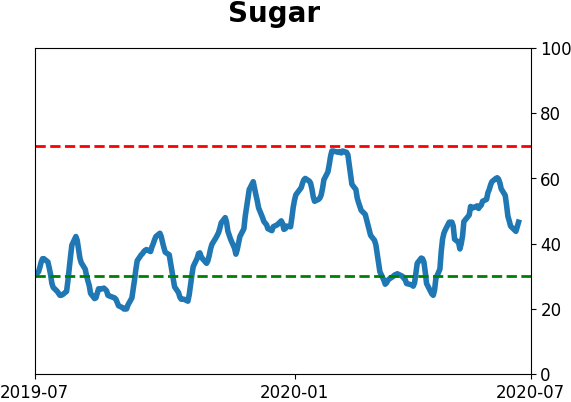

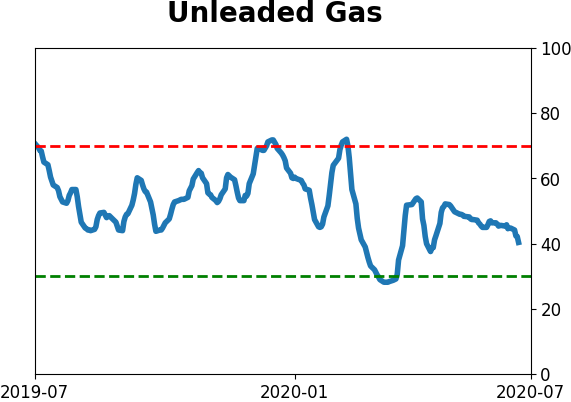

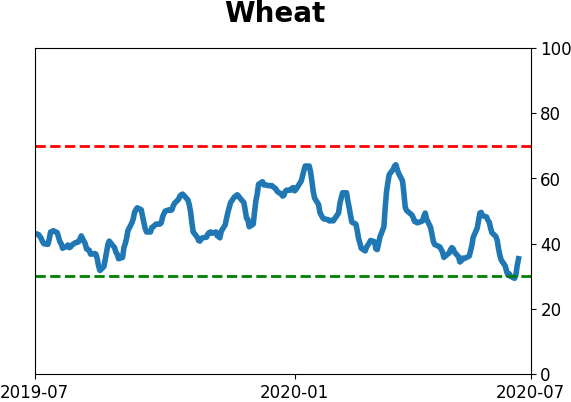

Optimism Index Thumbnails

|

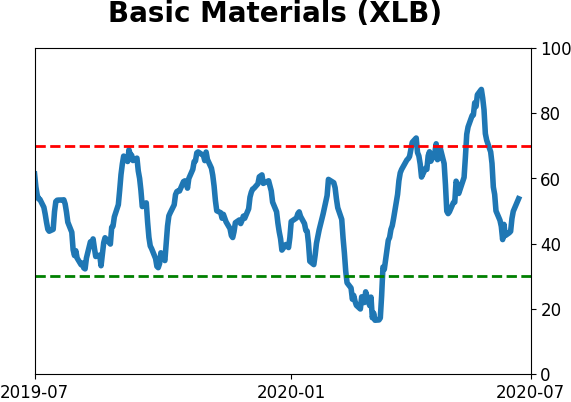

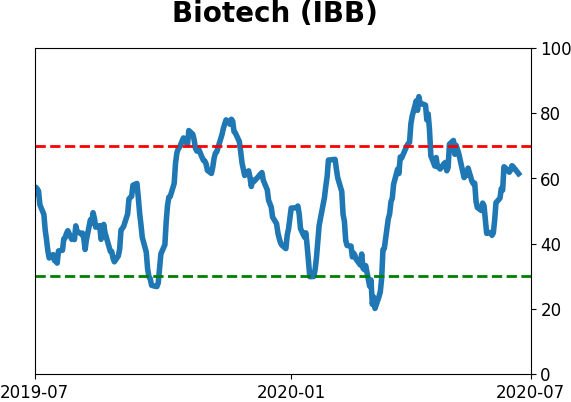

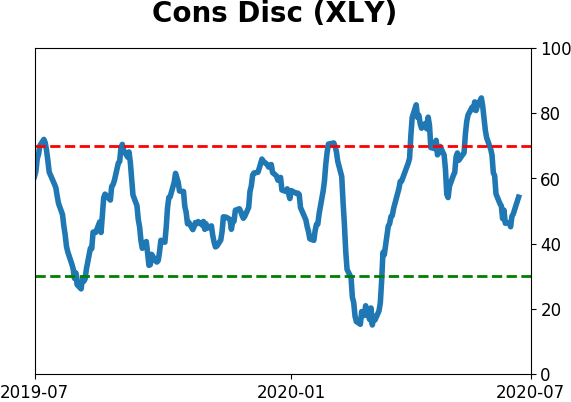

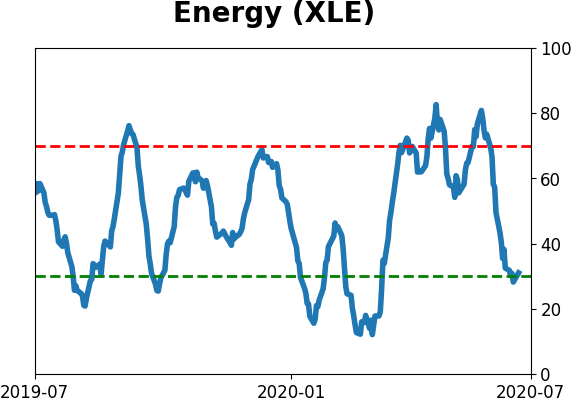

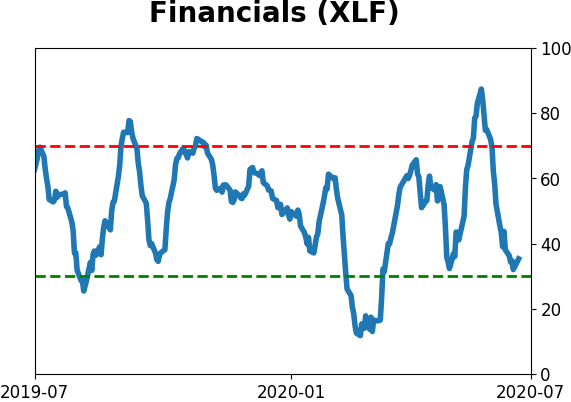

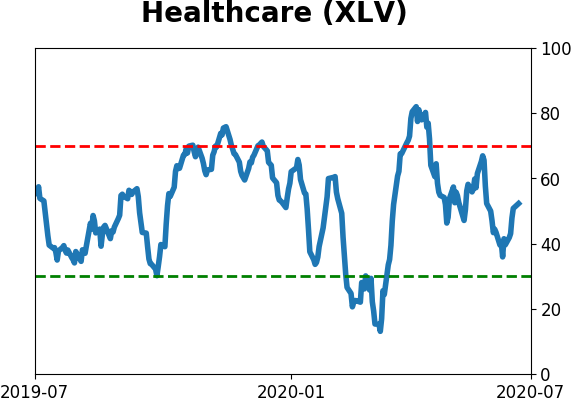

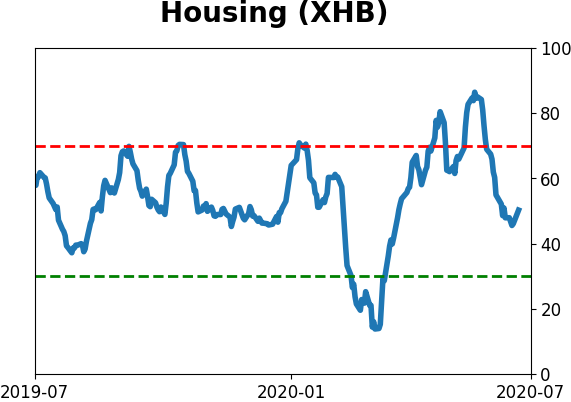

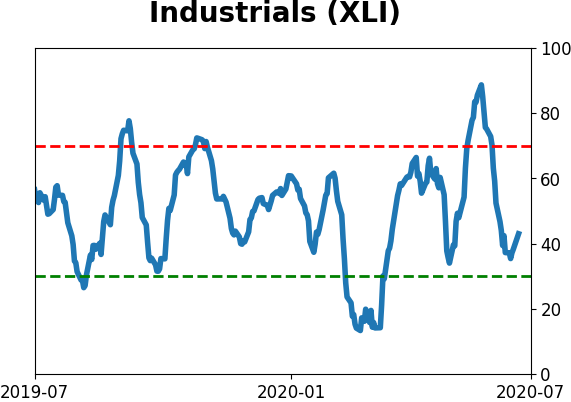

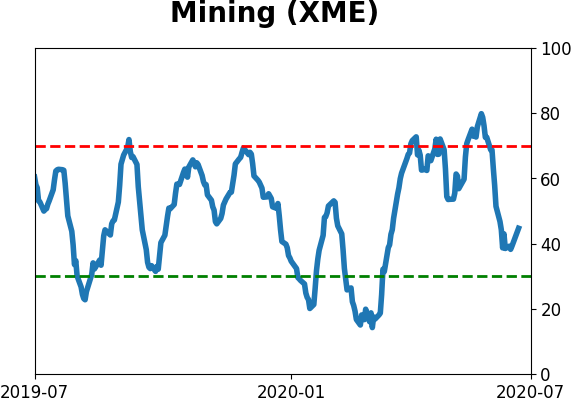

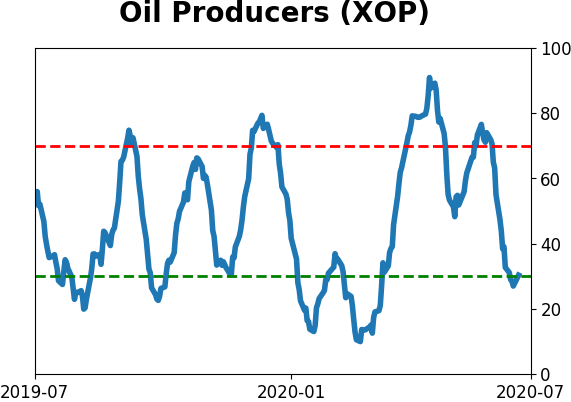

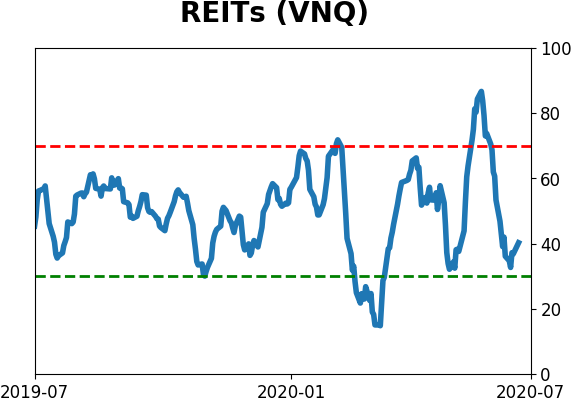

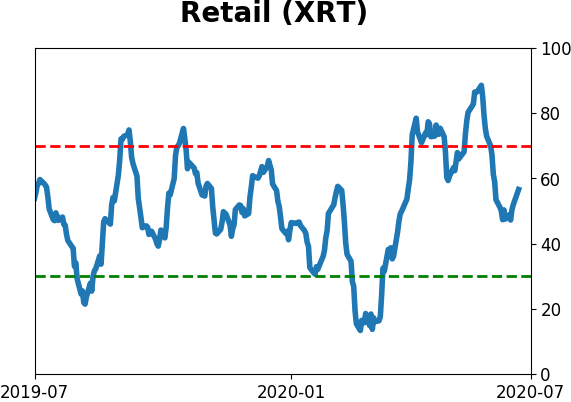

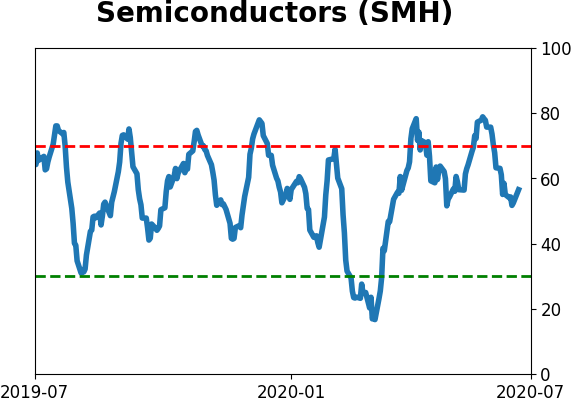

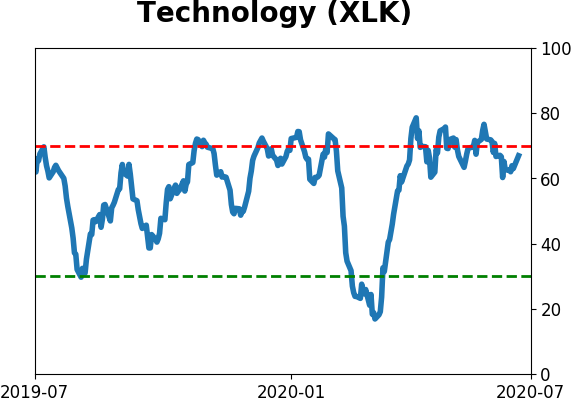

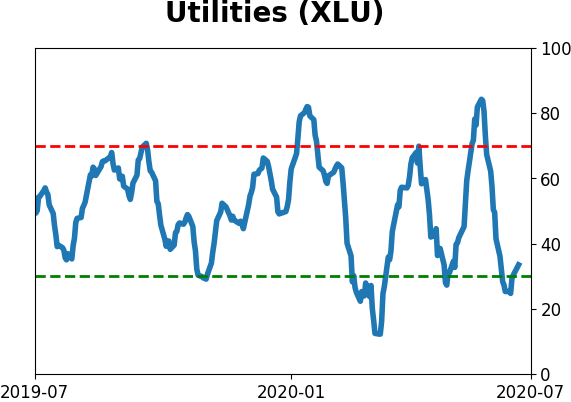

Sector ETF's - 10-Day Moving Average

|

|

|

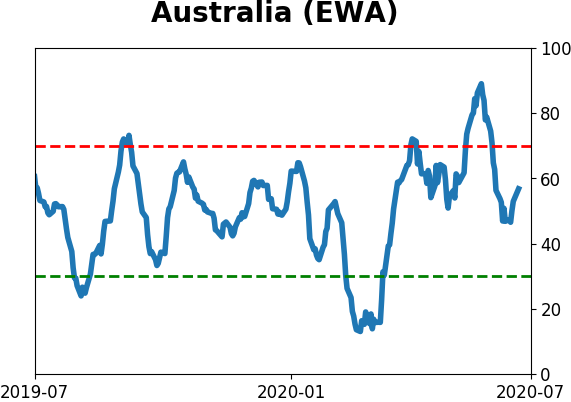

Country ETF's - 10-Day Moving Average

|

|

|

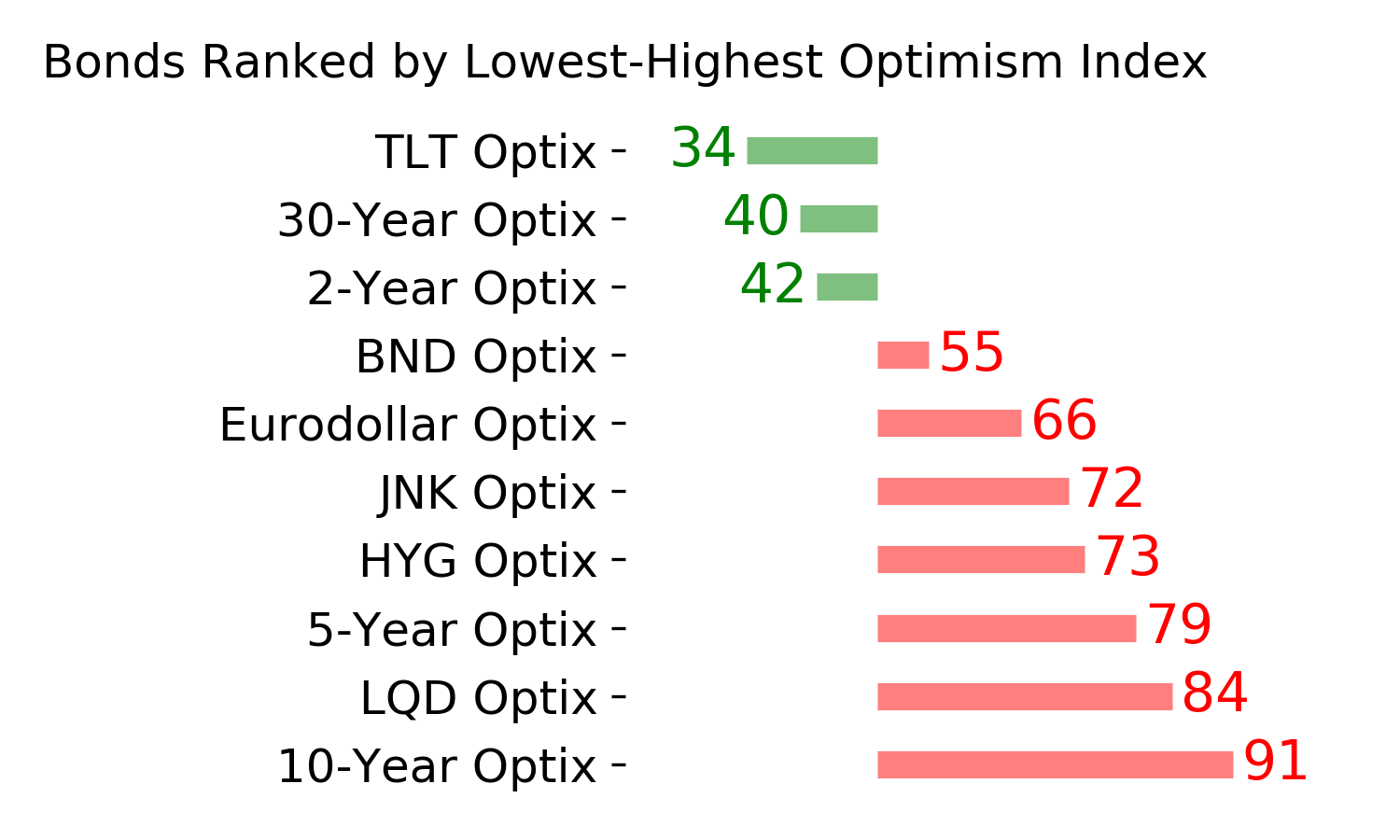

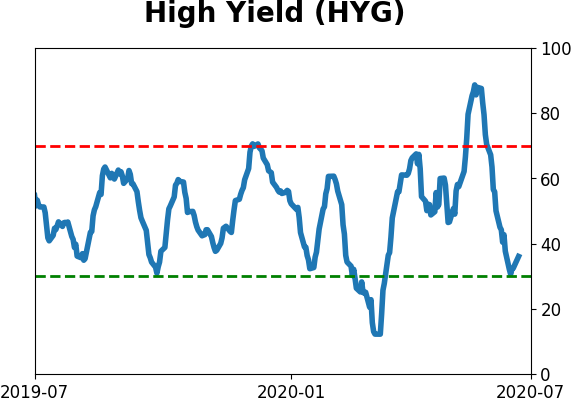

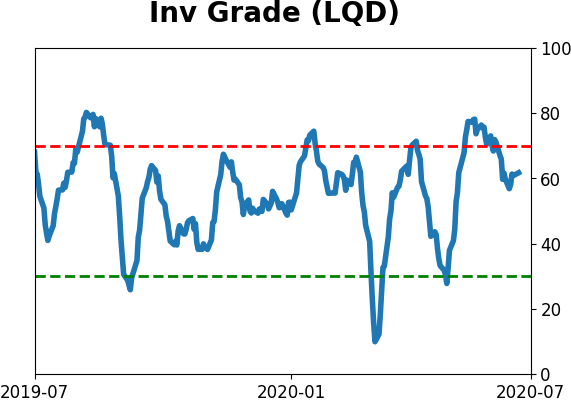

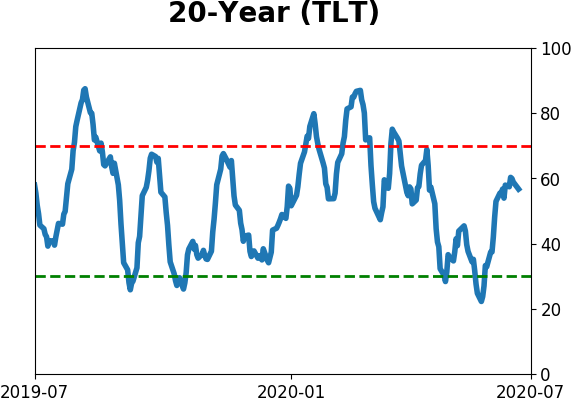

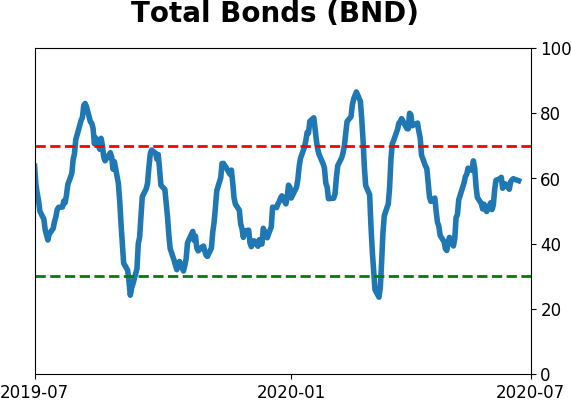

Bond ETF's - 10-Day Moving Average

|

|

|

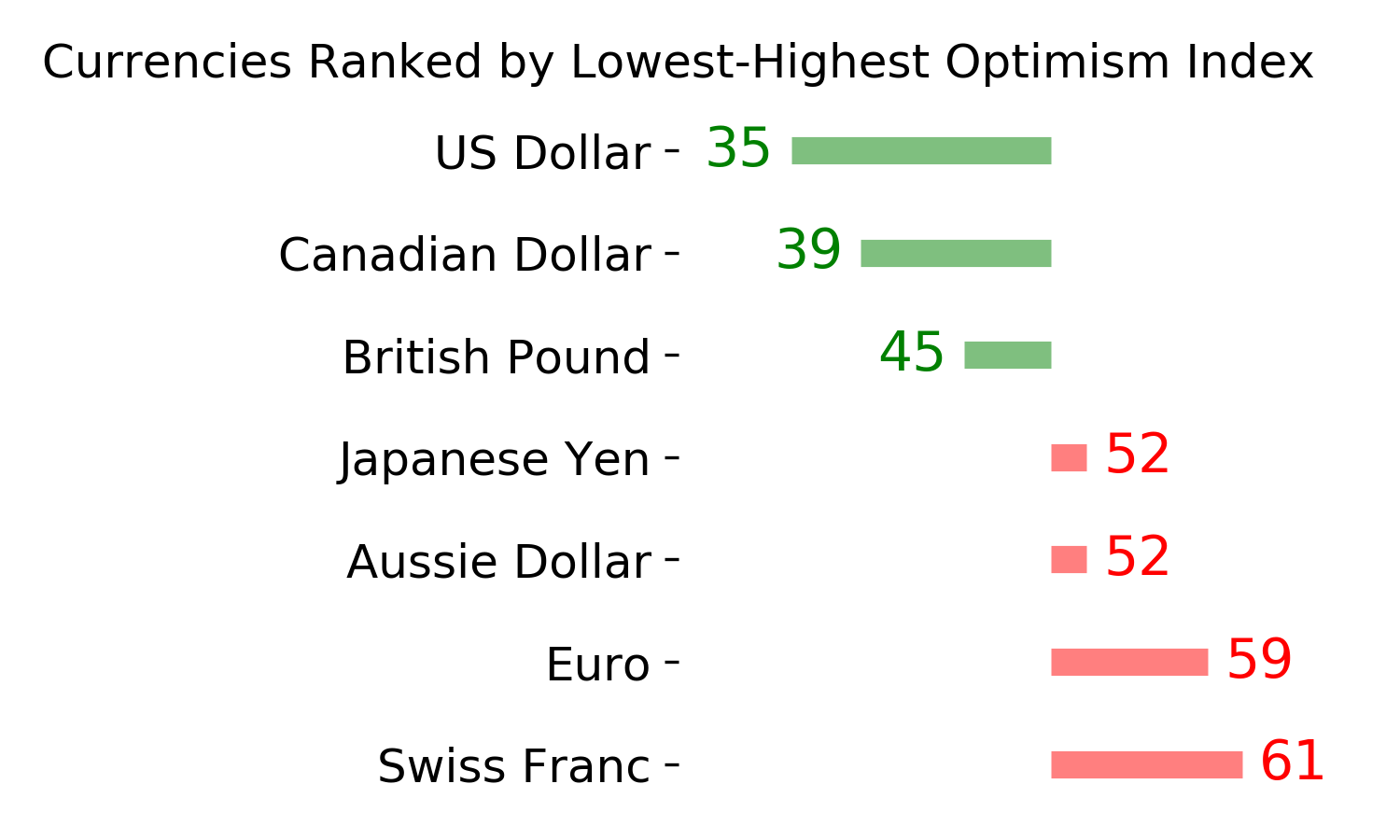

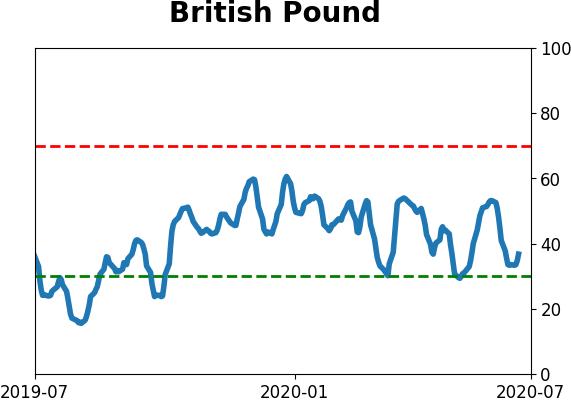

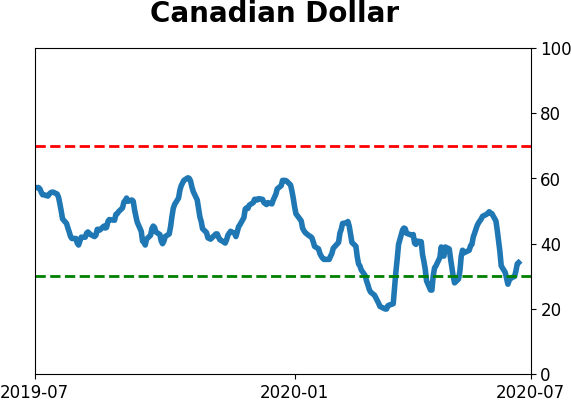

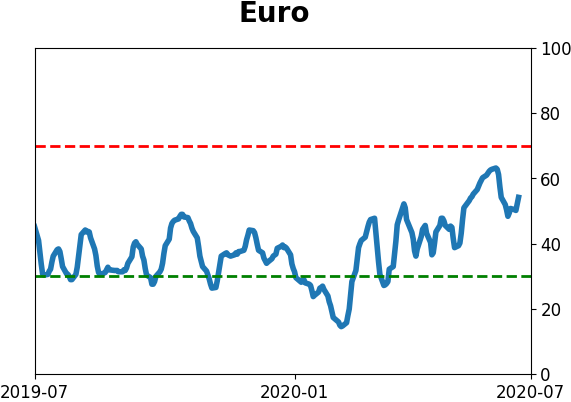

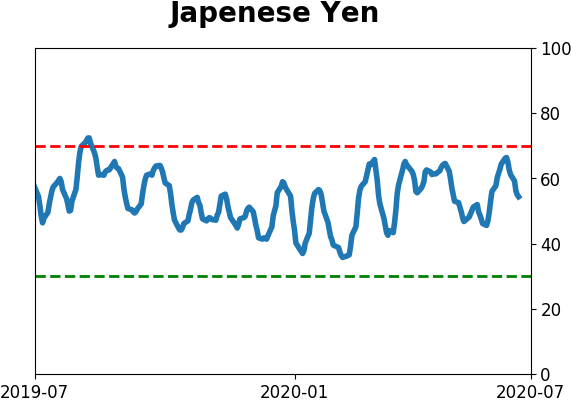

Currency ETF's - 5-Day Moving Average

|

|

|

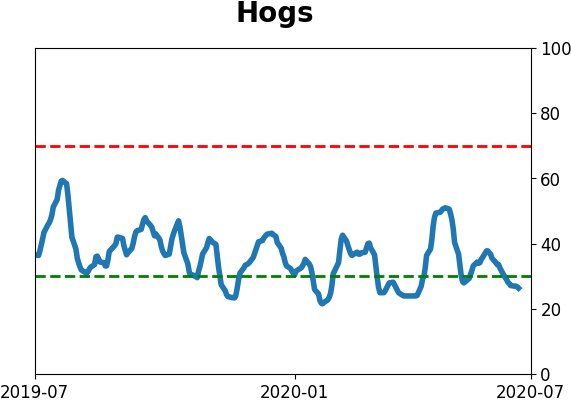

Commodity ETF's - 5-Day Moving Average

|

|