Headlines

|

|

And Away We Go...:

The ultimate goal of any investor or trader is to find the approach that allows them the opportunity to maximize their own tradeoff between reward and risk. My objective is to help you become the best investor you can be by developing a solid framework, helping focus on information that is relevant, and helping to expand your horizons.

No letup in leverage:

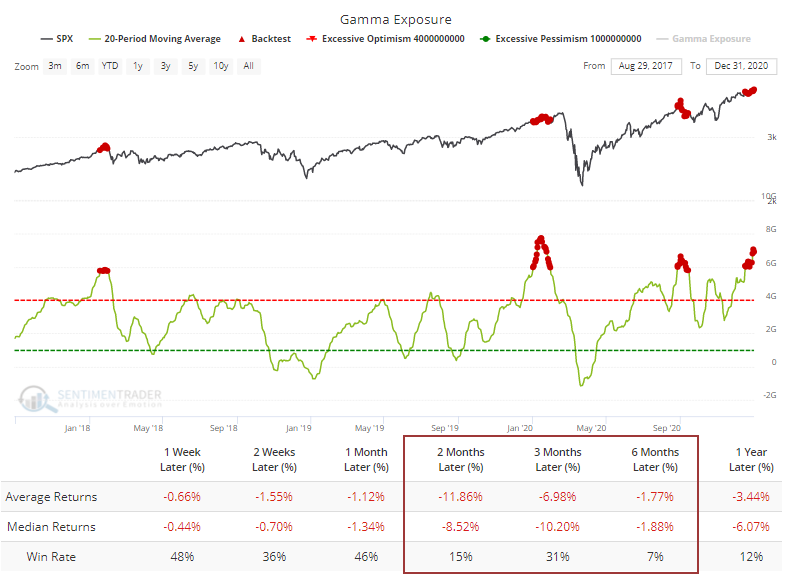

Options traders continue to press their bets, with the smallest among them accounting for about half of all speculative call buying volume and premiums spent. At the same time, Gamma Exposure has neared a record level, suggesting dangerous conditions.

Bottom Line:

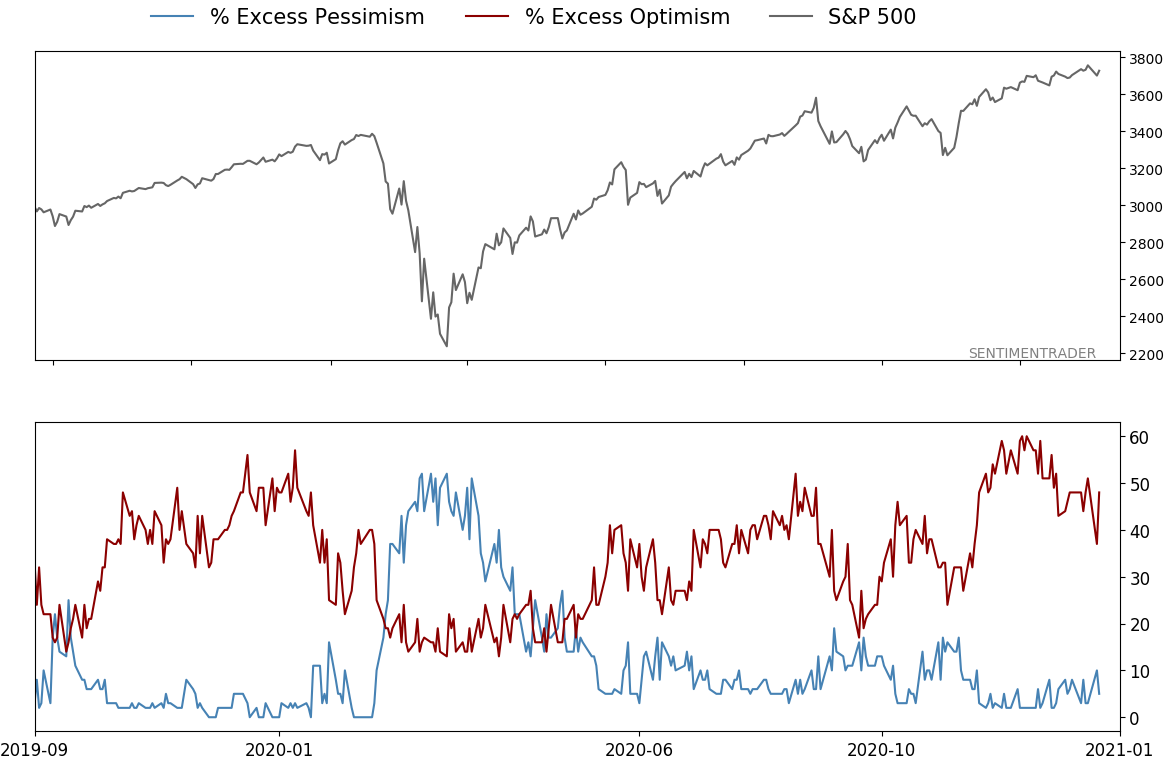

- The market environment is pristine, but with near-historic optimism, gains tend to be muted, with a high probability of being reversed at some point over the ensuing weeks.

|

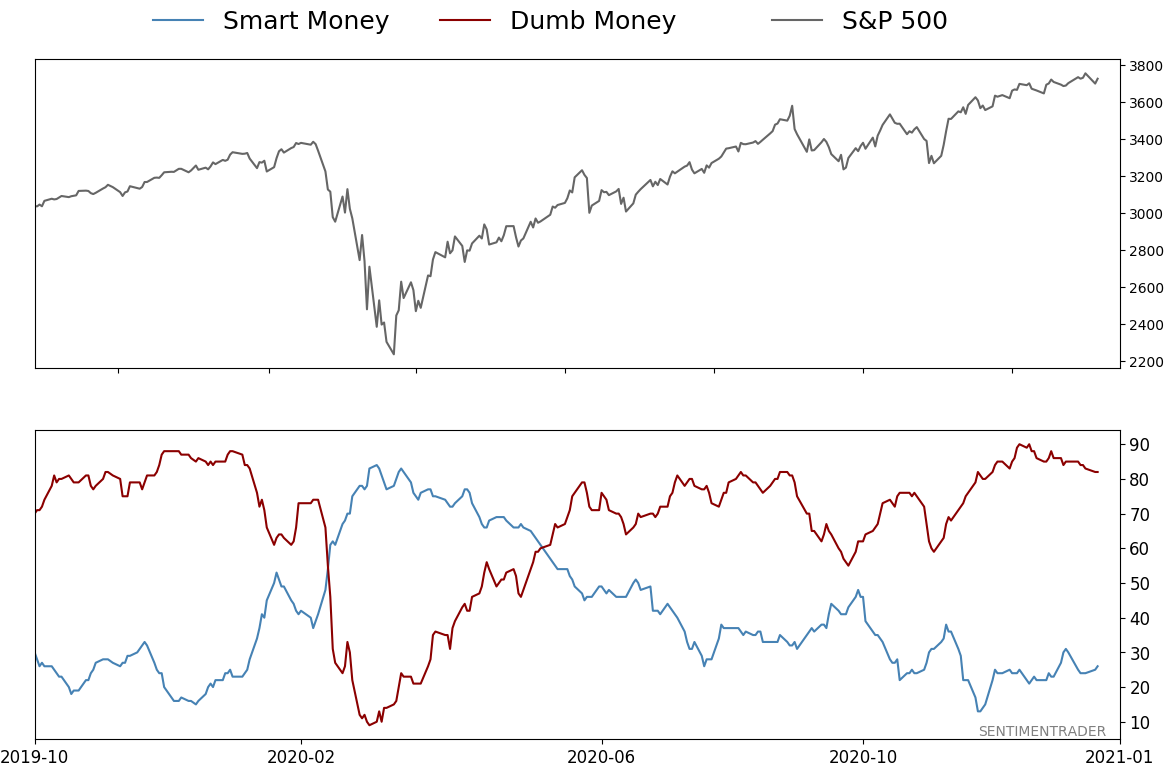

Smart / Dumb Money Confidence

|

Smart Money Confidence: 26%

Dumb Money Confidence: 82%

|

|

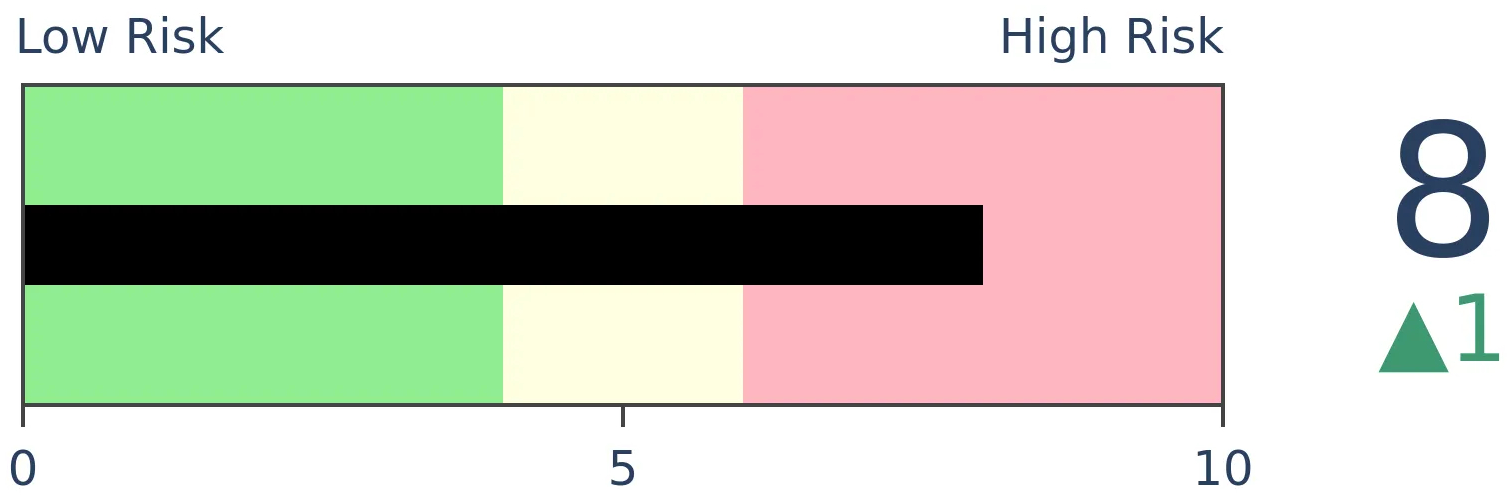

Risk Levels

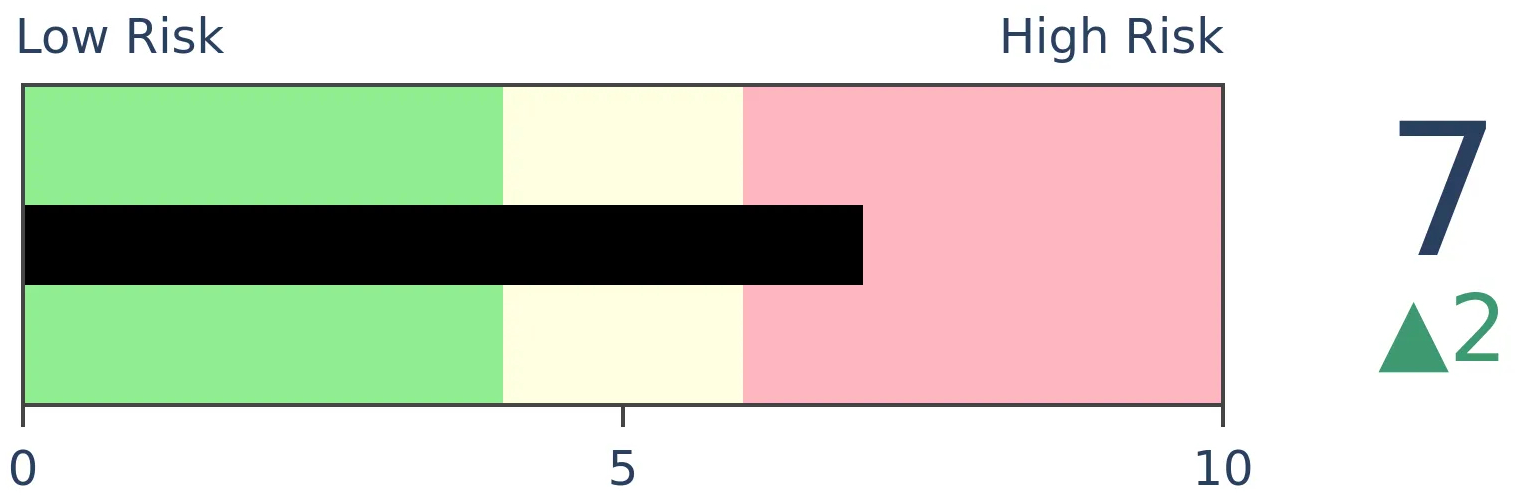

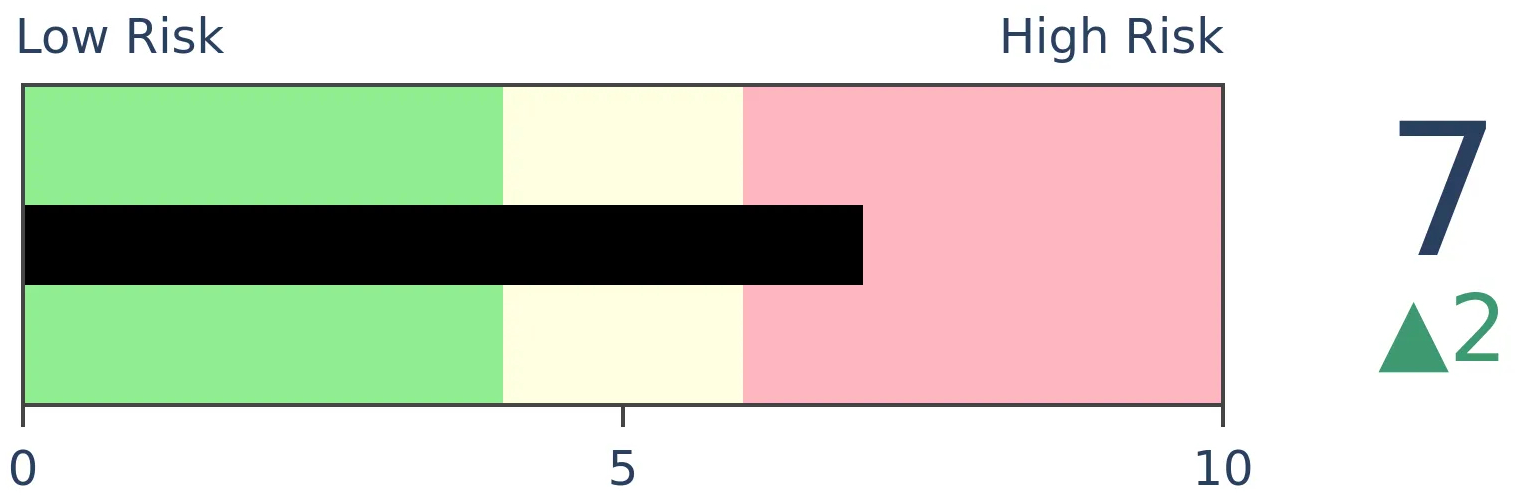

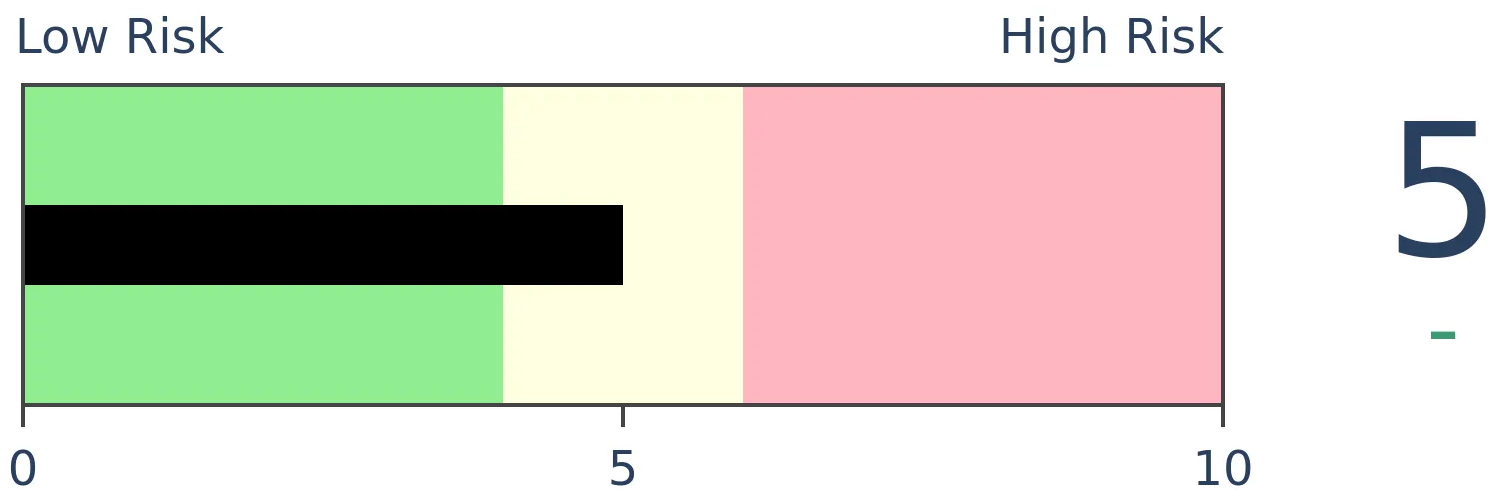

Stocks Short-Term

|

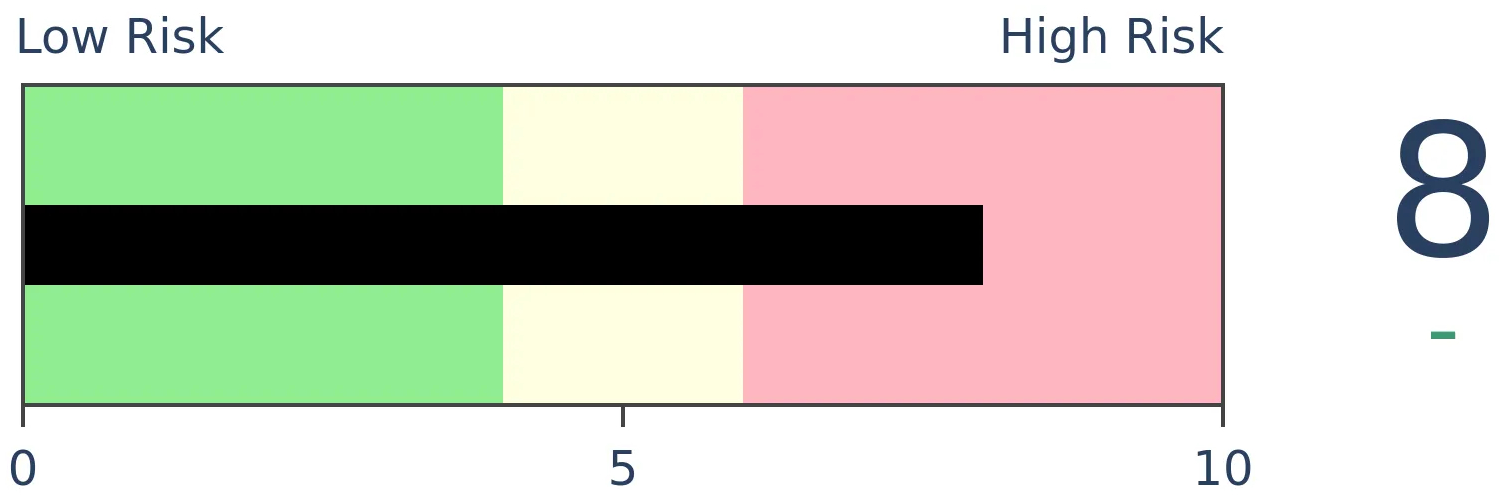

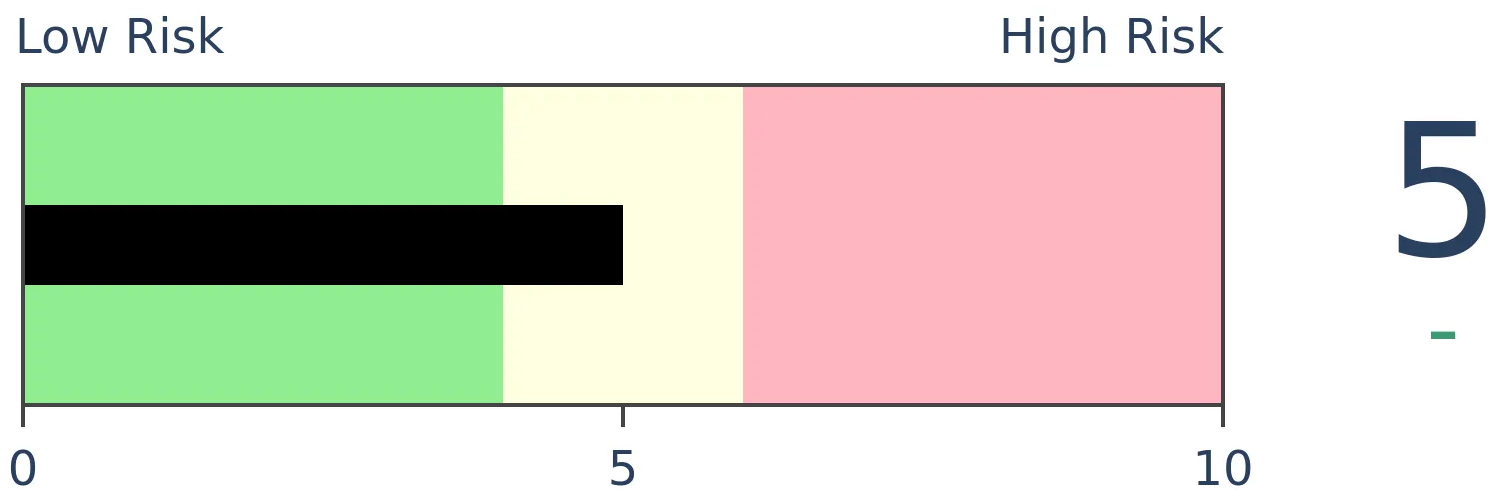

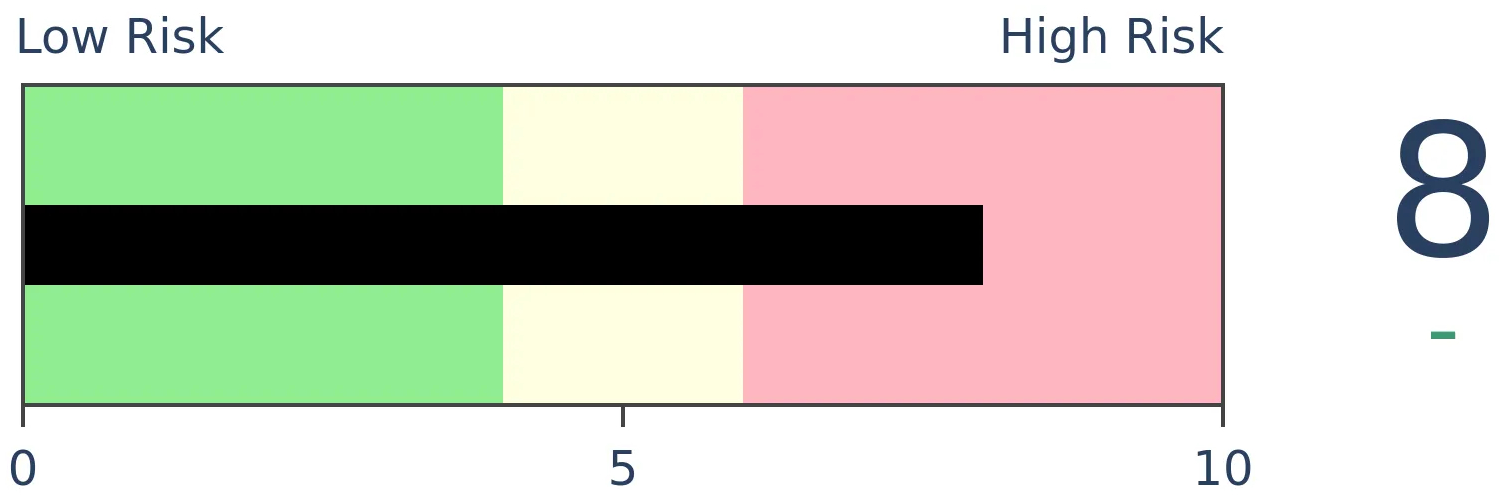

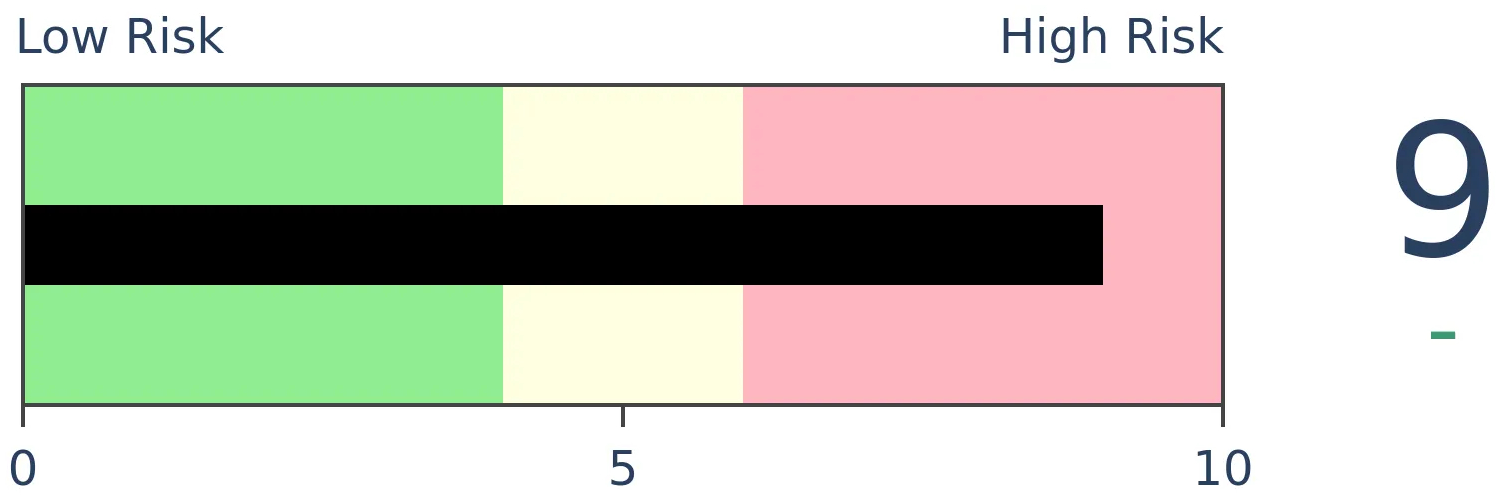

Stocks Medium-Term

|

|

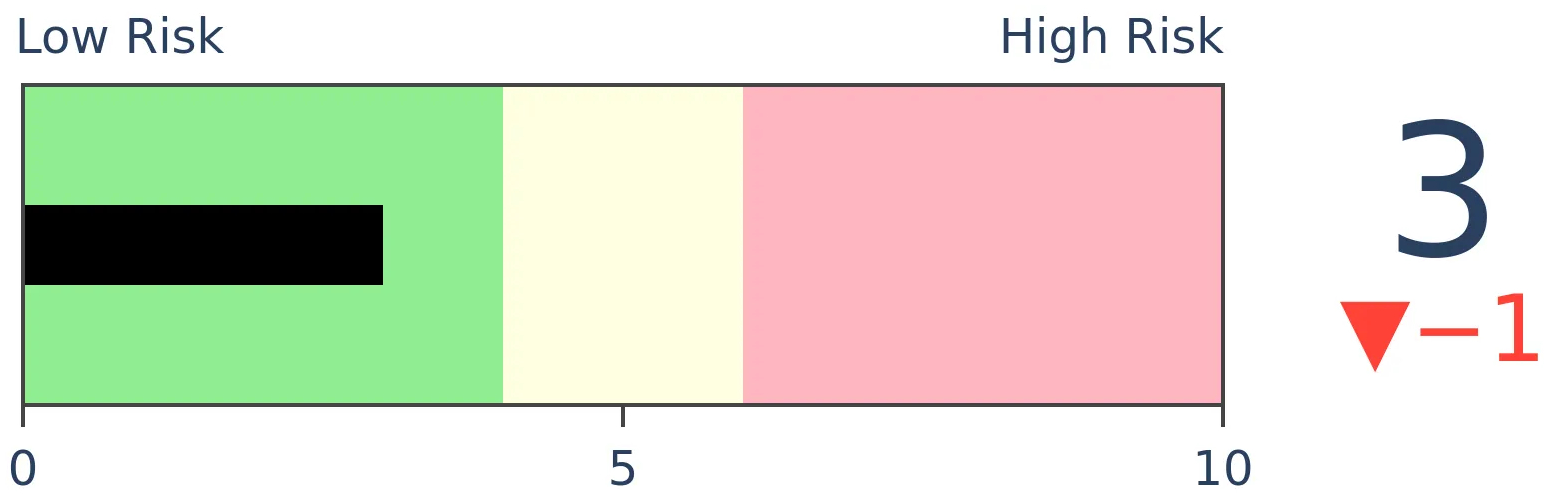

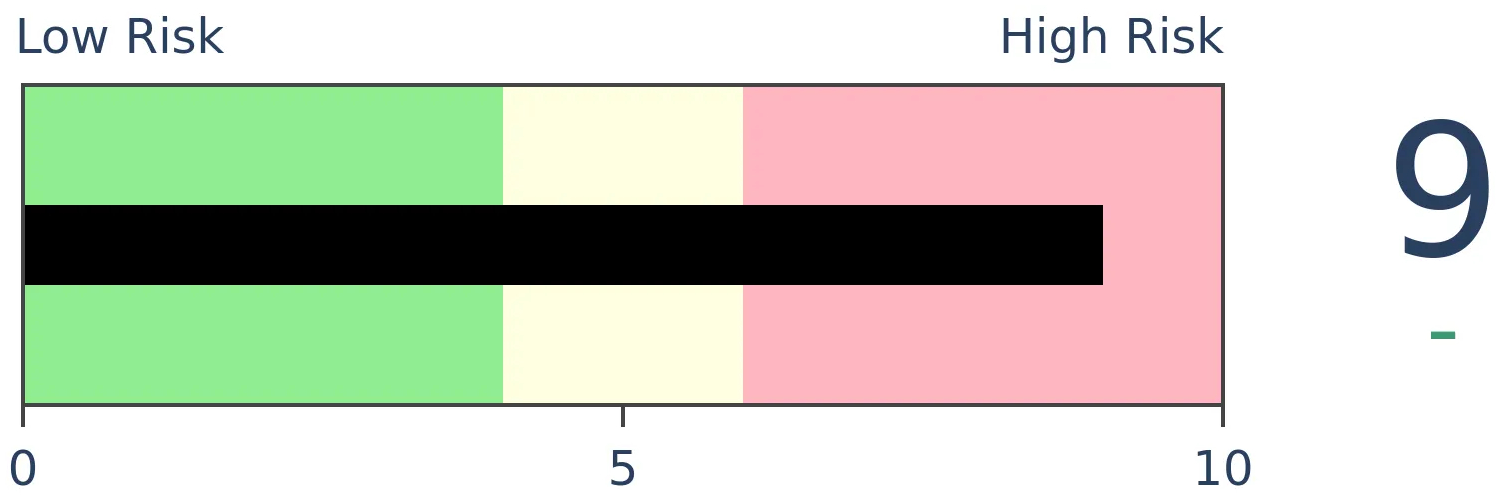

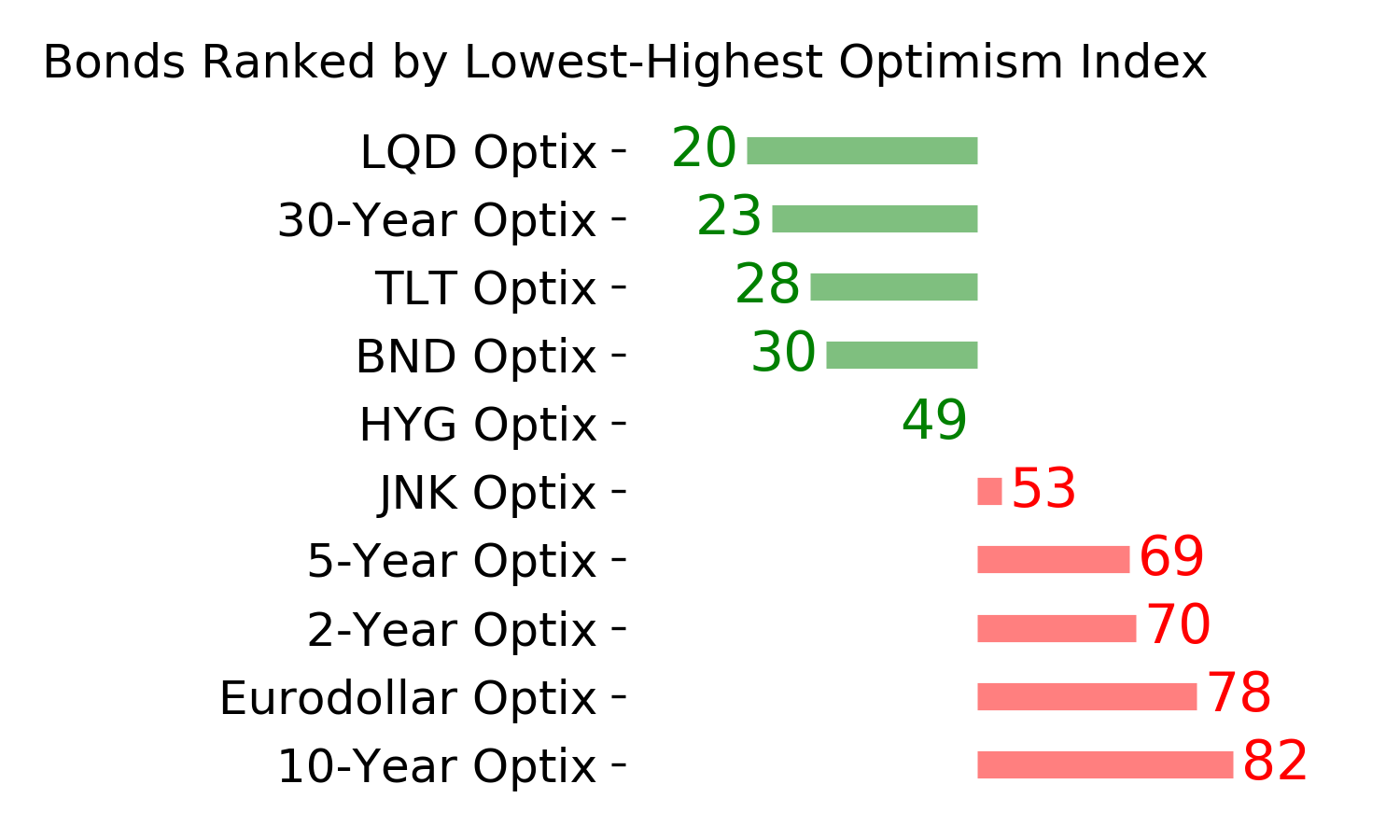

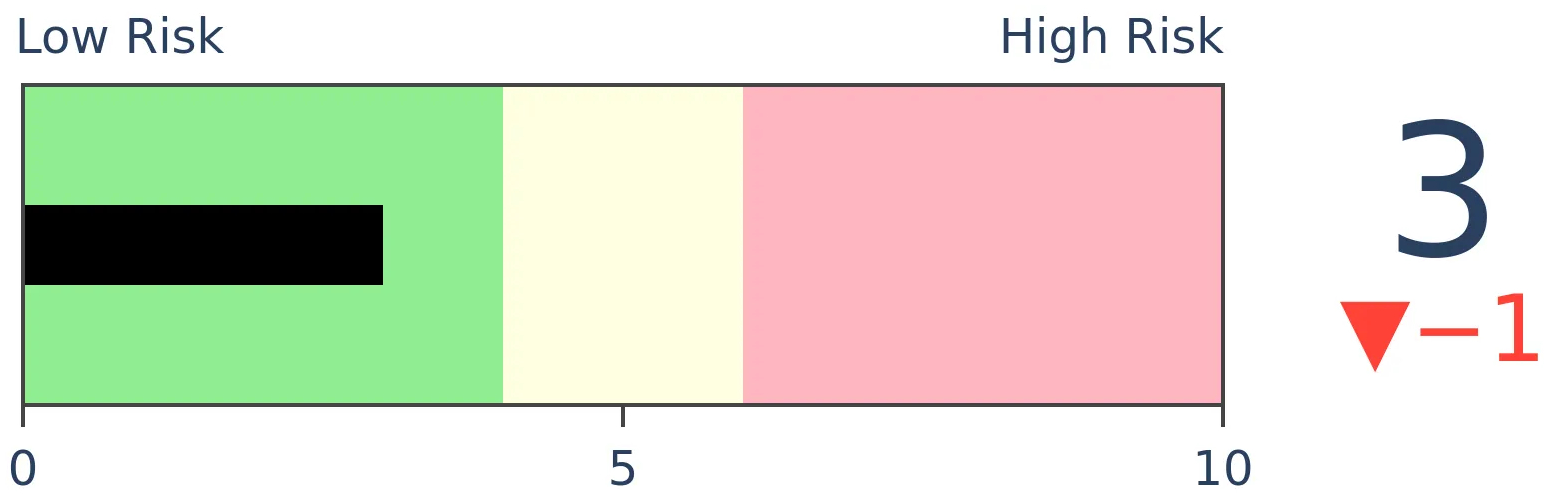

Bonds

|

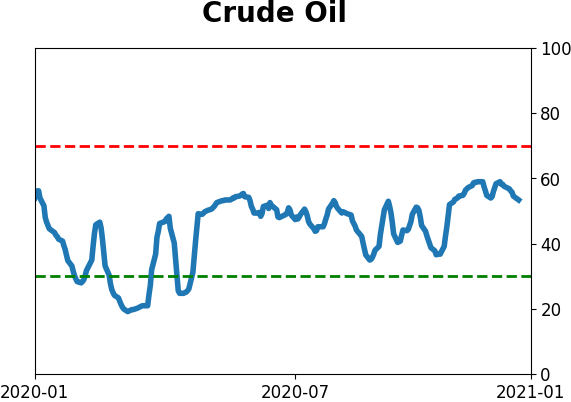

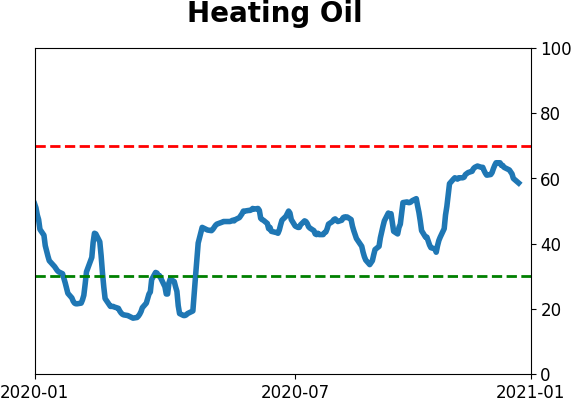

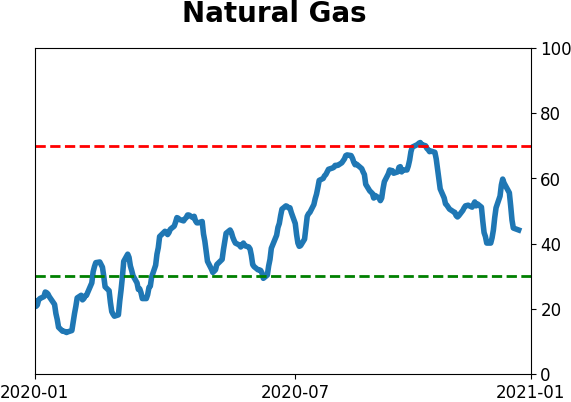

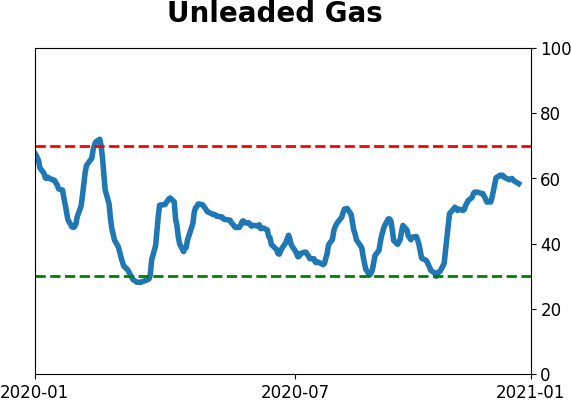

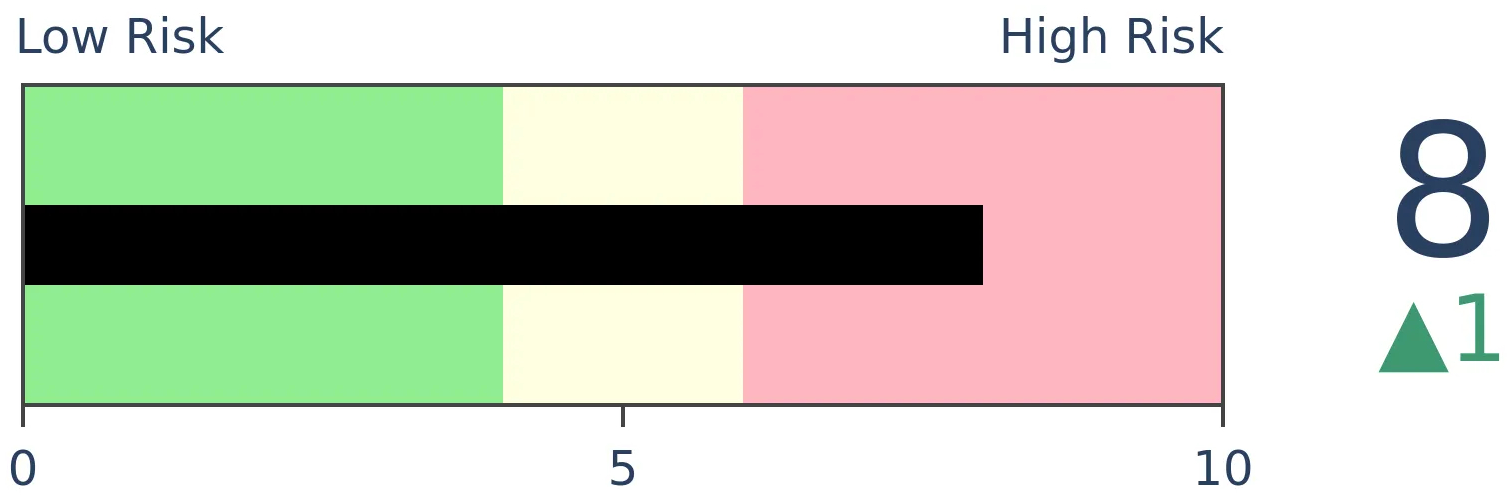

Crude Oil

|

|

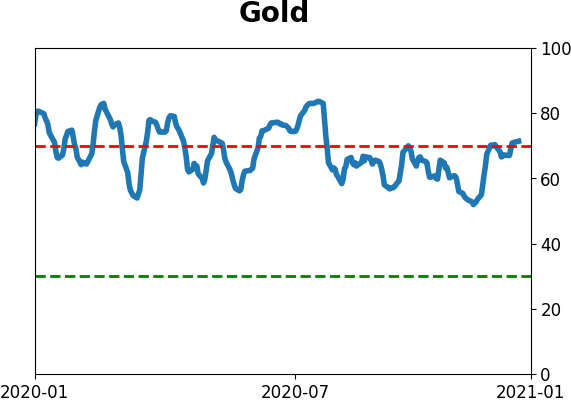

Gold

|

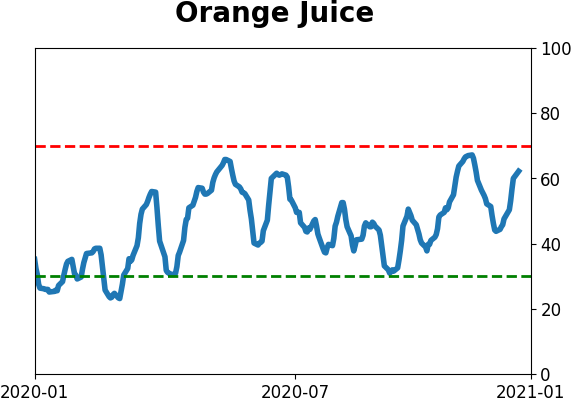

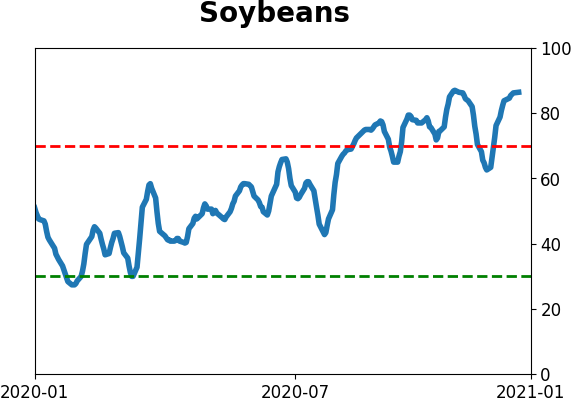

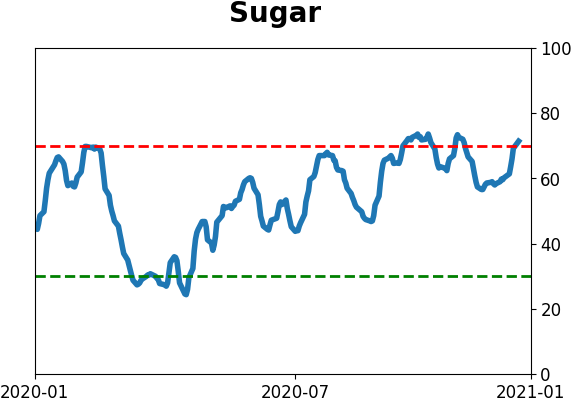

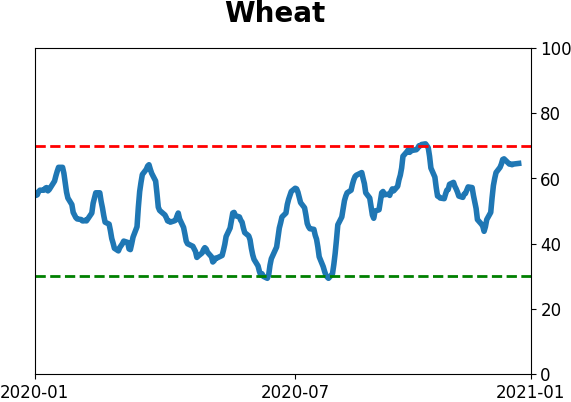

Agriculture

|

|

Research

BOTTOM LINE

The ultimate goal of any investor or trader is to find the approach that allows them the opportunity to maximize their own tradeoff between reward and risk. My objective is to help you become the best investor you can be by developing a solid framework, helping focus on information that is relevant, and helping to expand your horizons.

FORECAST / TIMEFRAME

None

|

Hi, my name is Jay Kaeppel and I am humbled and delighted to be joining Sentimentrader.com. Like you, I have been a fan, a follower, and a subscriber for a long time. When the opportunity to join the team arose, I jumped at the chance.

My purpose here is pretty straightforward. The primary objectives are to:

- Offer as much insight as I can muster on the topics of trading systems/strategies, seasonality, options trading and investing and trading in general;

- Help subscribers to get the most out of the vast array of information presented by and available at SentimenTrader

- Help subscribers to develop and focus their own ability to “think like a trader”

While we do not and will offer specific investment advice nor trading recommendations, I believe that teaching people how they can be more effective and efficient as traders themselves is far more useful than any random “tip” on the next “hot trade.”

This service enjoys a wide spectrum in terms of users – from beginners to veteran institutional traders. As such, there is certainly no such thing as one best way to approach investing or trading, so I will be moving in a variety of directions. Sometimes the things I write about may be geared to those who are new or relatively new to trading; other times we will get “down in the weeds” to talk more in-depth about specific advanced concepts.

The ultimate goal of any investor or trader is to find the approach that allows them the opportunity to maximize their own tradeoff between reward and risk - and whether or not that approach works for someone else is not relevant. For most individuals, this process involves first taking in as much information as possible, then eliminating various ideas as you go and narrowing them down to those that work for you. From there it is to your benefit to:

- Focus on your strategy (or strategies) and ignore the noise, while also…

- Continuing to consider new ideas that might enhance their current methodology…

- Without getting bogged down by the aforementioned noise

A delicate balancing act indeed, which explains why not everyone achieves great long-term success.

So, in a nutshell, my objective is to help you become the best trader/investor you can be by:

- Informing and reminding you of the need for – and what is involved in developing and maintaining - a solid trading framework

- Helping you to focus on information that is relevant and useful to your own approach

- Helping you to expand your horizons by introducing new ideas that you might not ever come up with on your own

The only thing I ask of you is to approach each piece with an open mind. Deciding which kernel of new information to allow into your “investor/trader realm” is one of the great challenges we all face. Some ideas can seem foreign or almost ludicrous at first blush. But the important thing is to filter each new idea carefully through your own mind before deciding whether it stays or goes, rather than lightly dismissing new ideas out of hand. Because you never know for sure what tidbit of information will be the one to take your investing/trading to the next level. One of my favorite sayings is, “Opportunity is where you find it.”

I intend to offer you the best of my years of experience as a programmer/trading system developer, commodity trading advisor, trading seminar developer/ instructor, futures, stock, options and ETF trader, and financial author to help you take your experience here to the next level.

And away we go…

BOTTOM LINE

Options traders continue to press their bets, with the smallest among them accounting for about half of all speculative call buying volume and premiums spent. At the same time, Gamma Exposure has neared a record level, suggesting dangerous conditions.

FORECAST / TIMEFRAME

None

|

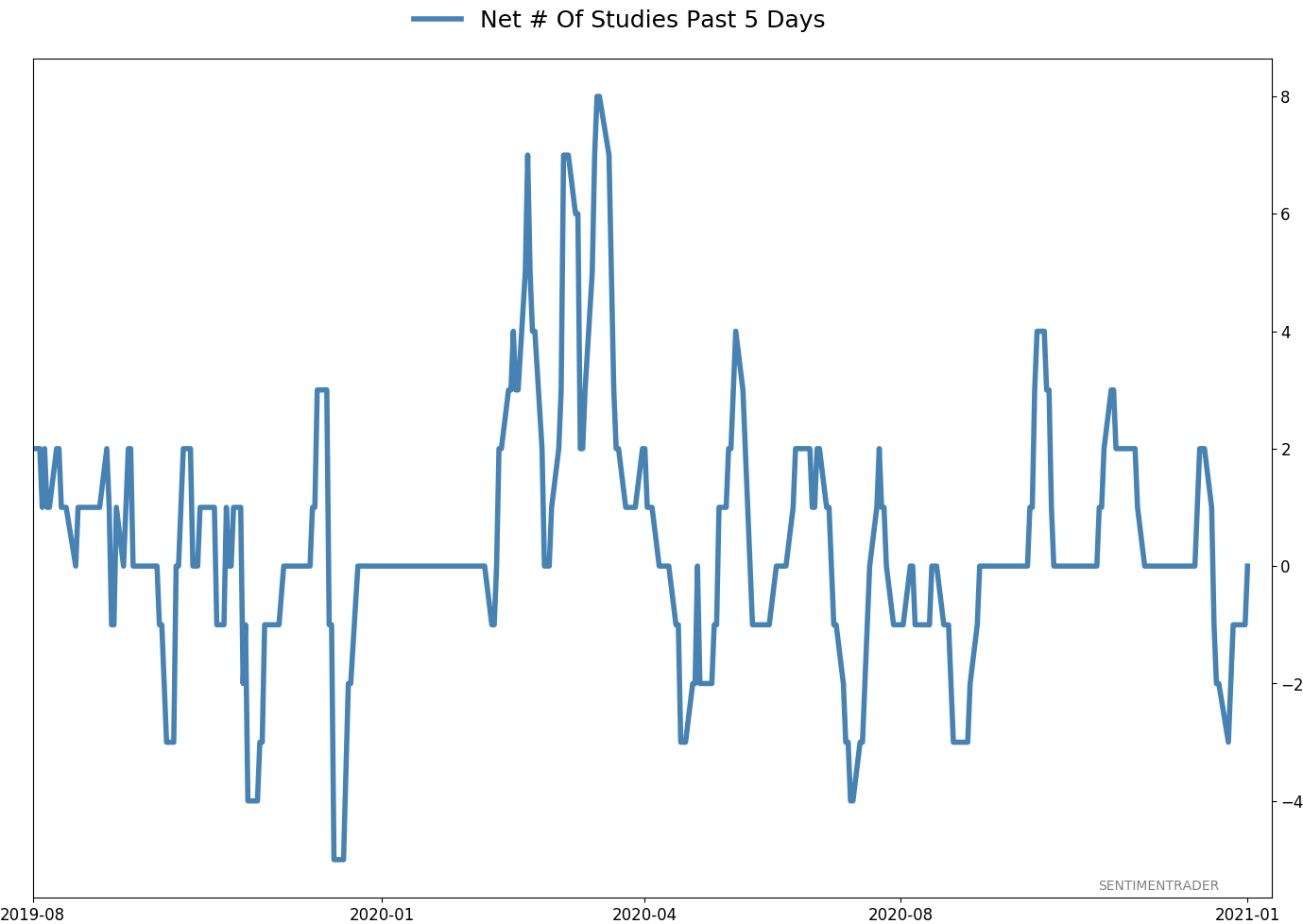

Despite a hefty loss in stocks on Monday, options traders not only focused 2-to-1 on equity call options, they actually increased their pace from where they left off last week. It seems like it's going to take more of a wallop to let air out of that balloon.

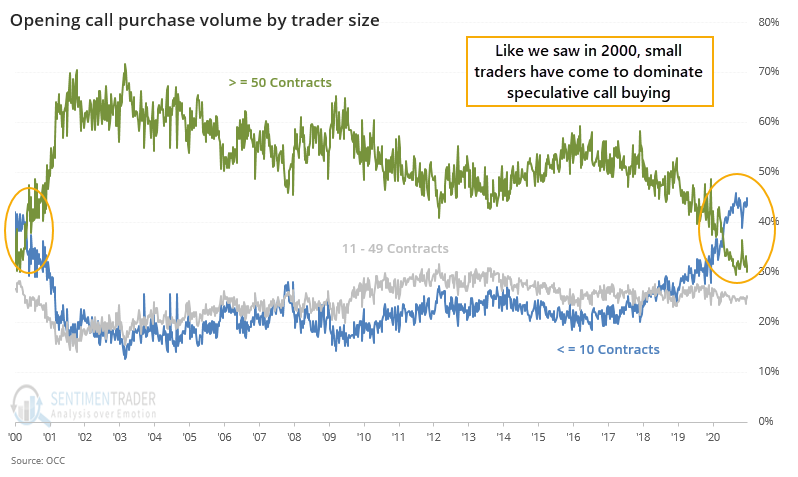

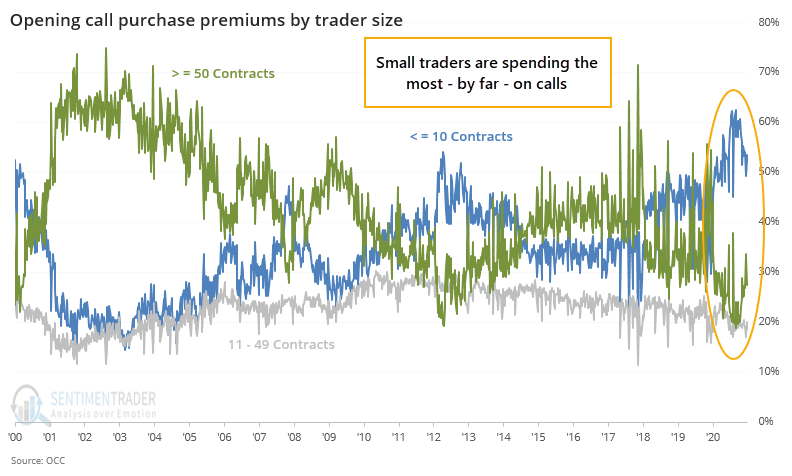

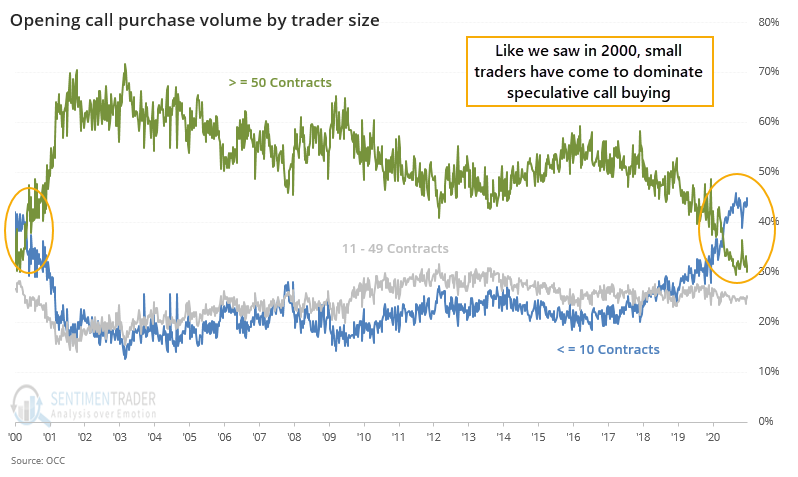

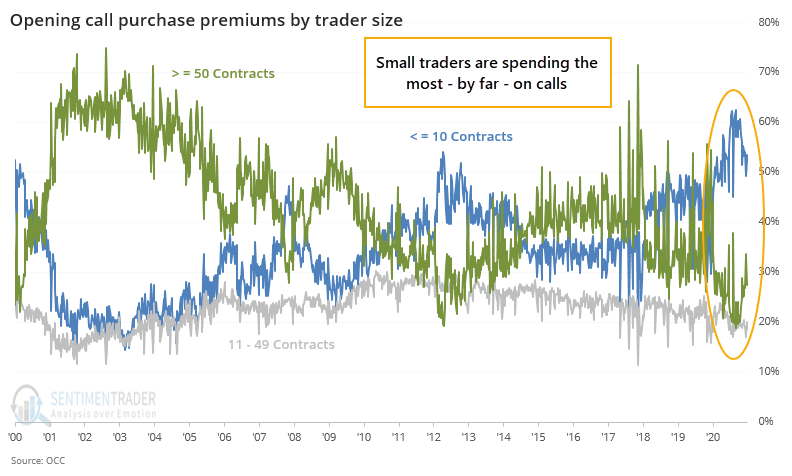

In June, we started to discuss the ramp higher in options trading, especially among the smallest of traders, and especially especially in the focus on speculative strategies. It reached a fever pitch near the end of August and into early September, settled back some as losses accrued, then came back in force during December.

Their enthusiasm didn't let up as they closed out the year. To end last week, the smallest of traders accounted for 45% of all opening call purchases, dwarfing the largest traders who accounted for only 30% of volume. That's the 2nd-widest spread since 2000, barely exceeded by the last week in August through the first week in September.

When it comes to the amount of money spent on those options, it's an even starker difference. The smallest of traders accounted for 54% of all call opening premiums spent, versus only 28% for the largest traders. This is not quite as extreme as it was in late August and early September when options were more expensive, but it still exceeds anything we've seen before.

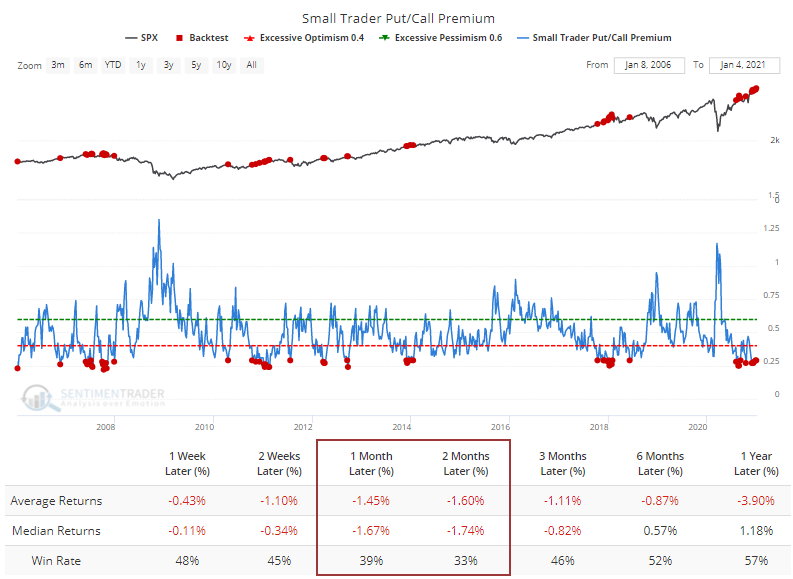

During the last week of December, the smallest of traders spent nearly $3.50 buying call options to open for every $1 in puts they bought. The Backtest Engine shows the results of other times they were so confident. That 1-2 month time frame was unkind.

Dealers often take the other side of these trades, and according to Squeezemetrics, they're heavily positioned to sell underlying stock on any meaningful move higher. The 20-day average of Gamma Exposure has neared a record high. Other times it approached these levels, forward returns were horrid.

Options market data has been troubling for a while, and while stocks have levitated, the danger hasn't gone away. By the looks of things, it's gotten even worse. The most reliable sentiment measures tend to be those that focus on real money and leveraged instruments. That's when emotion has the greatest impact. When we look at some of the most leveraged vehicles available to investors, there is widespread evidence of extreme speculation. It would be awfully rare for markets to accommodate that with gains.

Active Studies

| Time Frame | Bullish | Bearish | | Short-Term | 0 | 0 | | Medium-Term | 2 | 1 | | Long-Term | 14 | 2 |

|

Indicators at Extremes

Portfolio

| Position | Description | Weight % | Added / Reduced | Date | | Stocks | 10.6% VWO, 10.1% XLE, 8.5% RSP, 8.3% PSCE | 37.5 | Added 3% | 2021-01-05 | | Bonds | 10% BND, 10% SCHP, 10% ANGL | 27.8 | Reduced 0.1% | 2020-10-02 | | Commodities | GCC | 2.3 | Reduced 2.1%

| 2020-09-04 | | Precious Metals | GDX | 9.8 | Added 4.8% | 2020-12-01 | | Special Situations | | 0.0 | Reduced 5% | 2020-10-02 | | Cash | | 22.6 | | |

|

Updates (Changes made today are underlined)

There hasn't been much that changed in recent weeks, with sky-high sentiment on many measures receding a bit, but that's not necessarily a good sign, just ask February 2020. We still have the lingering positives from all the breadth thrust last year, as late as October and November. Those have a very good historical record at preceding higher prices over a longer time frame. Of more immediate concern is the explosion in speculation in the most leveraged parts of the market. So far, that hasn't translated to price troubles, though there have been more oddities n the latter half of December than we'd seen since August, like the major indexes rising but on very poor breadth. I continue to avoid tech- and cap-heavy indexes, and don't see that changing any time soon. Energy stocks are doing what they should, and I added a bit more there. I'm not a momentum trader and do not focus on pyramiding positions in this account - it's more about protecting capital - but I like the setup on a long-term time frame. RETURN YTD: 2.1% 2020: 8.1%, 2019: 12.6%, 2018: 0.6%, 2017: 3.8%, 2016: 17.1%, 2015: 9.2%, 2014: 14.5%, 2013: 2.2%, 2012: 10.8%, 2011: 16.5%, 2010: 15.3%, 2009: 23.9%, 2008: 16.2%, 2007: 7.8%

|

|

Phase Table

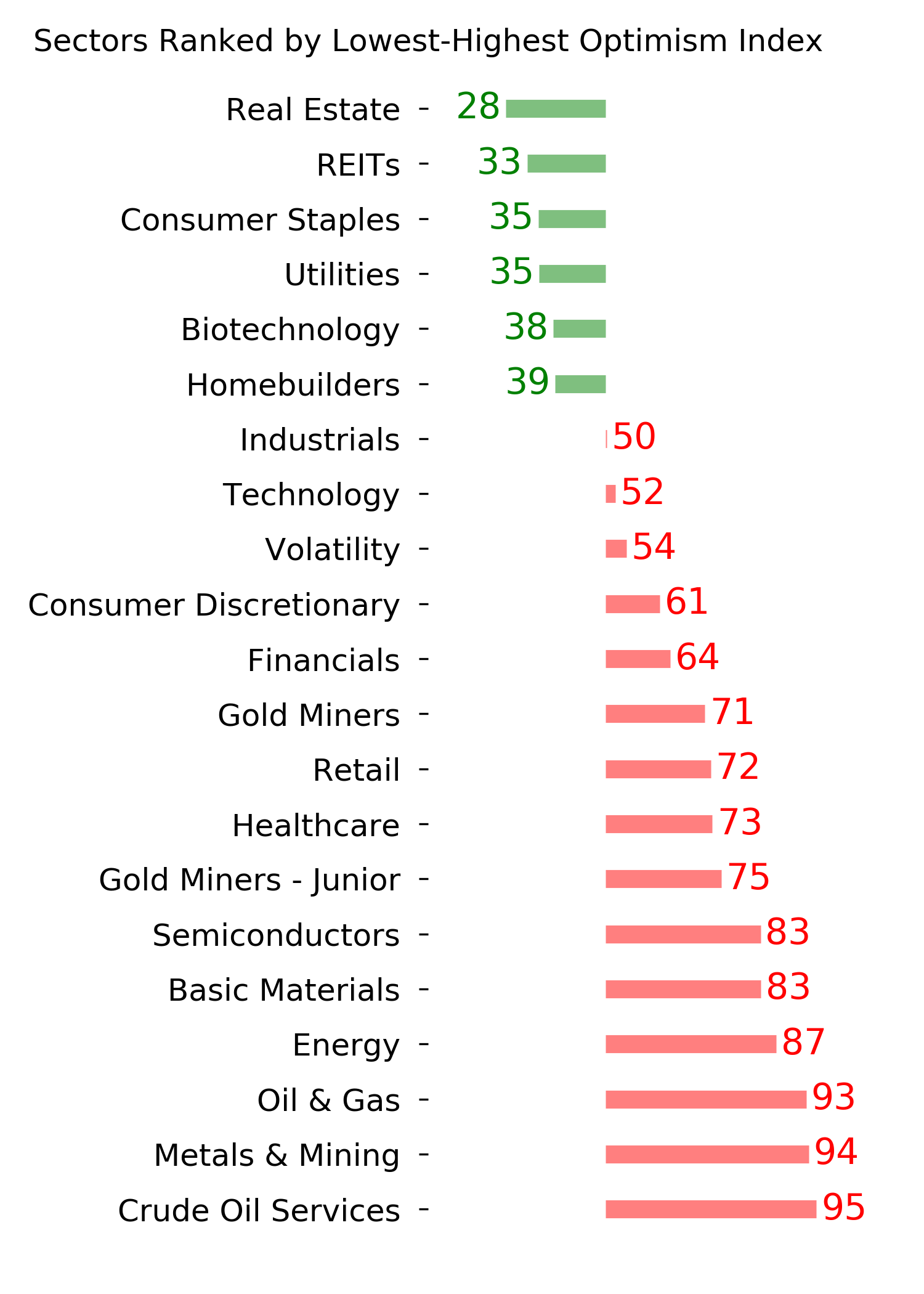

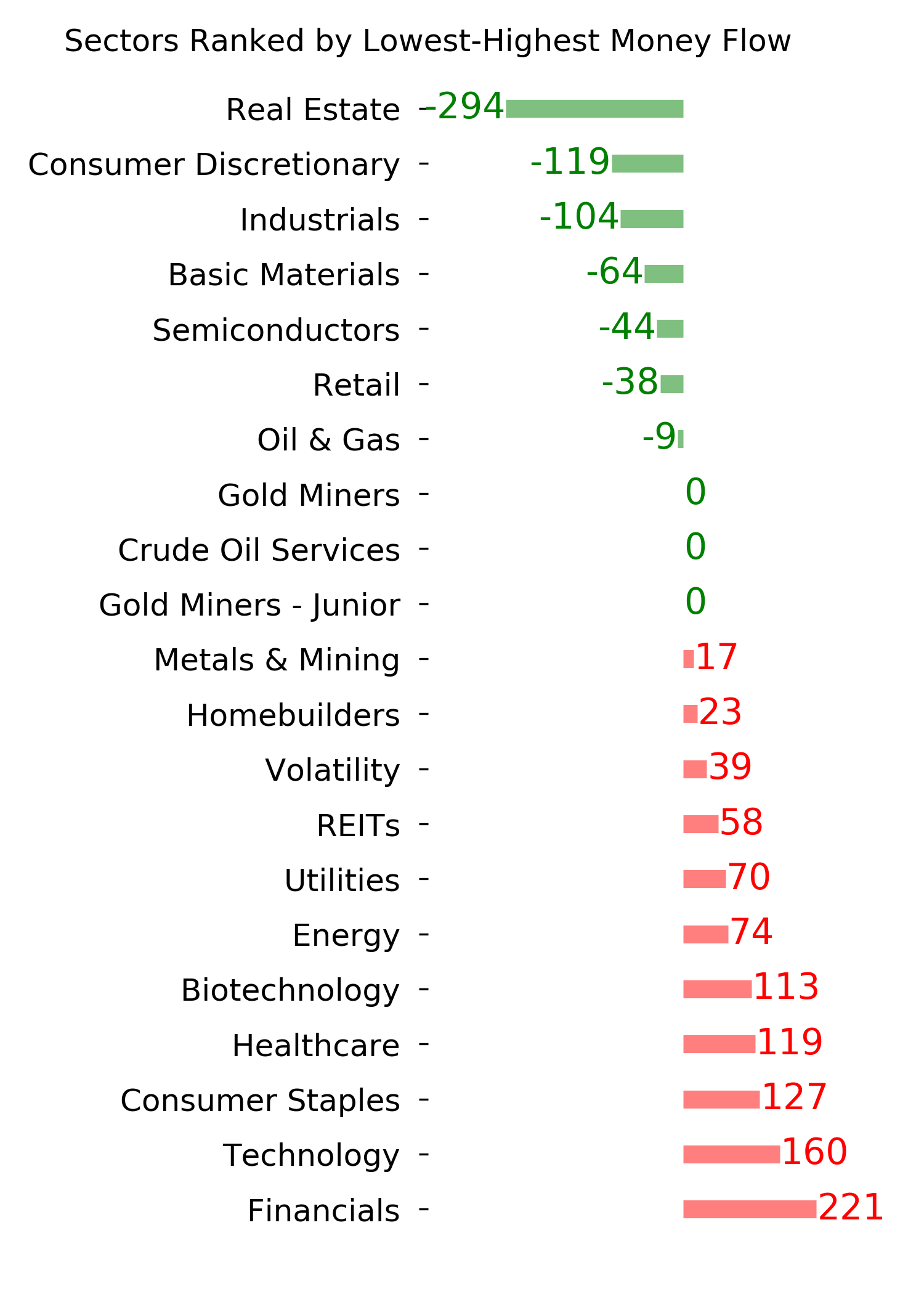

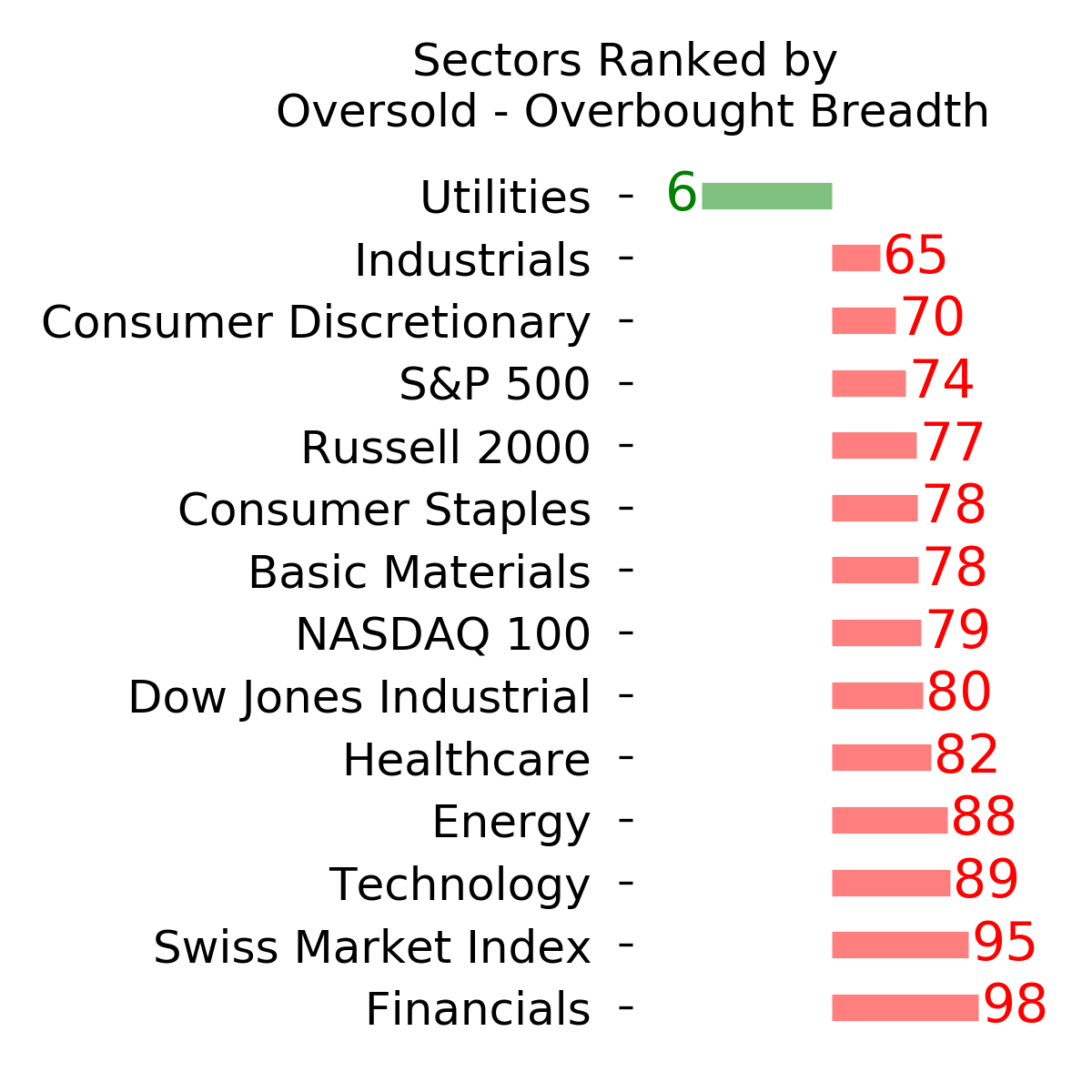

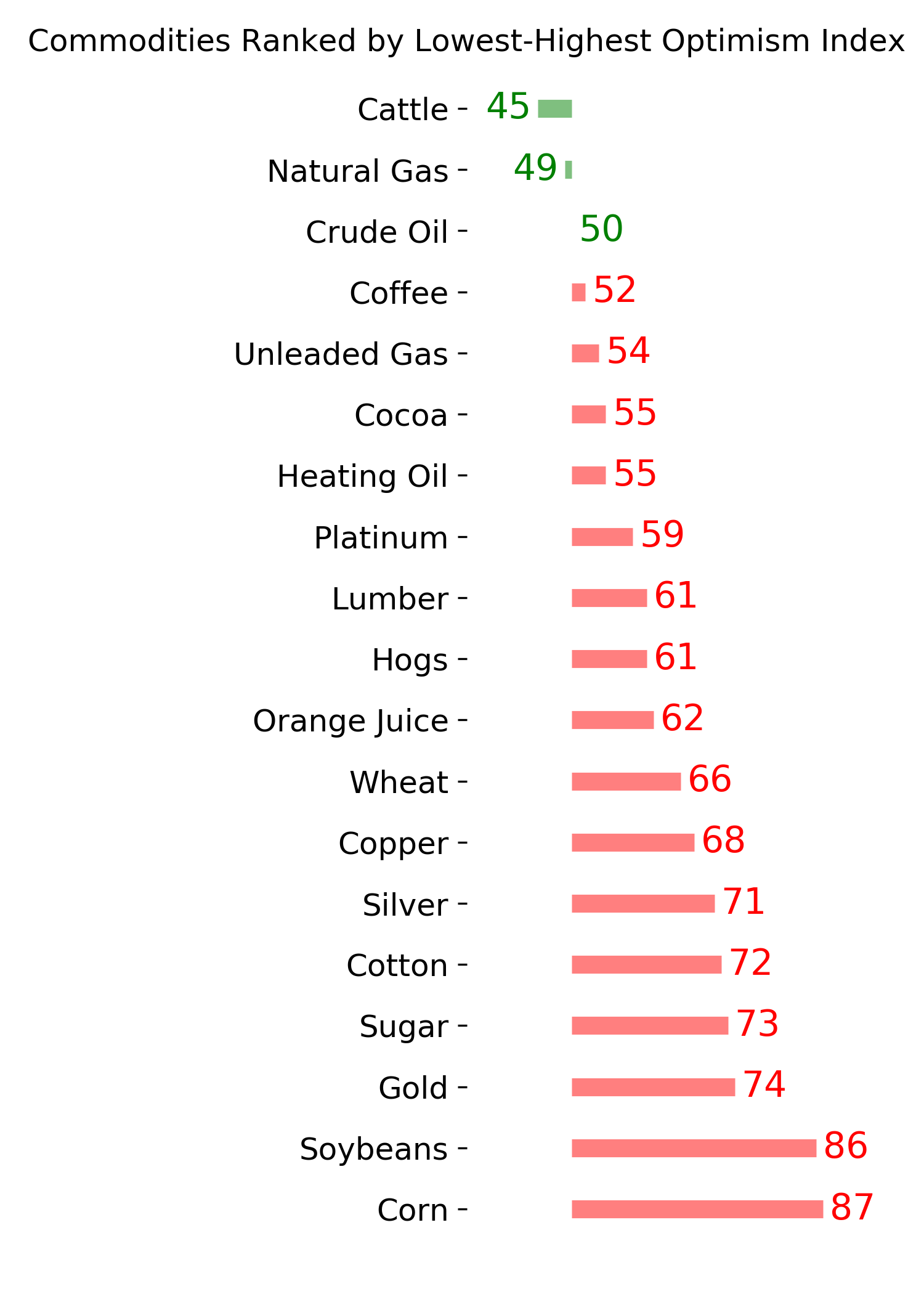

Ranks

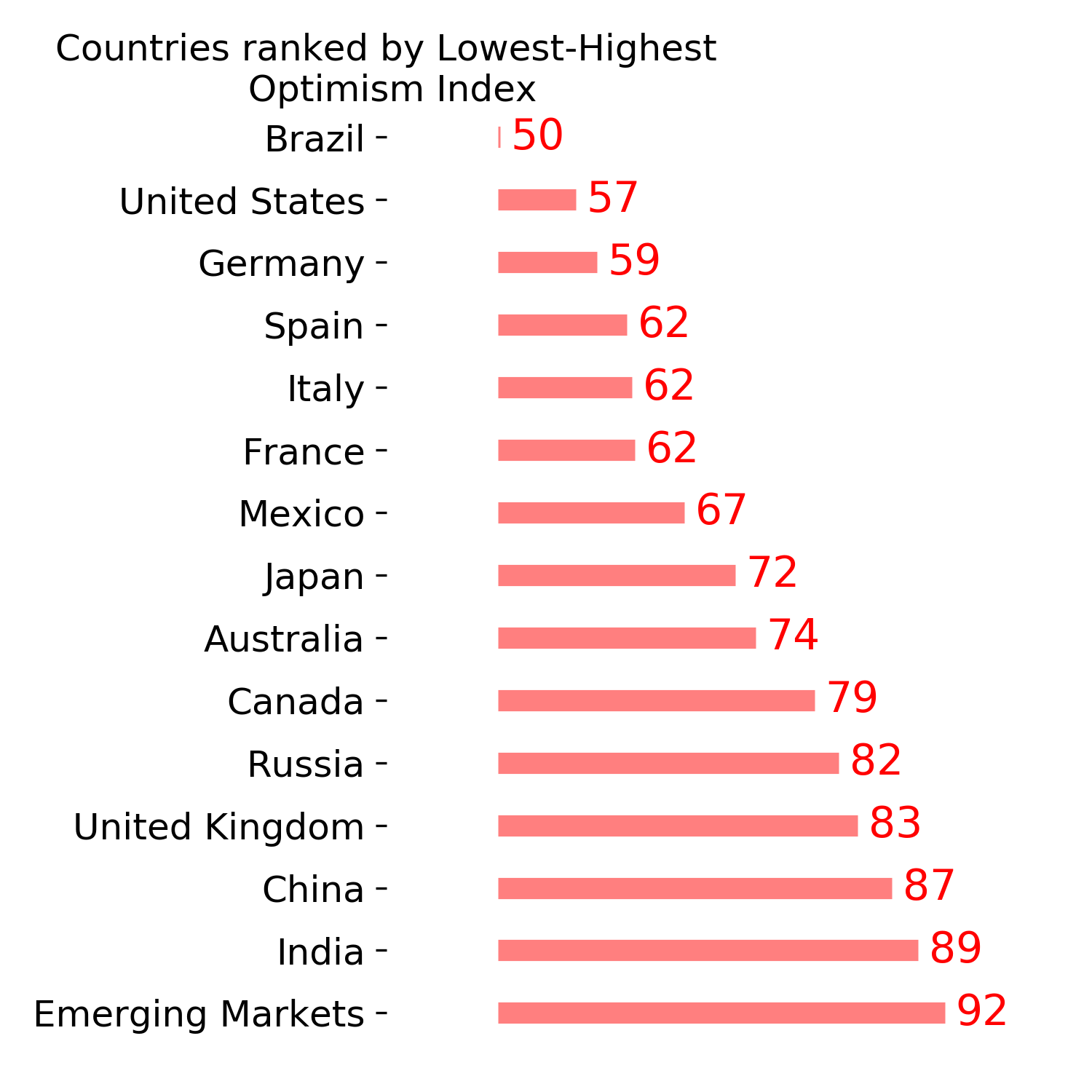

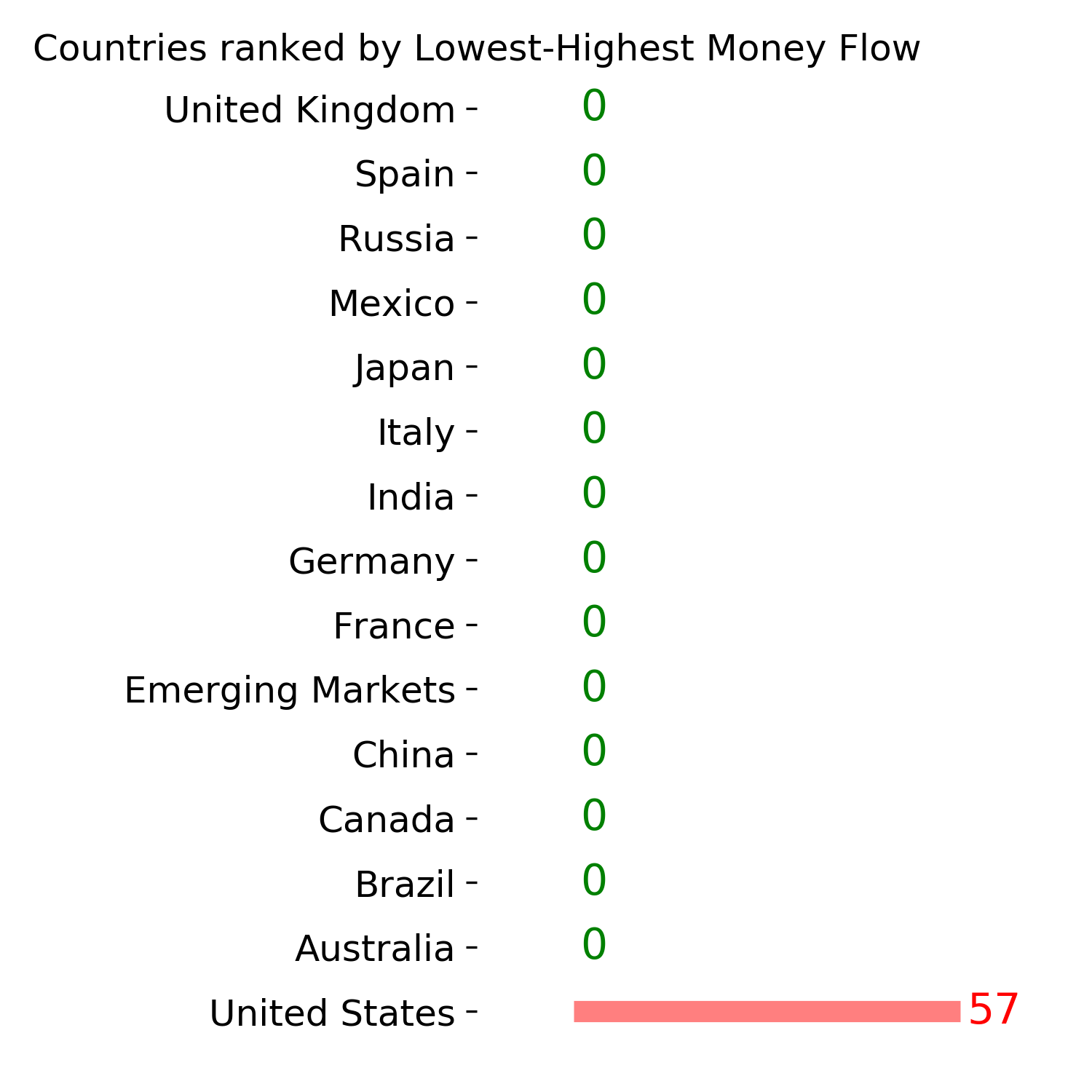

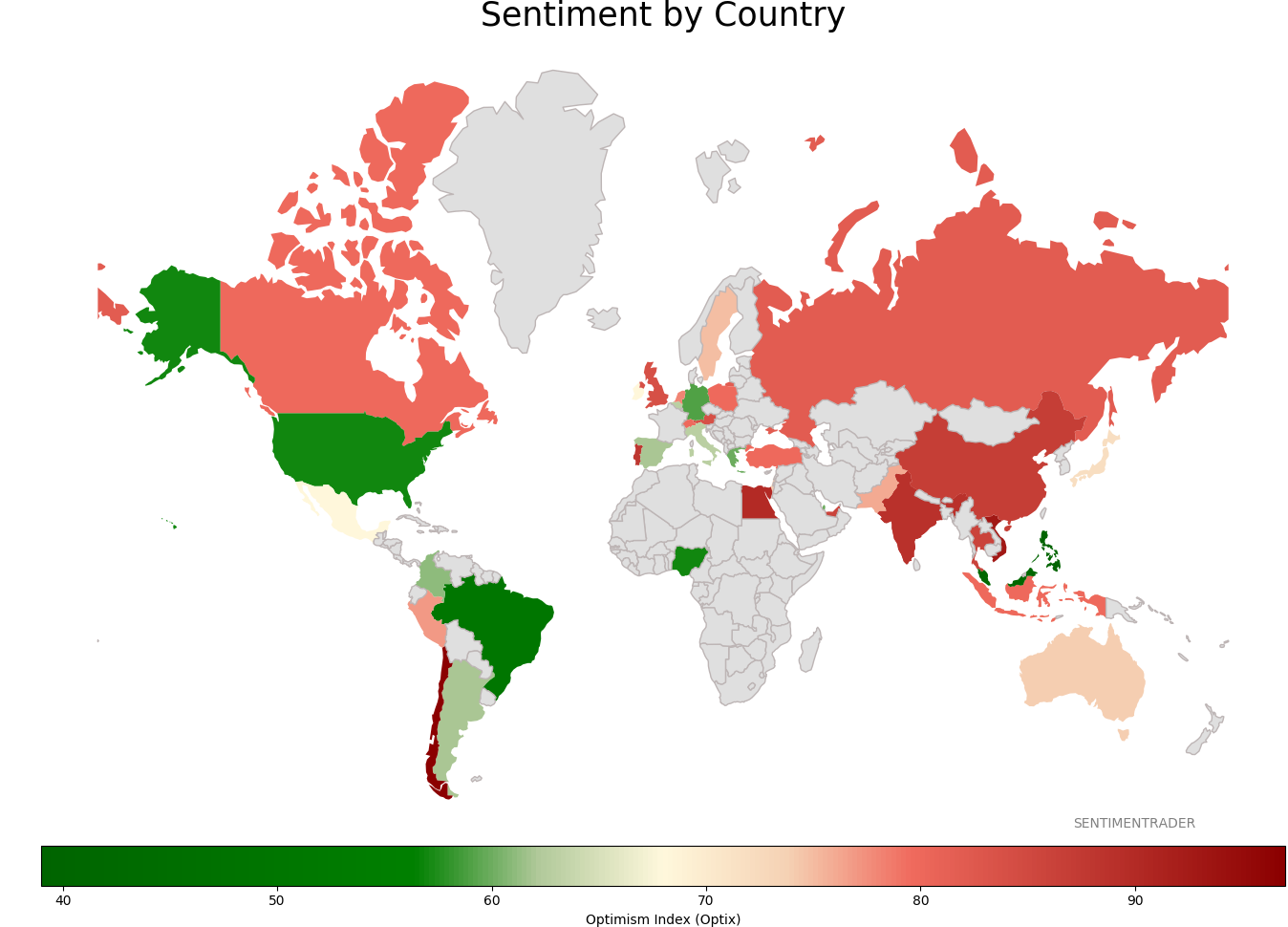

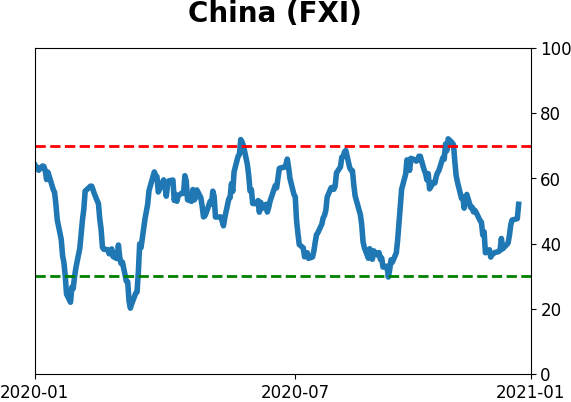

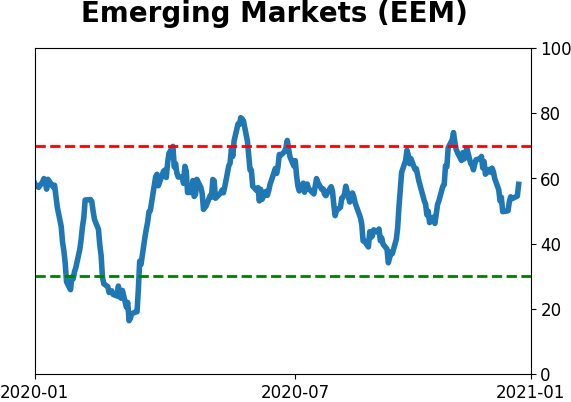

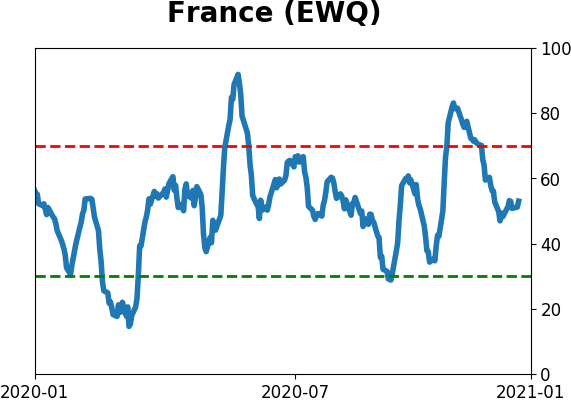

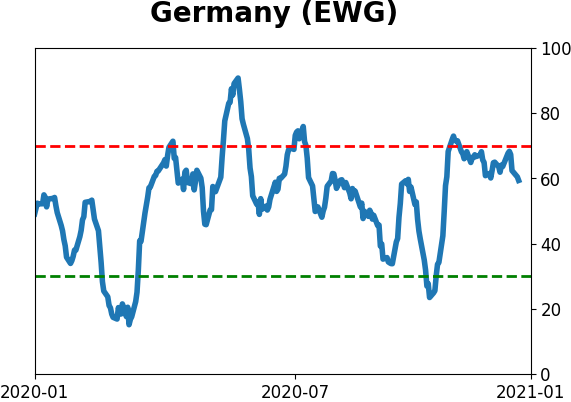

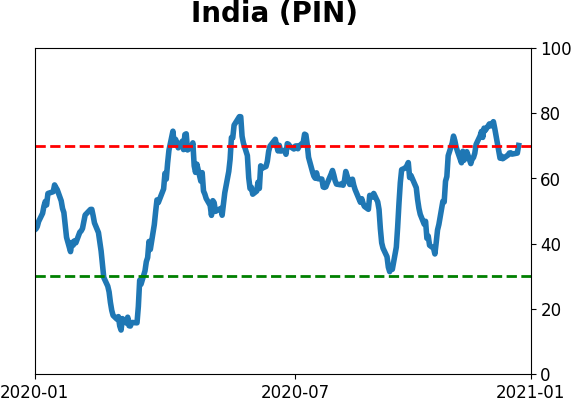

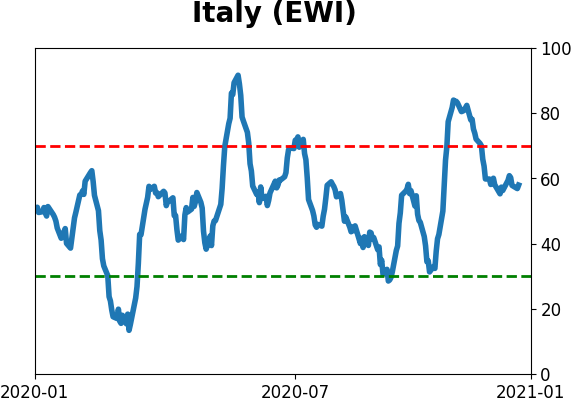

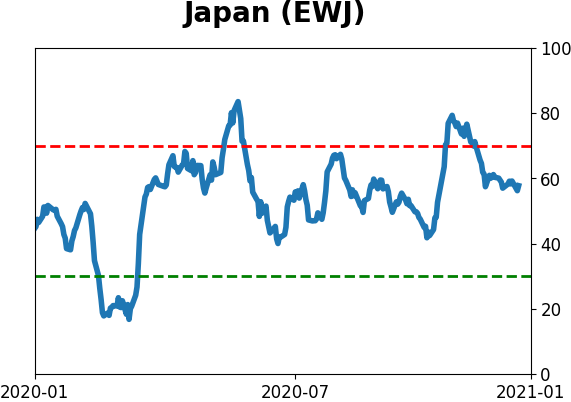

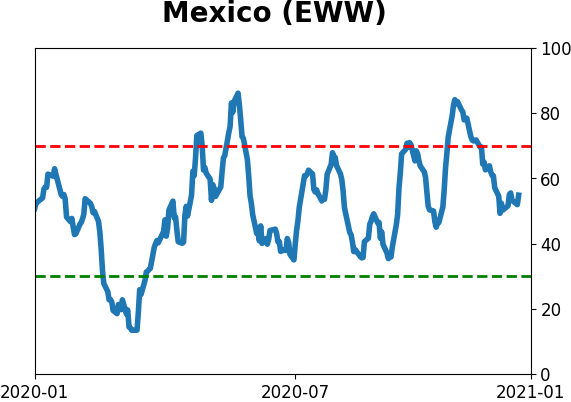

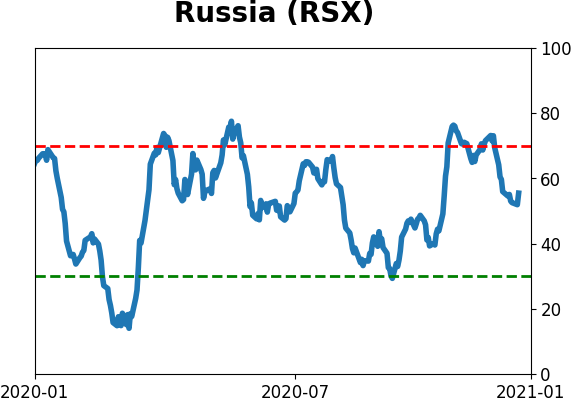

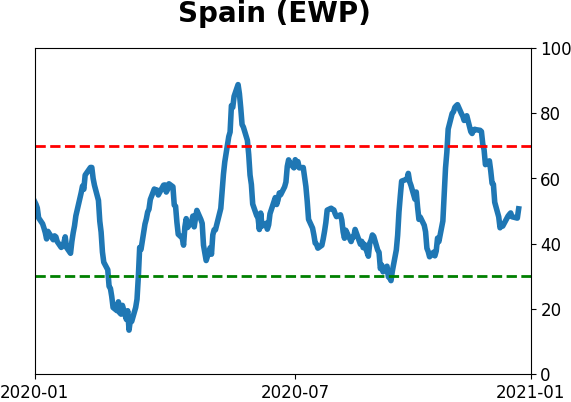

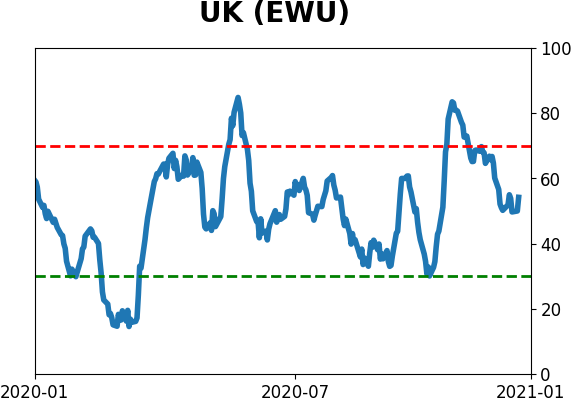

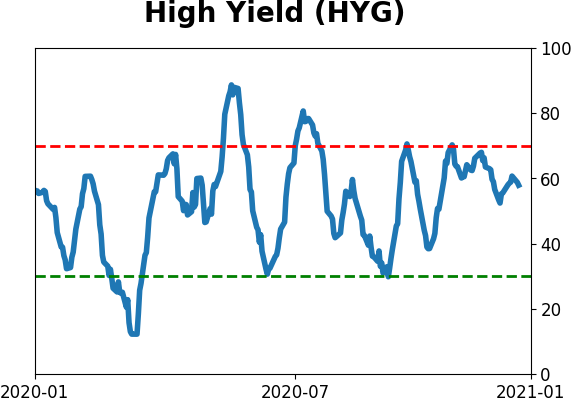

Sentiment Around The World

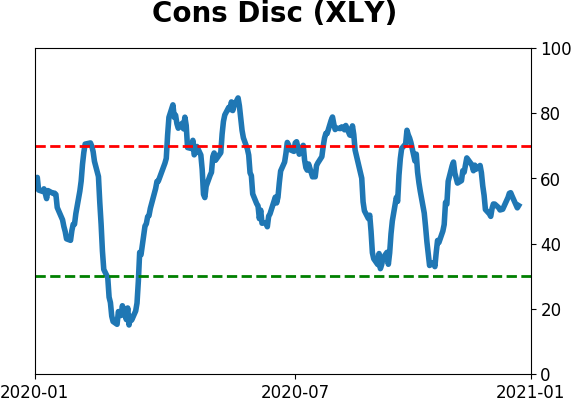

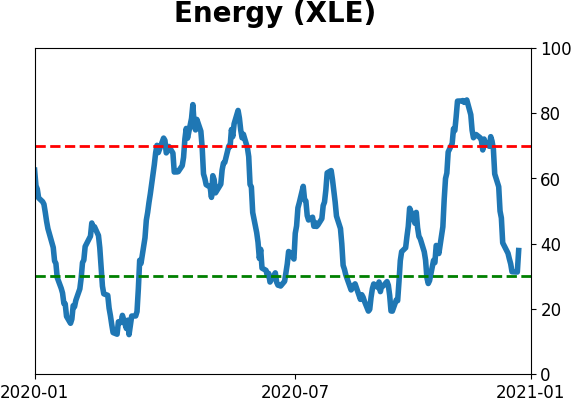

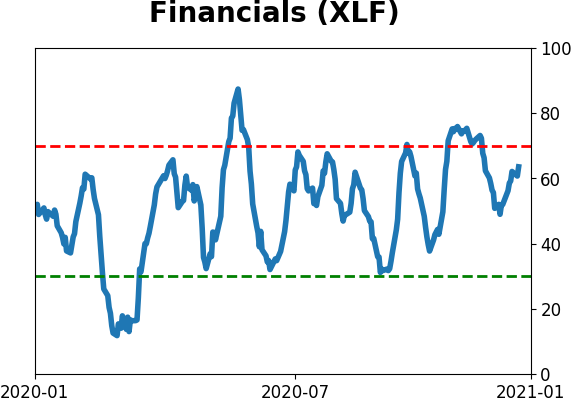

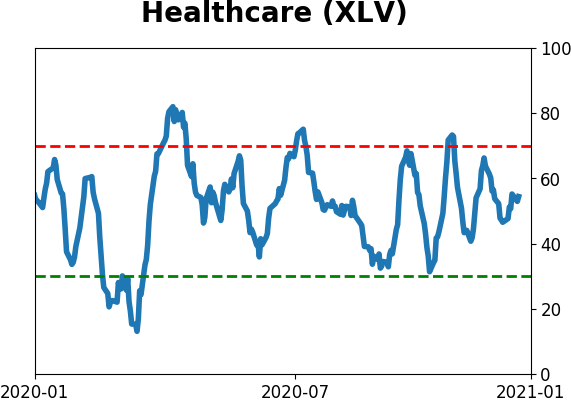

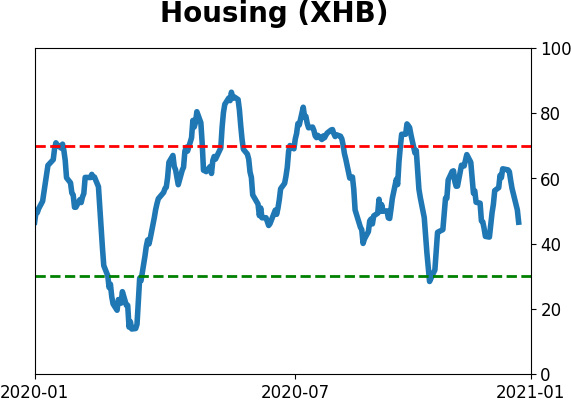

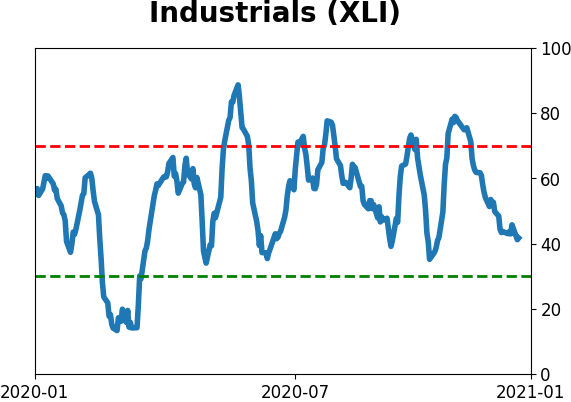

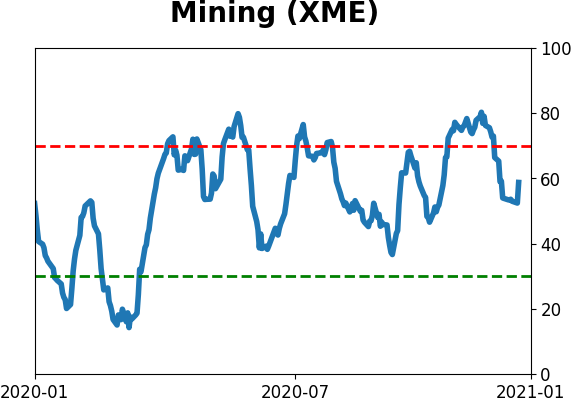

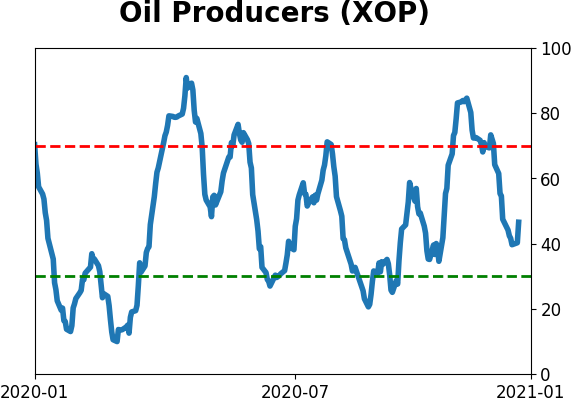

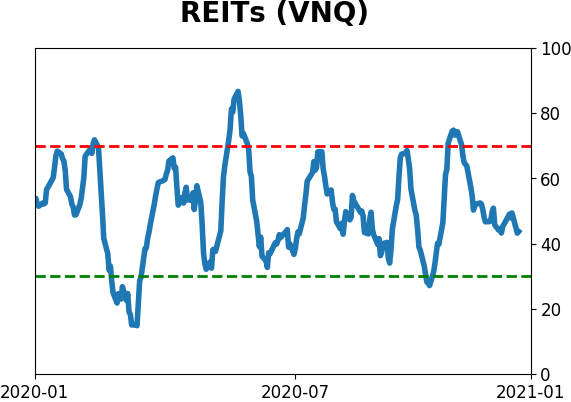

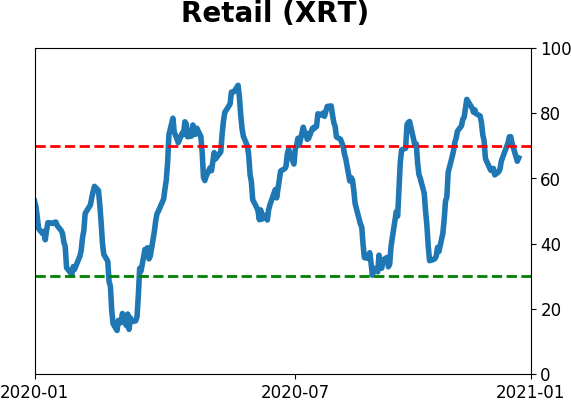

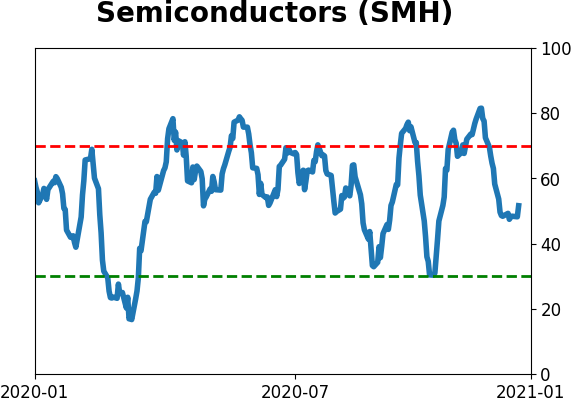

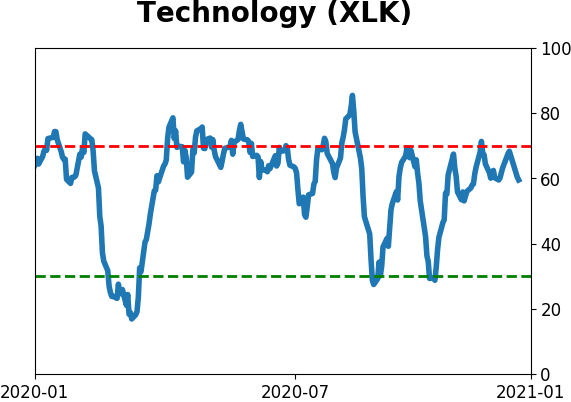

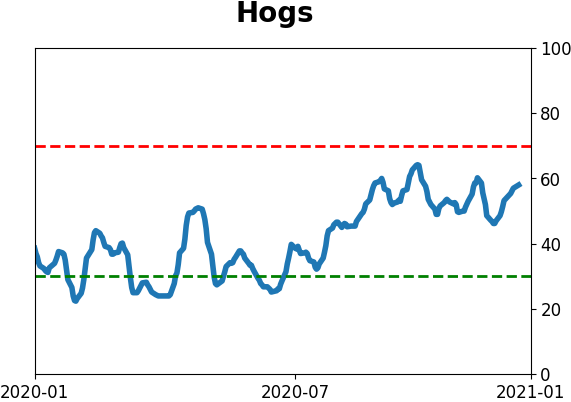

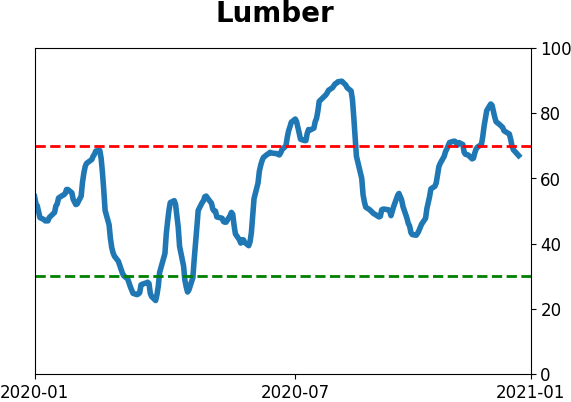

Optimism Index Thumbnails

|

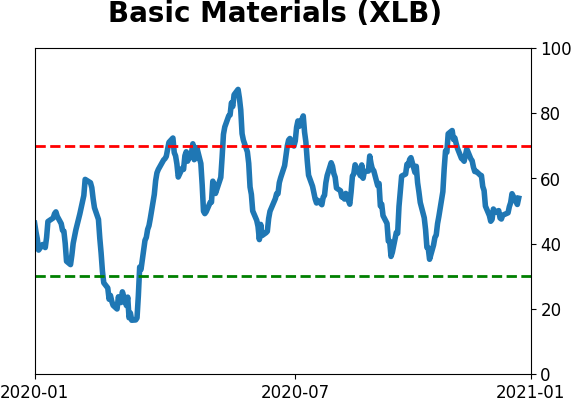

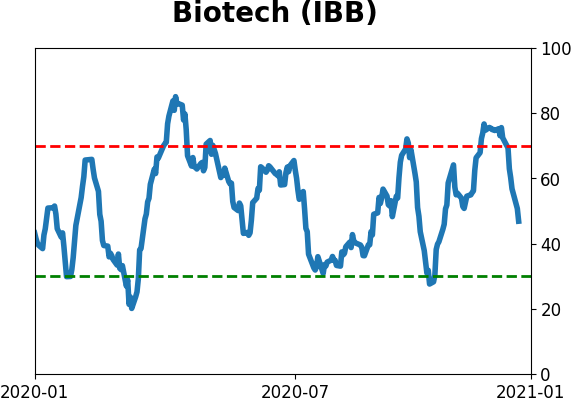

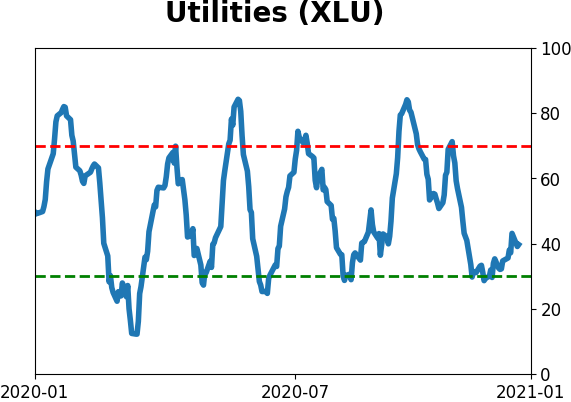

Sector ETF's - 10-Day Moving Average

|

|

|

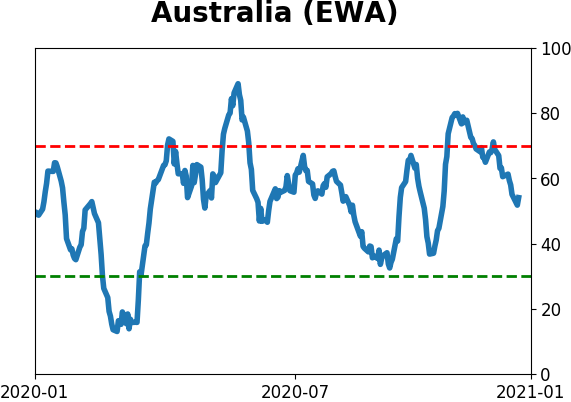

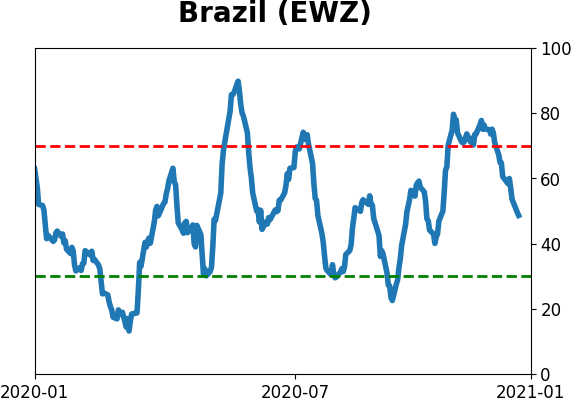

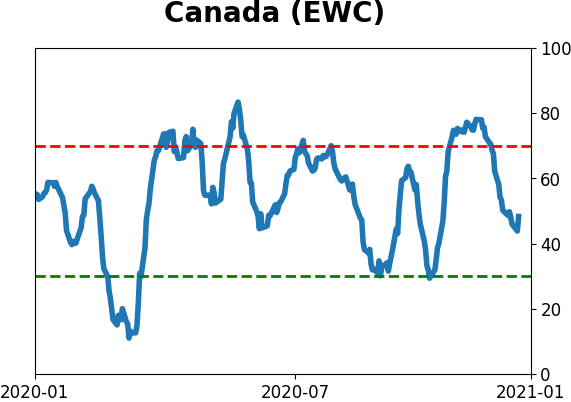

Country ETF's - 10-Day Moving Average

|

|

|

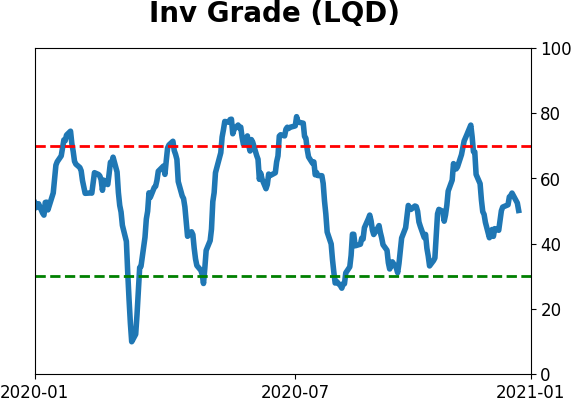

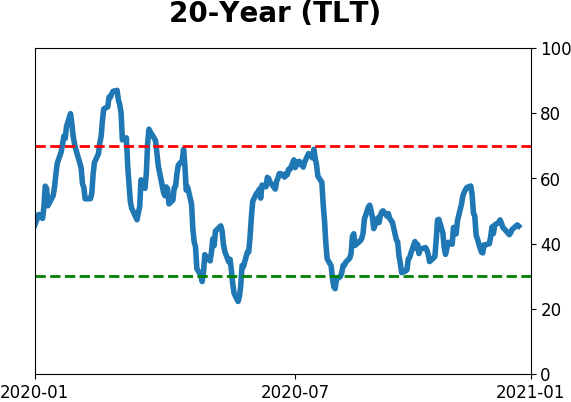

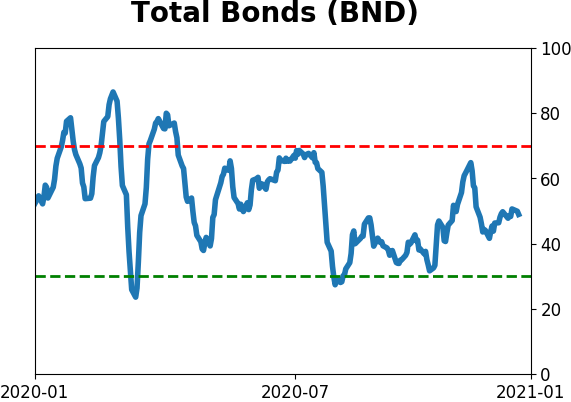

Bond ETF's - 10-Day Moving Average

|

|

|

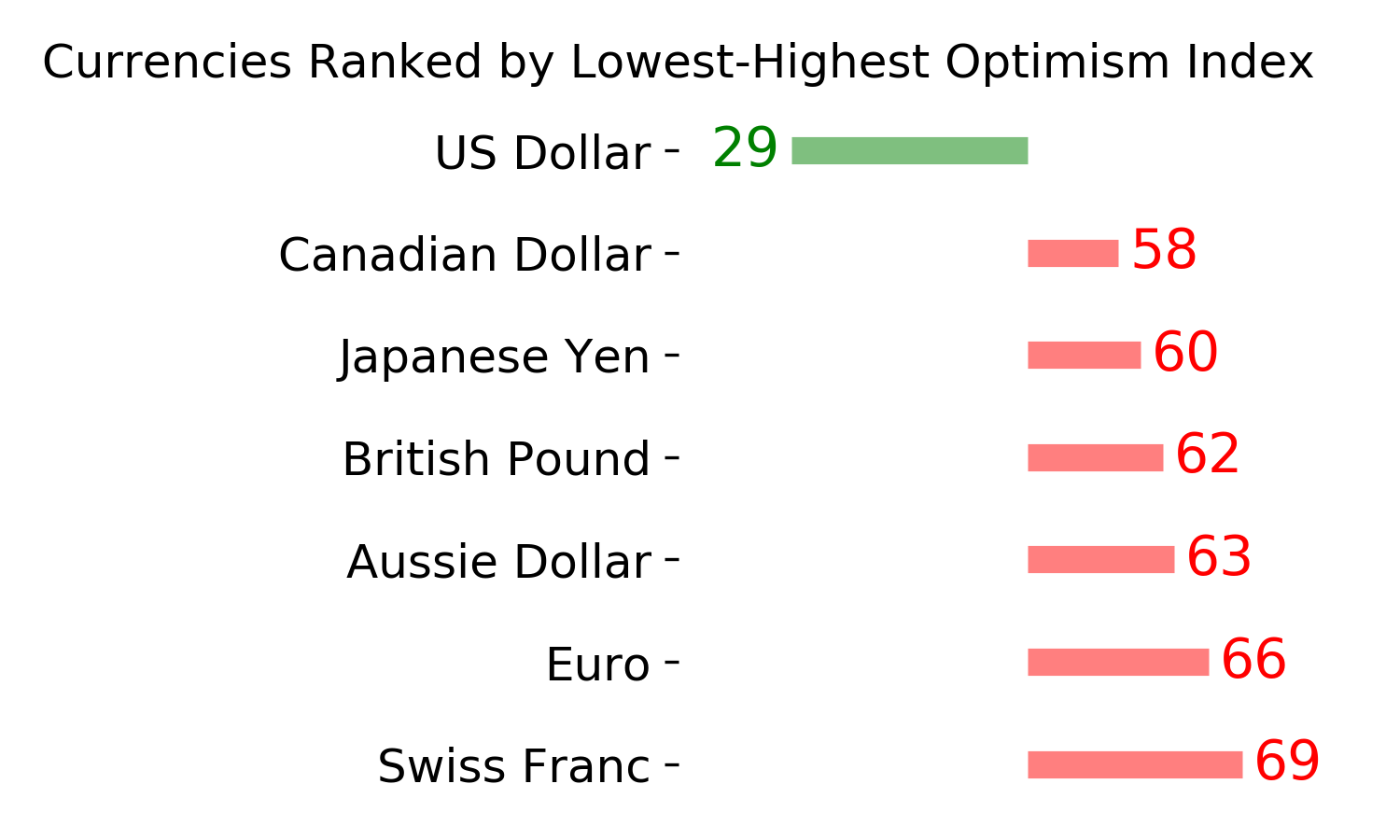

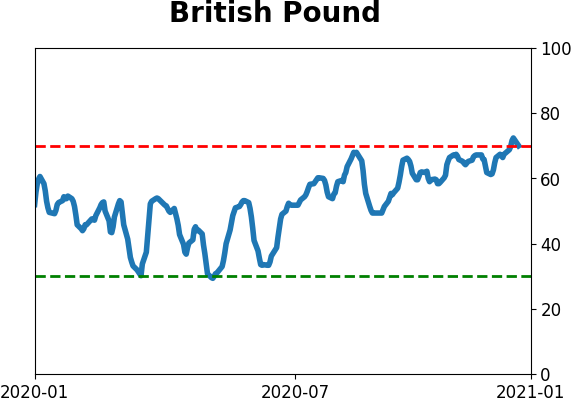

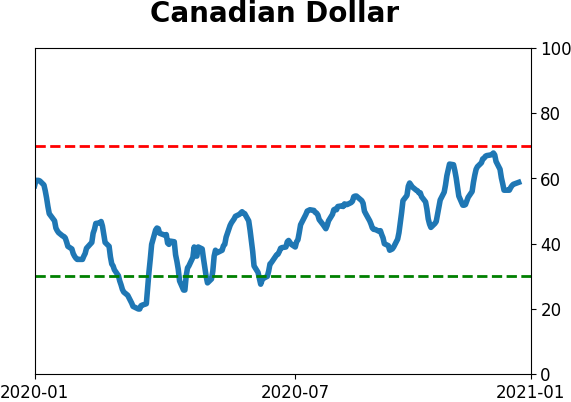

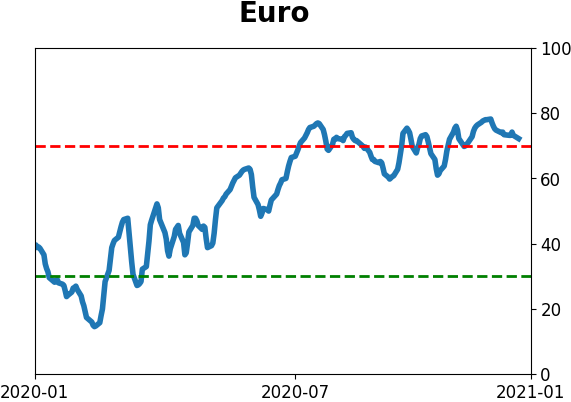

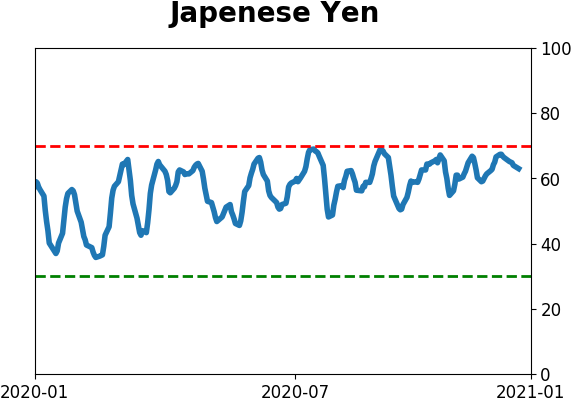

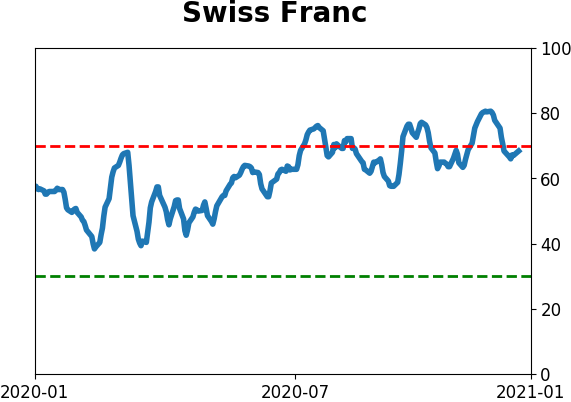

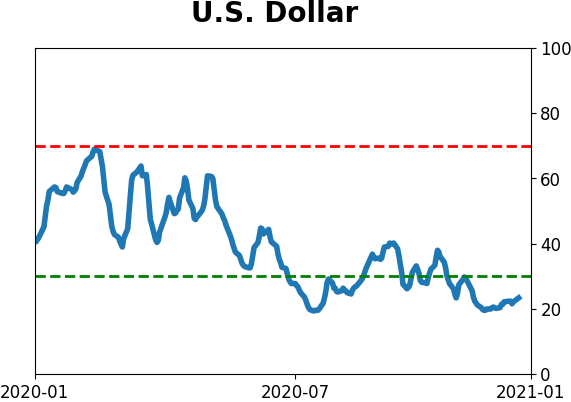

Currency ETF's - 5-Day Moving Average

|

|

|

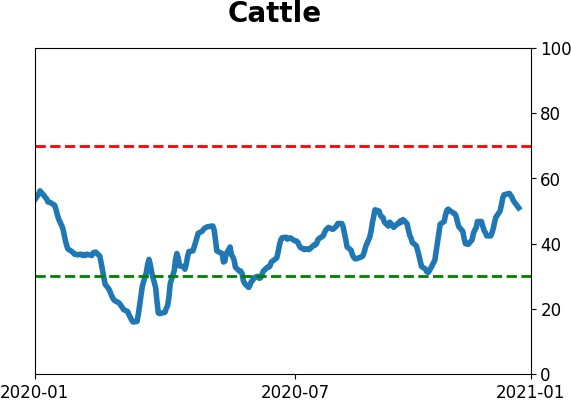

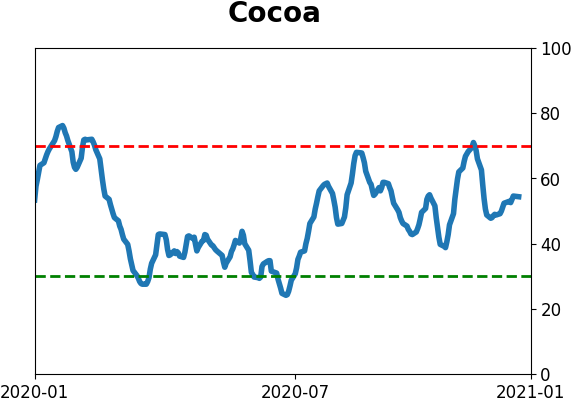

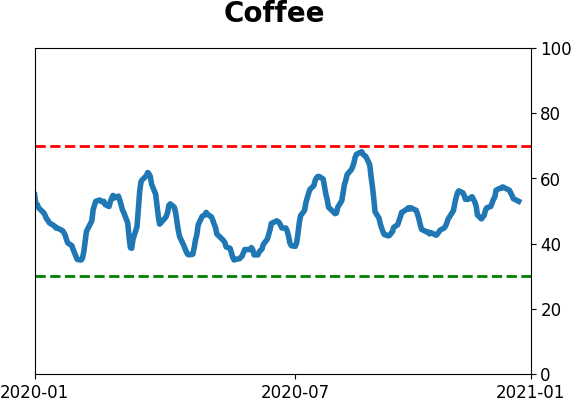

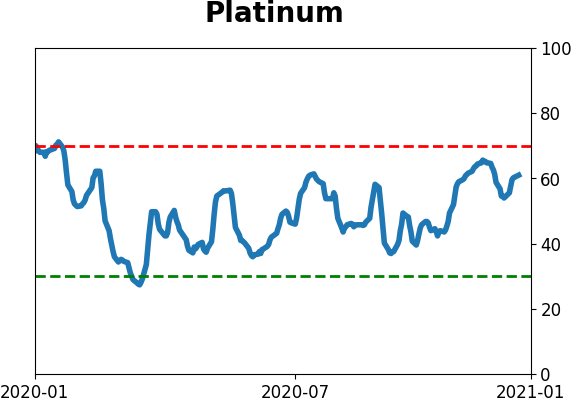

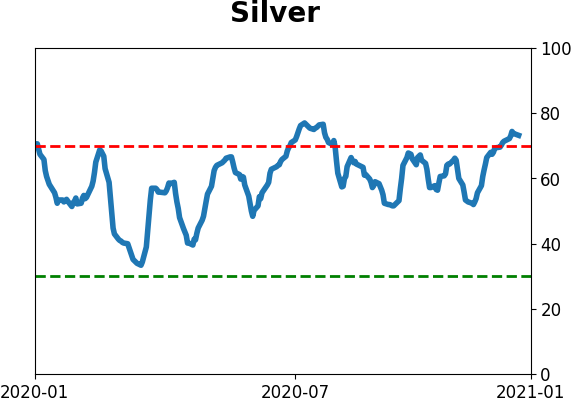

Commodity ETF's - 5-Day Moving Average

|

|