An attitudinal check in Dumb Money Confidence

Key points:

- Dumb Money Confidence has climbed above 60%, a threshold to watch

- During bear markets, Confidence usually doesn't get much higher before sellers emerge

- Watching the max gains and losses in the S&P 500 during the coming weeks will give us a hint as to long-term prospects

Trend-followers are embracing the rally

The Dumb Money has been buying, and confidence is returning. It's about time, after a historic stretch of deep pessimism.

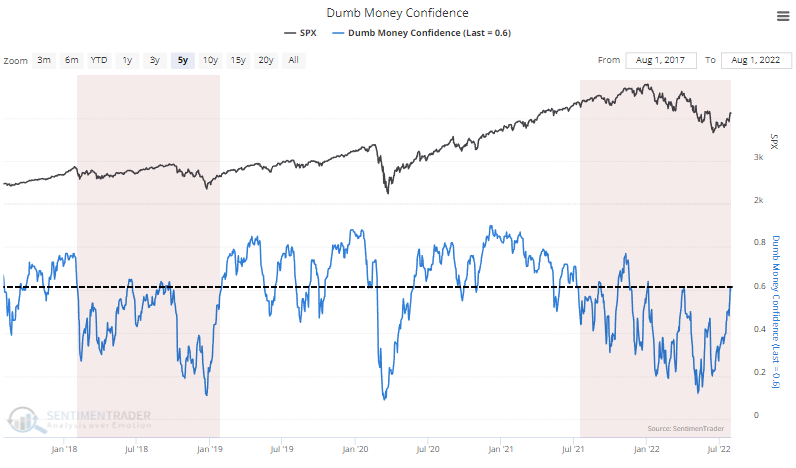

Even though small options traders are hesitant, others are not, and Dumb Money Confidence has climbed above 60% for the first time in months. This threshold generally serves as a good delineator between healthy and unhealthy markets. During persistent bull markets, the model consistently levitates above 60%.

When it stays below 60% consistently, sentiment is poor and periods of recovery tend to bring in sellers.

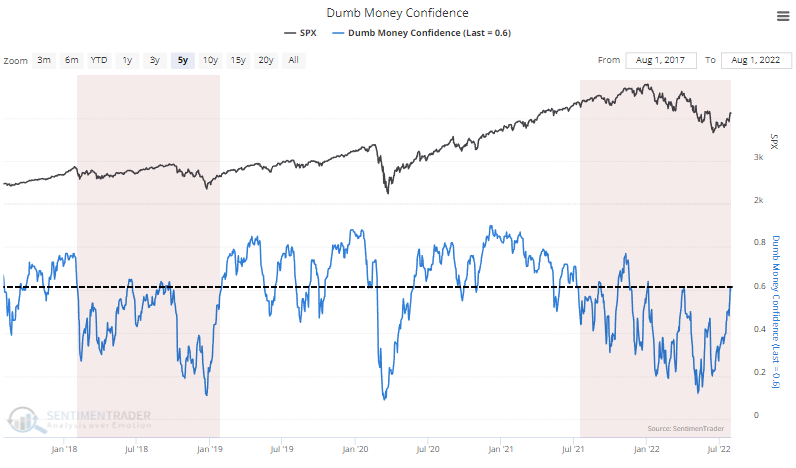

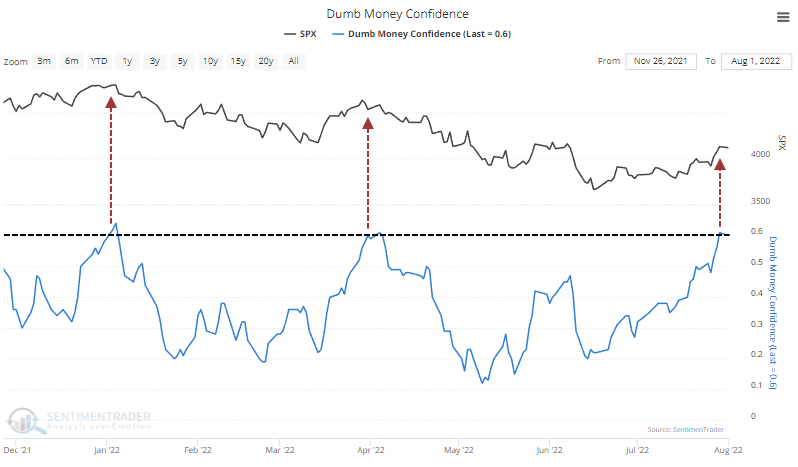

That's what happened the last two times it got this high since the peak. Once sentiment recovered to the degree it has now, stocks peaked, and the next down leg was imminent.

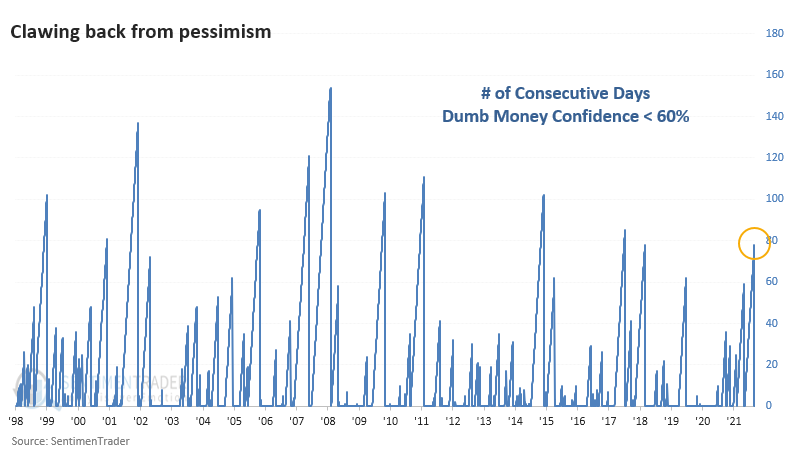

The current move above 60% in Dumb Money Confidence ended one of the longest streaks in sub-60% Confidence since we began computing this in 1998.

A recovery in sentiment is a good thing (during bear markets, not so much)

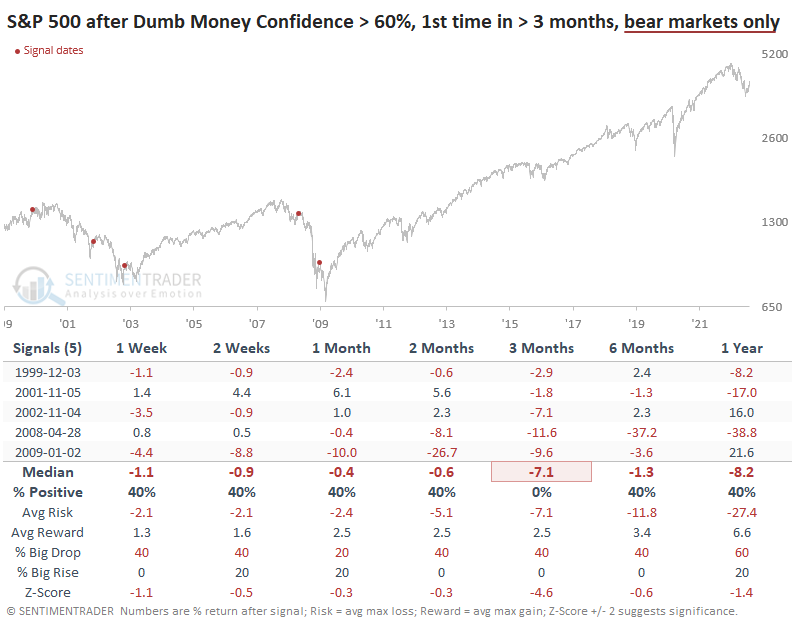

If we look only at recoveries in bear markets, it's clear that further gains tend to be muted. Almost by definition, forward returns will be weak, and this is only backward-looking. We don't know ahead of time whether it will be a bear market signal or a new bull market one.

The point is to see how the S&P behaved during these signals and how current investors behave relative to these.

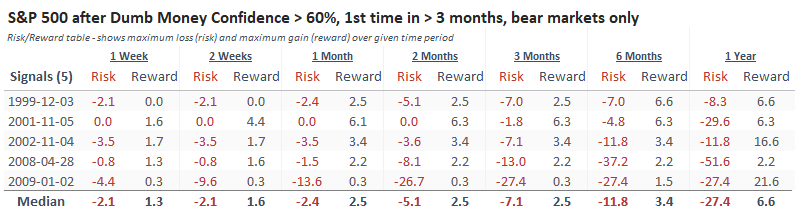

The Risk/Reward Table shows that the maximum gain across most time frames was muted - even up to six months later, the S&P 500 gained no more than 6.6% at any point.

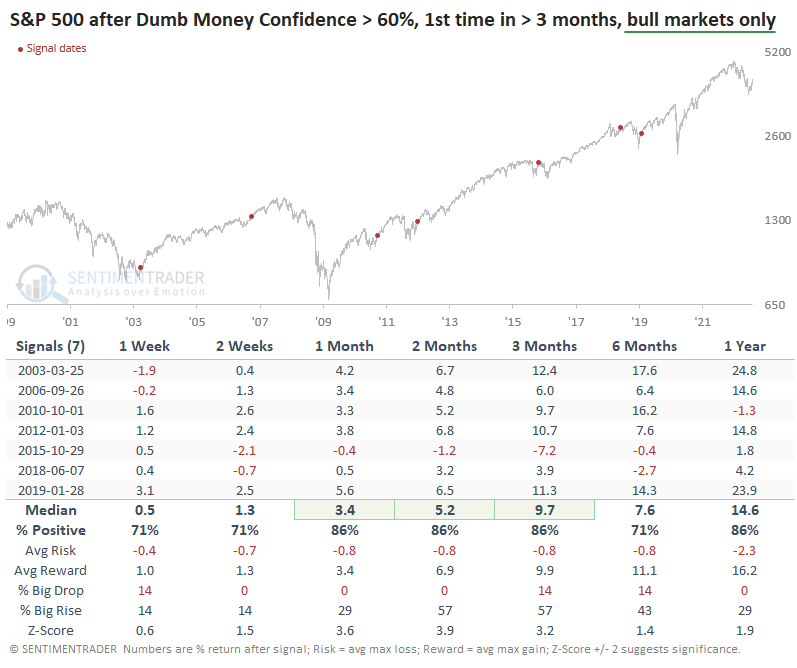

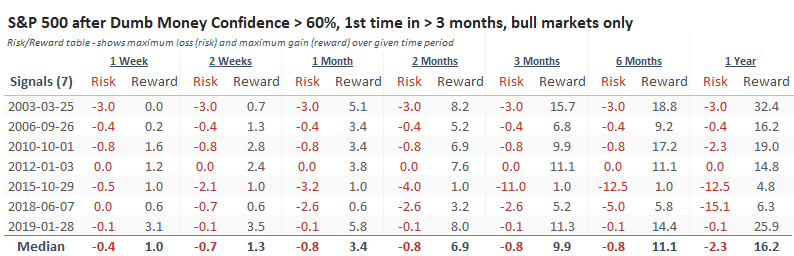

Contrast those returns to bull market instances shown below. Again, we don't know ahead of time in which table the current signal will belong.

After Confidence recovered during these market environments, there were few significant losses going forward. The only real exception was 2015 when the S&P suffered a double-digit drawdown within the next three months before recovering. The S&P rallied more than 6.6% within three months after five of the seven signals.

What the research tells us...

Unfortunately, this isn't immediately actionable. It's not clear at the time of the recovery in sentiment whether it might present us with a good opportunity to buy or sell (unlike the sentiment extremes and thrust signals in recent notes). This is more of an attitudinal check.

Sentiment has moved out of a pessimistic extreme, and during bear markets, it doesn't usually get a chance to recover much more before sellers sense an opportunity. During bull markets, those sellers usually get rolled right over. Whichever behavior we see in the weeks and months ahead will determine whether long-term investors would best be served by adding more exposure.