A split market, with a difference

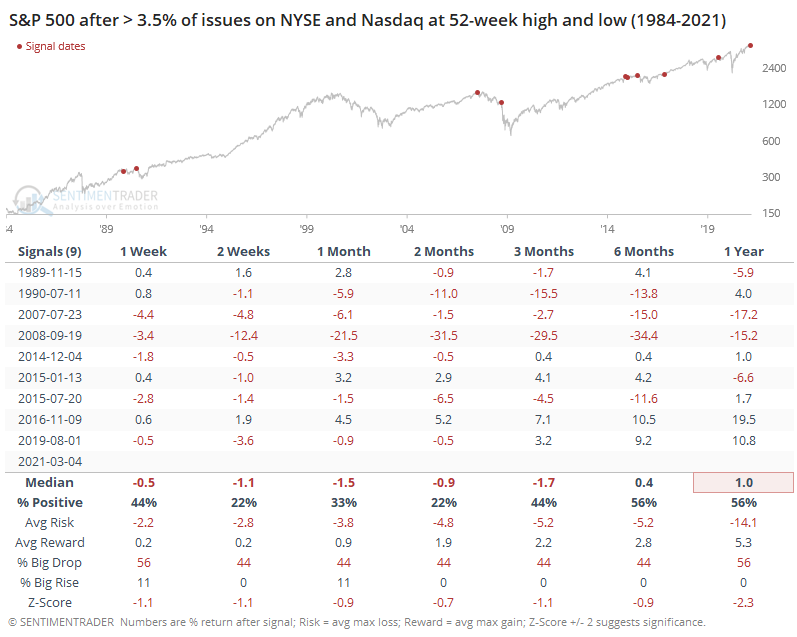

A few times last week, we looked at the "split" in the market between winners and losers. To one of the greatest degrees in history, we're seeing a large number of securities at 52-week highs and a large number at 52-week lows at the same time.

There is no doubt this is being heavily influenced by the sudden drop in SPACs, which have been distorting the breadth numbers for months. Whenever there is a split like this, there's always an excuse. In prior years, the split was "only" because of bank stocks, or energy stocks, or rate-sensitive issues. The vast majority of the time, that doesn't matter. It is what it is.

Does the influence of SPACs this time mean we should ignore the warnings? I dunno. Maybe? Trying to outsmart the indicators and guess when they matter and when they don't has never been consistently successful.

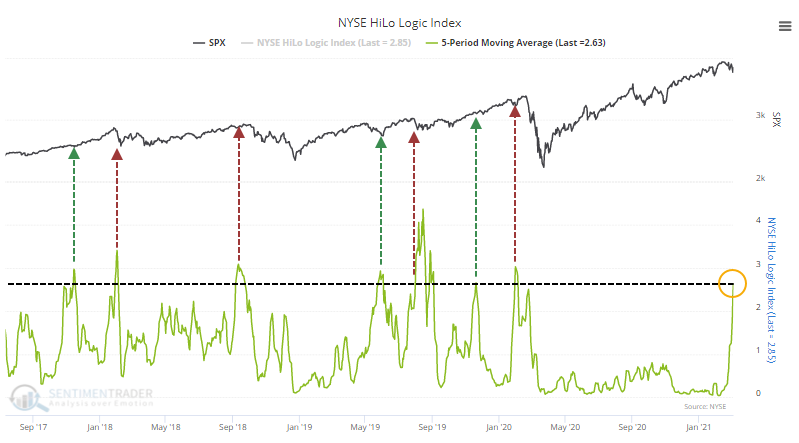

Last week, Jay noted that this kind of split is what makes the HiLo Logic Index spike higher. The indicator is simply the lesser of 52-week highs and 52-week lows. Bull markets are typically preceded by very low readings, when everything is in gear one way or the other. Bear markets, or at least tough market conditions, tend to be preceded by times when markets are split between winners and losers. Like now.

Over the past 5 days, the HiLo Logic Indexes on both the NYSE and Nasdaq have averaged a very high reading. In recent years, this has had a mixed record, roughly preceding 3 rallies and 4 declines. Generally, if it was going to matter, then it mattered right away.

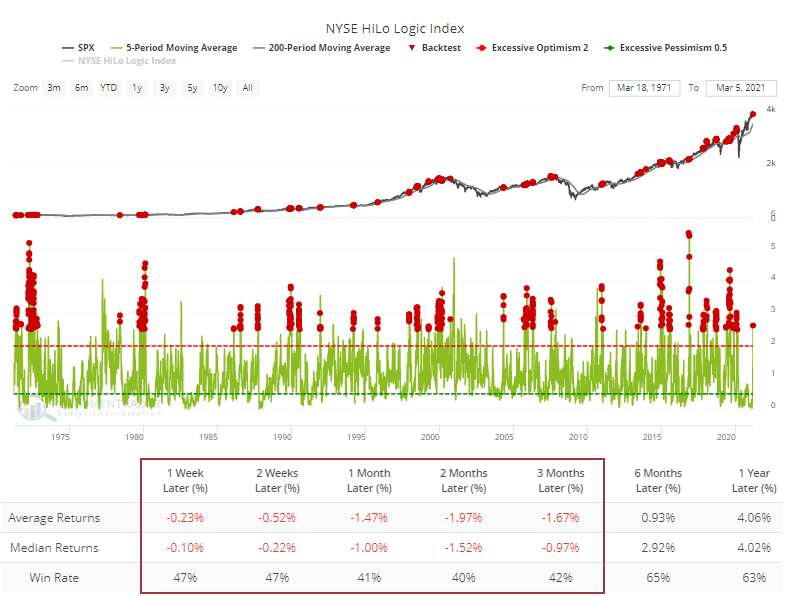

Over a long time frame, the Backtest Engine shows that anytime the NYSE figure averaged more than 2.5 over a week, forward returns were very poor. The test includes only those times when the S&P 500 was above a rising 200-day moving average at the time.

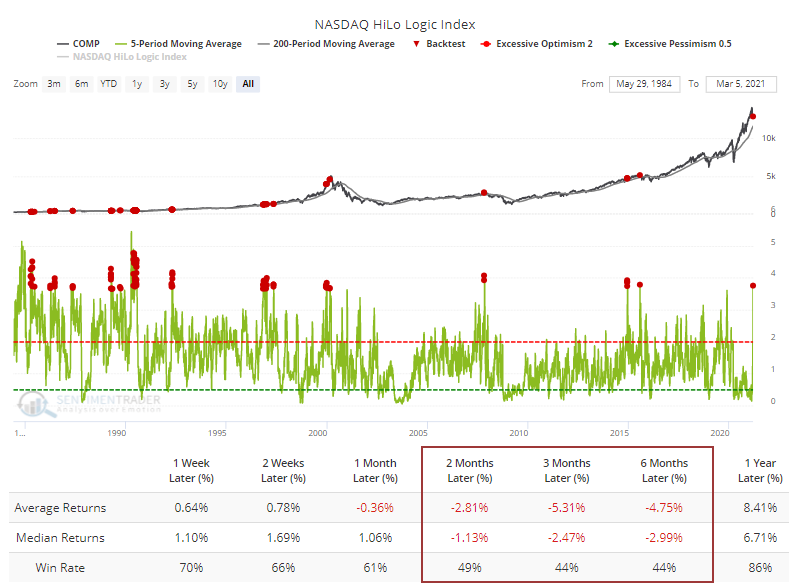

The same can be said for the Nasdaq.

In the Minutes last week, we looked at the combination of these on both exchanges, with the precedents being disturbing.

One of the saving graces this time is that leading up to the last week, the HiLo Logic has been extremely low. That's because 52-week highs had overwhelmed 52-week lows, once again thanks in large part to the roaring performance of SPACs. Other times the HiLo index was very low and then spiked higher, the declines tended to be more muted.

We rate these splits as a negative, with the modest caveats that it's being heavily influenced by one particular corner of the market, and it was preceded by very healthy internal conditions.