A recovery like few others

Global markets have recovered to a remarkable degree, as we saw last week.

Within the U.S., trends have been even more impressive, with a near-record percentage of industries trading above their medium-term trends.

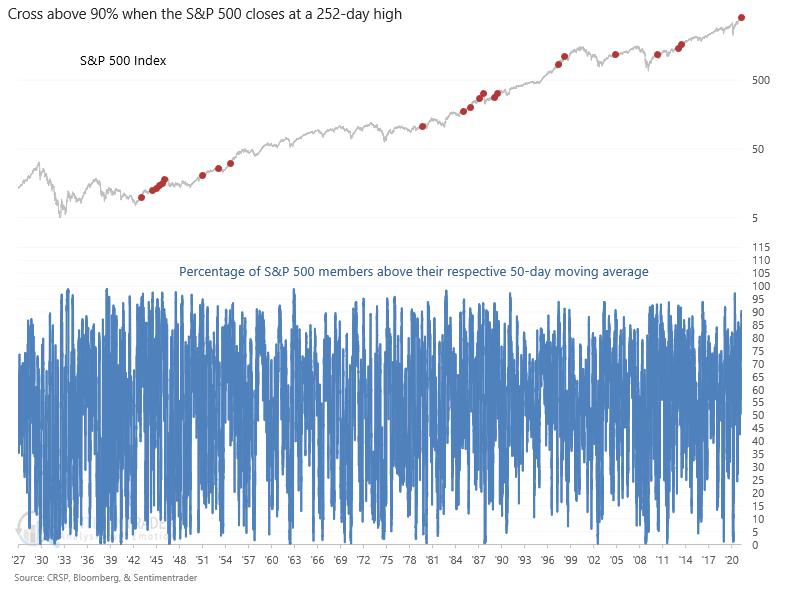

Drilling down further, the percentage of S&P 500 members trading above their 50-day moving averages registered a rare momentum buy signal last week, with more than 90% of members closing above that average.

It's always essential to put some context around trading signals as instances that occur after a bear market or a correction can influence overall signal performance. This one, for example, occurred at a 252-day high, which could suggest that futures gains may be muted since stocks have already risen so much.

When we go back to the 1920s and look for all similar setups, forward returns looked good even when they triggered at a 252-day high. Granted, returns weren't as good as when stocks were in the early stages of a bear market recovery, but that's to be expected.

| Stat Box Every stock but one in the Dow Industrials is trading above their 200-day moving average, a feat matched by only 24 other days in the past 5 years. |

What else we're looking at

- Full returns following momentum signals in different market environments

- A look at using LEAPs to replace an investment in a stock

- Even though stocks hit highs, very short-term momentum isn't confirming