A new bull in emerging markets

Key points:

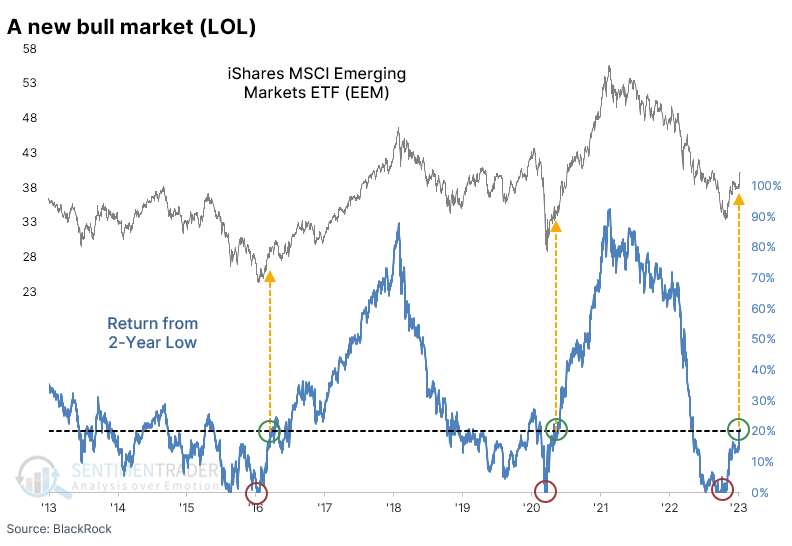

- The popular EEM fund of emerging market stocks has rallied more than 20% off its latest two-year low

- Calls for a "new bull market" tend to be accurate after behavior like this, with only one true failure

- Internal momentum has recovered as well, improving the likelihood of sustained gains

Emerging market indexes move into a possible new regime

At the risk of upsetting the delicate sensibilities of FinTwit hall monitors, emerging market stocks just entered a new bull market.

The definition of bull and bear markets is a silly pastime of people with way too much time on their hands. The precise definition doesn't matter because there are no rules in auction markets. As long as you're consistent, the parameters don't really matter.

For bull and bear markets, the financial media took hold of a 20% rally or decline, respectively. For consistency and ease, that's what we'll go with, and using that definition, the most popular fund for betting on emerging markets just surpassed that threshold.

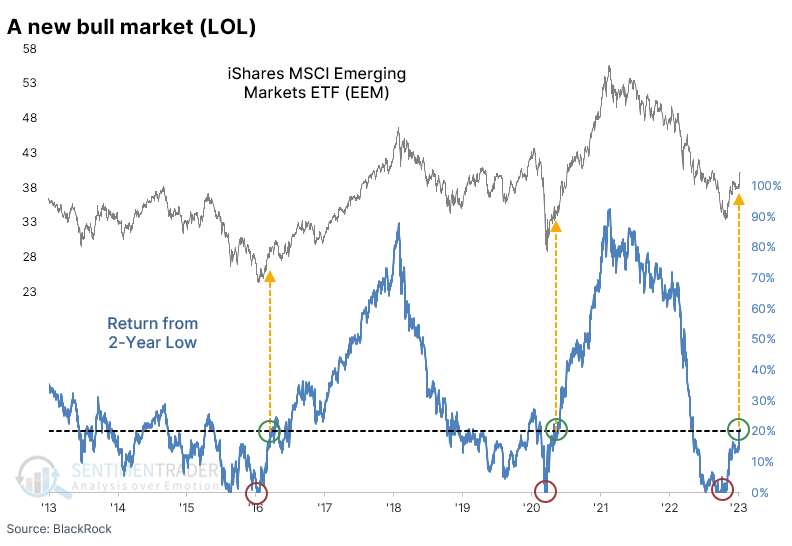

If we use the index underlying that fund, this is the 8th time in 35 years that it has rallied 20% from at least a two-year low. These stocks are prone to rapid flows in and out - surprisingly, this is the longest it has taken the stocks to rally from a low to a "new bull market."

Once it reached the 20% rally level, the stocks tended to give back some gains over the next 1-2 weeks. The only times they didn't, in 1998 and 2001, they continued to soar in the months ahead. The only true failure was earlier in 1998.

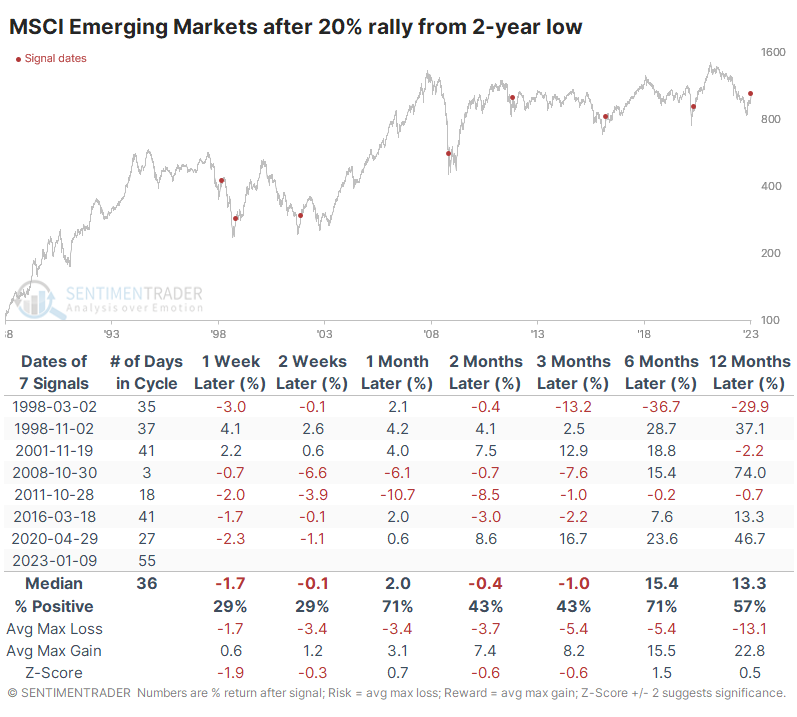

Internal momentum also recovered, then paused

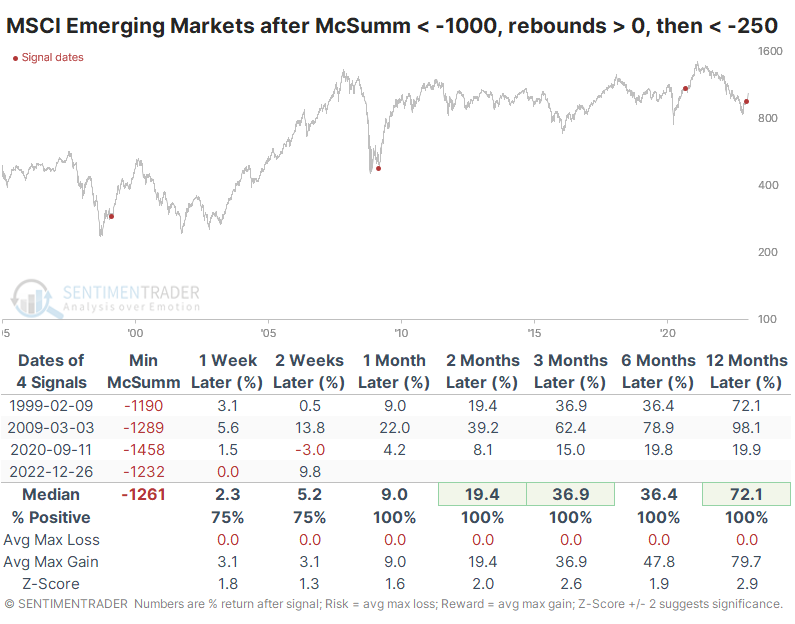

Thanks to the protracted and severe decline in many stocks populating the index, the McClellan Summation Index for emerging markets declined below -1000, noted in October. The recovery has been broad-based enough to push the Summation Index above zero. It has since pulled back to a modest negative reading.

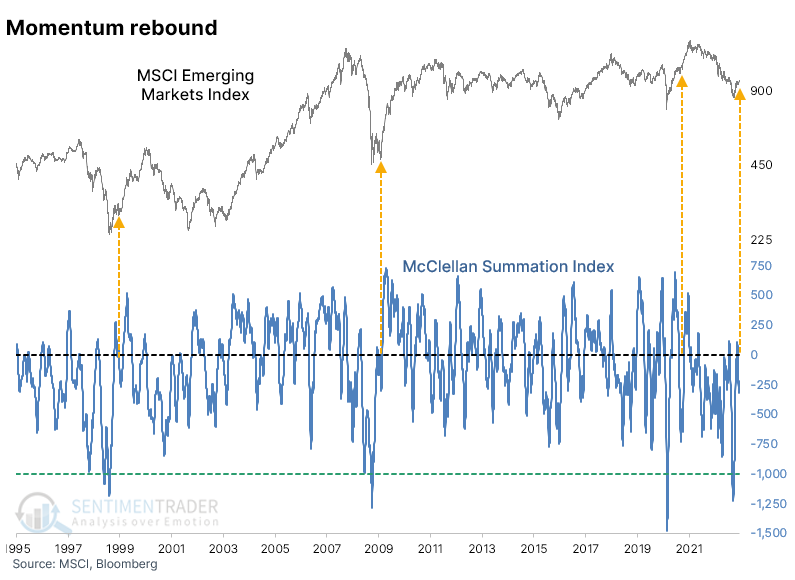

The table below shows the few times when investors in these stocks behaved similarly. These are times when the Summation Index plunged below -1000, rallied above zero, and then declined below -250. After each of the others, the stocks managed to gain 20% over the next six months.

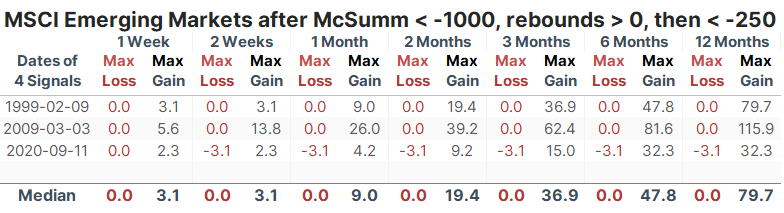

The table of maximum losses and gains over each time frame shows how skewed the returns were. Losses were minimal, while there was a rally of at least 30% within the next six months every time.

What the research tells us...

Chinese stocks got hammered last fall, dragging emerging markets indexes along with them. The recovery over the past few months has been impressive and at a pace typically not seen during ongoing bear markets, only at the end of them. The surge in Asian shares has positively impacted broader emerging market indexes, including the most popular ones. While the sample of similar behavior is tiny, it's encouraging for long-term investors. Shorter-term traders have had a more difficult time chasing such gains.