Mexican stocks are on the road to recovery

Key points:

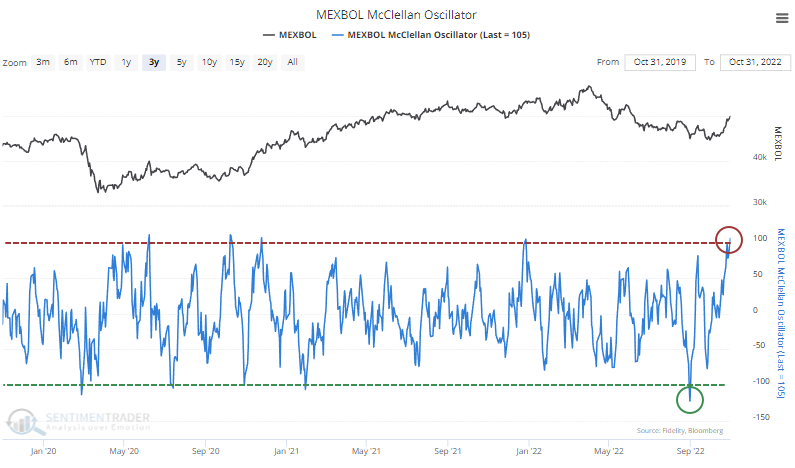

- Investors are clamoring for Mexican stocks, and the McClellan Oscillator for the Mexbol is surging

- Similar cycles from one extreme to the other in the Oscillator led to impressive returns

- The recovery is coming after a -1000 reading in the broader Summation Index for emerging markets

Mexican stocks come storming back

Some sectors have enjoyed a persistent and broad-based recovery over the past couple of weeks. Thanks partly to a stumble in the dollar, those moves have broadened out to other markets, including emerging ones.

Among the most impressive is Mexico. The McClellan Oscillator for the Mexbol index has surged from below -100 to above +100, one of the highest readings in years. An Oscillator this high means that advancing stocks far outpaced declining ones over a multi-week stretch.

With only rare exceptions, readings this high in the Oscillator tend to lead to poor short-term returns as buyers take a breather. But they also tend to precede above-average long-term returns, particularly when there is a cycle from an extremely low Oscillator reading to an extremely high one relatively quickly.

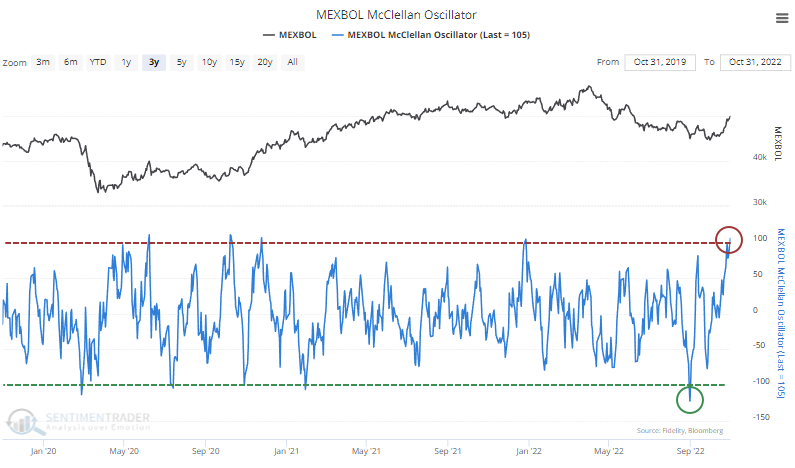

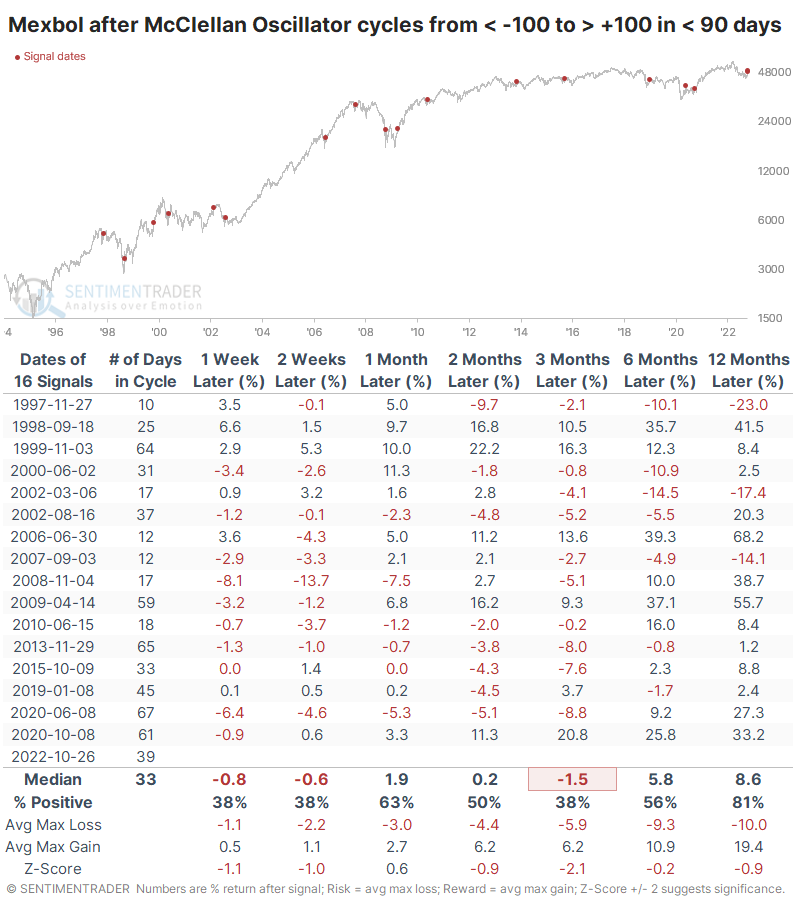

The table below shows these cycles for the Mexbol. True to form, short-term returns were weak, even going out to the medium-term of three months. But a year later, the index was higher 81% of the time.

A notable wrinkle in the table is that some of the worst returns occurred when the signal triggered with only a relatively minor pullback in the index. The table below filters the signals to only include those that triggered when the Mexbol was 10% or more below its most recent 52-week high.

Short-term returns were even weaker in these cases, but the index was higher all nine times over the next year. Its average return was a whopping 33.2%.

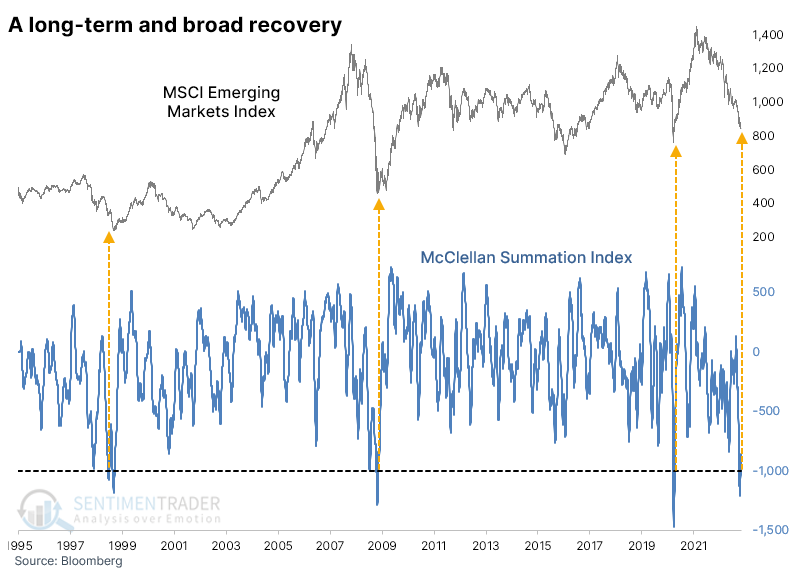

Due to the recovery in Mexico and several other emerging markets, the longer-term McClellan Summation Index for emerging markets has turned higher from one of the most depressed levels in nearly 30 years.

Since 1995, there have been 65 days with a Summation Index below -1000. Over the next year, the MSCI Emerging Markets Index showed a positive return after all 65 days, with a median return of +60.1%.

What the research tells us...

With signs of a trend change in the dollar, investors may be more willing to attempt investments in emerging economies. While fundamental concerns are as valid there as in the U.S., perhaps even more valid, signs are building that investors had become too pessimistic and are now returning in force. There aren't a lot of comparisons, but the ones we do have argue for higher prices.