ZEW survey shows optimism during dire conditions

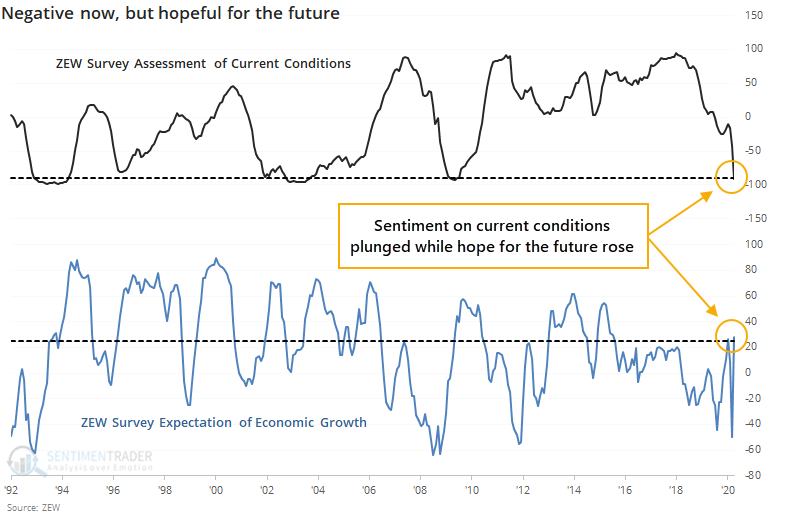

The latest survey of German confidence among financial experts showed a plunge in their estimation of current conditions. That's not surprising. What might be is that they appear hopeful about the future.

From ZEW:

Based on the ZEW Financial Market Test, up to 300 experts from banks, insurance companies and financial departments of selected corporations have been interviewed about their assessments and forecasts for important international financial market data every month since 1991. Participants are asked about their six-months expectations concerning the economy, inflation rates, interest rates, stock markets and exchange rates.

The release shows that sentiment on current conditions is the lowest since the financial crisis, and among the lowest in 30 years. But expectations about the future jumped into positive territory.

We might assume that this is an irrational bout of optimism during a time when investors have no idea what's going to happen. That's always the case, but if we look at the record of this survey, we can get a sense for whether they proved to be irrational or not.

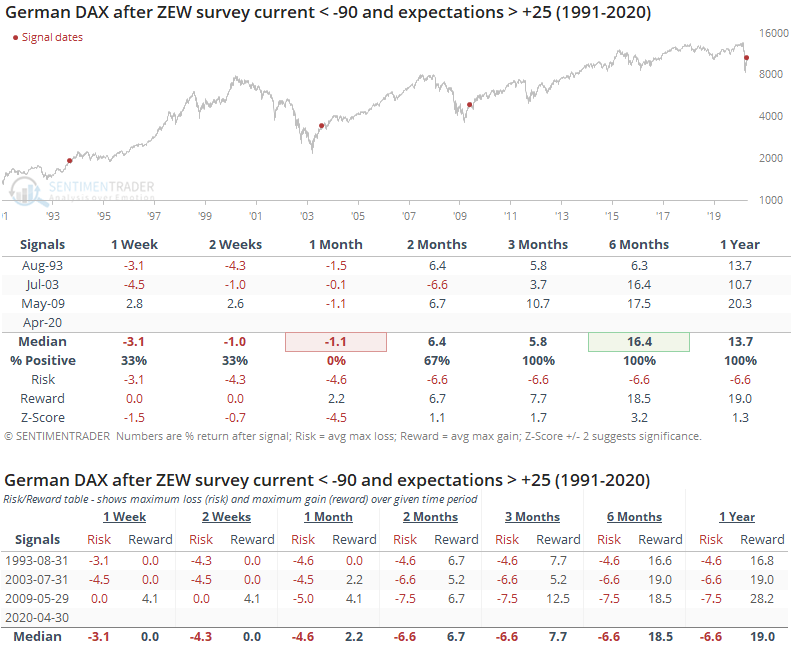

Below, we can see returns for the DAX when current conditions were on the floor, but they became hopeful about future conditions.

In the shorter-term, German stocks suffered, with negative returns all three times over the next month. The risk/reward was poor, with declines of at least 4% at some point within the month.

That proved to be about it for the losses, and the DAX soared in the months after that. By three months later, it was higher all three times, and the risk/reward over the medium- to long-term was excellent.

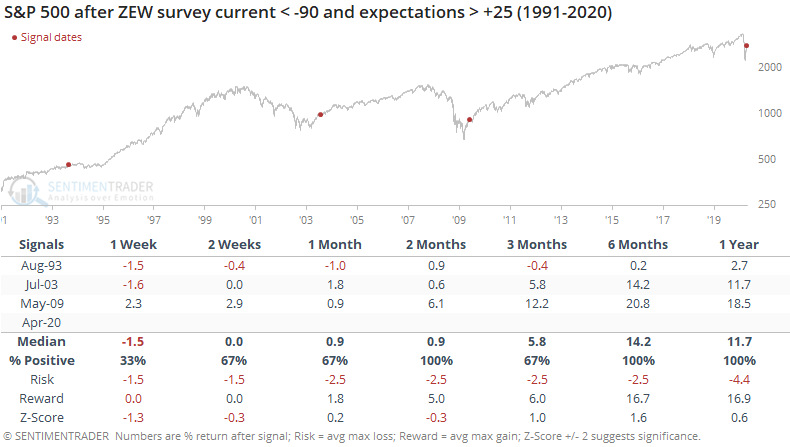

While the survey focused on the German economy, there is a lot of interconnectedness among global equities. When we saw these kinds of conditions in Germany, the S&P 500 generally followed, though it did better shorter-term and a little worse longer-term.

While it's tempting to form a knee-jerk conclusion about the survey and assume that optimism about the future is unwarranted, this group's history suggests it's a decent sign for later in the year.