Yields Rise As Leveraged Speculation Hits Record

This is an abridged version of our Daily Report.

So much for a safe haven

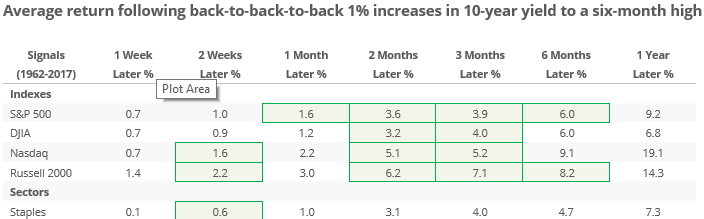

Even as stocks have wobbled, bonds have sold off hard for three straight days and yields are at a 6-month high. Similar moves led to consistent declines in yields going forward, but that’s because of the long-term bear market and cluster of readings in recent years. It was generally a good medium-term sign for stocks, especially REITs and Financials.

Leveraged speculation

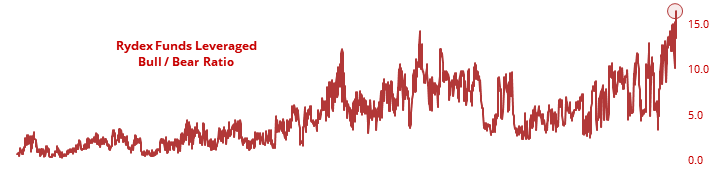

Traders in the Rydex family of mutual funds are leveraged to the long side to a record degree. There is nearly $17 invested in leveraged long funds for every $1 in leveraged short (inverse) funds.

Assets in leveraged ETFs aren’t as skewed, but the bull/bear ratio has still climbed to a new record. When speculation has been this rampant, the S&P 500 pulled back 5% both times.

A positive divergence

Despite the S&P 500, DJIA, and Nasdaq Composite all closing lower on the day, there were more advancing than declining issues on the NYSE, and four times more 52-week highs than lows. That has happened on 128 days since 1962.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.