Yield Curve Flips As Uncertainty Spikes

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

Normalizing

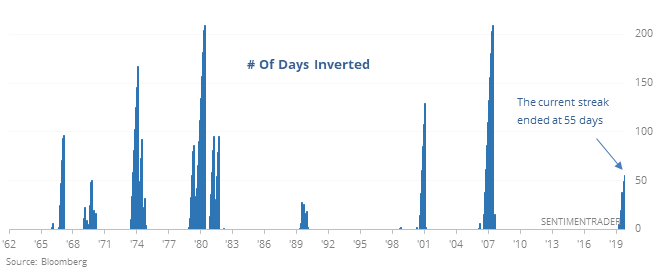

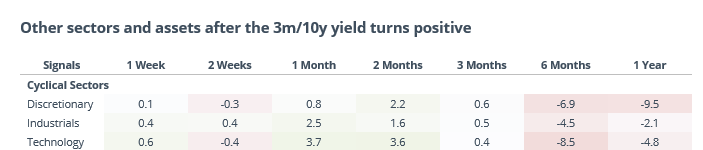

The most widely watched Treasury yield curve un-inverted in recent days, triggering some calls that now the risk for stocks has declined, that the worst is over. But that is backwards, as the initial inversion usually isn’t the trigger for trouble in stocks, that comes after the curve starts to normalize.

Forward returns in stocks were weak once this curve started to normalize, especially in some of the more cyclical sectors.

Trade(ing) Uncertainty

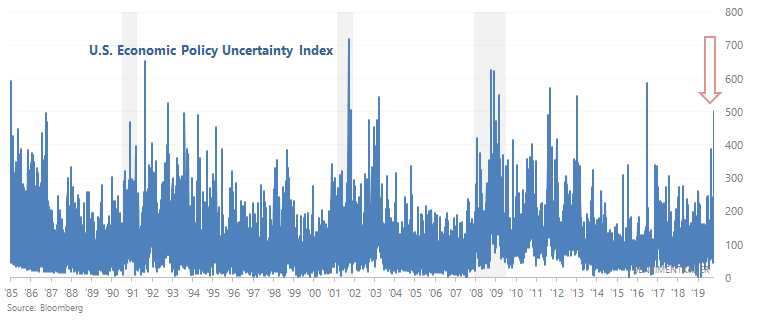

One moment "trade talks are going well", the next moment "trade talks turned sour", then trade talks "turned better again". Perhaps this is why the U.S. Economic Policy Uncertainty Index has spiked to the highest level since Brexit in 2016.

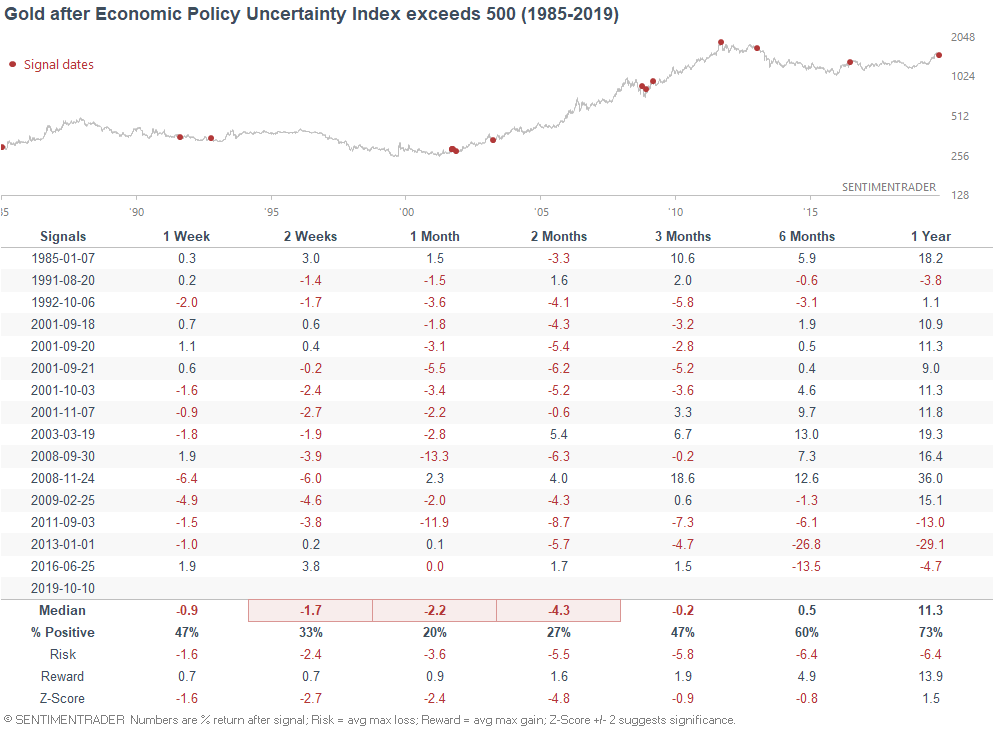

When the Economic Policy Uncertainty Index exceeded 500 in the past, the S&P's returns over the next 3-6 months were mostly bullish. Gold, however, did not do well over the next few weeks and months...