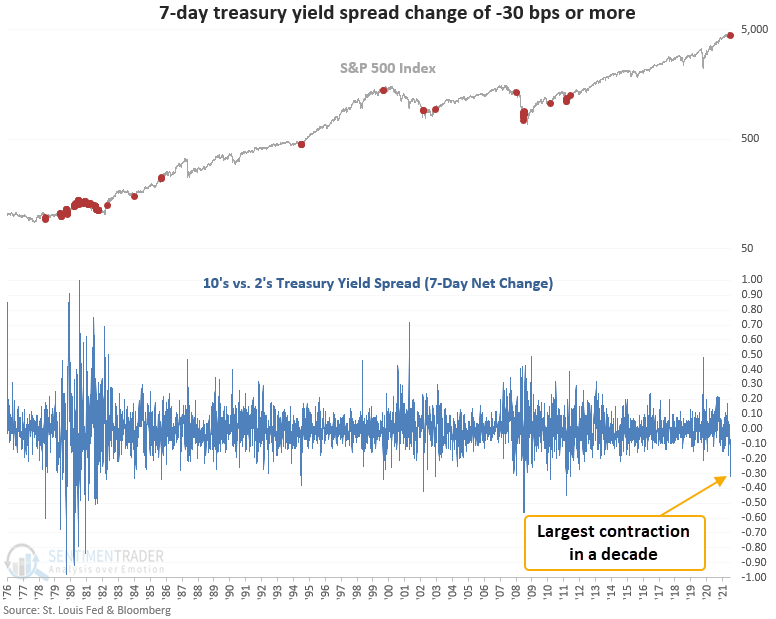

Yield curve collapse suggests near term caution

Key points:

- The 10's vs. 2's treasury yield spread has declined by 32 bps

- The sharp drop in the spread occurred over only the last 7 sessions

- Similar conditions preceded negative returns in the S&P 500 from 1-4 weeks later

A proxy for investor sentiment on the direction of the economy

When the 10's vs. 2's treasury yield spread declines, the yield curve is said to be "flattening." Typically, a flattening of the yield curve suggests softer economic conditions.

Conversely, when the 10's vs. 2's treasury yield spread increases, the yield curve is said to be "steepening." A steepening of the yield curve is typically, but not always, associated with more robust economic conditions.

What happens when the yield curve flattens by a meaningful amount

Let's assess the outlook for the stock market when the 7-day net change in the 10's versus 2's treasury yield spread falls by 30 basis points or more.

Significant declines in the treasury yield spread in a brief period are typically associated with growth scare corrections and bear markets.

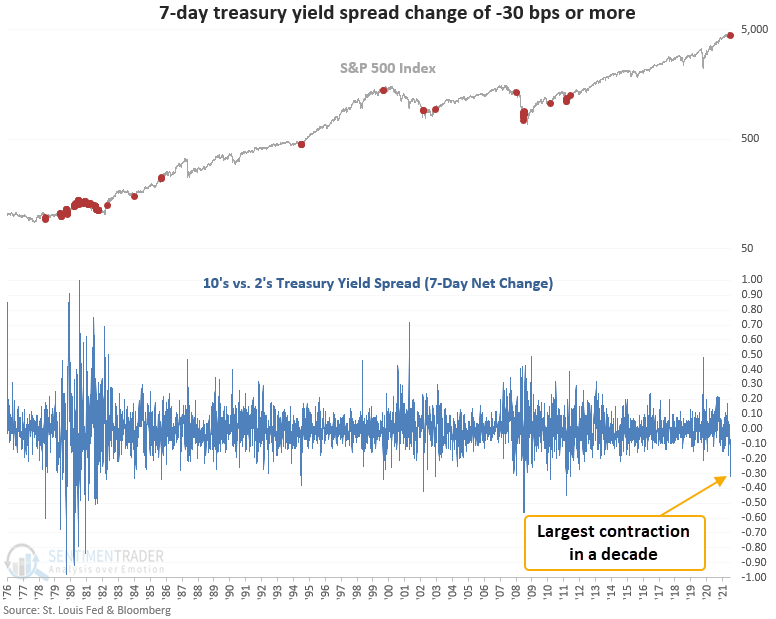

Similar signals preceded weak returns in the near term

This signal triggered 30 other times over the past 44 years. After the others, future returns and win rates were weak over the next 1-4 weeks. If we look at the returns post the peak in interest rates in 1981, we see negative returns at some point in the first 2 weeks in 13 out of 16 instances.

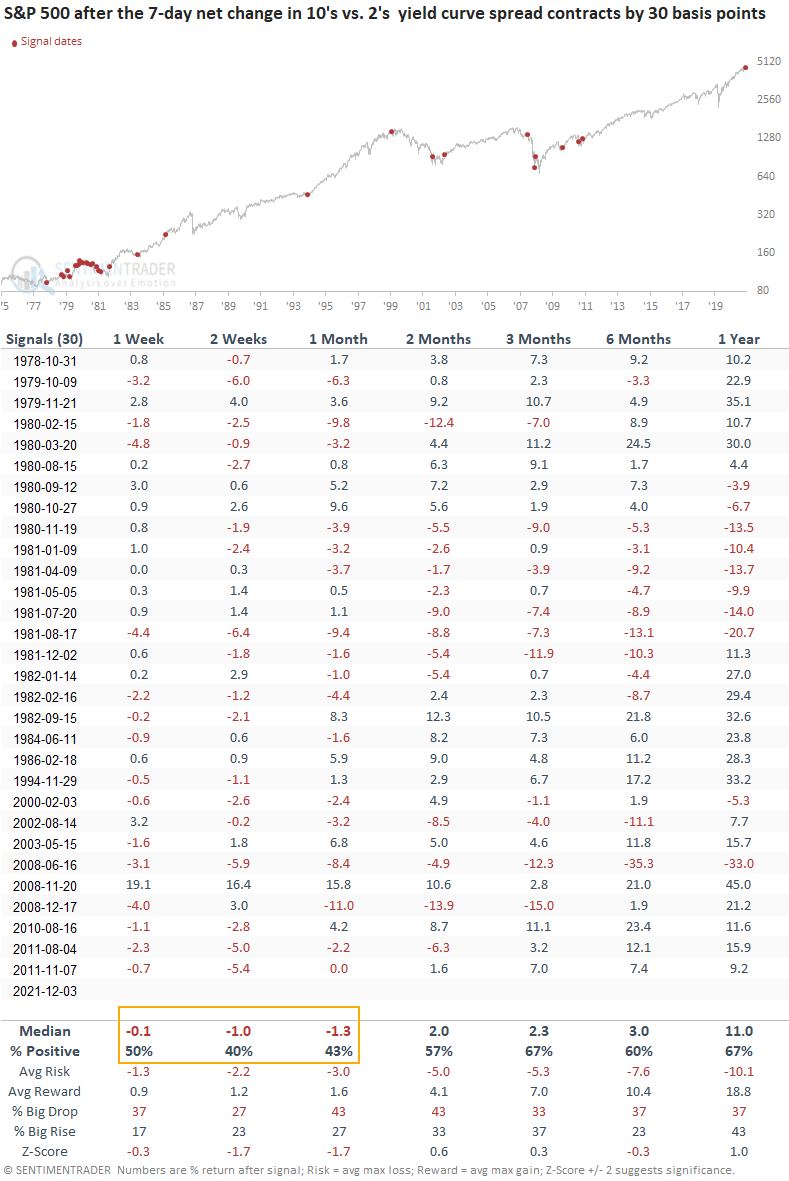

Returns after a flattening, but positive, curve

Let's add some context to the study. I will keep the original parameters but now isolate historical instances when the treasury yield spread was positive, which is the case now. The spread currently resides at +75 bps.

This signal triggered 14 other times over the past 42 years. After the others, future returns and win rates were weak on a short-term basis, with negative returns at some point in 12 out of 14 instances in the first 2 weeks. However, when the yield curve spread was positive, the S&P rose over the next year after 13 out of 14 signals.

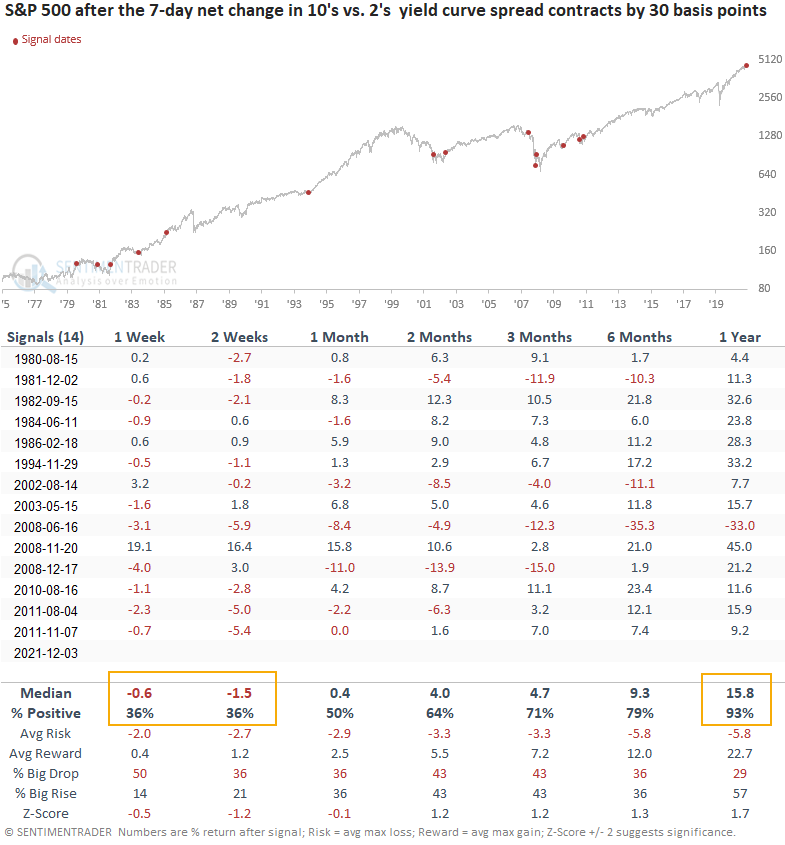

Returns after a flattening, but positive, curve during an uptrend

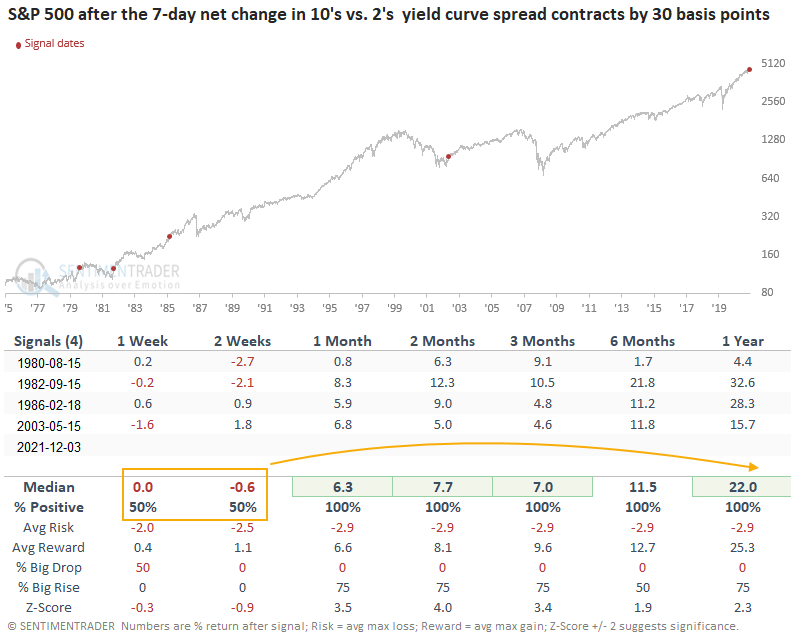

Let's add even more context to the study. I will keep the previous conditions and now include a trend filter. The S&P 500 must be trading above its 200-day moving average, which is the case now.

This signal triggered only 4 other times over the past 42 years. After the others, future returns and win rates suggest a 1-2 week pause. After the initial pause, results are undefeated across all time frames. The sample size is tiny, though, so that's always a caveat.

What the research tells us...

When the 10's vs. 2's yield curve spread registers a sharp decline over the trailing 7 day period, investor sentiment on the economy turns cautious, and stocks take a pause. Similar setups to what we're seeing now have preceded weak returns and win rates in the near term. However, when the yield curve spread is positive, and the S&P 500 is trading above its 200-day average, it's a pause that refreshes a bullish trend.