Yet Another Gap As Opening Fervor Continues

Stocks are on track for yet another gap up opening today, marking the fourth consecutive positive open.

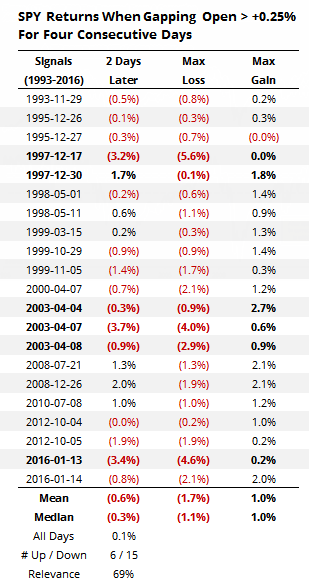

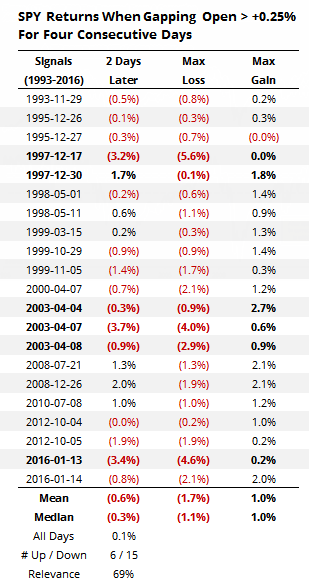

Since the inception of index futures in 1982, the S&P has never gapped up at least +1% for three consecutive sessions then gapped up at least 0.25% on the fourth. It happened after three gaps of at least +0.5% six times and at least +0.25% twenty-one times, shown below. The gaps that were at least +0.5% for the first three days are shown in bold.

The most consistent performance in the S&P was over the next two days, when weakness prevailed (returns are from the open of the 4th day to the close two days later). The risk-to-reward ratio was about even, suggesting that the downside edge was not great, but in terms of new buys - traders rushing in to chase the short-term gains - it was a poor bet way more often than not.

Of the six times that the gaps were at least +0.5% during the first three days, the next two sessions lost ground all but one time, though it's harder to draw a conclusion there because of the small sample and clustered dates.

This is just more confirmation of what we looked at yesterday, that short-term blasts like this give back some of the gains over the next several sessions an overwhelming amount of the time.

The exceptions are typically times when we're emerging from medium-term pessimism and about to embark on multi-week to multi-month rallies. As always, we'll be considering that here as well, meaning that we're looking for short-term weakness and if we don't get it then it adds to the probability that we'll see even higher prices in the coming weeks.

DISCLOSURE

With my personal portfolio that I show on the site for transparency purposes, my typical time frame is medium- to long-term so I tend to avoid very short-term adjustments. While reducing exposure to stocks here seems a little "cute", the fact is that we're seeing excessive (short-term) optimism in a downtrending market, so I prefer to reduce exposure in those cases. The risk, and it's substantial, is that this is one of the exceptions, buyers continue to plow in, and I'm left with less exposure than desired longer-term, leaving me to chase prices higher. So no major adjustments here, I'll just be looking to reduce exposure from ~46% to ~40%.