XLK And XLY Spike In Assets

It seems like there's a sudden desire to bet on a cyclical resurgence. But not really - it's mostly just a reflection of the looming rebalance to account for the new Communications Services sector.

On September 21, the XLY and XLK funds will be adjusted to account for the new fund, so we're going to see some weird spikes and plunges in asset levels in some funds over the coming week(s).

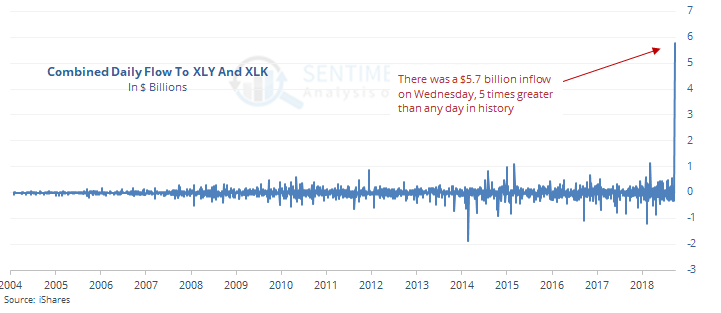

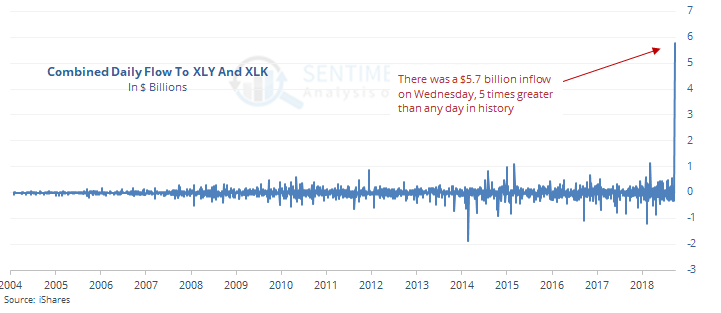

On Wednesday, more than $5.7 billion poured into the main iShares funds betting on Technology and Consumer Discretionary, XLK and XLY. That's more than 5 times greater than any other day in their history.

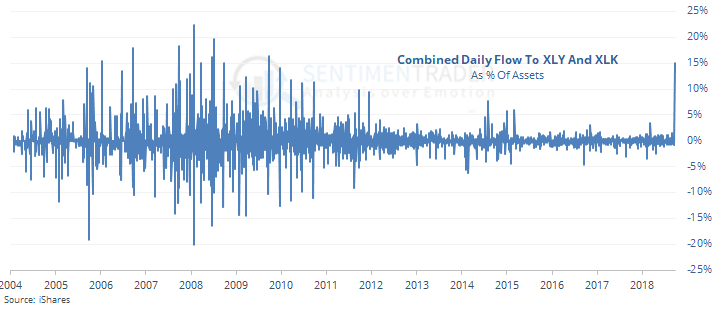

Because the asset base of both funds has grown substantially over the years, looking at the raw daily dollar value can be misleading at times like this. So if we look at the funds' inflow as a percentage of their asset base, we get this:

Still enormous. On average, the two funds increased their assets by nearly 15%, the most since 2010 when they were much smaller funds.

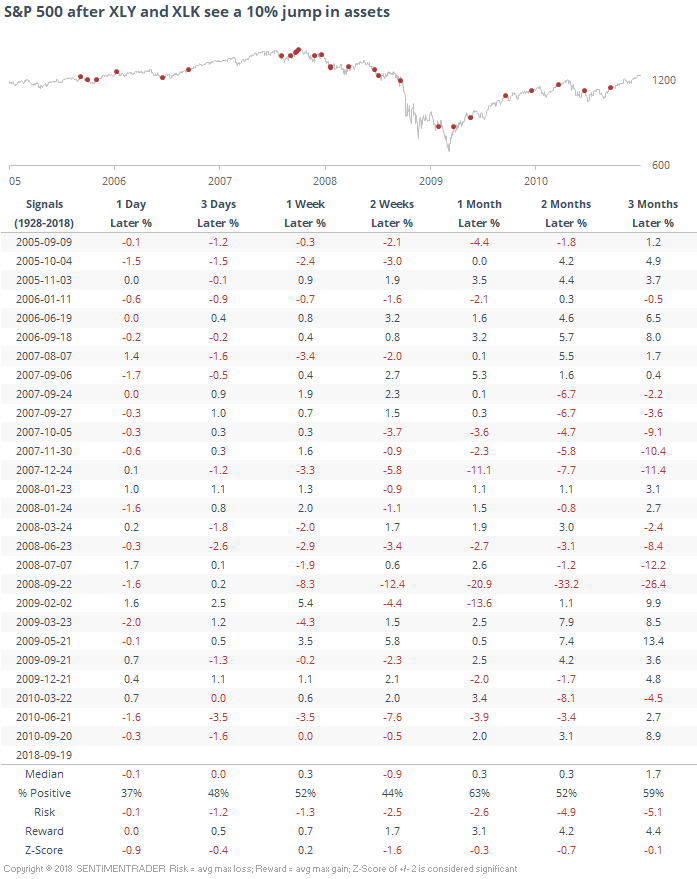

The other spikes in assets were "organic" and not tied to a rebalancing. So, we're not comparing apples to apples here. Just for fun, the following table shows what happened after the other times the two funds had a huge jump in assets in a single day. They all occurred between 2005-2010, and led to some negative returns for the S&P 500 in the shorter-term.

I don't think we can read much, if anything, into that because of the rebalance, so this is more just a heads-up to take the sector adjustments into account if looking at fund flows in the coming days and weeks.