Worst economic data since....

Recently released economic data in the U.S. and other countries is bad. Just how bad depends on what indicator you look at: Retail Sales, Industrial Production, employment figures, etc.

The problem with using economic data to make historical comparisons in a bear market/recession (trying to find the bottom of a recession/bear market) is that:

- There are only so few major bear markets and recessions in history.

- No 2 recessions are really that similar.

This is why I can find Indicator XYZ that tells you "the S&P and economy today is just like March 2008" (i.e. market can fall much more), and at the same time I can find another Indicator ABC that tells you "the S&P and economy today is just like March 2009" (i.e. bottom is in). Here's an example.

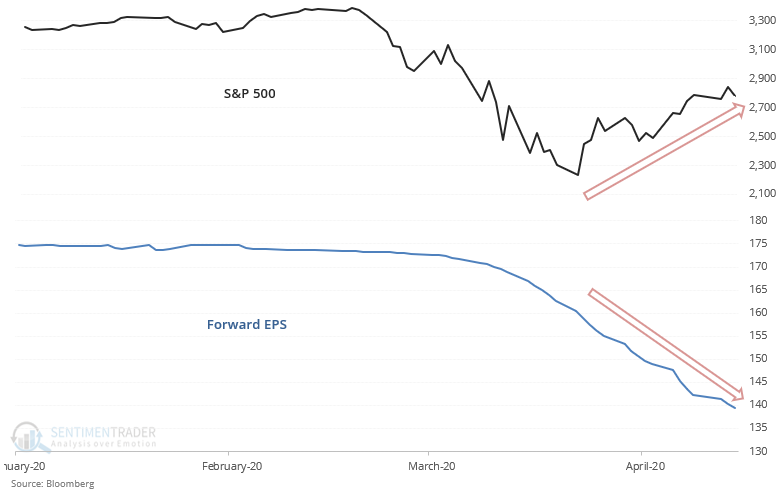

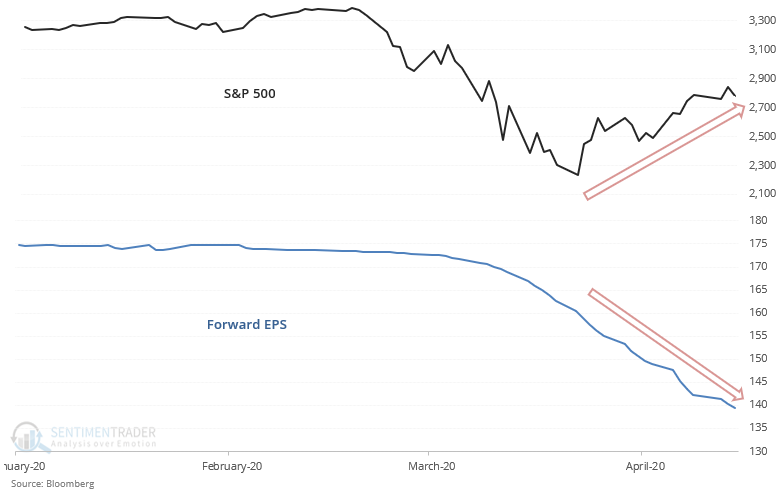

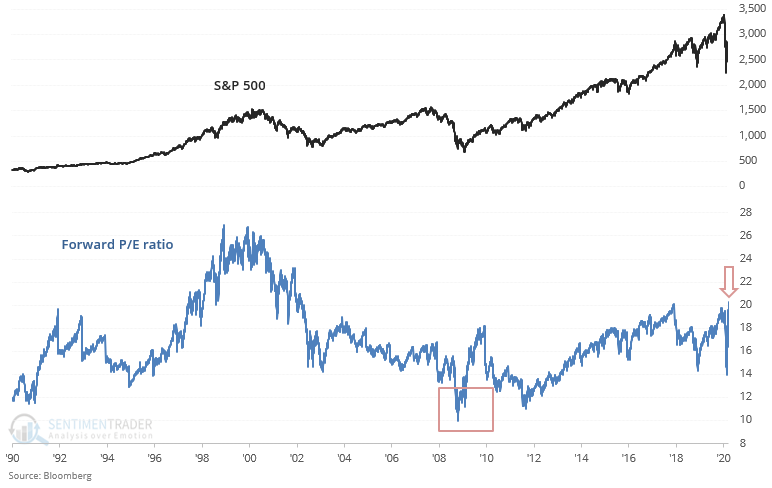

The S&P's significant rally from its March bottom has been accompanied by falling forward earnings:

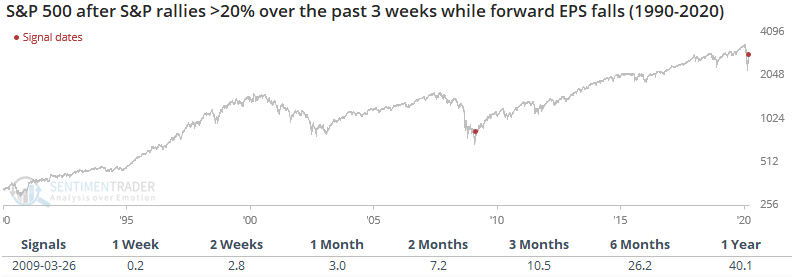

The only other time the S&P rallied significantly while forward earnings continued to fall was in March 2009, just as the bear market ended:

As you can see, such a surface level analysis would say "it's completely normal for earnings to fall while stocks spike! The last time this happened was at the bottom of the last bear market, as analysts were forced to adjust their expectations upwards! Prepare for an imminent and massive reversal!"

Here's the most important difference between today and March 2009. Valuations in March 2009 were SIGNIFICANTLY LOWER than they are today. While valuations do not matter on a 1 year forward basis, they certainly matter on a 5-10 year forward basis since valuations determine long term risk/reward. Much lower valuations back in March 2009 enabled stocks to climb significantly over the coming years. The S&P 500's forward P/E ratio is currently at 20, a level reached in January 2018 and late-2019. This implies that long term future returns will be low. Buyers beware: there is no sense for long term investors to chase stocks now. There are much better opportunities in private markets right now (e.g. real estate).

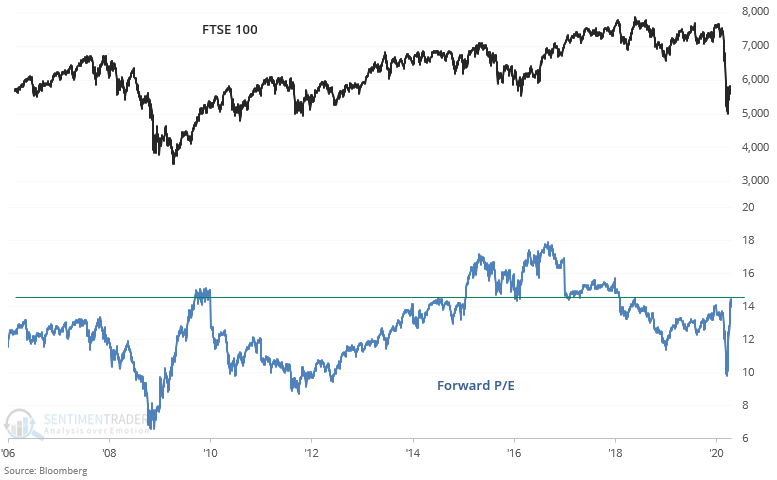

Although valuations outside the U.S. are more attractive than U.S. valuations, they have still increased significantly.

Here's Germany:

Here's Australia:

Here's the UK: