Worldwide stock markets ease out of corrections

Investor behavior is like we see near the end, but markets are showing the signs we typically see during the beginning stages of a long-term recovery with thrusts in breadth and the percentage of securities hitting 52-week highs. It's very strange.

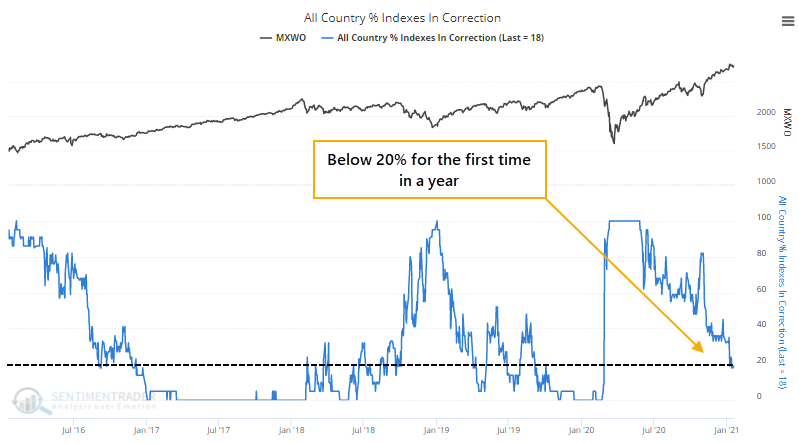

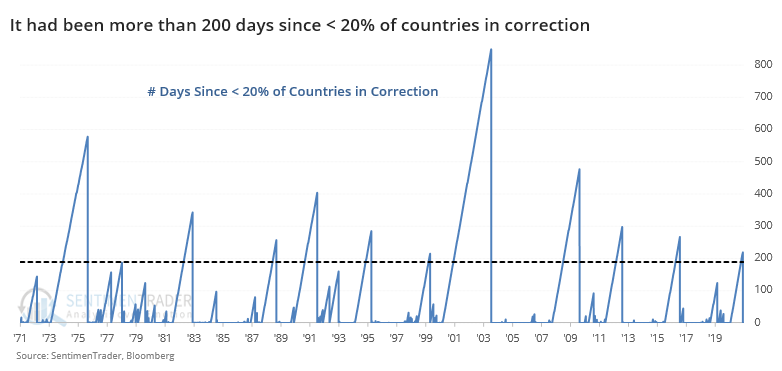

Among the signs of recovery, not just in the U.S. but worldwide, is that for the first time in more than 200 days, fewer than 20% of major world equity indexes are in corrections.

This ends one of the longer streaks since 1971 when more than 20% of countries had been in a correction at the same time.

After other streaks ended, it was a good longer-term sign for world stocks. The MSCI World Index showed a positive return over the next 6 months every time, and over the next 9-12 months all but once. Losses were minimal, and the risk/reward was excellent.

What else we're looking at

- A look at where we are in a typical Sentiment Cycle

- What that means vs. the market environment

- What happens to world markets, the S&P 500, small-caps and value stocks when there is a worldwide recovery

- Forward returns since 1928 when more than 80% of NYSE securities are trading above their 200-day moving average

- The benefits of a stock replacement strategy using options

- What happens when XLF sees big ETF inflows

- Active managers in the NAAIM survey are extremely confident but it doesn't mean what you think

- Breadth has been pristine, but some recent worrying signs

| Stat Box On Thursday, the Nasdaq Composite rose more than 0.5% to a record high, yet fewer than 45% of securities on the Nasdaq exchange advanced. That's only happened 9 other times in the past 35 years. |

Sentiment from other perspectives

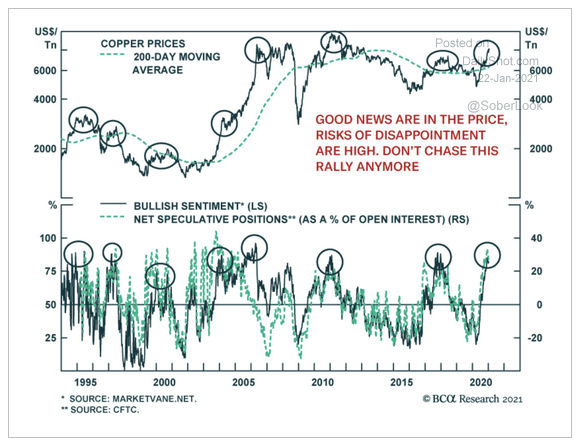

Confidence abounds across markets, not just in stocks. Commodities and industrial metals have seen outsized optimism as well. Bets on copper are now among the highest in 25 years. Source: BCA Research via Daily Shot

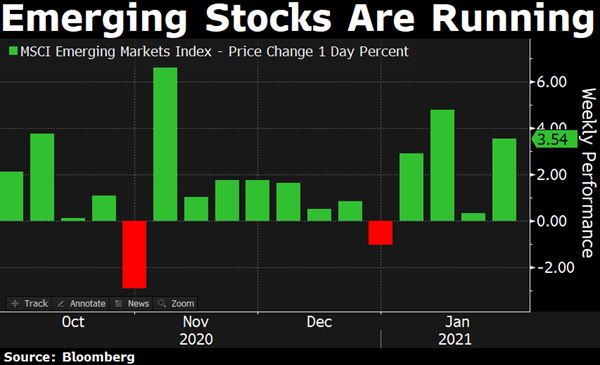

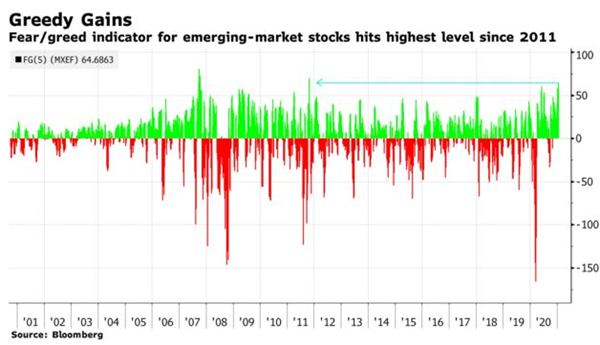

There is a high positive correlation between commodity markets and emerging market stocks, and the rally in the former has coincided with one in the latter. Bloomberg's proprietary Fear/Greed indicator is now in the danger zone for emerging stocks. Source: Bloomberg

Optimism does tend to percolate when a market has suffered only 2 losing weeks in 4 months. Source: Bloomberg TV