With Yet Another Positive Month, A Historic Set of Precedents

We saw on Tuesday that this has been one of the few times in history that both stocks and commodities have rallied so hard through this far into a year.

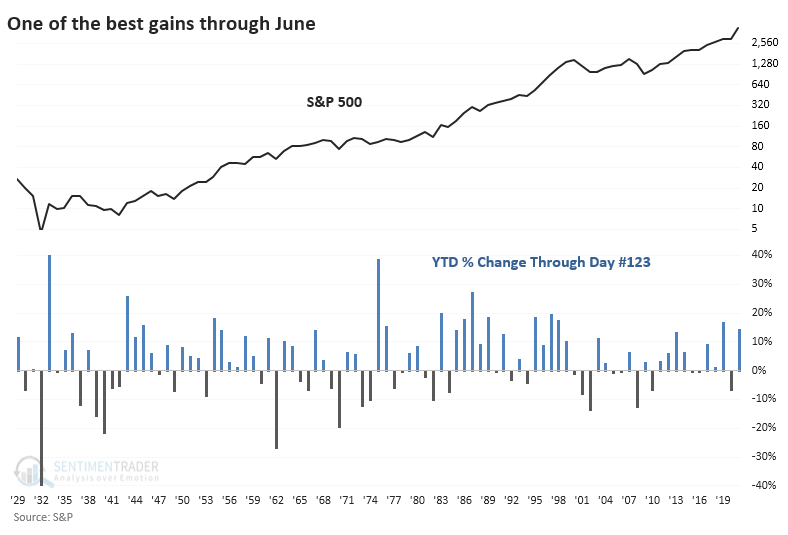

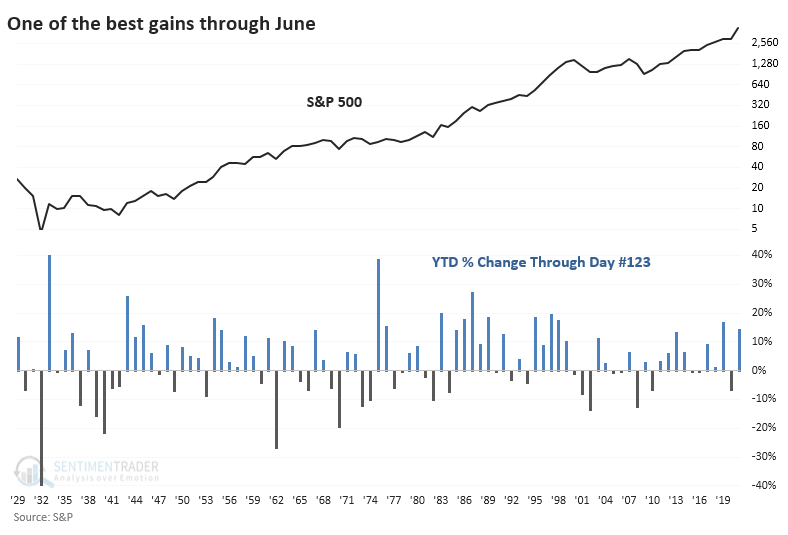

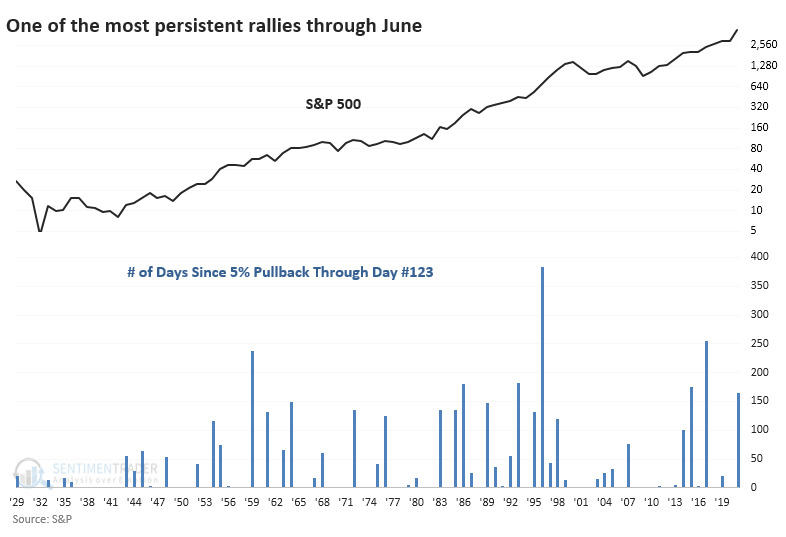

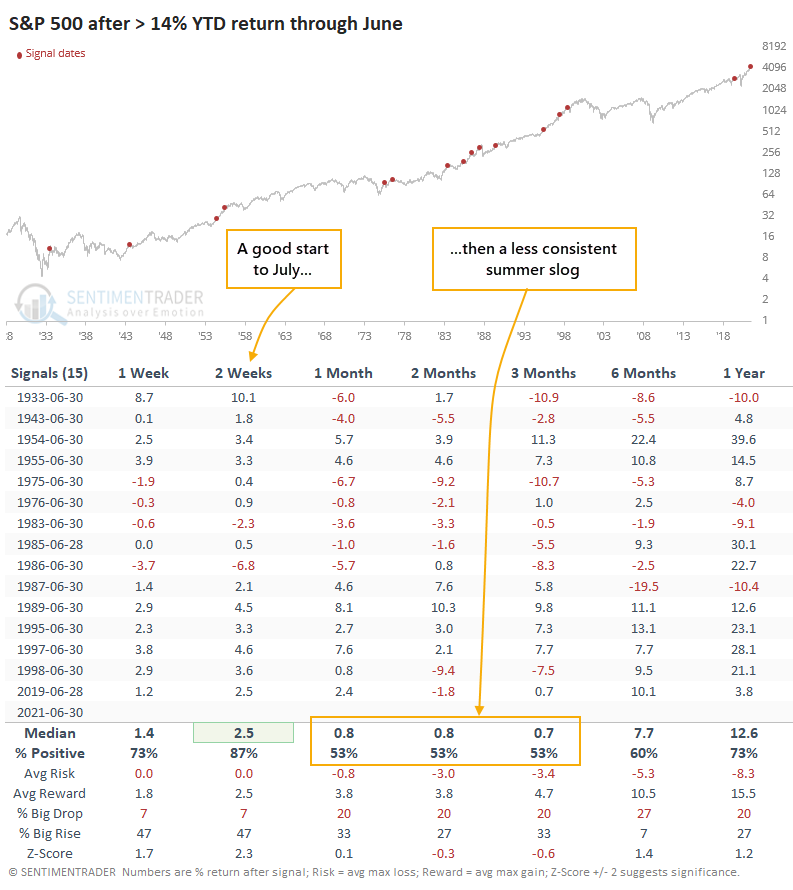

For stocks, in particular, it's been one of the best, most consistent, and most persistent rallies year-to-date in its history. Through the end of June, the S&P 500 has rallied more than 14%, ranking in the top 85% of all years since 1928.

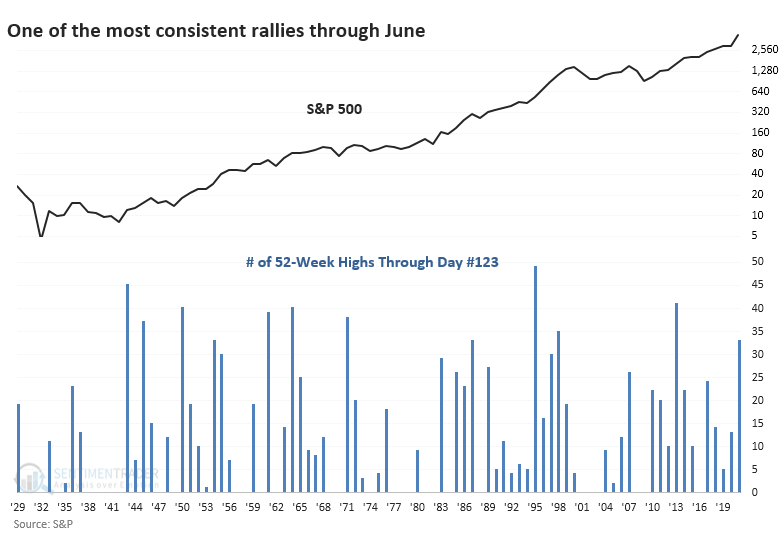

It's also been one of the most consistent years. The S&P has scored 34 record highs for the year already, ranking in the top 88% of all years.

And it has been a very persistent rally. The S&P has now gone more than 150 sessions since the index was more than 5% off of its peak. That streak ranks in the top 93% of all years since 1928.

A DECENT LONG TERM SIGN

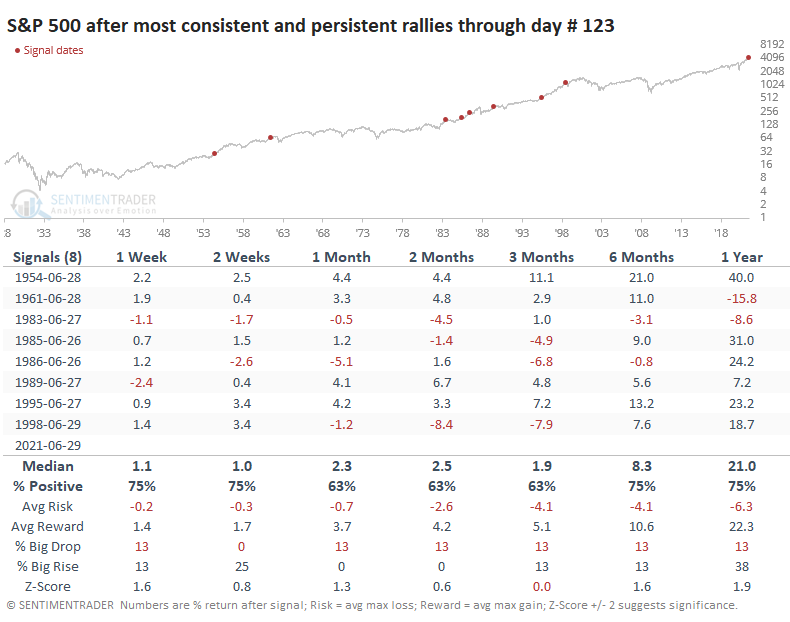

Momentum is a strong force and doesn't usually roll over easily. If we look at the strongest, most consistent, and most persistent years through June, this year ranks among the best.

The risk/reward was decent after the others. There were almost no large declines in the months ahead, but gains also tended to be limited. That's a combination of a lot of buying power potentially already used up, along with what has frequently been a summer soft spot.

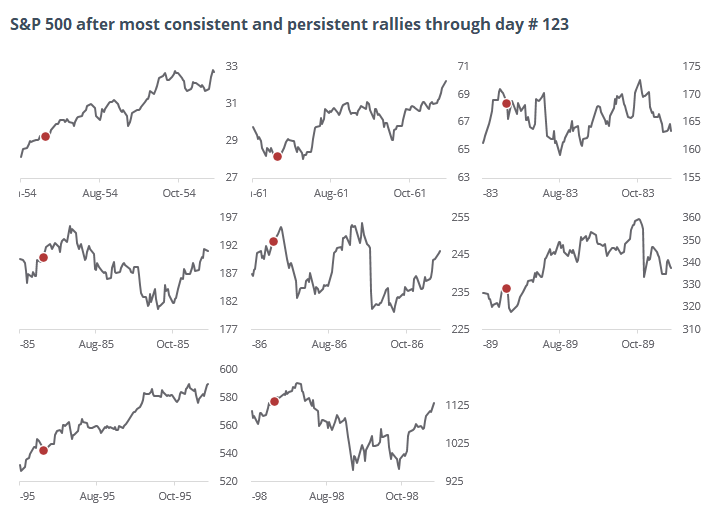

Looking more closely at those signals, we can see a lot of mixed trading activity. A couple of them (1954 and 1995) saw good gains in the months ahead without even much of a dip on any time frame. A couple of the others (1961 and 1989) saw a quick dip then decent gains. The other four had a tougher slog ahead.

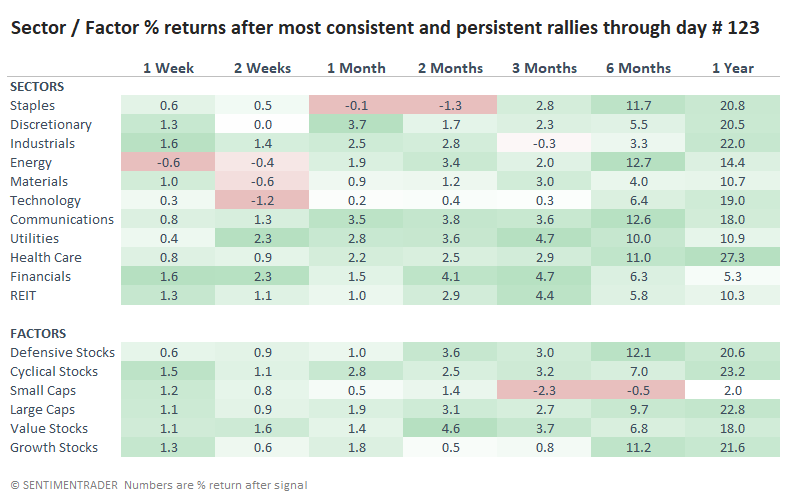

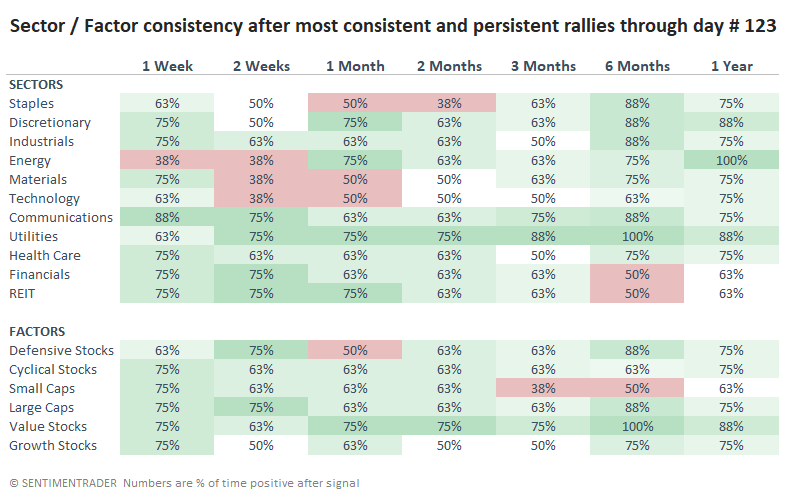

DEFENSIVE STOCKS HELD UP BEST

Among sectors, Energy showed the best gains through the end of the year, with other defensive sectors like Staples, Utilities, and Health Care also among the top. It's no surprise, then, that among factors, Defensive stocks showed the best gains, while it was tough sledding for Small-Caps.

Looking at consistency among sectors and factors, Utilities and Value stocks both showed gains every time over the next six months, while Small-Caps were up only half the time.

MOMENTUM THROUGH THE SPRING

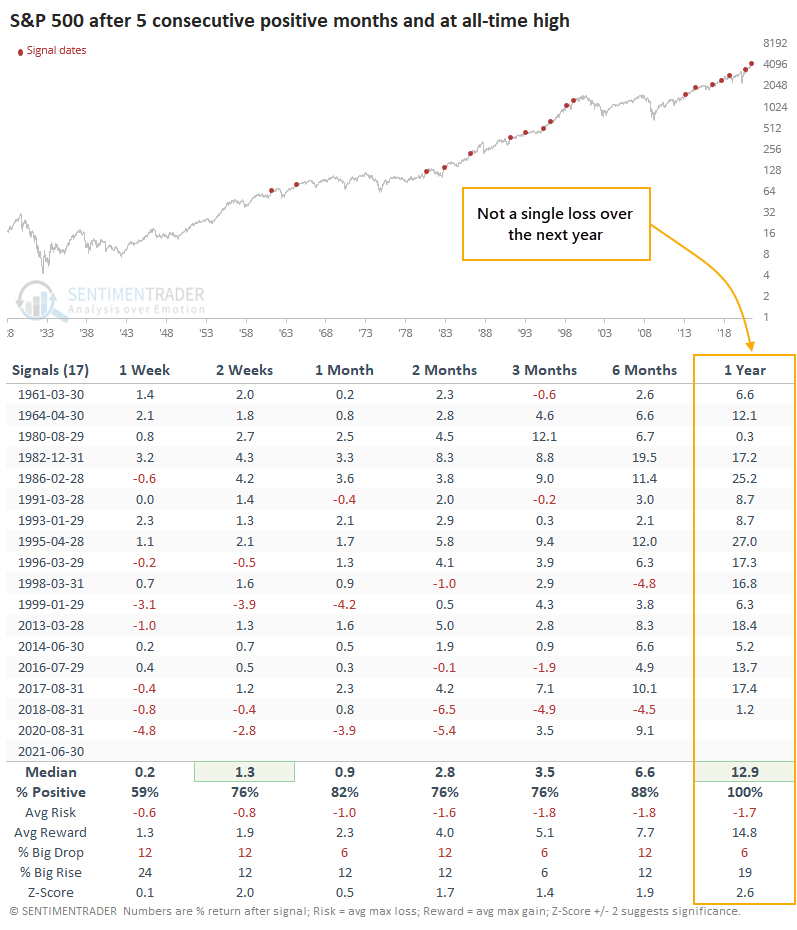

A couple of weeks ago, Jay outlined what was at stake in June. Namely, if the S&P 500 managed to close above 4204, it would trigger all kinds of positive seasonal momentum. And indeed it did.

Building on what he pointed out, the S&P closed higher for its 5th consecutive month. It also notched an all-time high. Out of the 17 other times the index did this, it never suffered a loss a year later.

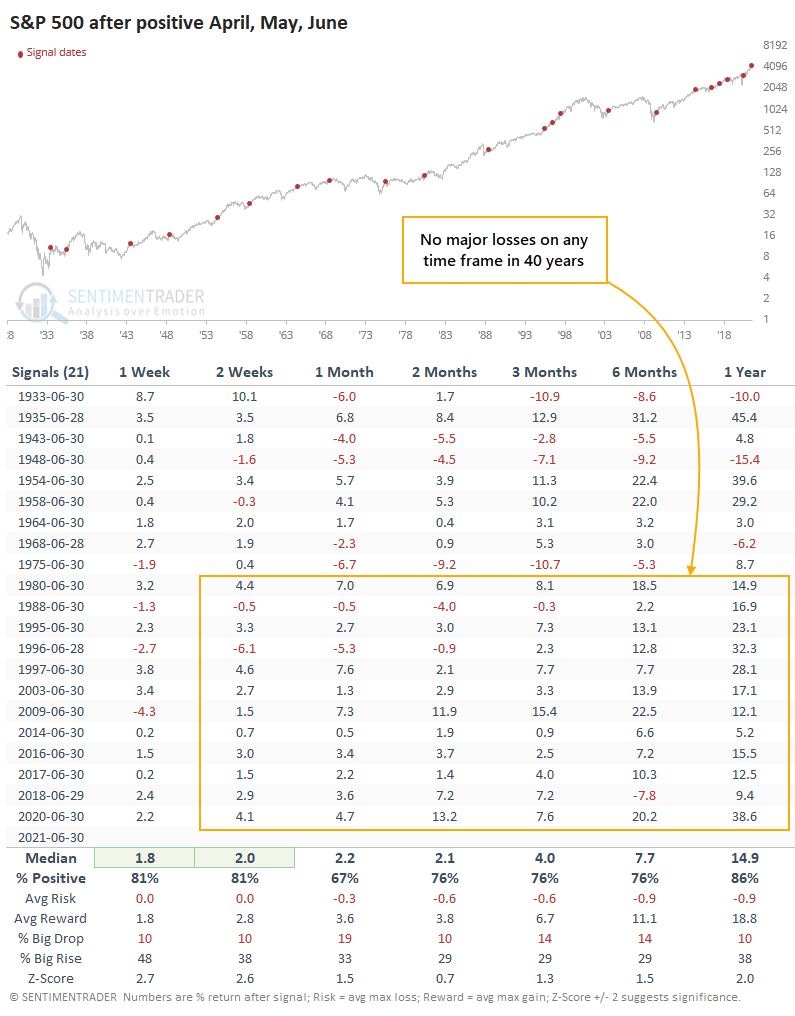

It avoided any "sell in May" reaction from a seasonal perspective and showed a monthly gain for each month in Q2. Over the past 40 years, that preceded gains, or sporadic, small losses, across all time frames.

The good quarter added to a good first quarter, allowing the S&P to gain more than 14% through June. The first couple weeks of July showed a gain after 13 out of 15 years, then there were less consistent gains during the peak of the summer, and average returns were mediocre.

Much of what we've seen pop up lately has suggested another bout of higher risk, with headwinds because of breadth divergences and seasonality starting after the first part of July.

Momentum in the indexes has been remarkable, rolling over every potential negative for months now. It's gone far beyond most (any?) historical precedent, with the most common excuse being an unprecedented fiscal and monetary stimulus. Whatever the reason, momentum is winning and shows no signs of stopping, at least for a passive index investor. Under the surface, there's a lot more tumult.

Given the above, it does seem more likely that momentum could carry even further through the first part of July. If that does come to pass, and we continue to see many stocks struggle under the surface, it should only add to the rising pile of divergence signals, raising the risk for July - September.

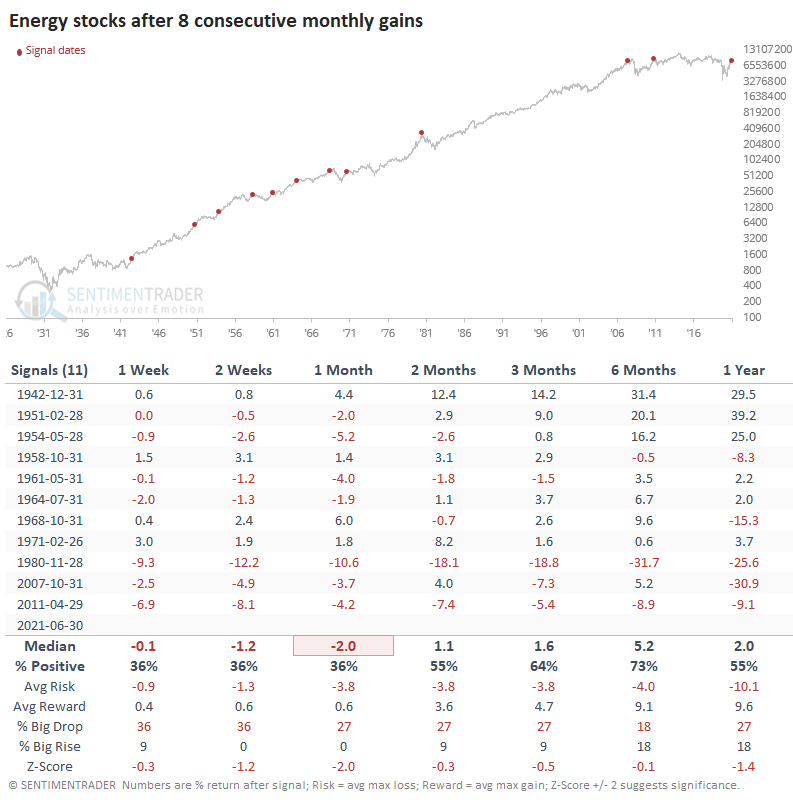

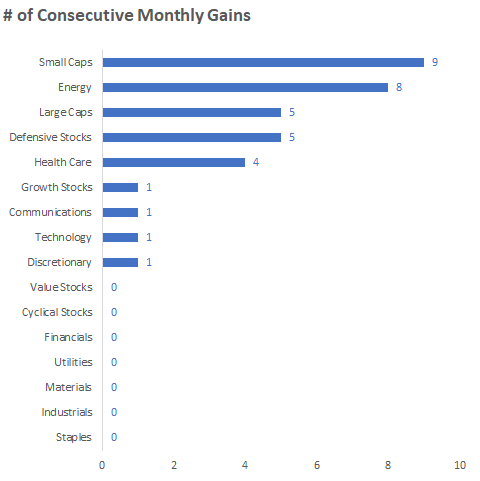

BEST STREAKS AMONG SECTORS AND FACTORS

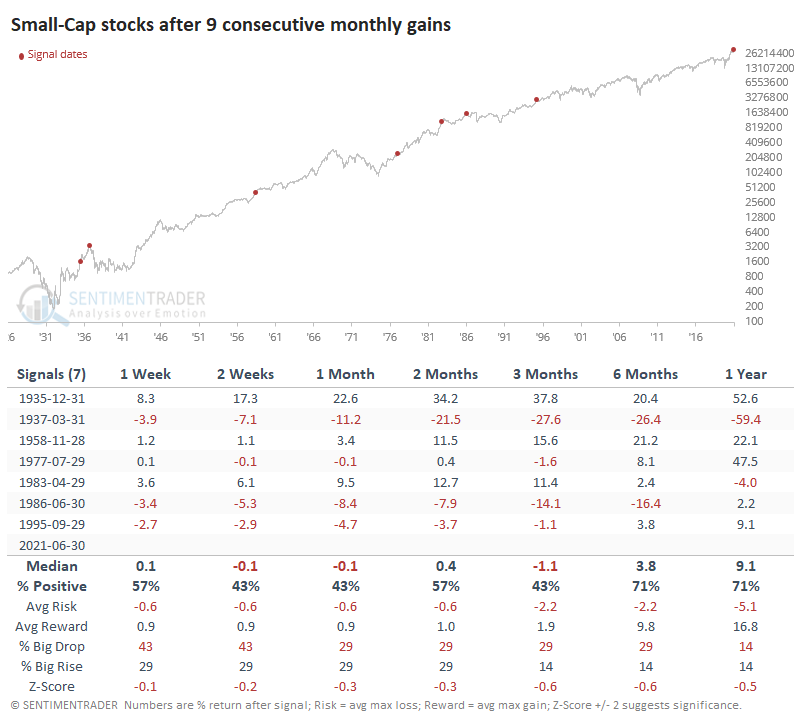

Driving the streaks of monthly gains, Small-Caps and Energy rank as the best. Both are enjoying winning streaks rarely matched since at least 1926.

For both, it was a mixed blessing. In 1935 and 1958, Small-Caps managed to keep tacking on more gains in the months ahead. Other than those, returns moderated as the stocks took a breather.

For Energy stocks, there was an even more consistent tendency to see the gains moderate, especially over the following month. On the positive side, the sector enjoyed gains over the next six months after 8 of the 11 precedents, with one of those losses being very small.