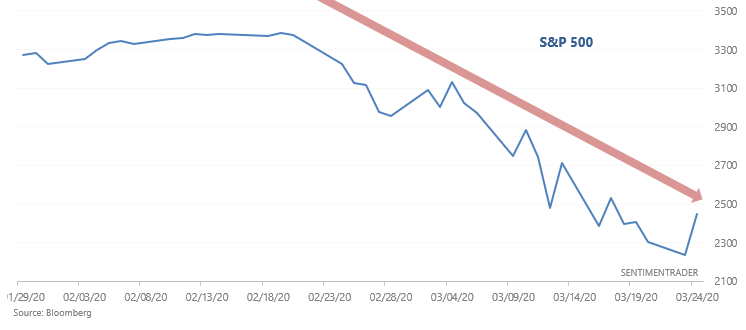

Will the S&P break this trend?

The stock market's crash over the past month and a half has been intense. Every time the S&P goes up and bulls think "this is the start of the reversal!", stocks get monkey hammered the next day. Could this time be different?

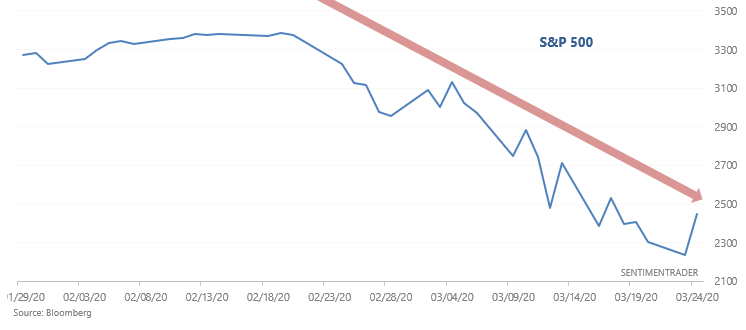

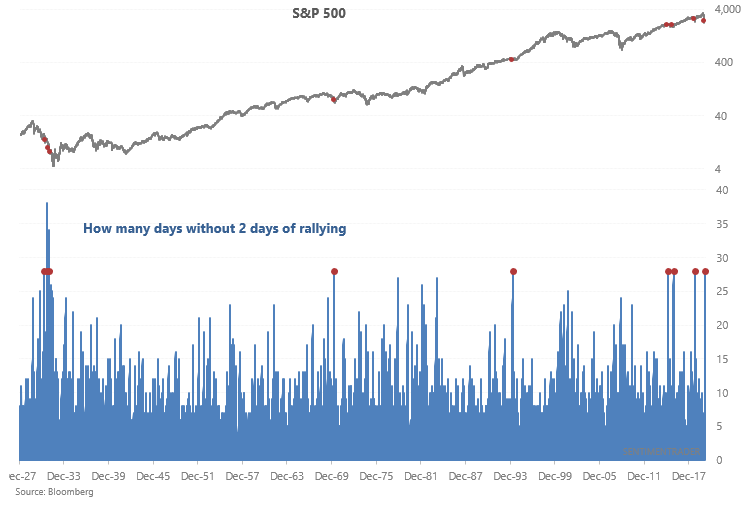

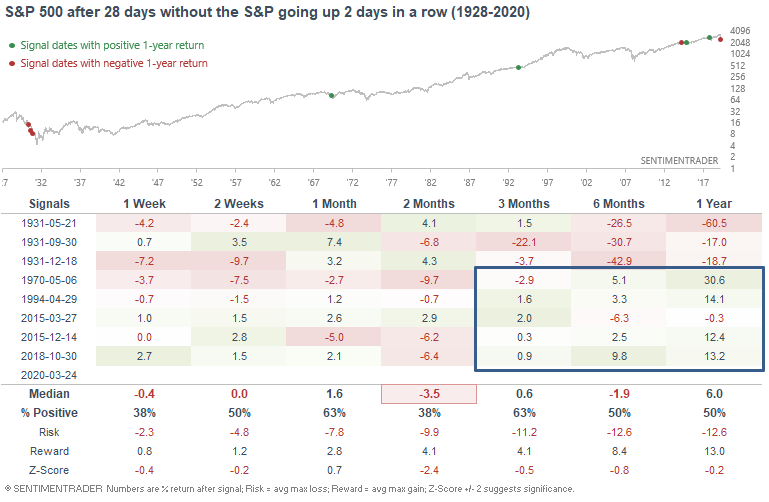

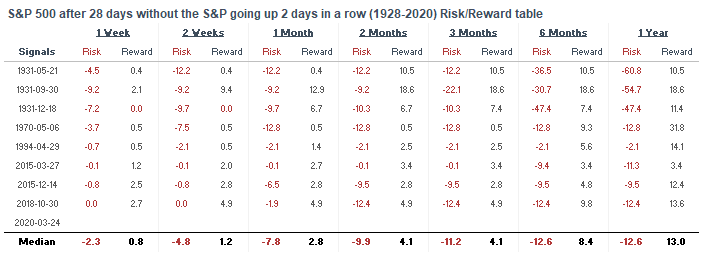

The S&P 500 has gone 28 days without a sustained 2 day rally. This is one of the longest streaks of all time, exceeded only by the 1929-1932 Great Depression crash.

Aside from the 1930s, such a prolonged downtrend usually led to the S&P rallying over the next 3-12 months. But including the Great Depression era, this wasn't as bullish over the next 3-12 months. Any analysis that involves dates from the Great Depression usually isn't very bullish, since the 1929-1932 crash was so severe.

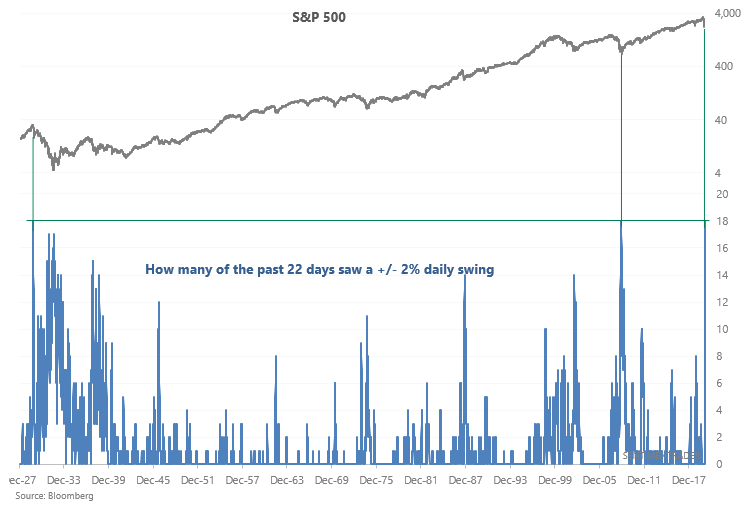

In the meantime, the # of +/- 2% daily swings in the past 22 days has matched prior records.

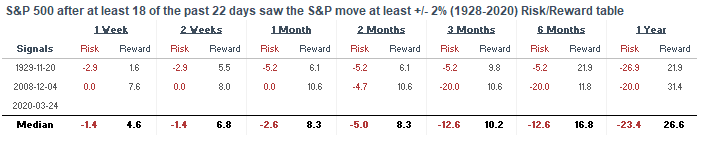

The only other times we saw this much volatility over the past 22 days came AFTER the S&P's medium term bottom was already in. This led to at least a double-digit rally over the next few weeks/months:

Here's what the S&P did in 1929:

Here's what the S&P did in 2008:

Bottom in, multi-week/month rally, then new lows.