Why Recession Risk Is More Bark Than Bite...For Now

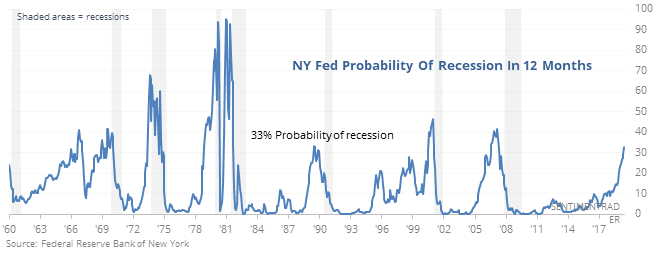

Recession around the corner

According to a model from the New York Fed, the risk of recession has risen to a point that has almost guaranteed an economic pullback in the past.

But that does not mean it was an imminent danger to stocks, which rose every time but once over the next few months. The only time it served as an immediate and successful warning to exit stocks was in 2000.

The dollar and gold both struggled, while bond yields typically rose in the shorter-term, and declined over the next 6 months.

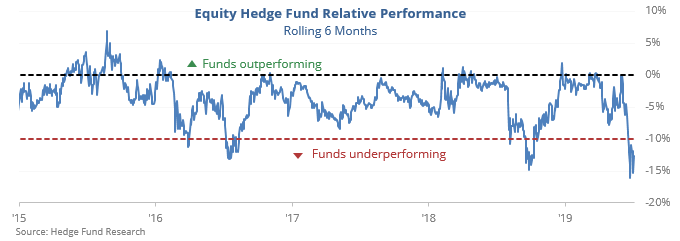

Funds’ relative returns

Equity hedge funds have carried low exposure to stocks for months, and that has hurt their returns. Over a rolling 6-month window, they’ve now trailed the S&P by the most since 2012.

This has a mean-reverting quality to it, suggesting stocks have gone too far, too fast over a shorter time frame.

High times for junk

The recent rally in high-yield bonds pushed more than a net 500 of them to new highs, nearly 30% of the 2,000+ bonds tracked by the Nasdaq.

That has been matched only twice in the past 15 years, in February 2005 and January 2010. Both times led to some short- to medium-term weakness but the thrusts both led to higher highs in the months ahead.

Rolling over

Momentum in health care stocks is rolling over from a high level. The 20-day average of the McClellan Oscillator has crossed below 50. According to the Backtest Engine, this has led to negative reuturns in XLV over the next 2-4 weeks 7 out of 9 times.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.