Why Monday was so unusual

It's always sketchy to make a big deal about a single trading session, especially in relation to drawing conclusions about future returns. Markets are too noisy, and sometimes there is a market event that throws things out of whack for a day or two.

At the risk of that, let's make a big deal about Monday.

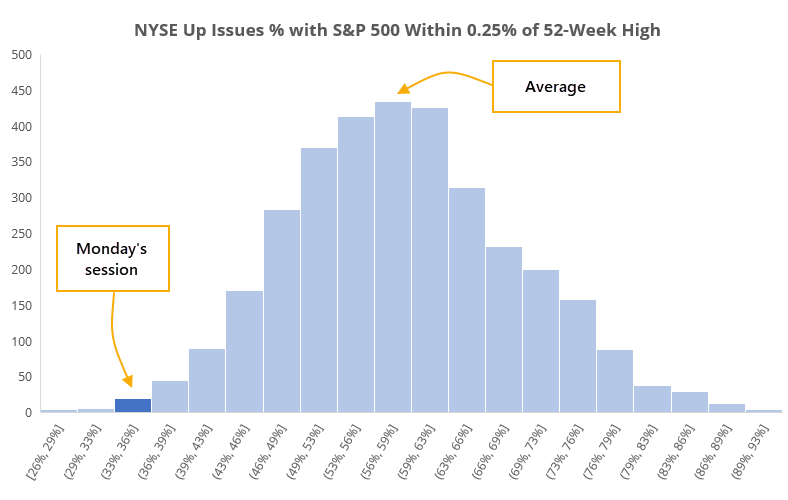

Despite the S&P 500 closing within 0.1% of a record high on Monday, fewer than 35% of securities on the NYSE managed to close above their closing price from Friday. That was the weakest Up Issues Ratio since 1946.

Since 1928, when the S&P 500 was within 0.25% of a 52-week high, an average of 58% of securities on the NYSE advanced for the day. There have been 3,331 days when the S&P was that close to a high, and the histogram below shows just how unusual Monday's session was.

In terms of what those weak days meant for forward returns, the S&P had some trouble holding near its highs when so many stocks had been declining under the surface. Every signal in the past 30 years showed a negative 1-month return.

What else we're looking at

- Detailed returns following extremely low Up Issues

- The McClellan Oscillator and Summation Index are also unusually low

- What it means when financials consistent underperform the broader market - and what that means right now

- What happens when optimism on the VXX volatility fund starts to ebb from enthusiasm

| Stat Box Over the past 20 days, an average of 92% of gold mining stocks have been mired in a bear market. This is the most since early 2014. |

Etcetera

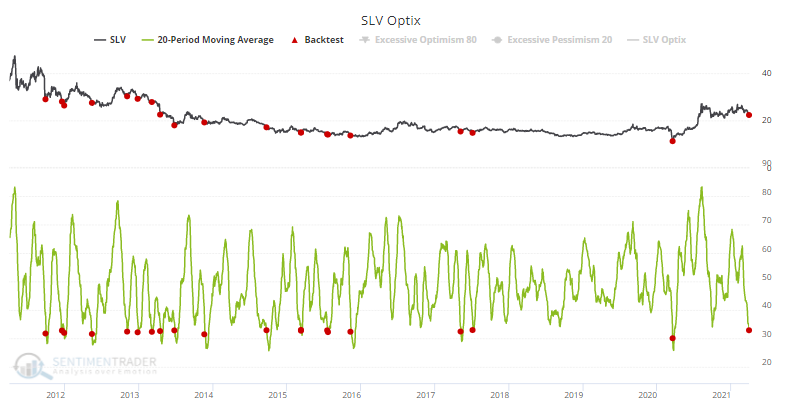

The shine has come off precious metals. A 20-day moving average of the Optimism Index for the SLV silver ETF is showing the least optimism since the big thrust starting a year ago. It's about as low as it got during the protracted bear market. Our Backtest Engine shows that even during the bear market, this kind of low optimism generated a positive return over the next month.

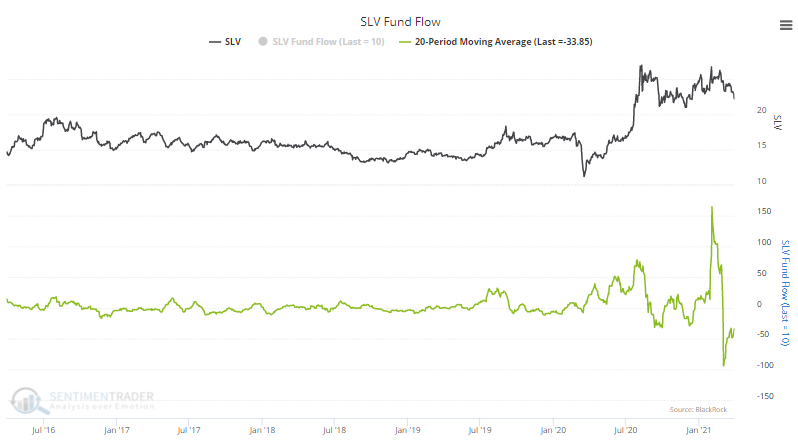

Traders are leaving. After a big spike in assets for a couple of days early in February, the SLV fund has been leaking funds. Over the past month, the fund has lost an average of nearly $34 million per day.

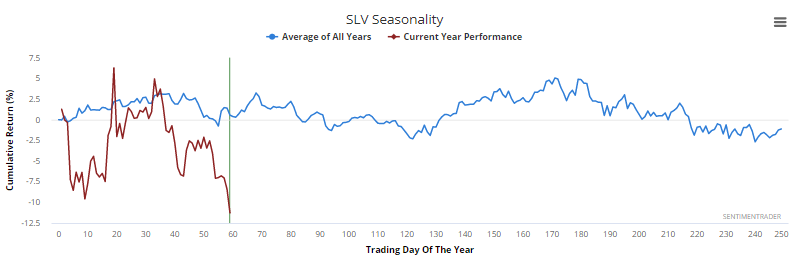

Seasonal boost? The spring winds typically provide a tailwind to SLV, as it has a positive seasonal bias in April...before a tougher stretch during the summer months.